Latin America Rotomolding Market

Market Size in USD Million

CAGR :

%

USD

157.06 Million

USD

219.82 Million

2024

2032

USD

157.06 Million

USD

219.82 Million

2024

2032

| 2025 –2032 | |

| USD 157.06 Million | |

| USD 219.82 Million | |

|

|

|

Rotomolding Market Analysis

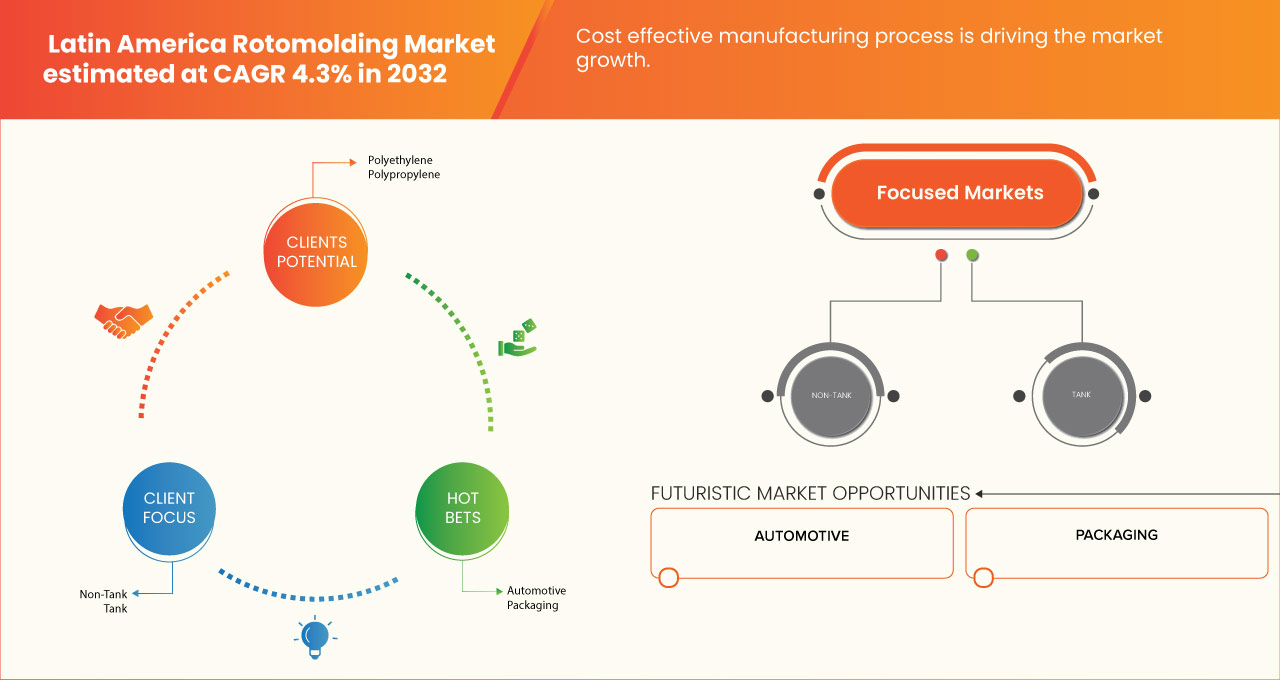

Growing demand for rotomolded products in agriculture and water management and cost-effective manufacturing process are some of the driving factors expected to propel the market growth. Some of the major restraints that may negatively impact the market growth are the fluctuating raw material costs and lack of advanced manufacturing technologies and skilled labor. Growth in infrastructure and construction projects in Latin America and increasing use of recycled materials are expected to create opportunities for the market growth. Stiff competition from imported rotomolded products and logistical and supply chain limitations are projected to challenge the market growth., thereby driving market growth in Latin America.

Rotomolding Market Size

Latin America rotomolding market size was valued at USD 157.06 million in 2024 and is projected to reach USD 219.82 million by 2032, with a CAGR of 4.3% during the forecast period of 2024 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Rotomolding Market Trends

“Growing Demand for Rotomolded Products in Agriculture and Water Management”

Rotational molding, with its ability to create durable, cost-effective, and customizable products, has led to widespread Machine Types in agriculture, particularly in water storage, irrigation systems, and crop protection. Rotomolded products such as tanks, containers, and irrigation components are highly valued for their ability to withstand harsh environmental conditions, including UV exposure, extreme temperatures, and physical wear. These characteristics make rotomolded products ideal for agricultural environments, where reliability and longevity are essential.

In water management, rotomolded tanks are extensively used for rainwater harvesting, water storage, and distribution. The increasing demand for efficient water management solutions, particularly in regions facing water scarcity or irregular rainfall patterns, has further boosted the market. Rotomolded products are especially popular because they are leak-proof, resistant to corrosion, and capable of holding large volumes of water in a compact and space-efficient design. These features are crucial in rural and semi-urban areas, where water infrastructure is often inadequate or inaccessible.

Report Scope and Market Segmentation

|

Attributes |

Rotomolding Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Brazil, Mexico, Argentina, Colombia, Peru, Venezuela, Chile, Bolivia, Rest of Latin America |

|

Key Market Players |

Tecma Group of Companies (U.S.), ROTOMAQ (Mexico), Rotomold Mexico (Mexico), Krompa (Mexico), and Brecher Manufacturing (U.S.) |

|

Market Opportunities |

Growth in infrastructure and construction projects in latin america Increasing use of recycled materials |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rotomolding Market Definition

Rotomolding or rotational molding, is a manufacturing process used to create hollow, seamless plastic products through a multi-stage process of molding. It involves placing a powdered polymer inside a mold that is then heated and rotated bi-axially in an oven. As the mold rotates, the heat melts the polymer, which evenly coats the interior surfaces of the mold, creating a uniform layer. Once the desired thickness is achieved, the mold is cooled and the solidified product is removed. Rotomolding is highly versatile, allowing for the creation of complex shapes and durable parts without seams or joints. Rotomolding products encompass a wide range of Machine Types, including tanks, containers, toys, automotive components, marine buoys, playground equipment, and custom-designed structures. They are known for their durability, cost-effectiveness, lightweight nature, and corrosion resistance, making them suitable for industries such as agriculture, healthcare, construction, and transportation. The process enables consistent production with minimal material waste.

Rotomolding Market Dynamics

Drivers

- Cost Effective Manufacturing Process

Rotational molding offers a relatively low-cost production method compared to other plastic manufacturing techniques such as injection molding or blow molding. This is particularly beneficial in markets where cost efficiency is a primary concern, such as in emerging economies across Latin America. The process involves heating plastic resin powder in a mold and then rotating the mold along two perpendicular axes to ensure the material evenly coats the interior. Once cooled, the mold is removed, revealing the finished product. This simple yet effective process eliminates the need for high-pressure systems or complicated injection machinery, reducing both capital investment and operational costs.

Another reason for the cost-effectiveness of rotomolding is the material usage. The method produces minimal waste, as it allows for the reuse of excess material, thereby optimizing material costs. Additionally, rotomolding can produce large, complex, hollow structures in a single cycle without the need for seams, joints, or additional assembly steps, further reducing production costs. The ability to create a wide range of shapes, sizes, and thicknesses in one mold reduces tooling costs, which can be a significant expense in traditional molding processes..

For instance,

In January 2021, according to a blog published by Roto Dynamics, rotomolding is a cost-effective manufacturing process due to its low tooling costs, minimal waste, and ability to produce complex shapes without the need for expensive molds. Ideal for small to medium production runs, it offers flexibility and high-quality results, making it a preferred choice for many industries.

- Growing Potential of Rotomolded Parts In New Sectors Such As Automotive, Furniture, Healthcare And Others

The growing potential of rotomolded parts in new sectors, such as automotive, furniture, healthcare, and others, is a promising trend driving the expansion of the rotomolding market in Latin America. Traditionally associated with industries such as agriculture, water management, and consumer goods, rotational molding is increasingly finding applications in more diverse sectors due to its versatility, cost-effectiveness, and ability to produce durable, lightweight, and complex parts.

In the automotive industry, rotomolded components are gaining popularity for use in interior and exterior parts, such as bumpers, fenders, storage bins, and door panels. The ability of rotomolding to create lightweight yet strong parts helps improve fuel efficiency while maintaining high durability and safety standards. Moreover, rotomolded parts are highly resistant to impact, UV exposure, and weathering, making them ideal for automotive applications, especially in vehicles designed for rugged environments or outdoor use.

Opportunities

- Growth In Infrastructure and Construction Projects in Latin America

The infrastructure and construction sectors in Latin America are undergoing a substantial expansion, driven by increased public and private investment, population growth, and the need to modernize aging infrastructure. This rapid development presents a significant growth opportunity for the rotomolding market in the region, as it aligns with the rising demand for high-performance, durable, and cost-effective plastic products and components used in a wide range of construction applications.

Rotomolding, known for its flexibility in producing seamless, hollow, and complex shapes with uniform wall thickness, is well-positioned to cater to the needs of the construction sector. The versatility of rotomolded products, such as tanks, containers, pipes, and fittings, can meet the unique requirements of diverse infrastructure projects, including water management, wastewater treatment, housing developments, and road construction. As governments in Latin America prioritize urbanization and the enhancement of public utilities, the demand for lightweight, corrosion-resistant, and durable products manufactured through rotational molding is expected to surge. Furthermore, the growing emphasis on sustainable construction practices offers an additional avenue for market expansion. Rotomolding enables the use of eco-friendly and recyclable materials, aligning with the region’s sustainability goals and regulatory mandates. This makes rotomolded solutions attractive to developers and contractors seeking to comply with environmental standards while optimizing costs and maintaining high-quality outputs..

For instance,

In October 2020, according to an article published on the World Bank website Brazil has been investing heavily in improving its water infrastructure, including water storage and treatment facilities, to address water scarcity and distribution issues. As rotomolded tanks, known for their durability, leak resistance, and ability to store large volumes of water, can play a critical role in these projects. This creates an opportunity for rotomolding companies to supply products tailored to water conservation and management solutions

- Increasing Use of Recycled Materials

The growing emphasis on environmental sustainability and circular economy practices in Latin America is accelerating the adoption of recycled materials across various industries, including the rotomolding market. This trend presents a substantial opportunity for rotomolders to strengthen their market position by delivering eco-friendly solutions that meet evolving consumer and regulatory demands.

The use of recycled resins in rotomolding processes enables manufacturers to produce high-quality, durable products while reducing their environmental footprint. This aligns with government regulations and corporate sustainability goals, making rotomolded products more attractive to environmentally-conscious customers, including construction firms, utilities, and consumer goods companies. By leveraging recycled materials, rotomolders can address the growing market demand for sustainable, lightweight, and versatile solutions, such as water tanks, containers, and outdoor furniture, without compromising on performance or cost-effectiveness. Moreover, the incorporation of recycled materials into rotomolded products can lead to cost savings in material procurement, as recycled resins are often more economical than virgin materials. These savings can be passed on to customers, enhancing the competitiveness of rotomolded products in price-sensitive markets. This cost advantage, combined with the increased appeal of sustainable solutions, positions rotomolders to capture new business opportunities and expand their customer base.

Restrains/Challenges

- Stiff Competition from Imported Rotomolded Products

The manufacturers benefit from economies of scale, advanced production techniques, and lower labor costs, which allow them to offer competitive pricing for rotomolded products, such as tanks, containers, and outdoor furniture. This price advantage makes it difficult for Latin American manufacturers to compete, particularly in price-sensitive sectors such as construction and consumer goods, where cost is a key consideration for buyers. Local manufacturers may struggle to match these lower prices without compromising on quality or increasing their production costs. Additionally, Asia-Pacific manufacturers often have established supply chains and distribution networks that enable them to deliver products more quickly and efficiently, further enhancing their competitiveness in the Latin American market. The sheer volume of imports from Asia also leads to market saturation, making it challenging for local companies to differentiate their products or maintain customer loyalty

- Logistical and Supply Chain Limitations

Latin America’s vast geography, coupled with underdeveloped transportation infrastructure in certain areas, often results in high logistical costs and extended lead times for the delivery of critical materials, such as resins and additives used in rotomolding. Delays in the supply chain can lead to production bottlenecks, affecting the timeliness and reliability of customer orders. This poses a significant challenge, particularly in industries like construction, agriculture, and consumer goods, where customers demand quick and consistent product availability. Additionally, supply chain inefficiencies may lead to increased reliance on imported materials, exposing manufacturers to global supply chain disruptions, currency fluctuations, and tariffs that can raise material costs. Local rotomolding businesses are also hindered by limited access to modern warehousing facilities and just-in-time inventory systems. This makes it difficult to optimize inventory levels, leading to higher carrying costs and potential stockouts. Furthermore, the fragmented nature of supply chains across the region can increase the complexity of procurement and distribution, ultimately impacting the competitiveness and profitability of rotomolding companies.

- Regulatory Framework Content

The regulatory landscape in the Latin American rotomolding market is diverse and evolving, with significant emphasis on environmental sustainability, product quality, trade policies, and workplace safety. Environmental regulations are pushing manufacturers towards eco-friendly practices, while product standards ensure that rotomolded items meet the necessary quality and safety benchmarks. Trade policies and agreements play a crucial role in shaping access to raw materials and influencing cost structures, while health and safety regulations help ensure safe manufacturing conditions.

Navigating this regulatory environment requires companies to stay updated on both local laws and international standards, especially if they intend to export to markets with strict requirements. By prioritizing regulatory compliance and aligning with global standards, Latin American rotomolding manufacturers can improve competitiveness, foster sustainable growth, and strengthen their position in both regional and international markets.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

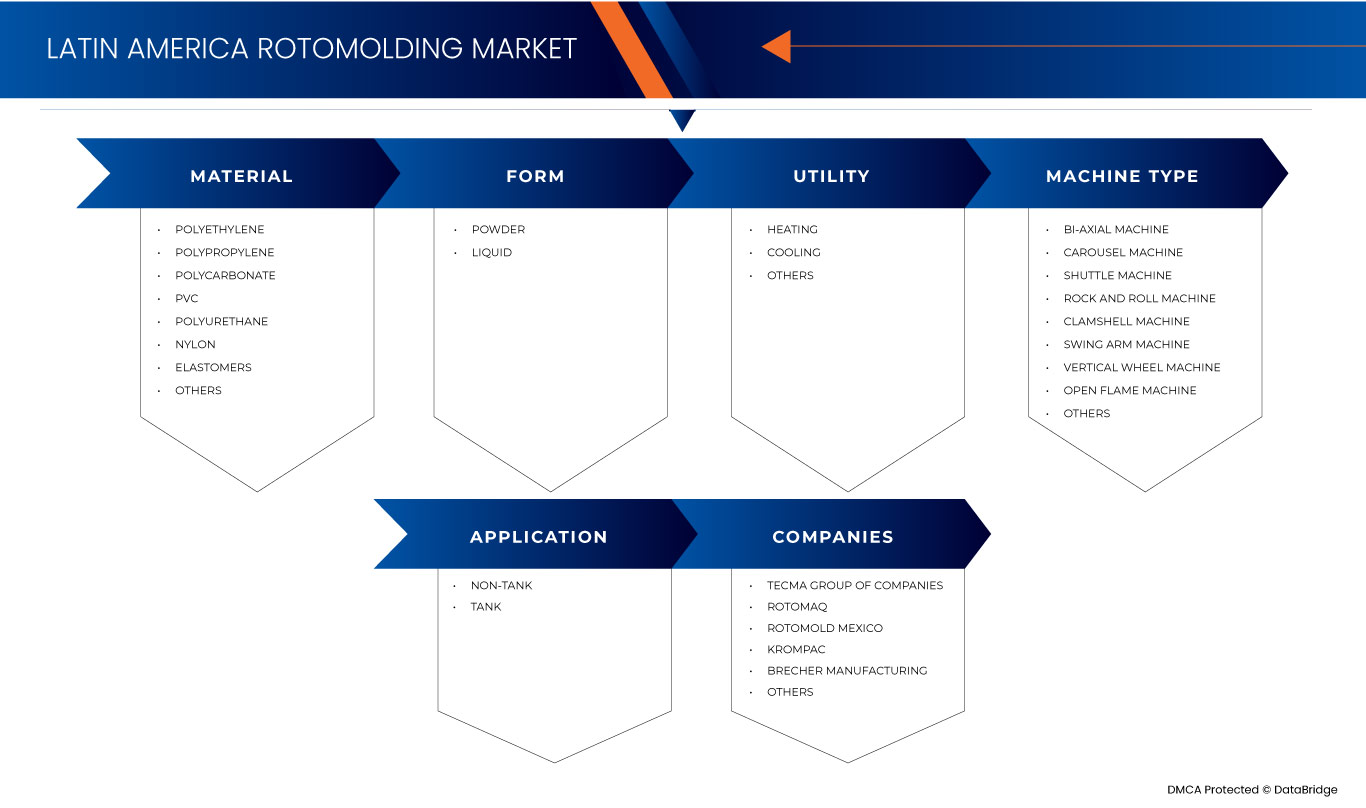

Latin America Rotomolding Market Scope

The market is segmented on the basis of materials, form, utility, machine type, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market Machine Types.

Materials

- Polyethylene

- Polypropylene

- Polycarbonate

- PVC

- Polyurethane

- Nylon

- Elastomers

- Others

Form

- Powder

- Liquid

Utility

- Heating

- Cooling

- Others

Machine Type

- Bi-Axial Machine

- Carousel Machin

- Shuttle Machine

- Rock and Roll Machine

- Clamshell Machine

- Swing Arm Machine

- Vertical Wheel Machine

- Open Flame Machine

- Others

Application

- Non-Tank

- Tank

Latin America Rotomolding Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, materials, form, utility, machine type, and application as referenced above.

The countries covered in the market are Brazil, Mexico, Argentina, Colombia, Peru, Venezuela, Chile, Bolivia, and rest of Latin America.

Brazil is expected to dominate the market due to advanced agricultural practices, strong research and development, and high demand for innovative solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Latin America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Latin America Rotomolding Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Latin America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Machine Type dominance. The above data points provided are only related to the companies' focus related to market.

Rotomolding Market Leaders Operating in the Market Are:

- Tecma Group of Companies (U.S.)

- ROTOMAQ (Mexico)

- Rotomold Mexico (Mexico)

- Krompa (Mexico)

- Brecher Manufacturing (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.5.1 MANUFACTURING CAPABILITIES

4.5.2 COST COMPETITIVENESS

4.5.3 QUALITY ASSURANCE AND COMPLIANCE

4.5.4 EXPERIENCE AND INDUSTRY EXPERTISE

4.5.5 SUPPLY CHAIN AND LOGISTICS MANAGEMENT

4.5.6 FLEXIBILITY AND CUSTOMIZATION

4.5.7 SUSTAINABILITY AND ENVIRONMENTAL CONSIDERATIONS

4.5.8 CUSTOMER SERVICE AND TECHNICAL SUPPORT

4.5.9 FINANCIAL STABILITY AND REPUTATION

4.5.10 TECHNOLOGY AND INNOVATION

4.6 PRICE INDEX

4.6.1 INTRODUCTION TO PRICE DYNAMICS

4.6.2 RAW MATERIAL COSTS AND THEIR IMPACT ON PRICING

4.6.3 EXCHANGE RATE FLUCTUATIONS AND THEIR INFLUENCE

4.6.4 PRODUCTION COSTS AND LABOR EXPENSES

4.6.5 TAX POLICIES AND TRADE AGREEMENTS

4.6.6 FUTURE OUTLOOK FOR THE PRICE INDEX

4.7 PRODUCTION CAPACITY OVERVIEW

4.7.1 BRAZIL

4.7.2 MEXICO

4.7.3 ARGENTINA

4.7.4 OTHER COUNTRIES: COLOMBIA, CHILE, AND PERU

4.7.5 CHALLENGES IMPACTING PRODUCTION CAPACITY ACROSS THE REGION

4.7.6 FUTURE OUTLOOK AND POTENTIAL FOR CAPACITY EXPANSION

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8.4 CONCLUSION

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS OF THE LATIN AMERICA ROTOMOLDING MARKET

4.9.1 ADVANCES IN ROTOMOLDING EQUIPMENT

4.9.2 IMPROVEMENT IN MATERIAL SCIENCE AND RESIN TECHNOLOGY

4.9.3 CUSTOMIZATION AND DESIGN INNOVATION

4.9.4 AUTOMATION AND PROCESS CONTROL

4.9.5 SUSTAINABILITY INITIATIVES

4.9.6 REGIONAL AND GLOBAL COLLABORATION

4.9.7 CONCLUSION

4.1 RAW MATERIAL COVERAGE IN THE LATIN AMERICAN ROTOMOLDING MARKET

4.10.1 POLYETHYLENE (PE)

4.10.2 POLYPROPYLENE (PP)

4.10.3 POLYVINYL CHLORIDE (PVC)

4.10.4 ENGINEERING PLASTICS AND SPECIALTY RESINS

4.10.5 RECYCLED AND SUSTAINABLE MATERIALS

4.10.6 ADDITIVES AND FILLERS FOR ENHANCED PERFORMANCE

4.10.7 CONCLUSION

5 REGULATORY COVERAGE

5.1 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY STANDARDS

5.2 PRODUCT STANDARDS AND QUALITY CONTROL REGULATIONS

5.3 TRADE POLICIES AND IMPORT/EXPORT REGULATIONS

5.4 HEALTH AND SAFETY REGULATIONS IN MANUFACTURING

5.5 CONCLUSION

6 CUSTOM DUTY PER COUNTRY/ORIGIN:

6.1 BRAZIL:

6.2 MEXICO:

6.3 ARGENTINA:

6.4 CHILE:

6.5 PERU:

6.6 VENEZUELA:

6.7 COLOMBIA:

6.8 BOLIVIA:

6.9 CUSTOMER NAME

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR ROTOMOLDED PRODUCTS IN AGRICULTURE AND WATER MANAGEMENT

7.1.2 COST EFFECTIVE MANUFACTURING PROCESS

7.1.3 GROWING POTENTIAL OF ROTOMOLDED PARTS IN NEW SECTORS SUCH AS AUTOMOTIVE, FURNITURE, HEALTHCARE AND OTHERS

7.2 RESTRAINTS

7.2.1 FLUCTUATING RAW MATERIAL COSTS

7.2.2 LACK OF ADVANCED MANUFACTURING TECHNOLOGIES AND SKILLED LABOR

7.3 OPPORTUNITIES

7.3.1 GROWTH IN INFRASTRUCTURE AND CONSTRUCTION PROJECTS IN LATIN AMERICA

7.3.2 INCREASING USE OF RECYCLED MATERIALS

7.4 CHALLENGES

7.4.1 STIFF COMPETITION FROM IMPORTED ROTOMOLDED PRODUCTS

7.4.2 LOGISTICAL AND SUPPLY CHAIN LIMITATIONS

8 LATIN AMERICA ROTOMOLDING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYPROPYLENE

8.3 POLYCARBONATE

8.4 PVC

8.5 POLYURETHANE

8.6 NYLON

8.7 ELASTOMERS

8.8 OTHERS

9 LATIN AMERICA ROTOMOLDING MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

10 LATIN AMERICA ROTOMOLDING MARKET, BY UTILITY

10.1 OVERVIEW

10.2 COOLING

10.3 OTHERS

11 LATIN AMERICA ROTOMOLDING MARKET, BY MACHINE TYPE

11.1 OVERVIEW

11.2 CAROUSEL MACHINE

11.3 SHUTTLE MACHINE

11.4 ROCK AND ROLL MACHINE

11.5 CLAMSHELL MACHINE

11.6 SWING ARM MACHINE

11.7 VERTICAL WHEEL MACHINE

11.8 OPEN FLAME MACHINE

11.9 OTHERS

12 LATIN AMERICA ROTOMOLDING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 TANK

13 LATIN AMERICA ROTOMOLDING MARKET, BY COUNTRY

13.1 LATIN AMERICA

13.1.1 BRAZIL

13.1.2 MEXICO

13.1.3 ARGENTINA

13.1.4 COLOMBIA

13.1.5 PERU

13.1.6 VENEZUELA

13.1.7 CHILE

13.1.8 BOLIVIA

13.1.9 REST OF LATIN AMERICA

14 LATIN AMERICA ROTOMOLDING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: LATIN AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 TECMA GROUP OF COMPANIES

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENT

16.2 ROTOMAQ

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 ROTOMOLD MEXICO

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 KROMPAC

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 BRECHER MANUFACTURING

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 LIST OF CUSTOMERS NAME

TABLE 2 LATIN AMERICA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 3 LATIN AMERICA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 LATIN AMERICA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 LATIN AMERICA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 LATIN AMERICA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 LATIN AMERICA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 8 LATIN AMERICA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 9 LATIN AMERICA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 LATIN AMERICA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 LATIN AMERICA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 12 LATIN AMERICA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 13 LATIN AMERICA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 14 LATIN AMERICA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 15 LATIN AMERICA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 LATIN AMERICA AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 LATIN AMERICA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 18 LATIN AMERICA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 19 LATIN AMERICA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 LATIN AMERICA ROTOMOLDING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 21 BRAZIL ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 22 BRAZIL POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 BRAZIL POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 BRAZIL ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 BRAZIL OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 BRAZIL ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 27 BRAZIL ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 28 BRAZIL ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 BRAZIL ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 BRAZIL NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 31 BRAZIL AUTOMOTIVE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 32 BRAZIL PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 33 BRAZIL BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 34 BRAZIL BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 BRAZIL AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 BRAZIL MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 37 BRAZIL FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 38 BRAZIL TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MEXICO ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 40 MEXICO POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MEXICO POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MEXICO ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MEXICO OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MEXICO ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 45 MEXICO ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 46 MEXICO ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MEXICO ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 MEXICO NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 49 MEXICO AUTOMOTIVE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 50 MEXICO PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 51 MEXICO BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 52 MEXICO BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 53 MEXICO AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 MEXICO MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 55 MEXICO FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 56 MEXICO TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ARGENTINA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 58 ARGENTINA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ARGENTINA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ARGENTINA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ARGENTINA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ARGENTINA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 63 ARGENTINA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 64 ARGENTINA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ARGENTINA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 ARGENTINA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 67 ARGENTINA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 68 ARGENTINA PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 69 ARGENTINA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 70 ARGENTINA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 ARGENTINA AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 72 ARGENTINA MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 73 ARGENTINA FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 74 ARGENTINA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 COLOMBIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 76 COLOMBIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 COLOMBIA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 COLOMBIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 COLOMBIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 COLOMBIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 81 COLOMBIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 82 COLOMBIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 COLOMBIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 COLOMBIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 85 COLOMBIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 86 COLOMBIA PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 87 COLOMBIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 88 COLOMBIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 89 COLOMBIA AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 90 COLOMBIA MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 91 COLOMBIA FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 92 COLOMBIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 PERU ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 94 PERU POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 PERU POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 PERU ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 PERU OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 PERU ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 99 PERU ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 100 PERU ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 PERU ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 PERU NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 103 PERU AUTOMOTIVE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 104 PERU PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 105 PERU BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 106 PERU BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 PERU AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 108 PERU MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 109 PERU FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 110 PERU TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 VENEZUELA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 112 VENEZUELA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 VENEZUELA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 VENEZUELA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 VENEZUELA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 VENEZUELA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 117 VENEZUELA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 118 VENEZUELA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 VENEZUELA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 VENEZUELA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 121 VENEZUELA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 122 VENEZUELA PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 123 VENEZUELA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 124 VENEZUELA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 VENEZUELA AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 VENEZUELA MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 127 VENEZUELA FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 128 VENEZUELA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 CHILE ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 130 CHILE POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 CHILE POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 CHILE ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 CHILE OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 CHILE ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 135 CHILE ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 136 CHILE ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 CHILE ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 138 CHILE NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 139 CHILE AUTOMOTIVE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 140 CHILE PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 141 CHILE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 142 CHILE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 CHILE AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 144 CHILE MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 145 CHILE FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 146 CHILE TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 BOLIVIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 148 BOLIVIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 BOLIVIA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 BOLIVIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 BOLIVIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 BOLIVIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 153 BOLIVIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 154 BOLIVIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 BOLIVIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 BOLIVIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 157 BOLIVIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 158 BOLIVIA PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 159 BOLIVIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 160 BOLIVIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 161 BOLIVIA AGRICULTURE IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 162 BOLIVIA MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 163 BOLIVIA FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 164 BOLIVIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 REST OF LATIN AMERICA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 LATIN AMERICA ROTOMOLDING MARKET

FIGURE 2 LATIN AMERICA ROTOMOLDING MARKET: DATA TRIANGULATION

FIGURE 3 LATIN AMERICA ROTOMOLDING MARKET: DROC ANALYSIS

FIGURE 4 LATIN AMERICA ROTOMOLDING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 LATIN AMERICA ROTOMOLDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 LATIN AMERICA ROTOMOLDING MARKET: MULTIVARIATE MODELLING

FIGURE 7 LATIN AMERICA ROTOMOLDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 LATIN AMERICA ROTOMOLDING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 LATIN AMERICA ROTOMOLDING MARKET: APPLICATION COVERAGE GRID

FIGURE 10 LATIN AMERICA ROTOMOLDING MARKET: SEGMENTATION

FIGURE 11 LATIN AMERICA ROTOMOLDING MARKET:-EXECUTIVE SUMMARY

FIGURE 12 EIGHT SEGMENTS COMPRISE THE LATIN AMERICA ROTOMOLDING MARKET, BY MATERIAL

FIGURE 13 GROWING DEMAND FOR ROTOMOLDED PRODUCTS IN AGRICULTURE AND WATER MANAGEMENT IS EXPECTED TO DRIVE THE LATIN AMERICA ROTOMOLDING MARKET IN THE FORECAST PERIOD

FIGURE 14 THE POLYETHYLENE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE LATIN AMERICA ROTOMOLDING MARKET IN 2025 AND 2032

FIGURE 15 PESTEL ANALYSIS

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR LATIN AMERICA ROTOMOLDING MARKET

FIGURE 21 LATIN AMERICA ROTOMOLDING MARKET: BY MATERIAL, 2024

FIGURE 22 LATIN AMERICA ROTOMOLDING MARKET, BY FORM, 2024

FIGURE 23 LATIN AMERICA ROTOMOLDING MARKET, BY UTILITY, 2024

FIGURE 24 LATIN AMERICA ROTOMOLDING MARKET, BY MACHINE TYPE, 2024

FIGURE 25 LATIN AMERICA ROTOMOLDING MARKET, BY APPLICATION, 2024

FIGURE 26 LATIN AMERICA ROTOMOLDING MARKET: SNAPSHOT (2024)

FIGURE 27 LATIN AMERICA ROTOMOLDING MARKET: COMPANY SHARE 2024 (%)

Latin America Rotomolding Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Latin America Rotomolding Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Latin America Rotomolding Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.