Middle East And Africa Aesthetic And Cosmetic Surgery Devices Market

Market Size in USD Million

CAGR :

%

USD

55.60 Million

USD

89.30 Million

2025

2033

USD

55.60 Million

USD

89.30 Million

2025

2033

| 2026 –2033 | |

| USD 55.60 Million | |

| USD 89.30 Million | |

|

|

|

|

Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market Size

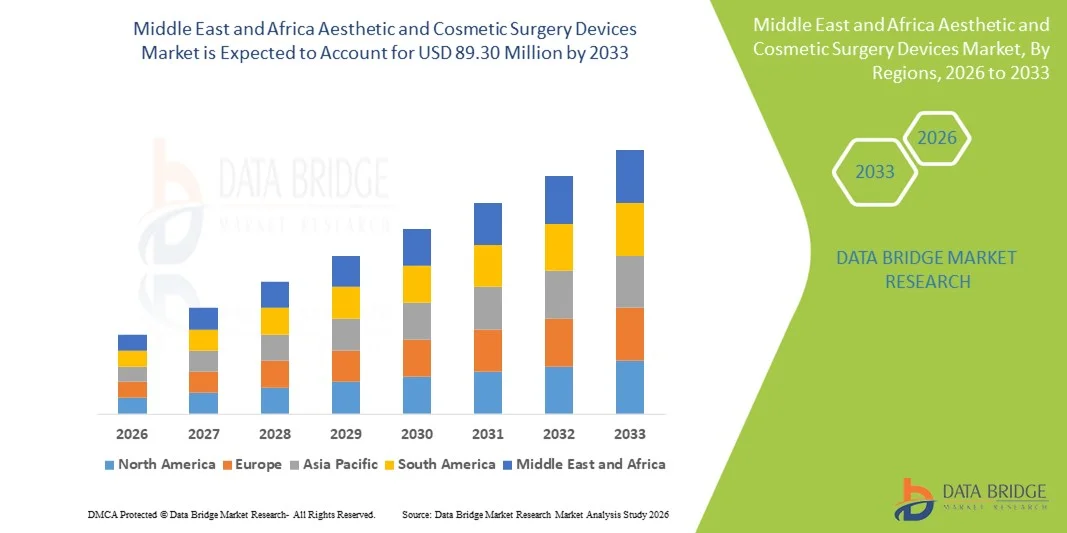

- The Middle East and Africa aesthetic and cosmetic surgery devices market size was valued at USD 55.60 million in 2025 and is expected to reach USD 89.30 million by 2033, at a CAGR of 6.1% during the forecast period

- The market growth is largely driven by rising awareness and demand for minimally invasive and non-invasive cosmetic procedures, coupled with technological advancements in laser, energy-based, and injectable devices across the region

- In addition, increasing disposable income, growing medical tourism, and the presence of aesthetic clinics and dermatology centers are encouraging adoption of advanced cosmetic surgery devices, positioning them as essential tools in modern aesthetic healthcare. These factors are collectively accelerating market expansion and boosting industry growth

Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market Analysis

- Aesthetic and cosmetic surgery devices, including breast implants, body implants, and custom-made implants, are becoming increasingly vital in clinics and hospitals across the UAE, Saudi Arabia, and South Africa due to their ability to provide minimally invasive, precise, and personalized cosmetic procedures

- The rising demand for these devices is primarily fueled by increasing awareness of aesthetic procedures, growing disposable incomes, expansion of medical tourism, and technological advancements in implant design and biomaterials

- The UAE dominated the Middle East and Africa market with the largest revenue share of 38.7% in 2025, supported by high adoption of advanced aesthetic devices in clinics, robust healthcare infrastructure, and a strong presence of international cosmetic device manufacturers, with Dubai and Abu Dhabi emerging as key hubs for cosmetic procedures

- South Africa is expected to be the fastest-growing country in the market during the forecast period due to increasing urbanization, growing patient awareness of cosmetic procedures, and gradual improvements in healthcare infrastructure

- Breast implants/mammary implants segment dominated the market with a share of 41.2% in 2025, driven by high demand for minimally invasive breast enhancement procedures and the widespread use of polymer-based implants for safety and biocompatibility

Report Scope and Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market Segmentation

|

Attributes |

Middle East and Africa Aesthetic and Cosmetic Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market Trends

Rising Adoption of Minimally Invasive and Personalized Procedures

- A key and accelerating trend in the Middle East and Africa aesthetic and cosmetic surgery devices market is the growing preference for minimally invasive procedures such as injectable fillers, laser-based treatments, and custom-made implants, which provide quicker recovery and reduced risk compared to traditional surgeries

- For instance, clinics in Dubai and Riyadh are increasingly using customized 3D-printed implants and polymer-based breast implants to meet individual patient requirements, enhancing procedural precision and patient satisfaction

- Advanced device integration with imaging technologies and treatment planning software allows practitioners to design personalized cosmetic procedures, improving outcomes and reducing post-operative complications

- Such innovations are fostering a more patient-centric approach in aesthetic healthcare, allowing clinics to offer tailored treatments and pre-visualize results for clients before procedures

- This trend is fundamentally transforming expectations for aesthetic care, pushing device manufacturers to develop advanced, precise, and customizable solutions, such as AI-assisted laser devices and patient-specific implants

- In addition, partnerships between device manufacturers and local distributors are expanding product reach, ensuring that even smaller clinics in emerging cities gain access to advanced aesthetic technologies

- Demand for advanced, minimally invasive, and personalized cosmetic surgery devices is growing rapidly in key countries such as the UAE, Saudi Arabia, and South Africa, as consumers increasingly prioritize safety, efficacy, and customized outcomes

Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market Dynamics

Driver

Increasing Demand Driven by Awareness, Income, and Medical Tourism

- The rising awareness of aesthetic procedures, coupled with growing disposable incomes and expansion of medical tourism, is a major driver of heightened demand for cosmetic surgery devices in the region

- For instance, in 2025, leading clinics in Dubai launched campaigns highlighting advanced laser devices and polymer-based implants to attract both local patients and medical tourists seeking high-quality procedures

- As patients increasingly seek safe, minimally invasive, and effective treatments, aesthetic clinics and hospitals are adopting advanced devices such as 3D-custom implants, energy-based devices, and laser systems to meet evolving need

- Furthermore, the growing presence of specialized cosmetic clinics and dermatology centers in Saudi Arabia and South Africa is promoting wider adoption of aesthetic devices, enabling access to cutting-edge treatments for more patients

- The convenience, precision, and customization offered by modern aesthetic devices are key factors driving adoption across clinics and hospitals, reinforcing their role as essential tools in elective and reconstructive procedures

- For instance, collaborations between international device manufacturers and local hospitals have enabled training programs for surgeons, accelerating adoption of advanced implants and laser technologies

- Rising social media influence and celebrity endorsements in the UAE and Saudi Arabia are increasing awareness of aesthetic trends, indirectly boosting demand for modern cosmetic surgery devices among younger demographics

Restraint/Challenge

High Cost, Regulatory Compliance, and Safety Concerns

- The high cost of advanced aesthetic devices, along with strict regulatory requirements, poses a significant challenge to broader market penetration in the Middle East and Africa

- For instance, some clinics in South Africa delay procurement of 3D-custom implants or energy-based devices due to the need for regulatory approvals and high upfront investment, limiting adoption among smaller facilities

- Safety concerns regarding implant materials, potential post-operative complications, and skin reactions can make patients hesitant to undergo cosmetic procedures, affecting overall market growth

- Addressing these challenges through rigorous clinical testing, adherence to local medical regulations, and transparent patient education is critical for building trust and confidence in the devices

- Although costs are gradually decreasing and polymer-based implants are gaining popularity, the premium pricing of high-end devices compared to conventional surgical tools remains a barrier, particularly for smaller clinics or cost-sensitive patients

- Overcoming these barriers through affordable device offerings, enhanced safety measures, and regulatory support will be crucial for sustaining growth in the region’s aesthetic and cosmetic surgery devices market

- For instance, inconsistent regulatory frameworks across countries in the Middle East and Africa complicate device approval processes, causing delays in product launches

- In addition, lack of skilled practitioners in some regions restricts optimal utilization of advanced devices, requiring investments in training and certification programs to expand market adoption

Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market Scope

The market is segmented on the basis of type, raw material, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into breast implants/mammary implants, implants for the body, and custom-made implants. The breast implant/mammary implant segment dominated the market with the largest market revenue share of 41.2% in 2025, driven by high demand for minimally invasive breast enhancement procedures. Patients and clinics in the UAE and Saudi Arabia prefer polymer-based breast implants for their biocompatibility and reduced risk of complications. The segment benefits from advancements in implant technology, including improved shapes, textures, and custom sizing options that enhance patient outcomes. Growing medical tourism in the region, particularly to Dubai and Abu Dhabi, is boosting adoption as international patients seek high-quality cosmetic procedures. Clinics report repeat procedures and combination treatments using breast implants, further increasing segment revenue. The segment also benefits from extensive promotion and awareness campaigns highlighting safe, effective, and aesthetically pleasing outcomes.

The custom-made implant segment is anticipated to witness the fastest growth rate of 19.5% from 2026 to 2033, fueled by increasing demand for personalized and patient-specific procedures. Surgeons are using 3D-printed implants for facial reconstruction, body contouring, and complex reconstructive surgeries, offering precise anatomical fit and improved cosmetic outcomes. The rising adoption of AI-assisted planning and imaging technologies allows practitioners to create implants tailored to patient anatomy. The segment growth is also driven by expanding investments in research and development by international device manufacturers targeting the Middle East and Africa. Patients are increasingly seeking customized solutions for better aesthetic and functional results, driving adoption in clinics and specialized hospitals. This trend is particularly strong in high-income countries such as the UAE and Saudi Arabia.

- By Raw Material

On the basis of raw material, the market is segmented into polymers, metals, and biomaterials. The polymers segment dominated the market with the largest revenue share of 45.6% in 2025, driven by widespread use in breast and body implants due to their safety, flexibility, and biocompatibility. Polymers offer long-lasting results with minimal adverse reactions and are preferred in both aesthetic and reconstructive surgeries. Clinics in Dubai, Riyadh, and Johannesburg favor polymer-based devices because they can be easily sterilized and customized according to patient requirements. The segment growth is supported by increasing R&D to improve polymer materials for durability, texture, and integration with other devices. Patient awareness of safer materials further drives demand. The segment also benefits from regulatory approvals for polymer-based devices in high-income countries, which accelerates adoption.

The biomaterials segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for implants made from natural or bioengineered tissues. Biomaterials provide better integration with patient tissue and reduce the risk of rejection or inflammation. Clinics and hospitals are increasingly using biomaterial-based implants in reconstructive surgeries and specialized aesthetic procedures. Technological advancements, such as bioactive coatings and regenerative materials, are enhancing the safety and performance of biomaterial implants. The rising focus on personalized medicine and patient-specific solutions is further driving segment growth. Growth is strongest in countries investing in advanced healthcare infrastructure, including UAE and South Africa.

- By End User

On the basis of end user, the market is segmented into clinics, hospitals, dermatology clinics, and others. The clinics segment dominated the market with the largest revenue share of 52.3% in 2025, owing to their specialization in elective cosmetic procedures and high adoption of advanced aesthetic devices. Clinics in the UAE and Saudi Arabia are early adopters of laser systems, injectable devices, and polymer-based implants. Patients prefer clinics for quick, minimally invasive treatments with shorter recovery times. Clinics benefit from higher procedural volumes and the ability to offer bundled treatments, increasing device utilization. The growing presence of medical tourism further strengthens the clinic segment. Partnerships with international device manufacturers also help clinics access the latest technology and training.

The hospitals segment is expected to witness the fastest growth rate of 18.7% from 2026 to 2033, driven by increasing use of aesthetic devices for reconstructive surgeries and advanced cosmetic procedures. Hospitals are adopting 3D-custom implants, biomaterial-based devices, and laser systems for complex cases. Rising investments in healthcare infrastructure across Saudi Arabia, South Africa, and UAE support hospital adoption. Hospitals also cater to medical tourists seeking comprehensive care, which further accelerates growth. Integration with other medical services, such as post-operative care and imaging, enhances the hospital segment’s appeal. Expansion of multi-specialty centers incorporating aesthetic and reconstructive surgery is another key driver.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail pharmacies. The direct tender segment dominated the market with the largest revenue share of 57.4% in 2025, supported by government and private hospital procurement, as well as large clinic orders. Direct tenders ensure reliable supply of high-value implants and advanced devices such as laser systems and 3D-custom implants. Major distributors partner with clinics and hospitals to provide training, after-sales support, and device maintenance, increasing adoption. Bulk purchasing reduces per-unit costs for high-end devices, further driving market share. Key hospitals in the UAE and Saudi Arabia favor direct tenders for regulatory compliance and product authenticity. The segment also benefits from long-term supply contracts and partnerships with international manufacturers.

The retail pharmacies segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing availability of minimally invasive devices, such as dermal fillers and small implantable devices, directly to dermatology clinics and cosmetic practitioners. Pharmacies offer convenient access to devices in smaller cities and emerging regions across the Middle East and Africa. Rising awareness campaigns and growing adoption of aesthetic procedures by younger populations are fueling retail distribution. The segment growth is further supported by e-commerce platforms supplying devices to clinics, making procurement easier. Convenience, speed of delivery, and competitive pricing make retail pharmacies increasingly attractive as a distribution channel.

Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market Regional Analysis

- The UAE dominated the Middle East and Africa market with the largest revenue share of 38.7% in 2025, supported by high adoption of advanced aesthetic devices in clinics, robust healthcare infrastructure, and a strong presence of international cosmetic device manufacturers, with Dubai and Abu Dhabi emerging as key hubs for cosmetic procedures

- Consumers in the region increasingly value minimally invasive procedures, personalized implants, and high-precision laser devices that offer improved safety, faster recovery, and better aesthetic outcomes

- This widespread adoption is further supported by rising disposable incomes, a technologically advanced healthcare infrastructure, and the presence of leading international device manufacturers, establishing the UAE as a key hub for cosmetic and reconstructive procedures in the region

The UAE Aesthetic and Cosmetic Surgery Devices Market Insight

The UAE aesthetic and cosmetic surgery devices market captured the largest revenue share of 38.7% in 2025 within the Middle East and Africa, fueled by high adoption of advanced devices in clinics and hospitals and the country’s growing medical tourism sector. Patients increasingly prioritize minimally invasive procedures, personalized implants, and precision laser devices for improved aesthetic outcomes. The rising disposable incomes, sophisticated healthcare infrastructure, and presence of leading international manufacturers further drive market expansion. In addition, awareness campaigns and celebrity endorsements are boosting demand for cosmetic procedures, making the UAE a key hub for elective and reconstructive surgeries in the region.

Saudi Arabia Aesthetic and Cosmetic Surgery Devices Market Insight

The Saudi Arabia market is projected to grow at a substantial CAGR throughout the forecast period, driven by rising awareness of aesthetic procedures and expanding investments in advanced healthcare infrastructure. Increasing disposable incomes and a growing focus on medical tourism are encouraging clinics and hospitals to adopt high-end devices, such as laser systems, 3D-custom implants, and energy-based devices. Consumers are drawn to minimally invasive solutions with shorter recovery times and personalized outcomes. Adoption spans both urban hospitals and private clinics, supporting growth across reconstructive, cosmetic, and dermatology applications.

South Africa Aesthetic and Cosmetic Surgery Devices Market Insight

The South Africa market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for cosmetic procedures among urban populations and increasing investment in healthcare facilities. Clinics and hospitals are rapidly adopting polymer-based implants, energy-based devices, and laser technologies to meet the growing patient demand for aesthetic and reconstructive treatments. Rising awareness about safe and effective procedures, coupled with an expanding middle class, is fueling market adoption. The availability of international devices through distributors and partnerships with local hospitals is also promoting market growth.

Egypt Aesthetic and Cosmetic Surgery Devices Market Insight

The Egypt market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing urbanization, rising disposable incomes, and growing awareness of aesthetic procedures. The country’s hospitals and dermatology clinics are adopting advanced implants and non-invasive devices to cater to both local and regional patients. Integration of modern devices with imaging and planning software enhances precision and patient outcomes. The demand for affordable, high-quality cosmetic procedures, combined with growing medical tourism from neighboring countries, is supporting market growth.

Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market Share

The Middle East and Africa Aesthetic and Cosmetic Surgery Devices industry is primarily led by well-established companies, including:

- AbbVie (U.S.)

- Lumenis (Israel)

- GC Aesthetics (U.K.)

- POLYTECH Health & Aesthetics GmbH (Germany)

- Sientra, Inc. (U.S.)

- Silimed (Brazil)

- Integra Lifesciences (U.S.)

- Lipoelastic A.S. (Czech Republic)

- Karl Storz SE & Co. KG (Germany)

- Merz Pharma GmbH & Co KGaA (Germany)

- Bausch Health (Canada)

- Venus Concept (Canada)

- Fotona (Slovenia)

- InMode Ltd. (Israel)

- Cynosure, LLC (U.S.)

- Asclepion Laser Technologies GmbH (Germany)

- Stryker (U.S.)

- HANSBIOMED CO. LTD (South Korea)

- LABORATOIRES ARION (France)

What are the Recent Developments in Middle East and Africa Aesthetic and Cosmetic Surgery Devices Market?

- In September 2025, Allergan Aesthetics announced that it would present its new AA Signature™ multimodal treatment approach at the Aesthetic & Anti‑Aging Medicine World Congress (AMWC) in Dubai, highlighting continued commitment to advancing skin quality and aesthetic clinical practices across global markets including the Middle East and Africa

- In June 2025, Shookra Clinics officially opened a next‑generation regenerative aesthetics and longevity center in Dubai, UAE, marking a significant advancement in the region’s aesthetic healthcare landscape. The clinic blends medical diagnostics, biotechnology, and state‑of‑the‑art aesthetic treatments under one luxury service model, utilizing AI‑powered skin analysis, biological age profiling, and genetic testing to tailor personalized regenerative protocols

- In July 2024, leading aesthetic device maker Alma Lasers introduced a new hybrid energy platform that combines laser and radiofrequency (RF) technologies, designed to deliver comprehensive body contouring and skin tightening solutions, thereby enhancing device offerings and treatment outcomes in the region

- In July 2024, Heka Trading unveiled a suite of advanced Lumenis aesthetic devices including Geneo X, Divine Pro, and triLift in the United Arab Emirates, signaling increased investment in high‑end non‑invasive aesthetic technologies in the Middle East. These platforms offer enhanced skin rejuvenation, tightening, and remodeling capabilities, expanding local clinics’ treatment portfolios with cutting‑edge laser and energy‑based solutions

- In January 2021, Candela announced the availability of its Frax Pro system, an FDA‑cleared non‑ablative fractional laser resurfacing device featuring both Frax 1550 and novel 1940 applicators, strengthening the portfolio of aesthetic resurfacing devices accessible in markets including the Middle East and Africa

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.