Middle East Africa Fluoroscopy C Arms Market

Market Size in USD Million

CAGR :

%

USD

26.64 Million

USD

35.90 Million

2024

2032

USD

26.64 Million

USD

35.90 Million

2024

2032

| 2025 –2032 | |

| USD 26.64 Million | |

| USD 35.90 Million | |

|

|

|

|

Middle East and Africa Fluoroscopy- C Arms Market Size

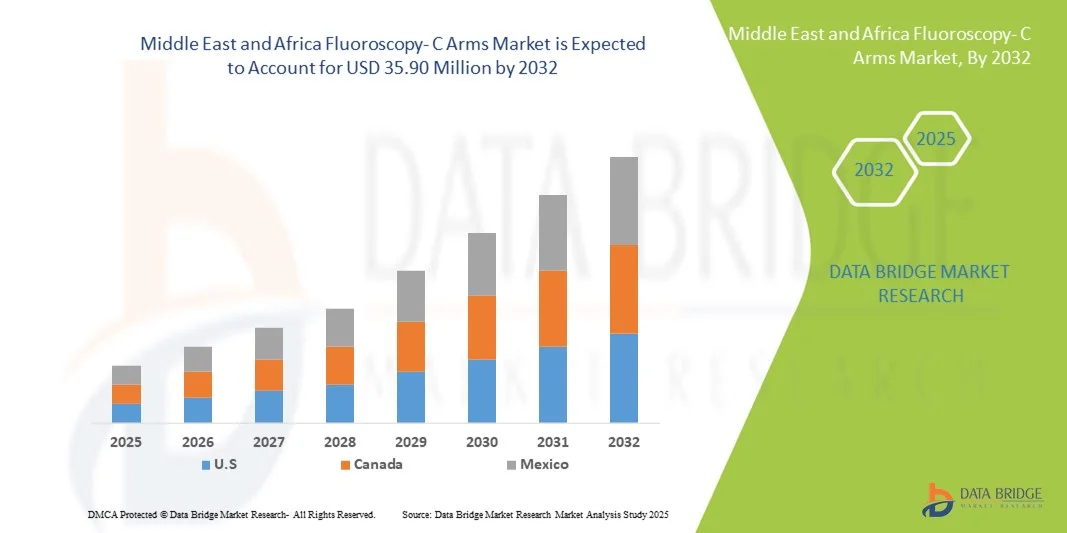

- The Middle East and Africa fluoroscopy- C arms market size was valued at USD 26.64 Million in 2024 and is expected to reach USD 35.90 Million by 2032, at a CAGR of 3.80% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in medical imaging technologies, particularly in diagnostic and interventional procedures, leading to increased demand for precise, real-time imaging solutions in hospitals and clinics

- Furthermore, rising incidences of chronic diseases, trauma cases, and orthopedic disorders are establishing fluoroscopy – C Arms systems as essential tools in modern medical imaging and surgery. These converging factors are accelerating the uptake of fluoroscopy – C arms solutions, thereby significantly boosting the industry's growth

Middle East and Africa Fluoroscopy- C Arms Market Analysis

- Fluoroscopy - C Arms, offering real-time X-ray imaging for surgical, orthopedic, and interventional procedures, are increasingly vital components of modern hospitals and diagnostic centers due to their precision, versatility, and ability to guide minimally invasive procedure

- The rising demand for fluoroscopy - C arms is primarily fueled by the growing prevalence of chronic diseases, increasing surgical volumes, and continuous advancements in imaging technology, such as flat-panel detectors and dose-reduction systems

- Saudi Arabia dominated the fluoroscopy- C arms market with the largest revenue share of 42.5% in 2024, characterized by early adoption of advanced medical imaging technologies, high healthcare expenditure, and a strong presence of key industry players, with Saudi hospitals and diagnostic centers experiencing substantial growth in Fluoroscopy- C Arms installations, particularly in new medical facilities and specialty clinics, driven by innovations from both established global companies and regional distributors

- The U.A.E. is expected to be the fastest-growing region in the fluoroscopy- C arms market during the forecast period, with a CAGR due to increasing urbanization, rising healthcare infrastructure investments, and growing demand for advanced diagnostic imaging solutions across hospitals and specialty centers

- The Conventional Fluoroscopy Systems segment dominated the largest market revenue share of 56.4% in 2024, driven by its widespread use across diagnostic imaging, orthopedic, and gastrointestinal procedures

Report Scope and Fluoroscopy- C Arms Market Segmentation

|

Attributes |

Fluoroscopy- C Arms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Fluoroscopy- C Arms Market Trends

Technological Advancements Enhancing Imaging Precision and Clinical Efficiency

- A significant and accelerating trend in the fluoroscopy - C arms market is the integration of advanced imaging technologies, artificial intelligence (AI), and real-time data analytics to enhance diagnostic accuracy and procedural efficiency. The fusion of AI algorithms with imaging systems is significantly improving visualization, image reconstruction, and radiation dose optimization in clinical settings

- For instance, leading manufacturers such as Siemens Healthineers and GE HealthCare have introduced AI-powered C-arm systems capable of providing automated image adjustments and enhanced clarity during complex surgical procedures. These advancements enable clinicians to obtain higher precision in real-time imaging while reducing procedure times and minimizing exposure risks

- The incorporation of machine learning and automated workflow solutions within C-arm systems allows clinicians to predict imaging requirements, optimize angles, and improve workflow productivity. For instance, Philips’ next-generation mobile C-arms use smart algorithms that automatically adjust parameters for optimal imaging, ensuring consistent quality even in challenging conditions. Furthermore, AI-driven analytics support better intraoperative decision-making by providing instant feedback on positioning and exposure levels

- The seamless integration of fluoroscopy - C arms with hospital information systems (HIS), picture archiving and communication systems (PACS), and electronic medical records (EMRs) facilitates efficient data transfer and centralized case management. This interoperability enhances operational efficiency, ensuring faster diagnosis, reduced manual errors, and improved coordination among medical staff

- This trend toward more intelligent, connected, and automated imaging systems is reshaping clinical workflows and improving patient outcomes. Consequently, companies such as Ziehm Imaging and Canon Medical Systems are developing advanced C-arm models featuring 3D imaging capabilities, AI-based workflow assistants, and reduced radiation technologies to meet the growing demand for precision and safety in medical imaging

- The rising adoption of AI-integrated and technologically advanced fluoroscopy systems across hospitals and surgical centers is driving strong growth in both developed and emerging markets, as healthcare providers increasingly prioritize enhanced imaging performance, efficiency, and patient safety

Middle East and Africa Fluoroscopy - C Arms Market Dynamics

Driver

Growing Demand for Minimally Invasive Procedures and Real-Time Imaging Capabilities

- The rising global demand for minimally invasive surgeries, combined with advancements in real-time imaging technologies, is a key driver of the fluoroscopy - C arms market. These systems are increasingly used in orthopedic, cardiovascular, and pain management procedures due to their superior visualization and precision

- For instance, in April 2024, Siemens Healthineers announced the launch of the Cios Alpha C-arm with improved dose reduction features and AI-guided positioning, aimed at enhancing surgical precision and safety. Such innovations are expected to accelerate market growth during the forecast period

- The increasing prevalence of chronic conditions such as cardiovascular diseases, orthopedic disorders, and trauma injuries has led to a growing need for efficient and image-guided treatment procedures. fluoroscopy - C arms provide surgeons with continuous real-time imaging, improving diagnostic accuracy and treatment outcomes

- Furthermore, technological developments such as flat-panel detectors, digital radiography, and 3D/4D imaging are enhancing image quality while reducing radiation exposure, making C-arms an indispensable tool in modern operating rooms

- The integration of advanced imaging modalities with surgical navigation systems and hybrid operating rooms is also contributing to the growing adoption of fluoroscopy - C arms across hospitals and specialty clinics

Restraint/Challenge

High Equipment Costs and Radiation Safety Concerns

- The high initial cost of fluoroscopy - C arm systems, along with maintenance expenses and training requirements, poses a significant challenge for smaller hospitals and clinics, particularly in developing regions. The cost burden often limits accessibility and delays equipment upgrades in budget-sensitive healthcare settings

- For instance, high-end mobile C-arms featuring 3D imaging and advanced dose management systems can represent a substantial investment, restricting adoption among smaller facilities

- Radiation safety remains another major concern, as prolonged exposure during interventional procedures can pose health risks for both patients and medical personnel. Addressing these safety issues through improved shielding, dose monitoring, and training programs is crucial for broader market acceptance

- Manufacturers are increasingly focusing on developing cost-effective models with enhanced radiation protection and optimized operational efficiency to cater to a wider range of healthcare institutions. Furthermore, government initiatives promoting safety compliance and equipment standardization are expected to mitigate these concerns over time

- Overcoming these challenges through affordable technological innovations, awareness programs on radiation safety, and supportive reimbursement frameworks will be vital for sustained growth of the Fluoroscopy - C Arms market

Middle East and Africa Fluoroscopy - C Arms Market Scope

The market is segmented on the basis of type, C-arm type, C-arm technology, application, and end user.

- By Type

On the basis of type, the Fluoroscopy - C Arms market is segmented into Conventional Fluoroscopy Systems and Remote-Controlled Fluoroscopy Systems. The Conventional Fluoroscopy Systems segment dominated the largest market revenue share of 56.4% in 2024, driven by its widespread use across diagnostic imaging, orthopedic, and gastrointestinal procedures. These systems are cost-effective, provide real-time imaging, and are suitable for both emergency and routine diagnostics. Hospitals and diagnostic centers prefer these systems due to their reliability, ease of operation, and compatibility with existing infrastructure. The adoption is further supported by advancements in digital detectors, image processing, and radiation dose optimization features, ensuring high-quality imaging and patient safety. Continuous investments in upgrading older systems to support hybrid imaging and 3D reconstruction also boost market share.

The Remote-Controlled Fluoroscopy Systems segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, fueled by the increasing demand for enhanced operator protection and patient safety. Remote-controlled systems reduce clinician exposure to radiation, allow precise positioning, and improve workflow efficiency. Hospitals and specialty clinics are adopting these systems in minimally invasive surgeries, interventional cardiology, and gastrointestinal procedures. Rising awareness about occupational safety and the need for standardized imaging protocols drive adoption. Technological innovations such as motorized C-arm movement, automated imaging protocols, and integration with PACS systems further accelerate growth. The expansion of healthcare infrastructure and ongoing investments in advanced surgical suites support rapid segment adoption.

- By C-Arm Type

On the basis of C-arm type, the Fluoroscopy - C Arms market is segmented into Fixed C-Arms and Mobile C-Arms. The Mobile C-Arms segment dominated the largest market revenue share of 44.8% in 2024, attributed to its portability, flexibility, and ease of use across multiple operating rooms. Mobile C-arms are extensively used in trauma care, orthopedic surgeries, and pain management procedures. Their ability to provide high-resolution imaging in confined spaces and adaptability to different hospital settings makes them highly preferred. Continuous innovation in flat-panel detectors, lightweight designs, and real-time image processing enhances workflow efficiency. High adoption in emergency rooms, outpatient surgical centers, and hybrid operating theaters further supports the segment. Hospitals favor mobile systems for their versatility, cost-effectiveness, and reduced installation requirements.

The Fixed C-Arms segment is expected to witness the fastest CAGR of 9.3% from 2025 to 2032, driven by rising investments in hybrid operating rooms and high-end surgical suites. Fixed C-arms provide consistent image quality, superior stability, and enhanced precision for complex interventional and minimally invasive procedures. Hospitals and specialty clinics adopting fixed systems benefit from long-term reliability, advanced imaging software, and integration with robotic-assisted surgery. Increasing infrastructure development in emerging economies and growing demand for advanced imaging in orthopedic and cardiovascular interventions propel segment growth.

- By C-Arm Technology

On the basis of C-arm technology, the Fluoroscopy - C Arms market is segmented into Flat Panel and Image Intensifiers. The Flat Panel segment held the largest market revenue share of 52.1% in 2024, owing to its superior image quality, low radiation exposure, and enhanced digital capabilities. Flat-panel C-arms are widely adopted for minimally invasive surgeries, interventional cardiology, and spinal procedures requiring high precision. Advanced image processing, 3D reconstruction, and dose reduction technologies contribute to their dominance. Hospitals and specialty clinics prefer flat-panel systems for workflow efficiency, reduced procedure times, and compatibility with PACS and digital health systems. Ongoing innovations such as dynamic collimation, high-speed image acquisition, and integration with surgical navigation platforms further strengthen adoption.

The Image Intensifiers segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2032, supported by cost-effective solutions for smaller hospitals and diagnostic centers. These systems remain popular in regions with budget constraints and in general diagnostic imaging procedures. Reliable performance, ease of maintenance, and compatibility with existing systems enhance their adoption. Expanding healthcare infrastructure and growing demand for basic imaging services in emerging markets further drive growth. Growing collaborations between equipment manufacturers and local distributors help in wider reach and faster deployment. Furthermore, favorable government policies and subsidies for diagnostic imaging in emerging economies support increased adoption of image intensifier-based C-Arms.

- By Application

On the basis of application, the Fluoroscopy - C Arms market is segmented into Diagnostic Applications, Surgical Applications, and Discography. The Surgical Applications segment accounted for the largest market revenue share of 49.6% in 2024, driven by increasing adoption in orthopedic, cardiovascular, and neurosurgical procedures. Surgical applications benefit from real-time imaging, precise visualization, and intraoperative guidance. Hospitals and specialty clinics are adopting C-arms to improve procedural accuracy and reduce patient complications. The segment is also supported by minimally invasive surgery trends, rising geriatric population, and growing incidence of chronic disorders requiring intervention. Innovations in software-guided navigation and hybrid OR integration further enhance the segment’s dominance.

The Diagnostic Applications segment is expected to witness the fastest CAGR of 9.5% from 2025 to 2032, fueled by increased demand for gastrointestinal, urological, and pain management diagnostics. Technological advancements enabling high-resolution images with reduced radiation exposure drive adoption in hospitals and outpatient diagnostic centers. Expansion of preventive care services and outpatient imaging facilities further supports growth. Rising awareness among patients about early disease detection and routine screenings is boosting demand. In addition, strategic partnerships between imaging solution providers and healthcare networks enhance accessibility and adoption of diagnostic C-Arms.

- By End User

On the basis of end user, the Fluoroscopy - C Arms market is segmented into Hospitals, Diagnostic Centers, and Specialty Clinics. The Hospitals segment dominated the largest market revenue share of 57.3% in 2024, driven by high surgical volumes, investment capacity, and integration of advanced imaging technologies in operating rooms. Hospitals benefit from comprehensive imaging suites supporting multidisciplinary procedures, intraoperative guidance, and patient monitoring. Adoption is further fueled by new hospital constructions and expansion of surgical services. Continuous demand for minimally invasive interventions and hybrid operating rooms maintains dominance.

The Diagnostic Centers segment is anticipated to witness the fastest CAGR of 10.1% from 2025 to 2032, driven by the rising demand for outpatient imaging services and affordable C-arm solutions. Expansion of diagnostic networks, early disease detection initiatives, and growing preference for non-hospital settings for routine imaging drive growth. Technological upgrades and portable solutions enhance adoption in diagnostic facilities. Increasing patient awareness about preventive healthcare and routine check-ups is boosting demand. Furthermore, collaborations between C-arm manufacturers and diagnostic center chains improve equipment availability and service efficiency, supporting market expansion.

Middle East and Africa Fluoroscopy- C Arms Market Regional Analysis

- Saudi Arabia fluoroscopy - C arms market dominated the Fluoroscopy - C Arms market with the largest revenue share of 42.5% in 2024, characterized by early adoption of advanced medical imaging technologies, high healthcare expenditure, and a strong presence of key industry players

- Hospitals and diagnostic centers in Saudi Arabia are increasingly investing in both fixed and mobile C-arm systems to enhance diagnostic and surgical capabilities. Government initiatives supporting digital health, hospital modernization, and technological innovation further bolster market growth, while collaborations with global medical technology firms sustain Saudi Arabia’s leading position in the MEA region

- Expansion of specialty clinics and adoption of minimally invasive procedures further drive the market.

U.A.E. Fluoroscopy - C Arms Market Insight

The U.A.E. fluoroscopy - C arms market is expected to be the fastest-growing region in the Fluoroscopy - C Arms market during the forecast period, with a projected CAGR of 9.8% from 2025 to 2032, driven by rapid urbanization, substantial healthcare infrastructure investments, and rising demand for advanced diagnostic imaging solutions across hospitals and specialty centers. Expansion of private hospitals, government healthcare initiatives, and increasing adoption of minimally invasive surgical procedures contribute to the UAE’s growth. The presence of international medical device suppliers and regional distributors further accelerates the adoption of cutting-edge C-arm technologies.

Middle East and Africa Fluoroscopy- C Arms Market Share

The Fluoroscopy- C Arms industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V.(Netherlands)

- Canon Medical Systems Corporation (Japan)

- Shimadzu Corporation (Japan)

- Ziehm Imaging GmbH (Germany)

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- Genoray Co., Ltd. (South Korea)

- Trivitron Healthcare (India)

Latest Developments in Middle East and Africa Fluoroscopy- C Arms Market

- In March 2021, GE Healthcare received 510(k) clearance from the U.S. FDA for its OEC 3D mobile C-arm system, enabling expanded clinical use of intraoperative 3D imaging for complex spine and orthopedic procedures

- In July 2022, Siemens Healthineers and Intuitive announced a collaboration to integrate advanced intraoperative imaging with robotic procedural workflows, improving image-guidance for minimally invasive and robotic interventions

- In November 2022, Canon Medical expanded its Alphenix interventional imaging family with the Alphenix 4D (multi-dimensional imaging) platform, targeting enhanced real-time imaging performance for complex vascular and neuro interventions

- In May 2024, Philips advanced its Zenition C-arm portfolio with regulatory clearances and product updates (Zenition 90), emphasizing higher-performance image chains and workflow features for hybrid and interventional suites

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.