Global Methyl Ester Ethoxylates Market Size

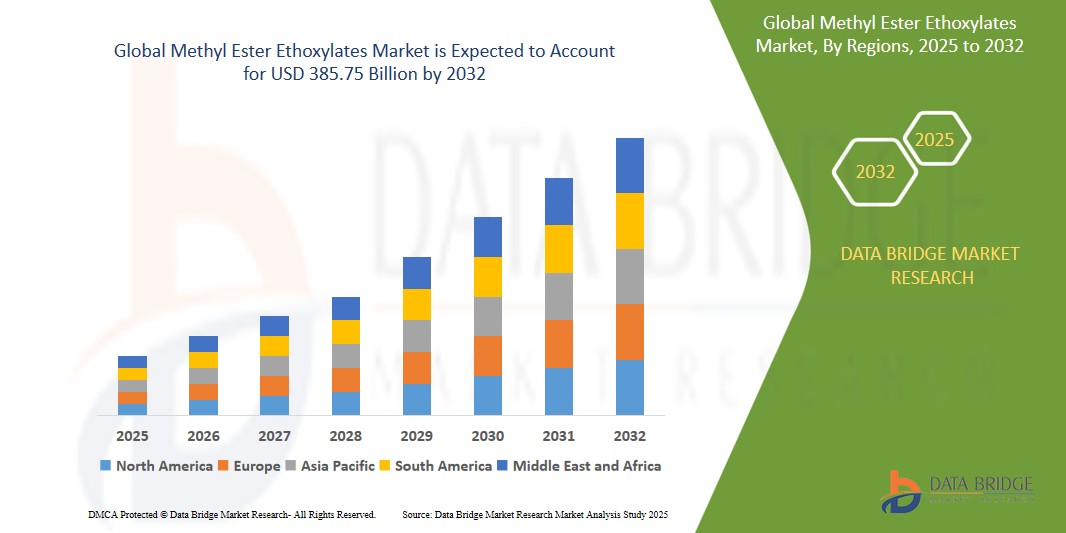

- The Global Methyl Ester Ethoxylates Market was valued at USD 253.27 billion in 2024 and is expected to reach USD 385.75 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.4%, primarily driven by the growing consumer awareness regarding health and wellness

- This growth is driven by factors such as busy lifestyles and a growing aging population are fuelling demand for products that enhance health and prevent disease

Global Methyl Ester Ethoxylate Market Analysis

- Methyl Ester Ethoxylates (MEE) are non-ionic surfactants synthesized by ethoxylation of fatty acid methyl esters, primarily derived from vegetable oils such as palm, soybean, or rapeseed oil. These biodegradable surfactants are characterized by excellent emulsifying, wetting, and dispersing properties. Due to their low toxicity and eco-friendly profile, MEE compounds are increasingly used across applications in household detergents, personal care products, industrial cleaners, agricultural adjuvants, and textile processing.

- The MEE market is witnessing steady expansion, driven by rising demand for sustainable and non-toxic surfactants in response to tightening environmental regulations and growing consumer awareness. Key manufacturers are focusing on developing high-performance, bio-based ethoxylates that meet stringent regulatory norms while offering enhanced cleaning efficiency. This push toward green chemistry is fostering innovation in feedstock sourcing and process optimization, helping MEE gain competitive ground against traditional petroleum-based surfactants.

- Asia-Pacific is emerging as the dominant region in the global methyl ester ethoxylate market, fueled by rapid industrial growth and expanding production capacities in countries like China, India, and Malaysia. The availability of abundant natural oil feedstocks, coupled with lower labor and operational costs, has positioned the region as a manufacturing hub for bio-based surfactants. For instance, in 2023, India’s export volume of MEE increased by 15% YoY, with notable demand from Europe for applications in eco-labeled detergents and agrochemical formulations.

- Globally, the shift toward sustainable chemical formulations and the adoption of circular economy principles are creating long-term growth opportunities for MEE. As end-user industries increasingly prioritize environmental compliance and product safety, methyl ester ethoxylates are gaining traction as a key alternative to conventional ethoxylates. Continued R&D in catalyst optimization, feedstock flexibility, and functional property enhancement is expected to shape the future of the MEE market, aligning it with evolving industrial sustainability goals and consumer preferences for green products.

Report Scope and Methyl Ester Ethoxylates Market

|

Attributes |

Methyl Ester Ethoxylates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific (APAC)

South America

Middle East and Africa (MEA)

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Methyl Ester Ethoxylates Market Trends

“Rising Adoption of Bio-Based Surfactants in Line with Green Chemistry Initiatives”

- A key trend shaping the global methyl ester ethoxylates market is the rising adoption of bio-based surfactants driven by global sustainability goals and a shift toward greener alternatives to conventional petrochemical-based surfactants.

- Amid increasing regulatory scrutiny and consumer demand for safer, environmentally friendly ingredients, manufacturers are focusing on developing MEE derived from renewable feedstocks such as palm, soybean, and rapeseed oils. These bio-based ethoxylates offer high biodegradability, lower aquatic toxicity, and effective surface-active properties, making them ideal for a wide range of end-use applications in home care, personal care, industrial cleaning, and agrochemicals.

- In response, producers are optimizing production technologies to reduce the carbon footprint and eliminate harmful byproducts, such as using enzyme catalysis, green ethoxylation processes, and zero-waste production models. These innovations not only enhance product performance but also align with the rising preference for eco-certified formulations in major consumer and industrial markets.

- For instance, companies like KLK Oleo and Clariant AG are expanding their portfolios of RSPO-certified and bio-based ethoxylates, enabling global detergent and personal care brands to meet their environmental targets while maintaining product efficacy. Meanwhile, Indorama Ventures has invested in R&D for sustainable surfactant development in response to growing European demand for low-impact cleaning ingredients.

- As industries move toward circular economy models and adopt ESG (Environmental, Social, and Governance) principles, the demand for bio-based methyl ester ethoxylates is expected to surge. This trend is fostering strategic alliances, capacity expansions, and portfolio realignments, positioning MEE as a central player in the future of sustainable surfactants and specialty chemicals.

Driver

“Rising Demand for Biodegradable and Eco-Friendly Surfactants in Detergents and Agrochemicals”

- The methyl ester ethoxylates market is being significantly driven by the growing need for biodegradable, low-toxicity surfactants, especially in industries like home care, industrial cleaning, and agriculture.

- In the detergents segment, consumers and manufacturers alike are seeking greener alternatives to conventional ethoxylates, spurred by environmental concerns and evolving regulatory frameworks (e.g., REACH, EPA Safer Choice).

- In agriculture, MEE is used as an adjuvant in pesticide and herbicide formulations, where its high emulsification and wetting efficiency improves product performance while minimizing environmental harm.

For instance, companies in Europe and North America are reformulating product lines with MEE to meet eco-label certifications and appeal to a growing base of eco-conscious consumers and farmers.

- With sustainability becoming a critical purchasing criterion across end-use sectors, methyl ester ethoxylates are increasingly viewed as the go-to solution for balancing performance and environmental compliance.

Opportunity

“Expansion into Premium Personal Care and Industrial Applications”

- The market presents considerable opportunity through portfolio diversification into high-value segments such as personal care formulations, textile processing, and metal cleaning.

- As consumer and industrial segments move toward milder, skin-safe, and non-irritant surfactants, MEE—with its naturally derived feedstock and non-ionic structure—offers strong appeal in shampoos, creams, and facial cleansers.

- For example, Clariant AG and KLK Oleo are actively marketing cosmetic-grade MEE blends that are both RSPO-certified and dermatologically safe, opening the door to premium positioning in personal care.

- In parallel, industrial sectors are adopting MEE in low-foam cleaners, metal degreasers, and textile finishing agents, capitalizing on its cost-effectiveness and eco-profile.

- By investing in application-specific formulations and co-developing with end users, manufacturers can unlock value-added applications and expand their customer base across B2B and B2C markets.

Restraint/Challenge

“Feedstock Price Volatility and Supply Chain Disruptions”

- A primary challenge in the methyl ester ethoxylates market arises from the volatile pricing and availability of natural oil-based feedstocks such as palm, soybean, and rapeseed oil.

- These raw materials are subject to climate impacts, geopolitical tensions, and trade regulations, which can affect both cost structure and production planning for MEE manufacturers.

- For instance, palm oil price fluctuations due to deforestation concerns or export bans in key producing countries like Indonesia and Malaysia have had ripple effects on bio-surfactant margins.

- Moreover, dependence on a limited number of oil feedstocks raises supply concentration risks, making the market vulnerable to disruption.

- To address this, companies must focus on feedstock diversification, backward integration, and strategic supplier partnerships to ensure consistent availability and pricing stability while maintaining sustainability commitments.

The market is segmented on the basis product type, application and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By Distribution Channel |

|

Methyl Ester Ethoxylates Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Methyl Ester Ethoxylates Market”

- Asia-Pacific currently dominates the global methyl ester ethoxylates (MEE) market, driven by large-scale consumption across detergents, agrochemicals, and industrial cleaning applications.

- China and India are key contributors due to the presence of major oleochemical producers, low-cost manufacturing infrastructure, and growing demand for eco-friendly surfactants in both industrial and consumer sectors.

- Strong agricultural activity across Southeast Asia has fueled the use of MEE as adjuvants in crop protection products, while the booming middle-class population is pushing demand for green household cleaners and personal care items.

- Asia-Pacific is also home to leading chemical manufacturers and R&D centers, which are driving cost-effective production innovations and regional supply chain resilience.

- Increasing regulatory emphasis on sustainable chemicals and expanding downstream applications are expected to sustain the region's leadership in the global MEE market.

“North America is Projected to Register the Highest Growth Rate”

- North America is expected to witness the highest CAGR in the methyl ester ethoxylates market, propelled by rising environmental awareness, stringent regulatory mandates, and growing demand for biodegradable surfactants across industries.

- The United States and Canada are leading the shift toward non-toxic, plant-derived ethoxylates in home care, personal care, and industrial formulations, aligned with EPA Safer Choice and Green Seal certifications.

- Strong R&D infrastructure, coupled with increasing investments in bio-based chemical production and a consumer preference for green-label products, is driving innovation and product adoption.

- The agriculture sector is also contributing to market expansion, with MEE-based surfactants increasingly used in sustainable crop protection and foliar formulations.

- Additionally, strategic collaborations between regional chemical giants and global brands, along with supportive government policies for clean manufacturing, are accelerating growth, positioning North America as a rapidly expanding market for methyl ester ethoxylates.

Methyl Ester Ethoxylates Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Elevance (U.S.)

- Indorama Ventures Public Company Limited (Thailand)

- Clariant AG (Switzerland)

- Guangzhou Jiangyan Chemical Co., Ltd (China)

- Kuala Lumpur Kepong Berhad (KLK) (Malaysia)

- Huntsman (U.S.)

- KLK Oleo (Malaysia)

- Lion Corporation (Japan)

- Ineos Group (UK)

- Jet Technologies (Australia)

Latest Developments in Global Methyl Ester Ethoxylates Market

- April 2022: Indorama Ventures Public Company Limited (IVL) completed its acquisition of 100% of Brazil-based Oxiteno SA Indústria e Comércio, a leading global supplier of high-value surfactants. Through the acquisition, IVL can extend its growth into highly attractive markets in Latin America and the United States, with additional potential to expand in Europe and Asia, which is expected to augment the growth of the market studied.

According to Cerved, the detergent and cleaning products sector grew moderately in 2021, supported by increasing demand from industrial, commercial, and household cleaning activities. Moreover, the surge in COVID-19 cases in the country fueled the demand for hygiene maintenance and cleanliness.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Methyl Ester Ethoxylates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Methyl Ester Ethoxylates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Methyl Ester Ethoxylates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.