Middle East And Africa Abrasive Market

Market Size in USD Billion

CAGR :

%

USD

5.37 Billion

USD

7.82 Billion

2025

2033

USD

5.37 Billion

USD

7.82 Billion

2025

2033

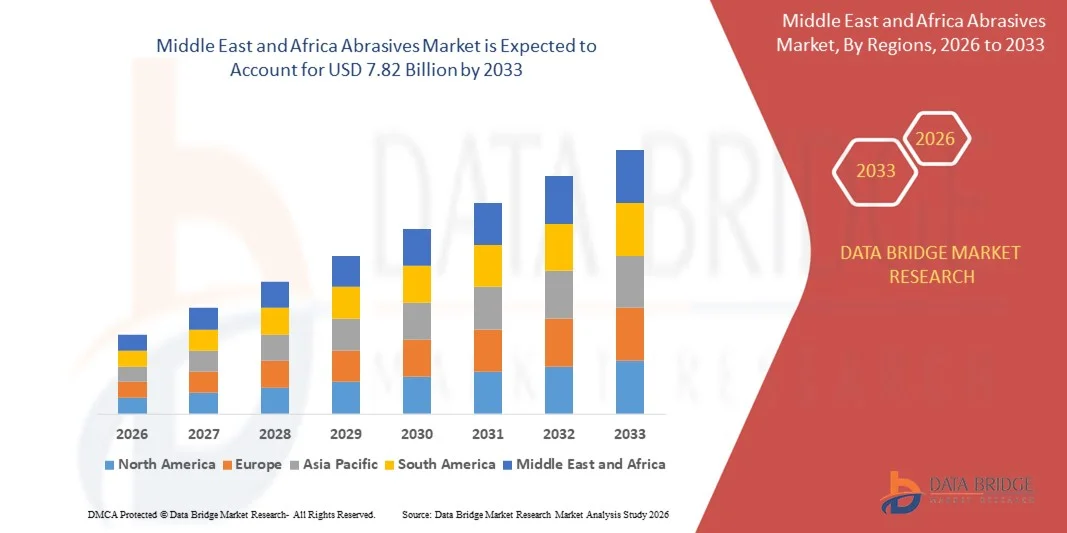

| 2026 –2033 | |

| USD 5.37 Billion | |

| USD 7.82 Billion | |

|

|

|

|

Middle East and Africa Abrasives Market Size

- The Middle East and Africa abrasives market size was valued at USD 5.37 billion in 2025 and is expected to reach USD 7.82 billion by 2033, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by the rising demand from industries such as automotive, metal fabrication, machinery, construction, and electronics

- Technological advancements in abrasive materials such as super abrasives and coated abrasives are contributing to enhanced efficiency and productivity

Middle East and Africa Abrasives Market Analysis

- The market is witnessing strong momentum driven by rapid industrialisation, expansion of production capacities, and rising adoption of advanced surface finishing and precision machining technologies

- Growing investments in infrastructure development and construction activities are boosting demand for abrasives across various applications

- South Africa dominated the abrasives market in the Middle East and Africa in 2025, driven by strong demand from metalworking, mining, and construction industries. High utilisation of grinding and cutting abrasives in mineral extraction, maintenance, and heavy-duty industrial equipment supports sustained market dominance

- U.A.E. is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa abrasives market due to rapid infrastructure development, large-scale construction projects, and growing adoption of advanced machining and finishing technologies

- The synthetic segment held the largest market revenue share in 2025 driven by its higher durability, uniform grain structure, and consistent performance across heavy-duty industrial applications. Synthetic abrasives are widely preferred in modern machining environments due to their superior cutting efficiency and suitability for precision processes

Report Scope and Middle East and Africa Abrasives Market Segmentation

|

Attributes |

Middle East and Africa Abrasives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Abrasives Market Trends

Shift Toward Precision and High-Performance Abrasive Solutions

- The growing demand for precision finishing in sectors such as automotive, aerospace, and general manufacturing is accelerating the adoption of advanced abrasive products. High-performance abrasives support superior material removal, tighter tolerances, and improved surface quality, making them essential for modern production processes. The shift is also driven by the need for highly reliable tools that can maintain consistency across large-scale and complex operations

- The rising use of automated grinding and polishing machinery is driving the need for engineered abrasives that offer consistency, durability, and enhanced operational efficiency. These solutions help reduce downtime and maintain output quality in highly automated environments, ensuring minimal process interruptions. They also enhance the performance of modern robotic and CNC systems that demand uniform abrasive behavior

- Increasing preference for coated and superabrasives is reshaping fabrication workflows, especially in tasks requiring low heat generation and minimal surface damage. Their longer service life and improved cutting efficiency make them suitable for high-precision applications that require stable output over extended cycles. These properties help manufacturers reduce tool change frequency and improve production throughput

- For instance, in 2023, multiple manufacturing facilities reported improved cost efficiency and higher machining accuracy after adopting ceramic-coated abrasive belts for precision component finishing. These belts provided better durability and more uniform finishing across large production cycles, reducing rework rates. Their enhanced wear resistance also minimized operational delays and tool replacement costs

- While high-performance abrasives are transforming production, sustained progress depends on continuous product innovation, operator training, and cost optimization. Manufacturers must prioritize application-specific solutions to meet evolving industry needs and ensure the best fit for diverse machining environments. Collaboration between abrasive producers and end users is becoming increasingly important for developing tailored solutions

Middle East and Africa Abrasives Market Dynamics

Driver

Rising Industrialization and Expansion of Manufacturing Activities

- The expansion of manufacturing, metalworking, and construction activities is increasing the demand for abrasives used for grinding, cutting, polishing, and finishing operations. As production scales up, abrasive tools become essential for improving efficiency and maintaining product quality across various materials. This trend is further supported by rising adoption of advanced machining techniques

- Industries are increasingly recognizing the benefits of advanced abrasives in reducing machining time, improving equipment longevity, and ensuring consistent finishing results. This awareness is driving higher adoption across small, mid-sized, and large production units seeking greater operational efficiency. The reliability of premium abrasives also reduces the risk of output variability

- Supportive industrial development, technological upgrades, and investments in modern fabrication processes are further boosting the need for reliable abrasive products. Growing use of CNC machines and precision machining tools is reinforcing demand for abrasives that can support high-speed operations. The integration of digital manufacturing systems is also contributing to more precise abrasive usage

- For instance, in 2022, several manufacturing plants reported enhanced productivity after integrating high-performance bonded and coated abrasives into their machining processes, improving output without major equipment modifications. These improvements helped streamline operations and reduce total machining costs. Plants also observed better tool performance and reduced maintenance requirements

- While industrial growth is supporting the market, consistent quality standards, technical support, and wider availability of advanced abrasive types remain essential for long-term adoption. Manufacturers must also address increasing expectations around operational efficiency and sustainability. Ensuring product reliability is key to building trust among end users

Restraint/Challenge

Fluctuating Raw Material Prices and Environmental Compliance Costs

- Abrasive producers face challenges due to fluctuations in the prices of raw materials such as aluminum oxide, silicon carbide, zirconia alumina, and synthetic diamonds. These variations affect overall manufacturing costs and influence product pricing for end users, especially in cost-sensitive sectors. Managing these fluctuations requires strategic sourcing and efficient production planning

- Compliance with strict environmental, occupational safety, and waste management regulations increases operational expenses for abrasive manufacturers. Smaller producers often struggle to meet these standards, limiting their competitiveness and ability to scale operations. These requirements also push companies to adopt cleaner and more sustainable production technologies

- Supply chain inconsistencies and variable access to key raw materials contribute to production delays, affecting product availability and reliability. Such disruptions can hinder market penetration, particularly for specialized abrasive products that require consistent material quality. Ensuring raw material stability is becoming a critical focus for manufacturers

- For instance, in 2023, several abrasive producers reported increased production expenses stemming from rising energy costs and stricter compliance requirements, impacting the affordability of premium abrasive solutions. These increased costs also influenced product development timelines and market pricing strategies. Many companies expressed concern about long-term cost sustainability

- While cost and regulatory challenges persist, improving supply chain resilience, promoting sustainable production practices, and optimizing raw material usage are critical for unlocking long-term growth potential. Companies must also invest in innovation to develop cost-effective alternatives without compromising performance. Strategic planning will be essential to remain competitive in a challenging market environment

Middle East and Africa Abrasives Market Scope

The market is segmented on the basis of raw materials, type, product, form, application, and end-user

- By Raw Materials

On the basis of raw materials, the Middle East and Africa abrasives market is segmented into natural and synthetic. The synthetic segment held the largest market revenue share in 2025 driven by its higher durability, uniform grain structure, and consistent performance across heavy-duty industrial applications. Synthetic abrasives are widely preferred in modern machining environments due to their superior cutting efficiency and suitability for precision processes.

The natural segment is expected to witness a steady growth rate from 2026 to 2033 supported by the increasing use of eco-friendly and cost-effective abrasive materials for light-to-medium finishing tasks. Natural abrasives are gaining traction among industries seeking sustainable alternatives that offer adequate performance for non-critical applications.

- By Type

On the basis of type, the Middle East and Africa abrasives market is segmented into coated abrasive, bonded abrasive, super abrasive, and others. The bonded abrasive segment held the largest market revenue share in 2025 owing to its extensive use in grinding, cutting, and heavy material removal across manufacturing and metalworking operations. Its structural strength and long service life make it a preferred choice for high-load applications.

The super abrasive segment is expected to witness the fastest growth rate from 2026 to 2033 driven by the rising demand for precision machining in sectors such as aerospace, automotive, and electronics. Super abrasives such as diamond and CBN offer superior hardness, thermal stability, and accuracy, making them ideal for high-tolerance processes.

- By Product

On the basis of product, the Middle East and Africa abrasives market is segmented into disc, cups, cylinder, and others. The disc segment dominated the market in 2025 due to its widespread usage in metal fabrication, woodworking, and surface preparation tasks. Disc abrasives offer versatility, ease of installation, and compatibility with various handheld and automated tools.

The cylinder segment is expected to witness the fastest growth rate from 2026 to 2033 supported by increasing adoption in applications requiring uniform material removal and internal surface finishing. Their cylindrical shape provides superior control and stability, making them suitable for industrial grinding and deburring operations.

- By Form

On the basis of form, the Middle East and Africa abrasives market is segmented into block form and powdered form. The block form segment held the largest market revenue share in 2025 driven by its high demand in polishing, sharpening, and manual finishing applications. Block abrasives are valued for their longevity, ease of handling, and suitability for both industrial and workshop environments.

The powdered form segment is expected to witness substantial growth from 2026 to 2033 encouraged by its increasing use in lapping, micro-finishing, and precision polishing processes. Powdered abrasives offer exceptional control over grain size distribution, enabling fine-grade finishing required in electronics, optics, and advanced manufacturing.

- By Application

On the basis of application, the Middle East and Africa abrasives market is segmented into grinding, cutting, polishing, drilling, finishing, and others. The grinding segment held the largest market revenue share in 2025 owing to its central role in material shaping, surface preparation, and heavy stock removal across manufacturing industries. Grinding abrasives are essential for achieving dimensional accuracy and smooth surfaces.

The polishing segment is expected to register strong growth from 2026 to 2033 supported by increasing demand for high-quality surface finishing in automotive, electronics, and consumer goods. Polishing abrasives enhance aesthetic appeal and functional performance, making them crucial in final-stage manufacturing processes.

- By End-User

On the basis of end-user, the Middle East and Africa abrasives market is segmented into automotive, machinery, aerospace and defence, metal fabrication, building and construction, medical devices, oil and gas, electrical and electronics, and others. The metal fabrication segment captured the largest market revenue share in 2025 driven by the extensive use of abrasives in welding, cutting, grinding, and surface preparation. Abrasives play a key role in improving production efficiency and maintaining structural quality.

The automotive segment is expected to witness significant growth from 2026 to 2033 propelled by rising demand for precision components, lightweight materials, and superior finishing standards in vehicle manufacturing. Advanced abrasives support high-accuracy machining, paint preparation, and surface correction, making them indispensable in automotive production.

Middle East and Africa Abrasives Market Regional Analysis

- South Africa dominated the abrasives market in the Middle East and Africa in 2025, driven by strong demand from metalworking, mining, and construction industries. High utilisation of grinding and cutting abrasives in mineral extraction, maintenance, and heavy-duty industrial equipment supports sustained market dominance

- The country’s mining sector, which requires continuous maintenance of machinery and processing equipment, contributes significantly to abrasive demand. The need for reliable, heavy-performance cutting and drilling tools drives consistent procurement of bonded and super abrasives

- Rising construction activity, along with growth in manufacturing and fabrication workshops, continues to fuel abrasive usage across South Africa. Demand for polishing, finishing, and surface preparation tools grows in tandem with residential, commercial, and industrial construction

U.A.E. Abrasives Market Insight

The U.A.E. abrasives market is expected to witness the fastest growth rate from 2026 to 2033 in the Middle East and Africa region, driven by rapid expansion in manufacturing, metal fabrication, and construction activities across the country. Strong investments in industrial automation, large-scale infrastructure projects, and the continued development of free-trade and industrial zones are accelerating the adoption of high-performance abrasive products. The country's growing focus on precision engineering, supported by advanced machinery imports and the rise of automotive and aerospace component manufacturing, is creating robust demand for coated, bonded, and super abrasives.

Middle East and Africa Abrasives Market Share

The Middle East and Africa abrasives industry is primarily led by well-established companies, including:

• Abrasive Technology Industries ATI (Saudi Arabia)

• Universal Abrasives (U.A.E.)

• Al Borax Abrasives Manufacturing (U.A.E.)

• Apex Abrasives Factory (U.A.E.)

• Elite Abrasives Middle East (U.A.E.)

• Al Humaidi Abrasives (Saudi Arabia)

• Fepa Gulf Abrasives (U.A.E.)

• Pan Gulf Abrasives (Saudi Arabia)

• Grinding Techniques (South Africa)

• Karbosan Middle East Division HQ-Based Entity (U.A.E.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Abrasive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Abrasive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Abrasive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.