Middle East Africa Solid Phase Extraction Market

Market Size in USD Million

CAGR :

%

USD

47.20 Million

USD

68.68 Million

2025

2033

USD

47.20 Million

USD

68.68 Million

2025

2033

| 2026 –2033 | |

| USD 47.20 Million | |

| USD 68.68 Million | |

|

|

|

|

Middle East and Africa Solid Phase Extraction Market Size

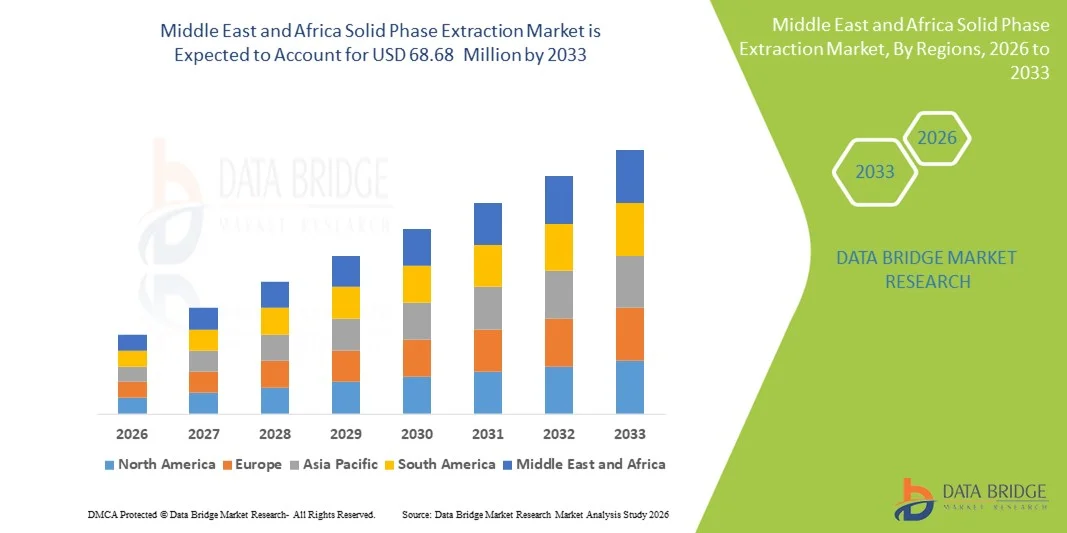

- The Middle East and Africa solid phase extraction market size was valued at USD 47.20 Million in 2025 and is expected to reach USD 68.68 Million by 2033, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced analytical techniques and automation in laboratories, driving demand for efficient and high-throughput sample preparation methods

- Furthermore, the growing need for accurate, reproducible, and cost-effective extraction processes across pharmaceutical, environmental, food, and chemical analysis applications is accelerating the uptake of Solid Phase Extraction solutions, thereby significantly boosting the industry's growth

Middle East and Africa Solid Phase Extraction Market Analysis

- Solid Phase Extraction (SPE) technology, providing efficient, selective, and reproducible sample preparation for various analytical applications, is increasingly vital for laboratories in pharmaceutical, environmental, food, and chemical industries due to its enhanced accuracy, throughput, and cost-effectiveness

- The escalating demand for SPE is primarily fueled by the growing need for high-quality analytical results, automation in laboratories, and regulatory compliance in quality control and research activities

- Saudi Arabia dominated the solid phase extraction market with the largest revenue share of 38% in 2025, characterized by advanced analytical laboratories, strong R&D infrastructure, and a robust presence of key market players, with substantial growth in SPE adoption, particularly in pharmaceutical, environmental, and food testing laboratories, driven by technological advancements and high-throughput requirements

- U.A.E. is expected to be the fastest-growing country in the solid phase extraction market during the forecast period, registering a CAGR of 11.2%, driven by rapid industrialization, increasing pharmaceutical and biotechnology research activities, rising demand for automated laboratory solutions, and expansion of advanced laboratory infrastructure

- The SPE Cartridge segment dominated the largest market revenue share of 46.5% in 2025, owing to its high reproducibility, versatility, and wide adoption across pharmaceutical, environmental, and food testing applications

Report Scope and Solid Phase Extraction Market Segmentation

|

Attributes |

Solid Phase Extraction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Solid Phase Extraction Market Trends

Advancements in Automation and High-Throughput Capabilities

- A notable and accelerating trend in the global solid phase extraction market is the adoption of automation and high-throughput systems that streamline sample preparation, reduce human error, and enhance reproducibility in analytical laboratories

- For instance, in March 2024, Gilson, Inc. launched its GX-274 ASPEC automation platform designed for high-throughput SPE applications, enabling faster sample processing and integration with laboratory information management systems (LIMS)

- Automation solutions are increasingly integrated with multi-well plates and robotic arms, allowing laboratories to process hundreds of samples simultaneously, enhancing efficiency and reducing labor costs

- The push for automated SPE workflows is further reinforced by increasing demand for complex sample matrices in pharmaceuticals, environmental testing, and food safety, where manual preparation is time-consuming and prone to variability

- Companies are also focusing on compact, bench-top automated SPE instruments that optimize laboratory space while delivering high precision and throughput, making these solutions highly attractive for both research and routine testing environments

- The trend emphasizes software-controlled extraction protocols and intelligent monitoring to ensure consistent quality and minimize reagent consumption, thus promoting sustainability in laboratory operations

Middle East and Africa Solid Phase Extraction Market Dynamics

Driver

Increasing Demand from Pharmaceutical, Environmental, and Food Testing Applications

- The rising requirement for precise and reproducible sample preparation across pharmaceutical, environmental, and food safety testing is a key driver for the solid phase extraction market

- For instance, In April 2025, Waters Corporation expanded its Oasis SPE product portfolio with new sorbent chemistries to improve analyte recovery and selectivity in pharmaceutical and clinical research workflows

- Pharmaceutical companies leverage SPE for bioanalysis, drug development, and quality control, while environmental laboratories use SPE to detect trace contaminants in water, soil, and air samples

- Food and beverage industries also adopt SPE techniques to identify pesticide residues, mycotoxins, and other contaminants, ensuring regulatory compliance and consumer safety

- Increasingly stringent regulatory standards globally, including those from FDA, EPA, and EFSA, are motivating laboratories to adopt SPE solutions that ensure accurate, reproducible, and reliable analytical results

- The versatility and reliability of SPE technology, combined with its ability to handle diverse sample matrices efficiently, are central to market expansion and adoption across multiple end-use sectors

Restraint/Challenge

High Costs of Advanced SPE Systems and Limited Skilled Personnel

- The relatively high cost of advanced automated SPE instruments and consumables can limit adoption, especially among smaller laboratories with budget constraints

- For instance, automated high-throughput SPE platforms often require significant capital investment and ongoing maintenance costs, which can be a barrier for emerging markets or smaller-scale research facilities

- In addition, effective operation of complex SPE systems requires skilled personnel trained in method development, system calibration, and troubleshooting

- The scarcity of trained professionals in laboratory automation and analytical chemistry can restrict the implementation of advanced SPE solutions, particularly in developing regions

- Addressing these challenges involves providing user-friendly interfaces, modular instrument designs, and comprehensive training programs from manufacturers to reduce operational complexity and improve accessibility

- Gradual cost reductions in consumables and entry-level automation solutions, coupled with increased training initiatives, are helping mitigate these constraints and facilitate broader adoption of Solid Phase Extraction technologies globally

Middle East and Africa Solid Phase Extraction Market Scope

The market is segmented on the basis of Type and Application.

- By Type

On the basis of type, the Solid Phase Extraction market is segmented into SPE Cartridge, SPE Disk, and Others. The SPE Cartridge segment dominated the largest market revenue share of 46.5% in 2025, owing to its high reproducibility, versatility, and wide adoption across pharmaceutical, environmental, and food testing applications. SPE cartridges are preferred for routine sample preparation, automated workflows, and reliable analyte recovery, which enhances their utility across laboratories. The strong focus on drug development, quality control, and regulatory compliance further supports the dominance of this segment. Its ability to handle diverse sample matrices efficiently and consistently makes it the go-to solution in analytical laboratories worldwide.

The SPE Disk segment is anticipated to witness the fastest growth rate, with a CAGR of 22.1% from 2026 to 2033, driven by the increasing need for rapid, high-throughput, and efficient sample processing. SPE disks are particularly effective for large-volume or complex samples, reducing solvent consumption and extraction times. The growing emphasis on automation, time-efficiency, and sustainability in laboratory workflows across pharmaceutical, food, and environmental sectors is fueling its adoption. Additionally, its design flexibility and compatibility with modern analytical instruments are key factors accelerating growth in this segment.

- By Application

On the basis of application, the Solid Phase Extraction market is segmented into Pharmaceuticals, Environmental, Food and Beverage Industry, Biological Fluids, and Others. The Pharmaceuticals segment accounted for the largest market revenue share of 44.8% in 2025, driven by stringent regulatory requirements, the need for precise and reproducible sample preparation, and the expanding drug development pipeline. High adoption of SPE techniques in bioanalytical testing, pharmacokinetics, and quality control laboratories contributes to its sustained dominance. The growing focus on clinical trials, high-throughput screening, and adherence to good laboratory practices further reinforces the segment’s strong market position.

The Environmental segment is expected to witness the fastest growth rate, with a CAGR of 21.9% from 2026 to 2033, due to rising regulatory mandates, increasing environmental monitoring, and the need for detection of trace contaminants in water, soil, and air. Laboratories are increasingly adopting SPE methods to enhance extraction efficiency and meet stringent detection limits. Moreover, the shift toward sustainable and automated workflows in environmental analysis, combined with the growing global focus on pollution control, is driving rapid adoption in this application segment.

Middle East and Africa Solid Phase Extraction Market Regional Analysis

- The MEA solid phase extraction market is projected to expand at a substantial CAGR throughout the forecast period, supported by the region’s growing pharmaceutical, chemical, and environmental testing industries

- Increasing regulatory requirements for food safety, environmental monitoring, and clinical testing are driving SPE adoption across key countries in the region

- Investments in advanced laboratory infrastructure, automation, and high-throughput sample preparation solutions are further propelling market growth

Saudi Arabia Solid Phase Extraction Market Insight

Saudi Arabia solid phase extraction market dominated the solid phase extraction market with the largest revenue share of 38% in 2025, characterized by advanced analytical laboratories, strong R&D infrastructure, and a robust presence of key market players. The country has witnessed substantial growth in SPE adoption, particularly in pharmaceutical, environmental, and food testing laboratories, driven by technological advancements and the increasing demand for high-throughput, automated sample preparation workflows.

U.A.E. Solid Phase Extraction Market Insight

The U.A.E. solid phase extraction market is expected to be the fastest-growing in the MEA region during the forecast period, registering a CAGR of 11.2%. Market growth is supported by rapid industrialization, increasing pharmaceutical and biotechnology research activities, expansion of advanced laboratory facilities, and rising demand for automated and high-throughput sample preparation solutions across clinical, environmental, and food testing laboratories.

Middle East and Africa Solid Phase Extraction Market Share

The Solid Phase Extraction industry is primarily led by well-established companies, including:

- Agilent Technologies (U.S.)

- Thermo Fisher Scientific (U.S.)

- Sigma-Aldrich (U.S.)

- Waters Corporation (U.S.)

- Merck KGaA (Germany)

- Phenomenex (U.S.)

- GL Sciences (Japan)

- Biotage AB (Sweden)

- Cambridge Isotope Laboratories (U.S.)

- CHROMABOND (Germany)

- Tecan Group (Switzerland)

- JT Baker (U.S.)

- Sciex (U.S.)

- Bio-Rad Laboratories (U.S.)

Latest Developments in Middle East and Africa Solid Phase Extraction Market

- In June 2025, a review article titled “Recent advances in accelerating solid‑phase extraction” highlighted the trend toward miniaturization, automation and improved sorbent materials in SPE workflows, signaling ongoing innovation in the SPE market to enhance throughput and analytical efficiency

- In March 2024, Waters Corporation announced the launch of its new “Oasis WAX/GCB & GCB/WAX Cartridges” designed specifically for PFAS analysis. These dual‑phase SPE cartridges simplify complex sample preparation, reduce processing time by approximately 30 minutes per batch, and help meet stringent regulatory requirements such as EPA Method 1633

- In August 2024, Phenomenex Inc. expanded its “Strata PFAS” portfolio by introducing single‑ and dual‑bed SPE cartridges with enhanced capacity and formats to address extraction and cleanup of complex PFAS matrices across multiple sample types

- In February 2023, Restek Corporation added two new mixed‑mode weak anion exchange (WAX) cartridges to its Resprep polymeric SPE catalog, enabling higher selectivity and better performance for challenging sample matrices in analytical workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.