Middle East Africa Antinuclear Antibody Test Market

Market Size in USD Million

CAGR :

%

USD

124.62 Million

USD

302.01 Million

2024

2032

USD

124.62 Million

USD

302.01 Million

2024

2032

| 2025 –2032 | |

| USD 124.62 Million | |

| USD 302.01 Million | |

|

|

|

|

Middle East and Africa Anti-Nuclear Antibody Test Market Size

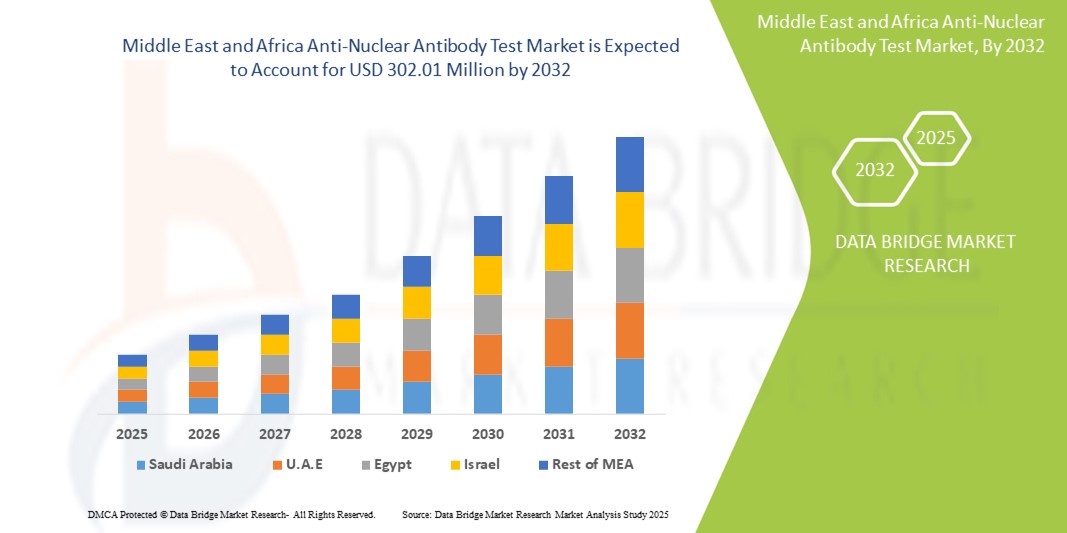

- The Middle East and Africa anti-nuclear antibody test market size was valued at USD 124.62 million in 2024 and is expected to reach USD 302.01 million by 2032, at a CAGR of 11.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of autoimmune diseases such as systemic lupus erythematosus (SLE), Sjögren's syndrome, and rheumatoid arthritis across the Middle East and Africa, necessitating advanced diagnostic solutions such as anti-nuclear antibody (ANA) tests

- Furthermore, rising awareness about early disease diagnosis, coupled with improving healthcare infrastructure and expanding access to laboratory services, is driving the adoption of ANA testing. These converging factors are accelerating the uptake of anti-nuclear antibody test solutions, thereby significantly boosting the Middle East and Africa anti-nuclear antibody test market growth

Middle East and Africa Anti-Nuclear Antibody Test Market Analysis

- Anti-nuclear antibody (ANA) tests, used to detect autoimmune disorders such as lupus and rheumatoid arthritis, are becoming increasingly essential in both clinical and laboratory settings across the Middle East and Africa. This is largely due to rising awareness of autoimmune diseases, improvements in diagnostic infrastructure, and the increasing availability of advanced immunology-based testing platforms

- The rising demand for ANA testing is primarily fueled by an increase in the prevalence of autoimmune conditions, advancements in laboratory technologies, and greater focus on early disease detection and management by regional healthcare authorities

- Saudi Arabia dominated the Middle East and Africa anti-nuclear antibody test market with the largest revenue share of 28.7% in 2024, driven by the country’s extensive healthcare modernization efforts and growing burden of autoimmune diseases such as systemic lupus erythematosus and rheumatoid arthritis

- U.A.E. is projected to be one of the fastest growing countries in the Middle East and Africa anti-nuclear antibody test market during the forecast period (2025–2032). This growth is attributed to increased health awareness, growing demand for early disease diagnosis, and the expansion of private healthcare providers offering autoimmune screening services

- The autoimmune diseases segment dominated the Middle East and Africa anti-nuclear antibody test market with a market share of 82.8% in 2024, owing to the high prevalence of conditions such as lupus, rheumatoid arthritis, and systemic sclerosis in the region, alongside rising awareness and access to diagnostic solutions. The segment continues to grow as healthcare providers prioritize early and accurate detection of autoimmune disorders, supported by increasing availability of advanced testing technologies and expanding clinical guidelines that include ANA testing as a standard diagnostic tool

Report Scope and Middle East and Africa Anti-Nuclear Antibody Test Market Segmentation

|

Attributes |

Middle East and Africa Anti-Nuclear Antibody Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Anti-Nuclear Antibody Test Market Trends

“Evolving Technological Integration Driving Market Transformation”

- A significant and accelerating trend in the Middle East and Africa anti-nuclear antibody (ANA) test market is the deeper incorporation of advanced technologies, improving diagnostic accuracy and workflow automation in laboratories and clinical settings

- For instance, next-generation ANA testing systems such as EUROPattern Microscope Live and Phadia Prime offer streamlined workflows, auto-classification of patterns, and seamless integration with laboratory information systems (LIS), enabling faster, more reliable autoimmune disease screening

- These systems utilize machine learning algorithms to enhance pattern recognition and reduce human error in IIF (Indirect Immunofluorescence) interpretation, a key advancement in ANA diagnostics where subjectivity has traditionally posed challenges

- The growing preference for multiplex and microarray-based ANA tests is enabling clinicians to simultaneously detect multiple autoantibodies with improved sensitivity, offering better differentiation among autoimmune conditions such as systemic lupus erythematosus (SLE), Sjögren’s syndrome, and scleroderma

- Integration of digital health platforms allows remote result sharing and centralized patient data management, significantly benefiting patients in rural and underserved areas. This trend is gaining traction in MEA countries investing in digital health transformation, such as Saudi Arabia and the U.A.E

- Leading companies such as Thermo Fisher Scientific and EUROIMMUN are actively expanding their presence in the MEA region by introducing fully automated platforms equipped with AI-enhanced decision support, allowing clinical labs to handle increasing testing volumes efficiently while maintaining high accuracy standards

- As healthcare systems in the Middle East and Africa modernize, the demand for high-throughput, automated ANA testing platforms continues to rise across hospitals, diagnostic laboratories, and research centers, supporting the region’s goal to improve early autoimmune disease detection and patient management

Middle East and Africa Anti-Nuclear Antibody Test Market Dynamics

Driver

“Growing Need Due to Rising Autoimmune Disorders and Diagnostic Awareness”

- The increasing incidence of autoimmune diseases such as systemic lupus erythematosus, rheumatoid arthritis, and Sjögren’s syndrome in the Middle East and Africa is significantly driving the demand for Anti-Nuclear Antibody (ANA) testing in the region

- For instance, several countries, including Saudi Arabia and South Africa, have reported rising healthcare utilization rates for autoimmune diagnostics, prompting health ministries to support early detection initiatives

- Increasing awareness among physicians and patients about the clinical utility of ANA testing in early and accurate diagnosis of autoimmune conditions is contributing to the market’s expansion

- Furthermore, the improvement in laboratory infrastructure, growth of private diagnostic labs, and greater accessibility to immunology testing across urban and semi-urban areas have made ANA tests more widely available

- The demand is also fueled by the emergence of multispecialty hospitals and diagnostic centers investing in ELISA, IIF, and multiplex platforms to enhance diagnostic precision and throughput

- As patient awareness improves and screening programs are expanded—especially for women, who are disproportionately affected by autoimmune conditions—the ANA testing market is expected to see continued growth across both public and private healthcare sectors in MEA

Restraint/Challenge

“Limited Laboratory Infrastructure and Affordability Constraints”

- The market in the Middle East and Africa faces key challenges due to underdeveloped laboratory infrastructure in several low-income countries and limited access to advanced diagnostic technologies in rural areas

- For instance, some Sub-Saharan African regions struggle with inadequate immunodiagnostic capabilities, relying heavily on central labs that are often overburdened or under-resourced

- Affordability is a major barrier for both providers and patients, especially when it comes to adopting advanced ANA detection techniques such as antigen microarrays or multiplex assays. The cost of reagents, automation platforms, and skilled technician training limits broader market penetration

- In addition, the lack of standardized diagnostic protocols and awareness among general practitioners about the use and interpretation of ANA test results can lead to inconsistent testing or misdiagnosis

- While global health partnerships and donor-supported diagnostic initiatives are addressing some of these gaps, the region still faces disparities in quality, availability, and affordability of ANA testing services

- To overcome these challenges, regional governments and diagnostic firms need to invest in infrastructure upgrades, offer cost-effective test kits, and focus on medical education and capacity building, particularly in underserved areas

Middle East and Africa Anti-Nuclear Antibody Test Market Scope

The market is segmented on the basis of antibody type, product, technique, application, end user, and distribution channel.

• By Antibody Type

On the basis of antibody type, the Middle East and Africa anti-nuclear antibody test market is segmented into extractable nuclear antigens (ENA), anti-DSDNA & histones, anti-DFS70 antibodies, anti-PM-SCL, anti-centromere antibodies, anti-SP100, and others. The extractable nuclear antigens (ENA) segment dominated the market with the largest revenue share of 34.6% in 2024, driven by its critical role in diagnosing specific autoimmune diseases such as Sjögren's syndrome, systemic sclerosis, and mixed connective tissue disease. The widespread clinical use and inclusion in diagnostic panels contribute to the segment's dominance.

The anti-DSDNA & histones segment is projected to register the fastest CAGR of 8.7% from 2025 to 2032, owing to their strong association with systemic lupus erythematosus (SLE) and growing demand for accurate diagnostic tools for lupus and related disorders.

• By Product

On the basis of product, the Middle East and Africa anti-nuclear antibody test market is segmented into instruments, consumables and reagents, and services. The consumables and reagents segment held the largest market revenue share of 49.3% in 2024, as these components are essential for repeated testing and are consumed in high volume in laboratories and diagnostic centers.

The services segment is expected to grow at the fastest CAGR of 9.2% during the forecast period, fueled by increasing outsourcing of diagnostic testing services and the growing focus on precision and efficiency in autoimmune disease diagnosis.

• By Technique

On the basis of technique, the Middle East and Africa anti-nuclear antibody test market is segmented into ELISA, indirect immunofluorescence (IIF), blotting test, antigen microarray, gel-based techniques, multiplex assay, flow cytometry, passive haemagglutination (PHA), and others. The ELISA segment accounted for the largest market share of 37.5% in 2024, due to its high sensitivity, cost-effectiveness, and widespread use in screening large volumes of samples.

The antigen microarray segment is projected to grow at the fastest CAGR of 10.1% from 2025 to 2032, supported by technological advancements and increasing adoption in high-throughput laboratories for multiplex autoantibody profiling.

• By Application

On the basis of application, the Middle East and Africa anti-nuclear antibody test market is segmented into autoimmune diseases and infectious diseases. The autoimmune diseases segment dominated the market with the largest revenue share of 82.8% in 2024, owing to the high prevalence of conditions such as lupus, rheumatoid arthritis, and systemic sclerosis in the region, alongside rising awareness and access to diagnostic solutions.

The infectious diseases segment is anticipated to grow at the highest CAGR of 7.6% during the forecast period, driven by emerging research connecting certain autoantibodies to chronic infections and cross-reactivity in diagnostic practices.

• By End User

On the basis of end user, the Middle East and Africa anti-nuclear antibody test market is segmented into hospitals, laboratories, diagnostic centers, research institutes, and others. The hospitals segment held the largest market share of 44.9% in 2024, due to the presence of in-house diagnostic facilities, high patient inflow, and increasing adoption of automated testing systems.

The diagnostic centers segment is projected to witness the fastest growth rate of 8.4% from 2025 to 2032, driven by decentralization of diagnostic services and rising patient preference for specialized, quicker test results.

• By Distribution Channel

On the basis of distribution channel, the Middle East and Africa anti-nuclear antibody test market is segmented into direct tender, retail sales, third-party distributor, and others. The direct tender segment captured the largest revenue share of 51.2% in 2024, as public hospitals and large diagnostic chains primarily procure testing systems and reagents through government or institutional tenders.

The third-party distributor segment is projected to register the highest CAGR of 9.5% during the forecast period, attributed to the growing presence of local and international distributors facilitating last-mile delivery and enhancing market access in remote areas.

Middle East and Africa Anti-Nuclear Antibody Test Market Regional Analysis

- Middle East and Africa dominated the anti-nuclear antibody test market with a notable revenue share of 14.3% in 2024, supported by increasing healthcare investments, growing prevalence of autoimmune diseases, and rising adoption of diagnostic testing across the region

- Countries in this region are gradually expanding their diagnostic infrastructure, with a particular focus on autoimmune diagnostics, enhancing the accessibility and efficiency of ANA testing.

- Healthcare providers and diagnostic laboratories in the region are actively adopting advanced techniques such as ELISA and indirect immunofluorescence (IIF), supported by government initiatives aimed at improving autoimmune disease detection rates. This increasing demand for precise and early diagnosis is contributing to the strong growth outlook of the Anti-Nuclear Antibody Test Market in the Middle East and Africa

Saudi Arabia Middle East and Africa Anti-Nuclear Antibody Test Market Insight

The Saudi Arabia anti-nuclear antibody test market accounted for the largest revenue share of 28.7% in the Middle East and Africa region in 2024, driven by the country’s extensive healthcare modernization efforts and growing burden of autoimmune diseases such as systemic lupus erythematosus and rheumatoid arthritis. The Saudi Vision 2030 initiative, which includes major investments in diagnostic technologies and laboratory infrastructure, is playing a crucial role in market growth.

U.A.E. Middle East and Africa Anti-Nuclear Antibody Test Market Insight

The U.A.E. anti-nuclear antibody test market held a revenue share of 19.5% in 2024 and is expected to witness significant growth during the forecast period, attributed to increased health awareness, growing demand for early disease diagnosis, and the expansion of private healthcare providers offering autoimmune screening services. High medical tourism inflow and government support for clinical lab advancements are further strengthening the ANA testing landscape in the country.

South Africa Middle East and Africa Anti-Nuclear Antibody Test Market Insight

The South Africa anti-nuclear antibody test market captured a revenue share of 16.2% in the Middle East and Africa market in 2024, supported by a high incidence of chronic autoimmune conditions, an expanding network of diagnostic laboratories, and collaborations between public health institutions and private diagnostic service providers. The presence of established laboratory networks such as Lancet and PathCare further facilitates access to ANA testing across urban and rural areas.

Egypt Middle East and Africa Anti-Nuclear Antibody Test Market Insight

The Egypt anti-nuclear antibody test market held a revenue share of 13.6% in 2024 and is projected to grow at a substantial CAGR during the forecast period, fueled by increasing healthcare expenditure, awareness campaigns for autoimmune disease detection, and a growing patient population seeking accurate diagnoses. The country's strategic partnerships with international diagnostic equipment suppliers are accelerating the adoption of ELISA- and IIF-based ANA testing technologies.

Middle East and Africa Anti-Nuclear Antibody Test Market Share

The Middle East and Africa anti-nuclear antibody test industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abbott (U.S.)

- Euroimmun Medizinische Labordiagnostika AG (Germany)

- ZEUS Scientific, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Grifols, S.A. (Spain)

- Inova (U.S.)

- Immuno Concepts NA Ltd. (U.S.)

- Antibodies Incorporated (U.S.)

- Erba Mannheim (Germany)

Latest Developments in Middle East and Africa anti-nuclear antibody test market

- In January 2023, Revvity’s EUROIMMUN has launched an automated indirect immunofluorescence test (IIFT) system to enhance diagnostic accuracy and efficiency in detecting autoantibodies. This innovation streamlines laboratory workflows, reduces manual errors, and positions EUROIMMUN to meet growing demand, ultimately driving revenue growth and reinforcing Revvity’s commitment to transformative healthcare solutions

- In January 2023, Quantum-Si announced a collaboration with Aviva Systems Biology to develop protein enrichment kits for enhanced protein sequencing. The kits will include immunoprecipitation tools to streamline workflows and enable in-depth analysis of protein variants, facilitating research into biological processes and diseases

- In November 2022, Bio-Rad has expanded its range of quality controls specifically for Abbott's clinical diagnostics platforms, enhancing laboratory performance and reliability. This initiative not only improves diagnostic accuracy and patient care but also strengthens Bio-Rad's competitive position in the healthcare market. By providing innovative quality control solutions, Bio-Rad aims to meet the growing demands of laboratories, ultimately driving revenue growth and reinforcing its commitment to advancing diagnostic excellence

- In May 2021, EUROIMMUN’s Anti-SARS-CoV-2 S1 Curve ELISA has received FDA Emergency Use Authorization, allowing for rapid and accurate detection of SARS-CoV-2 antibodies. This authorization enhances EUROIMMUN’s market position, expands its customer base, and supports Revvity’s mission to provide cutting-edge diagnostic solutions in response to public health needs

- In January 2021, Abnova announced the launch of its innovative high-throughput antibody production platform, which significantly accelerates the development of monoclonal antibodies. This advancement enhances the company’s capability to deliver customized antibodies more efficiently, positioning Abnova to better meet market demand and strengthen its competitive edge in the biopharmaceutical industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTRE’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

5.2 NORTH AMERICA REGULATORY SCENARIO

5.3 EUROPE REGULATORY SCENARIO

5.4 REGULATORY SUBMISSIONS

5.5 KEY INTERNATIONAL AUTHORITIES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF AUTOIMMUNE DISEASES ACROSS THE GLOBE

6.1.2 RISE IN AGING POPULATION

6.1.3 GROWING RESEARCH EFFORTS FOCUSED ON AUTOIMMUNE DISEASES

6.1.4 EXPANSION OF DIAGNOSTIC CENTERS AND LABORATORIES

6.2 RESTRAINTS

6.2.1 PROBLEM OF OBTAINING CONFIRMATORY RESULTS IN ANTI-NUCLEAR ANTIBODY TEST

6.2.2 LACK OF STANDARDIZATION FOR TESTING PROTOCOLS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION OF DIGITAL HEALTH SOLUTIONS

6.3.2 IMPROVEMENT IN HEALTHCARE INFRASTRUCTURE

6.3.3 INCREASE IN MIDDLE EAST AND AFRICA HEALTH INITIATIVES

6.4 CHALLENGES

6.4.1 HIGH COST OF TESTS AND EQUIPMENT

6.4.2 COMPETITION FROM ALTERNATIVE DIAGNOSTIC METHODS

7 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE

7.1 OVERVIEW

7.2 EXTRACTABLE NUCLEAR ANTIGENS (ENA)

7.2.1 ANTI-RO/SS-A AND ANTI-LA/SS-B

7.2.2 ANTI-SCL-70/ANTI-TOPOISOMERASE I

7.2.3 ANTI-NRNP/ANTI-U1-RNP

7.2.4 ANTI-SM

7.2.5 ANTI-JO-1

7.3 ANTI-DSDNA & HISTONES

7.4 ANTI-DFS70 ANTIBODIES

7.5 ANTI-PM-SCL

7.6 ANTI-CENTROMERE ANTIBODIES

7.7 ANTI-SP100

7.8 OTHERS

8 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 ANALYZERS

8.2.2 AUTOMATIC ANALYZERS

8.2.3 SEMI AUTOMATIC ANALYZERS

8.3 CONSUMABLES AND REAGENTS

8.3.1 REAGENTS

8.3.1.1 Reactive Reagents

8.3.1.2 Non Reactive Reagents

8.3.1.2.1 PBS Buffer Powder

8.3.1.2.2 Semi-Permeating Mounting Medium

8.3.1.2.3 Solutions

8.3.1.2.4 Others

8.3.2 ACCESSORIES

8.4 SERVICES

9 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE

9.1 OVERVIEW

9.2 ELISA

9.2.1 GENERIC ASSAY TECHNIQUE

9.2.2 ANTIGEN SPECIFIC ASSAY TECHNIQUE

9.3 INDIRECT IMMUNOFLUORESCENCE (IIF)

9.3.1 HEP-2 SUBSTRATE

9.3.2 CRITHIDIA LUCILIAE SUBSTRATE

9.4 BLOTTING TEST

9.4.1 DOT BLOT

9.4.2 WESTERN BLOT

9.5 ANTIGEN MICROARRAY

9.6 GEL BASED TECHNIQUES

9.6.1 COUNTER CURRENT IMMUNOELECTROPHORESIS (CIE)

9.6.2 DOUBLE IMMUNODIFFUSION (DID)

9.7 MULTIPLEX ASSAY

9.8 FLOW CYTOMETRY

9.9 PASSIVE HAEMAGGLUTINATION (PHA)

9.1 OTHERS

10 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 AUTOIMMUNE DISEASES

10.2.1 RHEUMATOID ARITHRITIS

10.2.2 SYSTEMIC LUPUS ERYTHEMATOSUS

10.2.3 SJOGREN SYNDROME

10.2.4 SCLERODERMA

10.2.5 POLYMYOSITIS

10.2.6 THYROIDITIS

10.2.7 MIXED CONNECTIVE TISSUE DISEASE (MCTD)

10.2.8 AUTOIMMUNE HEPATITIS

10.2.9 LYMPHOMAS

10.2.10 OTHERS

10.3 INFECTIOUS DISEASES

10.3.1 HEPATITIS C

10.3.2 HIV

10.3.3 EB VIRUS

10.3.4 PARVOVIRUS

10.3.5 OTHERS

11 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 LABORATORIES

11.4 DIAGNOSTIC CENTERS

11.5 RESEARCH INSTITUTES

11.6 OTHERS

12 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTOR

12.5 OTHERS

13 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E

13.1.4 EGYPT

13.1.5 KUWAIT

13.1.6 ISRAEL

13.1.7 BAHRAIN

13.1.8 OMAN

13.1.9 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ABBOTT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT/ SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 THERMO FISHER SCIENTIFIC INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

1.1.4 PRODUCT PORTFOLIO 234

16.2.4 RECENT DEVELOPMENT

16.3 INOVA DIAGNOSTICS

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 EUROIMMUN MEDIZINISCHE LABORDIAGNOSTIKA AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 REVVITY INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT UPDATES

16.6 BIO-RAD LABORATORIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AVIVA SYSTEMS BIOLOGY CORPORATION

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 A. MENARINI DIAGNOSTICS S.R.L

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AESKU.GROUP GMBH & CO. KG

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ANTIBODIES INCORPORATED

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ABNOVA CORPORATION

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 BIORBYT LTD

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 CUSABIO TECHNOLOGY LLC

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 DEMEDITEC DIAGNOSTIC GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 GENO TECHNOLOGY INC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 IMMUNO CONCEPTS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 LIFESPAN BIOSCIENCES, INC

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATES

16.18 MYBIOSOURCE.COM

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATES

16.19 ORIGENE TECHNOLOGIES, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 TRINITY BIOTECH

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 WUHAN FINE BIOTECH CO., LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT UPDATES

16.22 ZEUS SCIENTIFIC, INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA EXTRACTABLE NUCLEAR ANTIGENS (ENA) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA EXTRACTABLE NUCLEAR ANTIGENS (ENA) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA ANTI-DSDNA & HISTONES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA ANTI-DFS70 ANTIBODIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA ANTI-PM-SCL IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ANTI-CENTROMERE ANTIBODIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA ANTI-SP100 IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA OTHERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA SERVICES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA ANTIGEN MICROARRAY IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA MULTIPLEX ASSAY IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FLOW CYTOMETRY IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA PASSIVE HAEMAGGLUTINATION (PHA) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OTHERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA HOSPITALS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA LABORATORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA DIAGNOSTIC CENTERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA OTHERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA DIRECT TENDER IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA RETAIL SALES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA THIRD PARTY DISTRIBUTOR IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA OTHERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 72 SOUTH AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 SOUTH AFRICA EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 SOUTH AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 75 SOUTH AFRICA INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 SOUTH AFRICA ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 SOUTH AFRICA CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 SOUTH AFRICA REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 79 SOUTH AFRICA REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 80 SOUTH AFRICA NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 81 SOUTH AFRICA ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 82 SOUTH AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 83 SOUTH AFRICA ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 SOUTH AFRICA INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 85 SOUTH AFRICA BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 86 SOUTH AFRICA GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 SOUTH AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 88 SOUTH AFRICA AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 SOUTH AFRICA INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 90 SOUTH AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 91 SOUTH AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 92 SAUDI ARABIA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 SAUDI ARABIA EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 SAUDI ARABIA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 95 SAUDI ARABIA INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 SAUDI ARABIA ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 SAUDI ARABIA CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 98 SAUDI ARABIA REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 99 SAUDI ARABIA REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 100 SAUDI ARABIA NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 101 SAUDI ARABIA ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 102 SAUDI ARABIA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 103 SAUDI ARABIA ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 104 SAUDI ARABIA INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 105 SAUDI ARABIA BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 SAUDI ARABIA GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 SAUDI ARABIA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 108 SAUDI ARABIA AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 109 SAUDI ARABIA INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 SAUDI ARABIA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 111 SAUDI ARABIA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 112 U.A.E. ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 U.A.E. EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 U.A.E. ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 115 U.A.E. INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 U.A.E. ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 117 U.A.E. CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 118 U.A.E. REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 119 U.A.E. REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 120 U.A.E. NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 121 U.A.E. ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 U.A.E. ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 123 U.A.E. ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 124 U.A.E. INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 125 U.A.E. BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 U.A.E. GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 U.A.E. ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 128 U.A.E. AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 U.A.E. INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 U.A.E. ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 131 U.A.E. ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 132 EGYPT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 EGYPT EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 EGYPT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 135 EGYPT INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 136 EGYPT ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 137 EGYPT CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 138 EGYPT REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 139 EGYPT REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 140 EGYPT NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 EGYPT ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 142 EGYPT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 143 EGYPT ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 EGYPT INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 145 EGYPT BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 146 EGYPT GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 147 EGYPT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 148 EGYPT AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 EGYPT INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 EGYPT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 151 EGYPT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 152 KUWAIT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 KUWAIT EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 KUWAIT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 155 KUWAIT INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 156 KUWAIT ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 157 KUWAIT CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 158 KUWAIT REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 159 KUWAIT REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 KUWAIT NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 161 KUWAIT ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 162 KUWAIT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 163 KUWAIT ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 164 KUWAIT INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 165 KUWAIT BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 166 KUWAIT GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 KUWAIT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 168 KUWAIT AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 KUWAIT INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 170 KUWAIT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 171 KUWAIT ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 172 ISRAEL ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 173 ISRAEL EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 174 ISRAEL ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 175 ISRAEL INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 176 ISRAEL ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 177 ISRAEL CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 178 ISRAEL REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 179 ISRAEL REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 180 ISRAEL NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 181 ISRAEL ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 182 ISRAEL ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 183 ISRAEL ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 184 ISRAEL INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 185 ISRAEL BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 186 ISRAEL GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 187 ISRAEL ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 188 ISRAEL AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 189 ISRAEL INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 190 ISRAEL ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 191 ISRAEL ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 192 BAHRAIN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 193 BAHRAIN EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 194 BAHRAIN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 195 BAHRAIN INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 196 BAHRAIN ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 197 BAHRAIN CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 198 BAHRAIN REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 199 BAHRAIN REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 200 BAHRAIN NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 201 BAHRAIN ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 202 BAHRAIN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 203 BAHRAIN ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 204 BAHRAIN INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 205 BAHRAIN BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 206 BAHRAIN GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 207 BAHRAIN AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 208 BAHRAIN INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 209 BAHRAIN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 210 BAHRAIN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 211 OMAN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

TABLE 212 OMAN EXTRACTABLE NUCLEAR ANTIGENS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 213 OMAN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY PRODUCT, 2022-2031 (USD THOUSAND)

TABLE 214 OMAN INSTRUMENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 215 OMAN ANALYZERS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 216 OMAN CONSUMABLES AND REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 217 OMAN REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 218 OMAN REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 219 OMAN NON-REACTIVE REAGENTS IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 220 OMAN ACCESSORIES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 221 OMAN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 222 OMAN ELISA IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 223 OMAN INDIRECT IMMUNOFLUORESCENCE (IIF) IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 224 OMAN BLOTTING TEST IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 225 OMAN GEL BASED TECHNIQUES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 226 OMAN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY APPLICATION, 2022-2031 (USD THOUSAND)

TABLE 227 OMAN AUTOIMMUNE DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 228 OMAN INFECTIOUS DISEASES IN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 229 OMAN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 230 OMAN ANTI-NUCLEAR ANTIBODY TEST MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 231 REST OF MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET, BY ANTIBODY TYPE, 2022-2031 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: SEGMENTATION

FIGURE 12 SEVEN SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET INFECTION MARKET, BY ANTIBODY TYPE

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASING PREVALENCE OF AUTOIMMUNE DISEASES ACROSS THE GLOBE IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY MARKET DURING THE FORECAST PERIOD OF 2024 - 2031

FIGURE 16 EXTRACTABLE NUCLEAR ANTIGENS (ENA) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET IN 2024 & 2031

FIGURE 17 MARKET DYNAMICS

FIGURE 18 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY ANTIBODY TYPE, 2023

FIGURE 19 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY ANTIBODY TYPE, 2024-2031 (USD THOUSAND)

FIGURE 20 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY ANTIBODY TYPE, CAGR (2024-2031)

FIGURE 21 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY ANTIBODY TYPE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY PRODUCT, 2023

FIGURE 23 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY PRODUCT, 2024-2031 (USD THOUSAND)

FIGURE 24 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 25 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 26 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY TECHNIQUE, 2023

FIGURE 27 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY TECHNIQUE, 2024-2031 (USD THOUSAND)

FIGURE 28 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY TECHNIQUE, CAGR (2024-2031)

FIGURE 29 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY TECHNIQUE, LIFELINE CURVE

FIGURE 30 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY APPLICATION, 2023

FIGURE 31 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY APPLICATION, 2024-2031 (USD THOUSAND)

FIGURE 32 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 33 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY END USER, 2023

FIGURE 35 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY END USER, 2024-2031 (USD THOUSAND)

FIGURE 36 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY END USER, CAGR (2024-2031)

FIGURE 37 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY END USER, LIFELINE CURVE

FIGURE 38 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 39 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD THOUSAND)

FIGURE 40 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 41 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: SNAPSHOT (2023)

FIGURE 43 MIDDLE EAST AND AFRICA ANTI-NUCLEAR ANTIBODY TEST MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.