Middle East Africa Gas Equipment Market

Market Size in USD Billion

CAGR :

%

USD

10.41 Billion

USD

15.03 Billion

2025

2033

USD

10.41 Billion

USD

15.03 Billion

2025

2033

| 2026 –2033 | |

| USD 10.41 Billion | |

| USD 15.03 Billion | |

|

|

|

|

Middle East and Africa Gas Equipment Market Size

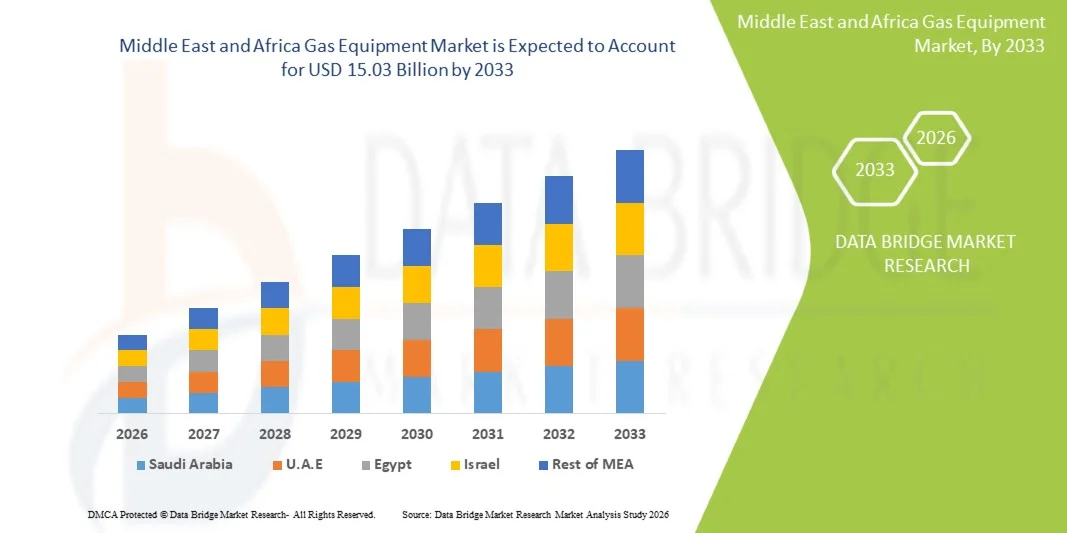

- The Middle East and Africa gas equipment market size was valued at USD 10.41 billion in 2025 and is expected to reach USD 15.03 billion by 2033, at a CAGR of 4.7% during the forecast period

- The market growth is largely fueled by increasing investments in natural gas infrastructure and technological advancements in gas handling and processing equipment across the region, leading to greater adoption in both industrial and energy sectors

- Furthermore, rising demand for safe, efficient, and integrated gas solutions in oil & gas, manufacturing, and energy utilities is establishing modern gas equipment as a critical component of regional energy and industrial strategies. These converging factors are accelerating the uptake of gas equipment solutions, thereby significantly boosting the industry’s growth

Middle East and Africa Gas Equipment Market Analysis

- Gas equipment, including gas delivery systems, regulators, flow devices, purifiers and filters, gas generating systems, gas detection systems, cryogenic products, and accessories, are increasingly vital components of energy infrastructure and industrial operations in MEA due to their role in ensuring safe, efficient, and reliable handling of industrial and medical gases across upstream, midstream, and downstream sectors

- The escalating demand for gas equipment is primarily fueled by growing investments in natural gas infrastructure, rising industrialization, and the regional push for cleaner and more sustainable energy solutions

- Saudi Arabia dominated the MEA gas equipment market with the largest revenue share of 28.5% in 2025, characterized by extensive natural gas reserves, major industrial and energy projects, and a strong presence of both regional and international gas equipment suppliers

- Nigeria is expected to be the fastest growing country in the MEA gas equipment market during the forecast period, driven by expanding gas exploration, rising industrial gas demand, and new infrastructure projects in energy, manufacturing, and healthcare sectors

- The gas detection systems segment dominated the MEA gas equipment market with a market share of 34.9% in 2025, driven by growing safety and regulatory requirements across oil & gas, chemicals, and metal fabrication industries, as well as increasing adoption of advanced monitoring technologies in industrial and healthcare facilities

Report Scope and Middle East and Africa Gas Equipment Market Segmentation

|

Attributes |

Middle East and Africa Gas Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Gas Equipment Market Trends

“Advancements in Smart Gas Monitoring and Automation”

- A significant and accelerating trend in the MEA gas equipment market is the increasing adoption of smart monitoring and automation technologies, including IoT-enabled gas detection, flow control systems, and predictive maintenance platforms. This integration enhances operational efficiency and safety across industrial, healthcare, and energy applications

- For instance, for gas delivery systems, smart IoT sensors can remotely monitor pressure and flow rates, alerting operators to anomalies in real-time, while automated flow devices allow seamless regulation of industrial gases across multiple sites

- Advanced automation in gas equipment enables features such as predictive maintenance, remote diagnostics, and optimization of gas usage. For instance, gas detection systems with AI-based analytics can identify leak patterns, reducing operational downtime and improving workplace safety

- The integration of smart gas equipment with centralized control platforms facilitates real-time monitoring of multiple processes, including gas generation, storage, and transportation, creating a unified and automated operational environment

- This trend towards intelligent, connected, and automated gas equipment is fundamentally reshaping expectations for safety, reliability, and efficiency, with companies such as Honeywell Gas and MSA Safety developing IoT-enabled gas monitoring solutions that provide real-time alerts and predictive insights

- The demand for automated and smart gas equipment is growing rapidly across oil & gas, chemicals, healthcare, and manufacturing sectors, as operators increasingly prioritize safety, compliance, and operational efficiency

- Integration with cloud-based platforms is enabling remote performance tracking and predictive analytics, allowing operators to reduce downtime and optimize gas consumption

- Collaborations between technology providers and local industrial players are accelerating the deployment of advanced monitoring systems, improving accessibility of smart gas equipment across emerging MEA markets

Middle East and Africa Gas Equipment Market Dynamics

Driver

“Growing Demand Due to Energy Infrastructure Expansion and Industrialization”

- The increasing investments in natural gas infrastructure and rising industrialization across MEA are significant drivers for the heightened demand for gas equipment

- For instance, in 2025, Siemens Energy announced the deployment of advanced gas control and detection systems for industrial facilities in Saudi Arabia and Nigeria, supporting energy infrastructure modernization

- As countries in the region expand oil, gas, and industrial facilities, gas equipment provides essential solutions for safe storage, transportation, and monitoring of industrial gases, offering a critical upgrade over older manual systems

- Furthermore, the push for cleaner energy solutions and the adoption of natural gas in industrial and healthcare applications make gas equipment an integral component of these systems, offering enhanced reliability and compliance

- The efficiency of automated monitoring, flow regulation, and detection capabilities, combined with the growing preference for centralized control and remote access, is propelling the adoption of gas equipment across multiple sectors

- Rising government initiatives and funding for energy and industrial infrastructure projects are further supporting the expansion of the gas equipment market

- Increasing industrial gas demand in sectors such as chemicals, food & beverage, and healthcare is driving companies to adopt more advanced gas delivery, purification, and detection equipment

Restraint/Challenge

“High Costs and Compliance with Safety Standards”

- The high initial costs of advanced gas equipment and stringent regulatory compliance requirements pose significant challenges to broader market adoption in MEA. Advanced monitoring, purification, and detection systems often require substantial capital investment, particularly for small and medium enterprises

- For instance, specialized cryogenic products and gas generating systems with integrated safety features can be prohibitively expensive for emerging industrial players, slowing adoption rates

- Ensuring compliance with local and international safety standards, including pressure, flow, and leak detection regulations, adds complexity and cost to equipment deployment. Companies such as MSA Safety and Honeywell Gas emphasize adherence to ISO and ANSI standards to mitigate safety risks

- While prices for standard gas equipment are gradually decreasing, the perceived premium for smart or highly automated systems can still hinder adoption, especially in developing economies or smaller industrial setups

- Overcoming these challenges through cost optimization, modular equipment solutions, and regulatory support will be vital for sustained growth in the MEA gas equipment market

- Limited local manufacturing capabilities in some MEA countries can increase dependency on imported equipment, further raising costs and lead times

- Skilled workforce shortages for installation, operation, and maintenance of advanced gas equipment pose additional adoption challenges, requiring training initiatives and capacity-building programs

Middle East and Africa Gas Equipment Market Scope

The market is segmented on the basis of equipment type, process, gas, and end-user

- By Equipment Type

On the basis of equipment type, the MEA gas equipment market is segmented into gas delivery systems, gas regulators, flow devices, purifiers and filters, gas generating systems, gas detection systems, cryogenic products, and accessories. The gas detection systems segment dominated the market with the largest revenue share of 34.9% in 2025, driven by increasing safety regulations and the critical need for leak detection across oil & gas, chemicals, and healthcare industries. Gas detection systems are essential for continuous monitoring, preventing hazardous leaks, and ensuring workplace safety in high-risk environments. The segment also benefits from integration with IoT and smart monitoring technologies, providing real-time alerts and predictive maintenance capabilities. The adoption of AI-based analytics further enhances detection accuracy and operational efficiency. Companies such as Honeywell Gas and MSA Safety are leading in this segment, developing advanced sensors for industrial and medical applications. High awareness of workplace safety and regulatory compliance in MEA countries such as Saudi Arabia, UAE, and Nigeria also supports the strong dominance of gas detection systems.

The gas generating systems segment is anticipated to witness the fastest growth rate of 8.5% CAGR from 2026 to 2033, fueled by rising industrialization and the increasing need for on-site gas generation in healthcare, manufacturing, and food & beverage sectors. Gas generating systems reduce dependency on cylinder-based supply and enable cost-effective, continuous gas availability. Technological advancements, such as compact oxygen and nitrogen generators, are enhancing accessibility and operational efficiency. Adoption is being driven by hospitals, laboratories, and manufacturing plants requiring reliable, uninterrupted gas supply. In addition, government initiatives to improve local industrial capabilities and healthcare infrastructure are accelerating the deployment of gas generating systems across MEA.

- By Process

On the basis of process, the market is segmented into gas generation, gas storage, gas detection, and gas transportation. The gas detection process segment dominated the market with a revenue share of 31% in 2025, reflecting the high importance of monitoring and safety in industrial and energy applications. Gas detection solutions prevent accidents, reduce downtime, and ensure compliance with regional safety standards. Advanced process integration with automated control systems allows real-time alerts and remote monitoring of multiple facilities. Companies are increasingly offering connected detection devices with predictive analytics to enhance operational reliability. The segment’s dominance is reinforced by regulatory mandates for safe handling of industrial and medical gases in MEA countries. Oil & gas, chemicals, and healthcare industries are the primary end-users driving demand.

The gas generation process segment is expected to witness the fastest CAGR of 9% from 2026 to 2033, driven by increasing investments in on-site gas production for industrial and healthcare applications. On-site gas generation reduces supply chain dependency and improves operational efficiency. The growth is also supported by rising adoption of compact, modular systems that are suitable for mid-sized facilities. Technological improvements, such as low-energy oxygen and nitrogen generation systems, are facilitating faster adoption. Countries investing in industrial expansion, such as Saudi Arabia, Egypt, and Nigeria, are driving regional demand. The increasing preference for self-sufficient gas supply solutions in remote or emerging industrial areas further accelerates growth.

- By Gas

On the basis of gas type, the market is segmented into nitrogen, hydrogen, helium, oxygen, carbon dioxide, and others. The oxygen segment dominated the market with a revenue share of 29% in 2025, driven by its extensive use in healthcare, industrial manufacturing, and food & beverage applications. Hospitals and clinics require reliable oxygen supply systems, especially in emerging markets across MEA. Industrial applications such as metal fabrication, chemical processing, and water treatment also contribute significantly to oxygen demand. The dominance of oxygen is further supported by investments in healthcare infrastructure and government-backed industrial projects. Advanced generation, purification, and delivery systems enhance reliability and operational efficiency. Key players are focusing on expanding production capacities and integrating smart monitoring for oxygen distribution.

The hydrogen segment is expected to witness the fastest CAGR of 10% from 2026 to 2033, fueled by increasing adoption in clean energy, oil refining, and chemical production. Growing interest in hydrogen as a sustainable energy source is driving investments in production and storage infrastructure. Technological developments in hydrogen generation and storage systems are improving safety and efficiency. Countries such as Saudi Arabia and UAE are actively promoting hydrogen projects under energy transition initiatives, boosting regional demand. Industrial players are also exploring hydrogen for fuel cells and industrial heating applications. The focus on sustainability and government incentives is further accelerating the growth of hydrogen gas equipment in MEA.

- By End-User

On the basis of end-user, the market is segmented into metal fabrication, chemicals, healthcare, oil & gas, food & beverage, and others. The oil & gas segment dominated the market with the largest revenue share of 36% in 2025, owing to the extensive natural gas reserves and industrial infrastructure in countries such as Saudi Arabia, UAE, and Nigeria. Gas equipment is essential for exploration, transportation, storage, and monitoring of hydrocarbons. Advanced gas detection, flow control, and delivery systems ensure safety and operational efficiency. The dominance is supported by government initiatives in oil & gas modernization and stringent regulatory requirements. Companies are investing in smart, automated equipment to optimize resource utilization and enhance safety across refineries and processing plants.

The healthcare segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, driven by the increasing demand for medical gases such as oxygen, nitrogen, and carbon dioxide in hospitals, laboratories, and clinics. Technological advancements in compact gas generators and purifiers facilitate on-site production and improve accessibility. The COVID-19 pandemic highlighted the critical need for reliable medical gas supply, accelerating adoption in emerging MEA countries. Integration of smart monitoring systems ensures patient safety and operational efficiency. Expanding healthcare infrastructure and rising patient volumes further contribute to the rapid growth of gas equipment demand in this segment.

Middle East and Africa Gas Equipment Market Regional Analysis

- Saudi Arabia dominated the MEA gas equipment market with the largest revenue share of 28.5% in 2025, characterized by extensive natural gas reserves, major industrial and energy projects, and a strong presence of both regional and international gas equipment suppliers

- Operators in the country highly value advanced gas detection, flow control, and delivery systems for ensuring safety, efficiency, and compliance with stringent industrial and environmental regulation

- This widespread adoption is further supported by government initiatives, high industrial spending, and the presence of leading regional and international gas equipment suppliers, establishing Saudi Arabia as the key hub for modern gas equipment in the Middle East

Saudi Arabia Gas Equipment Market Insight

The Saudi Arabia gas equipment market captured the largest revenue share of 28.5% in 2025, fueled by extensive natural gas reserves, large-scale industrialization, and significant investments in oil, gas, and energy infrastructure. Industrial operators and healthcare facilities are increasingly prioritizing advanced gas detection, flow control, and delivery systems to ensure safety, efficiency, and compliance. Government initiatives supporting energy infrastructure modernization, along with the presence of leading regional and international suppliers, are further driving market expansion. The adoption of smart, automated, and IoT-enabled gas equipment enhances operational monitoring, predictive maintenance, and process optimization, strengthening Saudi Arabia’s position as the dominant MEA market.

United Arab Emirates Gas Equipment Market Insight

The UAE gas equipment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the country’s growing industrial base, urbanization, and demand for energy-efficient and safe gas handling solutions. Stringent safety and environmental regulations, combined with high investments in oil & gas, healthcare, and manufacturing infrastructure, are encouraging adoption. Advanced gas delivery systems, purifiers, and detection equipment are increasingly integrated into industrial and commercial operations. The UAE’s strategic focus on smart cities and digitalized energy management further supports the market’s growth trajectory.

Nigeria Gas Equipment Market Insight

The Nigeria gas equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding industrial gas demand, energy infrastructure development, and rising investments in healthcare and manufacturing sectors. Gas equipment adoption is being accelerated by industrial safety regulations and the need for reliable gas generation, storage, and detection systems. Companies are deploying smart and automated solutions to optimize operations and reduce downtime. The country’s growing oil & gas sector, combined with industrial diversification, supports long-term market growth, positioning Nigeria as the fastest-growing country in the MEA region.

South Africa Gas Equipment Market Insight

The South Africa gas equipment market is poised to grow steadily, driven by rising industrialization, growing healthcare infrastructure, and increasing demand for efficient gas handling solutions across metals, chemicals, and food & beverage industries. Smart gas detection, flow control, and purification systems are being widely adopted to improve operational safety and process reliability. Government-backed initiatives promoting industrial safety and energy efficiency, along with an emphasis on modernizing hospitals and manufacturing facilities, are further supporting market expansion. South Africa is witnessing increasing investments from both domestic and international gas equipment suppliers.

Middle East and Africa Gas Equipment Market Share

The Middle East and Africa Gas Equipment industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- MSA Safety Incorporated (U.S.)

- Industrial Scientific Corporation (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Teledyne Gas and Flame Detection (U.S.)

- RKI Instruments (U.S.)

- LINDE PLC (U.K.)

- Gulf Cryo Holding Co. (U.A.E.)

- Blackline Safety Corp. (Canada)

- Sensirion AG (Switzerland)

- Siemens AG (Germany)

- Emerson Electric Co. (U.S.)

- TechnipFMC plc (U.K.)

- Yokogawa Electric Corporation (Japan)

- Schneider Electric SE (France)

- Azbil Corporation (Japan)

- ABB Ltd (Switzerland)

- Baker Hughes Company (U.S.)

What are the Recent Developments in Middle East and Africa Gas Equipment Market?

- In June 2025, Teledyne Gas & Flame Detection (GFD) opens a gas sensor manufacturing plant in Saudi Arabia. Teledyne GFD, in collaboration with Industrial Detection Solutions (IDS), is establishing a 699 m² manufacturing facility in Dammam, KSA, to produce gas detection sensors locally

- In May 2025, Sherbiny / Atheel begins local assembly of MSA S5000 gas detector in Saudi Arabia. In a big step for industrial localization, Sherbiny’s manufacturing arm Atheel Advanced Manufacturing launched local assembly of the General Monitors® S5000 fixed gas detector in Al-Khobar. This move supports Saudi Aramco’s IKTVA (In-Kingdom Total Value Add) program and aligns with Saudi Vision 2030 goals for domestic manufacturing

- In May 2025, MSA Safety signs detection assembly partnership with Sherbiny in Saudi Arabia. MSA Safety announced a formal partnership with Mohammed Hassan Sherbiny for Commerce to assemble its General Monitors S5000 gas monitors locally at Sherbiny’s Al‑Khobar facility. The facility is IKTVA-approved, emphasizing localization as a core part of the collaboration

- In April 2024, Honeywell becomes first gas‑detector maker to join Saudi Arabia’s “Made in Saudi” program. Honeywell announced that it would locally assemble and calibrate several of its gas detection devices (such as the BW Max XT II, BW MicroClip, and XNX Universal Transmitter) at its Saudi facility

- In April 2023, Honeywell breaks ground on an advanced manufacturing center for gas detection and automation at King Salman Energy Park (SPARK) in Saudi Arabia. Honeywell announced construction of a cutting‑edge facility at SPARK that will produce industrial automation gear, field instruments, and gas detection equipment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.