Middle East Africa Biofortification Market

Market Size in USD Million

CAGR :

%

USD

18.42 Million

USD

41.66 Million

2024

2032

USD

18.42 Million

USD

41.66 Million

2024

2032

| 2025 –2032 | |

| USD 18.42 Million | |

| USD 41.66 Million | |

|

|

|

|

Biofortification Market Size

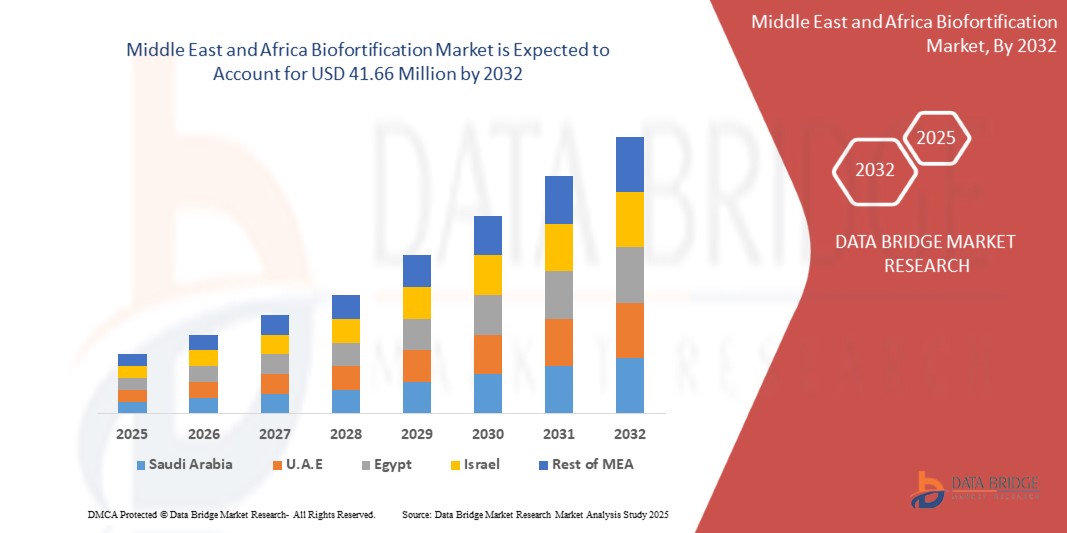

- The Middle East and Africa Biofortification Market size was valued at USD 18.42 million in 2024 and is expected to reach USD 41.66 million by 2032, growing at a CAGR of 10.90% during the forecast period.

- This growth is primarily fueled by increasing efforts to combat micronutrient deficiencies, growing focus on food and nutrition security, and advancements in biofortification technologies tailored to regional climatic and agricultural conditions.

Biofortification Market Analysis

- Biofortification refers to the process of increasing the nutritional value of staple crops through agronomic practices, conventional plant breeding, or modern biotechnology. It plays a crucial role in addressing "hidden hunger" by enriching crops with essential micronutrients such as iron, zinc, and vitamin A.

- The market is witnessing growing interest across the Middle East and Africa due to rising health awareness, government and NGO-led nutritional intervention programs, and a strong need to enhance the nutritional profile of staple foods without altering dietary habits.

- South Africa is expected to dominate the biofortification market with a market share of 31.52%, driven by its structured agricultural research ecosystem, partnerships with international organizations, and increasing prevalence of micronutrient deficiencies in rural populations.

- Nigeria is projected to be the fastest-growing country in the biofortification market during the forecast period, supported by large-scale public health initiatives, favorable climatic conditions for staple crops, and international collaborations promoting biofortified seed adoption.

- The Vitamin A segment is anticipated to lead the market with a share of 34.79%, owing to its significant role in reducing child mortality and vision-related disorders, alongside ongoing development of vitamin A-enriched sweet potatoes and maize varieties in the region.

Report Scope and Biofortification Market Segmentation

|

Attributes |

Biofortification Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biofortification Market Trends

“Growing Focus on Nutrition-Sensitive Agriculture and Food Security”

- One prominent trend in the Middle East and Africa Biofortification Market is the growing focus on nutrition-sensitive agriculture and regional food security enhancement.

- This trend is driven by increasing malnutrition rates, micronutrient deficiencies (especially iron, zinc, and vitamin A), and government and NGO initiatives promoting biofortified crops as a sustainable, cost-effective solution to hidden hunger.

For instance, organizations like HarvestPlus and local agricultural research institutions such as the Kenya Agricultural & Livestock Research Organization (KALRO) are working to scale up biofortified crops like vitamin A maize and iron-rich beans through farmer outreach and seed distribution.

- The integration of biofortification into national nutrition and agricultural strategies is gaining momentum, encouraging collaborations between public agencies, NGOs, and private seed companies.

- As more countries prioritize food security and health-centric agricultural models, biofortification is increasingly recognized as a strategic tool to deliver essential nutrients through staple crops and reduce dependence on external supplementation programs.

Biofortification Market Dynamics

Driver

“Government and Institutional Support Driving Biofortified Crop Adoption”

- Government and institutional support plays a crucial role in driving the adoption of biofortified crops across the Middle East and Africa.

- Several countries in the region have aligned biofortification efforts with broader national goals of improving public health and agricultural productivity, creating favorable policies and financial incentives for biofortified seed development and distribution.

- This support often comes in the form of subsidies, public-private partnerships, and integration into school feeding programs and rural development plans.

- With the involvement of global organizations such as the World Bank, Bill & Melinda Gates Foundation, and IFPRI, targeted investments are being made to improve seed availability, conduct field trials, and enhance farmer awareness.

For instance, the Senegalese Institute of Agricultural Research (ISRA) and Uganda’s Nalweyo Seed Company (NASECO) are collaborating on developing climate-resilient, iron- and zinc-rich varieties for smallholder farmers.

- As government agencies and global donors continue to champion biofortification as a scalable solution to malnutrition, adoption is expected to accelerate across both rural and peri-urban communities.

Restraint/Challenge

“Limited Consumer Awareness and Acceptance of Biofortified Crops”

- One of the primary challenges in the Middle East and Africa biofortification market is the limited consumer awareness and acceptance of biofortified crops.

- Despite the proven health benefits, many consumers are unfamiliar with biofortified foods or perceive them as genetically modified, leading to resistance in consumption and market penetration.

- In regions where cultural preferences and traditional crop varieties dominate consumption patterns, introducing new biofortified varieties poses both behavioral and communication challenges.

For instance, while vitamin A orange-fleshed sweet potatoes have shown promising health impacts, adoption has been slowed in some areas due to resistance to color and taste differences from traditional varieties.

- The lack of comprehensive consumer education campaigns and weak linkages between nutrition messaging and agricultural extension further compound the challenge.

- Unless addressed through awareness-building programs, improved labeling, and health communication efforts, the limited demand pull from consumers may hinder the scale-up of biofortified food systems in the region.

Biofortification Market Scope

The market is segmented on the basis of crop type, target nutrient, breeding technique, and application.

- By Crop Type

On the basis of crop type, the Middle East and Africa Biofortification Market is segmented into Sweet Potato, Rice, Wheat, Beans, and Others. The Sweet Potato segment dominates the market, accounting for the largest revenue share of 30.91% in 2025. This dominance is driven by the success of vitamin A-rich orange-fleshed sweet potatoes in combating micronutrient deficiencies across sub-Saharan Africa, supported by high acceptance among farmers and consumers due to its yield performance and nutritional benefits.

However, the Beans segment is expected to register the highest CAGR of 8.23% during the forecast period of 2025–2032. This growth is attributed to increasing demand for iron-rich beans in countries such as Rwanda and DR Congo, where iron deficiency remains a significant public health challenge. Additionally, their suitability to smallholder farming systems and support from regional research institutions are expected to drive adoption.

- By Target Nutrient

On the basis of target nutrient, the market is segmented into Iron, Zinc, Vitamin A, and Others. The Vitamin A segment held the largest market share of 36.48% in 2025, owing to widespread regional deficiency levels and the strong policy and NGO support for crops like orange maize and sweet potatoes. These crops are widely promoted in nutritional programs and public health interventions to combat vision and immune-related disorders.

Meanwhile, the Iron segment is projected to experience the highest CAGR of 8.71% during the forecast period. This expected growth is due to intensified efforts to reduce iron deficiency anemia in vulnerable populations through the promotion of iron-rich beans and pearl millet varieties, which are gaining traction in East and West African regions.

- By Breeding Technique

On the basis of breeding technique, the market is segmented into Conventional Plant Breeding, Agronomic Biofortification, and Genetic Engineering. The Conventional Plant Breeding segment dominated the market with a revenue share of 52.76% in 2025. This method remains the most widely used due to its regulatory acceptance, cost-effectiveness, and proven track record of developing resilient, biofortified crops suitable for local agro-climatic conditions.

Genetic Engineering is expected to witness the fastest CAGR of 7.89% during 2025–2032, driven by advancements in biotechnology and growing interest in crops like Golden Rice and provitamin A cassava. The potential to achieve higher nutrient concentration and faster breeding cycles makes this technique attractive, although regulatory hurdles and consumer skepticism continue to pose challenges.

- By Application

On the basis of application, the market is segmented into Food Industry, Nutraceuticals, Animal Feed, and Others. The Food Industry segment led the market with the largest share of 41.37% in 2025, driven by the increasing incorporation of biofortified crops into staple foods such as bread, flour, and porridge across schools and community nutrition programs.

The Nutraceuticals segment is expected to grow at the highest CAGR of 8.05% during the forecast period. This growth is attributed to rising consumer awareness of preventive healthcare and functional foods, along with increased interest from food supplement manufacturers in leveraging naturally fortified ingredients to meet health and wellness trends.

Middle East and Africa Biofortification Market Insight

The Middle East and Africa Biofortification Market is projected to grow steadily, with a forecast CAGR of 11.4% in 2025. Growth is fueled by increasing prevalence of micronutrient deficiencies, expanding government support for food security initiatives, and active involvement from international NGOs promoting nutrition-sensitive agriculture. The region’s reliance on staple crops and the need to improve their nutritional value are key drivers behind the adoption of biofortified varieties. Rising investments in agricultural research and development, combined with growing public awareness of malnutrition-related health issues, are expected to strengthen market momentum across sub-Saharan Africa and parts of the Middle East.

- Nigeria Biofortification Market Insight

Nigeria holds the largest market share in the Middle East and Africa Biofortification Market at 27.8% in 2025, driven by strong demand for vitamin A-rich crops such as orange-fleshed sweet potato and maize. The country's significant burden of malnutrition, especially among children and women, is prompting aggressive government-led interventions and partnerships with organizations like HarvestPlus and the Bill & Melinda Gates Foundation. These initiatives are fostering large-scale adoption of biofortified crops through extension services, farmer training programs, and integration into school feeding initiatives.

- Kenya Biofortification Market Insight

The Kenyan biofortification market is expected to record the highest CAGR of 13.6% during the forecast period, supported by robust agricultural extension systems, favorable agro-climatic conditions, and strong donor and institutional engagement. Iron-rich beans and vitamin A-enriched sweet potatoes are witnessing increased uptake, especially in rural and peri-urban communities. Additionally, growing consumer demand for nutritious food products and active promotion by the Ministry of Agriculture and allied stakeholders are accelerating commercialization and market penetration of biofortified crops.

Biofortification Market Players

The Biofortification Market Industry is primarily led by well-established companies, including:

- HarvestPlus (U.S.)

- Syngenta AG (Switzerland)

- BASF SE (Germany)

- Bayer AG (Germany)

- Corteva Agriscience (U.S.)

- Groupe Limagrain (France)

- Mahyco (India)

- AVRDC – The World Vegetable Center (Taiwan)

- Jamii Bora Seeds (Kenya)

- Western Seed Company Ltd. (Kenya)

- Nalweyo Seed Company (NASECO) (Uganda)

- Kenya Agricultural & Livestock Research Organization – KALRO (Kenya)

- Senegalese Institute of Agricultural Research – ISRA (Senegal)

Latest Developments in Middle East and Africa Biofortification Market

- In March 2025, HarvestPlus, in collaboration with Nigeria’s National Root Crops Research Institute (NRCRI), launched a new biofortified cassava variety rich in vitamin A. This development aims to combat widespread vitamin A deficiency and strengthen food security in rural Nigerian communities by promoting adoption through government extension services and subsidized seed programs.

- In February 2025, the International Institute of Tropical Agriculture (IITA) introduced iron-rich bean varieties in Kenya and Uganda through its regional biofortification outreach. Supported by the African Development Bank (AfDB), this initiative is set to improve nutritional outcomes for low-income households, especially women and children, while expanding market opportunities for nutrient-dense staple crops.

- In November 2024, the Ethiopian Institute of Agricultural Research (EIAR), in partnership with the BioInnovate Africa program, successfully developed and began field trials for zinc-enriched wheat varieties. This innovation targets micronutrient deficiencies in Ethiopia's wheat-dependent population and reflects ongoing efforts to mainstream biofortification into national crop breeding programs.

- In August 2024, Zambia’s Ministry of Agriculture partnered with CGIAR to roll out large-scale farmer training programs focused on agronomic biofortification practices, particularly zinc fertilization in maize. The initiative aims to improve productivity and nutrition simultaneously, making fortified staple crops more accessible through community demonstration plots and input subsidies.

- In May 2024, Uganda’s National Agricultural Research Organisation (NARO), in collaboration with HarvestPlus and local seed companies, launched commercial distribution of orange-fleshed sweet potato vines in Northern Uganda. With a focus on women-led farming cooperatives, this initiative is expected to enhance dietary diversity and reduce vitamin A deficiency among vulnerable populations in post-conflict zones.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East Africa Biofortification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East Africa Biofortification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East Africa Biofortification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.