Mexico Pet Care Products Market

Market Size in USD Billion

CAGR :

%

USD

4.58 Billion

USD

7.37 Billion

2024

2032

USD

4.58 Billion

USD

7.37 Billion

2024

2032

| 2025 –2032 | |

| USD 4.58 Billion | |

| USD 7.37 Billion | |

|

|

|

|

Mexico Pet Care Products Market Size

- The Mexico Pet Care Products Market was valued at USD 4.58 Billion in 2024 and is expected to reach USD 7.37 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.2%, primarily fueled by the increasing trend of pet humanization, rising disposable incomes, and growing awareness about pet health and wellness

- This growth is driven by factors such as the rising demand for premium pet food, veterinary care, and grooming products, along with the expansion of e-commerce and retail distribution channels. Additionally, increased focus on preventive healthcare and natural ingredient-based products is reshaping consumer preferences across urban centers in Mexico

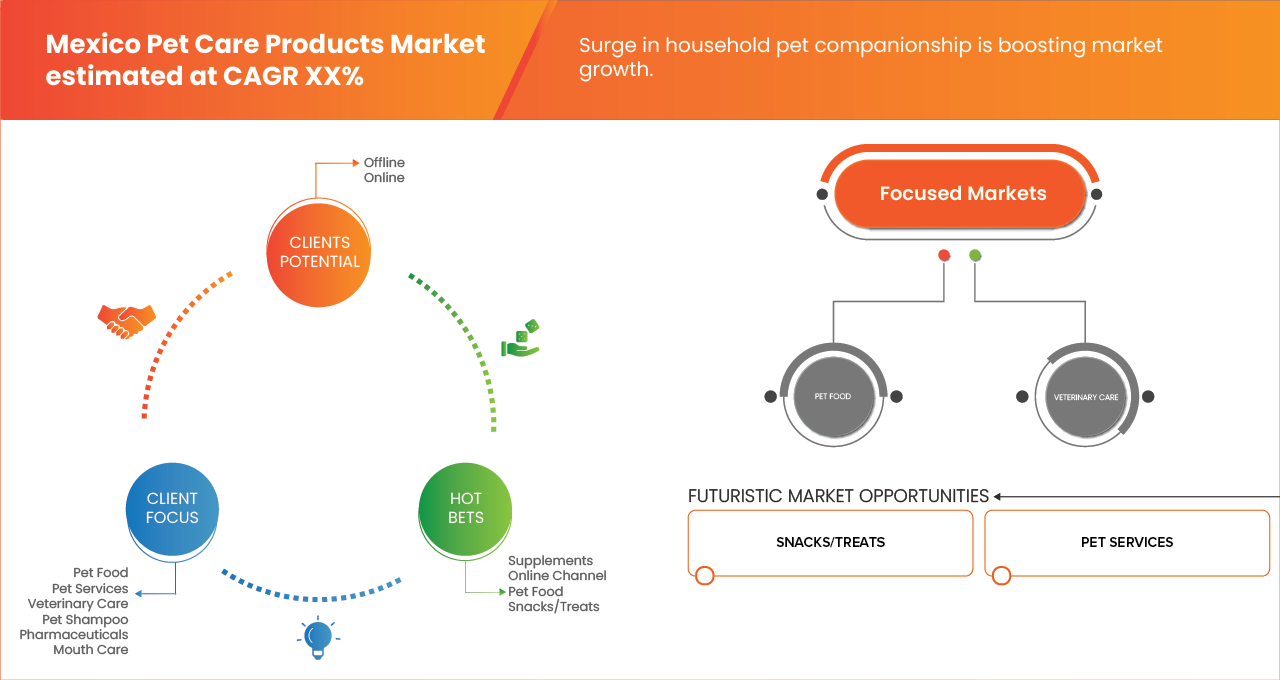

Mexico Pet Care Products Market Analysis

- The Mexico Pet Care Products Market in Mexico is witnessing steady growth, fueled by increasing pet ownership, rising disposable incomes, and the growing trend of pet humanization. Consumers are placing greater emphasis on pet health and nutrition, driving demand for functional foods, supplements, and grooming solutions. Products enriched with vitamins, omega fatty acids, and probiotics are gaining popularity due to their role in supporting immunity, digestion, and coat health in companion animals like dogs and cats. However, challenges remain in regulating product quality, addressing counterfeit items, and ensuring consistent availability across both urban and rural markets.

- In 2025, pet food segment will dominate driven by its increasing pet ownership, higher disposable incomes, growing health awareness, and demand for premium, organic, and specialized food products

- Leading manufacturers are investing in product innovation and localized branding strategies to cater to the preferences of Mexican pet owners. This includes flavor customization, sustainable packaging, and integration of natural ingredients. Product differentiation is also occurring through age-specific formulations, multi-functional treats, and the incorporation of herbal or organic components. As the market becomes more competitive, compliance with international guidelines such as AAFCO and FEDIAF, along with certification in areas like sustainability and cruelty-free testing, will be vital for maintaining market access and brand credibility.

Report Scope and Mexico Pet Care Products Market Segmentation

|

Attributes |

Mexico Pet Care Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mexico Pet Care Products Market Trends

“Surge In Household Pet Companionship”

- One prominent trend in the Mexico Pet Care Products Market is the surge in pet ownership directly drives demand for a wide range of pet care products, including pet food, grooming supplies, and healthcare solutions.

- The expanding number of pets across urban and semi-urban regions creates a substantial consumer base, intensifying the need for specialized and high-quality pet products. Increasing awareness among pet owners regarding the health, nutrition, and overall well-being of their pets further propels the consumption of premium and innovative offerings in the market. Consequently, the steady growth in pet ownership serves as a primary driver for the Mexico Pet Care Products Market, fueling market expansion and product diversification

- For instance, In July 2025, according to an article published by the Agriculture and Agri-Food Canada (AAFC), The total pet population in Mexico grew significantly from 24.7 million in 2016 to 32.2 million in 2021. Notably, the dog population increased to 22.5 million and the cat population to 6.3 million during this period. This sharp rise reflects growing demand for pet food, grooming, and healthcare products—acting as a key driver for the Mexico Pet Care Products Market.

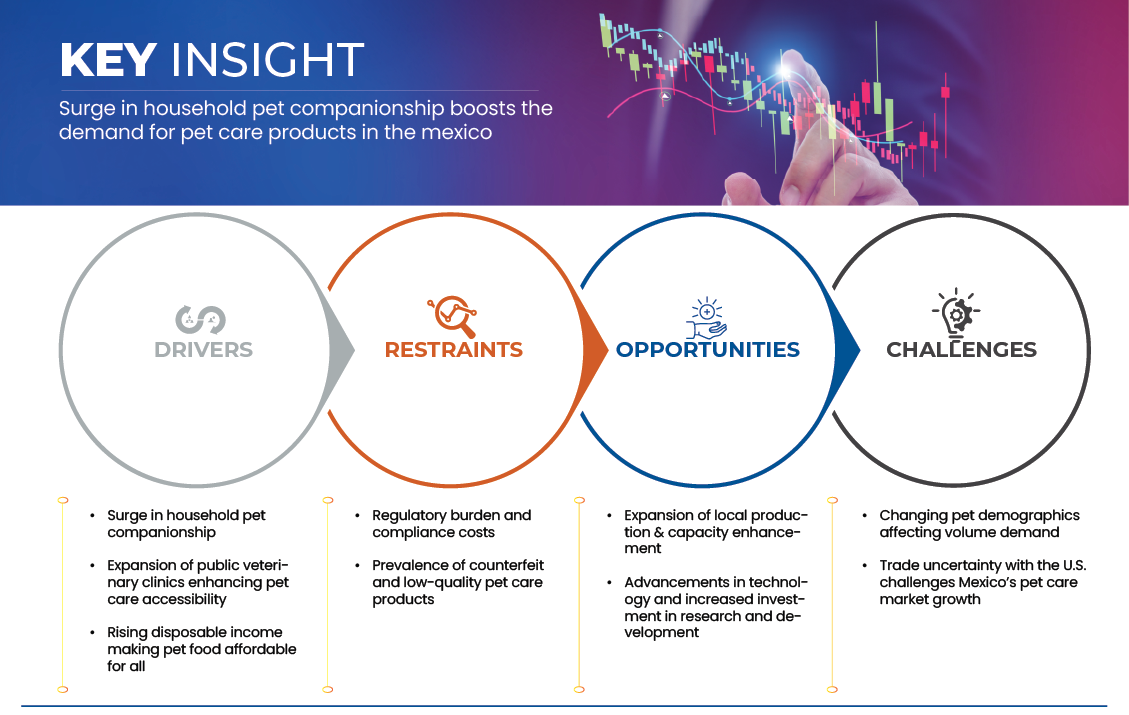

Mexico Pet Care Products Market Dynamics

Driver

“Expansion of Public Veterinary Clinics Enhancing Pet Care Accessibility”

- The establishment of public free veterinary clinics across Mexico significantly boosts the pet care ecosystem by making veterinary services more accessible to a wider segment of the population. These clinics reduce the financial burden of pet healthcare, encouraging more families—especially in low- and middle-income groups—to adopt and care for pets.

- As veterinary support becomes more available, pet owners are increasingly engaged in responsible pet care, which includes purchasing quality pet food, grooming supplies, hygiene products, and supplements. The increased interaction with veterinary professionals also raises awareness about pet nutrition, preventive care, and overall wellness, further influencing consumer behavior and driving demand for related products.

- Additionally, the integration of pet owners into formal veterinary systems strengthens the overall pet care infrastructure, creating opportunities for brands and retailers to expand their reach. By promoting pet ownership and enhancing care standards, the expansion of public veterinary clinics directly contributes to the rising demand for pet care goods—acting as a strong driver for the Mexico Pet Care Products Market.

- For instance, In February 2024, as published by Mexico News Daily, The new law mandating public veterinary clinics across Mexico ensures free preventive and emergency care for pets, including sterilization, vaccinations, and surgeries. With over 70% of households owning pets and rising abandonment rates, this initiative promotes responsible ownership and better pet health. Increased access to care encourages demand for related products—acting as a key driver for the Mexico Pet Care Products Market

Restraint/Challenge

“Regulatory Burden And Compliance Costs”

- The implementation of stricter regulations such as NOM-012-SAG/ZOO-2020, which replaces NOM-012-ZOO-1993, imposes significant compliance requirements on pet food manufacturers and importers in Mexico

- These updated standards mandate rigorous controls related to pet food safety, labeling accuracy, ingredient transparency, quality assurance, and import verification. To meet these requirements, companies must invest in upgraded manufacturing processes, laboratory testing, third-party certifications, and traceable supply chains. These obligations increase operational complexity and cost, particularly affecting small and mid-sized enterprises that lack the capital or infrastructure to absorb such changes efficiently.

- As a result, many of these players face delays in market entry, reduced competitiveness, or potential withdrawal from the market. The increased regulatory pressure not only raises barriers for new entrants but also limits innovation and flexibility for existing players—ultimately slowing down the overall growth of the industry. This mounting regulatory burden and the associated compliance costs act as a significant restraint for the Mexico Pet Care Products Market.

- The enforcement of NOM-012-SAG/ZOO-2020 has significantly increased the regulatory burden on Mexico’s pet care industry. With stricter standards for safety, labeling, traceability, and import verification, companies face rising compliance costs and operational complexity. This limitation disproportionately impact smaller manufacturers, limiting their competitiveness and market entry ultimately acting as a strong restraint for the Mexico Pet Care Products Market.

Mexico Pet Care Products Market Scope

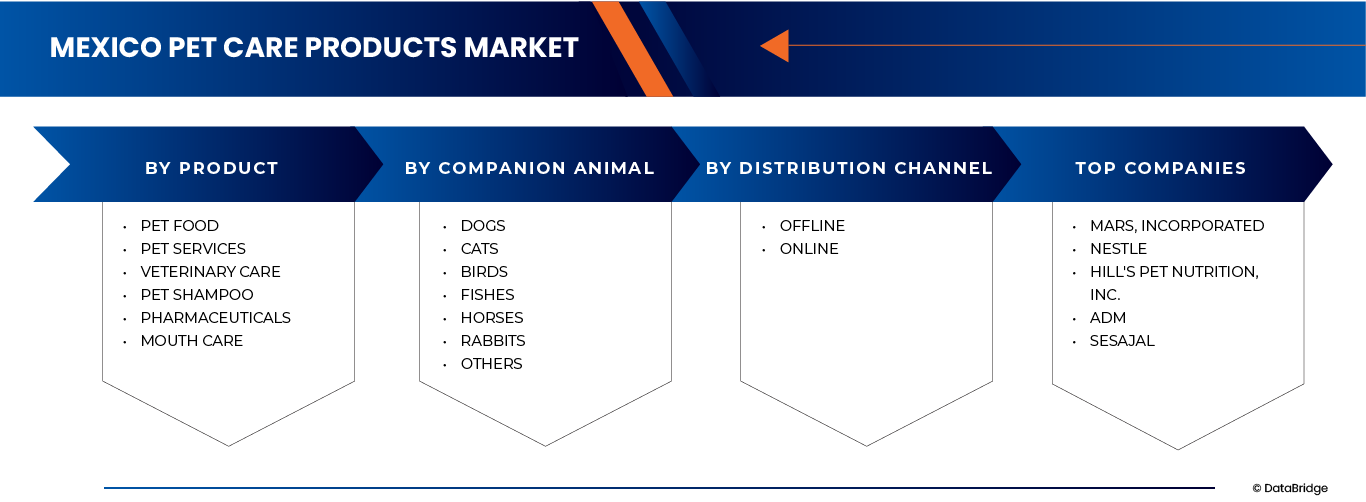

The Mexico Pet Care Products Market is segmented into three notable segments based on product, companion animal, and distribution channel.

• By Product

On the basis of product, the Mexico Pet Care Products Market is segmented into pet food, pet services, veterinary care, pet shampoo, pharmaceuticals, mouth care. In 2025, the pet food segment is forecasted to dominate with a market share of 76.33%, attributed to the growing awareness of pet nutrition, increasing demand for premium and functional food products, and the rising trend of pet humanization. Pet owners are increasingly prioritizing balanced diets that support digestive health, immunity, and overall well-being, leading to higher consumption of dry kibble, wet food, treats, and specialized diets.

Pet food is anticipated to gain traction with the CAGR of 6.3% during the forecast period of 2025 to 2032, driven by The expansion of organized retail, availability of a wide variety of branded options, and growing influence of veterinary recommendations have further strengthened the dominance of pet food within the overall market.

• By Companion Animal

On the basis of companion animal, the market is segmented into all dogs, cats, birds, fishes, horses, rabbits, others. In 2025, the Dogs segment is forecasted to dominate with a market share of 51.71% attributed to their widespread ownership across urban and semi-urban households, as well as increased spending on canine health, nutrition, and grooming. Dogs continue to be the most preferred companion animals in Mexico, driving demand for tailored pet food, supplements, and veterinary services.

The dogs segment is projected to expand steadily with a CAGR of 6.7% as it gains widespread popularity among urban households, driven by emotional companionship, increased adoption rates, and rising awareness about pet wellness.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into offline and online. In 2025, the offline segment is forecasted to dominate with a market share of 72.34%, due to the strong presence of supermarkets, pet specialty stores, veterinary clinics, and local retail outlets that offer convenience, immediate product availability, and in-person consultation. Many consumers in Mexico still prefer the tactile experience of shopping in-store, especially for pet food and grooming products. Established brand visibility, promotional in-store displays, and trusted relationships with local vendors further support the dominance of offline channels.

The offline segment is likely to witness accelerated growth of 5.9% during the forecast period, supported by the expansion of organized retail chains, increased presence of dedicated pet stores, and the growing availability of premium pet care products through veterinary clinics and supermarkets. Consumer preference for personalized advice, physical product inspection, and immediate purchases continues to drive footfall in offline outlets.

Mexico Pet Care Products Market Insight

Mexico is poised to be a key player in Latin America's pet care market in 2025, driven by rising pet ownership, urbanization, and growing awareness of animal wellness. Increased spending on premium pet food, grooming products, and veterinary care reflects the country’s shift toward pet humanization. Regulatory support from COFEPRIS and the expansion of e-commerce have improved access to high-quality products. Both global and local brands are investing in innovation, sustainable packaging, and wider distribution through vet clinics and retail chains. These factors, combined with a young, pet-loving population, continue to fuel strong growth in Mexico’s pet care industry.

The Major Market Leaders Operating in the Market Are:

- Mars, Incorporated (U.S.)

- Nestlé (Switzerland)

- Hill's Pet Nutrition, Inc. (U.S.)

- ADM (U.S.)

- SESAJAL (Mexico)

- Virbac (France)

- Schell & Kampeter, Inc. (Diamond Pet Foods) (U.S.)

- Elanco (U.S.)

- FLAGASA (Mexico)

- Vetoquinol (France)

- Grupo Nu3 (Mexico)

- New Technology in Food SA de CV (Mexico)

- Los Belenes (Mexico)

- PETMET DE MÉXICO, S. DE R.L. DE C.V. (Mexico)

Latest Developments in Mexico Pet Care Products Market

- In July 2025, Adisseo announced the upcoming launch of a new MetaSmart production facility, expected in late H2 2025, to meet the growing needs of the global dairy industry. This capacity expansion will bolster Adisseo’s ability to supply protected methionine, crucial for ruminant nutrition. The development supports the company’s strategic focus on sustainable dairy production and enhances its global supply reliability

- In February 2023, Adisseo announced the acquisition of Nor-Feed, a company specializing in natural plant-based additives for animal nutrition. This strategic move strengthens Adisseo’s portfolio in specialty feed ingredients and enhances its position in the sustainable and natural additives segment. The acquisition supports Adisseo’s innovation strategy and growth in the functional feed market

- In April 2025, NOVUS International expanded its presence in the Asian market by supporting Vietnam’s swine and poultry industries through targeted nutritional solutions and technical services. This initiative strengthens NOVUS’s regional market engagement, boosts brand visibility, and fosters customer loyalty. By addressing local production challenges with its key offerings—such as methionine supplements, enzyme feed additives, and gut health solutions—NOVUS enhances its market positioning and drives the adoption of its animal nutrition innovations across Vietnam

- In May 2025, At the FENAVI Valle event, NOVUS highlighted its ongoing commitment to unlocking soybean efficiency and promoting sustainable agricultural solutions. By showcasing their innovative approaches to enhancing crop yield and minimizing environmental impact, NOVUS underscored its leadership in the sector. Their contributions to the discussion on sustainable farming practices not only reinforce their role as industry pioneers but also align with global efforts to increase food security and reduce resource use. This engagement positions NOVUS as a key player in the agri-tech space, enhancing its reputation and potential for long-term growth by tapping into the growing demand for eco-friendly farming solutions

- In February 2023, Alltech and Finnforel have jointly acquired the Raisioaqua fish feed facility to complete a sustainable, circular-economy fish-farming chain in Finland. This partnership aims to enhance eco-friendly aquaculture nutrition and expand innovative recirculating aquaculture systems globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DISTRIBUTION CHANNEL GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 CONSUMER BUYING BEHAVIOR: MEXICO PET CARE PRODUCTS MARKET

4.2.1 EVOLVING CONSUMER MINDSET AND PET HUMANIZATION

4.2.2 PREFERENCE FOR PREMIUM, NATURAL, AND FUNCTIONAL PRODUCTS

4.2.3 RISING INFLUENCE OF DIGITAL AND OMNICHANNEL PLATFORMS

4.2.4 THE GROWING IMPORTANCE OF BRAND TRUST AND TRANSPARENCY

4.2.5 ROLE OF VETERINARIANS, RETAIL SPECIALISTS, AND PEER INFLUENCE

4.2.6 REGIONAL AND SOCIOECONOMIC DIFFERENTIATION IN PURCHASING PATTERNS

4.2.7 EMOTIONAL DRIVERS AND LIFESTYLE INTEGRATION

4.3 BRAND OUTLOOK

4.3.1 MARS INC.

4.3.2 NESTLÉ PURINA

4.3.3 CAMPI ALIMENTOS (GRUPO BACHOCO)

4.3.4 MALTACLEYTON (ADM SUBSIDIARY)

4.3.5 AFFINITY PETCARE AND OTHER REGIONAL PLAYERS

4.3.6 EMERGING TRENDS AFFECTING BRAND STRATEGIES

4.3.7 PRODUCT VS. BRAND OVERVIEW

4.3.8 INTERACTION AND STRATEGIC IMPORTANCE

4.3.9 EVOLVING CONSUMER PREFERENCES

4.3.10 PREMIUMIZATION AND MARKET SEGMENTATION

4.3.11 REGULATORY INFLUENCE ON BRAND POSITIONING

4.3.12 BRAND LOYALTY VS. EXPERIMENTATION

4.3.13 REGIONAL BRAND DYNAMICS

4.4 RAW MATERIAL COVERAGE

4.4.1 TYPES OF RAW MATERIALS USED AND THEIR SOURCING

4.4.1.1 ANIMAL-BASED PROTEINS

4.4.1.2 PLANT-BASED INGREDIENTS

4.4.1.3 VITAMINS, MINERALS, AND FUNCTIONAL ADDITIVES

4.4.1.4 RAW AND BARF DIET INGREDIENTS

4.4.1.5 EMERGING SUSTAINABLE ALTERNATIVES

4.4.1.6 QUALITY AND REGULATORY COMPLIANCE IN SOURCING

4.4.2 QUALITY CONTROL AND SUPPLIER RELATIONSHIPS

4.4.3 PROCESSING TECHNIQUES AND INNOVATION

4.4.4 SUPPLY CHAIN CHALLENGES AND ADAPTATIONS

4.4.5 CONCLUSION

4.5 VALUE CHAIN

4.5.1 PRODUCTION (6% – 20%)

4.5.2 PROCESSING & PACKAGING (8% – 22%)–

4.5.3 DISTRIBUTION & LOGISTICS (7% – 18%)

4.5.4 SALES & MARKETING (10% – 25%)

4.5.5 BUYERS/END USERS

4.6 PRODUCTION CAPACITY OF MANUFACTURERS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 PET INGREDIENT SOURCING:

4.7.2 MANUFACTURING & PRODUCT DEVELOPMENT

4.7.3 INGREDIENT RECEPTION AND INSPECTION

4.7.4 PRELIMINARY PROCESSING (GRINDING AND MIXING)

4.7.5 THERMAL PROCESSING (COOKING & EXTRUSION)

4.7.6 SHAPING AND FORMING

4.7.7 DRYING AND COOLING (FOR DRY FOODS/TREATS)

4.7.8 SAFETY & QUALITY ASSURANCE

4.7.9 PACKAGING

4.7.10 FINAL INSPECTION AND DISTRIBUTION PREPARATION

4.7.11 LOGISTICS, COLD CHAIN & TRANSPORTATION

4.7.12 COLD CHAIN FUNDAMENTALS AND INFRASTRUCTURE

4.7.13 WAREHOUSE & STORAGE PRACTICES:

4.7.14 TRANSPORT MODALITIES AND TECHNOLOGIES

4.7.15 TEMPERATURE MONITORING & DATA-DRIVEN MANAGEMENT

4.7.16 CUSTOMS, COMPLIANCE, AND CROSS-BORDER LOGISTICS

4.7.17 DISTRIBUTION CHANNELS AND RETAIL

4.7.18 EVOLVING DYNAMICS

4.7.19 CONSUMER ENGAGEMENT AND FEEDBACK LOOP

4.8 TECHNOLOGICAL ADVANCEMENTS: MEXICO PET CARE PRODUCTS MARKET

4.8.1 SMART PET DEVICES AND WEARABLES

4.8.2 AUTOMATED FEEDING AND PET NUTRITION TECHNOLOGY

4.8.3 SMART PACKAGING AND TRACEABILITY SOLUTIONS

4.8.4 ANALYTICS AND COMPUTER VISION IN PET HEALTH & DIAGNOSTICS

4.8.5 MODULAR SYSTEMS, INTEGRATION AND INTEROPERABILITY

4.8.6 ENVIRONMENTAL SUSTAINABILITY & MATERIAL INNOVATION

4.8.7 CHALLENGES, BARRIERS, AND ADOPTION CONSIDERATIONS

4.9 VENDOR SELECTION CRITERIA IN THE MEXICO PET CARE PRODUCTS MARKET

4.9.1 OVERVIEW OF VENDOR EVALUATION IN THE PET CARE INDUSTRY

4.9.2 PRODUCT QUALITY AND CONSISTENCY

4.9.3 SUPPLY CHAIN RELIABILITY AND LOGISTICS EFFICIENCY

4.9.4 INNOVATION AND PRODUCT DEVELOPMENT CAPABILITIES

4.9.5 REGULATORY COMPLIANCE AND CERTIFICATIONS

4.9.6 COST COMPETITIVENESS AND VALUE PROPOSITION

4.9.7 SUSTAINABILITY AND ETHICAL RESPONSIBILITY

4.9.8 TECHNOLOGICAL INTEGRATION AND DIGITAL READINESS

4.9.9 AFTER-SALES SUPPORT AND RELATIONSHIP MANAGEMENT

4.9.10 STRATEGIC FIT AND LONG-TERM PARTNERSHIP POTENTIAL

4.9.11 CONCLUSION

4.1 COST ANALYSIS BREAKDOWN FOR MEXICO PET CARE PRODUCTS MARKET

4.10.1 INTRODUCTION

4.10.2 RAW MATERIAL AND MANUFACTURING COSTS

4.10.3 PACKAGING AND LOGISTICS COSTS

4.10.4 MARKETING, RETAIL, AND REGULATORY COSTS

4.10.5 EMERGING COST TRENDS

4.10.6 CONCLUSION:-

4.11 PROFIT MARGINS SCENARIO: MEXICO PET CARE PRODUCTS MARKET

4.11.1 INTRODUCTION

4.11.2 COST MANAGEMENT AND MARGIN FORMATION

4.11.3 BRANDING, PRODUCT DIFFERENTIATION, AND PRICING STRATEGY

4.11.4 DISTRIBUTION CHANNELS AND THEIR IMPACT ON MARGINS

4.11.5 REGULATORY AND MACROECONOMIC INFLUENCES

4.11.6 EMERGING TRENDS AND STRATEGIC RESPONSE

4.11.7 PROFIT MARGIN IN RANGE

4.11.8 CONCLUSION

4.12 INNOVATION TRACKER AND STRATEGIC ANALYSIS: MEXICO PET CARE PRODUCTS MARKET

4.12.1 MAJOR DEALS AND STRATEGIC ALLIANCES

4.12.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.12.3 TIMELINES AND MILESTONES

4.12.4 INNOVATION STRATEGIES AND METHODOLOGIES

4.12.5 FUTURE OUTLOOK

4.13 PRICING ANALYSIS

5 TARIFFS & IMPACT ON THE MEXICO PET CARE PRODUCTS MARKET

5.1 CURRENT TARIFF RATE (S)

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 SUPPLY CHAIN OPTIMIZATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.7.4 DOMESTIC COURSE OF CORRECTION

6 REGULATION COVERAGE ON THE MEXICO PET CARE PRODUCTS MARKET

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 SURGE IN HOUSEHOLD PET COMPANIONSHIP

7.1.2 EXPANSION OF PUBLIC VETERINARY CLINICS ENHANCING PET CARE ACCESSIBILITY

7.1.3 RISING DISPOSABLE INCOME MAKING PET FOOD AFFORDABLE FOR ALL

7.2 RESTRAINTS

7.2.1 REGULATORY BURDEN AND COMPLIANCE COSTS

7.2.2 PREVALENCE OF COUNTERFEIT AND LOW-QUALITY PET CARE PRODUCTS

7.3 OPPORTUNITIES

7.3.1 EXPANSION OF LOCAL PRODUCTION & CAPACITY ENHANCEMENT

7.3.2 ADVANCEMENTS IN TECHNOLOGY AND INCREASED INVESTMENT IN RESEARCH AND DEVELOPMENT

7.3.3 GOVERNMENT SUPPORT FOR ANIMAL WELFARE

7.4 CHALLENGES

7.4.1 CHANGING PET DEMOGRAPHICS AFFECTING VOLUME DEMAND

7.4.2 TRADE UNCERTAINTY WITH THE U.S. CHALLENGES MEXICO’S PET CARE MARKET GROWTH

8 MEXICO PET CARE PRODUCTS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 PET FOOD

8.3 PET SERVICES

8.4 VETERINARY CARE

8.5 PET SHAMPOO

8.6 PHARMACEUTICALS

8.7 MOUTH CARE

9 MEXICO PET CARE PRODUCTS MARKET, BY COMPANION ANIMAL

9.1 OVERVIEW

9.2 DOGS

9.3 CATS

9.4 BIRDS

9.5 FISHES

9.6 HORSES

9.7 RABBITS

9.8 OTHERS

10 MEXICO PET CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 MEXICO PET CARE PRODUCTS MARKET: COMPANY LANDSCAPE

11.1 COMPANY VALUE SHARE ANALYSIS: MEXICO

12 SWOT ANALYSIS

13 COMAPANY PROFILES

13.1 MARS, INCORPORATED

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 NESTLE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 HILL'S PET NUTRITION, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 ADM

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 SESAJAL

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 BIMEDA, INC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 BIOMAA

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 ELANCO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 FLAGASA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GRUPO NU3

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 LOS BELENES

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 NOW FOODS

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 NEW TECHNOLOGY IN FOOD SA DE CV

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 PETMET DE MÉXICO S. DE RL DE CV

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 SCHELL & KAMPETER, INC

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 VETOQUINOL

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 VIRBAC

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 COMPETITIVE BRAND STRATEGIES AND MARKET POSITIONING IN THE MEXICO PET CARE PRODUCTS MARKET

TABLE 2 KEY BRAND AND PRODUCT DIMENSIONS IN THE MEXICO PET CARE PRODUCTS MARKET

TABLE 3 PRODUCTION CAPACITY OF MANUFACTURERS

TABLE 4 SUMMARY OF KEY MILESTONES

TABLE 5 KEY METRICS AND TRENDS IN THE MEXICO PET CARE MARKET

TABLE 6 MEXICO PET CARE PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 7 MEXICO PET FOOD MARKET IN PET CARE PRODUCTS, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MEXICO PET FOOD MARKET IN PET CARE PRODUCTS, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 9 MEXICO SNACKS/TREATS IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MEXICO SNACKS/TREATS IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 11 MEXICO PET SERVICES IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MEXICO VETERINARY CARE IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MEXICO SUPPLEMENTS IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MEXICO FIRST AID IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MEXICO PET SHAMPOO IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MEXICO PET SHAMPOO IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 17 MEXICO PHARMACEUTICALS IN PET CARE PRODUCTS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 18 MEXICO PHARMACEUTICALS IN PET CARE PRODUCTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 19 MEXICO MOUTH CARE IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 MEXICO PET CARE PRODUCTS MARKET, BY COMPANION ANIMAL, 2018-2032 (USD THOUSAND)

TABLE 21 MEXICO PET CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 22 MEXICO OFFLINE IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MEXICO ONLINE IN PET CARE PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MEXICO PET CARE PRODUCTS MARKET

FIGURE 2 MEXICO PET CARE PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO PET CARE PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 MEXICO PET CARE PRODUCTS MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 MEXICO PET CARE PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO PET CARE PRODUCTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MEXICO PET CARE PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MEXICO PET CARE PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DISTRIBUTION CHANNEL GRID

FIGURE 10 MEXICO PET CARE PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 MEXICO PET CARE PRODUCTS MARKET: SEGMENTATION

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 SIX SEGMENTS COMPRISE THE MEXICO PET CARE PRODUCTS MARKET, BY PRODUCT (2024)

FIGURE 15 SURGE IN HOUSEHOLD PET COMPANIONSHIP IS EXPECTED TO DRIVE THE MEXICO PET CARE PRODUCTS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE PET FOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO PET CARE PRODUCTS MARKET IN 2025 AND 2032

FIGURE 17 VALUE CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS

FIGURE 19 MEXICO PET CARE PRODUCTS MARKET, 2023-2032, AVERAGE SELLING PRICE (USD/TON)

FIGURE 20 DROC ANALYSIS

FIGURE 21 MEXICO PET CARE PRODUCTS MARKET: BY PRODUCT, 2024

FIGURE 22 MEXICO PET CARE PRODUCTS MARKET: BY COMPANION ANIMAL, 2024

FIGURE 23 MEXICO PET CARE PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 24 MEXICO PET CARE PRODUCTS MARKET: COMPANY SHARE 2024 (%)

Mexico Pet Care Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Mexico Pet Care Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Mexico Pet Care Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.