Middle East and Africa Atomic Layer Deposition Market Analysis and Insights

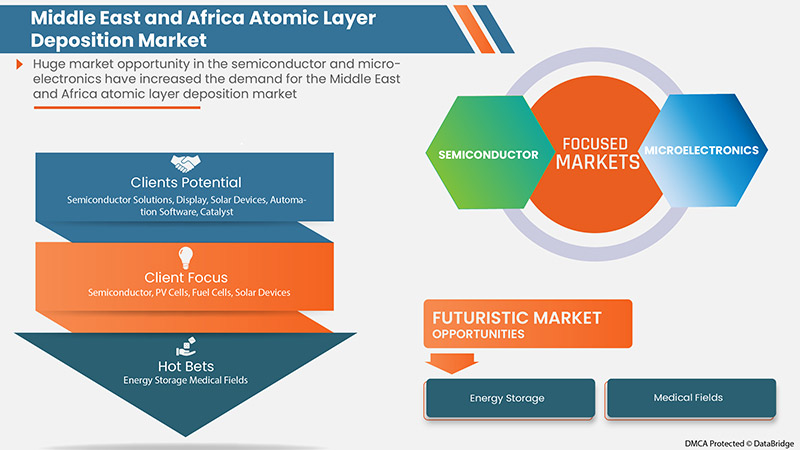

The Middle East and Africa atomic layer deposition market is expected to drive due to an increase in demand for semiconductor industries. As semiconductor is the main component or application of ALD, the increase in demand for semiconductor help increases the demand for ALD. Some other factors expected to drive the market growth are raising concerns about energy harvesting results in the high growth of photovoltaic (PV) cells.

The primary factor anticipated to limit the market is the high initial investment cost in producing ALD, which has affected the market growth.

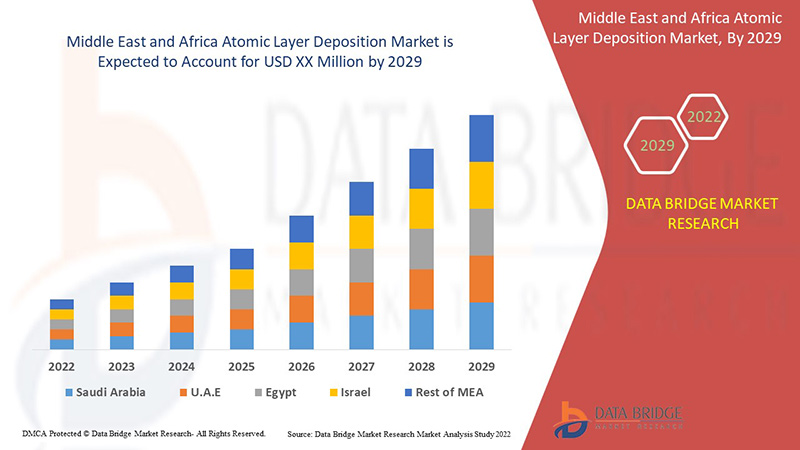

Data Bridge Market Research analyses that the Middle East and Africa atomic layer deposition market will grow at a CAGR of 12.6% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

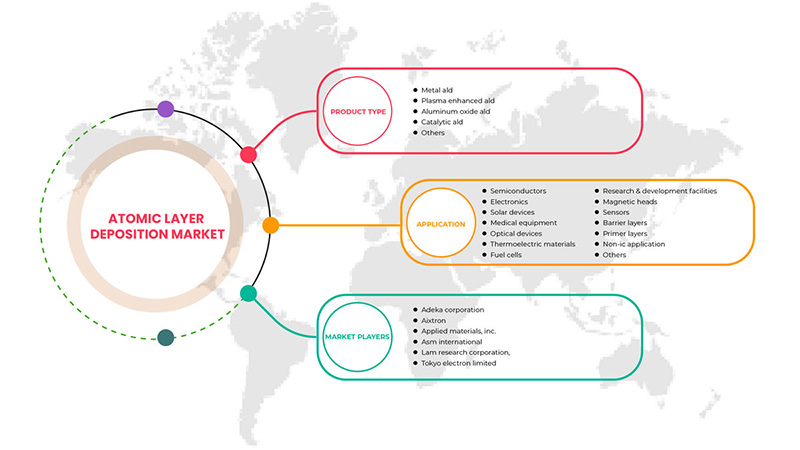

Segments Covered |

By Product Type (Metal ALD, Aluminium Oxide ALD, Plasma Enhanced ALD, Catalytic ALD, Others), Application (Semiconductors, Solar Devices, Electronics, Medical Equipment, Research & Development Facilities, Fuel Cells, Optical Devices, Thermoelectric Materials, Magnetic Heads, Sensors, Barrier Layers, Primer Layers, Non—IC Application, Others). |

|

Countries Covered |

Saudi Arabia, South Africa, Egypt, UAE, Israel, and the rest of the Middle East and Africa. |

|

Market Players Covered |

LAM RESEARCH CORPORATION, Kurt J. Lesker Company, ANRIC TECH., Forge Nano Inc., Merck KGaA, among others. |

Market Definition

Atomic layer deposition (ALD) refers to the process of deposition of precursor materials on substrates for improving or modifying properties such as chemical resistance, strength, and conductivity. The process is considered a sub-division of chemical vapor deposition (CVD) in atomic layer deposition. Most of the time, two chemicals are utilized for the reaction, generally called precursors.

Middle East and Africa Atomic Layer Deposition Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers:

- HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS

Microelectronics is a process of manufacturing electronic components at the microscopic level. The microelectronics market is rapidly growing due to the demand for inexpensive and lightweight equipment. Microelectronics components include transistors, capacitors, diodes, resistors, inductors, and others. All these electronic components are used to manufacture mobile phones, laptops, electronic toys, and others.

- RAISING CONCERN ON ENERGY HARVESTING RESULTS IN HIGH GROWTH OF PHOTOVOLTAIC (PV) CELLS

Photovoltaic (PV) is commonly called an energy harvesting technology, and the technology is used to convert solar energy into electric energy, which is electricity. The demand for photovoltaic cells has been increasing due to the relatively low price and wide range of applications such as solar traffic lights, solar power pumps, solar lamps, solar power calculators, and others.

Restraint:

- HIGH INITIAL INVESTMENT COSTS

Atomic layer deposition (ALD) is the deposition of precursor materials on substrates to improve/modify properties such as conductivity, chemical resistance, and strength. To provide ALD services, the provider has to buy equipment for the atomic layer deposition process, such as Cambridge NanoTech Fiji F200 Atomic Layer Deposition System, Open Load ALD System: OpAL, ALD 200L Series from Kurt J. Lesker Company, Cambridge NanoTech Savannah Series Atomic Layer Deposition System, Plasma & Thermal ALD System: FlexAL, Ion Beam Deposition System: IonFab IBD and Cambridge NanoTech Savannah Series Atomic Layer Deposition System.

The price of each piece of equipment is around USD 10000, and the provider must buy all equipment to provide all types of atomic layer deposition services. The cost of equipment would be very high to provide all types of atomic layer deposition services. Thus, many buyers will avoid buying due to the high cost compared to regular furniture.

Opportunity

- TREND OF MINIATURIZATION

Miniaturization is the process of manufacturing the smallest mechanical, electronic, and optical devices. In other words, it is a process of making electronic devices smaller. Miniaturization is in trend because everyone wants smaller, compacted, more portable devices. Now nanotechnology has the potential to transform the molecular beam into nano-devices (functional). This is a big step toward miniaturization.

Challenge

- ALTERNATIVES OF ATOMIC LAYER DEPOSITION

The chemical vapor deposition process is widely used to produce high-quality, high-performance thin films. The chemical vapor deposition process is commonly used in the semiconductor industry. On the other hand, physical vapor deposition (PVD) is a method used to produce thin films and coatings with high temperature, high strength, excellent abrasion resistance, and others. Chemical vapor deposition and physical vapor deposition can be used as alternatives to atomic layer deposition due to the below advantages over atomic layer deposition.

- Chemical vapor deposition has a higher deposition rate than atomic layer deposition

- In chemical vapor deposition, deposit material is hard to evaporate

- The physical vapor deposition process can operate in low temperatures as compared to atomic layer deposition

- Physical vapor deposition can control the chemical composition

Recent Development

- In September 2020, Lam Research introduced Advanced Dielectric Gapfill Technology to Enable Next-Generation Devices. This technology combines the ability to produce high-quality oxide films with superior gap-fill performance in a single processing system with the productivity advantages offered by our industry-leading quad station module architecture. Its goal is to provide customers with the most enabling ALD technology.

Middle East and Africa Atomic Layer Deposition Market Scope

The Middle East and Africa atomic layer deposition market is segmented based on product type, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Metal ALD

- Aluminium Oxide ALD

- Plasma Enhanced ALD

- Catalytic ALD

- Others

On the basis of product type, the Middle East and Africa atomic layer deposition market is classified into metal ALD, aluminium oxide ALD, plasma enhanced ALD, catalytic ALD, and others.

Application

- Semiconductors

- Electronics

- Solar Devices

- Medical Equipment

- Optical Devices

- Thermoelectric Materials

- Fuel Cells

- Research & Development Facilities

- Magnetic Heads

- Sensors

- Barrier Layers

- Primer Layers

- Non-IC Application

- Others

On the basis of application, the Middle East and Africa atomic layer deposition market is classified into semiconductors, solar devices, electronics, medical equipment, research & development facilities, fuel cells, optical devices, thermoelectric materials, magnetic heads, sensors, barrier layers, primer layers, non—IC application, and others.

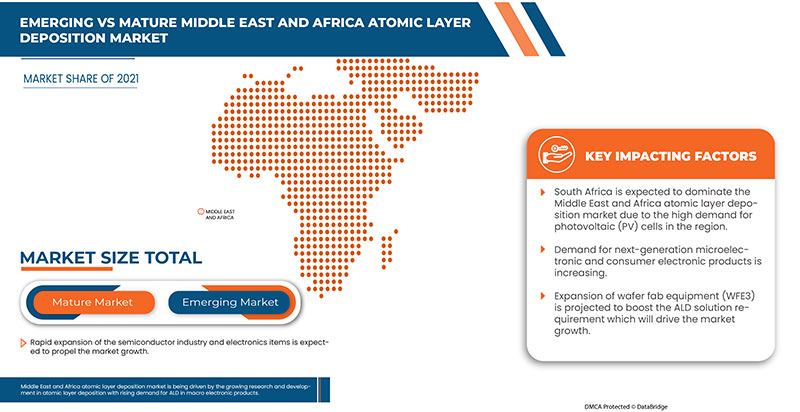

Middle East and Africa Atomic Layer Deposition Market Regional Analysis/Insights

The Middle East and Africa atomic layer deposition market is analyzed, and market size insights and trends are provided based on country, product type, and application, as referenced above.

Some countries covered in the Middle East and Africa atomic layer deposition market report are Saudi Arabia, South Africa, Egypt, UAE, Israel, and the rest of the Middle East and Africa.

South Africa is expected to dominate the Middle East and Africa atomic layer deposition market in terms of market share and revenue. It is estimated to maintain its dominance during the forecast period due to the region's high demand for microelectronics and consumer electronics.

The region section of the report also provides individual market-impacting factors and changes in regulations that impact the market's current and future trends. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Middle East African brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Atomic Layer Deposition Market Share Analysis

The competitive Middle East and Africa atomic layer deposition market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the company's focus on the Middle East and Africa atomic layer deposition market.

Some of the major players operating in the Middle East and Africa atomic layer deposition market are LAM RESEARCH CORPORATION, Kurt J. Lesker Company, ANRIC TECH., Forge Nano Inc., Merck KGaA, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East Africa Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS

5.1.2 RAISING CONCERN ON ENERGY HARVESTING RESULTS IN HIGH GROWTH OF PHOTOVOLTAIC (PV) CELLS

5.1.3 RAPID EXPANSION OF THE SEMICONDUCTOR INDUSTRY

5.2 RESTRAINT

5.2.1 HIGH INITIAL INVESTMENT COSTS

5.3 OPPORTUNITIES

5.3.1 TREND OF MINIATURIZATION

5.3.2 GROWING RESEARCH AND DEVELOPMENT IN ATOMIC LAYER DEPOSITION TECHNOLOGY

5.4 CHALLENGE

5.4.1 ALTERNATIVES OF ATOMIC LAYER DEPOSITION

6 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 METAL ALD

6.3 ALUMINUM OXIDE ALD

6.4 PLASMA ENHANCED ALD

6.5 CATALYTIC ALD

6.6 OTHERS

7 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SEMICONDUCTORS

7.2.1 METAL ALD

7.2.2 ALUMINUM OXIDE ALD

7.2.3 CATALYTIC ALD

7.2.4 PLASMA ENHANCED ALD

7.2.5 OTHERS

7.3 ELECTRONICS

7.3.1 METAL ALD

7.3.2 ALUMINUM OXIDE ALD

7.3.3 CATALYTIC ALD

7.3.4 PLASMA ENHANCED ALD

7.3.5 OTHERS

7.4 SOLAR DEVICES

7.4.1 ALUMINUM OXIDE ALD

7.4.2 PLASMA ENHANCED ALD

7.4.3 METAL ALD

7.4.4 CATALYTIC ALD

7.4.5 OTHERS

7.5 MEDICAL EQUIPMENT

7.5.1 METAL ALD

7.5.2 ALUMINUM OXIDE ALD

7.5.3 CATALYTIC ALD

7.5.4 PLASMA ENHANCED ALD

7.5.5 OTHERS

7.6 OPTICAL DEVICES

7.6.1 METAL ALD

7.6.2 ALUMINUM OXIDE ALD

7.6.3 CATALYTIC ALD

7.6.4 PLASMA ENHANCED ALD

7.6.5 OTHERS

7.7 THERMOELECTRIC MATERIALS

7.7.1 METAL ALD

7.7.2 ALUMINUM OXIDE ALD

7.7.3 CATALYTIC ALD

7.7.4 PLASMA ENHANCED ALD

7.7.5 OTHERS

7.8 MAGNETIC HEADS

7.8.1 METAL ALD

7.8.2 ALUMINUM OXIDE ALD

7.8.3 CATALYTIC ALD

7.8.4 PLASMA ENHANCED ALD

7.8.5 OTHERS

7.9 RESEARCH & DEVELOPMENT FACILITIES

7.9.1 METAL ALD

7.9.2 ALUMINUM OXIDE ALD

7.9.3 CATALYTIC ALD

7.9.4 PLASMA ENHANCED ALD

7.9.5 OTHERS

7.1 FUEL CELLS

7.10.1 METAL ALD

7.10.2 ALUMINUM OXIDE ALD

7.10.3 CATALYTIC ALD

7.10.4 PLASMA ENHANCED ALD

7.10.5 OTHERS

7.11 SENSORS

7.11.1 METAL ALD

7.11.2 ALUMINUM OXIDE ALD

7.11.3 CATALYTIC ALD

7.11.4 PLASMA ENHANCED ALD

7.11.5 OTHERS

7.12 BARRIER LAYERS

7.12.1 METAL ALD

7.12.2 ALUMINUM OXIDE ALD

7.12.3 CATALYTIC ALD

7.12.4 PLASMA ENHANCED ALD

7.12.5 OTHERS

7.13 PRIMER LAYERS

7.13.1 METAL ALD

7.13.2 ALUMINUM ALD

7.13.3 CATALYTIC ALD

7.13.4 PLASMA ENHANCED ALD

7.13.5 OTHERS

7.14 NON-IC APPLICATION

7.14.1 METAL ALD

7.14.2 ALUMINUM ALD

7.14.3 CATALYTIC ALD

7.14.4 PLASMA ENHANCED ALD

7.14.5 OTHERS

7.15 OTHERS

7.15.1 METAL ALD

7.15.2 ALUMINUM ALD

7.15.3 CATALYTIC ALD

7.15.4 PLASMA ENHANCED ALD

7.15.5 OTHERS

8 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY REGION

8.1 MIDDLE EAST & AFRICA

8.1.1 SOUTH AFRICA

8.1.2 SAUDI ARABIA

8.1.3 UNITED ARAB EMIRATES

8.1.4 EGYPT

8.1.5 ISRAEL

8.1.6 REST OF MIDDLE EAST & AFRICA

9 COMPANY LANDSCAPE: MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9.2 NEW PRODUCT LAUNCH

9.3 MERGERS,AWARDS AND ACQUISITIONS

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 LAM RESEARCH CORPORATION.

11.1.1 COMPANY SNAPSHOT

11.1.2 RECENT FINANCIALS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATE

11.2 APPLIED MATERIALS, INC.

11.2.1 COMPANY SNAPSHOT

11.2.2 RECENT FINANCIALS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

11.3 TOKYO ELECTRON LIMITED

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 ASM INTERNATIONAL

11.4.1 COMPANY SNAPSHOT

11.4.2 RECENT FINANCIALS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT UPDATE

11.5 AIXTRON

11.5.1 COMPANY SNAPSHOT

11.5.2 RECENT FINANCIALS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT UPDATE

11.6 ADEKA CORPORATION

11.6.1 COMPANY SNAPSHOT

11.6.2 RECENT FINANCIALS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT UPDATE

11.7 ANRIC TECH.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT UPDATES

11.8 BENEQ

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 ENCAPSULIX

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT UPDATE

11.1 FORGE NANO INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 HZO INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT UPDATE

11.12 KURT J. LESKER COMPANY

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATE

11.13 MERCK KGAA

11.13.1 COMPANY SNAPSHOT

11.13.2 RECENT FINANCIALS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT UPDATES

11.14 OXFORD INSTRUMENTS

11.14.1 COMPANY SNAPSHOT

11.14.2 RECENT FINANCIALS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT UPDATE

11.15 PICOSUN OY.

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT UPDATES

11.16 SENTECH INSTRUMENTS GMBH

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT UPDATE

11.17 VEECO INSTRUMENTS INC.

11.17.1 COMPANY SNAPSHOT

11.17.2 RECENT FINANCIALS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT UPDATES

12 QUESTIONNAIRE

13 RELATED REPORT

List of Table

TABLE 1 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA METAL ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA ALUMINUM OXIDE ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PLASMA ENHANCED ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CATALYTIC ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MAGNETIC HEADS ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA RESEARCH & DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA RESEARCH & DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 UNITED ARAB EMIRATES ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 UNITED ARAB EMIRATES ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 UNITED ARAB EMIRATES SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 UNITED ARAB EMIRATES ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 UNITED ARAB EMIRATES SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 UNITED ARAB EMIRATES MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 UNITED ARAB EMIRATES OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 UNITED ARAB EMIRATES THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 UNITED ARAB EMIRATES FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 UNITED ARAB EMIRATES RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 UNITED ARAB EMIRATES MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 UNITED ARAB EMIRATES SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 UNITED ARAB EMIRATES BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 UNITED ARAB EMIRATES PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 UNITED ARAB EMIRATES NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 UNITED ARAB EMIRATES OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 EGYPT ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 EGYPT ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 EGYPT SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 EGYPT ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 EGYPT SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 EGYPT MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 EGYPT OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 EGYPT THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 EGYPT FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 EGYPT RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 EGYPT MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 EGYPT SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 EGYPT BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 EGYPT PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 EGYPT NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 EGYPT OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 ISRAEL ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 118 ISRAEL ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 ISRAEL SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 ISRAEL ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 ISRAEL MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 ISRAEL OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 ISRAEL THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 ISRAEL FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 ISRAEL RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 ISRAEL MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 ISRAEL SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 ISRAEL BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 ISRAEL PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 ISRAEL NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 ISRAEL OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 REST OF MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: SEGMENTATION

FIGURE 14 HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET IN THE FORECAST PERIOD

FIGURE 15 METAL ALD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET

FIGURE 17 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA ATOMIC LAYER DEPOSITION MARKET: COMPANY SHARE 2021 (%)

Middle East Africa Atomic Layer Deposition Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East Africa Atomic Layer Deposition Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East Africa Atomic Layer Deposition Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.