Middle East and Africa 2D Display for Defense and Aerospace Market Analysis and Size

The 2D display market for aerospace and defense is a specialized market that provides displays for military and commercial aerospace applications. Displays used in this market must meet stringent requirements for reliability, performance, and durability, as well as comply with various regulatory standards. The market for 2D displays for aerospace and defense is expected to experience steady growth in the coming years, driven by increasing demand for advanced display technologies, the growth of the aerospace and defense industry, and the need for improved situational awareness and communication capabilities in military and commercial aviation. The emergence of new technologies, such as high-resolution displays, touch screens, and augmented reality displays, is also expected to drive growth in this market.

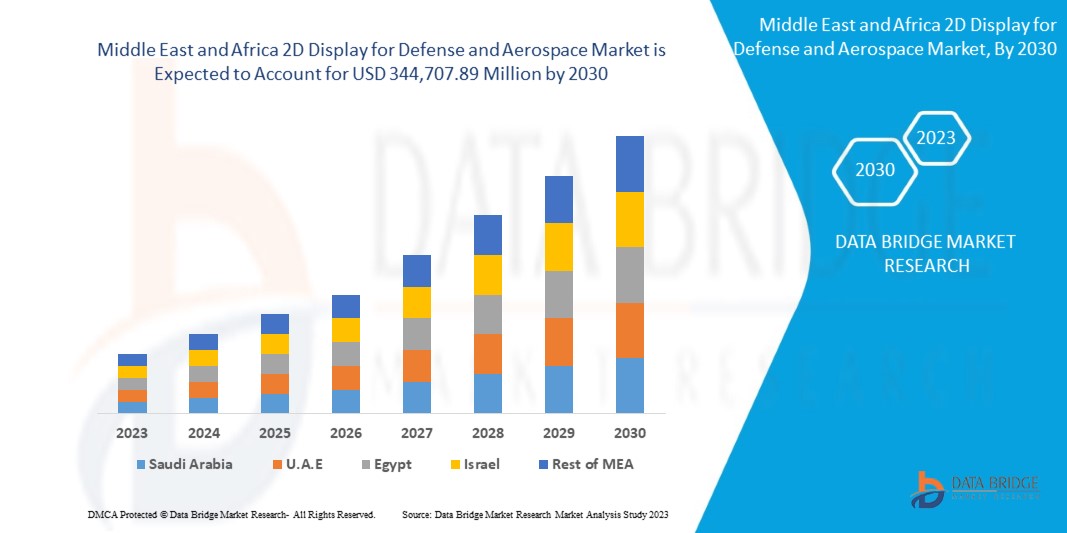

Data Bridge Market Research analyses that the Middle East and Africa 2D display for defense and aerospace market is expected to reach a value of USD 344,707.89 million by 2030, at a CAGR of 3.8%during the forecast period. The Middle East and Africa 2D Display for Defense and Aerospace market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Display Technology (Liquid Crystal Displays (LCD), Light Emitting Diode (LED), Organic LED (OLED), Micro-LED, Others), Type (Touch, Non-Touch), Resolution (Full HD, HD, 4K, Others), Panel Size (5 Inches to 10 Inches, Greater Than 10 Inches, Less Than 5 Inches), Display Type (Conventional Display, Smart Display), Sales Channel (OEMS, Retailer), Application (Aerospace, Defense) |

|

Countries Covered |

U.A.E., Saudi Arabia, Israel, Egypt, South Africa, Bahrain, Qatar, Kuwait, Oman, Rest of Middle East and Africa |

|

Market Players Covered |

Astronautics Corporation of America, FDS Avionics Corp., Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., Collins Aerospace, and Elbit Systems Ltd.

|

Market Definition

A display device is an output device for presenting information in visual or tactile form. When the supplied input information has an electrical signal, the display is called an electronic display. A 2D-head-mounted display (HMD) is a display device worn on the head or as part of a helmet that has a small display optic in front of one (monocular HMD) or each eye (binocular HMD). An HMD has many uses, including gaming, aviation, engineering, and medicine. Virtual reality headsets are HMDs combined with IMUs. There is also an optical head-mounted display (OHMD), a wearable display that can reflect projected images and allow a user to see through it.

Middle East and Africa 2D Display for Defense and Aerospace Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- GROWTH IN THE MILITARY MODERNIZATION PROGRAMS ACROSS THE GLOBE

Military modernization is updating and improving a nation's military capabilities and equipment to meet current, and future security challenges better. It involves acquiring new weapons systems, technologies, and infrastructure, as well as the development of new strategies and doctrines. Military modernization is important for a nation as it helps maintain a credible deterrence capability against potential adversaries, enhances military readiness and effectiveness, and ensures the military can perform its assigned roles and missions. As nations across the globe are increasing their respective defense budgets, the number of military modernization programs is also increasing.

- GROWTH IN THE DEMAND FOR ADVANCED DISPLAY TECHNOLOGIES

The defense of government across the globe and the aerospace industry requires advanced displays that can provide high-resolution images, real-time information, and enhanced situational awareness to pilots and soldiers. As such, there is a growing demand for 2D displays that can meet these requirements.

OPPORTUNITY

- INCREASE IN DEMAND FOR SIMULATION AND TRAINING SYSTEMS

Simulation and training systems in the defense and aerospace industry are tools and technologies used to simulate real-world scenarios and train military personnel and pilots. These systems can simulate various scenarios, from routine operations to complex battlefield scenarios, and allow military personnel to train and hone their skills in a safe, controlled environment. The importance of simulation and training systems in the defense and aerospace industry cannot be overstated. These systems help to ensure that military personnel is well-trained and prepared for any situation they may encounter. In addition, they help reduce the risk of accidents or mishaps during training exercises or missions.

RESTRAINTS/CHALLENGES

- STRINGENT GOVERNMENT REGULATIONS

Stringent government regulations are expected to restrain Middle East and Africa 2d display for the defense and aerospace market by creating obstacles in the procurement and use of certain 2d display technologies. These regulations are put in place to ensure that the technologies being used in the defense and aerospace industry meet certain safety and security standards

- HIGH TECHNOLOGICAL OBSOLESCENCE IN DEFENSE AND AEROSPACE SECTOR

Technological obsolescence refers to being outdated due to technological advancements. This means that technology, product, or service that was once popular and in high demand may become irrelevant and unusable as newer and more advanced technologies are developed and widely available. In the market context, technological obsolescence can occur when the 2d display technology used in defense and aerospace becomes outdated and is replaced by newer and more advanced technologies, leading to a decline in demand for the older technology. This is a challenge in the defense and aerospace industry, where the technology needs to be constantly updated and improved to keep up with the changing needs and requirements of the military. In the case of 2D displays for defense and aerospace, technological obsolescence can limit the market's growth in several ways.

Post-COVID-19 Impact on Middle East and Africa 2D Display for Defense and Aerospace Market

The COVID-19 pandemic has significantly impacted the aerospace and defense industry, including the market for 2D displays. The pandemic has led to a decline in air travel and a reduction in defense spending, which has impacted demand for 2D displays used in aircraft and defense applications. One of the major impacts of the pandemic has been disruptions in Middle East and Africa supply chain, which have led to shortages of raw materials and components used in the manufacturing of 2D displays. This has caused delays in the production and delivery of displays, which has impacted the ability of aerospace and defense companies to complete their projects on time. The pandemic has also resulted in a decline in demand for commercial aircraft, which has affected the demand for 2D displays used in cockpit displays and other applications. Additionally, the reduction in defense spending has led to a slowdown in military procurement, which has impacted the demand for displays used in military applications.

Recent Developments

- In March 2022, Nighthawk Flight Systems, Inc. announced that the company had earned AS9100/ISO9001 certificate. This certification has allowed the company to design and Manufacture compact integrated display systems. Which is used for general aviation, business aviation, military, air transport, and regional aircraft under the Middle East and Africa 2D display for defense and aerospace market

- In August 2020, Aspen Avionics, Inc. announced that the company has agreed with the AIRO group of aerospace companies. This step has expanded the company's investments, and resources and increased its technologies in not only avionics for general aviation but also to offer avionics products for manned and unmanned flight platforms for commercial, military, robotics, and multi-modal aircraft under Middle East and Africa 2D display for defense and aerospace market

Middle East and Africa 2D Display for Defense and Aerospace Market Scope

Middle East and Africa 2D display for defense and aerospace market is segmented based on display technology, type, resolution, panel size, display type, sales channel, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

By Display Technology

- Liquid Crystal Displays (LCD)

- Light Emitting Diode (LED)

- Organic LED (OLED)

- Micro-LED

- Others

On the basis of display technology, Middle East and Africa 2D display for defense and aerospace market is segmented into liquid crystal displays (LCD), light emitting diode (LED), organic LED (OLED), micro-LED, and others.

By Type

- Touch

- Non-Touch

On the basis of type, Middle East and Africa 2D display for defense and aerospace market is segmented into touch and non-touch.

By Resolution

- Full HD

- HD

- 4K

- Others

On the basis of resolution, Middle East and Africa 2D display for defense and aerospace market is segmented into full HD, HD, 4K, and others.

By Panel Size

- 5 Inches to 10 Inches

- Greater Than 10 Inches

- Less Than 5 Inches

On the basis of panel size, Middle East and Africa 2D display for defense and aerospace market is segmented into 5 inches to 10 inches, greater than 10 inches, and less than 5 inches.

By Display Type

- Conventional Display

- Smart Display

On the basis of display type, Middle East and Africa 2D display for defense and aerospace market is segmented into conventional display and smart display.

By Sales Channel

- OEMS

- Retailer

On the basis of sales channel, Middle East and Africa 2D display for defense and aerospace market is segmented into OEMS and retailer.

By Application

- Aerospace

- Defense

On the basis of application, Middle East and Africa 2D display for defense and aerospace market is segmented into aerospace and defense

Middle East and Africa 2D Display for Defense and Aerospace Market Regional Analysis/Insights

Middle East and Africa 2D display for defense and aerospace Market is analyzed. As referenced above, market size insights and trends are provided by display technology, type, resolution, panel size, display type, sales channel, and application.

The countries covered in the Middle East and Africa 2D display for defense and Aerospace market report are U.A.E., Saudi Arabia, Israel, Egypt, South Africa, Bahrain, Qatar, Kuwait, Oman, and the rest of Middle East and Africa.

Saudi Arabia dominates in the Middle East and Africa region as Saudi Arabia is strategically located in the MEA region, making it a hub for aerospace and defense activities in the region and a strong military and aerospace industry, with many leading companies involved in the design, development, and manufacturing of 2D displays is expected to boost the market growth.

The region section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Middle East and Africa 2D Display for Defense and Aerospace Market Share Analysis

Middle East and Africa 2D display for defense and aerospace Market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on Middle East and Africa 2D display for defense and aerospace market.

Some of the major players operating in the Middle East and Africa 2D display for defense and aerospace market are Astronautics Corporation of America, FDS Avionics Corp., Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., Collins Aerospace, and Elbit Systems Ltd., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 TECHNOLOGICAL TRENDS

4.3 COMPANY COMPARATIVE ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PATENT ANALYSIS

4.6 CASE STUDY

4.7 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MILITARY MODERNIZATION PROGRAMS ACROSS THE GLOBE

5.1.2 GROWING DEMAND FOR ADVANCED DISPLAY TECHNOLOGIES

5.1.3 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS

5.1.4 INCREASE IN TECHNOLOGICAL ADVANCEMENTS IN DISPLAY TECHNOLOGY

5.2 RESTRAINTS

5.2.1 HIGH DEVELOPMENT AND MANUFACTURING COSTS ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN DEMAND FOR SIMULATION AND TRAINING SYSTEMS

5.3.2 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 RISE IN DEMAND FOR HEAD-MOUNTED DISPLAYS (HMDS)

5.3.4 EXPANSION OF THE DEFENSE AND AEROSPACE INDUSTRY ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INTEGRATION CHALLENGES ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.4.2 HIGH TECHNOLOGICAL OBSOLESCENCE IN DEFENCE AND AEROSPACE SECTOR

6 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

6.1 OVERVIEW

6.2 LIQUID CRYSTAL DISPLAYS (LCD)

6.3 LIGHT EMITTING DIODE (LED)

6.4 ORGANIC LED (OLED)

6.4.1 RIGID

6.4.2 FLEXIBLE

6.4.3 FOLDABLE

6.5 MICRO-LED

6.6 OTHERS

7 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TOUCH

7.3 NON-TOUCH

8 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION

8.1 OVERVIEW

8.2 FULL HD

8.3 HD

8.4 4K

8.5 OTHERS

9 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE

9.1 OVERVIEW

9.2 5 INCHES TO 10 INCHES

9.3 GREATER THAN 10 INCHES

9.4 LESS THAN 5 INCHES

10 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE

10.1 OVERVIEW

10.2 CONVENTIONAL DISPLAY

10.3 SMART DISPLAY

11 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 OEMS

11.3 RETAIL

12 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 AEROSPACE

12.2.1 BY TYPE

12.2.1.1 PRIMARY FLIGHT DISPLAY

12.2.1.2 MULTI-FUNCTIONAL DISPLAY

12.2.1.3 BACKUP DISPLAY

12.2.1.4 MISSION DISPLAY

12.2.2 BY TYPE

12.2.2.1 AIRCRAFT

12.2.2.2 HELICOPTERS

12.2.2.3 OTHERS

12.3 DEFENCE

12.3.1 BY TYPE

12.3.1.1 LAND

12.3.1.2 AIRBORNE

12.3.1.3 NAVAL

13 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 U.A.E.

13.1.3 EGYPT

13.1.4 SOUTH AFRICA

13.1.5 ISRAEL

13.1.6 BAHRAIN

13.1.7 KUWAIT

13.1.8 QATAR

13.1.9 OMAN

13.1.10 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HONEYWELL INTERNATIONAL INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THALES

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SOLUTION PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 COLLINS AEROSPACE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SOLUTION PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 EXCELITAS TECHNOLOGIES CORP.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCTS PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 BAE SYSTEMS

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCTS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASPEN AVIONICS, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ASTRONAUTICS CORPORATION OF AMERICA

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCTS PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 AVMAP SRL

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCTS PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BARCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SOLUTION PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 DIEHL STIFTUNG & CO. KG

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 D&T INC

16.11.1 COMPANY SNAPSHOT

16.11.2 SOLUTION PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 ELBIT SYSTEMS LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 BUSINESS PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FDS AVIONICS CORP.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCTS PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GARMIN LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KORRY

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MEGGIT PLC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCTS PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NIGHTHAWK FLIGHT SYSTEMS, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ROSEN AVIATION.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SCIOTEQ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 US MICRO PRODUCTS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 WINMATE INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PATENT ANALYSIS

TABLE 2 REGULATORY STANDARDS

TABLE 3 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA LIQUID CRYSTAL DISPLAYS (LCD) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA LIGHT EMITTING DIODE (LED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA MICRO-LED IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA OTHERS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA NON-TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA FULL HD IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA HD IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA 4K IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA 5 INCHES TO 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA GREATER THAN 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA LESS THAN 5 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA CONVENTIONAL DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA SMART DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OEMS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA RETAIL IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 47 SAUDI ARABIA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 50 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 51 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 53 SAUDI ARABIA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 SAUDI ARABIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 SAUDI ARABIA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SAUDI ARABIA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 58 U.A.E. ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 61 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 62 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 64 U.A.E. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 65 U.A.E. AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.A.E. AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 U.A.E. DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 69 EGYPT ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 72 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 73 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 76 EGYPT AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 EGYPT AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH AFRICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH AFRICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 91 ISRAEL ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 94 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 95 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 97 ISRAEL 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 98 ISRAEL AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 ISRAEL AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 ISRAEL DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 102 BAHRAIN ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 105 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 106 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 108 BAHRAIN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 109 BAHRAIN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 BAHRAIN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 BAHRAIN DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 113 KUWAIT ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 116 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 117 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 119 KUWAIT 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 120 KUWAIT AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 KUWAIT AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 KUWAIT DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 124 QATAR ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 127 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 128 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 130 QATAR 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 131 QATAR AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 QATAR AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 133 QATAR DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 135 OMAN ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 138 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 139 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 141 OMAN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 142 OMAN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 OMAN AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 OMAN DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 REST OF MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA 2D DIPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MULTIVARIATE MODELLING

FIGURE 10 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DISPLAY TECHNOLOGY CURVE

FIGURE 11 THE MARKET CHALLENGE MATRIX BY DISPLAY TECHNOLOGY

FIGURE 12 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 13 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 14 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS IS EXPECTED TO BE A KEY DRIVER FOR MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 LIQUID CRYSTAL DISPLAYS (LCD) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET IN 2023 TO 2030

FIGURE 16 TECHNOLOGY TRENDS IN 2D DISPLAY FOR AEROSPACE AND DEFENSE

FIGURE 17 COMPANY COMPARISON

FIGURE 18 VALUE CHAIN FOR THE MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 20 TOP 7 DEFENSE BUDGET OF NATION ACROSS THE GLOBE OF 2023 (IN USD)

FIGURE 21 MILITARY EXPENDITURE (% OF GDP) OF U.S., U.K., INDIA, CHINA, AND RUSSIA (2013-2021)

FIGURE 22 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TECHNOLOGY, 2022

FIGURE 23 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY TYPE, 2022

FIGURE 24 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY RESOLUTION, 2022

FIGURE 25 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY PANEL SIZE, 2022

FIGURE 26 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TYPE, 2022

FIGURE 27 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY SALES CHANNEL, 2022

FIGURE 28 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY APPLICATION, 2022

FIGURE 29 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SNAPSHOT (2022)

FIGURE 30 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022)

FIGURE 31 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 MIDDLE EAST AND AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY DISPLAY TECHNOLOGY (2023-2030)

FIGURE 34 MIDDLE EAST & AFRICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY SHARE 2022 (%)

Middle East And Africa 2d Display For Defense And Aerospace Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa 2d Display For Defense And Aerospace Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa 2d Display For Defense And Aerospace Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.