Mexico Oncology Drugs Market

Market Size in USD Billion

CAGR :

%

USD

1.88 Billion

USD

4.30 Billion

2025

2033

USD

1.88 Billion

USD

4.30 Billion

2025

2033

| 2026 –2033 | |

| USD 1.88 Billion | |

| USD 4.30 Billion | |

|

|

|

|

Mexico Oncology Drugs Market Size

- The Mexico Oncology Drugs Market was valued at USD 1.88 billion in 2024 and is expected to reach USD 4.30 billion by 2032, at a CAGR of 10.9% during the forecast period

- This growth is driven by factors such as increasing demand for biologics, advancements in cell line engineering, rising investments in biotechnology research, and expanding applications in gene therapy

- Furthermore, continuous technological advancements in cell line engineering, process optimization, and bioproduction automation are enhancing productivity and product quality. These converging factors are accelerating CHO cell utilization in biologics development, thereby significantly boosting the market’s growth

Mexico Oncology Drugs Market Analysis

- Oncology drugs are pharmaceutical agents specifically designed to prevent, diagnose, or treat various types of cancer by targeting malignant cells while minimizing damage to healthy tissues. These drugs include chemotherapy agents, targeted therapies, immunotherapies, and hormonal treatments that have become essential tools in modern cancer management. Oncology drugs are characterized by their ability to inhibit tumor growth, induce cancer cell death, and improve patient survival outcomes.

- One of the primary focuses of oncology drug development is the creation of targeted and immunotherapeutic agents that can selectively attack cancer cells based on genetic and molecular markers. These advanced therapies are often engineered to enhance efficacy, reduce side effects, and offer more personalized treatment options. The growing understanding of cancer biology and advancements in precision medicine are ensuring improved reliability and effectiveness in cancer care.

- In 2025, the Targeted Drugs segment is expected to dominate the market with a 42.42% market share owing to the rising adoption of molecularly targeted drugs, the growing burden of solid tumors, and an increasing number of approvals for biologics and biosimilars tailored for oncology treatment.

Report Scope and Mexico Oncology Drugs Market Segmentation

|

Attributes |

Oncology Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mexico Oncology Drugs Market Trends

“Growing Integration of Artificial Intelligence (AI) in Oncology Drug Development”

- One prominent trend in the Mexico Oncology Drugs Market is the increasing integration of artificial intelligence (AI) across various stages of oncology drug discovery, clinical trials, and personalized treatment planning.

- AI algorithms are being utilized to analyze vast genomic and clinical datasets, predict drug responses, identify novel therapeutic targets, and optimize treatment regimens with greater precision than traditional research methods.

- For instance, machine learning models can process patient-specific data to predict tumor behavior, treatment efficacy, and potential side effects—significantly reducing the time and cost associated with oncology drug development and clinical decision-making.

- This technology enables faster identification of effective drug candidates, improved accuracy in patient stratification, and enhanced success rates in clinical trials.

- The integration of AI is transforming oncology research and healthcare delivery in Mexico, leading to more efficient drug development, personalized treatment approaches, and a stronger competitive advantage for companies adopting advanced digital and data-driven solutions.

Mexico Oncology Drugs Market Dynamics

Driver

“Rising Use of Artificial Intelligence and Genomic Tools in Oncology Research”

- The rising application of artificial intelligence (AI), genomic profiling, and molecular biology tools in oncology research is emerging as a key driver for the Mexico Oncology Drugs Market. As technologies such as CRISPR-based gene editing, next-generation sequencing (NGS), RNA-seq, and single-cell omics advance, oncology research is shifting from traditional therapeutic development to precision-driven, molecularly targeted innovation. These tools allow researchers to better understand tumor genetics, identify novel biomarkers, and design highly specific therapeutic interventions.

- This shift expands market demand across three interconnected areas: (1) drug discovery—where genomics and AI-driven models accelerate the identification of potential cancer targets and molecules; (2) clinical research and diagnostics—where multi-omics data integration supports personalized treatment selection and resistance prediction; and (3) biomanufacturing and production—where automation and digital-twin technologies enhance biologics production and quality assurance.

- In January 2025, a study published by the National Institutes of Health (NIH) highlighted the growing integration of AI-powered genomic analysis for tumor profiling and drug response prediction, underscoring its role in advancing personalized oncology treatment. Similarly, in April 2025, another NIH article emphasized the importance of integrating transcriptomic and epigenomic data to refine therapeutic targeting strategies in cancer biology.

- The rising use of genomic and AI-based approaches in oncology is not only strengthening the precision and efficiency of cancer drug development but also establishing a foundation for next-generation therapies. This convergence of data science and molecular biology is accelerating innovation, expanding access to advanced treatments, and reinforcing Mexico’s oncology market as a growing hub for precision medicine and biopharmaceutical advancements.

Restraint/Challenge

“High Cost of Oncology Drug Development and Treatment as a Market Restraint”

- The high cost associated with oncology drug development, production, and treatment delivery represents a major restraint on the Mexico Oncology Drugs Market. Developing new cancer therapies—especially biologics, targeted therapies, and immunotherapies—requires substantial investment in research, clinical trials, specialized manufacturing, and regulatory compliance, driving up overall costs for both manufacturers and patients.

- These high costs are further compounded by expensive raw materials, complex production technologies, specialized infrastructure, and the need for skilled professionals in oncology research and clinical care. Moreover, stringent regulatory requirements and long approval timelines add to the financial burden on pharmaceutical companies and delay market entry for innovative treatments.

- As a result, limited affordability and accessibility remain persistent challenges, particularly in lower-income populations and rural areas where access to advanced oncology care is restricted. The high cost of branded cancer drugs can also limit their inclusion in public healthcare programs and restrict availability within the private market.

- For instance, reports from global and regional health authorities have highlighted that oncology biologics and immunotherapies are among the costliest therapeutic categories, significantly contributing to rising healthcare expenditures worldwide. This underscores the financial strain associated with cancer drug development and distribution.

- Despite the growing demand for effective cancer therapies, the capital-intensive nature of oncology drug R&D and production, along with high treatment costs, continues to restrain market growth in Mexico. These financial and infrastructural barriers limit broader adoption and hinder equitable access to advanced cancer care.

Mexico Oncology Drugs Market Scope

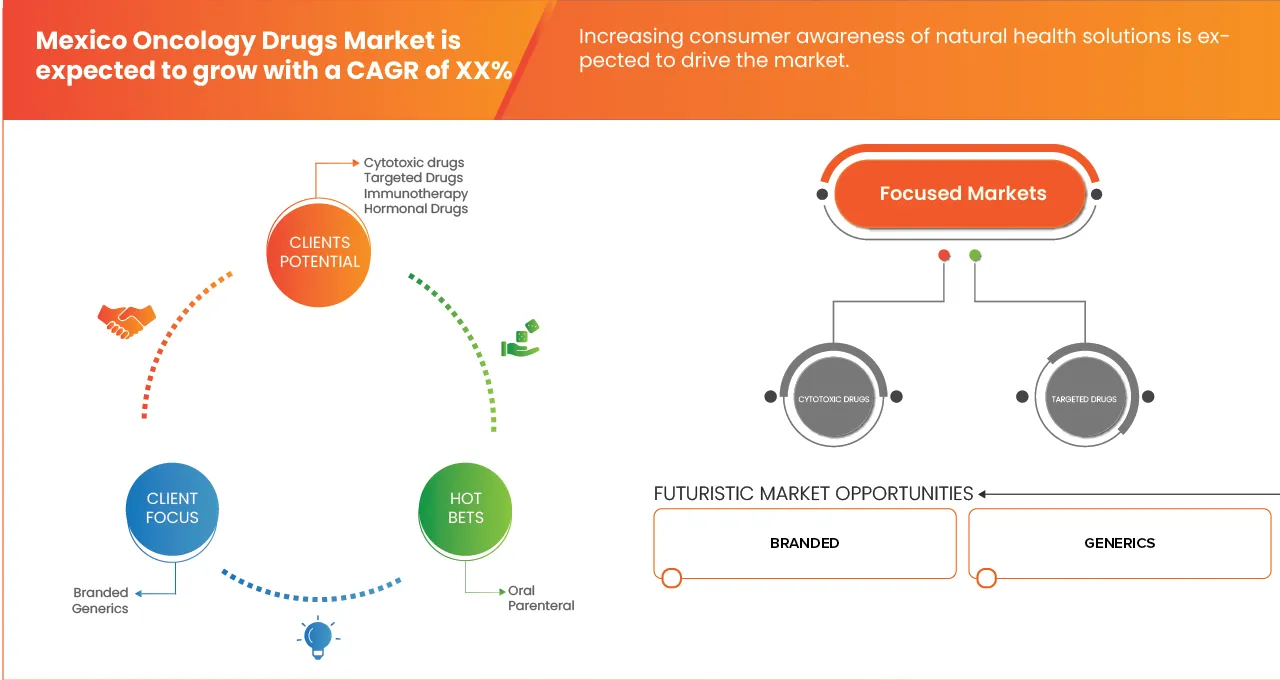

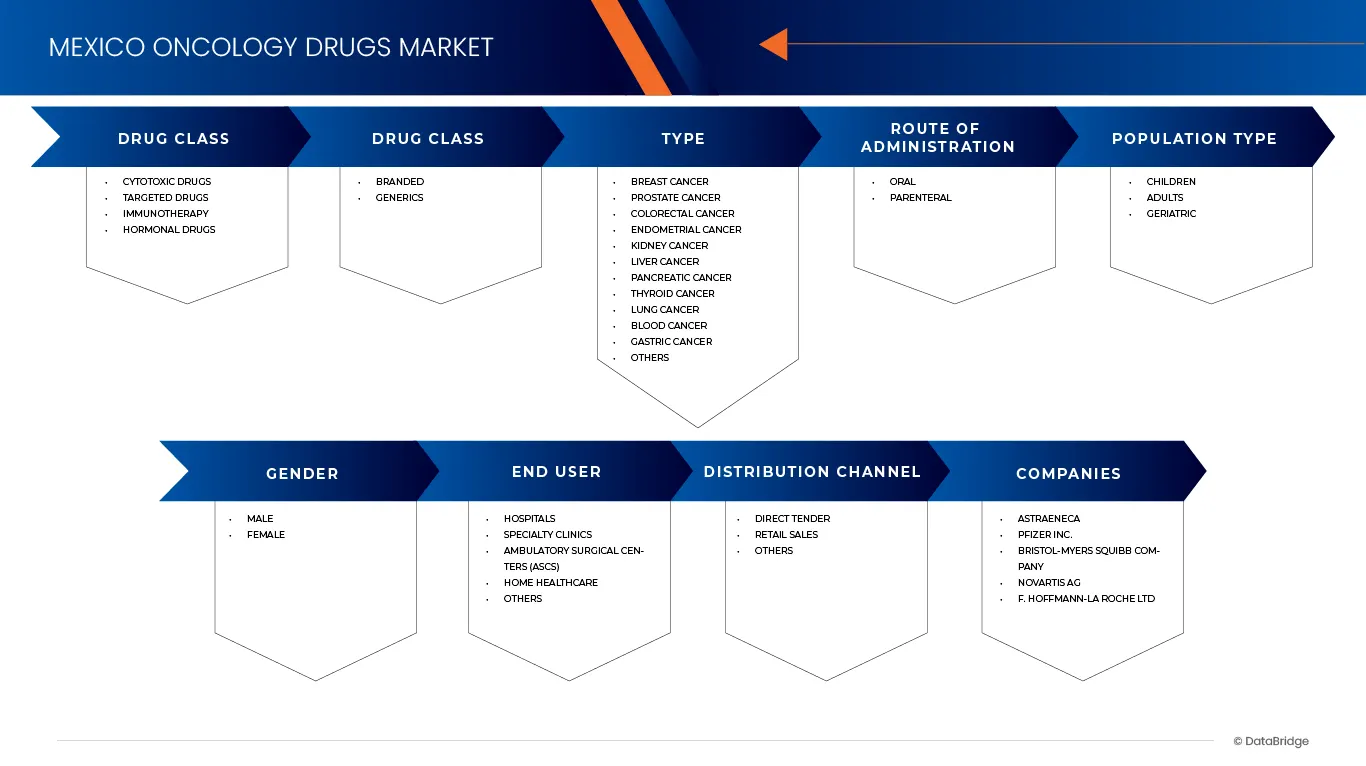

The market is segmented on the Drug Class, Drugs Type, Type, Route of Administration, Population Type, Gender, End User, Distribution Channel.

- By Drug Class

On the basis of type, the market is segmented into Cytotoxic drugs, Targeted Drugs, Immunotherapy, and Hormonal Drugs. In 2025, the Targeted Drugs segment is expected to dominate the market with 42.42%, and expected to be fastest growing segment with 11.6% CAGR. the increasing adoption of precision medicine, rising demand for therapies with higher efficacy and lower toxicity, and rapid growth in monoclonal antibodies and tyrosine kinase inhibitors. These therapies are increasingly preferred over conventional cytotoxic drugs, particularly for breast, lung, and hematologic cancers, driving strong market growth.

- By Drugs Type

On the basis of Drugs Type, the market is segmented into Branded, and Generics, In 2025, the Branded segment is expected to dominate the market with 76.12%, and expected to be fastest growing segment with 11% CAGR, the higher adoption of innovative and patented oncology therapies, strong physician preference for clinically proven drugs, extensive marketing and promotional activities by pharmaceutical companies, and greater patient trust in established brands. Additionally, branded drugs often offer advanced formulations, better efficacy, and improved safety profiles compared to generics, which further drives their market share in Mexico’s oncology therapeutics landscape.

- By Type

On the basis of Type, the market is segmented into Breast Cancer, Prostate Cancer, Colorectal Cancer, Endometrial Cancer, Kidney Cancer, Liver Cancer, Pancreatic Cancer, Thyroid Cancer, Lung cancer, Blood Cancer, Gastric Cancer, and Others, In 2025, the Breast Cancer segment is expected to dominate the market with 24.85%, and expected to be fastest growing segment with 13.4% CAGR, population, increasing adoption of targeted therapies and immunotherapies for advanced stages, rising awareness about early diagnosis and treatment, and significant investment in research and drug development. The growing use of precision medicine and combination therapy approaches for lung cancer further drives the demand for effective oncology drugs in this segment.

- By Route of Administration

On the basis of Route of Administration, the market is segmented into Oral, Parenteral, In 2025, the Parenteral segment is expected to dominate the market with 65.55%, This dominance is driven by the high utilization of injectable formulations in oncology treatments, particularly for biologics, monoclonal antibodies, and cytotoxic chemotherapies that require precise dosing and rapid systemic action. Parenteral administration ensures better bioavailability and immediate therapeutic response, which is critical for advanced-stage cancers and hospital-based treatments. Moreover, the increasing availability of intravenous infusion therapies and advancements in injectable drug delivery systems further support the dominance of the parenteral segment in Mexico’s Mexico Oncology Drugs Market.

- By Population Type

On the basis of Population Type, the market is segmented into Children, Adults, Geriatric, In 2025, the Adults segment is expected to dominate the market with 82.23%, and Adults expected to be fastest growing segment with 11.1% CAGR. The dominance of the rising incidence of age-related cancers such as lung, prostate, colorectal, and breast cancer among older adults. The growing elderly population in Mexico, coupled with longer life expectancy and increased access to cancer diagnostics and treatments, is driving higher demand for oncology drugs within this age group.

- By Gender

On the basis of Gender, the market is segmented into Male, Female, In 2025, the Female segment is expected to dominate the market with 52.51%, and Female expected to be fastest growing segment with 11.2% CAGR. The dominance the higher prevalence of certain cancers such as prostate, lung, liver, and colorectal cancers among men in Mexico. Lifestyle factors such as higher tobacco and alcohol consumption, occupational exposures, and lower participation in preventive health screenings further contribute to increased cancer incidence in males, driving greater demand for oncology drugs within this segment.

- By End User

On the basis of End User, the market is segmented into Hospitals, Specialty Clinics, Ambulatory Surgical Centers (ASCS), Home Healthcare, and Others, In 2025, the Hospitals segment is expected to dominate the market with 54.57%, and Hospitals expected to be fastest growing segment with 11.0% CAGR. The dominance of the market due to the high volume of cancer diagnoses and treatments conducted in hospital settings, availability of advanced infrastructure for chemotherapy and biologic drug administration, and presence of multidisciplinary oncology teams. Additionally, hospitals serve as primary centers for clinical trials, specialized cancer care, and government-funded treatment programs, further reinforcing their leading position in Mexico’s Mexico Oncology Drugs Market.

- By Distribution Channel

On the basis of Distribution Channel, the market is segmented into Direct Tender, Retail Sales and Others, In 2025, the Retail Sales segment is expected to dominate the market with 68.58%, and Retail Sales expected to be fastest growing segment with 11.0% CAGR. The dominance of the due to large-scale government procurement by public healthcare institutions such as IMSS and ISSSTE. Centralized purchasing ensures cost efficiency, wider access to oncology treatments, and stable drug supply across public hospitals, strengthening the segment’s market share in Mexico.

Mexico Oncology Drugs Market Regional Analysis

- Mexico represents one of the most rapidly expanding oncology drug markets in Latin America, driven by a rising cancer burden, growing awareness about early diagnosis, and improved access to advanced treatment options. The country has witnessed a steady increase in the incidence of cancers such as breast, lung, prostate, colorectal, and cervical cancer, fueling demand for innovative therapies including targeted drugs and immunotherapies.

- The Mexican government, through initiatives under INSABI (Instituto de Salud para el Bienestar), IMSS (Instituto Mexicano del Seguro Social), and ISSSTE (Instituto de Seguridad y Servicios Sociales de los Trabajadores del Estado), continues to enhance public access to oncology treatments. These centralized procurement programs under the Direct Tender distribution channel ensure cost efficiency and broaden the reach of essential cancer medicines across public hospitals and healthcare institutions.

- The private healthcare sector in Mexico is also expanding rapidly, supported by the growing presence of specialized oncology centers, an increasing number of clinical trials, and partnerships between multinational pharmaceutical companies and local distributors. This expansion facilitates the introduction of novel biologics, biosimilars, and personalized medicine approaches.

- Despite strong growth prospects, challenges such as high treatment costs, unequal access between urban and rural regions, and complex reimbursement procedures continue to limit patient access to advanced oncology therapies. Nevertheless, ongoing investments in healthcare infrastructure, rising insurance coverage, and the government’s focus on strengthening cancer care delivery are expected to sustain Mexico’s Mexico Oncology Drugs Market growth in the coming years.

The Major Market Leaders Operating in the Market Are:

- AstraZeneca (U.K.)

- Pfizer Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Merck & Co., Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- ARCHIMED (France)

- Astellas Pharma Inc. (Japan)

- Bayer AG (Germany)

- BeOne Medicines (China)

- Boehringer Ingelheim International GmbH (Germany)

- Daiichi Sankyo Company, Limited (Japan)

- Eisai Co., Ltd. (Japan)

- FANASA (Mexico)

- Florencia Healthcare (India)

- Glenmark Pharmaceuticals Ltd. (India)

- Ipsen Pharma (France)

- Johnson & Johnson and its Affiliates (U.S.)

- Knight Therapeutics Inc. (Canada)

- Marzam (Mexico)

- Nadro (Mexico)

- ONCO ESPECIALIZADOS (Mexico)

- PISA (Mexico)

- Probemedic Distribuciones, S.A. de C.V. (Mexico)

- Sanofi (France)

Latest Developments in Mexico Oncology Drugs

- In March 2024, AstraZeneca acquired Fusion Pharmaceuticals (~USD 2 billion) to bolster its oncology pipeline, especially in next‑generation radioconjugates. Fusion’s lead drug candidate, FPI-2265, is a novel radioconjugate designed to treat metastatic castration-resistant prostate cancer (mCRPC), an advanced and difficult-to-treat form of prostate cancer that no longer responds to hormone therapy. Currently in mid-stage clinical trials, FPI-2265 works by delivering targeted radiation directly to prostate cancer cells, potentially improving treatment efficacy while reducing side effects compared to traditional therapies. By acquiring Fusion Pharmaceuticals, AstraZeneca is positioning itself at the forefront of innovative cancer treatments, expanding its capabilities in precision oncology and addressing unmet needs in prostate cancer care.

- In May 2025, AstraZeneca India recently received expanded regulatory approval for its drug Tagrisso (osimertinib) to be used as a monotherapy for patients with locally advanced, unresectable Stage III non-small cell lung cancer (NSCLC) whose disease has not progressed following platinum-based chemoradiation therapy. This approval is grounded in the positive results of the Phase III LAURA clinical trial, which demonstrated that Tagrisso significantly improves progression-free survival in these patients compared to placebo. Importantly, the trial showed that Tagrisso is effective not only in controlling the cancer in the lungs but also in preventing or delaying disease progression in the central nervous system (CNS), including the brain, which is a common site for metastasis in lung cancer. This expanded indication offers a critical treatment option for patients who have limited choices after initial chemoradiation, helping to improve outcomes and potentially extend survival while maintaining quality of life.

- In February 2025, Pfizer has announced that Jeffrey Legos, PhD, MBA, will join the company as Chief Oncology Officer. Dr. Legos will be responsible for leading Pfizer’s Oncology Research & Development, overseeing all functions from pre-clinical to late-stage clinical development activities. He will report to Chris Boshoff, M.D., PhD, Chief Scientific Officer and President of Pfizer Research & Development, and will represent Oncology on Pfizer’s R&D Leadership Team. Dr. Legos will succeed Roger Dansey, M.D., Interim Chief Oncology Officer, who will transition to retirement.

- In February 2025, Pfizer's ADCETRIS (brentuximab vedotin) combination regimen for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL). The U.S. FDA has approved. This approval is based on positive data from the Phase 3 ECHELON-3 trial, which demonstrated a significant reduction in the risk of death and a clinically meaningful improvement in overall survival (OS) compared to lenalidomide and rituximab plus placebo.

- In September 2024, Bristol Myers Squibb (BMS) is set to present data at the European Society for Medical Oncology (ESMO) 2024 conference, showcasing their ongoing leadership in immuno-oncology and the progression of assets from their differentiated research platforms. The presentation will highlight advancements in their immuno-oncology development, including long-term data for Opdivo (nivolumab) and Yervoy (ipilimumab) in metastatic melanoma, as well as promising results from novel modalities and combination therapies in various cancer types. This event underscores BMS's commitment to advancing cancer treatment and improving patient outcomes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MEXICO ONCOLOGY DRUGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER'S FIVE FORCES ANALYSIS

4.3 PIPELINE ANALYSIS — MEXICO ONCOLOGY DRUGS MARKET

4.3.1 PHASE DISTRIBUTION

4.3.2 KEY TRENDS IN THE EXPANDED PIPELINE

4.3.3 GEOGRAPHICAL AND INSTITUTIONAL TRENDS

4.3.4 STRATEGIC INSIGHTS

4.4 MERGERS AND ACQUISITIONS

4.4.1 LICENSING

4.4.2 COMMERCIALIZATION AGREEMENTS

4.5 DRUG TREATMENT RATE IN MATURED MARKETS

4.5.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.5.2 PATIENT FLOW DIAGRAM

4.5.3 KEY PRICING STRATEGIES

4.5.4 KEY PATIENT ENROLLMENT STRATEGIES

4.5.5 INTERVIEWS WITH SPECIALISTS

5 EPIDEMIOLOGY

5.1 INCIDENCE OF ALL BY GENDER

5.2 TREATMENT RATE

5.3 MORTALITY RATE

5.4 PATIENT TREATMENT SUCCESS RATES

6 REGULATION COVERAGE.

6.1 NORTH AMERICA

6.1.1 PRODUCT CODES

6.1.2 CERTIFIED STANDARDS

6.1.3 SAFETY STANDARDS

6.1.3.1 MATERIAL HANDLING & STORAGE

6.1.3.2 TRANSPORT & PRECAUTIONS

6.1.3.3 HAZARD IDENTIFICATION

6.1.4 REGULATION COVERAGE – MEXICO ONCOLOGY DRUGS MARKET

6.1.4.1 PRODUCT CODES

6.1.4.2 CERTIFIED STANDARDS

6.1.5 SAFETY STANDARDS

6.1.5.1 MATERIAL HANDLING & STORAGE

6.1.5.2 TRANSPORT & PRECAUTIONS

6.1.5.3 1HAZARD IDENTIFICATION

6.1.6 VARIATION IN REGULATIONS BASED ON ONCOLOGY DRUG TYPES

6.1.6.1 SMALL MOLECULE CHEMOTHERAPY AGENTS

6.1.7 BIOLOGICS (MONOCLONAL ANTIBODIES, CYTOKINES, CELL-BASED THERAPIES)

6.1.7.1 BIOSIMILARS

6.1.7.2 IMMUNOTHERAPIES (CHECKPOINT INHIBITORS, CYTOKINE THERAPIES)

6.1.7.3 ADVANCED THERAPIES (GENE THERAPY, CAR-T CELLS)

7 MEXICO ONCOLOGY DRUG MARKET: MARKET OVERVIEW

7.1 DRIVER

7.1.1 INCREASED ADOPTION OF IMMUNOTHERAPY & NEW TREATMENT REGIMENS

7.1.2 RISING CANCER INCIDENCE AND MORTALITY

7.1.3 GROWING AWARENESS & CLINICAL EVIDENCE

7.2 RESTRAINTS

7.2.1 HIGH COST AND AFFORDABILITY

7.2.2 FRAGMENTED AND UNDER-RESOURCED HEALTH SYSTEM

7.2.3 SUPPLY CHAIN ISSUES AND DRUG SHORTAGES

7.3 OPPORTUNITIES

7.3.1 RISING HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME

7.3.2 INCREASING RESEARCH AND DEVELOPMENT ACTIVITIES

7.3.3 TECHNOLOGICAL ADVANCEMENTS IN ONCOLOGY DRUG DEVELOPMENT AND DELIVERY

7.3.4 STRINGENT RULES & REGULATIONS

7.3.5 LIMITED ACCESS, INFRASTRUCTURE, AND DISTRIBUTION OF ONCOLOGY DRUGS

7.3.6 ECONOMIC AND INSTITUTIONAL CHALLENGES IN MARKET SUSTAINABILITY

8 MEXICO ONCOLOGY DRUGS MARKET, BY DRUG CLASS

8.1 OVERVIEW

8.2 TARGETED DRUGS

8.2.1 MONOCLONAL ANTIBODIES

8.2.1.1 TRASTUZUMAB

8.2.1.2 BEVACIZUMAB

8.2.1.3 RITUXIMAB

8.2.1.4 OFATUMUMAB

8.2.1.5 OBINUTUZUMAB

8.2.1.6 ALEMTUZUMAB

8.2.1.7 OTHERS

8.2.2 TYROSINE KINASE INHIBITORS

8.2.2.1 IMATINIB

8.2.2.2 DASATINIB

8.2.2.3 NILOTINIB

8.2.2.4 BOSUTINIB

8.2.2.5 SUNITINIB

8.2.2.6 PONATINIB

8.2.2.7 OTHERS

8.2.3 PROTEASOME INHIBITOR

8.2.3.1 BORTEZOMIB

8.2.3.2 CARFILZOMIB

8.2.3.3 OTHERS

8.2.4 OTHERS

8.3 CYTOTOXIC DRUGS

8.3.1 ALKYLATING AGENT

8.3.1.1 CISPLATIN

8.3.1.2 CARBOPLATIN

8.3.1.3 CYCLOPHOSPHAMIDE

8.3.1.4 MELPHALAN

8.3.1.5 CHLORAMBUCIL

8.3.1.6 OTHERS

8.3.2 ANTIMETABOLITES

8.3.2.1 METHOTREXATE

8.3.2.2 FLUOROURACIL

8.3.2.3 GEMCITABINE

8.3.2.4 CYTARABINE (ARA-C)

8.3.2.5 AZACITIDINE

8.3.2.6 FLUDARABINE

8.3.2.7 OTHERS

8.3.3 ANTIMITOTIC DRUGS

8.3.3.1 VINCRISTINE

8.3.3.2 VINBLASTINE

8.3.3.3 CABAZITAXEL

8.3.3.4 OTHERS

8.3.4 TOPOISOMERASE INHIBITORS (I AND II)

8.3.4.1 ANTHRACYCLINE

8.3.4.1.1 DOXORUBICIN

8.3.4.1.2 DAUNORUBICIN

8.3.4.1.3 IDARUBICIN

8.3.4.1.4 OTHERS

8.3.4.2 ETOPOSIDE

8.3.4.3 IRINOTECAN

8.3.4.4 TOPOTECAN

8.3.4.5 OTHERS

8.4 IMMUNOTHERAPY

8.4.1 CAR T-CELL THERAPY

8.4.1.1 AXICABTAGENE CILOLEUCEL

8.4.1.2 TISAGENLECLEUCEL

8.4.1.3 BREXUCABTAGENE AUTOLEUCEL

8.4.1.4 OTHERS

8.4.2 IMMUNOMODULATORY DRUGS (IMIDS)

8.4.2.1 LENALIDOMIDE

8.4.2.2 POMALIDOMIDE

8.4.2.3 THALIDOMIDE

8.4.3 CYTOKINES

8.4.3.1 INTERFERONS

8.4.3.1.1 INTERFERON ALFA-2B

8.4.3.1.2 INTERFERON ALFA-2A

8.4.3.2 INTERLEUKINS (ILS)

8.4.4 OTHERS

8.5 HORMONAL DRUGS

8.5.1 SELECTIVE ESTROGEN RECEPTOR MODULATORS (SERMS)

8.5.1.1 TAMOXIFEN (NOLVADEX)

8.5.1.2 TOREMIFENE (FARESTON)

8.5.2 ESTROGEN PRODUCTION BLOCKERS

8.5.2.1 LETROZOLE

8.5.2.2 ANASTROZOLE

8.5.2.3 EXEMESTANE

8.5.2.4 OTHERS

8.5.3 OTHER ANTIESTROGEN DRUGS

8.5.4 OVARIAN FUNCTION BLOCKERS

8.5.4.1 GOSERELIN

8.5.4.2 LEUPRORELIN

8.5.4.3 TRIPTORELIN

8.6 OTHERS

9 MEXICO ONCOLOGY DRUGS MARKET, BY DRUGS TYPE

9.1 OVERVIEW

9.2 BRANDED

9.3 GENERICS

10 MEXICO ONCOLOGY DRUGS MARKET, BY TYPE

10.1 OVERVIEW

10.2 LUNG CANCER

10.2.1 TARGETED DRUGS

10.2.2 CYTOTOXIC DRUGS

10.2.3 IMMUNOTHERAPY

10.2.4 HORMONAL DRUGS

10.3 BREAST CANCER

10.3.1 TARGETED DRUGS

10.3.2 HORMONAL DRUGS

10.3.3 CYTOTOXIC DRUGS

10.3.4 IMMUNOTHERAPY

10.4 BLOOD CANCER

10.4.1 LEUKEMIA

10.4.2 NON-HODGKIN LYMPHOMA

10.4.3 MULTIPLE MYELOMA

10.4.4 HODGKIN LYMPHOMA

10.4.5 TARGETED DRUGS

10.4.6 CYTOTOXIC DRUGS

10.4.7 IMMUNOTHERAPY

10.4.8 HORMONAL DRUGS

10.5 COLORECTAL CANCER

10.5.1 IMMUNOTHERAPY

10.5.2 CYTOTOXIC DRUGS

10.5.3 TARGETED DRUGS

10.5.4 HORMONAL DRUGS

10.6 PROSTATE CANCER

10.6.1 HORMONAL DRUGS

10.6.2 TARGETED DRUGS

10.6.3 CYTOTOXIC DRUGS

10.6.4 IMMUNOTHERAPY

10.7 LIVER CANCER

10.7.1 TARGETED DRUGS

10.7.2 CYTOTOXIC DRUGS

10.7.3 IMMUNOTHERAPY

10.7.4 HORMONAL DRUGS

10.8 PANCREATIC CANCER

10.8.1 TARGETED DRUGS

10.8.2 CYTOTOXIC DRUGS

10.8.3 IMMUNOTHERAPY

10.8.4 HORMONAL DRUGS

10.9 KIDNEY CANCER

10.9.1 TARGETED DRUGS

10.9.2 CYTOTOXIC DRUGS

10.9.3 IMMUNOTHERAPY

10.9.4 HORMONAL DRUGS

10.1 GASTRIC CANCER

10.10.1 CYTOTOXIC DRUGS

10.10.2 TARGETED DRUGS

10.10.3 IMMUNOTHERAPY

10.10.4 HORMONAL DRUGS

10.11 ENDOMETRIAL CANCER

10.11.1 CYTOTOXIC DRUGS

10.11.2 TARGETED DRUGS

10.11.3 HORMONAL DRUGS

10.11.4 IMMUNOTHERAPY

10.12 THYROID CANCER

10.12.1 TARGETED DRUGS

10.12.2 CYTOTOXIC DRUGS

10.12.3 IMMUNOTHERAPY

10.12.4 HORMONAL DRUGS

10.13 OTHERS

10.13.1 TARGETED DRUGS

10.13.2 CYTOTOXIC DRUGS

10.13.3 IMMUNOTHERAPY

10.13.4 HORMONAL DRUGS

11 MEXICO ONCOLOGY DRUGS MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 PARENTERAL

11.3 ORAL

11.3.1 TABLETS

11.3.2 CAPSULE

11.3.3 PILL

11.3.4 OTHERS

12 MEXICO ONCOLOGY DRUGS MARKET, BY POPULATION TYPE

12.1 OVERVIEW

12.2 GERIATRIC

12.3 ADULTS

12.4 CHILDREN

13 MEXICO ONCOLOGY DRUGS MARKET, BY GENDER

13.1 OVERVIEW

13.2 MALE

13.3 FEMALE

14 MEXICO ONCOLOGY DRUGS MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITAL

14.2.1 PUBLIC

14.2.2 PRIVATE

14.3 SPECIALTY CLINICS

14.4 AMBULATORY SURGICAL CENTERS

14.5 HOME HEALTHCARE

14.6 OTHERS

15 MEXICO ONCOLOGY DRUGS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 RETAIL SALES

15.3.1 HOSPITALS PHARMACY

15.3.2 RETAIL PHARMACY

15.3.3 ONLINE PHARMACY

15.4 OTHERS

16 MEXICO ONCOLOGY DRUGS MARKET, COMPANY LANDSCAPE

16.1 MANUFACTURER COMPANY SHARE ANALYSIS: MEXICO

16.2 DISTRIBUTOR COMPANY SHARE ANALYSIS: MEXICO

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 ASTRAZENECA

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 PFIZER INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 BRISTOL-MYERS SQUIBB COMPANY

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT NEWS

18.4 ESTEVE

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 NOVARTIS AG

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 F. HOFFMANN-LA ROCHE LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 MERCK & CO., INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ABBVIE INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 AMGEN INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ARCHIMED

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 ASTELLAS PHARMA INC.

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 BAYER AG

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 BEONE MEDICINES

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 BOEHRINGER INGELHEIM GMBH

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 DAIICHI SANKYO COMPANY, LIMITED.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 EISAI CO., LTD.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 FANASA

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 FLORENCIA HEALTHCARE

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 GLENMARK PHARMACEUTICALS LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 IPSEN PHARMA

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENT

18.21 JOHNSON & JOHNSON AND ITS AFFILIATES

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENT/NEWS

18.22 KNIGHT THERAPEUTICS INC.

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 MARZAM

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 NADRO

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENTS

18.25 ONCO ESPECIALIZADOS

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 PISA

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 PROBEMEDIC DISTRIBUCIONES, SA DE CV

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 SANOFI

18.28.1 COMPANY SNAPSHOT

18.28.2 REVENUE ANALYSIS

18.28.3 PRODUCT PORTFOLIO

18.28.4 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 MEXICO ONCOLOGY DRUGS MARKET, BY DRUG CLASS, 2018-2032 (USD THOUSAND)

TABLE 2 MEXICO TARGETED DRUGS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MEXICO MONOCLONAL ANTIBODIES IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 MEXICO TYROSINE KINASE INHIBITORS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MEXICO PROTEASOME INHIBITOR IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MEXICO CYTOTOXIC DRUGS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MEXICO ALKYLATING AGENT IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MEXICO ANTIMETABOLITES IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MEXICO ANTIMITOTIC DRUGS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MEXICO TOPOISOMERASE INHIBITORS (I AND II) IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MEXICO ANTHRACYCLINES IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MEXICO IMMUNOTHERAPY IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MEXICO CAR T-CELL THERAPY IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MEXICO IMMUNOMODULATORY DRUGS (IMIDS) IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MEXICO CYTOKINES IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MEXICO INTERFERONS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 MEXICO HORMONAL DRUGS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MEXICO SELECTIVE ESTROGEN RECEPTOR MODULATORS (SERMS) IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MEXICO ESTROGEN PRODUCTION BLOCKERS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 MEXICO OVARIAN FUNCTION BLOCKERS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MEXICO ONCOLOGY DRUGS MARKET, BY DRUGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MEXICO ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MEXICO LUNG CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MEXICO BREAST CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MEXICO BLOOD CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MEXICO BLOOD CANCER IN ONCOLOGY DRUGS MARKET, BY DRUGS, 2018-2032 (USD THOUSAND)

TABLE 27 MEXICO COLORECTAL CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MEXICO PROSTATE CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 MEXICO LIVER CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MEXICO PANCREATIC CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MEXICO KIDNEY CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MEXICO GASTRIC CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MEXICO ENDOMETRIAL CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MEXICO THYROID CANCER IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MEXICO OTHERS IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MEXICO ONCOLOGY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 37 MEXICO ORAL IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MEXICO ONCOLOGY DRUGS MARKET, BY POPULATION TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MEXICO ONCOLOGY DRUGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 40 MEXICO ONCOLOGY DRUGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 41 MEXICO HOSPITAL IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MEXICO ONCOLOGY DRUGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 43 MEXICO RETAIL SALES IN ONCOLOGY DRUGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MEXICO ONCOLOGY DRUGS MARKET: SEGMENTATION

FIGURE 2 MEXICO ONCOLOGY DRUGS MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO ONCOLOGY DRUGS MARKET: DROC ANALYSIS

FIGURE 4 MEXICO ONCOLOGY DRUGS MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 MEXICO ONCOLOGY DRUGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO ONCOLOGY DRUGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MEXICO ONCOLOGY DRUGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MEXICO ONCOLOGY DRUGS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 MEXICO ONCOLOGY DRUGS MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 FOUR SEGMENTS COMPRISE THE MEXICO ONCOLOGY DRUGS MARKET, BY DRUG CLASS

FIGURE 13 INCREASING CONSUMER AWARENESS OF NATURAL HEALTH SOLUTIONS EXPECTED TO DRIVE THE MEXICO ONCOLOGY DRUGS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO ONCOLOGY DRUGS MARKET IN 2025 & 2032

FIGURE 15 DROC ANALYSIS

FIGURE 16 MEXICO ONCOLOGY DRUGS MARKET: BY DRUG CLASS, 2024

FIGURE 17 MEXICO ONCOLOGY DRUGS MARKET: BY DRUG CLASS, 2025 TO 2032 (USD THOUSAND)

FIGURE 18 MEXICO ONCOLOGY DRUGS MARKET: BY DRUG CLASS, CAGR (2025- 2032)

FIGURE 19 MEXICO ONCOLOGY DRUGS MARKET: BY DRUG CLASS, LIFELINE CURVE

FIGURE 20 MEXICO ONCOLOGY DRUGS MARKET: BY DRUGS TYPE, 2024

FIGURE 21 MEXICO ONCOLOGY DRUGS MARKET: BY DRUGS TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 22 MEXICO ONCOLOGY DRUGS MARKET: BY DRUGS TYPE, CAGR (2025- 2032)

FIGURE 23 MEXICO ONCOLOGY DRUGS MARKET: BY DRUGS TYPE, LIFELINE CURVE

FIGURE 24 MEXICO ONCOLOGY DRUGS MARKET: BY TYPE, 2024

FIGURE 25 MEXICO ONCOLOGY DRUGS MARKET: BY TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 26 MEXICO ONCOLOGY DRUGS MARKET: BY TYPE, CAGR (2025- 2032)

FIGURE 27 MEXICO ONCOLOGY DRUGS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 28 MEXICO ONCOLOGY DRUGS MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 29 MEXICO ONCOLOGY DRUGS MARKET: BY ROUTE OF ADMINISTRATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 30 MEXICO ONCOLOGY DRUGS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025- 2032)

FIGURE 31 MEXICO ONCOLOGY DRUGS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 32 MEXICO ONCOLOGY DRUGS MARKET: BY POPULATION TYPE, 2024

FIGURE 33 MEXICO ONCOLOGY DRUGS MARKET: BY POPULATION TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 34 MEXICO ONCOLOGY DRUGS MARKET: BY POPULATION TYPE, CAGR (2025- 2032)

FIGURE 35 MEXICO ONCOLOGY DRUGS MARKET: BY POPULATION TYPE, LIFELINE CURVE

FIGURE 36 MEXICO ONCOLOGY DRUGS MARKET: BY GENDER, 2024

FIGURE 37 MEXICO ONCOLOGY DRUGS MARKET: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 38 MEXICO ONCOLOGY DRUGS MARKET: BY GENDER, CAGR (2025- 2032)

FIGURE 39 MEXICO ONCOLOGY DRUGS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 40 MEXICO ONCOLOGY DRUGS MARKET: BY END USER, 2024

FIGURE 41 MEXICO ONCOLOGY DRUGS MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 42 MEXICO ONCOLOGY DRUGS MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 43 MEXICO ONCOLOGY DRUGS MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 MEXICO ONCOLOGY DRUGS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 45 MEXICO ONCOLOGY DRUGS MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 46 MEXICO ONCOLOGY DRUGS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 47 MEXICO ONCOLOGY DRUGS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 MEXICO ONCOLOGY DRUGS MARKET: COMPANY SHARE 2024 (%)

FIGURE 49 MEXICO ONCOLOGY DRUGS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.