Latam Rfid Tags Market

Market Size in USD Billion

CAGR :

%

USD

1.31 Billion

USD

2.77 Billion

2024

2032

USD

1.31 Billion

USD

2.77 Billion

2024

2032

| 2025 –2032 | |

| USD 1.31 Billion | |

| USD 2.77 Billion | |

|

|

|

|

RFID Tags Market Size

- The LATAM RFID tags market was valued at USD 1.31 billion in 2024 and is expected to reach USD 2.77 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.9%, primarily driven by the increasing demand for supply chain transparency and

- This growth is driven by factors such as inventory management across retail and logistics sectors

RFID Tags Market Analysis

- RFID (Radio Frequency Identification) tags are essential components in modern tracking and data capture systems, enabling automatic identification and real-time data transmission across a variety of industries

- RFID tags are widely used in applications such as supply chain management, inventory tracking, asset management, and contactless payment systems

- The demand for RFID tags in LATAM is significantly driven by the rising need for supply chain transparency, operational efficiency, and regulatory compliance across industries such as retail, logistics, healthcare, and agriculture

- Brazil and Mexico emerge as the dominant markets within LATAM, supported by rapid digital transformation, expanding retail networks, and government initiatives promoting smart infrastructure

- For instance, major retail chains and logistics companies in Brazil have adopted RFID to streamline inventory management, reduce shrinkage, and improve last-mile delivery accuracy. Mexico’s customs and border control systems are also increasingly utilizing RFID for cargo tracking and security monitoring

- In LATAM, RFID tags market is experiencing robust growth, fueled by increasing adoption across industries such as retail, logistics, agriculture, healthcare, and manufacturing

Report Scope and RFID Tags Market Segmentation

|

Attributes |

RFID Tags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

LATAM

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

RFID Tags Market Trends

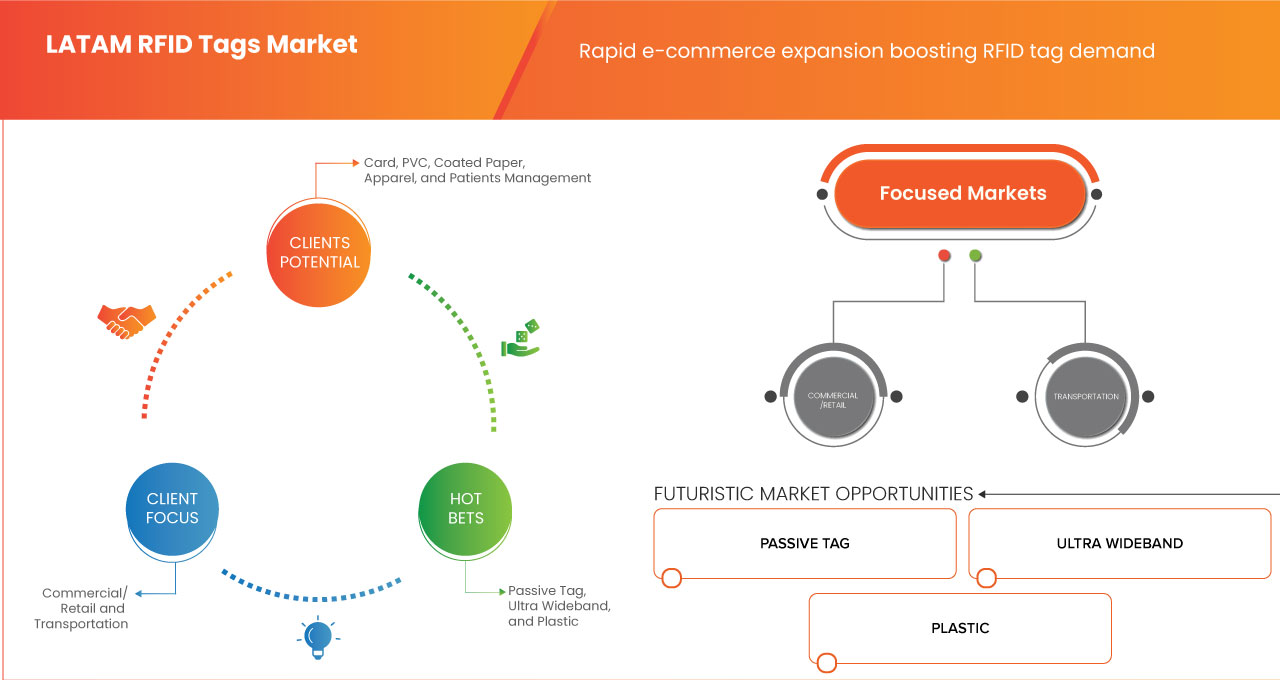

“Rapid E-Commerce Expansion Boosting RFID Tag Demand”

- One prominent trend in the LATAM RFID tags market is the rapid e-commerce expansion boosting RFID tag demand

- This technology enables real-time inventory tracking, automates warehouse operations, and streamlines last-mile delivery

- For instance, in September 2024, a study by Reuters outlined Brazil's Pix payment system was set to overtake credit cards in e-commerce by 2025, growing faster than expected. Launched in 2020, Pix became widely used for instant, free transactions, driving financial inclusion and increasing merchant adoption

- The increasing reliance on digital payments and efficient logistics solutions is accelerating RFID adoption across industries. RFID technology is revolutionizing e-commerce by improving inventory management, optimizing order processing, and ensuring faster deliveries

- Its integration in warehouses and logistics hubs minimizes errors, enhances tracking accuracy, and boosts operational efficiency

RFID Tags Market Dynamics

Driver

“Increasing RFID Tag Adoption in Logistics and Warehouse Operations”

- The growing demand for efficient supply chain management, real-time inventory tracking, and seamless logistics operations is driving the adoption of RFID technology in warehouses and distribution centers

- RFID provides significant advantages over traditional barcode systems by enabling automated, high-speed scanning of multiple items simultaneously, reducing manual labor, and minimizing human errors

- Logistics providers and warehouse operators are leveraging RFID for accurate stock monitoring, automated order fulfillment, and improved asset tracking

- In addition, RFID enhances security by preventing theft and unauthorized access to inventory

For instance,

- In March 2023, Maersk expanded its footprint in Latin America by opening new warehouses in Chile and Peru, strengthening its supply chain operations. The company invested in sustainable solutions, including lithium battery-powered equipment and optimized buildings. These facilities enhanced inventory management, order fulfillment, and distribution efficiency. The growth of warehouse infrastructure increased the demand for RFID in logistics, boosting the market by improving supply chain visibility and automation

- In February 2025, article by Maersk highlighted that a market on tackling supply chain disruptions in Latin America. The company focused on supplier diversification, visibility, and contingency planning to improve logistics. Maersk emphasized RFID technology for real-time tracking, enhancing efficiency and reducing delays. As businesses adopt RFID for better supply chain management, demand for RFID tags continues to rise

- RFID technology is rapidly transforming supply chain, logistics, and warehouse operations in Latin America by enabling automation, real-time tracking, and improved efficiency. Companies such as Maersk are leveraging RFID for enhanced visibility, while retailers and manufacturers use it for inventory accuracy and security

Opportunity

“Government Investments in Smart City Projects Accelerate the Adoption of RFID Solutions”

- Growing government investments in smart city projects across Latin America are accelerating the adoption of RFID solutions, creating a significant opportunity for the RFID tags market

- As cities implement RFID-based systems for transportation management, automated tolling, and public transit tracking, demand for RFID tags is expected to rise

- This trend opens avenues for RFID solution providers to expand their footprint in LATAM, offering innovative applications for urban mobility, parking management, and infrastructure optimization

- With smart city initiatives driving digital transformation, the need for RFID-enabled efficiency and real-time data insights will continue to grow, fueling market expansion

For instance,

- In June 2023, as per RFID Journal, Brazil is expanding its RFID-based electronic toll payment system, offering discounts of up to 70% to encourage adoption. This initiative, backed by government policies, aims to enhance traffic flow and promote contactless payments across various services. Aligned with broader smart city projects, the investment in RFID tolling is accelerating the adoption of RFID technology in transportation

- In January 2023, Avery Dennison Corporation reported that it is investing USD 100 million in a new RFID manufacturing facility in Querétaro, Mexico, set to be operational by Q1 2024. As the company’s largest RFID plant globally, it will create over 600 technology jobs and enhance the supply chain in the Americas

- The growing government investments in smart city initiatives across Latin America present a significant opportunity for the expansion of the RFID tags market. As cities adopt digital solutions to enhance efficiency, security, and public services, RFID technology will play a crucial role in enabling seamless urban management

Restraint/Challenge

“Technical Complexities in Integration of RFID in Various Devices”

- The integration of RFID technology into various retail and logistics devices in the LATAM market presents significant technical challenges

- Ensuring seamless compatibility between RFID tags, readers, and existing enterprise systems requires advanced infrastructure and expertise, which many businesses in the region may lack

- Factors such as interference from metal surfaces, signal disruptions, and the need for customized software solutions further complicate deployment

For instance,

- In March 2025, as per Indiaretailing.com, fashion retailers are struggling to scale RFID technology due to high costs, inconsistent tag quality, signal interference, and integration challenges with legacy systems. These technical complexities pose a significant challenge for the LATAM RFID tags market, as retailers in the region may face similar issues in integrating RFID across various devices

- The technical complexities involved in integrating RFID technology across various devices pose a significant challenge to its widespread adoption in the LATAM market

RFID Tags Market Scope

The market is segmented on the basis wafer size, tag type, type, frequency, form factor, material, and application.

|

Segmentation |

Sub-Segmentation |

|

By Wafer Size |

|

|

By Tag Type |

|

|

By Type |

|

|

By Frequency

|

|

|

By Form Factor |

|

|

By Material

|

|

|

By Application |

|

RFID Tags Market Regional Analysis

“Brazil is the Dominant and the Fastest Growing Country in the LATAM RFID Tags Market”

- Brazil leads the LATAM RFID tags market, driven by its large-scale industrialization, strong logistics and retail sectors, and increasing adoption of RFID technology across supply chains

- The country’s market size is the highest in 2024 and is projected to nearly double by 2032, with a CAGR of 10.4%, outpacing Mexico, Argentina, Colombia, and Chile

- While Mexico follows closely, Brazil’s dominance is fueled by government initiatives, advanced manufacturing adoption, and growing demand in transportation and asset tracking applications

- Other LATAM countries show steady growth, but their RFID adoption remains relatively lower due to smaller industrial bases and slower digital transformation

RFID Tags Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Fujitsu (Japan)

- Zebra Technologies Corp. (U.S.)

- Checkpoint Systems, Inc (A Division of CCL Industries Inc.) (U.S.)

- STMicroelectronics (Switzerland)

- AVERY DENNISON CORPORATION (U.S.)

- NXP Semiconductors (Netherlands)

- Pepperl+Fuchs SE (Germany)

- dormakaba Group (Switzerland)

- CPCON GROUP (Brazil)

- HID Global Corporation (Part of ASSA ABLOY) (U.S.)

- Impinj, Inc. (U.S.)

- Viaonda RFID (Brazil)

- Identiv, Inc. (U.S.)

- Alien Technology, LLC (U.S.)

- Convergence Systems Limited (Hong Kong)

- ARDES (France)

Latest Developments in LATAM RFID Tags Market

- In January 2023, as per CDW LLC, retail leaders highlighted how RFID technology transformed inventory management, loss prevention, and supply chain visibility. Companies like fast retailing and LVMH used RFID to track products, prevent theft, and enhance customer experiences. Lowe’s implemented RFID-enabled security for power tools, while frictionless checkout solutions improved shopping convenience. The technology increased real-time inventory accuracy to 98%, boosting operational efficiency. In logistics, RFID’s ability to automate tracking and streamline supply chain processes drove its market growth, reinforcing its role in digital transformation across industries

- In October 2024, Impinj opened its first RAIN RFID and IoT research and development office in Porto Alegre, Brazil, within PUCRS’s Tecnopuc. This expansion aimed to strengthen Impinj’s presence in the region by growing its engineering team and supporting its decade-long commitment to Brazil’s market. The new office contributed to the development of Brazil’s RFID market by fostering innovation, enhancing local expertise, and encouraging wider adoption of RAIN RFID technology in logistics, retail, and supply chain sectors

- In November 2022, as per Universal Postal Union, Correios Brazil implemented RFID tags on postal cargo containers with support from UPU and GS1 to improve tracking efficiency. Around 2,000 RFID readers were installed at sorting hubs to automate parcel monitoring. The system reduced manual barcode scanning and enhanced tracking accuracy. This initiative strengthened the RFID market in Brazil by increasing demand for RFID solutions in logistics and postal services, setting a new standard for postal tracking efficiency

- In August 2021, Correios Brazil launched an RFID-based tracking system with support from the Universal Postal Union and GS1. The project introduced RFID tags on packages and cargo containers to improve tracking efficiency. Readers were installed at major postal hubs to automate inventory updates and reduce errors. This innovation accelerated e-commerce by ensuring faster, more reliable deliveries. The adoption of RFID strengthened Brazil’s logistics sector and promoted the technology’s broader use in postal services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF LATAM RFID TAGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 WAFER SIZE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PENETRATION AND GROWTH PROSPECT MAPPING

4.2 COMPETITOR KEY PRICING STRATEGIES

4.3 TECHNOLOGY ANALYSIS OF THE LATAM RFID TAGS MARKET

4.4 COMPANY COMPETITIVE ANALYSIS

4.5 COMPANY SERVICE PLATFORM MATRIX FOR LATAM RFID TAGS MARKET

4.6 FUNDING DETAILS—INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR

4.7 USE CASE AND ITS ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING RFID TAG ADOPTION IN LOGISTICS AND WAREHOUSE OPERATIONS

5.1.2 GROWING RFID USAGE IN TEXTILE AND APPAREL SUPPLY CHAINS

5.1.3 RAPID E-COMMERCE EXPANSION BOOSTING RFID TAG DEMAND

5.1.4 INCREASING RFID USE IN AGRICULTURE AND LIVESTOCK MANAGEMENT

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION COSTS OF RFID SYSTEM

5.2.2 LACK OF STANDARDIZED REGULATIONS COMPLICATES CROSS-BORDER IMPLEMENTATION

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INVESTMENTS IN SMART CITY PROJECTS ACCELERATE THE ADOPTION OF RFID SOLUTIONS

5.3.2 TRANSFORMATION OF SUPPLY CHAIN OPERATIONS THROUGH RFID ENABLED INVENTORY MANAGEMENT

5.3.3 PROLIFERATION OF RFID TAGS IN RETAIL SECTOR FOR EQUIPMENT TRACKING

5.4 CHALLENGES

5.4.1 TECHNICAL COMPLEXITIES IN INTEGRATION OF RFID IN VARIOUS DEVICES

5.4.2 WEAK IT AND WIRELESS CONNECTIVITY INFRASTRUCTURE IN RURAL AREAS

6 LATAM RFID TAGS MARKET, BY WAFER SIZE

6.1 OVERVIEW

6.2 LESS THAN 200 MM

6.3 200 TO 300 MM

6.4 OTHERS

7 LATAM RFID TAGS MARKET, BY TAG TYPE

7.1 OVERVIEW

7.2 PASSIVE TAG

7.3 ACTIVE TAG

8 LATAM RFID TAGS MARKET, BY TYPE

8.1 OVERVIEW

8.2 NORMAL TAG

8.3 SMART TAG

9 LATAM RFID TAGS MARKET, BY FREQUENCY

9.1 OVERVIEW

9.2 ULTRA WIDEBAND

9.3 BLUETOOTH

10 LATAM RFID TAGS MARKET, BY FORM FACTOR

10.1 OVERVIEW

10.2 CARD

10.3 LABEL

10.4 KEY FOB

10.5 IMPLANTS

10.6 BUTTON

10.7 PAPER TICKETS

10.8 WRISTBAND

10.9 OTHERS

10.9.1 THE WRAP

10.9.2 SCREW

10.9.3 BOLTABLE

10.9.4 SHACKLE

10.9.5 CLINCH

10.9.6 SLING

10.9.7 EMBEDDABLE

10.9.8 EYELET

10.9.9 PUSH

11 LATAM RFID TAGS MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.2.1 PVC

11.2.2 PET

11.2.3 ABS

11.2.4 OTHER

11.3 METAL

11.3.1 ALUMINUM

11.3.2 STAINLESS STEEL

11.3.3 STEEL

11.3.4 TITANIUM

11.3.5 OTHER

11.4 PAPER

11.4.1 COATED PAPER

11.4.2 ECO FRIENDLY PAPER

11.4.3 OTHER

11.5 GLASS

11.5.1 BOROSILICATE GLASS

11.5.2 PYREX GLASS

11.5.3 MICRO GLASS ENCAPSULATION

11.5.4 OTHER

11.6 OTHERS

11.6.1 SILICON

11.6.2 CERAMIC

11.6.3 RUBBER

12 LATAM RFID TAGS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 COMMERCIAL/RETAIL

12.2.1 APPAREL

12.2.2 KIOSK

12.2.3 LAUNDRY

12.2.4 JEWELRY TRACKING

12.2.5 INDUSTRIAL MATERIAL MANAGEMENT

12.2.6 IT ASSET TRACKING

12.2.7 ADVERTISING

12.2.8 OTHERS

12.3 TRANSPORTATION, LOGISTICS & SUPPLY CHAIN

12.4 HEALTHCARE

12.4.1 PATIENTS MANAGEMENT

12.4.2 WASTE MANAGEMENT

12.4.3 DRUGS MANAGEMENT

12.4.4 LABORATORY MANAGEMENT

12.4.5 EQUIPMENT MANAGEMENT

12.4.6 OTHERS

12.5 SECURITY & ACCESS CONTROL

12.5.1 ACCESS CONTROL

12.5.2 COUNTERFEITING & THEFT CONTROL/PREVENTION

12.5.3 VEHICULAR TAGS

12.5.4 PASSPORT

12.5.5 OTHER RETAIL

12.6 PAYMENT AND TICKET SYSTEM

12.6.1 CONTACTLESS PAYMENTS

12.6.2 PUBLIC TRANSPORT

12.6.3 EVENT TICKETING

12.6.4 PARKING MANAGEMENT

12.6.5 OTHER

12.7 ANIMAL TRACKING

12.8 AEROSPACE

12.8.1 BAGGAGE TRACKING

12.8.2 MATERIALS MANAGEMENT

12.8.3 FLYABLE PARTS TRACKING

12.8.4 LIFETIME TRACEABILITY

12.8.5 MRO

12.8.6 OTHERS

12.9 DEFENSE

12.9.1 BORDER SECURITY

12.9.2 WEAPON MANAGEMENT TRACKING

12.9.3 SOLDIER MOVEMENT TRACKING

12.1 SPORTS

12.11 OTHERS

13 LATAM RFID TAGS MARKET

13.1 LATAM

13.1.1 BRAZIL

13.1.2 MEXICO

13.1.3 ARGENTINA

13.1.4 COLOMBIA

13.1.5 CHILE

13.1.6 PERU

13.1.7 ECUADOR

13.1.8 CUBA

13.1.9 URUGUAY

13.1.10 PARAGUAY

13.1.11 BOLIVIA

13.1.12 REST OF LATAM

14 LATAM RFID TAGS MARKET

14.1 COMPANY SHARE ANALYSIS: LATAM

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 FUJITSU

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 ZEBRA TECHNOLOGIES CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 CHECKPOINT SYSTEMS, INC(A DIVISION OF CCL INDUSTRIES INC.)

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 STMICROELECTRONICS

16.4.1 COMPANY SNAPSHOT

16.4.1 REVENUE ANALYSIS

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 AVERY DENNISON CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS/NEWS

16.6 ALIEN TECHNOLOGY, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ARDES

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 CONVERGENCE SYSTEMS LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CPCON GROUP

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DORMAKABA GROUP

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 HID GLOBAL CORPORATION (PART OF ASSA ABLOY)

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 IDENTIV, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 IMPINJ, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 NXP SEMICONDUCTORS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 PEPPERL+FUCHS SE

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 VIAONDA RFID

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 TECHNOLOGY MATRIX

TABLE 2 COMPANY COMPETITIVE ANALYSIS

TABLE 3 COMPANY SERVICE PLATFORM MATRIX

TABLE 4 USED CASE ANALYSIS

TABLE 5 PRICING OF DIFFERENT RFID TAGS

TABLE 6 LATAM RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 7 LATAM RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 LATAM RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 LATAM RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 10 LATAM RFID TAGS MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 11 LATAM OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 LATAM RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND))

TABLE 13 LATAM PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 LATAM METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 LATAM PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 LATAM GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 LATAM OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 LATAM RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 LATAM COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 LATAM HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 LATAM SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 LATAM PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 LATAM AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 LATAM DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 LATAM RFID TAGS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 26 BRAZIL RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 27 BRAZIL RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 BRAZIL RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 BRAZIL RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 30 BRAZIL RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 31 BRAZIL OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 BRAZIL RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 33 BRAZIL PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 BRAZIL METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 BRAZIL PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 BRAZIL GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 BRAZIL OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 BRAZIL RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 BRAZIL COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 BRAZIL HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 BRAZIL SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 BRAZIL PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 BRAZIL AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 BRAZIL DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MEXICO RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 46 MEXICO RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MEXICO RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MEXICO RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 49 MEXICO RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 50 MEXICO OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MEXICO RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 52 MEXICO PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MEXICO METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MEXICO PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MEXICO GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MEXICO OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MEXICO RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 MEXICO COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MEXICO HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MEXICO SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MEXICO DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ARGENTINA RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 65 ARGENTINA RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ARGENTINA RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 ARGENTINA RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 68 ARGENTINA RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 69 ARGENTINA OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 ARGENTINA RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 71 ARGENTINA PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 ARGENTINA METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 ARGENTINA PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 ARGENTINA GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 ARGENTINA OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 ARGENTINA RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 ARGENTINA COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 ARGENTINA HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 ARGENTINA SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 ARGENTINA PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 ARGENTINA AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 ARGENTINA DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 COLOMBIA RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 84 COLOMBIA RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 COLOMBIA RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 COLOMBIA RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 87 COLOMBIA RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 88 COLOMBIA OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 COLOMBIA RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 90 COLOMBIA PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 COLOMBIA METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 COLOMBIA PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 COLOMBIA GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 COLOMBIA OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 COLOMBIA RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 COLOMBIA COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 COLOMBIA HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 COLOMBIA SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 COLOMBIA PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 COLOMBIA AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 COLOMBIA DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 CHILE RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 103 CHILE RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CHILE RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 CHILE RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 106 CHILE RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 107 CHILE OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 CHILE RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 109 CHILE PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 CHILE METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 CHILE PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 CHILE GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 CHILE OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 CHILE RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 CHILE COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 CHILE HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 CHILE SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 CHILE PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 CHILE AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CHILE DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 PERU RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 122 PERU RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 PERU RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 PERU RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 125 PERU RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 126 PERU OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 PERU RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 128 PERU PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 PERU METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 PERU PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 PERU GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 PERU OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 PERU RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 134 PERU COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 PERU HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 PERU SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 PERU PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 PERU AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 PERU DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 ECUADOR RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 141 ECUADOR RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 ECUADOR RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 ECUADOR RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 144 ECUADOR RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 145 ECUADOR OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 ECUADOR RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 147 ECUADOR PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 ECUADOR METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 ECUADOR PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 ECUADOR GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 ECUADOR OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 ECUADOR RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 ECUADOR COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 ECUADOR HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 ECUADOR SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 ECUADOR PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 ECUADOR AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 ECUADOR DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 CUBA RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 160 CUBA RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 CUBA RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 CUBA RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 163 CUBA RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 164 CUBA OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 CUBA RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 166 CUBA PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 CUBA METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CUBA PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 CUBA GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 CUBA OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 CUBA RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 172 CUBA COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 CUBA HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CUBA SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CUBA PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CUBA AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CUBA DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 URUGUAY RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 179 URUGUAY RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 URUGUAY RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 URUGUAY RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 182 URUGUAY RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 183 URUGUAY OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 URUGUAY RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 185 URUGUAY PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 URUGUAY METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 URUGUAY PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 URUGUAY GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 URUGUAY OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 URUGUAY RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 191 URUGUAY COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 URUGUAY HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 URUGUAY SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 URUGUAY PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 URUGUAY AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 URUGUAY DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 PARAGUAY RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 198 PARAGUAY RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 PARAGUAY RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 PARAGUAY RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 201 PARAGUAY RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 202 PARAGUAY OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 PARAGUAY RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 204 PARAGUAY PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 PARAGUAY METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 PARAGUAY PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 PARAGUAY GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 PARAGUAY OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 PARAGUAY RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 PARAGUAY COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 PARAGUAY HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 PARAGUAY SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 PARAGUAY PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 PARAGUAY AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 PARAGUAY DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 BOLIVIA RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

TABLE 217 BOLIVIA RFID TAGS MARKET, BY TAG TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 BOLIVIA RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 BOLIVIA RFID TAGS MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 220 BOLIVIA RFID TAG MARKET, BY FORM FACTOR, 2018-2032 (USD THOUSAND)

TABLE 221 BOLIVIA OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 BOLIVIA RFID TAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 223 BOLIVIA PLASTIC IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 BOLIVIA METAL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 BOLIVIA PAPER IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 BOLIVIA GLASS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 BOLIVIA OTHERS IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 BOLIVIA RFID TAGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 229 BOLIVIA COMMERCIAL/RETAIL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 BOLIVIA HEALTHCARE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 BOLIVIA SECURITY & ACCESS CONTROL IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 BOLIVIA PAYMENT AND TICKET SYSTEM IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 BOLIVIA AEROSPACE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 BOLIVIA DEFENSE IN RFID TAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 REST OF LATAM RFID TAGS MARKET, BY WAFER SIZE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 LATAM RFID TAGS MARKET: SEGMENTATION

FIGURE 2 LATAM RFID TAGS MARKET: DATA TRIANGULATION

FIGURE 3 LATAM RFID TAGS MARKET: DROC ANALYSIS

FIGURE 4 LATAM RFID TAGS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 LATAM RFID TAGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 LATAM RFID TAGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 LATAM RFID TAGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 LATAM RFID TAGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 LATAM RFID TAGS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 LATAM RFID TAGS MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE LATAM RFID TAGS MARKET, BY WAFER SIZE (2024)

FIGURE 12 LATAM RFID TAGS MARKET: EXECUTIVE SUMMARY

FIGURE 13 INCREASING RFID TAG ADOPTION IN LOGISTICS AND WAREHOUSE OPERATIONS IS EXPECTED TO DRIVE LATAM RFID TAGS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 LESS THAN 200 MM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF LATAM RFID TAGS MARKET IN 2025 & 2032

FIGURE 15 MARKET OVERVIEW

FIGURE 16 LATAM TEXTILE AND CLOTHING EXPORT TO INDIA

FIGURE 17 LATAM TEXTILE AND CLOTHING IMPORTS FROM INDIA

FIGURE 18 LATAM RFID TAGS MARKET: BY WAFER SIZE , 2024

FIGURE 19 LATAM RFID TAGS MARKET: TAG TYPE, 2024

FIGURE 20 LATAM RFID TAGS MARKET: BY TYPE, 2024

FIGURE 21 LATAM RFID TAGS MARKET: BY FREQUENCY, 2024

FIGURE 22 LATAM RFID TAGS MARKET: BY FORM FACTOR, 2024

FIGURE 23 LATAM RFID TAGS MARKET: BY MATERIAL, 2024

FIGURE 24 LATAM RFID TAGS MARKET: BY APPLICATION, 2024

FIGURE 25 LATAM RFID TAGS MARKET: SNAPSHOT, 2024

FIGURE 26 LATAM RFID TAGS MARKET: COMPANY SHARE 2024 (%)

Latam Rfid Tags Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Latam Rfid Tags Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Latam Rfid Tags Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.