Middle East Africa Aws Managed Services Market

Market Size in USD Million

CAGR :

%

USD

96.56 Million

USD

265.93 Million

2024

2032

USD

96.56 Million

USD

265.93 Million

2024

2032

| 2025 –2032 | |

| USD 96.56 Million | |

| USD 265.93 Million | |

|

|

|

|

AWS Managed Services Market Size

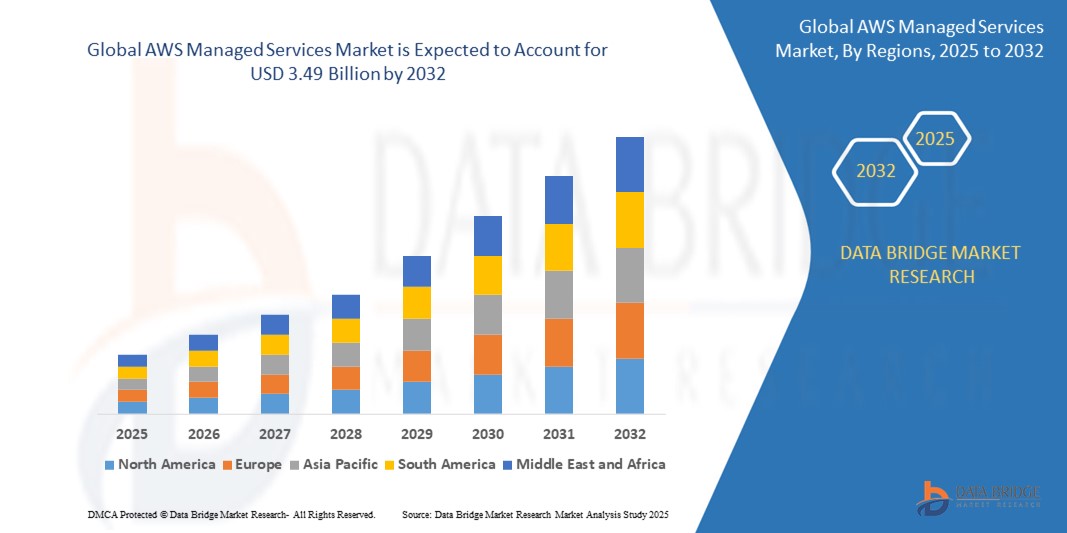

- The Middle East and Africa AWS Managed Services Market size was valued at USD 96.56 million in 2024 and is expected to reach USD 265.93 million by 2032, at a CAGR of 13.5% during the forecast period

- This growth is driven by factors such as the increasing cloud adoption, digital transformation initiatives, and rising investments in smart city and e-government projects.

AWS Managed Services Market Analysis

- AWS managed services are the set of services and tools that assists in providing AWS cloud managing services to the customers that automate infrastructure management for the Amazon web services deployments.

- The services are focused at large enterprises that want a basic way to major for migrating the on premise server or workloads to the cloud specifically to public cloud but also use private or hybrid clouds. AWS managed services are considered due to various reasons such as low cost of the services, data protection, accessibility, upgradation, data storage, continuous monitoring of the cloud and others.

- Saudi Arabia is expected to dominate the AWS Managed Servicess market due to its strategic investment in cloud infrastructure, exemplified by Amazon Web Services' (AWS) commitment to launch a new AWS Region in the Kingdom

- U.A.E. is expected to be the fastest growing region in the AWS Managed Services Market during the forecast period due to rapid cloud adoption, smart city initiatives, and strong government-led digital transformation.

- Operations Services segment is expected to dominate the market with a market share of 51.78% due to growing demand for 24/7 infrastructure monitoring, security management, and automated system operations

Report Scope and AWS Managed Services Market Segmentation

|

Attributes |

AWS Managed Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

AWS Managed Services Market Trends

“Growing Demand for Multi-Cloud and Hybrid Cloud Environments”

- One of the most prominent trends in the AWS Managed Services market is the rising adoption of multi-cloud and hybrid cloud strategies. Organizations today are no longer relying solely on a single cloud vendor; instead, they're spreading their workloads across multiple cloud platforms to reduce vendor lock-in, increase resilience, and ensure compliance with local data regulations. AWS Managed Services providers are playing a critical role in helping businesses seamlessly integrate AWS with other platforms like Microsoft Azure or private clouds. These providers ensure compatibility, smooth data migration, unified security management, and operational consistency across environments.

- As enterprises pursue digital transformation, flexibility becomes key, especially for those in regulated industries like healthcare and finance. Hybrid cloud models also allow for legacy systems to coexist with modern cloud applications. This blended approach is making it easier for businesses to innovate without completely overhauling existing IT infrastructure. MSPs offering expertise in hybrid and multi-cloud strategies are seeing high demand. This trend is expected to accelerate as cloud maturity grows Middle-Eastly

- For instance, In February 2023, HSBC adopted a hybrid cloud approach with support from AWS Managed Services. The bank moved key workloads to AWS while retaining sensitive customer data in its private data centers. This allowed HSBC to innovate in customer service and digital banking while meeting regulatory compliance needs. AWS MSPs ensured smooth integration, unified monitoring, and consistent security policies. This hybrid model improved agility without compromising data governance

AWS Managed Services Market Dynamics

Driver

“Rising Focus on Security, Compliance, and Data Governance”

- As businesses move critical workloads to the cloud, data security and compliance have become top priorities—making it a major driver for the AWS Managed Services market. Managing cloud security requires continuous monitoring, patching, encryption, access controls, and regulatory alignment. AWS provides the infrastructure and security tools, but configuring and maintaining them properly can be complex, especially across industries with strict standards like finance, healthcare, or government.

- Managed Service Providers step in to fill this gap with specialized security services—such as 24/7 threat detection, incident response, compliance audits, and secure architecture design. They ensure that organizations meet standards like GDPR, HIPAA, or ISO 27001 without overwhelming internal teams. With data breaches on the rise, the assurance of strong governance and real-time threat visibility is a key selling point. MSPs help companies avoid fines, reputational damage, and legal risk while maintaining performance. As cyber threats evolve, security-focused managed services are becoming mission-critical.

For instance,

- In May 2024, Dubai Islamic Bank worked with an AWS MSP to tighten its cloud security and meet UAE Central Bank compliance guidelines. The provider deployed AWS WAF, GuardDuty, and encryption at rest using KMS. Real-time monitoring and automated threat detection significantly reduced vulnerability windows. The MSP also handled regular compliance reporting, ensuring full regulatory alignment. This enabled the bank to innovate securely without compromising on governance

Opportunity

“Rise of AI and Machine Learning Integration in Cloud Services”

- SMEs are increasingly turning to cloud solutions to compete with larger enterprises, creating a significant opportunity for AWS Managed Services providers. Many of these smaller firms lack in-house IT expertise to manage complex cloud infrastructure, making managed services an ideal solution. AWS offers scalable and cost-effective services that can grow with SMEs as their needs evolve

- Managed service providers can help them migrate workloads, ensure security, manage costs, and maintain compliance with regional data regulations. In fast-growing economies like India, UAE, and Southeast Asia, digitalization is becoming essential for survival, driving this adoption further. MSPs offering pay-as-you-go models, tailored services, and local language support can attract this segment effectively. SMEs also benefit from automated backups, disaster recovery, and round-the-clock technical support that managed services provide. By reducing technical barriers and upfront investment, AWS managed services lower the entry threshold for smaller players

For instance,

- In September 2021, HealthPlix Technologies, a Bengaluru-based startup, launched its AI-driven Electronic Medical Records (EMR) platform on AWS. This platform, utilized by over 10,000 doctors across 370 cities, integrates Amazon SageMaker for clinical decision support, enabling doctors to generate e-prescriptions in under 30 seconds. The platform's analytics capabilities, powered by Amazon Redshift and Amazon Athena, assist in identifying patient trends and improving care outcomes

- As a result, there's a rising demand for simplified, yet robust, cloud solutions among SMEs. This presents a sustainable growth path for providers focusing on small business needs

Restraint/Challenge

“High Cost of Managed Services for Small and Medium Enterprises (SMEs)”

- While AWS Managed Services bring immense value, the cost involved can be a significant hurdle—especially for small and medium-sized enterprises. Many MSPs structure their pricing on usage, SLAs, or bundled support, which might not align with the lean budgets of smaller businesses. For SMEs just beginning their cloud journey, these upfront and ongoing costs can feel like a steep commitment. The complexity of services such as real-time monitoring, custom automation, or advanced security only adds to the total bill.

- Additionally, some providers charge premiums for 24/7 support, compliance services, or multi-region deployments. For cost-sensitive businesses, this can lead to underutilization of the cloud or delay in adopting managed services altogether. Although AWS does offer cost optimization tools, navigating them without expert help can be difficult. As a result, many SMEs either rely on basic cloud usage or seek cheaper alternatives with limited support. This cost barrier could slow down the broader democratization of managed cloud services.

For instance,

- In early 2024, a small logistics startup in Kenya explored AWS Managed Services for scaling its backend operations. However, after receiving pricing estimates for continuous monitoring and 24/7 support, the startup decided to handle infrastructure management in-house. They found the monthly cost too high compared to their operational budget. This limited their ability to access advanced cloud features. The case highlights how pricing can restrict adoption for smaller firms

AWS Managed Services Market Scope

The market is segmented on the basis services type, deployment mode, organization size and industry vertical

|

Segmentation |

Sub-Segmentation |

|

Services type |

|

|

Deployment mode |

|

|

Organization size |

|

|

Industry vertical |

|

In 2025, the Operations Services is projected to dominate the market with a largest share in segment

In 2025, the Operations Services segment is projected to dominate the AWS Managed Services market with the largest share of 51.78%. This growth is fueled by rising demand for continuous cloud infrastructure monitoring, automated system management, and robust security operations. As businesses move more critical workloads to the cloud, they require round-the-clock support to ensure uptime, compliance, and cost efficiency. Managed service providers offer these operational capabilities through scalable, real-time solutions, making them essential to modern cloud strategies

The Cloud Migration Services is expected to account for the largest share during the forecast period in market

The Cloud Migration Services segment is expected to account for the largest share of 47.65% during the forecast period in the AWS Managed Services market. This is primarily due to the surge in digital transformation efforts across industries, where enterprises are shifting legacy systems to the cloud to enhance scalability, flexibility, and performance. As organizations increasingly adopt hybrid and multi-cloud environments, the need for expert-led, secure, and efficient migration processes is growing rapidly. Managed service providers play a vital role in minimizing downtime, managing data integrity, and ensuring compliance throughout the migration journey

AWS Managed Services Market Regional Analysis

“Saudi Arabia Holds the Largest Share in the AWS Managed Services Market”

- Saudi Arabia holds the largest share in the AWS Managed Services market across the Middle East, driven by aggressive digital transformation goals under Vision 2030. The country has seen strong government backing for cloud adoption, especially in sectors like healthcare, finance, and public services. AWS’s announcement of a $5.3 billion investment to build a new infrastructure region by 2026 further strengthens the local cloud ecosystem.

- This move ensures data residency compliance, which is critical for regulated industries. The rising demand for advanced technologies such as AI, IoT, and big data analytics has accelerated cloud uptake across enterprises.

- Additionally, partnerships with local telcos and IT firms have helped tailor services to regional needs. Saudi businesses are increasingly relying on AWS Managed Services for scalability, automation, and 24/7 operations. As a result, the Kingdom is emerging as the regional hub for cloud innovation and managed service excellence.

“U.A.E. is Projected to Register the Highest CAGR in the AWS Managed Services Market”

- The United Arab Emirates (UAE) is projected to register the highest Compound Annual Growth Rate (CAGR) in the AWS Managed Services market during the forecast period. This growth is primarily driven by the UAE's strategic initiatives aimed at fostering digital transformation across various sectors.

- The government's Vision 2021 and Dubai's Smart City project emphasize the adoption of smart technologies, which has significantly increased the demand for cloud computing services. Additionally, the establishment of local data centers by major cloud providers ensures compliance with data sovereignty regulations, further boosting the adoption of AWS Managed Services.

- The private sector's rapid embrace of cloud computing to enhance operational efficiency and gain a competitive edge also contributes to the market's expansion. As a result, the UAE is emerging as a leading hub for cloud innovation and managed service excellence in the Middle East.

AWS Managed Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- RACKSPACE US INC,

- Smartronix Inc.,

- Mission Cloud Services, Inc,

- Claranet limited,

- Capgemini,

- DXC Technology Company,

- Onica,

- Accenture,

- Slalom, LLC,

- 8K Miles Software Services Ltd.,

- e-Zest Solutions,

- Great Software Laboratory,

- Cloudnexa,

- Logicworks,

- CLOUDREACH,

- AllCloud,

Latest Developments in Middle-East AWS Managed Services Market

- In October 2024, Rackspace deepened its relationship with AWS by entering a multi-year agreement to speed up cloud and AI adoption for Middle-East clients. As part of this move, Rackspace introduced a new offering—Rackspace Rapid Migration Offer (RRMO)—in September, aimed at helping businesses quickly shift from traditional data centers to AWS. The service bundle includes everything from initial planning and setup to full migration support and around-the-clock operational monitoring

- In December 2024, Mission Cloud Services—an advanced AWS consulting partner—was acquired by CDW. This deal enhances CDW's cloud services portfolio, integrating Mission Cloud’s AWS-focused expertise with CDW’s Digital Velocity team. Known for tailored managed services and AI support, Mission Cloud strengthens CDW’s ability to guide clients through complex AWS deployments

- In June 2024, Claranet and AWS announced a five-year partnership focused on cloud transformation. A key part of this agreement includes setting up a Cloud Centre of Excellence, where over 1,200 tech professionals will be trained and certified. The initiative is designed to equip businesses with new AWS-powered solutions that boost agility and competitiveness.

- In August 2024, Accenture teamed up with AWS to help businesses scale AI in a secure and controlled way. Together, they introduced the Responsible AI Platform, a framework built on AWS that focuses on risk, compliance, and ethical AI use. This solution enables clients to deploy AI at scale while ensuring trust, oversight, and accountability in its implementation

- In November 2023, DXC and AWS expanded their collaboration to help nearly a thousand clients transition more deeply into the cloud. A key component of this effort includes training 15,000 DXC employees in AWS technologies over five years. DXC has also chosen AWS as its main cloud provider, enabling it to innovate faster and deliver more streamlined services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.