Middle East And Africa Aniline Market

Market Size in USD Million

CAGR :

%

USD

422.47 Million

USD

603.39 Million

2025

2033

USD

422.47 Million

USD

603.39 Million

2025

2033

| 2026 –2033 | |

| USD 422.47 Million | |

| USD 603.39 Million | |

|

|

|

|

Middle East and Africa Aniline Market Size

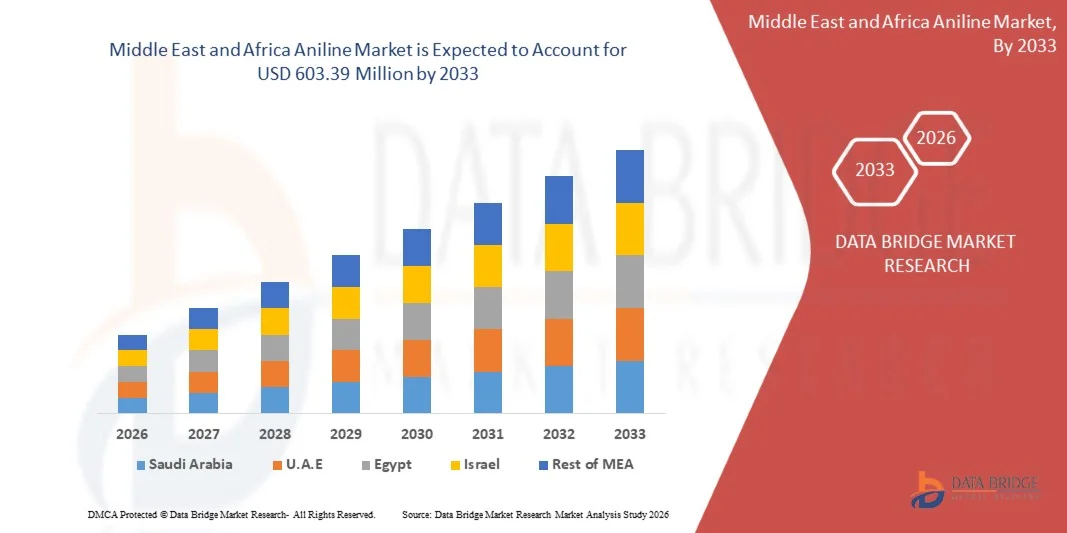

- The Middle East and Africa Aniline Market size was valued at USD 422.47 million in 2025 and is expected to reach USD 603.39 million by 2033, at a CAGR of 4.7% during the forecast period

- The growth of the Aniline Market is primarily driven by rising demand for MDI (methylene diphenyl diisocyanate) in polyurethane production, expanding applications in construction, automotive, and furniture industries, and increasing industrialization in emerging economies, which boosts the need for insulation materials and coatings.

- In addition, the market is supported by advancements in chemical manufacturing, expanding use of aniline in pharmaceuticals, dyes, and rubber-processing chemicals, and growing investments in sustainable production technologies. These factors collectively accelerate market adoption and significantly contribute to the overall expansion of the industry.

Middle East and Africa Aniline Market Analysis

- The Middle East and Africa Aniline Market encompasses the production, processing, and utilization of aniline in polyurethane, dyes & pigments, rubber-processing chemicals, and pharmaceutical intermediates, driven by rapid infrastructure development, growth in automotive manufacturing, and rising demand for insulation materials in construction and energy projects across the region.

- The rising adoption of aniline is propelled by expanding polyurethane foam applications, increasing investment in chemical manufacturing, and manufacturers’ strategic shift toward higher-efficiency, specialty-grade derivatives, aimed at meeting growing regional requirements for durable coatings, advanced polymers, and flexible foam solutions across industrial and consumer sectors.

- Saudi Arabia is expected to dominate the Middle East and Africa Aniline Market with the largest market share of 39.27% in 2026 and is also projected to record the highest CAGR during the forecast period, driven by rapid expansion of the country’s polyurethane and construction industries, strong investments in downstream chemical manufacturing under the Saudi Vision 2030 initiative, and the presence of large-scale MDI and isocyanate production facilities. In addition, growing demand for insulation materials in infrastructure, energy, and industrial projects, along with strategic partnerships between global chemical players and domestic producers, is further strengthening Saudi Arabia’s leadership in aniline consumption and production capacity across the region.

- The Nitrobenzene Hydrogenation segment is expected to dominate the Middle East and Africa Aniline Market with the largest market share of 70.82% in 2026, primarily due to its established role as the most efficient, cost-effective, and industrially scalable method for aniline production. This process benefits from high conversion rates, reliable yield consistency, and compatibility with large-volume petrochemical operations, making it the preferred technology among regional manufacturers. Additionally, increasing investment in downstream polyurethane and MDI production, coupled with expanding chemical processing capacity across Saudi Arabia and the broader GCC, continues to strengthen demand for nitrobenzene hydrogenation as the leading production route in the Middle East and Africa.

Report Scope and Middle East and Africa Aniline Market Segmentation

|

Attributes |

Middle East and Africa Aniline Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Aniline Market Trends

“Strong Demand from Polyurethane / MDI”

- Rising industrial preference for high-performance polyurethane systems acts as a strong driver for the global aniline market, as aniline is the essential precursor for MDI production. Industries such as construction, automotive, insulation, and appliances increasingly prioritize materials that deliver durability, thermal efficiency and lightweight performance—directly increasing consumption of MDI and, therefore, aniline.

- Demand growth incentivizes MDI producers and integrated chemical manufacturers to expand capacity, secure raw material supply chains, and invest in advanced catalytic technologies to improve efficiency and yield. As a result, aniline producers scale operations, broaden supply footprints, and enhance process optimization to meet long-term polyurethane market needs.

- In 2025, construction sector assessments across Asia and the Middle East highlighted accelerated infrastructure development and rising adoption of energy-efficient building materials, reinforcing the need for rigid polyurethane foam—one of the largest downstream applications of aniline-derived MDI.

- In 2024, multiple chemical industry outlook reports signaled strong growth in automotive production, especially in EV manufacturing, where polyurethane foams and coatings are used for lightweighting, noise insulation and interior comfort—further amplifying demand for aniline-based MDI.

- In 2025, global material-innovation briefings emphasized the shift toward high-performance, sustainable insulation and cushioning materials, noting that polyurethane solutions continue to dominate due to superior thermal, mechanical and structural properties. This industry orientation accelerates demand for aniline as a critical feedstock supporting polyurethane and MDI value chains.

Middle East and Africa Aniline Market Dynamics

Driver

“Rising demand for mdi-based polyurethanes in construction, automotive, and appliances”

- Growth in polyurethane-centered innovations across construction, automotive, and appliance manufacturing acts as a principal demand driver for the global Aniline market, because aniline is the core feedstock for MDI, which is essential in producing rigid and flexible polyurethane foams, coatings, adhesives and insulation materials. Manufacturers in these end-use sectors continue to prioritise materials that provide superior energy efficiency, structural strength, lightweighting, and durability—needs that strongly favour MDI-based polyurethanes. This sustained shift accelerates aniline consumption and stimulates investment in higher-capacity, more efficient MDI production systems. Evidence from industry outlooks and manufacturing policy frameworks further supports continuous expansion of polyurethane-oriented value chains in construction and mobility sectors.

- In 2025, several global chemical producers announced capacity expansions in MDI and polyurethane systems to meet rising construction-driven demand for rigid insulation foams, which are increasingly mandated in building codes focused on thermal efficiency and sustainability. These expansions signal strong, long-term demand pull for upstream aniline production.

- Industry leaders such as BASF, Huntsman, Wanhua, and Covestro are advancing process efficiency, expanding integrated aniline–MDI facilities, and developing specialised polyurethane formulations for next-generation automotive interiors, EV battery insulation, comfort foams, and durable appliance components. These capacity additions and product innovations highlight how high-performance polyurethane applications directly reinforce growth in aniline consumption.

- At the same time, global sustainability and energy-efficiency initiatives—including green-building certifications, insulation standards, and lightweighting policies—are creating favourable conditions for polyurethane adoption, thereby increasing the need for MDI and its precursor aniline. Regulations promoting energy-efficient construction and low-emission vehicles significantly strengthen demand for MDI-based material solutions.

- Together, these developments illustrate how the convergence of functional performance requirements, regulatory sustainability pressures, and rapid innovation within polyurethane technology is driving continuous growth, diversification, and upstream investment within the aniline sector. The structural alignment between MDI demand and polyurethane market expansion ensures that aniline remains a strategically critical chemical in global industrial manufacturing.

Restraint/Challenge

“Benzene price volatility and exposure to cyclical aromatics margins”

- Volatility in benzene prices functions as a major restraint for the global Aniline market, because benzene is the primary feedstock, and fluctuations in crude oil, refinery operations, and aromatics supply-demand cycles directly influence aniline production costs and profit margins. Producers and downstream MDI manufacturers face continuous margin pressure when benzene values move unpredictably forcing operational adjustments, shorter planning cycles, and more conservative production strategies. This dynamic often limits the ability of aniline suppliers to maintain stable pricing or commit to long-term supply agreements, constraining investment confidence across the value chain.

- For instance – In 2024–2025, global benzene markets experienced sharp fluctuations due to a combination of refinery outages, shifts in reformate economics, and variable styrene and cyclohexane operating rates, which tightened aromatics balances and caused significant cost instability for aniline manufacturers. These disruptions highlighted the sensitivity of the aniline industry to external feedstock shocks and cyclical aromatics profitability.

- Industry leaders such as BASF, Covestro, and Wanhua have reported the need for careful inventory management, hedging strategies, and selective run-rate optimization during high benzene price phases, demonstrating how volatility in upstream aromatics markets forces producers to alter operational behaviour and delay new investment during unfavorable cycles.

- In parallel, global chemical-sector analyses emphasize that benzene–MDI value chains are increasingly exposed to cyclical downturns driven by macroeconomic slowdowns, reduced construction activity, or weaker automotive manufacturing, which compress aromatics margins and reduce the ability of producers to pass through cost increases. These cyclical downturns amplify the financial and operational risks associated with benzene-derived aniline production.

- Together, these conditions illustrate how the convergence of feedstock volatility, cyclical aromatics margins, and macroeconomic sensitivity poses a sustained structural challenge to the aniline sector, limiting margin stability and influencing investment decisions, capacity utilization, and long-term planning across global aniline–MDI markets.

Middle East and Africa Aniline Market Scope

The Middle East and Africa Malt Extracts and Kvass Wort Concentrates Market is segmented into six segments based on Production Process, Grade & purity, Manufacturing Process, Application, End User, Distribution Channel

- By Production Process

On the basis of production process, the aniline market is segmented into Nitrobenzene Hydrogenation, Integrated Nitration–Hydrogenation (Benzene-to-Aniline), Bio-Based Routes (Pilot/Emerging), Other Emerging Pathways. In 2026, the Nitrobenzene Hydrogenation segment is expected to dominate the market with a market share of 70.82% Rye is growing with the CAGR of 4.9% in the forecast period 2026 to 2033, largely because this route remains the most established, cost-efficient, and industrially scalable production technology for aniline. The process benefits from mature reactor designs, well-optimized catalysts, and broad global availability of nitrobenzene, enabling manufacturers to achieve high yields, consistent product quality, and reliable large-volume output. Additionally, the strong integration of major MDI producers with nitrobenzene aniline value chains further reinforces its cost competitiveness, reducing exposure to supply disruptions and enhancing operational efficiency.

- By Grade & Purity

On the basis of grade & purity, the aniline market is segmented into Standard Industrial Grade (≥99.5%), High Purity Grade (≥99.9%) and Salts and Formulations. In 2026, the Standard Industrial Grade (≥99.5%) segment is expected to dominate the market with a market share of 71.21% growing with the CAGR of 4.9% in the forecast period 2026 to 2033, primarily because this purity level meets the bulk requirements of major downstream applications—particularly MDI production for polyurethane foams used in construction, automotive, and appliance manufacturing. The grade offers an optimal balance of cost-effectiveness and performance, enabling large-scale producers to operate efficiently while maintaining consistent chemical specifications for high-volume industrial processes.

- By Manufacturing Process

On the basis of form, the Middle East and Africa Malt Extracts and Kvass Wort Concentrates Market is segmented into Liquid, Powder, Concentrate. In 2026, the liquid segment is expected to dominate the market with a share of 58.28% growing with the CAGR of 7.5% in the forecast period 2026 to 2033, due to its superior solubility, ease of blending, and wider application in beverages, bakery, and pharmaceutical formulations. Liquid forms offer better flavor dispersion, faster processing, and higher efficiency for manufacturers, making them the preferred choice across multiple end-use industries

- By Manufacturing process

On the basis of Manufacturing Process, the aniline market is segmented into Cold Rolling & Annealing, Melt Spinning, Powder Metallurgy, and Others. In 2026, the Cold Rolling & Annealing segment is expected to dominate the market with a share of 62.06% growing with the CAGR of 7.1% in the forecast period 2026 to 2033, due to largely because this manufacturing route delivers superior structural uniformity, enhanced mechanical strength, and improved surface quality that are essential for high-performance applications. The process enables precise control over thickness, grain refinement, and overall material integrity, making it the preferred method for industries that require tight tolerance, high durability, and consistent performance in downstream components

- By Application

On the basis of Application, the aniline market is segmented into Methylene Diphenyl Diisocyanate (MDI) Production, Rubber Processing Chemicals, Dyes & Pigments, Agrochemicals, Pharmaceuticals and Others. In 2026, the Methylene Diphenyl Diisocyanate (MDI) Production segment is expected to dominate the market with a share of 57.71% is growing with the CAGR of 5.1% in the forecast period 2026 to 2033, due to primarily because MDI is the largest and most critical downstream application of aniline globally. MDI serves as the key building block for polyurethane foams used extensively in construction insulation, automotive components, furniture, bedding, refrigeration systems, and various industrial materials. The continued expansion of infrastructure projects, energy-efficient building standards, lightweight automotive manufacturing, and durable appliance production reinforces strong, sustained demand for MDI.

- By End user

On the basis of End User, the aniline market is segmented into Automotive, Furniture & Appliances, Textiles & Leather, Electrical & Electronics, Construction and Others. In 2026, the Automotive segment is expected to dominate the market with a market share of 41.92% is growing with the CAGR of 5.2% in the forecast period 2026 to 2033, due to the extensive use of malt extracts and kvass wort concentrates in both alcoholic and non-alcoholic drink formulations. Their ability to enhance flavor, sweetness, color, and fermentation efficiency, along with rising consumer demand for craft, functional, and natural beverages, strongly drives this segment’s growth.

- By distribution channel

On the basis of distribution channel, the market is segmented into Direct and Retail. In 2026, the Direct segment is expected to dominate the market with a market share of 73.65% growing with the CAGR of 5.0% in the forecast period 2026 to 2033, due to primarily because large-scale industrial consumers such as MDI manufacturers, polyurethane producers, and chemical intermediates companies prefer direct procurement from suppliers to ensure consistent supply, bulk volumes, and competitive pricing. Direct sales enable streamlined logistics, long-term supply agreements, and integrated quality assurance, which are critical for maintaining uninterrupted production in highly specialized downstream processes.

Middle East and Africa Aniline Market Regional Analysis

- Middle East and Africa is capturing a regional share of 39.27% in 2026, supported by well-established industrial demand and emerging applications in construction insulation, automotive components, and specialty chemicals. The region also demonstrates the strongest CAGR of 6.5%, indicating rapid growth compared with other regions. Expansion is driven by rising infrastructure development, adoption of energy-efficient building materials, and increasing investments in automotive and appliance manufacturing that rely on MDI-derived polyurethane products.

- The region benefits from the presence of key domestic and regional chemical manufacturers, supportive trade policies, and favorable regulatory and pricing conditions, all of which facilitate market penetration and ensure consistent supply for industrial consumers. Additionally, initiatives to promote sustainable and high-performance materials in construction and automotive sectors strengthen the long-term growth outlook for aniline in Middle East and Africa.

Saudi Arabia Aniline Market Insight

The Saudi Arabia Aniline Market is poised for strong growth, supported by the rapid expansion of the country’s polyurethane value chain, especially driven by rising demand for MDI in construction, automotive, and appliance industries. The Saudi polyurethane market is projected to grow at a significant rate, with its MDI segment expanding due to Vision 2030–led infrastructure development and industrial diversification.

Middle East and Africa Aniline Market Share

The Aniline industry is primarily led by well-established companies, including:

- BASF (Germany)

- Covestro AG (Germany)

- Wanhua (China)

- China Risun Group Limited (China)

- Bondalti (Portugal)

- Sumitomo Chemical Co., Ltd. (Japan)

- Gujarat Narmada Valley Fertilizers & Chemicals Limited (India)

- Merck & Co., Inc. (U. S)

- LANXESS (Germany)

- Panoli Intermediates India Pvt. Ltd. (India)

- Huntsman International LLC (U.S.)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- JSK Chemicals (India)

- Henan Sinowin Chemical Industry Co., Ltd. (China)

Latest Developments in Middle East and Africa Aniline Market

- In 2024, Covestro launched a pilot plant in Leverkusen, Germany, to produce bio-based aniline from plant-derived biomass. This initiative marked a significant milestone in sustainable chemical manufacturing, as it demonstrated the technical feasibility of producing aniline entirely from renewable sources using a combination of fermentation and catalytic conversion. The bio-based aniline is primarily used for MDI (methylene diphenyl diisocyanate) production, a key component in polyurethane foams for insulation, furniture, and automotive applications. By scaling up this technology, Covestro is reducing reliance on petroleum-based feedstocks and advancing the global push toward environmentally friendly chemical processes.

- In April 2024, the French biotech company Pili successfully industrialized the production of a bio-based aniline derivative, specifically anthranilic acid, using microbial fermentation. The company produced several tons at commercial scale, enabling the material to be used in dyes, pigments, and other fine chemicals. Pili’s achievement highlights how biotechnology can offer scalable, renewable alternatives to traditional petrochemical routes while reducing environmental impact. It also demonstrates growing market acceptance for bio-based intermediates in industries that rely heavily on aromatic compounds.

- In 2025, BASF announced plans to expand its MDI capacity in Shanghai, China, and as part of its “Winning Ways” strategy, the company is upgrading its nitrobenzene/aniline unit to operate longer each year (from ~7,500 to ~8,000 hours). Because aniline is a key precursor to MDI, the expansion naturally raises upstream aniline demand, supporting additional capacity growth. This move further strengthens BASF’s integrated value chain in Asia-Pacific, enhancing long-term supply security for both intermediates and downstream polyurethane products.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PRICING ANALYSIS

4.3 VENDOR SELECTION CRITERIA

4.3.1 MATERIAL SOURCING AND QUALITY

4.3.2 MANUFACTURING CAPABILITIES

4.3.3 COST COMPETITIVENESS

4.3.4 FLEXIBLITY AND COLLABORATIONS

4.3.5 SUPPLY CHAIN RELIABILITY

4.3.6 SUSTAINABILITY PRACTICES

4.4 BRAND OUTLOOK

4.4.1 COMPANY VS BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO – MIDDLE EAST AND AFRICA ANILINE MARKET

4.5.1 INTRODUCTION

4.5.2 ENVIRONMENTAL CONCERNS

4.5.3 INDUSTRY RESPONSE

4.5.4 GOVERNMENT’S ROLE

4.5.5 ANALYST RECOMMENDATIONS

4.5.6 CONCLUSION

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 GROUP 1 PREMIUM CHEMICAL PRODUCERS

4.6.2 GROUP 2 PRICE-SENSITIVE MID-SIZED FORMULATORS

4.6.3 GROUP 3 INDUSTRIAL USERS WITH LOGISTICS FOCUS

4.6.4 GROUP 4 COST-FOCUSED SMALL PROCESSORS / TRADERS

4.6.5 GROUP 5 SPECIALTY APPLICATION MANUFACTURERS

4.6.6 GROUP 6 EMERGING MARKET LARGE BUYERS

4.7 COST ANALYSIS BREAKDOWN — MIDDLE EAST AND AFRICA ANILINE MARKET

4.7.1 RAW MATERIAL COSTS

4.7.2 UTILITIES AND ENERGY CONSUMPTION

4.7.3 LABOUR, WORKFORCE CAPABILITIES, AND STAFFING COSTS

4.7.4 PROCESS TECHNOLOGY, EQUIPMENT, AND MAINTENANCE COSTS

4.7.5 ENVIRONMENTAL COMPLIANCE AND SAFETY MANAGEMENT COSTS

4.7.6 PACKAGING AND PRODUCT HANDLING COSTS

4.7.7 LOGISTICS, TRANSPORTATION, AND STORAGE COSTS

4.7.8 OVERHEADS, ADMINISTRATIVE, AND SUPPORT COSTS

4.7.9 CONCLUSION

4.8 INDUSTRY ECOSYSTEM ANALYSIS — MIDDLE EAST AND AFRICA ANILINE MARKET

4.8.1 INTRODUCTION

4.8.2 PROMINENT COMPANIES

4.8.3 SMALL & MEDIUM-SIZED COMPANIES

4.8.4 END USERS

4.8.5 CONCLUSION

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS — MIDDLE EAST AND AFRICA ANILINE MARKET

4.9.1.1 Joint Ventures

4.9.1.2 Mergers and Acquisitions

4.9.1.3 Licensing and Partnership

4.9.1.4 Technology Collaborations

4.9.1.5 Strategic Divestments

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 PATENT ANALYSIS

4.10.1 PATENT QUALITY AND STRENGTH

4.10.2 EGION PATENT LANDSCAPE

4.10.3 IP STRATEGY AND MANAGEMENT

4.10.4 PATENT FAMILIES

4.10.5 LICENSING & COLLABORATION

4.11 PROFIT MARGINS SCENARIO — MIDDLE EAST AND AFRICA ANILINE MARKET

4.11.1 FEEDSTOCK VOLATILITY AND MARGIN SENSITIVITY

4.11.2 OPERATIONAL EFFICIENCY AND COST-POSITIONING MARGINS

4.11.3 ENVIRONMENTAL COMPLIANCE, SAFETY INVESTMENTS, AND MARGIN PRESSURE

4.11.4 DOWNSTREAM DEMAND CYCLES AND MARGIN REALIZATION

4.11.5 REGIONAL COMPETITIVENESS AND MARGIN DIVERGENCE

4.11.6 COMPETITIVE INTENSITY AND MARGIN EROSION RISK

4.11.7 CONCLUSION

4.12 RAW MATERIAL COVERAGE

4.12.1 NITROBENZENE

4.12.2 BENZENE

4.12.3 HYDROGEN

4.12.4 CATALYST

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 INTRODUCTION

4.13.2 RAW MATERIAL SOURCING & PROCUREMENT

4.13.2.1 Feedstock Acquisition

4.13.2.2 Supplier Qualification & Quality Assurance

4.13.2.3 Risk Mitigation & Sustainability

4.13.3 PROCESSING & MANUFACTURING (CHEMICAL SYNTHESIS)

4.13.3.1 Nitration of Benzene

4.13.3.2 Hydrogenation to Aniline

4.13.3.3 Purification & Finishing

4.13.3.4 By-product and Waste Management

4.13.3.5 Occupational Safety & Process Safety

4.13.4 LOGISTICS, PACKAGING & DISTRIBUTION

4.13.4.1 Packaging for Transport

4.13.4.2 Storage and Warehousing

4.13.4.3 Transportation & Regulatory Compliance

4.13.4.4 Risk Management in Transit

4.13.5 COMMERCIAL CHANNELS & END-USE DISTRIBUTION

4.13.5.1 Primary End-Use Markets

4.13.5.2 Sales & Contracting Models

4.13.5.3 Value-Added Services

4.13.5.4 Logistics Alignment with Demand Patterns

4.13.6 QUALITY MANAGEMENT, TRACEABILITY & REGULATORY COMPLIANCE

4.13.6.1 Quality Assurance & Control

4.13.6.2 Regulatory Governance

4.13.6.3 Documentation Systems & Information Flow

4.13.7 RISK MANAGEMENT ACROSS THE SUPPLY CHAIN

4.13.7.1 Supply Risk

4.13.7.2 Process Safety Risk

4.13.7.3 Logistical Risk

4.13.7.4 Regulatory & Compliance Risk

4.13.7.5 Quality Risk

4.13.8 SUSTAINABILITY AND FUTURE TRENDS

4.13.8.1 Environmental Footprint Reduction

4.13.8.2 Circular Economy Initiatives

4.13.8.3 Regulatory & Policy Drivers

4.13.8.4 Technology Innovation

4.13.9 CONCLUSION

4.14 TECHNOLOGICAL ADVANCEMENT

4.14.1 ADVANCED CATALYTIC HYDROGENATION SYSTEMS

4.14.2 CLEANER AND SAFER NITRATION TECHNOLOGIES

4.14.3 BIO-BASED AND RENEWABLE-FEEDSTOCK ANILINE DEVELOPMENT

4.14.4 DIGITALIZATION, AUTOMATION, AND INDUSTRY 4.0 IN ANILINE PRODUCTION

4.14.5 EFFLUENT TREATMENT, EMISSION CONTROL, AND ENVIRONMENTAL TECHNOLOGIES

4.14.6 ENERGY EFFICIENCY AND HEAT-RECOVERY INNOVATIONS

4.14.7 WASTE MINIMIZATION, BY-PRODUCT UTILIZATION, AND CIRCULAR-ECONOMY APPROACHES

4.14.8 APPLICATION-SPECIFIC INNOVATION IN ANILINE DERIVATIVES

4.14.9 CONCLUSION

4.15 VALUE CHAIN ANALYSIS

4.15.1 RAW MATERIAL SOURCING & PRODUCTION

4.15.2 PROCESSING & MANUFACTURING

4.15.3 DISTRIBUTION & LOGISTICS

4.15.4 SALES & MARKETING

4.15.5 BUYERS / END USERS

4.15.6 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN MARKET

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 IMPACT ON PRICES

5.5.1 DIRECT IMPACT ON LANDED COSTS

5.5.2 IMPACT ON DOMESTIC PRODUCER PRICING POWER

5.6 CONCLUSION

6 REGULATION COVERAGE — MIDDLE EAST AND AFRICA ANILINE MARKET

6.1 INTRODUCTION:

6.2 PRODUCT CODES

6.2.1 CHEMICAL IDENTIFIERS

6.2.2 HARMONIZED SYSTEM AND TARIFF CODES

6.2.3 INDEX AND INVENTORY LISTINGS

6.3 CERTIFIED STANDARDS

6.3.1 INTERNATIONAL STANDARDS AND QUALITY SYSTEMS

6.3.2 PACKAGING AND CERTIFICATION FOR TRADE

6.3.3 ANALYTICAL AND ENVIRONMENTAL TESTING STANDARDS

6.4 SAFETY STANDARDS

6.4.1 MATERIAL HANDLING & STORAGE

6.4.2 TRANSPORT & PRECAUTIONS

6.4.3 HAZARD IDENTIFICATION

6.5 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR MDI-BASED POLYURETHANES IN CONSTRUCTION, AUTOMOTIVE, AND APPLIANCES

7.1.2 GROWTH IN RUBBER PROCESSING AND TIRE MANUFACTURING

7.1.3 HIGH DEMAND OF DYES, PIGMENTS & SPECIALTY CHEMICALS

7.1.4 RISING DEMAND FROM PHARMACEUTICALS AND AGROCHEMICALS

7.2 RESTRAINTS

7.2.1 BENZENE PRICE VOLATILITY AND EXPOSURE TO CYCLICAL AROMATICS MARGINS

7.2.2 STRINGENT ENVIRONMENTAL, HEALTH, AND SAFETY REGULATIONS FOR TOXIC AND HAZARDOUS SUBSTANCES

7.3 OPPORTUNITIES

7.3.1 BIO-BASED ANILINE DEVELOPMENT

7.3.2 CATALYST AND PROCESS INTENSIFICATION FOR ENERGY EFFICIENCY AND LOWER EMISSIONS

7.3.3 CAPACITY EXPANSIONS ACROSS ASIA-PACIFIC AND INTEGRATED UPSTREAM BENZENE ADVANTAGES

7.4 CHALLENGES

7.4.1 COMPLIANCE WITH REACH/TSCA AND OCCUPATIONAL EXPOSURE LIMITS ACROSS REGIONS

7.4.2 LOGISTICS AND HANDLING CONSTRAINTS FOR HAZARDOUS MATERIALS IN BULK SHIPMENTS

8 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS

8.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

8.2 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.3 NITROBENZENE HYDROGENATION

8.4 INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE)

8.5 BIO-BASED ROUTES (PILOT/EMERGING)

8.6 OTHER EMERGING PATHWAYS

8.7 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.7.1 FIXED-BED TRICKLE FLOW REACTORS

8.7.2 SLURRY-PHASE REACTORS

8.7.3 OTHERS

8.8 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

8.8.1 RANEY NICKEL

8.8.2 PALLADIUM ON CARBON (PD/C)

8.8.3 COPPER-CHROMITE

8.8.4 PLATINUM ON CARBON (PT/C)

8.8.5 OTHERS

8.9 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.9.1 ASIA PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

8.10.1 MIXED ACID ROUTE (HNO₃/H₂SO₄)

8.10.2 ORGANIC NITRATION ROUTE

8.10.3 OTHERS

8.11 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

8.11.1 CONTINUOUS

8.11.2 BATCH

8.12 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA PACIFIC

8.12.2 EUROPE

8.12.3 NORTH AMERICA

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

8.13.1 BIO-BASED NITROBENZENE PRECURSORS

8.13.2 FERMENTATION-DERIVED INTERMEDIATES

8.13.3 OTHERS

8.14 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 CATALYTIC AMINATION OF PHENOL/CHLOROBENZENE

8.15.2 ELECTROCATALYTIC / LOW-CARBON PROCESSES

8.15.3 DIRECT AMINATION OF BENZENE VIA NOVEL CATALYST SYSTEMS

8.15.4 PLASMA-ASSISTED NITRATION & HYDROGENATION

8.15.5 CO₂-DERIVED AROMATIC INTERMEDIATES (CARBON-UTILIZATION)

8.15.6 OTHERS

8.16 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA PACIFIC

8.16.2 EUROPE

8.16.3 NORTH AMERICA

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

9 MIDDLE EAST AND AFRICA ANILINE MARKET, BY GRADE & PURITY

9.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

9.2 MIDDLE EAST AND AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

9.3 STANDARD INDUSTRIAL GRADE (≥99.5%)

9.4 HIGH PURITY GRADE (≥99.9%)

9.5 SALTS AND FORMULATIONS

9.6 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

9.6.1 ISO TANKS

9.6.2 DRUMS

9.6.3 IBC

9.6.4 OTHERS

9.7 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

9.8.1 PHARMACEUTICAL INTERMEDIATES

9.8.2 SPECIALTY DYES & PIGMENTS

9.8.3 OTHERS

9.9 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA PACIFIC

9.9.2 EUROPE

9.9.3 NORTH AMERICA

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

9.1 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 ANILINE HYDROCHLORIDE

9.10.2 BLENDED GRADES FOR RUBBER CHEMICALS

9.10.3 ANILINE SULFATE

9.10.4 STABILIZED ANILINE SOLUTIONS

9.10.5 CUSTOM SALT FORMULATIONS

9.10.6 ANILINE ACETATE

9.10.7 OTHERS

9.11 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

10 MIDDLE EAST AND AFRICA ANILINE MARKET, BY APPLICATION

10.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

10.2 MIDDLE EAST AND AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

10.3 METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION

10.4 RUBBER PROCESSING CHEMICALS

10.5 DYES & PIGMENTS

10.6 AGROCHEMICALS

10.7 PHARMACEUTICALS

10.8 OTHERS

10.9 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.9.1 RIGID FOAMS

10.9.2 FLEXIBLE FOAMS

10.9.3 OTHERS

10.1 MIDDLE EAST AND AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.10.1 BUILDING INSULATION PANELS

10.10.2 REFRIGERATION INSULATION

10.10.3 OTHERS

10.11 MIDDLE EAST AND AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 FURNITURE & BEDDING

10.11.2 AUTOMOTIVE SEATING

10.11.3 OTHERS

10.12 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA PACIFIC

10.12.2 EUROPE

10.12.3 NORTH AMERICA

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.13.1 ANTIOXIDANTS (PPDS)

10.13.2 ACCELERATORS & OTHER INTERMEDIATES

10.13.3 OTHERS

10.14 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.14.1 ASIA PACIFIC

10.14.2 EUROPE

10.14.3 NORTH AMERICA

10.14.4 SOUTH AMERICA

10.14.5 MIDDLE EAST & AFRICA

10.15 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.15.1 AZO DYES INTERMEDIATES

10.15.2 SULFUR DYES INTERMEDIATES

10.15.3 OTHERS

10.16 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.16.1 ASIA PACIFIC

10.16.2 EUROPE

10.16.3 NORTH AMERICA

10.16.4 SOUTH AMERICA

10.16.5 MIDDLE EAST & AFRICA

10.17 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.17.1 HERBICIDE INTERMEDIATES

10.17.2 OTHER CROP PROTECTION INTERMEDIATES

10.18 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA PACIFIC

10.18.2 EUROPE

10.18.3 NORTH AMERICA

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.19.1 API INTERMEDIATES

10.19.2 PROCESSING AIDS

10.2 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.20.1 ASIA PACIFIC

10.20.2 EUROPE

10.20.3 NORTH AMERICA

10.20.4 SOUTH AMERICA

10.20.5 MIDDLE EAST & AFRICA

10.21 MIDDLE EAST AND AFRICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.21.1 ASIA PACIFIC

10.21.2 EUROPE

10.21.3 NORTH AMERICA

10.21.4 SOUTH AMERICA

10.21.5 MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA ANILINE MARKET, BY END USER

11.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

11.2 MIDDLE EAST AND AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

11.3 AUTOMOTIVE

11.4 FURNITURE & APPLIANCES

11.5 TEXTILES & LEATHER

11.6 ELECTRICAL & ELECTRONICS

11.7 CONSTRUCTION

11.8 OTHERS

11.9 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 OEM APPLICATIONS

11.9.2 AFTERMARKET APPLICATIONS

11.1 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA PACIFIC

11.10.2 EUROPE

11.10.3 NORTH AMERICA

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 BEDDING & UPHOLSTERY

11.11.2 REFRIGERATION & HVAC

11.11.3 OTHERS

11.12 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA PACIFIC

11.12.2 EUROPE

11.12.3 NORTH AMERICA

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

11.13 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.13.1 DYEING

11.13.2 FINISHING

11.13.3 OTHERS

11.14 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.14.1 ASIA PACIFIC

11.14.2 EUROPE

11.14.3 NORTH AMERICA

11.14.4 SOUTH AMERICA

11.14.5 MIDDLE EAST & AFRICA

11.15 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.15.1 INSULATION FOAMS

11.15.2 ENCAPSULATION MATERIALS

11.15.3 OTHERS

11.16 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.16.1 ASIA PACIFIC

11.16.2 EUROPE

11.16.3 NORTH AMERICA

11.16.4 SOUTH AMERICA

11.16.5 MIDDLE EAST & AFRICA

11.17 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.17.1 RESIDENTIAL

11.17.2 COMMERCIAL & INDUSTRIAL

11.17.3 OTHERS

11.18 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.18.1 ASIA PACIFIC

11.18.2 EUROPE

11.18.3 NORTH AMERICA

11.18.4 SOUTH AMERICA

11.18.5 MIDDLE EAST & AFRICA

11.19 MIDDLE EAST AND AFRICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.19.1 ASIA PACIFIC

11.19.2 EUROPE

11.19.3 NORTH AMERICA

11.19.4 SOUTH AMERICA

11.19.5 MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL

12.1 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

12.2 MIDDLE EAST AND AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.3 DIRECT

12.4 INDIRECT

12.5 MIDDLE EAST AND AFRICA DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 MIDDLE EAST AND AFRICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.6.1 ONLINE

12.6.2 OFFLINE

12.7 MIDDLE EAST AND AFRICA INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 MIDDLE EAST AND AFRICA ANILINE MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 UNITED ARAB EMIRATES

13.1.3 SOUTH AFRICA

13.1.4 EGYPT

13.1.5 KUWAIT

13.1.6 QATAR

13.1.7 OMAN

13.1.8 ISRAEL

13.1.9 BAHRAIN

13.1.10 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA ANILINE MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 DISTRIBUTORS COMPANY PROFILE

16.1 AZELIS

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 KESSLER CHEMICAL, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 SHILPA CHEMSPEC INTERNATIONAL PVT LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 TRADE SYNDICATE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 UNIVAR SOLUTIONS LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 MANUFACTURERS COMPANY PROFILE

17.1 BASF SE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 COVESTRO AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CHINA RISUN GROUP LIMITED

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 WANHUA CHEMICAL GROUP CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 BONDALTI

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 HENAN SINOWIN CHEMICAL INDUSTRY CO., LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 HUNTSMAN CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.9 JSK CHEMICALS AHMEDABAD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LANXESS

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 MERCK (SIGMA-ALDRICH)

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 PANOLI INTERMEDIATES INDIA PVT.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SUMITOMO CHEMICAL CO., LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 COMPANY VS BRAND OVERVIEW

TABLE 3 KEY PERFORMANCE INDICATORS (KPIS) & METRICS FOR CLIMATE-CHANGE READINESS

TABLE 4 INDIAN AUTOMOBILE PRODUCTION TRENDS:

TABLE 5 PRODUCER PRICE INDEX BY INDUSTRY: SYNTHETIC DYE AND PIGMENT MANUFACTURING:

TABLE 6 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA ANILINE MARKET, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ANILINE MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA

TABLE 56 MIDDLE EAST AND AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 SAUDI ARABIA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 84 SAUDI ARABIA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 85 SAUDI ARABIA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 SAUDI ARABIA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 87 SAUDI ARABIA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 88 SAUDI ARABIA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 89 SAUDI ARABIA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 SAUDI ARABIA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 91 SAUDI ARABIA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 92 SAUDI ARABIA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 SAUDI ARABIA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 SAUDI ARABIA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 SAUDI ARABIA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 SAUDI ARABIA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 SAUDI ARABIA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 SAUDI ARABIA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 SAUDI ARABIA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 SAUDI ARABIA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 103 SAUDI ARABIA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 SAUDI ARABIA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 SAUDI ARABIA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 SAUDI ARABIA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 SAUDI ARABIA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 109 SAUDI ARABIA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 UNITED ARAB EMIRATES ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 111 UNITED ARAB EMIRATES NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 112 UNITED ARAB EMIRATES NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 UNITED ARAB EMIRATES INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 114 UNITED ARAB EMIRATES INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 115 UNITED ARAB EMIRATES BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 116 UNITED ARAB EMIRATES OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 UNITED ARAB EMIRATES ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 118 UNITED ARAB EMIRATES STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 119 UNITED ARAB EMIRATES HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 120 UNITED ARAB EMIRATES SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 UNITED ARAB EMIRATES ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 UNITED ARAB EMIRATES METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 UNITED ARAB EMIRATES RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 UNITED ARAB EMIRATES FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 UNITED ARAB EMIRATES RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 UNITED ARAB EMIRATES DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 UNITED ARAB EMIRATES AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 UNITED ARAB EMIRATES PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 UNITED ARAB EMIRATES ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATES FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 UNITED ARAB EMIRATES TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATES ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 UNITED ARAB EMIRATES CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 UNITED ARAB EMIRATES ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 136 UNITED ARAB EMIRATES INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 SOUTH AFRICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 138 SOUTH AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 139 SOUTH AFRICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 SOUTH AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 141 SOUTH AFRICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 142 SOUTH AFRICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 143 SOUTH AFRICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 SOUTH AFRICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 145 SOUTH AFRICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 146 SOUTH AFRICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 147 SOUTH AFRICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 SOUTH AFRICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 SOUTH AFRICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 SOUTH AFRICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 SOUTH AFRICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 SOUTH AFRICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 SOUTH AFRICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 SOUTH AFRICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 SOUTH AFRICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 SOUTH AFRICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 157 SOUTH AFRICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 SOUTH AFRICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 SOUTH AFRICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 SOUTH AFRICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 SOUTH AFRICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 163 SOUTH AFRICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 EGYPT ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 165 EGYPT NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 166 EGYPT NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 EGYPT INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 168 EGYPT INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 169 EGYPT BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 170 EGYPT OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 EGYPT ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 172 EGYPT STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 173 EGYPT HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 174 EGYPT SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 EGYPT ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 EGYPT METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 EGYPT RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 EGYPT FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 EGYPT RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 EGYPT DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 EGYPT AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 EGYPT PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 EGYPT ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 184 EGYPT AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 EGYPT FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 EGYPT TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 EGYPT ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 EGYPT CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 EGYPT ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 190 EGYPT INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 KUWAIT ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 192 KUWAIT NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 193 KUWAIT NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 KUWAIT INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 195 KUWAIT INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 196 KUWAIT BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 197 KUWAIT OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 KUWAIT ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 199 KUWAIT STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 200 KUWAIT HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 201 KUWAIT SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 KUWAIT ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 KUWAIT METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 KUWAIT RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 KUWAIT FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 KUWAIT RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 KUWAIT DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 KUWAIT AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 KUWAIT PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 KUWAIT ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 211 KUWAIT AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 KUWAIT FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 KUWAIT TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 KUWAIT ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 KUWAIT CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 KUWAIT ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 217 KUWAIT INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 QATAR ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 219 QATAR NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 220 QATAR NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 QATAR INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 222 QATAR INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 223 QATAR BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 224 QATAR OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 QATAR ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 226 QATAR STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 227 QATAR HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 228 QATAR SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 QATAR ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 QATAR METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 QATAR RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 QATAR FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 QATAR RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 QATAR DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 QATAR AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 QATAR PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 QATAR ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 238 QATAR AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 QATAR FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 QATAR TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 QATAR ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 QATAR CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 QATAR ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 244 QATAR INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 OMAN ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 246 OMAN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 247 OMAN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 OMAN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 249 OMAN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 250 OMAN BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 251 OMAN OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 OMAN ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 253 OMAN STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 254 OMAN HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 255 OMAN SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 OMAN ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 257 OMAN METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 OMAN RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 OMAN FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 OMAN RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 OMAN DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 OMAN AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 OMAN PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 OMAN ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 265 OMAN AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 OMAN FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 OMAN TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 OMAN ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 OMAN CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 OMAN ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 271 OMAN INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 ISRAEL ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 273 ISRAEL NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 274 ISRAEL NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 ISRAEL INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 276 ISRAEL INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 277 ISRAEL BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 278 ISRAEL OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 ISRAEL ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 280 ISRAEL STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 281 ISRAEL HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 282 ISRAEL SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 ISRAEL ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 284 ISRAEL METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 ISRAEL RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 ISRAEL FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 ISRAEL RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 ISRAEL DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 ISRAEL AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 ISRAEL PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 ISRAEL ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 292 ISRAEL AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 ISRAEL FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 ISRAEL TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 295 ISRAEL ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 ISRAEL CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 ISRAEL ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 298 ISRAEL INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 BAHRAIN ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 300 BAHRAIN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 301 BAHRAIN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 BAHRAIN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 303 BAHRAIN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 304 BAHRAIN BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 305 BAHRAIN OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 BAHRAIN ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 307 BAHRAIN STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 308 BAHRAIN HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 309 BAHRAIN SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 310 BAHRAIN ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 311 BAHRAIN METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 312 BAHRAIN RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 313 BAHRAIN FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 314 BAHRAIN RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 315 BAHRAIN DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 316 BAHRAIN AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 317 BAHRAIN PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 318 BAHRAIN ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 319 BAHRAIN AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)