Laboratory Information Systems Lis Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

3.19 Billion

2024

2032

USD

1.58 Billion

USD

3.19 Billion

2024

2032

| 2025 –2032 | |

| USD 1.58 Billion | |

| USD 3.19 Billion | |

|

|

|

|

Laboratory Information Systems (LIS) Market Analysis

The global laboratory information systems (LIS) market is experiencing significant growth due to the increasing demand for efficient data management systems in healthcare and laboratory settings. A key driver is the rising need for automation in diagnostic laboratories to manage the growing volume of patient data, streamline laboratory workflows, and ensure accurate results. Advances in healthcare IT, particularly the integration of cloud-based solutions, are enabling labs to securely store, share, and analyze data, enhancing operational efficiency. Also, the growing adoption of personalized medicine, the rising prevalence of chronic diseases, and the need for regulatory compliance are contributing to the expansion of the LIS market. The COVID-19 pandemic also highlighted the importance of efficient lab systems in managing testing and diagnostics, further accelerating demand. Challenges include high implementation costs and a lack of skilled professionals to manage complex LIS systems, but with increasing government support and technological advancements, the market is expected to continue its upward trajectory across regions such as North America, Europe, and emerging economies in the Asia Pacific.

Laboratory Information Systems (LIS) Market Size

The global laboratory information systems (LIS) market size was valued at USD 1.58 billion in 2024 and is projected to reach USD 3.19 billion by 2032, with a CAGR of 9.15 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Global Laboratory Information Systems (LIS) Market Trends

“Rise in Focus on cloud-based solutions”

One prominent trend in the Global Laboratory Information Systems (LIS) market is the growing adoption of cloud-based solutions. As healthcare organizations seek to enhance operational efficiency and reduce costs, many are transitioning from traditional on-premises systems to cloud-based LIS. This shift allows for greater flexibility, scalability, and accessibility, enabling laboratories to manage their data and workflows more effectively. Cloud-based LIS solutions facilitate real-time data sharing and collaboration among healthcare providers, improving the overall quality of patient care. In addition, these systems often require lower upfront investment and maintenance costs, making them an attractive option for laboratories of all sizes.

Moreover, the increasing focus on interoperability and integration with other healthcare systems is driving the demand for cloud-based LIS. As healthcare providers move towards value-based care models, the need for seamless data exchange between laboratories, electronic health records (EHRs), and other health information systems has become paramount. Cloud-based LIS can easily integrate with existing healthcare IT infrastructures, allowing for comprehensive data analytics and reporting. This trend is further supported by regulatory initiatives aimed at promoting interoperability, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act in the United States. As laboratories continue to prioritize efficiency, data security, and enhanced patient outcomes, the shift towards cloud-based LIS is expected to accelerate, shaping the future landscape of laboratory information management.

Report Scope and Laboratory Information Systems (LIS) Market Segmentation

|

Attributes |

Laboratory Information Systems (LIS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Thermofisher Scientific Inc. (U.S.), Roper Technologies Inc. (U.S.), PerkinElmer Inc. (U.S.), Illumina Inc. (U.S.), Agilent Technologies Inc. (U.S.), Agaram Technologies Pvt. Ltd. (India), Autoscribe Informatics (England), Benchling (U.S.), CompuGroup Medical (Germany), CliniSys (U.K.), Epic Systems Corporation (U.S.), Infors AG (Switzerland), KritiLIMS.in (India), Labsols (U.K.), LabVantage Solutions Inc. (U.S.), LQMS (Dubai), MCKESSON CORPORATION (U.S.), Novatek International (Canada), Shimadzu Corporation (Japan), Siemens AG (Germany), and Starlims Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Laboratory Information Systems (LIS) Market Definition

A laboratory information management system (LIMS) software helps in the effective management of samples and data associated with it. With the help of LIMS, a lab can integrate instruments, manage samples, and automate the workflows. LIMS software is also being used in modern genomics. The unprecedented amount of data that is generated from modern genomics is easily managed with the help of the LIMS software. Owing to the increased efforts of clinicians and researchers for the betterment of lab operations and the increasing number of samples in the labs, the demand for LIMS software is increasing, which is further contributing to the growth of the market to an extent.

Laboratory Information Systems (LIS) Market Dynamics

Drivers

- Increase in the Requirement of Quick-Decision Making Process in Biotechnology

The implementations and success of LIMS in the manufacturing industries are deeply influenced by quality, security, and compliance requirements. Moreover, recently there has been an increasing focus on target-based drug development activities by biotechnology and pharmaceutical companies in various developing regions such as Japan, U.S & other countries. Today’s laboratories generate vast amounts of valuable data. Tracking samples and associated test data through the laboratory, and using that data to generate certificates of analysis, management reports and other information-based insights has become important factor in managing and optimizing the laboratory and the business. Therefore, LIMS are opted to manage the laboratory workflow, organize the data efficiently and support the business of the laboratory.

For instances,

In December 2021, according to the article published in Autoscribe Informatics, The Garvan Institute of Medical Research in Australia utilizes Matrix Gemini LIMS to efficiently manage samples for genomics and stem cell research, enabling rapid analysis and decision-making. This capability allows researchers to adapt quickly to new findings and regulatory demands, highlighting the growing need for quick decision-making processes in biotechnology as a key driver for the LIMS market

In June 2021, according to the article published on LiMSforum, Matrix Mortuary Manager has transformed the management of deceased individuals by replacing manual, paper-centric processes with an intuitive electronic system. Its integration with CaroMont Health Medical Center’s EPIC Electronic Medical Records (EMR) allows for seamless transfer of patient records, reducing transcription errors and enabling quick decision-making. This increasing requirement for efficiency and accuracy in biotechnology acts as a significant driver for the LIMS market.

- Rising Demand for Advanced Computational Tools in Research Laboratory

Nowadays, biological research has become data-intensive as it involves the collection and analysis of data from millions of different species. Also, as algorithms for analyzing biological data have become more sophisticated, so the capabilities of electronic computers have also advanced. To manage these large amounts of data, and to derive insight into biological phenomena, scientists and researchers started using a variety of computational tools.

Computational tools can be of different type such like databases and data management tools which is used to integrate large amounts of heterogeneous biological data, presentation tools algorithms which is used to extract meaning and useful information from large amounts of data.

All these computational tools provides a common data model for abstracting retrieved data and presenting integrated data objects to the end-user applications. They also assist the researchers in managing query optimization and other complex issues developed in experiments. And biological databases are always changing, so integration of tools has also become a necessarily ongoing task. Not only new data are being integrated within the existing database structure but there also requires a structural changes in the database framework, thus, biological paradigms must be redesigned from time to time to keep up with the advance computational tools. So, for characterization of genes, determining structural and physiochemical properties of proteins, phylogenetic analyses, and performing simulations of biomolecules, the use of computational tools are never ending in research for which there is a huge demand in medical field and thereby driving the growth of laboratory information management system market significantly.

For instance,

In August 2024, according to the article published on 50Cell,The shift towards computational data-centric research techniques in life sciences illustrates the rising demand for advanced computational tools in research laboratories. As computational researchers gain independence and leadership roles in biomedical projects, they leverage the growing availability of public data for analysis. This trend highlights the necessity for robust data management solutions, positioning LIMS as a key driver for the market

In December 2023, according to the article published on ThermoFisher Scientific, CSIRO's selection of Thermo Fisher Scientific for an enterprise LIMS solution exemplifies the rising demand for advanced computational tools in research laboratories. This centralized system aims to standardize intake, analysis, and reporting across CSIRO's labs, enhancing operational efficiency and data accuracy. This increasing need for sophisticated data management underscores the growing importance of LIMS, acting as a key driver for the market

Opportunities

- Increasing Strategic Decisions

Various organizations are stepping forward for partnership and collaboration to develop a platform and knowledge base tools in bioinformatics that can be used to improve and automate genome interpretation by researchers. Not only this, with the help of partnerships and agreement both the companies can develop a new suite of technologies and platforms that will help the researcher and scientists in the future to make diagnoses simpler and easy based on a patient’s genome which will lead to better health outcomes. Also, the collaborations facilitates better understanding of complex diseases such as cancer through genome mapping and will benefit both the companies to continue to improve its biomedical services to its clients. With the help of a long term agreement, the both companies can utilize a specialized bioinformatics solutions and resources, providing the researchers a platform which will help to offer data processing to their primary client in base-large pharmaceutical labs, biotechnology companies and academic research centers. Such partnership and mutual agreement not only benefits both the companies, but are also creating a lots of opportunity for the market to grow.

For instance,

In November 2020, PerkinElmer, Inc. had announced the acquisition of Horizon Discovery Group plc and completed the acquisition in the first quarter. This had helped the company to diversify the product portfolio with the inclusion of gene editing and gene modulation tools in the applied genomics solution

In May 2020, Autoscribe Informatics had announced the release of a new and improved Matrix Gemini Pharmaceutical/Manufacturing LIMS to meet the changing needs of the pharmaceutical as well as manufacturing and regulated industries. This had helped the company to reduce cost & risk and decrease the time required for batch release

- Advancements in R&D Labs Specially in Pharmaceutical Sector

Informatics field generates a massive amount of data and researcher and scientists understands that some scientific and medical breakthrough might be hidden within this big data, so it has become essential for them to use advance computational tools for increasing research efficiency. Also from past few years, government has been committed to support the ever-growing demands, challenges and advances in modern biology and life science field. With the proper support by government entities, different organization are playing a pivotal role in big data analysis, software development, high performance computing for public health and medical research in laboratory.

Moreover, there have been advancements of research and development (R&D) in various sectors, especially in pharmaceutical owing to the increasing number of clinical trials in the laboratory. For instance, as per the congressional budget office (CBO) report, the pharmaceutical industry devoted USD 83 billion to R&D expenditures in 2019. Those expenditures covered a variety of activities, including discovering and testing new drugs, developing incremental innovations such as product extensions, and clinical testing for safety-monitoring or marketing purpose. In particular, spending on drug R&D increased by nearly 50 percent between 2015 and 2019. Moreover, from 2015 to 2019, the FDA had approved about twice as many new drugs as it did a decade earlier.

For instance,

In May 2024, according to the article published by Deloitte, Research and development returns in the global pharmaceutical industry are on the rise, with recent figures showing improvement over previous years, according to Deloitte's analysis of major pharmaceutical companies. This recovery underscores the need for efficient data management and analysis in R&D labs. As a result, this trend presents a valuable opportunity for growth in the LIMS market

In June 2021, according to the article published on Science Direct, The evolution of medicines from crude herbal preparations to sophisticated drug products reflects significant advancements in R&D labs, particularly in the pharmaceutical sector. This progression necessitates enhanced data management and analysis capabilities, driving the demand for LIMS solutions. As pharmaceutical manufacturing practices scale and become more complex, this trend presents a valuable opportunity for the LIMS market to expand

Restraints/Challenges

- Lack of Skilled & Trained Professionals to Use the Computational Tools

Progress in technology and algorithms has transformed the field of informatics in a certain way. Currently, the informatics field is undergoing an enormous expansion and with advent of technologies, it has become essential to understand and learn the computational tools. One current problem is a lack of trained personnel in this interdisciplinary field, which bridges biology, medicine, mathematics, statistics and computer science. To date, it is seen that there is a lack of resources and training in the bioinformatics field, which is creating a barrier in the growth of the field. Also most practitioners and researchers are self-taught, having migrated either from biology into computing or from the mathematical sciences into biology, with the interest of the explosion in data and the intrinsic value and importance of the data. To able to use the advanced computational tools, it is mandatory for the users to have the core skills experience in the field. Also, establishing adequate training programs in informatics, from undergraduate level upwards, is essential.

For instance,

In March 2021, according to the article published by TechRepublic, Despite an average increase of £1.48 million in digital investments by UK businesses in 2020 to adapt to pandemic demands, many employees remain untrained in using new computational tools effectively. This gap in skills and training hinders the full utilization of laboratory information management systems, posing a significant challenge for the LIMS market's growth and implementation

In January 2019, according to the article published EdTech Digest, The majority of today’s workforce lacked access to computer science education during their formative years, leading to a significant skills gap in using advanced computational tools. This deficiency limits the effective implementation of laboratory information management systems, as untrained professionals struggle to maximize their potential. Consequently, this skills gap presents a considerable challenge for the LIMS market

- Regulatory Hurdles and Need for Proper Training For Self-Injection Devices

Laboratory information management system (LIMS) are characterized by voluminous and incremental datasets and complex data analytics methods. The machine learning methods used in bioinformatics are iterative and complex as they are scaled to handle big data using the distributed and parallel computing technologies. Usually big data tools are used to perform computation in batch-mode and are not optimized for iterative processing and high data dependency among operations. Moreover, there is a lack standard big data architectures and tools for many important bioinformatics problems, such as module identification, detection of complexes over growing protein-protein interaction data, fast analysis of massive DNA, RNA, and protein sequencing. Over time, informatics and health related data are created and accumulated continuously, resulting in an incredible volume of data, thereby rising data complexity and errors. Numerous clustering methods have been proposed from past few decades but there is always a lack of user friendly tools. The volume, variety, and incremental nature are imposing a challenges on the data analytics. Although various computational tools have been developed over the years to handle the informatics problems. But the tools developed are mostly standalone and not designed for very large scale data. However, apart from certain sequence analysis tools, the other existing tools are not adequate for handling big data or not suitable for cloud computing infrastructure. And the existing big data architectures do not provide a comprehensive solution to researcher, which is further creating a major challenge for the market to grow.

For instance,

In March 2021, according to an article published by ScienceDirect, laboratory Information Management Systems (LIMS) are commonly utilized to streamline laboratory operations. However, existing LIMS often lack features specifically designed to enhance the safety of laboratory work, which is a critical concern for biosafety laboratories (BSLs). This gap emphasizes the data complexity and the absence of user-friendly tools, presenting a challenge for the global LIMS market as BSLs seek systems that prioritize safety alongside operational efficiency.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Laboratory Information Systems (LIS) Market Scope

The market is segmented on the basis of component, product, delivery, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Service

- Software

- Sample Management Software

- Reporting Software

- Workflow Management Software

- EMR/EHR Software

- Others Software

Product

- Integrated LIS

- Standalone LIS

Delivery

- Cloud-based

- Remotely-hosted

- On-premise

End User

- Hospital laboratories

- Independent laboratories

- Physician office laboratories

- Others

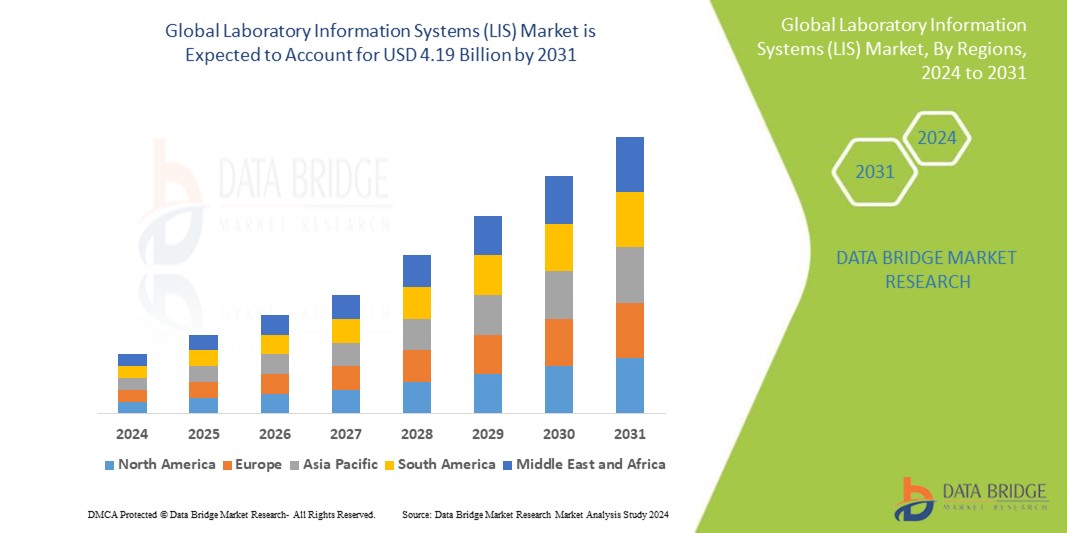

Laboratory Information Systems (LIS) Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, component, product, delivery, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the market due to its well-established healthcare infrastructure and high adoption rate of advanced technologies, including cloud-based solutions and automation. Supportive government initiatives and significant investments in healthcare IT drive innovation and enhance the efficiency of laboratory operations in the region.

Asia-Pacific is expected to be the fastest growing due to rapid advancements in healthcare infrastructure and an increasing focus on adopting digital health solutions. Also, the rising prevalence of chronic diseases and the need for efficient laboratory management systems further fuel the demand for LIS in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Laboratory Information Systems (LIS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Laboratory Information Systems (LIS) Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina Inc. (U.S.)

- PerkinElmer (U.S.)

- Roper Technologies (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Compugroup Medical (Germany)

- Agaram Technologies (India)

- Autoscribe (U.K.)

- Benchling (U.S.)

- Eusoft Ltd (Portugal)

- Infor AG (U.S.)

- Kriti LIMS (India)

- Labvantage Solutions Inc. (U.S.)

- Labware (U.S.)

- McKesson Corporation (U.S.)

- Orchard Software Corporation (U.S.)

- Labsols (India)

- Novatek International (Canada)

- Lqms Software Solutions (U.S.)

- Starlims Corporation (A Subsidiary Of Abbott) (U.S.)

Latest Developments in Laboratory Information Systems (LIS) Market

- In September 2024, The Company announced the completion of its acquisition of BIOVECTRA, enhancing its contract development and manufacturing capabilities. This move expanded Agilent's CDMO services and supported gene editing, reflecting its commitment to advancing therapeutics programs with best-in-class manufacturing

- In July 2021, STARLIMS Corporation had signed a definitive agreement with Francisco Partners for the STARLIMS informatics product suite and related business assets from Abbott. This partnership will further help the company to get well positioned for continued growth in the competitive market

- In April 2023, Microsoft and Epic has expanded their partnership to integrate generative AI into healthcare, leveraging Azure OpenAI Service with Epic's EHR software. This collaboration aims to boost productivity, enhance patient care, and improve the financial integrity of health systems worldwide

- In October 2024, Xybion has launched LIMS 10.0, a modern, AI-enabled solution enhancing lab efficiency across industries. Featuring an intuitive interface, integrated QMS, and robust functionalities like inventory management and audit trails, it transforms laboratory operations and accelerates compliance and throughput globally

- In On September 2024, LabVantage Solutions partnered with Henkel to create an integrated R&D platform, connecting LabVantage LIMS and SAP PLM. This collaboration aimed to streamline processes, enhance data sharing, and drive digital transformation in Henkel’s consumer brands division

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.