Malaysia Metal Roofing Market

Market Size in USD Million

CAGR :

%

USD

144.67 Million

USD

231.65 Million

2024

2035

USD

144.67 Million

USD

231.65 Million

2024

2035

| 2025 –2035 | |

| USD 144.67 Million | |

| USD 231.65 Million | |

|

|

|

|

Metal Roofing Market Size

- The Malaysia metal roofing market was valued at USD 144.67 million in 2024 and is expected to reach USD 231.65 million by 2035, at a CAGR of 4.4% during the forecast period

- The market growth is largely fueled by the rising consumer preference for sustainable and energy-efficient metal roofing solutions, including coated and eco-friendly roofing systems that offer durability and lower environmental impact

- This growth is driven by factors such as strong government support for domestic infrastructure development, increased investments in residential and commercial construction, and growing awareness of long-lasting roofing alternatives. Initiatives promoting green building standards and urban development are further boosting the adoption of metal roofing across Malaysia

Metal Roofing Market Analysis

- The Malaysia metal roofing market is experiencing steady growth, driven by rising demand for durable, cost-effective, and sustainable construction materials. Homeowners and builders are increasingly choosing metal roofing due to its long lifespan, resistance to extreme weather, recyclability, and low maintenance, especially in urban and semi-urban areas

- Metal roofing is widely used across multiple sectors in Malaysia, including residential, commercial, industrial, and agricultural buildings. It remains a preferred choice due to its lightweight structure, thermal reflectivity, corrosion resistance, and adaptability to tropical climates. Ongoing innovations, such as insulated metal panels and coated steel sheets—further boost its adoption

- The market growth is supported by strong government infrastructure development programs, growing urbanization, and rising investments in housing and commercial projects. Government incentives for green building practices and energy-efficient materials are also accelerating the use of metal roofing across public and private sector construction

- Among product types, the corrugated panels segment is expected to dominate the market due to its cost-effectiveness, ease of installation, durability, and wide availability. Its ability to withstand harsh weather conditions and suitability for various applications across industrial, agricultural, and residential sectors further boosts demand

- The industrial segment is expected to dominate the market due to the increasing construction of manufacturing facilities, warehouses, and storage units. The demand for durable, cost-effective, and low-maintenance roofing solutions in industrial applications significantly drives the adoption of metal roofing in this segment

Report Scope and Metal roofing market Segmentation

|

Attributes |

Metal roofing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metal Roofing Market Trends

“Surge in Infrastructure and Housing Projects Driving Metal Roofing Demand in Malaysia”

- The rising construction activities across Malaysia’s residential, commercial, and industrial sectors are propelling demand for high-performance roofing materials. This upward trajectory is largely attributed to national urban development plans and infrastructure initiatives that continue to generate new building projects throughout the country

- Major government strategies like the Twelfth Malaysia Plan are placing strong emphasis on urban infrastructure, sustainable construction, and modernization. These efforts are accelerating construction timelines and increasing material requirements, with metal roofing systems gaining significant traction due to their durability and efficiency

- According to the Construction Industry Development Board (CIDB), Malaysia’s construction sector is expected to expand by 12.3% in 2025, backed by residential housing schemes and infrastructure investments. This anticipated growth directly supports greater demand for materials such as metal roofing, which aligns with fast-track construction schedules

- Metal roofing is increasingly preferred due to its long service life, resilience against harsh weather, low maintenance, and compatibility with diverse architectural designs. These qualities make it a go-to solution for both developers and contractors aiming for cost-effective and reliable construction outcomes

- With the national shift toward green building practices, recyclable and eco-friendly roofing solutions like metal roofing are becoming mainstream. Their role in reducing environmental impact while offering thermal efficiency makes them integral to sustainable development objectives in Malaysia’s evolving construction landscape

Metal Roofing Market Dynamics

Driver

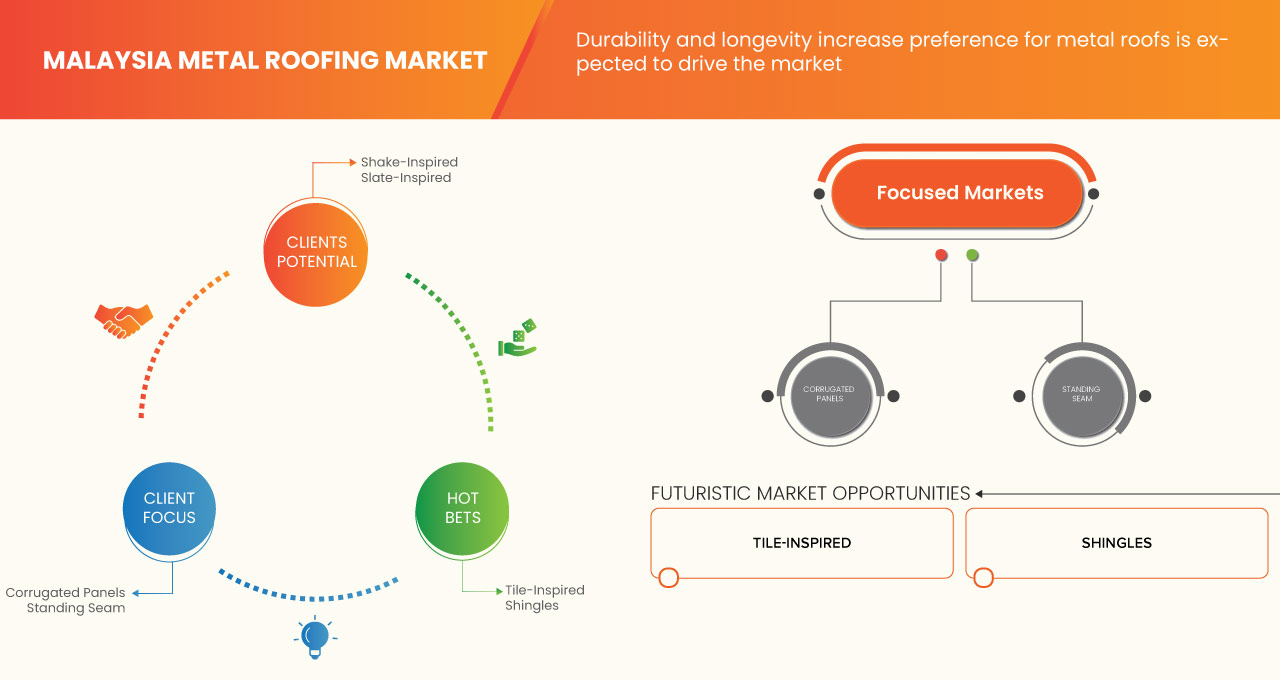

“Durability and Longevity Increase Preference for Metal Roofs”

- In Malaysia, the demand for metal roofing systems is gaining strong momentum due to their ability to endure the country’s tropical climate, including prolonged exposure to UV rays, heavy rainfall, and high humidity. These weather-resistant properties make metal roofs far more durable than conventional alternatives like asphalt shingles or clay tiles, which are more prone to cracking, warping, and water damage over time

- One of the key advantages of metal roofing is its minimal maintenance requirements. Unlike other materials that may need regular repair or cleaning due to moss, algae, or water-related degradation, metal roofs retain structural integrity and appearance for decades, contributing to lower lifecycle maintenance costs

- Metal roofing systems can last over 40 to 50 years with proper care, offering long-term value for property owners and developers. This extended lifespan is particularly valued in residential and commercial developments where cost-efficiency, structural stability, and return on investment are critical decision-making factors

- The performance of metal roofs has been further enhanced by innovations in protective coatings and metal alloys. Advanced formulations help improve corrosion resistance and fire performance, making metal roofing an ideal solution in regions with extreme weather fluctuations or high environmental stress

Opportunities

“Urbanization Boosts Demand for Modern Roofing”

- Rapid urban expansion in Malaysia is driving construction of residential, commercial, and industrial buildings, increasing demand for metal roofing solutions

- Government initiatives for affordable housing and infrastructure projects are accelerating roofing material consumption

- Rising preference for durable, low-maintenance, and aesthetically appealing roofing in urban developments favors metal roofing adoption

- Growth of smart cities and green building initiatives encourages use of energy-efficient roofing materials

- Urban redevelopment and renovation projects create recurring demand for modern roofing upgrades

- Higher disposable incomes and lifestyle upgrades in urban areas contribute to increased investments in premium roofing solutions

- Developers and contractors in urban zones increasingly prioritize fast-installation and weather-resistant roofing systems, which metal roofing provides

- Demand for soundproof and heat-reflective roofing grows in densely populated urban regions

Restraint/Challenge

“High Initial Installation Cost Limits Market Adoption”

- Although metal roofing offers long-term value through durability and low maintenance, its high initial installation cost remains a major barrier to adoption in Malaysia. Premium materials such as aluminum, zinc, and coated steel are substantially more expensive upfront than conventional roofing options like asphalt shingles or clay tiles, making them less accessible for price-sensitive buyers.

- The elevated material costs are compounded by the need for skilled labor and specialized equipment during installation. Unlike traditional roofing systems that can be installed by general contractors, metal roofing often requires trained professionals, which adds to total project expenses—especially for complex architectural designs or large-scale structures.

- This upfront cost differential becomes particularly significant for individual homeowners, small-scale developers, and public sector housing programs that operate on limited budgets. Even when aware of the long-term benefits such as energy savings and extended service life, many stakeholders struggle to justify the higher capital expenditure.

- In regions such as rural and semi-urban Malaysia, affordability remains a key consideration in construction decision-making. In these markets, the cost advantage of traditional roofing materials outweighs the long-term value proposition of metal roofing, leading to continued reliance on lower-cost alternatives.

- Without targeted government incentives, industry subsidies, or increased awareness of lifecycle cost savings, the high installation cost will continue to constrain growth. Overcoming this challenge is crucial to expanding the reach of metal roofing in Malaysia’s diverse construction landscape and ensuring broader market penetration.

Metal Roofing Market Scope

The market is segmented on the basis of product type, material, price, color, thickness, and length, and application.

- By Product Type

On the basis of product type, the market is segmented into corrugated panels, standing seam, tile-inspired, shingles, shake-inspired, slate-inspired, and others. The standing seam is further segmented by type in to snap lockmechanical seamnail/fastener flange and batten panel. The mechanical seam is further segmented by type in to single lock (90-degree seam) and double lock (180-degree seam). The double lock (180-degree seam) segment is further segmented by type in to 1.5-inch double lock and 2-inch double lock profile. The batten panel is further segmented by type in to snap cap and tee seam. In 2025, the corrugated panels segment is expected to dominate the market with a market share of 39.07% due to its cost-effectiveness, ease of installation, durability, and wide availability. Its ability to withstand harsh weather conditions and suitability for various applications across industrial, agricultural, and residential sectors further boosts demand.

The corrugated panels segment is anticipated to witness the fastest growth rate of 4.7% from 2025 to 2035, driven by their rising adoption in the commercial and hospitality sectors due to their high durability, cost-effectiveness, and modern aesthetic appeal for roofing and cladding applications.

- By Material

On the basis of material, the market is segmented into steel, aluminum, stone-coated, zinc, copper, tin, bronze, and others. The steel segment is further segmented by type in to galvalume steel, galvanized steel and weathering steel. In 2025, the steel segment is expected to dominate the market with a market share of 69.28% due to its superior strength, affordability, wide availability, and excellent resistance to harsh weather conditions, making it the preferred choice for both residential and commercial roofing applications.

The steel segment is anticipated to witness the fastest growth rate of 4.5% from 2025 to 2035, driven by its increasing use in the commercial and hospitality sectors due to its structural strength, fire resistance, ease of installation, and long lifespan. Its versatility and ability to support large-span roofing systems also make it ideal for modern architectural designs in these sectors.

- By Price

On the basis of price, the market is categorized into 5.1 to 10 USD, Up to 5 USD and more than 10 USD. In 2025, the 5.1 to 10 USD segment is expected to dominate the market with a market share of 47.69% due to its balance between cost and quality, making it an attractive option for both residential and commercial buyers seeking durable and aesthetically appealing roofing materials at an affordable price point.

The 5.1 to 10 USD segment is anticipated to witness the fastest growth rate of 4.6% from 2025 to 2035, driven by growing preference for mid-range roofing products that offer an optimal balance of quality, performance, and affordability. This price range appeals to commercial and hospitality developers seeking cost-effective yet durable solutions, making it a popular choice in large-scale construction and renovation projects.

- By Color

On the basis of color, the market includes standard color, matte finishes, and designer finishes. The gray color is further segmented by type into ash gray, slate gray, and charcoal gray. The white color is further segmented into regal white and bone white. The bronze color is categorized into medium and dark shades. The red color is divided into colonial red and regal red, while the blue color includes slate blue and regal blue. The matte finishes segment is further classified into black, grey, bronze, zinc metallic, and others. Within grey, the types include musket grey and charcoal grey. The designer finishes segment is further divided into distressed wood, blackened copper, speckled copper, aged copper, patina, vintage, speckled rust, and others. In 2025, the standard color segment is expected to dominate the market with a market share of 75.36% due to its wide availability, lower cost compared to premium finishes, and its popularity in both residential and commercial construction for offering a clean and neutral aesthetic that complements various architectural styles.

The standard color segment is anticipated to witness the fastest growth rate of 4.4% from 2025 to 2035, driven by its widespread availability, compatibility with various building designs, and growing demand for neutral and timeless color options in both residential and commercial roofing projects. Standard colors are also more readily stocked and supported by manufacturers, making them a convenient and cost-effective choice for developers and contractors.

- By Thickness

On the basis of market, the market is segmented into 26 gauge, 24 gauge, 29 gauge, 22 gauge, 20 gauge, others. In 2025, the 26 gauge segment is expected to dominate the market with a market share of 35.80% due to its ideal balance between strength and flexibility, making it suitable for diverse roofing applications. Its affordability, ease of handling, and effectiveness in providing weather resistance further contribute to its widespread adoption.

The 26 gauge segment is anticipated to witness the fastest growth rate of 4.8% from 2025 to 2035, driven by its optimal balance between strength and flexibility, making it suitable for a wide range of residential, commercial, and light industrial roofing applications. Its widespread availability, ease of installation, and cost-efficiency compared to thicker gauges also contribute to its growing adoption in both new construction and renovation projects.

- By Length

On the basis of length, the market is segmented into 12 FT, 10 FT, 14 FT, 16 FT, 8 FT, and others. In 2025, the 12 FT segment is expected to dominate the market with a market share of 30.50% due to its optimal length for efficient coverage, reduced material waste, and ease of installation. It is widely preferred in both residential and commercial projects for minimizing seams and enhancing structural uniformity.

The the 12 FT segment is anticipated to witness the fastest growth rate of 4.9% from 2025 to 2035, driven by its suitability for covering larger roof areas with fewer seams, reducing installation time and labor costs. Its popularity in both residential and commercial projects is also supported by ease of transport, reduced material wastage, and better alignment with standard roof dimensions, making it a preferred choice among contractors and builders.

- By Application

On the basis of application, the market includes industrial, commercial, residential, and agricultural. The industrial segment is further categorized by application into manufacturing facilities, warehouses and storage units, and others. The commercial segment is divided into retail centers, office, educational institutions, healthcare, recreational, transportation, and others. The agricultural segment is further segmented by application into poultry house, barn, grain storage, and others. The barn segment is further classified into livestock barn, hay barn, and dairy barn. In 2025, the industrial segment is expected to dominate the market with a market share of 36.46% due to rising Malaysia demand for luxury apparel, traditional garments, and sustainable fashion products.

The industrial segment is anticipated to witness the fastest growth rate of 4.7% from 2025 to 2035, driven by the increasing number of manufacturing facilities, warehouses, and logistics centers across developing regions. The demand for durable, weather-resistant, and low-maintenance roofing materials is high in industrial applications, making metal roofing an ideal choice. Additionally, the ability of metal roofs to support insulation and solar panel integration further enhances their appeal in energy-conscious industrial developments.

Metal Roofing Market Scope Share:

The metal roofing market industry is primarily led by well-established companies, including:

- Astino Berhad (Malaysia)

- Evergold Metal Roofing Sdn. Bhd. (Malaysia)

- Swissma (Malaysia)

- Overseametal Sdn Bhd (Malaysia)

- Roofseal (M) Sdn. Bhd. (Malaysia)

- Komiya Roofing (M) Sdn Bhd (Malaysia)

- Kong Hong (KT) Sdn Bhd (Malaysia)

- Thung Hing Metal Industry Sdn. (Malaysia)

- MUTIARA METAL ENTERPRISE SDN BHD (Malaysia)

- Dep Soon Steel Sdn. Bhd. (Malaysia)

- Juta Steel Sdn. Bhd. (Malaysia)

- Le Nam Megasheet (Malaysia)

- Power Metal & Steel (M) Sdn. Bhd. (Malaysia)

- Nikkata Metal Roofing Industries Sdn Bhd (Malaysia)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PATENT ANALYSIS

4.1.1 PATENT QUALITY AND STRENGTH

4.1.2 PATENT FAMILIES

4.1.3 LICENSING AND COLLABORATIONS

4.1.4 REGION PATENT LANDSCAPE

4.1.5 IP STRATEGY AND MANAGEMENT

4.1.6 PATENT FILING TRENDS BY ROOF TYPE (2016–2024)

4.2 COST ANALYSIS BREAKDOWN: MALAYSIA METAL ROOFING MARKET

4.2.1 RAW MATERIAL COSTS

4.2.2 PROCESSING AND PROFILING COSTS

4.2.3 LABOR AND OVERHEAD COSTS

4.2.4 PACKAGING AND MATERIAL HANDLING

4.2.5 TRANSPORTATION AND LOGISTICS

4.2.6 REGULATORY COMPLIANCE AND CERTIFICATION

4.2.7 INSTALLATION AND POST-SALE SERVICES (OPTIONAL ADD-ON COST)

4.2.8 MARKETING, DISTRIBUTION, AND CHANNEL MARGINS

4.2.9 PROFIT MARGIN CONSIDERATION

4.2.10 CONCLUSION

4.3 CUSTOMER BEHAVIOR & PREFERENCES IN THE MALAYSIA METAL ROOFING MARKET

4.3.1 CUSTOMER SEGMENTATION BY END-USE APPLICATION

4.3.2 KEY PURCHASE DECISION DRIVERS

4.3.3 INFORMATION SOURCES AND PURCHASING JOURNEY

4.3.4 REGIONAL BEHAVIOR AND PREFERENCES

4.3.5 BRAND PERCEPTION AND LOYALTY BEHAVIOR

4.3.6 EMERGING PREFERENCES AND BEHAVIORAL TRENDS

4.3.7 LIFECYCLE BEHAVIOR AND REPURCHASE TRIGGERS

4.4 RAW MATERIAL SOURCING ANALYSIS: MALAYSIA METAL ROOFING MARKET

4.4.1 PRIMARY RAW MATERIAL INPUTS

4.4.2 GEOGRAPHIC SOURCING PATTERNS AND TRADE DEPENDENCIES

4.4.3 LOCAL SUPPLY CAPABILITIES AND LIMITATIONS

4.4.4 PROCUREMENT STRATEGIES AND COST DYNAMICS

4.4.5 GRADE SELECTION AND QUALITY STANDARDIZATION

4.4.6 CHALLENGES IN RAW MATERIAL SOURCING

4.4.7 STRATEGIC SOURCING RECOMMENDATIONS

4.4.8 ENVIRONMENTAL AND COMPLIANCE CONSIDERATIONS

4.4.9 CONCLUSION

4.5 STRATEGIC RECOMMENDATIONS FOR KEY PLAYERS IN THE MALAYSIA METAL ROOFING MARKET

4.5.1 PRODUCT DIFFERENTIATION AND INNOVATION

4.5.2 MARKET EXPANSION AND DISTRIBUTION NETWORK OPTIMIZATION

4.5.3 PRICING AND COST MANAGEMENT

4.5.4 BRANDING AND MARKETING STRATEGIES

4.5.5 REGULATORY ALIGNMENT AND GOVERNMENT ENGAGEMENT

4.5.6 STRATEGIC COLLABORATIONS AND PARTNERSHIPS

4.5.7 DIGITAL TRANSFORMATION AND SMART MANUFACTURING

4.5.8 AFTER-SALES SUPPORT AND WARRANTY PROGRAMS

4.5.9 TALENT DEVELOPMENT AND TRAINING PROGRAMS

4.5.10 COMPETITIVE INTELLIGENCE AND BENCHMARKING

4.6 SUPPLY CHAIN ANALYSIS: MALAYSIA METAL ROOFING MARKET

4.6.1 RAW MATERIAL SOURCING AND STEEL COIL PROCUREMENT

4.6.2 ROLL FORMING, PROFILING, AND COATING OPERATIONS

4.6.3 FABRICATION, ACCESSORIES, AND PACKAGING

4.6.4 DISTRIBUTION, LOGISTICS, AND INSTALLATION NETWORKS

4.6.5 MARKET TRENDS AND FUTURE OUTLOOK

4.6.6 CONCLUSION

4.7 CONSUMER BUYING BEHAVIOUR

4.8 IMPORT EXPORT SCENARIO

4.8.1 IMPORT SCENARIO

4.8.2 EXPORT SCENARIO

4.8.3 CONSUMPTION SCENARIO

4.8.4 PRODUCTION SCENARIO

4.9 TECHNOLOGICAL TRENDS IN THE MALAYSIA METAL ROOFING MARKET

4.9.1 ADVANCED COATING TECHNOLOGIES

4.9.2 INTEGRATION OF SMART ROOFING SYSTEMS

4.9.3 USE OF LIGHTWEIGHT AND HIGH-STRENGTH ALLOYS

4.9.4 PREFABRICATION AND MODULAR ROOFING SOLUTIONS

4.9.5 DIGITAL DESIGN AND CUSTOMIZATION TOOLS

4.9.6 SUSTAINABLE MANUFACTURING PRACTICES

4.1 TARIFFS AND THEIR IMPACT ON THE MARKET

4.10.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.10.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.10.3 VENDOR SELECTION CRITERIA DYNAMICS

4.10.4 IMPACT ON SUPPLY CHAIN

4.10.4.1 RAW MATERIAL PROCUREMENT

4.10.4.2 MANUFACTURING AND PRODUCTION

4.10.4.3 LOGISTICS AND DISTRIBUTION

4.10.4.4 PRICE PITCHING AND POSITION OF MARKET

4.10.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.10.5.1 SUPPLY CHAIN OPTIMIZATION

4.10.5.2 JOINT VENTURE ESTABLISHMENTS

4.10.6 IMPACT ON PRICES

4.10.7 REGULATORY INCLINATION

4.10.7.1 FTAS ASEAN FTAS AND TRADE ALIGNMENT

4.10.7.2 BONDING & DUTY WAIVERS

4.10.7.3 SAFEGUARD & ANTI-DUMPING REGULATIONS

4.10.7.4 INDUSTRIAL POLICY ALIGNMENT

4.11 FACTORS INFLUENCING BUYING DECISION OF END-USERS IN THE MALAYSIA METAL ROOFING MARKET

4.11.1 CLIMATIC PERFORMANCE AND WEATHER RESILIENCE

4.11.2 MATERIAL TYPE, THICKNESS, AND COATING QUALITY

4.11.3 ARCHITECTURAL DESIGN AND AESTHETICS

4.11.4 COST AND LONG-TERM VALUE

4.11.5 ENERGY EFFICIENCY AND GREEN CERTIFICATIONS

4.11.6 SUPPLIER REPUTATION AND AFTER-SALES SERVICE

4.11.7 INSTALLATION EASE AND TECHNICAL COMPATIBILITY

4.11.8 FIRE RESISTANCE, SAFETY, AND COMPLIANCE STANDARDS

4.11.9 MARKETING, AWARENESS, AND EDUCATION PROGRAMS

4.11.10 CONCLUSION

4.12 IMPACT OF ECONOMIC SLOWDOWN ON THE MALAYSIA METAL ROOFING MARKET

4.12.1 IMPACT OF PRICE

4.12.2 IMPACT ON SUPPLY CHAIN

4.12.3 IMPACT ON SHIPMENT

4.12.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.12.5 CONCLUSION

4.13 ENVIRONMENTAL IMPACT OF THE MALAYSIA METAL ROOFING MARKET

4.13.1 LIFECYCLE EMISSIONS AND ENERGY USE

4.13.2 URBAN HEAT ISLAND (UHI) MITIGATION

4.13.3 WASTE GENERATION AND RECYCLING

4.13.4 WATER RUNOFF AND POLLUTION

4.13.5 ROLE IN GREEN BUILDING AND CIRCULAR ECONOMY

4.13.6 CONCLUSION

4.14 INDUSTRY ECO-SYSTEM ANALYSIS OF THE MALAYSIA METAL ROOFING MARKET

4.14.1 RAW MATERIAL SUPPLIERS

4.14.2 FABRICATION PLANTS

4.14.3 INSTALLERS & CONTRACTORS

4.14.4 POLICY & REGULATION

4.14.5 LOGISTICS INFRASTRUCTURE

4.14.6 ACCESSORIES & FINISHES

4.14.7 CERTIFICATIONS

4.15 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.15.1 JOINT VENTURES

4.15.2 MERGERS AND ACQUISITIONS (M&A)

4.15.3 LICENSING AND PARTNERSHIPS

4.16 COMPANY’S OVERVIEW

4.16.1 SWISSMA BUILDING TECHNOLOGIES SDN. BHD.

4.16.2 THUNG HING METAL INDUSTRY SDN. BHD.

4.16.3 ASTINO BERHAD

4.16.4 YARKER INDUSTRIES

4.16.5 SJ CLASSIC INDUSTRIES SDN. BHD.

4.16.6 KHP STEEL PRODUCT (M) SDN. BHD.

4.16.7 NS BLUESCOPE MALAYSIA SDN. BHD

4.16.8 RENZO BUILDERS (M) SDN. BHD.

4.16.9 UNITED SEASONS SDN. BHD.

4.16.10 TWENTY-TWENTY TECHNOLOGY SDN. BHD.

4.16.11 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSTRUCTION ACTIVITIES BOOST DEMAND FOR METAL ROOFING

6.1.2 DURABILITY AND LONGEVITY INCREASE PREFERENCE FOR METAL ROOFS

6.1.3 GOVERNMENT INFRASTRUCTURE PROJECTS STIMULATE ROOFING MATERIAL CONSUMPTION

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INSTALLATION COST LIMITS MARKET ADOPTION

6.2.2 FLUCTUATING RAW MATERIAL PRICES IMPACT PROFIT MARGINS

6.3 OPPORTUNITIES

6.3.1 RISING GREEN BUILDING TRENDS FAVOR SUSTAINABLE ROOFING SOLUTIONS

6.3.2 URBANIZATION BOOSTS DEMAND FOR MODERN ROOFING

6.4 CHALLENGES

6.4.1 SKILLED LABOR SHORTAGE HAMPERS QUALITY METAL ROOF INSTALLATIONS

6.4.2 COMPETITION FROM ALTERNATIVE ROOFING MATERIALS LIMITS GROWTH

7 MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CORRUGATED PANELS

7.3 STANDING SEAM

7.4 TILE-INSPIRED

7.5 SHINGLES

7.6 SHAKE-INSPIRED

7.7 SLATE-INSPIRED

7.8 OTHERS

8 MALAYSIA METAL ROOFING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 STEEL

8.3 ALUMINUM

8.4 STONE-COATED

8.5 ZINC

8.6 COPPER

8.7 TIN

8.8 BRONZE

8.9 OTHERS

9 MALAYSIA METAL ROOFING MARKET, BY PRICE

9.1 OVERVIEW

9.2 5.1 TO 10 USD

9.3 UP TO 5 USD

9.4 MORE THAN 10 USD

10 MALAYSIA METAL ROOFING MARKET, BY COLOR

10.1 OVERVIEW

10.2 STANDARD COLOR

10.3 MATTE FINISHES USD

10.4 DESIGNER FINISHES

11 MALAYSIA METAL ROOFING MARKET, BY THICKNESS

11.1 OVERVIEW

11.2 26 GAUGE

11.3 24 GAUGE

11.4 29 GAUGE

11.5 22 GAUGE

11.6 20 GAUGE

11.7 OTHERS

12 MALAYSIA METAL ROOFING MARKET, BY LENGTH

12.1 OVERVIEW

12.2 12 FT

12.3 10 FT

12.4 14 FT

12.5 16 FT

12.6 8 FT

12.7 OTHERS

13 MALAYSIA METAL ROOFING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 INDUSTRIAL

13.3 COMMERCIAL

13.4 RESIDENTIAL

13.5 AGRICULTURAL

14 MALAYSIA METAL ROOFING MARKET, BY REGION

14.1 MALAYSIA

14.1.1 PENINSULAR

14.1.2 SABAH METAL

14.1.3 SARAWAK

14.1.4 REST OF MALAYSIA

15 MALAYSIA METAL ROOFING MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MALAYSIA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 ASTINO BERHAD

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 EVERGOLD METAL ROOFING SDN. BHD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 SWISSMA

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 OVERSEAMETAL SDN BHD

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 ROOFSEAL (M) SDN. BHD

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 DEP SOON STEEL SDN. BHD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 JUTA STEEL SDN BHD

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 KOMIYA ROOFING (M) SDN BHD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 KONG HONG (KT) SDN BHD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LE NAM MEGASHEET

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 MUTIARA METAL ENTERPRISE SDN BHD

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 NIKKATA METAL ROOFING INDUSTRIES SDN BHD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 POWER METAL & STEEL SDN. BHD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 THUNG HING METAL INDUSTRY SDN BHD

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 CUSTOMER JOURNEY PHASES AND DOMINANT CHANNELS:

TABLE 2 CONSUMER BUYING BEHAVIOUR

TABLE 3 STRATEGIC INNOVATION TYPES AND THEIR ROLE IN ENHANCING COMPETITIVENESS IN MALAYSIA'S METAL ROOFING MARKET

TABLE 4 REGULATORY COVERAGE

TABLE 5 MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 6 MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ. FT)

TABLE 7 MALAYSIA STANDING SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 8 MALAYSIA MECHANICAL SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 9 MALAYSIA DOUBLE LOCK (180-DEGREE SEAM) IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 10 MALAYSIA BATTEN PANEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 11 MALAYSIA METAL ROOFING MARKET, BY MATERIAL, 2015-2035 (USD THOUSAND)

TABLE 12 MALAYSIA STEEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 13 MALAYSIA METAL ROOFING MARKET, BY PRICE, 2015-2035 (USD THOUSAND)

TABLE 14 MALAYSIA METAL ROOFING MARKET, BY COLOR, 2015-2035 (USD THOUSAND)

TABLE 15 MALAYSIA STANDARD COLOR IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 16 MALAYSIA GRAY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 17 MALAYSIA WHITE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 18 MALAYSIA BRONZE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 19 MALAYSIA RED IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 20 MALAYSIA BLUE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 21 MALAYSIA MATTE FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 22 MALAYSIA GREY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 23 MALAYSIA DESIGNER FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 24 MALAYSIA METAL ROOFING MARKET, BY THICKNESS, 2015-2035 (USD THOUSAND)

TABLE 25 MALAYSIA METAL ROOFING MARKET, BY LENGTH, 2015-2035 (USD THOUSAND)

TABLE 26 MALAYSIA METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 27 MALAYSIA INDUSTRIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 28 MALAYSIA COMMERCIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 29 MALAYSIA AGRICULTURE IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 30 MALAYSIA BARN IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 31 MALAYSIA METAL ROOFING MARKET, BY REGION, 2015-2035 (USD THOUSAND)

TABLE 32 MALAYSIA METAL ROOFING MARKET, BY REGION, 2015-2035 (THOUSAND SQ FT)

TABLE 33 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 34 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ FT)

TABLE 35 PENINSULAR MALAYSIA STANDING SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 36 PENINSULAR MALAYSIA MECHANICAL SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 37 PENINSULAR MALAYSIA DOUBLE LOCK (180-DEGREE SEAM) IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 38 PENINSULAR MALAYSIA BATTEN PANEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 39 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY MATERIAL, 2015-2035 (USD THOUSAND)

TABLE 40 PENINSULAR MALAYSIA STEEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 41 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY PRICE, 2015-2035 (USD THOUSAND)

TABLE 42 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY COLOR, 2015-2035 (USD THOUSAND)

TABLE 43 PENINSULAR MALAYSIA STANDARD COLOR IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 44 PENINSULAR MALAYSIA GRADE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 45 PENINSULAR MALAYSIA WHITE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 46 PENINSULAR MALAYSIA BRONZE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 47 PENINSULAR MALAYSIA RED IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 48 PENINSULAR MALAYSIA BLUE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 49 PENINSULAR MALAYSIA MATTE FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 50 PENINSULAR MALAYSIA GREY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 51 PENINSULAR MALAYSIA DESIGNER FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 52 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY THICKNESS, 2015-2035 (USD THOUSAND)

TABLE 53 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY LENGTH, 2015-2035 (USD THOUSAND)

TABLE 54 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 55 PENINSULAR MALAYSIA INDUSTRIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 56 PENINSULAR MALAYSIA COMMERCIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 57 PENINSULAR MALAYSIA AGRICULTURE IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 58 PENINSULAR MALAYSIA BARN IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 59 SABAH METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 60 SABAH METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ FT)

TABLE 61 SABAH STANDING SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 62 SABAH MECHANICAL SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 63 SABAH DOUBLE LOCK (180-DEGREE SEAM) IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 64 SABAH BATTEN PANEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 65 SABAH METAL ROOFING MARKET, BY MATERIAL, 2015-2035 (USD THOUSAND)

TABLE 66 SABAH STEEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 67 SABAH METAL ROOFING MARKET, BY PRICE, 2015-2035 (USD THOUSAND)

TABLE 68 SABAH METAL ROOFING MARKET, BY COLOR, 2015-2035 (USD THOUSAND)

TABLE 69 SABAH STANDARD COLOR IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 70 SABAH GRADE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 71 SABAH WHITE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 72 SABAH BRONZE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 73 SABAH RED IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 74 SABAH BLUE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 75 SABAH MATTE FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 76 SABAH GREY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 77 SABAH DESIGNER FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 78 SABAH METAL ROOFING MARKET, BY THICKNESS, 2015-2035 (USD THOUSAND)

TABLE 79 SABAH METAL ROOFING MARKET, BY LENGTH, 2015-2035 (USD THOUSAND)

TABLE 80 SABAH METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 81 SABAH INDUSTRIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 82 SABAH COMMERCIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 83 SABAH AGRICULTURE IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 84 SABAH BARN IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 85 SARAWAK METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 86 SARAWAK METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ FT)

TABLE 87 SARAWAK STANDING SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 88 SARAWAK MECHANICAL SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 89 SARAWAK DOUBLE LOCK (180-DEGREE SEAM) IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 90 SARAWAK BATTEN PANEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 91 SARAWAK METAL ROOFING MARKET, BY MATERIAL, 2015-2035 (USD THOUSAND)

TABLE 92 SARAWAK STEEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 93 SARAWAK METAL ROOFING MARKET, BY PRICE, 2015-2035 (USD THOUSAND)

TABLE 94 SARAWAK METAL ROOFING MARKET, BY COLOR, 2015-2035 (USD THOUSAND)

TABLE 95 SARAWAK STANDARD COLOR IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 96 SARAWAK GRADE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 97 SARAWAK WHITE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 98 SARAWAK BRONZE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 99 SARAWAK RED IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 100 SARAWAK BLUE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 101 SARAWAK MATTE FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 102 SARAWAK GREY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 103 SARAWAK DESIGNER FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 104 SARAWAK METAL ROOFING MARKET, BY THICKNESS, 2015-2035 (USD THOUSAND)

TABLE 105 SARAWAK METAL ROOFING MARKET, BY LENGTH, 2015-2035 (USD THOUSAND)

TABLE 106 SARAWAK METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 107 SARAWAK INDUSTRIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 108 SARAWAK COMMERCIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 109 SARAWAK AGRICULTURE IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 110 SARAWAK BARN IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 111 REST OF MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 112 REST OF MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ FT)

List of Figure

FIGURE 1 MALAYSIA METAL ROOFING MARKET

FIGURE 2 MALAYSIA METAL ROOFING MARKET: DATA TRIANGULATION

FIGURE 3 MALAYSIA METAL ROOFING MARKET: DROC ANALYSIS

FIGURE 4 MALAYSIA METAL ROOFING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 MALAYSIA METAL ROOFING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MALAYSIA METAL ROOFING MARKET: MULTIVARIATE MODELLING

FIGURE 7 MALAYSIA METAL ROOFING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MALAYSIA METAL ROOFING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MALAYSIA METAL ROOFING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MALAYSIA METAL ROOFING MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 SEVEN SEGMENTS COMPRISE THE MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING CONSTRUCTION ACTIVITIES IS EXPECTED TO DRIVE THE MALAYSIA METAL ROOFING MARKET IN THE FORECAST PERIOD OF 2025 TO 2035

FIGURE 15 THE CORRUGATED PANELS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MALAYSIA METAL ROOFING MARKET IN 2025 AND 2035

FIGURE 16 PATENT ANALYSIS BY PRODUCT

FIGURE 17 TOTAL PATENTS IN THE METAL ROOFING MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MALAYSIA METAL ROOFING MARKET

FIGURE 19 MALAYSIA METAL ROOFING MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 MALAYSIA METAL ROOFING MARKET: BY MATERIAL, 2024

FIGURE 21 MALAYSIA METAL ROOFING MARKET: BY PRICE, 2024

FIGURE 22 MALAYSIA METAL ROOFING MARKET: BY COLOR, 2024

FIGURE 23 MALAYSIA METAL ROOFING MARKET: BY THICKNESS, 2024

FIGURE 24 MALAYSIA METAL ROOFING MARKET: BY LENGTH, 2024

FIGURE 25 MALAYSIA METAL ROOFING MARKET: BY APPLICATION, 2024

FIGURE 26 MALAYSIA METAL ROOFING MARKET: COMPANY SHARE 2024 (%)

Malaysia Metal Roofing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Malaysia Metal Roofing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Malaysia Metal Roofing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.