Mexico Tractors Market

Market Size in USD Billion

CAGR :

%

USD

23.09 Billion

USD

35.28 Billion

2025

2033

USD

23.09 Billion

USD

35.28 Billion

2025

2033

| 2026 –2033 | |

| USD 23.09 Billion | |

| USD 35.28 Billion | |

|

|

|

|

Mexico Tractors Market Size

- The Mexico Tractors Market was valued at ESP 23.09 billion in 2024 and is expected to reach ESP 35.28 billion by 2032, at a CAGR of 5.59% during the forecast period

- Market expansion is driven by robust construction activity, rapid urbanization, and government-led infrastructure initiatives, which are boosting demand for durable, high-quality machinery.

- Additionally, the growing focus on eco-friendly, low-emission, and high-performance technologies is creating new opportunities for both international and domestic manufacturers to strengthen their market presence.

Mexico Tractors Market Analysis

- The Mexico Tractors Market is witnessing steady growth, supported by rapid urbanization, evolving consumer lifestyles, and the increasing adoption of healthy eating habits. The rising consumption of canned and frozen foods, coupled with a growing vegan population and the expansion of convenience stores, is fueling market demand.

- However, challenges such as high fruit and vegetable wastage and insufficient cold-chain infrastructure continue to restrain growth. Despite these hurdles, digitalization of retail, manufacturer-led initiatives, advancements in freezing technologies, and the rising demand for longer shelf-life produce are creating promising opportunities for future expansion.

- México (Estado de México) is expected to dominate the Mexico Tractors Market, accounting for the largest revenue share of 10.35% in 2025. This dominance is attributed to rapid urban development, large-scale infrastructure projects, and strong residential and commercial construction activity across the region. The presence of major industrial zones, expanding retail hubs, and sustained government investment in infrastructure modernization further strengthens Estado de México’s position as the key growth center in the country’s tractors market.

- Jalisco is expected to be the fastest-growing region in the Mexico Tractors market during the forecast period with a CAGR of 7.48%, fueled by rapid urban development, expanding infrastructure projects, and rising residential and commercial construction activity. The presence of emerging industrial clusters, growing retail networks, and increased government investment in agricultural and infrastructure modernization further supports Jalisco’s position as a key growth hub in Mexico’s tractors market.

- The 35-75HP segment is expected to dominate the Mexico Tractors Market with a market share of 24.00% in 2025, driven by segment’s widespread availability, cost-effectiveness, and versatility, making it suitable for diverse agricultural and industrial applications. Additionally, the increasing demand for medium-horsepower tractors that balance performance, fuel efficiency, and operational flexibility further reinforces this segment’s strong market position.

Report Scope and Mexico Tractors Market Segmentation

|

Attributes |

Mexico Tractors Key Market Insights |

|

Segments Covered |

|

|

States Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include regulatory standards, demand for comfort and luxury, technological advancements, role of tractor in agricultural revolution, pricing analysis, case study analysis, company comparative analysis, sustainability initiatives, state-wise growth opportunities, PESTLE analysis, supply chain analysis, consumer purchase decision process, key strategic initiatives, consumer buying behaviour. |

Mexico Tractors Market Trends

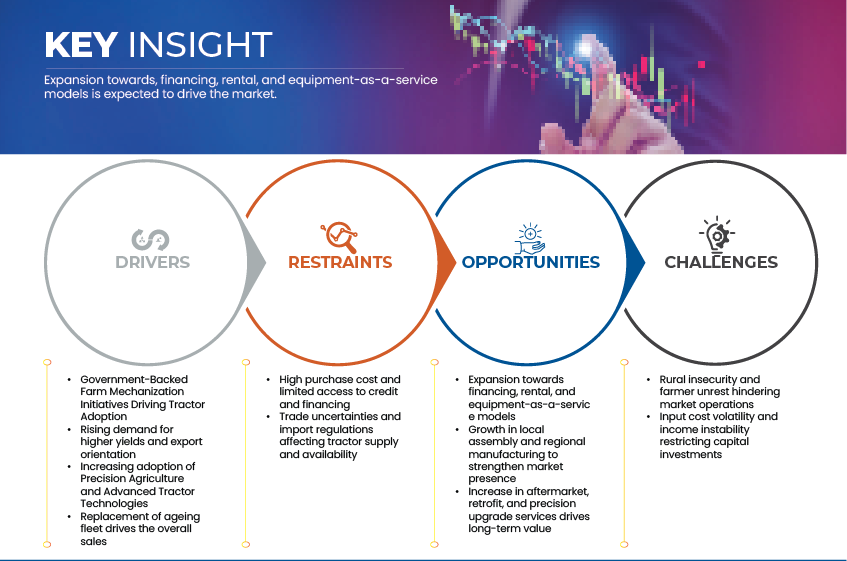

“Expansion Towards, Financing, Rental, And Equipment-As-A-Service Models”

- The expansion toward financing, rental, and equipment-as-a-service (EaaS) models is transforming the dynamics of Mexico’s tractor market. As high upfront costs limit direct ownership, farmers are increasingly turning to flexible alternatives such as lease-based access, pay-per-use models, and cooperative equipment sharing. These solutions not only reduce financial burdens but also allow small and mid-sized farmers to adopt modern, high-performance tractors without heavy capital investment. Supported by agri-fintech platforms, dealer-led financing, and institutional credit initiatives, this shift is fostering greater mechanization and improving productivity across Mexico’s diverse agricultural landscape.

- In February 2025, John Deere México launched new leasing and rental solutions under its “Plan Verde Productivo,” providing farmers with options to lease tractors and pay based on usage hours, supporting the growing Equipment-as-a-Service (EaaS) trend in the country.

- In November 2024, BBVA México and the Consejo Nacional Agropecuario (CNA) signed a partnership to boost financing for agricultural equipment and technology upgrades, aiming to expand access to credit across more than 20 states in Mexico.

- The growing emphasis on financing, rental, and Equipment-as-a-Service (EaaS) models is reshaping tractor ownership in Mexico, making mechanization more attainable for small and medium-scale farmers. By lowering upfront costs and enabling flexible access to advanced machinery, these models are fostering higher adoption rates and ensuring more efficient utilization of agricultural assets across the country.

Mexico Tractors Market Dynamics

Driver

“Government-Backed Farm Mechanization Initiatives Driving Tractor Adoption”

- The growth of the Mexico tractor market is being significantly influenced by government-backed farm mechanization initiatives aimed at enhancing agricultural productivity and efficiency. Various programs and policy frameworks, including Producción para el Bienestar and rural credit support schemes, have been implemented to promote the adoption of modern farming equipment. Through these initiatives, subsidies, financial assistance, and training programs are being extended to farmers to encourage the transition from traditional manual practices to mechanized operations. As a result, tractor penetration across medium and large-scale farms in Mexico is being steadily increased, fostering greater modernization within the country’s agricultural sector.

- As announced by the Secretaría de Agricultura y Desarrollo Rural (SADER) in March 2024, the government allocated over MX $16 billion under the Producción para el Bienestar program to support small and medium farmers through direct subsidies and equipment financing, thereby promoting tractor adoption and farm mechanization across rural Mexico.

- As reported by the Mexican Ministry of Agriculture in August 2023, the expansion of the MasAgro initiative introduced localized mechanization service hubs across eight agricultural states, providing access to two- and four-wheel tractors for smallholder farmers and enhancing productivity in staple crop production.

- As stated by the Government of Jalisco in October 2024, the state launched its Programa de Apoyo a la Mecanización Agrícola, providing partial subsidies for the purchase of new tractors and implements, reflecting regional efforts to modernize farming and strengthen agricultural output through mechanized cultivation.

- Government-backed mechanization programs are playing a crucial role in accelerating tractor adoption across Mexico. By offering subsidies, credit support, and state-level assistance, these initiatives are enabling farmers to modernize operations and improve productivity. Continued policy support is expected to sustain tractor demand and strengthen Mexico’s transition toward efficient, technology-driven agriculture.

Restraints

“High Purchase Cost And Limited Access To Credit And Financing”

- These cost pressures have led many producers to implement selective price adjustments, reduce packaging volumes, or shift to waterborne formulations with lower resin dependency. However, persistent volatility in global commodity markets continues to constrain profit margins and limit the ability of local manufacturers to invest in product innovation and sustainability transitions.

- High purchase costs combined with limited access to affordable credit and financing options remain major barriers to tractor adoption in Mexico. A large share of small and medium-scale farmers continue to operate under tight financial constraints, making it difficult to invest in new machinery despite the clear benefits of mechanization. While government-backed credit programs and agricultural banks exist, their reach is often limited, especially in rural and remote regions. This financial gap continues to restrict fleet modernization and slows the overall pace of mechanization in the Mexican agricultural sector.

- As noted by the digital-finance platform Verqor in March 2025, more than 90 % of Mexican farmers lack access to formal financing, constraining their ability to purchase tractors and mechanized equipment.

- According to the credit-line transaction signed by Inter‑American Development Bank (IDB) for Mexico’s rural agricultural sector in October 2024, only 2.5 % of small-scale producers secured any type of bank loan in 2022, reflecting severely limited financing for equipment purchases

- The organization FinTerra highlights in its 2024 report that, despite annual credit demand of up to US $18 billion among agricultural producers in Mexico, existing formal credit provision remains under US $10 billion, signalling a wide financing gap for asset purchases including tractors

- High tractor costs and limited financing access remain key barriers to mechanization in Mexico. Many small farmers struggle to secure affordable loans, restricting equipment upgrades. Expanding rural credit access and subsidy programs will be essential to accelerate tractor adoption and boost agricultural productivity.

Mexico Tractors Market Scope

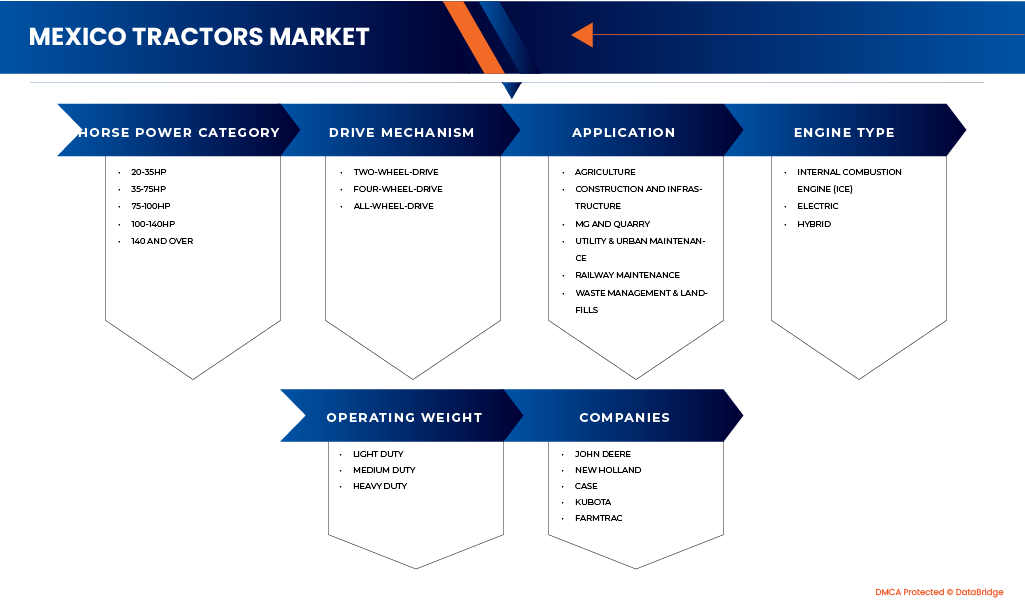

The market is segmented on the basis of horse power category, drive mechanism, application, engine type, operating weight.

- By Horse Power Category

On the basis of horse power category, the Mexico Tractor Market is segmented into 20–35 HP, 35–75 HP, 75–100 HP, 100–140 HP, and 140 HP & Above. In 2025, the 35-75 HP segment is expected to dominate the market with a 24.00% share, supported by affordability, ease of operation, and high suitability for small and medium-sized farms. This segment is favored by farmers for light-duty agricultural tasks, offering efficient performance and lower maintenance costs across Mexico’s diverse agricultural landscape.

The 35-75HP segment is projected to be the fastest-growing horse power category in the Mexico Tractors Market, registering the highest CAGR of 6.14% during the forecast period. This growth is driven by the rising adoption of medium-power tractors that offer an optimal balance of performance, fuel efficiency, and versatility for small to mid-sized farms. Increasing demand for cost-effective mechanization, coupled with the expansion of mixed-use agricultural operations and government subsidies supporting mid-range equipment purchases, further strengthens this segment’s growth outlook. Additionally, technological advancements and the availability of multi-functional tractor models suitable for both field and transport applications are expected to accelerate demand in the coming years.

- By Application

On the basis of Application, the Mexico Tractors Market is categorized Agriculture, Construction and Infrastructure, Mining and Quarring, Utility & Urban Maintenance, Railway Maintenance, and Waste Management & Landfills. In 2025, the Agriculture segment is expected to dominate the market with a 60.30% share, supported by widespread use of tractors for plowing, tilling, planting, and harvesting activities. The segment’s leadership is further supported by the affordability and accessibility of agricultural tractors, along with government programs promoting farm mechanization and improved credit availability for small and medium farmers.

the Construction and infrastructure segment is projected to record the fastest growth, expanding at a CAGR of 5.92% during the forecast period. This growth is fueled by rising infrastructure investments, rapid urbanization, and expanding public works projects, which are increasing the demand for heavy-duty tractors and earthmoving machinery. Additionally, government-led development initiatives, private construction activity, and the adoption of technologically advanced equipment for greater efficiency and sustainability are further propelling this segment’s expansion in the coming years.

- By Engine Type

On the basis of engine type, the Mexico Tractors Market is segmented into Internal Combustion Engine (ICE), Electric, and Hybrid. In 2025, the Internal Combustion Engine (ICE) segment is projected to dominate the market with a 93.11% share, driven by proven reliability, high power output, and cost-effectiveness compared to emerging alternatives. The widespread availability of diesel and gasoline infrastructure, coupled with lower upfront costs and strong aftermarket service networks, continues to support the dominance of ICE tractors across both agricultural and non-agricultural applications.

the Internal Combustion Engine (ICE) segment is also expected to be the fastest-growing, registering a CAGR of 5.68% during the forecast period. This growth is fueled by rising mechanization in agriculture, expansion of infrastructure projects, and increasing demand for high-torque tractors capable of handling diverse terrain and workloads. Furthermore, continuous advancements in fuel efficiency, emission control technologies, and engine durability are reinforcing the sustained adoption of ICE-powered tractors, even as the market gradually transitions toward hybrid and electric alternatives.

- By Drive Mechanism

On the basis of drive mechanism, the Mexico Tractors Market is segmented into Two-Wheel-Drive, Four-Wheel-Drive, All-Wheel-Drive. In 2025, the Two-Wheel-Drive segment is expected to dominate the market with a 93.16% share, primarily due to its affordability, ease of maintenance, and suitability for light to medium agricultural operations. These tractors are widely preferred by small and medium-scale farmers for routine field tasks such as tilling, hauling, and plowing, especially in regions with relatively flat terrains. Their lower ownership costs, fuel efficiency, and availability of local service networks further strengthen their adoption across rural areas of Mexico.

The Two-Wheel-Drive segment is projected to be the fastest-growing, registering a CAGR of 5.75% during the forecast period. This growth is supported by expanding mechanization in smallholder farms, rising rural income levels, and government programs promoting agricultural modernization. Additionally, increasing demand for cost-effective, energy-efficient, and multipurpose tractors for crop cultivation, transportation, and land preparation activities is driving segment expansion. The segment’s robust performance across both agricultural and light construction applications underscores its continued market dominance through 2032.

- By Operating Weight

On the basis of operating weight, the Mexico Tractors Market is segmented into Light Duty, Medium Duty, and Heavy Duty. In 2025, the Light Duty segment is expected to dominate the market with a 78.63% share, primarily due to its affordability, versatility, and suitability for small- to mid-scale agricultural operations. Light duty tractors are widely used for tasks such as plowing, tilling, mowing, and material transport on small farms and orchards. Their compact design, fuel efficiency, and ease of maneuverability make them particularly attractive for regions with limited landholding sizes and narrow field layouts. The segment also benefits from increasing mechanization among smallholder farmers, availability of financing options, and growing adoption of entry-level tractors across rural Mexico.

The Medium Duty segment is also projected to be the fastest-growing, registering a CAGR of 6.00% during the forecast period. This growth is attributed to expanding commercial farming, increasing use of tractors in construction and utility applications, and rising demand for multipurpose, high-torque machinery capable of handling both agricultural and industrial workloads. Medium duty tractors are gaining traction among medium-scale farms and contractors seeking equipment that balances power, durability, and operating efficiency. Additionally, technological advancements in transmission systems, hydraulic performance, and fuel efficiency are further accelerating the adoption of medium-duty tractors in the Mexico market.

Mexico Tractors Market Regional Analysis

- México (Estado de México) is expected to dominate the Mexico Tractors Market, accounting for the largest revenue share of 10.35% in 2025. This dominance is attributed to rapid urban development, large-scale infrastructure projects, and strong residential and commercial construction activity across the region. The presence of major industrial zones, expanding retail hubs, and sustained government investment in infrastructure modernization further strengthens Estado de México’s position as the key growth center in the country’s tractors market.

- Jalisco is expected to be the fastest-growing region in the Mexico Tractors market during the forecast period with a CAGR of 7.48%, fueled by rapid urban development, expanding infrastructure projects, and rising residential and commercial construction activity. The presence of emerging industrial clusters, growing retail networks, and increased government investment in agricultural and infrastructure modernization further supports Jalisco’s position as a key growth hub in Mexico’s tractors market

Jalisco Tractor Market Insight

The Jalisco tractor market represents a key growth hub within the Mexico Tractors Market, driven by rapid agricultural modernization, expanding agribusiness investments, and strong government support for mechanization. The region’s diverse crop base, growing food processing industry, and improved access to credit and financing programs are further accelerating tractor adoption. Additionally, infrastructure development, expansion of irrigation systems, and the rise of commercial farming operations are expected to strengthen Jalisco’s position as one of the fastest-growing regional markets for tractors in Mexico.

Chihuahua Tractor Market Insight

The Chihuahua Tractor Market is anticipated to witness steady growth, underpinned by expanding agricultural activities, increasing investment in irrigation infrastructure, and rising adoption of advanced farming equipment. The region’s strong focus on crop diversification, particularly in grains and horticulture, along with government incentives promoting farm mechanization, is driving consistent demand for tractors. Additionally, improvements in rural logistics, access to financing options, and the growing presence of local dealerships and service networks are expected to further support market expansion in Chihuahua over the forecast period.

The Major Market Leaders Operating in the Market Are:

- Deere & Company (U.S.)

- CNH Industrial N.V. (U.K.)

- KUBOTA Corporation (Japan)

- Farmtrac (India)

- LOVOL Corporation (China)

- AGCO Corporation (Massey Ferguson) (U.S.)

- Tractors and Farm Equipment Limited (India)

- McCormick (Parent Company- Argo Tractors S.p.A.) (Italy)

- Mahindra&Mahindra (India)

- Solis (China)

- Sonalika (India)

- Zoomlion (China)

- YTO Group (China)

Latest Developments in Mexico Tractor Market

- In October 2025, Lovol showcased its new-energy tractor series and China’s first smart-agriculture AI-model at the China International Agricultural Machinery Exhibition (CIAME) in Wuhan, demonstrating its commitment to intelligence, electrification, and full-chain smart-agriculture solutions.

- In September 2025, the McCormick X8.634 VT-Drive, introduced, is the flagship tractor model delivering 340 HP with advanced VT-Drive transmission and the innovative Clever Cab for enhanced operator comfort and visibility. This model combines power, cutting-edge technology, and comfort, positioning it as a leading contender for the Tractor of the Year 2026 award.

- In September 2025, AGCO announced a EUR 54 million investment at its AGCO Power plant to expand production of low-emission engines, reinforcing its commitment to sustainable, high-efficiency powertrains.

- In August 2025, TAFE opened a MXD 280 million tractor assembly plant in Aguascalientes aimed at boosting assembly capacity, creating 300+ jobs, and producing electric tractors aligned with Mexico’s sustainable mobility goals.

- In January 2025, Mahindra Mexico showcased its newly launched model Mahindra 2025 at Expo Agroalimentaria, one of the largest agri-business exhibitions in Latin America. The tractor was highlighted as a powerhouse performer tailored to meet the requirements of Mexican farmers. Mahindra’s strong presence in Mexico is supported by efficient diesel performance, extensive spare parts availability, robust warranty, and financing schemes, driving favorable acceptance among local farmers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 COUNTRY-WISE TRACTOR ECOSYSTEM

4.2.1 INTRODUCTION

4.2.2 GLOBAL OVERVIEW AND MARKET DYNAMICS

4.2.3 MEXICO’S ROLE IN THE GLOBAL TRACTOR SUPPLY CHAIN

4.2.4 EMERGING SHIFTS IN GLOBAL TRADE PATTERNS

4.2.5 STRATEGIC IMPLICATIONS FOR MEXICO

4.3 CASE STUDY ANALYSIS

4.3.1 CASE STUDY 1: JOHN DEERE & THE HIGH-VALUE EXPORT FARMER

4.3.2 CASE STUDY 2: MASSEY FERGUSON & THE FINANCING CONUNDRUM

4.3.3 CASE STUDY 3: MAHINDRA & THE SMALLHOLDER "EJIDATARIO"

4.3.4 CASE STUDY 5: CNH INDUSTRIAL'S "PRECISION FOR ALL" STRATEGY

4.3.5 CASE STUDY 3: KUBOTA'S "RIGHT-SIZING FOR SMALLHOLDERS" STRATEGY

4.3.6 CONCLUSION

4.4 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

4.5 CONSUMER BUYING BEHAVIOR

4.6 CONSUMER PURCHASE DECISION PROCESS

4.6.1 PROBLEM RECOGNITION

4.6.2 INFORMATION SEARCH

4.6.3 INTERNAL SEARCH

4.6.4 EXTERNAL SEARCH

4.6.5 ALTERNATIVE EVALUATION

4.6.6 PURCHASE DECISION

4.6.7 POST-PURCHASE BEHAVIOR

4.6.8 INFLUENCING FACTORS

4.7 DEMAND FOR COMFORT AND LUXURY

4.7.1 ERGONOMIC CAB DESIGN

4.7.2 ADVANCED CLIMATE CONTROL

4.7.3 DIGITAL CONTROLS AND CONNECTIVITY

4.7.4 SUPERIOR SEATING AND OPERATOR COMFORT

4.7.5 ALL-WEATHER CABINS

4.7.6 ENHANCED SAFETY FEATURES

4.8 TECHNOLOGICAL ADVANCEMENTS

4.8.1 OVERVIEW

4.8.2 KEY TECHNOLOGY DOMAINS

4.8.2.1 PRECISION AGRICULTURE AND CONNECTIVITY

4.8.2.2 AUTOMATION & SMART MACHINES

4.8.2.3 SUSTAINABLE & ALTERNATIVE POWERTRAINS

4.8.2.4 AFTER-SALES, LOCALISATION & SERVICE TECH

4.8.3 CONCLUSION

4.9 KEY STRATEGIC INITIATIVES — MEXICO TRACTOR MARKET

4.9.1 PRODUCT INNOVATION AND TECHNOLOGICAL INTEGRATION

4.9.2 STRENGTHENED CAPITAL MARKET POSITIONING

4.9.3 MANUFACTURING EXPANSION AND SUPPLY CHAIN STRENGTHENING

4.9.4 STRATEGIC OEM COLLABORATIONS AND PRODUCT DIVERSIFICATION

4.9.5 DOMESTIC MANUFACTURING EXPANSION AND EMPLOYMENT GENERATION

4.9.6 PRODUCT DIFFERENTIATION AND HIGH-PERFORMANCE SEGMENT GROWTH

4.9.7 STRATEGIC SYNERGY AND MARKET IMPLICATIONS

4.9.8 OUTLOOK AND STRATEGIC CONCLUSION

4.1 PRICING ANALYSIS

4.10.1 COMPACT / SPECIALIZED TRACTORS (20–40 HP) — SMALLHOLDERS, ORCHARDS, VINEYARDS, VEGETABLE GROWERS

4.10.2 UTILITY / MID-UTILITY TRACTORS (40–80 HP) — SMALL & MEDIUM FARMS (MOST COMMON)

4.10.3 MID-TO-HIGH / PREMIUM-MID (80–150 HP) — COMMERCIAL FARMS, CONTRACTORS

4.10.4 HIGH-POWER & SPECIALTY (>150 HP) — LARGE COMMERCIAL, INDUSTRIAL, CUSTOM WORK

4.11 ROLE OF TRACTORS IN AGRICULTURAL REVOLUTION

4.11.1 HISTORICAL CONTEXT

4.11.2 STRUCTURAL IMPACT ON AGRICULTURE

4.11.2.1 PRODUCTIVITY GROWTH

4.11.2.2 EXPANSION OF CULTIVATED AREA

4.11.2.3 EMPLOYMENT TRANSFORMATION

4.11.3 GOVERNMENT AND INSTITUTIONAL SUPPORT

4.11.4 MODERN MECHANIZATION WAVE

4.11.5 SOCIOECONOMIC OUTCOMES

4.11.5.1 HIGHER RURAL INCOMES IN MECHANIZED REGIONS

4.11.5.2 EXPORT COMPETITIVENESS IN FRUITS, VEGETABLES, AND GRAINS

4.11.5.3 REDUCED RURAL-URBAN MIGRATION IN MECHANISED ZONES

4.11.6 CONCLUSION

4.12 SUPPLY CHAIN ANALYSIS

4.12.1 UPSTREAM INPUTS: RAW MATERIALS AND COMPONENTS

4.12.1.1 RAW MATERIAL SOURCING

4.12.1.2 COMPONENT MANUFACTURING & SUB-ASSEMBLY

4.12.2 MANUFACTURING & ASSEMBLY OPERATIONS

4.12.2.1 MANUFACTURING FOOTPRINT IN MEXICO

4.12.2.2 PRODUCT CONFIGURATION & LOCALIZATION

4.12.3 LOGISTICS, DISTRIBUTION & DEALER NETWORKS

4.12.3.1 INBOUND LOGISTICS

4.12.3.2 DEALER NETWORK & OUTBOUND DISTRIBUTION

4.12.3.3 AFTER-SALES SERVICE AND PARTS FLOW

4.12.4 MARKET ACCESS, FINANCING & DEMAND-PULL MECHANISMS

4.12.4.1 FINANCING & MECHANIZATION SCHEMES

4.12.4.2 IMPORT/EXPORT AND TRADE FLOWS

4.12.4.3 DEMAND VOLATILITY AND SEASONALITY

4.12.5 RISK FACTORS AND SUPPLY-CHAIN DISRUPTIONS

4.12.5.1 RAW-MATERIAL AND COMPONENT SUPPLY RISK

4.12.5.2 TRADE-POLICY, TARIFF AND EXCHANGE-RATE RISK

4.12.5.3 INFRASTRUCTURE, LOGISTICS AND TRANSPORTATION RISK

4.12.5.4 DEMAND-SIDE & REPLACEMENT-CYCLE RISK

4.12.5.5 AFTER-SALES AND SPARE-PART RISK

4.12.5.6 TECHNOLOGY, SUSTAINABILITY & REGULATORY RISK

4.13 SUSTAINABILITY INITIATIVES

4.13.1 GOVERNMENT SUPPORT FOR SUSTAINABLE FARMING

4.13.2 ADOPTION OF FUEL-EFFICIENT AND ALTERNATIVE-FUEL TRACTORS

4.13.3 PRECISION AGRICULTURE AND SMART TECHNOLOGIES

4.13.4 TRAINING AND CAPACITY BUILDING

4.13.5 EMERGING MARKET TRENDS

4.13.6 CLIMATE-RESPONSIVE AGRICULTURE

4.13.7 CONCLUSION

4.14 STATE-WISE GROWTH OPPORTUNITIES

4.14.1 NORTHERN AND NORTHWESTERN STATES (SINALOA, SONORA, BAJA CALIFORNIA, CHIHUAHUA, COAHUILA)

4.14.2 CENTRAL REGION (JALISCO, GUANAJUATO, MICHOACÁN, PUEBLA, ESTADO DE MÉXICO)

4.14.3 SOUTHERN AND SOUTHEASTERN STATES (OAXACA, CHIAPAS, YUCATÁN, QUINTANA ROO, TABASCO)

4.14.4 WESTERN PLATEAU AND GRAIN BELT (ZACATECAS, DURANGO, SAN LUIS POTOSÍ)

4.14.5 URBAN AND INDUSTRIAL APPLICATIONS (MEXICO CITY, NUEVO LEÓN, QUERÉTARO)

5 REGULATORY STANDARDS

5.1 CERTIFICATION OF AGRICULTURAL MACHINERY & TRACTORS

5.2 SAFETY AND MACHINERY STANDARDS

5.3 IMPORT & EMISSION REQUIREMENTS

5.4 CIRCULATION ON ROADS & LOCAL USAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GOVERNMENT-BACKED FARM MECHANIZATION INITIATIVES DRIVING TRACTOR ADOPTION

6.1.2 RISING DEMAND FOR HIGHER YIELDS AND EXPORT ORIENTATION

6.1.3 INCREASING ADOPTION OF PRECISION AGRICULTURE AND ADVANCED TRACTOR TECHNOLOGIES

6.1.4 REPLACEMENT OF AGEING FLEET DRIVES THE OVERALL SALES

6.2 RESTRAINTS

6.2.1 HIGH PURCHASE COST AND LIMITED ACCESS TO CREDIT AND FINANCING

6.2.2 TRADE UNCERTAINTIES AND IMPORT REGULATIONS AFFECTING TRACTOR SUPPLY AND AVAILABILITY

6.3 OPPORTUNITY

6.3.1 EXPANSION TOWARDS FINANCING, RENTAL, AND EQUIPMENT-AS-A-SERVICE MODELS

6.3.2 GROWTH IN LOCAL ASSEMBLY AND REGIONAL MANUFACTURING TO STRENGTHEN MARKET PRESENCE

6.3.3 INCREASE IN AFTERMARKET, RETROFIT, AND PRECISION UPGRADE SERVICES DRIVES LONG-TERM VALUE

6.4 CHALLENGES

6.4.1 RURAL INSECURITY AND FARMER UNREST HINDERING MARKET OPERATIONS

6.4.2 INPUT COST VOLATILITY AND INCOME INSTABILITY RESTRICTING CAPITAL INVESTMENTS

7 MEXICO TRACTOR MARKET, BY HORSE POWER CATEGORY

7.1 OVERVIEW

7.2 20-35HP

7.3 35-75HP

7.4 75-100HP

7.5 100-140HP

7.6 140 AND OVER

8 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM

8.1 OVERVIEW

8.2 TWO-WHEEL-DRIVE

8.3 FOUR-WHEEL-DRIVE

8.4 ALL-WHEEL-DRIVE

9 MEXICO TRACTORS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AGRICULTURE

9.3 CONSTRUCTION AND INFRASTRUCTURE

9.4 MINING AND QUARRY

9.5 UTILITY & URBAN MAINTENANCE

9.6 RAILWAY MAINTENANCE

9.7 WASTE MANAGEMENT & LANDFILLS

10 MEXICO TRACTORS MARKET, BY ENGINE TYPE

10.1 OVERVIEW

10.2 INTERNAL COMBUSTION ENGINE (ICE)

10.3 ELECTRIC

10.4 HYBRID

11 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT

11.1 OVERVIEW

11.2 LIGHT DUTY

11.3 MEDIUM DUTY

11.4 HEAVY DUTY

12 MEXICO TRACTOR MARKET, BY STATE

12.1 OVERVIEW

12.1.1 AGUASCALIENTES

12.1.2 BAJA CALIFORNIA SUR

12.1.3 CAMPECHE

12.1.4 CHIAPAS

12.1.5 CHIHUAHUA

12.1.6 CIUDAD DE MÉXICO

12.1.7 COAHUILA

12.1.8 DURANGO

12.1.9 GUANAJUATO

12.1.10 GUERRERO

12.1.11 HIDALGO

12.1.12 JALISCO

12.1.13 MÉXICO (ESTADO DE MÉXICO)

12.1.14 MICHOACÁN

12.1.15 MORELOS

12.1.16 NAYARIT

12.1.17 NUEVO LEÓN

12.1.18 OAXACA

12.1.19 PUEBLA

12.1.20 QUERÉTARO

12.1.21 QUANTA ROO

12.1.22 SAN LUIS POTOSÍ

12.1.23 SALONA

12.1.24 SONORA

12.1.25 TABASCO

12.1.26 TAMAULIPAS

12.1.27 TLAXCALA

12.1.28 VERACRUZ

12.1.29 YUCATÁN

12.1.30 ZACATECAS

13 MEXICO TRACTORS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MEXICO

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CNH INDUSTRIAL N.V.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.3.1 NEW HOLLAND

15.1.3.2 CASE

15.1.4 RECENT DEVELOPMENT

15.2 DEERE & COMPANY

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 AGCO CORPORATION (MASSEY FERGUSON).

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 KUBOTA CORPORATION.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 MAHINDRA&MAHINDRA LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FARMTRAC MÉXICO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 LOVOL CORPORATION.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 MCCORMICK (A SUBSIDIARY OF ARGO TRACTORS S.P.A.)

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 SOLIS MEXICO TRACTOR

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 SONALIKA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 TRACTORS AND FARM EQUIPMENT LIMITED

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 YTO GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ZOOMLION HEAVY INDUSTRY SCIENCE&TECHNOLOGY CO., LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

TABLE 2 TRACTOR PRICING ANALYSIS BY TYPE AND HORSEPOWER

TABLE 3 TIMELINE: TRACTORS AND AGRICULTURAL REVOLUTION IN MEXICO

TABLE 4 STATE-WISE GROWTH OPPORTUNITIES IN THE MEXICO

TABLE 5 KEY REGULATORY STANDARDS GOVERNING TRACTORS IN MEXICO

TABLE 6 MEXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 7 MEXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 8 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 9 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 10 MEXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 ( THOUSAND)

TABLE 11 MEXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 12 MEXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 ( THOUSAND)

TABLE 13 MEXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 14 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 ( THOUSAND)

TABLE 15 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 16 MEXICO TRACTOR MARKET, BY STATE, 2018-2032 (ESP THOUSAND)

TABLE 17 MEXICO TRACTOR MARKET, BY STATE, 2018-2032 (UNITS)

TABLE 18 MEXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 19 MEXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 20 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 21 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 22 MEXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 23 MEXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 24 MEXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 25 MEXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 26 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 27 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 28 AGUASCALIENTES TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 29 AGUASCALIENTES TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 30 AGUASCALIENTES TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 31 AGUASCALIENTES TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 32 AGUASCALIENTES TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 33 AGUASCALIENTES TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 34 AGUASCALIENTES TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 35 AGUASCALIENTES TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 36 AGUASCALIENTES TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 37 AGUASCALIENTES TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 38 BAJA CALIFORNIA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 39 BAJA CALIFORNIA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 40 BAJA CALIFORNIA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 41 BAJA CALIFORNIA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 42 BAJA CALIFORNIA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 43 BAJA CALIFORNIA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 44 BAJA CALIFORNIA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 45 BAJA CALIFORNIA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 46 BAJA CALIFORNIA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 47 BAJA CALIFORNIA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 48 BAJA CALIFORNIA SUR TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 49 BAJA CALIFORNIA SUR TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 50 BAJA CALIFORNIA SUR TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 51 BAJA CALIFORNIA SUR TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 52 BAJA CALIFORNIA SUR TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 53 BAJA CALIFORNIA SUR TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 54 BAJA CALIFORNIA SUR TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 55 BAJA CALIFORNIA SUR TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 56 BAJA CALIFORNIA SUR TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 57 BAJA CALIFORNIA SUR TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 58 CAMPECHE TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 59 CAMPECHE TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 60 CAMPECHE TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 61 CAMPECHE TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 62 CAMPECHE TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 63 CAMPECHE TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 64 CAMPECHE TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 65 CAMPECHE TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 66 CAMPECHE TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 67 CAMPECHE TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 68 CHIAPAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 69 CHIAPAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 70 CHIAPAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 71 CHIAPAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 72 CHIAPAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 73 CHIAPAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 74 CHIAPAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 75 CHIAPAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 76 CHIAPAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 77 CHIAPAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 78 CHIHUAHUA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 79 CHIHUAHUA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 80 CHIHUAHUA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 81 CHIHUAHUA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 82 CHIHUAHUA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 83 CHIHUAHUA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 84 CHIHUAHUA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 85 CHIHUAHUA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 86 CHIHUAHUA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 87 CHIHUAHUA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 88 CIUDAD DE MÉXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 89 CIUDAD DE MÉXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 90 CIUDAD DE MÉXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 91 CIUDAD DE MÉXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 92 CIUDAD DE MÉXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 93 CIUDAD DE MÉXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 94 CIUDAD DE MÉXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 95 CIUDAD DE MÉXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 96 CIUDAD DE MÉXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 97 CIUDAD DE MÉXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 98 COAHUILA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 99 COAHUILA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 100 COAHUILA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 101 COAHUILA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 102 COAHUILA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 103 COAHUILA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 104 COAHUILA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 105 COAHUILA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 106 COAHUILA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 107 COAHUILA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 108 COLIMA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 109 COLIMA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 110 COLIMA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 111 COLIMA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 112 COLIMA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 113 COLIMA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 114 COLIMA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 115 COLIMA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 116 COLIMA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 117 COLIMA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 118 DURANGO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 119 DURANGO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 120 DURANGO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 121 DURANGO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 122 DURANGO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 123 DURANGO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 124 DURANGO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 125 DURANGO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 126 DURANGO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 127 DURANGO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 128 GUANAJUATO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 129 GUANAJUATO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 130 GUANAJUATO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 131 GUANAJUATO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 132 GUANAJUATO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 133 GUANAJUATO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 134 GUANAJUATO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 135 GUANAJUATO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 136 GUANAJUATO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 137 GUANAJUATO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 138 GUERRERO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 139 GUERRERO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 140 GUERRERO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 141 GUERRERO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 142 GUERRERO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 143 GUERRERO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 144 GUERRERO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 145 GUERRERO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 146 GUERRERO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 147 GUERRERO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 148 HIDALGO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 149 HIDALGO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 150 HIDALGO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 151 HIDALGO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 152 HIDALGO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 153 HIDALGO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 154 HIDALGO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 155 HIDALGO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 156 HIDALGO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 157 HIDALGO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 158 JALISCO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 159 JALISCO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 160 JALISCO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 161 JALISCO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 162 JALISCO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 163 JALISCO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 164 JALISCO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 165 JALISCO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 166 JALISCO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 167 JALISCO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 168 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 169 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 170 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 171 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 172 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 173 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 174 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 175 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 176 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 177 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 178 MICHOACÁN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 179 MICHOACÁN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 180 MICHOACÁN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 181 MICHOACÁN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 182 MICHOACÁN TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 183 MICHOACÁN TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 184 MICHOACÁN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 185 MICHOACÁN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 186 MICHOACÁN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 187 MICHOACÁN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 188 MORELOS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 189 MORELOS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 190 MORELOS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 191 MORELOS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 192 MORELOS TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 193 MORELOS TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 194 MORELOS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 195 MORELOS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 196 MORELOS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 197 MORELOS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 198 NAYARIT TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 199 NAYARIT TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 200 NAYARIT TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 201 NAYARIT TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 202 NAYARIT TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 203 NAYARIT TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 204 NAYARIT TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 205 NAYARIT TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 206 NAYARIT TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 207 NAYARIT TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 208 NUEVO LEÓN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 209 NUEVO LEÓN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 210 NUEVO LEÓN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 211 NUEVO LEÓN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 212 NUEVO LEÓN TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 213 NUEVO LEÓN TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 214 NUEVO LEÓN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 215 NUEVO LEÓN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 216 NUEVO LEÓN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 217 NUEVO LEÓN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 218 OAXACA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 219 OAXACA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 220 OAXACA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 221 OAXACA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 222 OAXACA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 223 OAXACA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 224 OAXACA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 225 OAXACA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 226 OAXACA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 227 OAXACA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 228 PUEBLA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 229 PUEBLA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 230 PUEBLA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 231 PUEBLA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 232 PUEBLA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 233 PUEBLA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 234 PUEBLA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 235 PUEBLA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 236 PUEBLA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 237 PUEBLA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 238 QUERÉTARO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 239 QUERÉTARO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 240 QUERÉTARO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 241 QUERÉTARO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 242 QUERÉTARO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 243 QUERÉTARO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 244 QUERÉTARO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 245 QUERÉTARO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 246 QUERÉTARO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 247 QUERÉTARO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 248 QUANTA ROO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 249 QUANTA ROO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 250 QUANTA ROO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 251 QUANTA ROO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 252 QUANTA ROO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 253 QUANTA ROO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 254 QUANTA ROO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 255 QUANTA ROO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 256 QUANTA ROO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 257 QUANTA ROO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 258 SAN LUIS POTOSÍ TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 259 SAN LUIS POTOSÍ TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 260 SAN LUIS POTOSÍ TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 261 SAN LUIS POTOSÍ TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 262 SAN LUIS POTOSÍ TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 263 SAN LUIS POTOSÍ TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 264 SAN LUIS POTOSÍ TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 265 SAN LUIS POTOSÍ TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 266 SAN LUIS POTOSÍ TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 267 SAN LUIS POTOSÍ TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 268 SALONA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 269 SALONA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 270 SALONA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 271 SALONA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 272 SALONA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 273 SALONA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 274 SALONA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 275 SALONA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 276 SALONA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 277 SALONA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 278 SONORA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 279 SONORA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 280 SONORA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 281 SONORA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 282 SONORA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 283 SONORA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 284 SONORA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 285 SONORA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 286 SONORA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 287 SONORA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 288 TABASCO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 289 TABASCO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 290 TABASCO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 291 TABASCO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 292 TABASCO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 293 TABASCO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 294 TABASCO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 295 TABASCO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 296 TABASCO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 297 TABASCO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 298 TAMAULIPAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 299 TAMAULIPAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 300 TAMAULIPAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 301 TAMAULIPAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 302 TAMAULIPAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 303 TAMAULIPAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 304 TAMAULIPAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 305 TAMAULIPAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 306 TAMAULIPAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 307 TAMAULIPAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 308 TLAXCALA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 309 TLAXCALA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 310 TLAXCALA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 311 TLAXCALA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 312 TLAXCALA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 313 TLAXCALA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 314 TLAXCALA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 315 TLAXCALA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 316 TLAXCALA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 317 TLAXCALA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 318 VERACRUZ TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 319 VERACRUZ TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 320 VERACRUZ TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 321 VERACRUZ TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 322 VERACRUZ TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 323 VERACRUZ TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 324 VERACRUZ TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 325 VERACRUZ TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 326 VERACRUZ TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 327 VERACRUZ TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 328 YUCATÁN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 329 YUCATÁN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 330 YUCATÁN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 331 YUCATÁN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 332 YUCATÁN TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 333 YUCATÁN TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 334 YUCATÁN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 335 YUCATÁN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 336 YUCATÁN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 337 YUCATÁN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 338 ZACATECAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 339 ZACATECAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 340 ZACATECAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 341 ZACATECAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 342 ZACATECAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 343 ZACATECAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 344 ZACATECAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 345 ZACATECAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 346 ZACATECAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 347 ZACATECAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

List of Figure

FIGURE 1 MEXICO TRACTOR MARKET

FIGURE 2 MEXICO TRACTOR MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO TRACTOR MARKET: DROC ANALYSIS

FIGURE 4 MEXICO TRACTOR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO TRACTOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO TRACTOR MARKET: MULTIVARIATE MODELLING

FIGURE 7 MEXICO TRACTOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MEXICO TRACTOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MEXICO TRACTOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 MEXICO TRACTOR MARKET: SEGMENTATION

FIGURE 12 FIVE SEGMENTS COMPRISE GLOBAL ELECTRICAL STEEL MARKET, BY HORSE POWER CATEGORY (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GOVERNMENT-BACKED FARM MECHANIZATION INITIATIVES DRIVING TRACTOR ADOPTION TO DRIVE THE MEXICO TRACTOR MARKET IN THE FORECAST PERIOD

FIGURE 15 THE HORSE POWER CATEGORY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO TRACTOR MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 MEXICO TRACTOR MARKET: BY HORSE POWER CATEGORY, 2024

FIGURE 18 MEXICO TRACTORS MARKET: BY DRIVE MECHANISM, 2024

FIGURE 19 MEXICO TRACTORS MARKET: APPLICATION, 2024

FIGURE 20 MEXICO TRACTORS MARKET: ENGINE TYPE, 2024

FIGURE 21 MEXICO TRACTORS MARKET: OPERATING WEIGHT, 2024

FIGURE 22 MEXICO TRACTORS MARKET: COMPANY SHARE 2024 (%)

Mexico Tractors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Mexico Tractors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Mexico Tractors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.