Latin America Plant Breeding And Crispr Plants Market

Market Size in USD Billion

CAGR :

%

USD

8.16 Billion

USD

16.86 Billion

2024

2032

USD

8.16 Billion

USD

16.86 Billion

2024

2032

| 2025 –2032 | |

| USD 8.16 Billion | |

| USD 16.86 Billion | |

|

|

|

|

Plant Breeding and CRISPR Plant Market Size

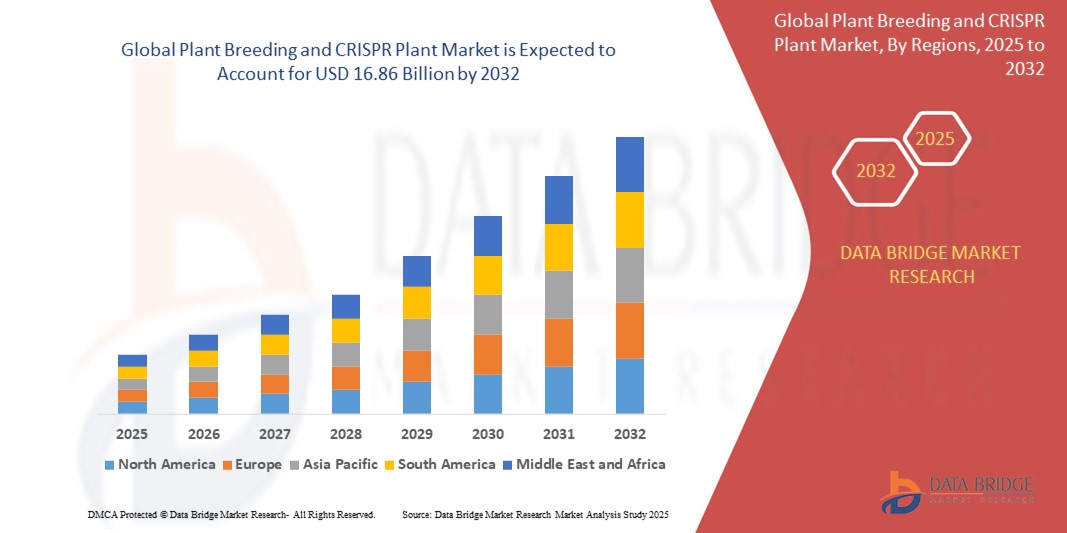

- The Latin America plant breeding and CRISPR plant market size was valued at USD 8.16 billion in 2024 and is expected to reach USD 16.86 billion by 2032, at a CAGR of 9.5% during the forecast period

- The market growth is primarily driven by the increasing adoption of advanced agricultural technologies, growing demand for high-yield and disease-resistant crops, and the rising need for sustainable farming practices to address food security challenges

- The integration of CRISPR technology and biotechnological breeding methods is revolutionizing crop improvement, enabling precise genetic modifications to enhance crop resilience and productivity, thereby accelerating market expansion

Plant Breeding and CRISPR Plant Market Analysis

- Plant breeding and CRISPR technologies are critical components of modern agriculture, enabling the development of crops with enhanced traits such as higher yields, resistance to diseases, and tolerance to environmental stresses. These technologies are vital for improving agricultural productivity in Latin America, a region with significant agricultural output

- The rising demand for plant breeding and CRISPR solutions is fueled by increasing population pressures, climate change challenges, and the need for sustainable farming practices to ensure food security

- Brazil dominated the Latin America plant breeding & CRISPR plant market with the largest revenue share of 39.1% in 2024, driven by its robust agricultural sector, widespread adoption of biotechnological innovations, and strong presence of key industry players

- Argentina is expected to be the fastest-growing country in the Latin America plant breeding & CRISPR plant market during the forecast period, attributed to increasing investments in agricultural research, rising adoption of genetically modified crops, and favorable government policies promoting sustainable agriculture

- The Conventional Breeding segment dominated the largest market revenue share of 55% in 2024, driven by its cost-effectiveness, lack of regulatory scrutiny, and established use in staple crops such as cereals and grains, particularly in Brazil, which dominates the market due to its robust agricultural sector

Report Scope and Plant Breeding and CRISPR Plant Market Segmentation

|

Attributes |

Plant Breeding and CRISPR Plant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Latin America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plant Breeding and CRISPR Plant Market Trends

“Increasing Integration of Advanced Genomic Tools and CRISPR Technologies”

- The Latin America plant breeding and CRISPR plant market is experiencing a significant trend toward the integration of advanced genomic tools, such as CRISPR-Cas9, and high-throughput phenotyping technologies

- These technologies enable precise genetic modifications and rapid analysis of plant traits, providing deeper insights into crop performance, stress tolerance, and yield potential

- CRISPR-based solutions allow for targeted gene editing, enabling the development of crops with enhanced traits such as disease resistance, drought tolerance, and improved nutritional content

- For instance, companies and research institutions in Brazil and Argentina are leveraging CRISPR to develop pest-resistant soybean varieties and climate-resilient maize, optimizing agricultural productivity

- This trend is enhancing the value proposition of plant breeding systems, making them more attractive to farmers and agribusinesses aiming to meet rising food demands

- Genomic tools analyze vast arrays of plant traits, including growth rates, stress responses, and nutrient uptake, enabling breeders to develop superior crop varieties efficiently

Plant Breeding and CRISPR Plant Market Dynamics

Driver

“Rising Demand for High-Yielding and Climate-Resilient Crops”

- The increasing demand for high-yielding, disease-resistant, and climate-resilient crops, driven by population growth and food security concerns, is a major driver for the Latin America plant breeding and CRISPR plant market

- Plant breeding and CRISPR technologies enhance crop productivity by offering traits such as herbicide tolerance, disease resistance, and yield improvement, critical for addressing agricultural challenges

- Government initiatives in countries such as Brazil, which dominates the market, are promoting the adoption of advanced breeding techniques to boost agricultural output and support export-driven economies

- The expansion of biotechnological infrastructure and increasing investments in agricultural R&D, particularly in Argentina—the fastest-growing market—are enabling the development of innovative crop varieties

- Major crops such as cereals, oilseeds, and pulses are benefiting from these advancements, with Brazil leading in soybean and maize production and Argentina excelling in wheat and canola

Restraint/Challenge

“High Costs of Implementation and Regulatory Challenges”

- The substantial initial investment required for adopting advanced biotechnological tools, such as CRISPR and molecular breeding platforms, can be a significant barrier for small-scale farmers and agribusinesses in Latin America

- Developing and deploying genetically edited crops involves costly infrastructure, including laboratory facilities and skilled personnel, which may limit adoption in resource-constrained regions

- Regulatory challenges and varying biosafety frameworks across Latin American countries pose a major hurdle. Stringent regulations on genetically modified organisms (GMOs) and gene-edited crops, particularly in countries outside Brazil and Argentina, raise concerns about compliance and market acceptance

- Public apprehension regarding the safety and environmental impact of CRISPR-edited crops further complicates adoption, especially in regions with strong consumer preference for non-GMO products

- These factors can deter widespread adoption and limit market expansion, particularly in less developed agricultural markets within Latin America

Plant Breeding and CRISPR Plant market Scope

The market is segmented on the basis of type, process, traits, and application.

- By Type

On the basis of type, the Latin America Plant Breeding & CRISPR Plant Market is segmented into Conventional Breeding and Biotechnological Breeding. The Conventional Breeding segment dominated the largest market revenue share of 55% in 2024, driven by its cost-effectiveness, lack of regulatory scrutiny, and established use in staple crops such as cereals and grains, particularly in Brazil, which dominates the market due to its robust agricultural sector.

The Biotechnological Breeding segment is expected to witness the fastest growth rate of 15.8% from 2025 to 2032, propelled by the increasing adoption of advanced techniques such as CRISPR-Cas9 and molecular breeding. This growth is particularly strong in Argentina, the fastest-growing country, due to rising investments in agricultural biotechnology and supportive regulations for gene-edited crops.

- By Process

On the basis of process, the Latin America Plant Breeding & CRISPR Plant Market is segmented into Selection, Hybridization, and Mutation Breeding. The Hybridization segment accounted for the largest market revenue share of 40% in 2024, driven by its ability to produce high-yield, resilient crop varieties, widely used in Brazil for crops such as corn and soybeans. This segment benefits from established breeding programs and farmer preference for hybrid seeds.

The Mutation Breeding segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by its application in creating crops with superior traits such as disease resistance and herbicide tolerance. Argentina’s rapid adoption of advanced breeding technologies, supported by research collaborations, fuels this segment’s growth.

- By Traits

On the basis of traits, the Latin America Plant Breeding & CRISPR Plant Market is segmented into Herbicide Tolerance, Disease Resistance, Yield Improvement, and Others. The Herbicide Tolerance segment held the largest market revenue share of 38% in 2024, driven by increasing regulations on chemical pesticides and the need for efficient weed management in Brazil’s expansive agricultural fields. Technologies such as BASF’s Clearfield herbicide tolerance system are widely adopted.

The Yield Improvement segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for high-yield crops to meet food security needs in Argentina. Advancements in CRISPR technology and marker-assisted selection are accelerating the development of crops with enhanced productivity.

- By Application

On the basis of application, the Latin America Plant Breeding & CRISPR Plant Market is segmented into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Other Crop Types. The Cereals & Grains segment dominated the market with a revenue share of 45% in 2024, driven by Brazil’s leadership in corn and wheat production and the economic importance of these crops for food security and export markets.

The Oilseeds & Pulses segment is anticipated to witness the fastest growth rate of 16.5% from 2025 to 2032, driven by increasing demand for sustainable edible oils and plant-based proteins, particularly in Argentina. The adoption of CRISPR for developing high-yield soybean and canola varieties, coupled with investments from companies such as Bayer, supports this growth.

Plant Breeding and CRISPR Plant Market Regional Analysis

- Brazil dominated the Latin America plant breeding & CRISPR plant market with the largest revenue share of 39.1% in 2024, driven by its robust agricultural sector, widespread adoption of biotechnological innovations, and strong presence of key industry players

- Government support for agricultural innovation and strong export-driven agriculture further bolster the market. The integration of CRISPR technology in cereals & grains and oilseeds & pulses supports both domestic consumption and global trade

Argentina Plant Breeding & CRISPR Plant Market Insight

Argentina is expected to witness the fastest growth rate in the Latin America plant breeding and CRISPR plant market, propelled by increasing investments in agricultural biotechnology and a focus on sustainable crop production. The adoption of CRISPR and hybrid breeding for traits such as disease resistance and drought tolerance is rising, driven by the need to address climate variability. The country's growing agribusiness sector and emphasis on export-oriented crops, such as soybeans and corn, enhance market expansion.

Plant Breeding and CRISPR Plant Market Share

The plant breeding and CRISPR plant industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Limagrain (France)

- DLF (Denmark)

- Bioceres Crop Solutions (Argentina)

- Bayer AG (Germany)

- Syngenta Crop Protection AG (Switzerland)

- Corteva Agriscience (U.S.)

- KWS SAAT SE & Co. KGaA (Germany)

- Advanta (India)

- GDM (Spain)

What are the Recent Developments in Latin America Plant Breeding and CRISPR Plant Market?

- In June 2024, significant advancements in CRISPR-Cas9 technology reshaped the global plant breeding landscape, with growing emphasis on non-GMO applications to enhance drought tolerance, pest resistance, and photosynthetic efficiency in staple crops. Researchers from the University of California, Berkeley and the University of Illinois demonstrated how CRISPR-Cas9 could be used to increase gene expression in rice by modifying upstream regulatory DNA—boosting photosynthesis without introducing foreign genes. These innovations are particularly relevant to regions such as Latin America, where climate-resilient agriculture is critical, and adoption of such technologies continues to expand

- In September 2024, Corteva Inc. partnered with U.S.-based gene editing innovator Pairwise, investing $25 million to form a five-year joint venture aimed at accelerating CRISPR-based crop development. The collaboration, launched under Corteva Catalyst™, focuses on enhancing climate resilience, yield, and nutritional value in staple crops such as corn and soy. By leveraging Pairwise’s Fulcrum™ gene editing platform, the initiative seeks to deliver precise, non-GMO improvements that address global food security challenges. With Corteva’s strong presence in Latin America, these advancements are expected to benefit farmers across the region

- In September 2023, Bayer AG expanded its fruits and vegetables portfolio by acquiring the strawberry breeding program of the UK’s National Institute of Agricultural Botany (NIAB). With over 40 years of horticultural innovation at East Malling, the program includes the Malling™ Fruits portfolio and focuses on developing premium genetics for protected and open-field strawberry cultivation. This strategic acquisition enables Bayer to meet rising global demand for year-round, high-quality strawberries. Although not specific to Latin America, Bayer’s strong presence in the region suggests these innovations will be tailored for local markets

- In March 2023, Corteva Agriscience unveiled a groundbreaking gene-editing technology designed to enhance disease resistance in elite corn hybrids. Using CRISPR, the innovation strategically combines and repositions native disease-resistant traits within the corn genome, targeting major threats such as Northern leaf blight, Southern rust, and anthracnose stalk rot. This approach minimizes production stress, boosts plant health, and increases yield potential. While initially focused on North American conditions, the technology is scalable and holds significant promise for corn-producing regions in Latin America, where Corteva maintains a strong presence

- In August 2022, Bayer AG expanded its investment in sustainable agriculture by acquiring a 65% majority stake in CoverCress Inc., a U.S.-based producer of low-carbon oilseed crops. Developed from field pennycress using advanced breeding and gene-editing techniques, CoverCress™ offers the dual benefits of a cover crop and a harvestable source for renewable diesel and animal feed. This strategic acquisition aligns with Bayer’s sustainability goals by helping reduce nitrogen fertilizer dependence and agricultural carbon emissions. While focused on North America, the technology holds promise for adoption in Latin America, where Bayer maintains a strong agricultural footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.