Middle East And Africa Aluminum Casting Market

Market Size in USD Billion

CAGR :

%

USD

4.60 Billion

USD

7.91 Billion

2024

2032

USD

4.60 Billion

USD

7.91 Billion

2024

2032

| 2025 –2032 | |

| USD 4.60 Billion | |

| USD 7.91 Billion | |

|

|

|

|

Middle East and Africa Aluminum Casting Market Size

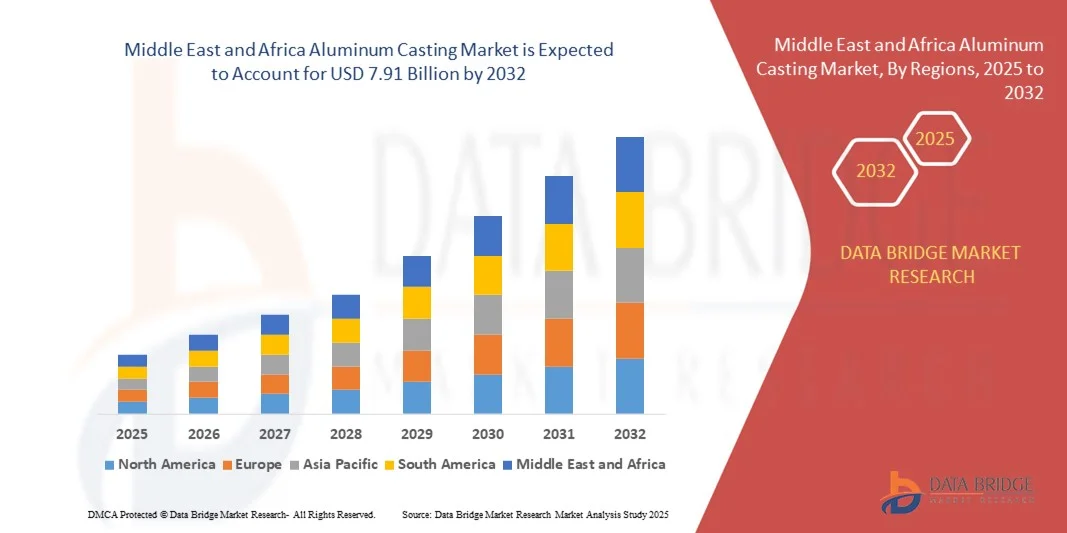

- The Middle East and Africa Aluminum Casting Market size was valued at USD 4.60 billion in 2024 and is projected to reach USD 7.91 billion by 2032, growing at a CAGR of 7.00% during the forecast period.

- The market growth is primarily driven by increasing industrialization, expansion of the automotive and construction sectors, and rising demand for lightweight, high-performance components across various applications.

- Additionally, advancements in casting technologies, coupled with a focus on sustainable manufacturing practices and energy-efficient solutions, are fueling adoption in both established and emerging markets. These combined factors are accelerating the uptake of aluminum casting solutions, thereby significantly boosting the industry’s growth.

Middle East and Africa Aluminum Casting Market Analysis

- Aluminum castings, providing lightweight, high-strength components for automotive, construction, and industrial applications, are increasingly critical in modern manufacturing due to their durability, corrosion resistance, and adaptability to complex designs.

- The rising demand for aluminum casting is primarily driven by the growth of the automotive sector, expansion in construction activities, and the need for energy-efficient, lightweight solutions across industrial applications.

- U.A.E. dominated the Middle East and Africa Aluminum Casting Market with the largest revenue share of 37.2% in 2024, supported by significant industrial infrastructure, investments in automotive and aerospace sectors, and the presence of key casting manufacturers, particularly in countries like the UAE and Saudi Arabia, where demand for high-performance aluminum components is rising.

- Saudi Arabia is expected to be the fastest-growing region in the Middle East and Africa Aluminum Casting Market during the forecast period due to rapid industrialization, infrastructure development, and increasing automotive production in countries such as South Africa and Nigeria.

- The expendable mold casting segment dominated the market with the largest revenue share of 57.4% in 2024, driven by its suitability for producing complex geometries, lightweight components, and high-performance parts across automotive and industrial applications.

Report Scope and Middle East and Africa Aluminum Casting Market Segmentation

|

Attributes |

Aluminum Casting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Aluminum Casting Market Trends

Advancements in Lightweight and High-Performance Aluminum Components

- A significant and accelerating trend in the Middle East and Africa Aluminum Casting Market is the increasing adoption of lightweight, high-performance aluminum components across automotive, aerospace, and industrial applications. This shift is driven by the need for improved fuel efficiency, reduced emissions, and enhanced structural performance.

- For instance, automotive manufacturers are increasingly using aluminum engine blocks, chassis components, and body panels to reduce vehicle weight while maintaining strength and durability. Similarly, aerospace companies are integrating aluminum castings in structural components to optimize weight without compromising safety and performance.

- Advances in casting technologies, such as high-pressure die casting and vacuum-assisted casting, enable the production of complex geometries with tight tolerances and superior surface finishes. These innovations improve component performance and reliability while reducing production time and material waste.

- The growing focus on sustainable manufacturing practices is also driving adoption, as aluminum is highly recyclable and can be reused without significant loss of material properties. This aligns with global environmental regulations and corporate sustainability goals, particularly in rapidly industrializing regions of the Middle East and Africa.

- Companies such as Emirates Global Aluminium and SABIC are developing high-strength aluminum alloys and advanced casting solutions tailored to automotive, construction, and aerospace sectors, supporting both performance optimization and environmental sustainability.

- The demand for lightweight, durable, and efficient aluminum castings is expanding rapidly across the Middle East and Africa, driven by industrial growth, infrastructure projects, and the increasing emphasis on energy-efficient and environmentally responsible manufacturing practices.

Middle East and Africa Aluminum Casting Market Dynamics

Driver

Growing Demand Driven by Industrial Expansion and Lightweight Material Adoption

- The rapid industrialization across the Middle East and Africa, along with rising demand from automotive, construction, and aerospace sectors, is a significant driver for the increasing uptake of aluminum castings.

- For instance, in 2024, Emirates Global Aluminium expanded its production capacity to cater to growing demand for high-strength, lightweight aluminum components in automotive and construction applications. Such initiatives by key companies are expected to drive the aluminum casting market growth during the forecast period.

- As manufacturers increasingly prioritize fuel efficiency, reduced structural weight, and improved performance, aluminum castings provide a versatile solution compared to heavier traditional materials like steel. Advanced castings offer durability, corrosion resistance, and design flexibility, making them ideal for high-performance applications.

- Furthermore, the ongoing development of smart and energy-efficient buildings, coupled with infrastructure projects in emerging markets, is fueling the adoption of aluminum castings in structural and architectural applications, where both strength and lightweight properties are essential.

- The demand for precision-engineered components, including automotive engine parts, chassis, and industrial machinery, is further propelling growth, supported by advancements in high-pressure die casting, vacuum-assisted casting, and other modern production technologies.

Restraint/Challenge

High Production Costs and Technical Skill Requirements

- The relatively high initial investment required for advanced aluminum casting facilities, machinery, and technology can pose a challenge for small- and medium-sized manufacturers in the region.

- For instance, setting up high-precision die-casting lines or adopting vacuum-assisted casting techniques involves substantial capital expenditure and skilled workforce training, which may limit market penetration in developing areas.

- Additionally, maintaining consistent quality in aluminum castings requires technical expertise and stringent process controls. Variations in alloy composition, temperature, and cooling rates can impact the performance and reliability of final products, posing challenges for manufacturers with limited experience or resources.

- While automation and modern casting technologies are gradually reducing manual labor requirements and improving efficiency, the need for trained personnel and quality assurance processes remains a critical barrier.

- Overcoming these challenges through investment in advanced casting technologies, workforce training, and process optimization will be vital for sustained growth and competitiveness in the Middle East and Africa aluminum casting market.

Middle East and Africa Aluminum Casting Market Scope

Middle East and Africa aluminum casting market is segmented on the basis of process, source, application, and end-user.

- By Process

On the basis of process, the Middle East and Africa Aluminum Casting Market is segmented into expendable mold casting and non-expendable mold casting. The expendable mold casting segment dominated the market with the largest revenue share of 57.4% in 2024, driven by its suitability for producing complex geometries, lightweight components, and high-performance parts across automotive and industrial applications. Manufacturers prefer expendable mold processes due to their ability to minimize machining requirements and accommodate design flexibility.

The non-expendable mold casting segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by growing demand for cost-effective, reusable mold solutions, particularly in medium to high-volume production scenarios, where durability, repeatability, and lower operational costs make it a compelling choice.

- By Source

On the basis of source, the market is segmented into primary (fresh aluminum) and secondary (recycled aluminum). The primary aluminum segment held the largest revenue share of 62.1% in 2024, driven by the consistent supply of high-quality aluminum and its superior mechanical properties required for critical applications such as engine components, chassis parts, and industrial machinery. Rising industrialization and automotive production in the region support this demand.

The secondary aluminum segment is projected to witness the fastest CAGR of 21.5% from 2025 to 2032, fueled by growing environmental awareness, government initiatives promoting recycling, and cost advantages. Recycled aluminum adoption is increasing in construction, automotive, and consumer goods due to its energy efficiency and sustainability benefits.

- By Application

On the basis of application, the Middle East and Africa Aluminum Casting Market is segmented into intake manifolds, oil pan housings, structural parts, chassis parts, cylinder heads, engine blocks, transmissions, wheels and brakes, heat transfers, and others. The structural parts segment dominated the market with a revenue share of 38.7% in 2024, owing to its widespread use in automotive and construction applications requiring lightweight yet durable components.

The wheels and brakes segment is expected to witness the fastest CAGR of 20.3% from 2025 to 2032, driven by increasing vehicle production, the push for fuel efficiency, and rising adoption of lightweight aluminum alloys for enhanced performance and reduced emissions.

- By End-User

On the basis of end-user, the Middle East and Africa Aluminum Casting Market is segmented into automotive, building and construction, industrial, household appliances, aerospace, electronics and electrical, engineering tools, and others. The automotive segment accounted for the largest revenue share of 45.6% in 2024, driven by the demand for lightweight, high-strength components, regulatory pressures for emission reduction, and the proliferation of electric vehicles.

The aerospace segment is projected to witness the fastest CAGR of 22.1% from 2025 to 2032, owing to the increasing adoption of aluminum castings in aircraft components for weight optimization, fuel efficiency, and performance enhancement, alongside growing commercial and defense aviation activities in the region.

Middle East and Africa Aluminum Casting Market Regional Analysis

- U.A.E. dominated the Aluminum Casting Market with the largest revenue share of 37.2% in 2024, driven by rapid industrialization, expansion of the automotive and construction sectors, and rising demand for lightweight, high-performance components.

- Manufacturers and end-users in the region increasingly prefer aluminum castings for their strength-to-weight ratio, corrosion resistance, and versatility across automotive, industrial, and construction applications.

- This widespread adoption is further supported by government initiatives promoting sustainable manufacturing, advancements in casting technologies, and growing investments in energy-efficient solutions, establishing aluminum casting as a preferred choice for both established industries and emerging markets across the Middle East and Africa.

Saudi Arabia Aluminum Casting Market Insight

The Saudi Arabia aluminum casting market captured a significant revenue share in 2024, driven by the country’s large-scale infrastructure projects, expanding automotive production, and government initiatives to diversify the industrial sector. Demand for lightweight, high-performance aluminum components in construction, transportation, and industrial machinery applications is fueling market growth. Additionally, the adoption of advanced casting technologies and a focus on sustainable, energy-efficient manufacturing practices are further accelerating market expansion.

U.A.E. Aluminum Casting Market Insight

The UAE aluminum casting market is expected to witness substantial growth during the forecast period, fueled by rapid urbanization, increasing commercial and residential construction, and investments in aerospace, defense, and automotive sectors. The use of high-quality aluminum castings in modern buildings, vehicles, and industrial equipment, along with technological advancements in production processes, is driving market adoption. Government initiatives supporting industrial innovation and energy efficiency are also contributing to growth.

South Africa Aluminum Casting Market Insight

The South Africa aluminum casting market is projected to grow steadily, driven by automotive manufacturing, industrial machinery production, and mining equipment fabrication. Rising demand for lightweight and corrosion-resistant aluminum components, along with government efforts to modernize the industrial base, is promoting adoption across automotive, construction, and industrial sectors. Investment in advanced casting technologies and improved energy efficiency further supports market expansion.

Egypt Aluminum Casting Market Insight

The Egypt aluminum casting market is anticipated to expand at a notable CAGR during the forecast period, fueled by infrastructure development, growth in automotive assembly, and investments in construction and energy projects. Increasing demand for durable, lightweight aluminum components in structural, mechanical, and automotive applications is driving market adoption. The integration of sustainable manufacturing practices and technological advancements in casting is further boosting market growth.

Middle East and Africa Aluminum Casting Market Share

The Aluminum Casting industry is primarily led by well-established companies, including:

• Gulf Aluminum Rolling Mills (U.A.E.)

• Sabic (Saudi Arabia)

• Emirates Global Aluminium (U.A.E.)

• Alcoa (U.S.)

• Noranda Aluminum (Canada)

• Constellium (France)

• Hindalco Industries (India)

• China Zhongwang Holdings (China)

• Novelis (U.S.)

• ElvalHalcor (Greece)

• Mubadala Aluminium (U.A.E.)

• Al Jazeera Steel Products (Qatar)

• Aluminium Bahrain (Bahrain)

• National Aluminium Products Company (Saudi Arabia)

• Maaden Aluminium (Saudi Arabia)

• Sundwiger Aluminium (Germany)

• AAI (African Aluminium Industries) (South Africa)

• Metallum (South Africa)

• Alumeco (U.A.E.)

• Aluminium Bahrain Rolling (Bahrain)

What are the Recent Developments in Middle East and Africa Aluminum Casting Market?

- In April 2023, Emirates Global Aluminium (EGA), a leading aluminum producer in the UAE, announced the expansion of its advanced aluminum casting facilities to meet growing demand in the automotive and construction sectors. The initiative focuses on delivering high-quality, lightweight, and energy-efficient aluminum components, highlighting EGA’s commitment to innovation and sustainable manufacturing practices in the Middle East and Africa region.

- In March 2023, South African Foundries Ltd. launched a new line of precision aluminum castings tailored for industrial machinery and automotive applications. This strategic development underscores the company’s focus on enhancing product performance and durability, supporting local manufacturers, and reinforcing its presence in the expanding regional aluminum casting market.

- In March 2023, Egyptian Aluminum Company (EGAL) successfully inaugurated a state-of-the-art aluminum casting unit designed to cater to the growing construction and transportation sectors. By adopting cutting-edge casting technologies, EGAL is enhancing production efficiency, improving component quality, and driving the region toward more sustainable manufacturing practices.

- In February 2023, Aluminium Bahrain B.S.C. (Alba) announced a collaboration with regional automotive OEMs to supply high-performance aluminum castings for engine and structural components. This partnership emphasizes Alba’s dedication to supporting industrial growth, promoting lightweight solutions, and expanding the adoption of aluminum castings across diverse applications in the Middle East and Africa.

- In January 2023, United Casting Solutions (UCS), a regional leader in precision aluminum components, unveiled a new automated casting line in the UAE designed for aerospace and automotive applications. The initiative highlights UCS’s focus on integrating advanced technology, improving production efficiency, and delivering high-quality, lightweight aluminum components to meet rising regional demand.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Aluminum Casting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Aluminum Casting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Aluminum Casting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.