Mexico Dietary Supplements Market

Market Size in USD Million

CAGR :

%

USD

1,827.79 Million

USD

2,880.27 Million

2025

2033

USD

1,827.79 Million

USD

2,880.27 Million

2025

2033

| 2026 –2033 | |

| USD 1,827.79 Million | |

| USD 2,880.27 Million | |

|

|

|

|

Mexico Dietery Supplements Market Size

- The Mexico Dietary Supplements Market was valued at USD 1,827.79 million in 2025 and is expected to reach USD 2880.27 million by 2033

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.9%, driven by the increasing adoption of cloud-based solutions, digital transformation initiatives across industries, and the rising need for real-time data analytics to enhance business efficiency and decision-making

- This growth is further fueled by the rising demand for dietary supplements in Mexico, driven by increasing health awareness, growing fitness trends, and a surge in preventive healthcare consumption among the population.

Mexico Dietery Supplements Market Analysis

- Rising health awareness and preventive healthcare trends in Mexico are boosting demand for dietary supplements, including vitamins, minerals, proteins, and herbal products, with urban populations increasingly adopting these products to improve overall wellness and immunity.

- Vitamins dominate the Mexican market due to wide consumer acceptance, while protein and herbal supplements are gaining traction, driven by fitness trends, holistic health practices, and growing interest in functional nutrition among millennials and working professionals.

- Distribution channels in Mexico include pharmacies, health stores, supermarkets, and online platforms, with e-commerce rapidly expanding due to convenience, wider product availability, and growing digital adoption, complementing traditional retail’s strong regional presence.

- Market growth is supported by rising disposable incomes, urbanization, government health initiatives, and increasing consumer willingness to invest in preventive nutrition, positioning Mexico as a key emerging market for dietary supplements in Latin America.

- The Vitamins segment is expected to dominate the market with a market share of 30.02% due to wider product availability, and growing digital adoption, complementing traditional retail’s strong regional presence

Report Scope and Mexico Dietary Supplements Market Segmentation

|

Attributes |

Mexico Dietery Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mexico Dietery Supplements Market Trends

“Increasing public focus on preventive health, wellness practices”

- Increasing public focus on preventive health, wellness practices and nutrition improvement in Mexico is emerging as a significant driver for the Mexico Dietary Supplements Market.

- Greater awareness of healthy lifestyles, rising interest in immunity-support products and expanding engagement with fitness, weight-management and general wellbeing routines are stimulating consumer adoption of supplements across age groups.

- National health campaigns, expanding access to digital health information and growing recognition of nutrition’s role in chronic-disease prevention have further strengthened openness to supplementation.

- As consumers pursue proactive self-care rather than reactive treatment, the demand for vitamins, minerals, herbal extracts, probiotics and functional nutrition products is being reinforced across both urban and semi-urban populations.

Mexico Dietery Supplements Market Dynamics

Driver

“Increase in Chronic Disease Burden”

- Rising public health awareness and the escalating burden of chronic and lifestyle-related diseases are serving as key demand drivers for the Mexico Dietary Supplements Market in Mexico. As consumers become more mindful of preventive healthcare, nutrition optimization and immune support,

- Demand for vitamins, minerals, functional foods and herbal supplements is expanding. Concurrently, elevated rates of obesity, diabetes, hypertension and micronutrient deficiencies are prompting individuals to adopt supplementation as part of self-care strategies. These developments are broadening the target audience for dietary supplements and increasing willingness to invest in wellness-oriented products across demographic segments..

- It is concluded that the rising health-awareness and chronic disease burden in Mexico form a foundational driver for the Mexico Dietary Supplements Market. The documented high prevalence of obesity, diabetes, hypertension and sub-optimal nutritional patterns creates a substantial addressable consumer segment seeking preventive and supportive supplementation.

- As wellness culture strengthens and consumer self-care investment grows, market participants are positioned to capture incremental demand through targeted nutritional-support products, especially if they align with preventive-health narratives.

Opportunity

“Differentiated Product Development Like Plant‑Based, Organic,Clean‑Label, Tailored to Specific Demographics”

- The growing consumer preference for plant-based, organic, clean-label and demographic-tailored dietary supplements in Mexico is being assessed as a strategic market opportunity. As wellness-oriented consumers place higher value on ingredient transparency, sustainability, hypoallergenic or vegan formulations, and age- or lifestyle-specific product positioning (e.g., female health, senior vitality, active sports nutrition), manufacturers are positioned to introduce differentiated SKUs and premium-tier brands.

- With the Mexican market showing increased uptake of natural-ingredient, herbal and plant-based formats, there exists a clear opening for product innovation, premiumization and segmentation. These developments enable value-chain participants to access underserved niches, command higher unit pricing, extend shelf-life, and foster brand loyalty through customised formulations and sustainable credentials.

- It is concluded that differentiated product development centred on plant-based, organic, clean-label and demographic-tailored formulations represents a high-leverage opportunity for the Mexican Mexico Dietary Supplements Market.

- The documented growth of wellness segments, the explicit consumer preference for natural and plant-derived formats, and the global momentum behind clean-label nutrition all point toward a favourable environment for targeted innovation. Market participants that develop premium, niche-oriented formulations—backed by transparency, sustainability and segmentation—are well positioned to capture elevated price points, enhance brand loyalty and extend consumption from broad to specialised consumer segments.

Restraint/Challenge

“Regulatory Ambiguity, Quality & Safety Concerns”

- Regulatory ambiguity and persistent quality and safety concerns are acting as material restraints on the Mexico Dietary Supplements Market in Mexico. The lack of mandatory pre-market registration for many supplement categories, the broad product classification options and variability in enforcement create uncertainty for suppliers and manufacturers.

- This regulatory complexity raises risks of non-compliance, inconsistent product quality and safety breaches, which can erode consumer confidence, increase liability exposure and elevate costs for certification, testing and liability insurance. These dynamics have the effect of slowing new product launches, raising barriers to market entry and limiting the potential for scale particularly among smaller firms that lack dedicated regulatory-governance infrastructure.

- It is concluded that regulatory ambiguity combined with quality and safety concerns imposes a significant operational burden on the dietary supplements sector in Mexico. The absence of comprehensive mandatory registration for many products,

- variations in classification and enforcement, and potential for sub-standard or unsafe products entering the market reduce industry predictability and elevate risk profiles. Market participants will therefore need to invest in enhanced regulatory-governance, quality-assurance protocols and consumer-trust frameworks to mitigate risk, maintain brand integrity and enable sustainable growth..

Mexico Dietery Supplements Market Scope

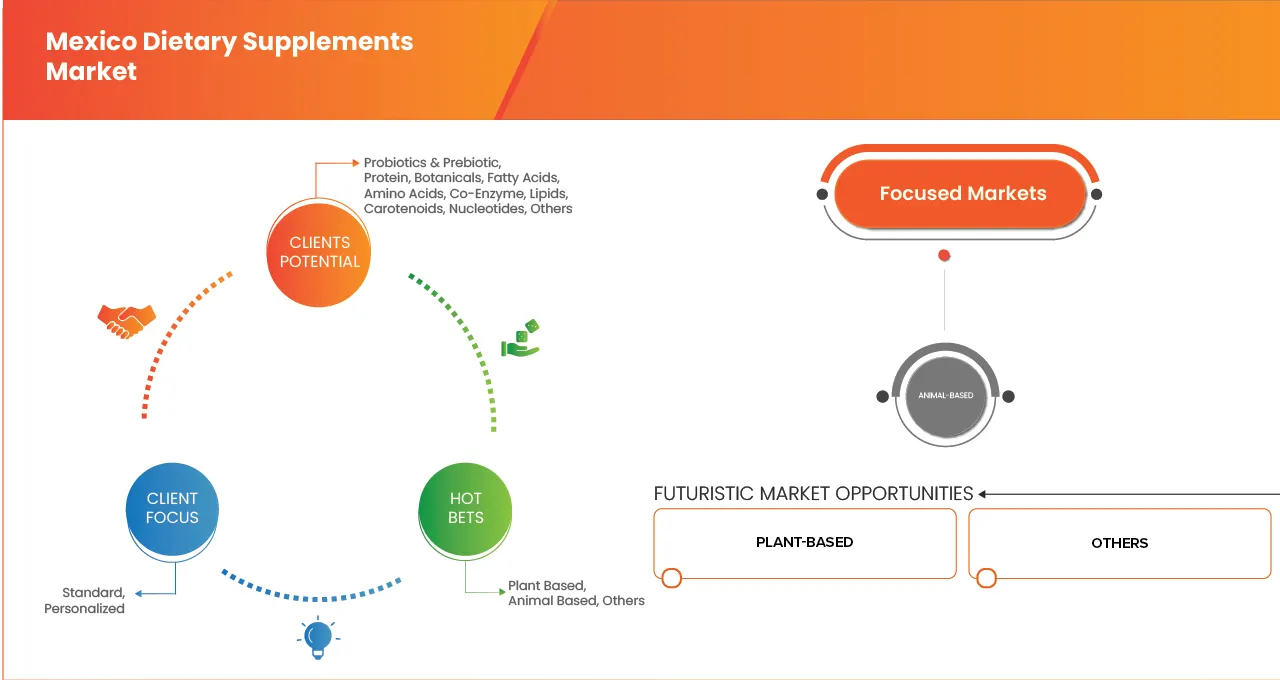

The Mexico Dietary Supplements Market is categorized into nine notable segments based on, product, type, product category, source type, nature, form, function, end user, and distribution channel.

- By Product

On the basis of Product, the Mexico Dietary Supplements Market is segmented into vitamins, minerals, probiotics & prebiotics, protein, botanicals, fatty acids, amino acids, co-enzyme, lipids, carotenoids, nucleotides, and others. In 2026, the vitamins segment is expected to dominate the Mexico Dietary Supplements Market with a 30.02% market share.

The vitamins segment is also expected to register the highest CAGR of 5.2% due to increasing consumer awareness regarding micronutrient deficiencies, growing emphasis on preventive healthcare, widespread availability of cost-effective multivitamin products, and rising recommendations from healthcare professionals for daily vitamin intake to support immunity, energy metabolism, and overall well-being.

- By Type

On the basis of Type, the market is segmented into single compound, and blended/ fortified. In 2026, the single compound segment is expected to dominate the Mexico Dietary Supplements Market, with a 62.91% market share.

The type segment is also expected to register the highest CAGR of 6.5%, driven by increasing consumer preference for targeted nutritional solutions, rising awareness of specific micronutrient deficiencies, greater transparency and trust associated with single-ingredient formulations, and the growing use of individual vitamins, minerals, and amino acids for personalized health and wellness management.

- By Product category

On the basis of Product Category, the market is segmented into standalone, and personalized. In 2026, the standard segment is expected to dominate the Mexico Dietary Supplements Market, with 80.03% market share.

The vitamins segment is also expected to register the highest CAGR of 5.6%, driven by its wide availability, lower cost compared to personalized formulations, strong consumer familiarity with conventional supplement formats, and the continued popularity of single-purpose products such as multivitamins, minerals, and probiotics that address common health concerns without requiring customized regimens.

- By Source Type

On the basis of Source Type, the market is segmented into plant based, animal based, and others. The animal based segment is segmented into bovine, fish, poultry, pork, and others. The plant based segment is further sub segmented into plants, nuts, cereals, legumes, and others. In 2026, the plant based segment is expected to dominate the Mexico Dietary Supplements Market, with a 62.80% market share.

The source type segment is also expected to register the highest CAGR of 5.6%, driven by rising consumer inclination toward natural and clean-label products, increasing adoption of vegetarian and flexitarian lifestyles, growing concerns over sustainability and animal welfare, and the expanding availability of plant-derived ingredients such as herbal extracts, plant proteins, and plant-based vitamins that are perceived as safer and more environmentally friendly.

- By Nature

On the basis of Nature, the market is segmented into conventional and organic. In 2026, the conventional segment is expected to dominate the Mexico Dietary Supplements Market, with 81.83% market share.

The nature segment is also expected to register the highest CAGR of 6.0%, driven by its broader product availability, lower price points compared to organic alternatives, strong consumer trust in established conventional supplement brands, and higher penetration across mass retail, pharmacies, and online channels, making it more accessible to a wider population base.

- By Form

On the basis of Form, the market is segmented into nutraceutical products, soft gels, powders, gummies & jellies, lipids, and premixes. The nutraceutical products segmented is further sub segmented into tablets, capsules, and others. In 2026, the nutraceutical products segment is expected to dominate the Mexico Dietary Supplements Market, with a 47.91% market share.

The form segment is also expected to register the highest CAGR of 5.6%, driven by their ease of consumption, long shelf life, widespread consumer familiarity, cost-effectiveness, and strong availability across retail pharmacies, e-commerce platforms, and health stores, making them the preferred choice for daily supplementation

- By Function

On the basis of Function, the market is segmented into general well-being, immunity, sports nutrition, digestive health, heart health, weight management, bone and joint health, skin health, hair health, nail health, others. In 2026, the general well-being segment is expected to dominate the Mexico Dietary Supplements Market, with a 28.31% market share.

The function segment is also expected to register the highest CAGR of 5.7%, driven by growing consumer awareness about preventive healthcare, increasing focus on maintaining overall health and vitality, rising adoption of daily multivitamins and nutritional supplements, and a preference for products that support holistic wellness rather than targeting specific health conditions.

- By End User

On the basis of End User, the market is segmented into women, men, senior citizens, and children. In 2026, the women segment is expected to dominate the Mexico Dietary Supplements Market, with a 35.40% market share.

The end user segment is also expected to register the highest CAGR of 5.7%, driven by increasing health awareness among women, rising demand for supplements supporting beauty, bone health, and hormonal balance, greater focus on preventive healthcare, and the growing popularity of personalized nutrition and wellness products tailored to women’s specific physiological needs.

- By Distribution Channel

On the basis of Distribution channel, the market is segmented into store-based retailers and online based retailers. In 2026, the store-based retailers segment is expected to dominate the Mexico Dietary Supplements Market, with a 68.52% market share.

The distribution channel segment is also expected to register the highest CAGR of 5.5%, driven by strong consumer preference for in-person shopping experiences, immediate product availability, and the trust associated with purchasing from established physical outlets like pharmacies, supermarkets, and health stores.

The Major Market Leaders Operating in the Market Are:

The Mexico Dietary Supplements Market industry is primarily led by well-established companies, including:

- Nestlé S.A. (Switzerland)

- Herbalife International of America, Inc. (U.S.)

- GNC Holdings, LLC (U.S.)

- Optimum Nutrition, Inc. (U.S.)

- NOW Foods (U.S.)

- Garden of Life (U.S.)

- Jarrow Formulas, Inc. (U.S.)

- Solaray (U.S.)

- Botanic Supplements (U.S.)

- Nature's Way Brands, LLC (U.S.)

- MuscleTech (U.S.)

- TecNutritions (U.S.)

- PH&S (U.S.)

- Vital Botanics (United Kingdom)

- DiBAR Laboratories (U.S.)

Latest Developments in Mexico Dietary Supplements Market

- In March 2025, Herbalife announced a major strategic move by entering a binding agreement to acquire Pro2col Health, Pruvit Ventures, and a majority stake in Link BioSciences. Through this acquisition, Herbalife gains complete ownership of Pro2col Health, a digital health company known for its biometric-driven nutrition app, and Pruvit Ventures, a leader in ketone-based dietary supplements. Additionally, acquiring 51% of Link BioSciences gives Herbalife access to advanced capabilities in manufacturing personalized nutritional supplements, including DNA- and biomarker-based formulations. This combined deal strengthens Herbalife’s shift toward personalized, tech-enabled nutrition, allowing the company to blend digital wellness tools with tailored supplement solutions and expand its next-generation product portfolio.

- In May 2024, Optimum Nutrition launched “Gold Standard Hydration” to expand into the electrolyte and endurance segment in the U.S., accompanied by a national marketing campaign focused on sports recovery and athletic performance.

- In July 2025, NOW Foods announced that its in-house laboratories had expanded ISO 17025 accreditation to cover additional chemical and biological scopes, reflecting strengthened analytical capabilities and quality control infrastructure.

- In August 2024, NOW Foods introduced a sugar-free Omega-3 Gummy Chews product delivering 750 mg of fish oil per chew, designed with an advanced delivery system and targeting improved omega-3 intake through a user-friendly format.

- In January 2024, NOW Foods was announced as the official sports nutrition partner of the Brooks Beasts Track Club, aligning NOW’s performance-nutrition brand with elite athletes and elevating brand visibility in the competitive sports segment.

Mexico Dietary Supplements Market Regional Analysis

In Mexico, the Mexico Dietary Supplements Market shows a clear regional concentration and urban-driven growth. The central region — especially around Mexico City along with other major urban hubs — dominates consumption, thanks to high population density, higher disposable incomes, well-developed retail distribution networks and widespread health-awareness among city dwellers. Moreover, urban consumers, particularly younger and middle-class segments, are increasingly drawn to supplements for preventive health, wellness, fitness, muscle recovery and general nutritional support — a shift fueled by rising incidence of lifestyle diseases, growing fitness culture, and demand for clean-label and plant-based formulations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MEXICO DIETARY SUPPLEMENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 END USER COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 BRAND OUTLOOK

4.4 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.4.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.4.1.1 JOINT VENTURES

4.4.1.2 MERGERS AND ACQUISITIONS

4.4.1.3 LICENSING AND PARTNERSHIP

4.4.1.4 TECHNOLOGY COLLABORATIONS

4.4.1.5 STRATEGIC DIVESTMENTS

4.4.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.4.3 STAGE OF DEVELOPMENT

4.4.4 TIMELINES AND MILESTONES

4.4.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.4.6 FUTURE OUTLOOK

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5.4 CONCLUSION

4.6 TECHNOLOGICAL ADVANCEMENT — MEXICO DIETARY SUPPLEMENTS MARKET

4.6.1 DIGITAL MANUFACTURING & AUTOMATION IN SUPPLEMENT PRODUCTION

4.6.2 ADVANCED FORMULATION TECHNOLOGIES: CLINICAL INGREDIENTS & DELIVERY SYSTEMS

4.6.3 SUSTAINABLE INGREDIENT SOURCING & BIO-BASED INNOVATIONS

4.6.4 TESTING, QUALITY ASSURANCE & REGULATORY TECHNOLOGY

4.6.5 PACKAGING, TRACEABILITY & SUPPLY CHAIN VISIBILITY

4.6.6 CONCLUSION

4.7 CONSUMER BUYING BEHAVIOUR

4.8 SUPPLY CHAIN ANALYSIS FOR THE MEXICO DIETARY SUPPLEMENTS MARKET

4.8.1 RAW-MATERIAL PROCUREMENT

4.8.2 MANUFACTURING & FORMULATION

4.8.3 QUALITY CONTROL, TESTING & REGULATORY PRE-CLEARANCE

4.8.4 PACKAGING, LABELLING & CLAIMS CONTROL

4.8.5 LOGISTICS, WAREHOUSING & DISTRIBUTION

4.8.6 DISTRIBUTION CHANNELS (RETAIL, PHARMACIES, ONLINE & MODERN TRADE)

4.8.7 POST-MARKET SURVEILLANCE, ENFORCEMENT & RECALLS

4.8.8 KEY BOTTLENECKS, RISKS & RECOMMENDED MITIGATIONS

4.9 VALUE CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 RAW MATERIAL SUPPLY

4.9.3 COMPONENT MANUFACTURING AND PROCESSING

4.9.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.9.5 DISTRIBUTION AND LOGISTICS

4.9.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.9.7 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S)

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMISATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 CONCLUSION

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 INCREASING PUBLIC FOCUS ON PREVENTIVE HEALTH, WELLNESS PRACTICES

7.1.2 INCREASE IN CHRONIC DISEASE BURDEN

7.1.3 GROWTH OF E‑COMMERCE / BROADER DISTRIBUTION & CONVENIENCE

7.2 RESTRAINT

7.2.1 REGULATORY AMBIGUITY, QUALITY & SAFETY CONCERNS

7.2.2 LIMITED AWARENESS & EDUCATIONAL GAPS, ESPECIALLY OUTSIDE MAJOR CITIES

7.3 OPPORTUNITIES

7.4 DIFFERENTIATED PRODUCT DEVELOPMENT LIKE PLANT‑BASED, ORGANIC, CLEAN‑LABEL, TAILORED TO SPECIFIC DEMOGRAPHICS

7.4.1 LEVERAGING DIGITAL MARKETING & INFLUENCER CHANNELS

7.5 CHALLENGES

7.5.1 HIGH COST OF COMPLIANCE, R&D, AND SUPPLY CHAIN CONSTRAINTS

7.5.2 COMPETITION, MARKET SATURATION & CONSUMER TRUST ISSUES

8 MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE COMPOUND

8.3 BLENDED/ FORTIFIED

9 MEXICO DIETARY SUPPLEMENTS MARKET, BY PRODUCT CATEGORY

9.1 OVERVIEW

9.2 STANDARD

9.3 PERSONALIZED

10 MEXICO DIETARY SUPPLEMENTS MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 VITAMINS

10.3 MINERALS

10.4 PROBIOTICS & PREBIOTIC

10.5 PROTEIN

10.6 BOTANICALS

10.7 FATTY-ACIDS

10.8 A MINO ACIDS

10.9 CO-ENZYME

10.1 LIPIDS

10.11 CAROTENOIDS

10.12 NUCLEOTIDES

10.13 OHTERS

11 MEXICO DIETARY SUPPLEMENTS MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 MEXICO DIETARY SUPPLEMENTS MARKET, BY SOURCE

12.1 OVERVIEW

12.2 PLANT BASED

12.3 ANIMAL BASED

12.4 OTHERS

13 MEXICO DIETARY SUPPLEMENTS MARKET, BY FORM

13.1 OVERVIEW

13.2 NUTRACEUTICAL PRODUCTS

13.2.1 TABLETS

13.2.2 CAPSULE

13.2.3 OTHERS

13.3 SOFT GELS

13.4 POWDERS

13.5 GUMMIES & JELLIES

13.6 LIQUIDS

13.7 PREMIXES

14 MEXICO DIETARY SUPPLEMENTS MARKET, BY FUNCTION

14.1 OVERVIEW

14.2 GENERAL WELL-BEING

14.3 IMMUNITY

14.4 SPORTS NUTRITION

14.5 DIGESTIVE HEALTH

14.6 HEART HEALTH

14.7 WEIGHT MANAGEMENT

14.8 BONE AND JOINT HEALTH

14.9 SKIN HEALTH

14.1 HAIR HEALTH

14.11 NAIL HEALTH

14.12 OTHERS

15 MEXICO DIETARY SUPPLEMENTS MARKET, BY END USER

15.1 OVERVIEW

15.2 WOMEN

15.3 MEN

15.4 CHILDREN

16 MEXICO DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 STORE BASED RETAIL

16.2.1 PHARMACIES

16.2.2 SUPERMARKET/HYPERMARKET

16.2.3 SPECIALITY STORES

16.2.4 HEALTH AND BEAUTY STORES

16.2.5 CONVENIENCE STORE

16.2.6 OTHERS

16.3 ONLINE BASED RETAIL

17 MEXICO DIETARY SUPPLEMENTS MARKET

17.1 COMPANY SHARE ANALYSIS: MEXICO

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 NESTLÉ S.A.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 HERBALIFE INTERNATIONAL OF AMERICA, INC.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 GNC HOLDINGS, LLC

19.3.1 COMPANY SNAPSHOT

19.3.2 PRODUCT PORTFOLIO

19.3.3 RECENT DEVELOPMENT

19.4 OPTIMUM NUTRITION

19.4.1 COMPANY SNAPSHOT

19.4.2 PRODUCT PORTFOLIO

19.4.3 RECENT DEVELOPMENT

19.5 NOW FOODS

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 RECENT DEVELOPMENT

19.6 BOTANIC SUPPLEMENTS (A SUBSIDIARY COMPANY OF BOTANIC HEALTHCARE)

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.6.4 RECENT DEVELOPMENT

19.7 DIBAR LABORATORIES

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 GARDEN OF LIFE

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 JARROW FORMULAS, INC.

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 MUSCLETECH.

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 NATURE'S WAY BRANDS, LLC.

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 PH&S

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 SOLARAY

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 TECNUTRITIONS

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 VITALBOTANICS

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE, 2026-2033(USD MILLION)

TABLE 3 MEXICO DIETARY SUPPLEMENTS MARKET, BY PRODUCT CATEGORY, 2026-2033(USD MILLION)

TABLE 4 MEXICO DIETARY SUPPLEMENTS MARKET, BY PRODUCT CATEGORY, 2026-2033(USD MILLION)

TABLE 5 VITAMINS IN MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE, 2026-2033(USD MILLION)

TABLE 6 VITAMIN B IN MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE, 2026-2033(USD MILLION)

TABLE 7 MINERAL IN MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE, 2026-2033(USD MILLION)

TABLE 8 LIPIDS IN MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE, 2026-2033(USD MILLION)

TABLE 9 CAROTENOIDS IN MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE, 2026-2033(USD MILLION)

TABLE 10 MEXICO DIETARY SUPPLEMENTS MARKET, BY NATURE, 2018-2033 (USD MILLION)

TABLE 11 MEXICO DIETARY SUPPLEMENTS MARKET, BY SOURCE, 2018-2033 (USD MILLION)

TABLE 12 PLANT BASED IN MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE, 2026-2033(USD MILLION)

TABLE 13 ANIMAL BASED IN MEXICO DIETARY SUPPLEMENTS MARKET, BY TYPE, 2026-2033(USD MILLION)

TABLE 14 MEXICO DIETARY SUPPLEMENTS MARKET, BY FORM, 2018-2033 (USD MILLION)

TABLE 15 MEXICO DIETARY SUPPLEMENTS MARKET, NUTRACEUTICAL PRODUCTS, BY TYPE, 2018-2033 (USD MILLION)

TABLE 16 MEXICO DIETARY SUPPLEMENTS MARKET, BY FUNCTION, 2018-2033 (USD MILLION)

TABLE 17 MEXICO DIETARY SUPPLEMENTS MARKET, BY END USER, 2018-2033 (USD MILLION)

TABLE 18 MEXICO DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 19 MEXICO DIETARY SUPPLEMENTS MARKET, STORE BASED RETAIL, BY TYPE, 2018-2033 (USD MILLION)

List of Figure

FIGURE 1 MEXICO DIETARY SUPPLEMENTS MARKET: SEGMENTATION

FIGURE 2 MEXICO DIETARY SUPPLEMENTS MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO DIETARY SUPPLEMENTS MARKET: DROC ANALYSIS

FIGURE 4 MEXICO DIETARY SUPPLEMENTS MARKET: COUNTRY WISE MARKET ANALYSIS

FIGURE 5 MEXICO DIETARY SUPPLEMENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO DIETARY SUPPLEMENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MEXICO DIETARY SUPPLEMENTS MARKET: PRODUCT LIFELINE CURVE

FIGURE 8 MEXICO DIETARY SUPPLEMENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MEXICO DIETARY SUPPLEMENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MEXICO DIETARY SUPPLEMENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 END USER COVERAGE GRID

FIGURE 12 MEXICO DIETARY SUPPLEMENTS MARKET: SEGMENTATION

FIGURE 13 MEXICO DIETARY SUPPLEMENTS MARKET: EXECUTIVE SUMMARY

FIGURE 14 TWELEVE SEGMENTS COMPRISE THE MEXICO DIETARY SUPPLEMENTS MARKET, BY PRODUCT (2025)

FIGURE 15 MEXICO DIETARY SUPPLEMENTS MARKET: STRATEGIC DECISIONS

FIGURE 16 INCREASING PUBLIC FOCUS ON PREVENTIVE HEALTH, WELLNESS PRACTICES IS EXPECTED TO DRIVE THE MEXICO DIETARY SUPPLEMENTS MARKET GROWTH IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 VITAMIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO DIETARY SUPPLEMENTS MARKET IN THE FORECAST PERIOD OF 2026 & 2033

FIGURE 18 PESTAL ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO DIETARY SUPPLEMENTS MARKET

FIGURE 20 MEXICO DIETARY SUPPLEMENTS MARKET: BY TYPE, 2025

FIGURE 21 MEXICO DIETARY SUPPLEMENTS MARKET: BY PRODUCT CATEGORY, 2025

FIGURE 22 MEXICO DIETARY SUPPLEMENTS MARKET: BY PRODUCT, 2025

FIGURE 23 MEXICO DIETARY SUPPLEMENTS MARKET: BY NATURE, 2025

FIGURE 24 MEXICO DIETARY SUPPLEMENTS MARKET: BY SOURCE, 2025

FIGURE 25 MEXICO DIETARY SUPPLEMENTS MARKET: BY FORM, 2025

FIGURE 26 MEXICO DIETARY SUPPLEMENTS MARKET: BY FUNCTION, 2025

FIGURE 27 MEXICO DIETARY SUPPLEMENTS MARKET: BY END USER, 2025

FIGURE 28 MEXICO DIETARY SUPPLEMENTS MARKET BY DISTRIBUTION CHANNEL, 2024

FIGURE 29 MEXICO DIETARY SUPPLEMENTS MARKET: COMPANY SHARE 2025 (%)

Mexico Dietary Supplements Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Mexico Dietary Supplements Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Mexico Dietary Supplements Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.