Middle East And Africa Animal And Human Vaccines Market

Market Size in USD Billion

CAGR :

%

USD

3.67 Billion

USD

5.68 Billion

2024

2032

USD

3.67 Billion

USD

5.68 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 5.68 Billion | |

|

|

|

|

Middle East and Africa Animal and Human Vaccines Market Size

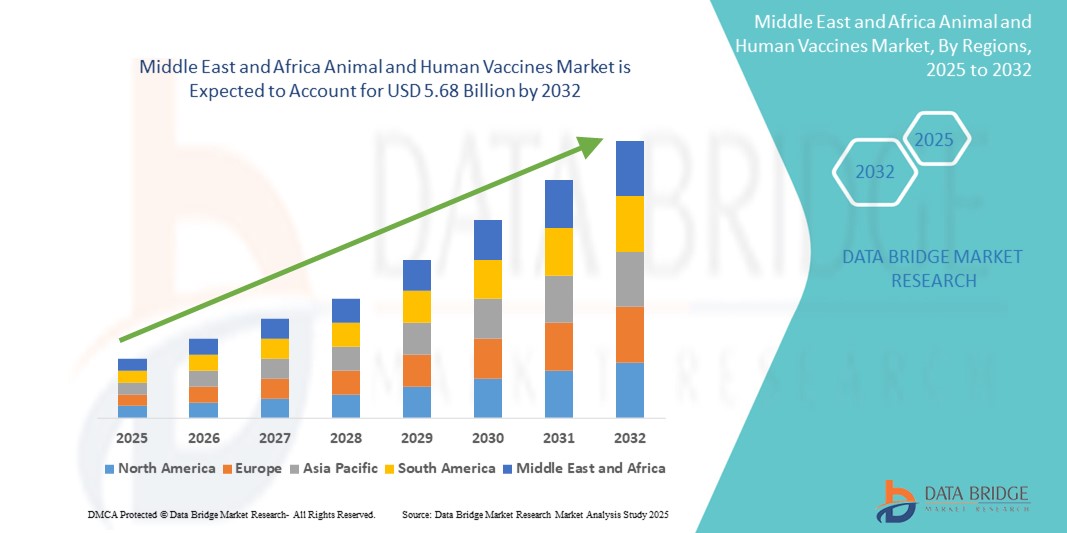

- The Middle East and Africa animal and human vaccines market size was valued at USD 3.67 billion in 2024 and is expected to reach USD 5.68 billion by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is largely fueled by the increasing prevalence of zoonotic and infectious diseases in the region, leading to greater investments in preventive healthcare for both animals and humans. Government-backed vaccination programs, public health initiatives, and awareness campaigns are contributing to the widespread adoption of animal and human vaccines across the Middle East and Africa

- Furthermore, the rising demand for food safety and sustainable livestock production is propelling the uptake of veterinary vaccines. Countries such as Saudi Arabia, South Africa, and the UAE are actively implementing animal health regulations, thus supporting the development and distribution of high-quality vaccines in the veterinary sector

Middle East and Africa Animal and Human Vaccines Market Analysis

- Animal and human vaccines are increasingly vital tools in the Middle East and Africa for preventing infectious diseases and improving public health outcomes across both human populations and livestock, especially in regions vulnerable to zoonotic diseases and endemic infections

- The rising demand for vaccines in the region is largely driven by increased awareness of immunization programs, government and WHO-backed vaccination initiatives, and growing investments in veterinary healthcare and livestock management

- Saudi Arabia dominated the Middle East and Africa animal and human vaccines market with the largest revenue share of 28.3% in 2024, due to strong national immunization campaigns, advanced healthcare infrastructure, and increasing adoption of modern veterinary practices aimed at improving food security and public health

- U.A.E. is expected to be the fastest-growing country in the Middle East and Africa animal and human vaccines market during the forecast period, fueled by rapid urbanization, rising pet ownership, supportive regulatory frameworks, and private sector involvement in human and animal vaccine R&D

- Human segment dominated the Middle East and Africa animal and human vaccines market with a market share of 61.3% in 2024, driven by widespread government-led immunization programs, increasing healthcare expenditure, and growing awareness about vaccine-preventable diseases. Initiatives by organizations such as WHO and GAVI have further strengthened access to life-saving vaccines for populations across the region

Report Scope and Middle East and Africa Animal and Human Vaccines Market Segmentation

|

Attributes |

Middle East and Africa Animal and Human Vaccines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Animal and Human Vaccines Market Trends

“Growing Emphasis on Immunization and Zoonotic Disease Control”

- A significant and accelerating trend in the Middle East and Africa animal and human vaccines market is the rising emphasis on immunization programs for both humans and animals to combat the increasing burden of infectious and zoonotic diseases

- For instance, in January 2024, the World Health Organization (WHO) collaborated with the Ministries of Health across several African nations to expand measles and polio vaccination coverage through mobile outreach programs. These efforts are enhancing vaccine access in rural and underserved areas, fueling market growth for human vaccines in the region

- On the animal health front, government-backed campaigns aimed at eradicating rabies, foot-and-mouth disease, and brucellosis are increasing the demand for veterinary vaccines. In April 2023, Boehringer Ingelheim announced a renewed partnership with African veterinary authorities to supply livestock vaccines, addressing a major cause of economic loss in agriculture-dependent communities

- Moreover, international aid programs and non-governmental organizations (NGOs) such as GAVI and UNICEF are supporting the procurement and distribution of routine childhood vaccines, strengthening the infrastructure and funding for the human vaccine sector in the Middle East and Africa

- The ongoing emergence of zoonotic diseases such as Rift Valley fever and Middle East Respiratory Syndrome (MERS) has further spotlighted the “One Health” approach—encouraging integrated vaccination efforts for both human and animal populations to prevent cross-species outbreaks

- The market is also seeing expansion through technological innovations like thermostable vaccines and combination vaccines, which simplify distribution and increase uptake, particularly in remote areas with limited cold chain access

- As awareness rises about the economic and health impacts of preventable diseases, the demand for cost-effective and accessible vaccine solutions continues to grow, positioning the Middle East and Africa as a high-potential region for both global and local vaccine manufacturers

Middle East and Africa Animal and Human Vaccines Market Dynamics

Driver

“Growing Demand Due to Zoonotic Disease Burden and Government Immunization Drives”

- The rising incidence of zoonotic diseases and infectious outbreaks across the Middle East and Africa, combined with increasing governmental focus on large-scale vaccination programs, is a major driver for the heightened demand for both animal and human vaccines

- For instance, in April 2024, the World Health Organization (WHO) and GAVI supported several African nations with measles and polio vaccination campaigns targeting underserved rural populations. These efforts are expected to significantly propel the Middle East and Africa Animal and Human Vaccines industry growth in the forecast period

- As public and private stakeholders become more aware of the health and economic impacts of preventable diseases, vaccines are increasingly viewed as essential tools for public health preparedness and livestock productivity, especially in agriculture-reliant economies

- Furthermore, the rise in veterinary infrastructure, mobile clinics, and cold chain improvements are enabling broader access to both livestock and pet vaccines, particularly in rural and peri-urban regions. This expansion is making animal vaccines more integral to food security and export compliance

- The growing emphasis on the “One Health” approach—linking human, animal, and environmental health—has resulted in greater investment in integrated immunization solutions, creating new opportunities across sectors. This interconnection is fostering cross-collaboration between ministries of health and agriculture

- In addition, expanding awareness among farmers, pet owners, and health practitioners, along with supportive regulations and public health mandates, is accelerating the uptake of Middle East and Africa Animal and Human Vaccines products and solutions, thereby significantly boosting the industry's growth

Restraint/Challenge

“Limited Infrastructure and High Vaccine Storage Costs”

- Underdeveloped healthcare and veterinary infrastructure in several parts of the Middle East and Africa region poses a significant challenge to the broader deployment of vaccination programs. Inconsistent electricity supply and weak cold chain logistics make vaccine storage and distribution complex, especially in remote or conflict-affected areas

- For instance, according to UNICEF, over 25% of vaccines in Africa are lost due to cold chain failures—highlighting the critical gap in storage and transport reliability, especially for temperature-sensitive biologics

- Addressing these challenges requires investments in solar-powered refrigeration, mobile cold chain units, and real-time temperature monitoring systems. Several organizations, including PATH and the Bill & Melinda Gates Foundation, are currently funding pilot projects across East and West Africa to improve vaccine infrastructure

- Furthermore, the high cost of certain advanced vaccines—particularly those targeting newer or less common diseases—limits accessibility for low-income populations and smallholder farmers. Subsidies, pooled procurement, and local manufacturing could help overcome these barriers

- While the region is witnessing increased external support and partnerships, local capacity-building and training of healthcare/veterinary staff remain essential for long-term sustainability and coverage expansion

- Overcoming these infrastructure and cost-related hurdles will be crucial for unlocking the full potential of the Middle East and Africa animal and human vaccines market and ensuring equitable access across all socio-economic groups

Middle East and Africa Animal and Human Vaccines Market Scope

The market is segmented on the basis of type, end user, and distribution channel.

- By Type

On the basis of type, the Middle East and Africa animal and human vaccines market is segmented into human and animal. The human segment dominated the largest market revenue share of 61.3% in 2024, driven by widespread government-led immunization programs, increasing healthcare expenditure, and growing awareness about vaccine-preventable diseases. Initiatives by organizations such as WHO and GAVI have further strengthened access to life-saving vaccines for populations across the region.

The animal segment is anticipated to witness the fastest growth rate of 7.9% CAGR from 2025 to 2032, fueled by rising demand for livestock immunization to prevent zoonotic outbreaks, ensure food security, and comply with international trade standards. The growth of pet ownership is also contributing to rising demand for companion animal vaccines.

- By End User

On the basis of end user, the Middle East and Africa animal and human vaccines market is segmented into hospitals, clinics, and others. The hospitals segment accounted for the largest market revenue share of 47.6% in 2024, owing to the central role of hospitals in government immunization campaigns, routine vaccination drives, and emergency response efforts during outbreaks.

The clinics segment is projected to register the fastest CAGR of 6.8% from 2025 to 2032, as private clinics and veterinary centers increasingly adopt comprehensive vaccination protocols. These settings are especially critical in expanding access to both human and animal vaccines in suburban and semi-urban areas.

- By Distribution Channel

On the basis of distribution channel, the Middle East and Africa animal and human vaccines market is segmented into direct tenders, retail sales, and others. The direct tenders segment held the largest market revenue share of 52.4% in 2024, primarily driven by bulk procurement through government contracts, international health agencies, and large public sector tenders

The retail sales segment is expected to witness the fastest growth rate of 7.3% CAGR from 2025 to 2032, owing to increased availability of vaccines through pharmacies, veterinary retail chains, and online platforms. This channel is particularly gaining traction in urban areas with high demand for convenience and accessibility

Middle East and Africa Animal and Human Vaccines Market Regional Analysis

- Middle East and Africa accounted for 17.4% of the global animal and human vaccines market revenue in 2024, driven by rising government immunization programs, increasing zoonotic disease outbreaks, and growing public awareness about the importance of vaccines for both humans and animals

- The region is witnessing a surge in vaccine demand due to expanding healthcare access, international support from organizations like WHO and Gavi, and the rising need for livestock protection to support food security

- Countries across the region are investing in improved cold chain infrastructure and local manufacturing capabilities to boost self-reliance and ensure equitable vaccine distribution

Saudi Arabia Middle East and Africa Animal and Human Vaccines Market Insight

The Saudi Arabia animal and human vaccines market captured the largest market revenue share within the Middle East at 23.5% in 2024, fueled by the government’s strategic Vision 2030 focus on healthcare and veterinary service modernization. High livestock density and food security initiatives have spurred demand for animal vaccines, while increasing investment in pediatric and adult immunization is driving growth in the human segment. The country is also strengthening R&D and regulatory frameworks to support local vaccine manufacturing.

U.A.E. Middle East and Africa Animal and Human Vaccines Market Insight

The U.A.E. animal and human vaccines market accounted for 17.8% of the MEA market in 2024, supported by high per capita health expenditure, growing pet ownership, and robust disease monitoring systems. The government’s push to establish a biotechnology and pharmaceutical hub is drawing investments into vaccine production and innovation. Human vaccine uptake is further bolstered by advanced public health infrastructure and strong demand for travel and adult vaccines.

South Africa Middle East and Africa Animal and Human Vaccines Market Insight

The South animal and human vaccines market held a substantial market share of 21.4% in 2024, driven by strong public-sector immunization programs and high awareness of zoonotic disease threats. Its veterinary vaccine market is well established, supporting both domestic livestock needs and regional exports. The government's emphasis on healthcare access and national vaccine campaigns ensures a high human vaccine penetration rate, particularly among infants and young children.

Egypt Middle East and Africa Animal and Human Vaccines Market Insight

The Egypt animal and human vaccines market accounted for 14.7% of the MEA Animal and Human Vaccines market in 2024. The country has seen a surge in demand for poultry and livestock vaccines, particularly in response to avian influenza and foot-and-mouth disease outbreaks. Government efforts to enhance routine immunization coverage and expand rural outreach are driving the human vaccines segment. Egypt is also investing in domestic vaccine manufacturing capacity to reduce import dependency.

Israel Middle East and Africa Animal and Human Vaccines Market Insight

The Israel animal and human vaccines market represented 9.2% of the regional market share in 2024, leveraging its advanced pharmaceutical and biotech industries. High vaccination coverage, particularly for childhood and seasonal vaccines, underpins strong human vaccine sales. Israel’s innovation ecosystem contributes to regional vaccine development, and the country maintains a growing market for veterinary vaccines for pets and livestock, supported by digital health monitoring platforms.

Middle East and Africa Animal and Human Vaccines Market Share

The Middle East and Africa animal and human vaccines industry is primarily led by well-established companies, including:

- GSK plc. (U.K.)

- Merck & Co., Inc. (U.S.)

- Sanofi (France)

- Boehringer Ingelheim International GmbH (Germany)

- Ceva Santé Animale (France)

- Onderstepoort Biological Products SOC (PTY) LTD (South Africa)

- M.C.I Santé Animale (Morocco)

- Biogénesis Bagó (Argentina)

- Hester Biosciences Limited (India)

Latest Developments in Middle East and Africa Animal and Human Vaccines Market

- In January 2023, Senvelgo, the recent innovation from Boehringer Ingelheim, has secured the prestigious Animal Health Best New Product for Companion Animals award. This accolade recognizes Senvelgo for its remarkable contribution to simplifying and enhancing the treatment of diabetic cats. Boehringer Ingelheim's commitment to innovation is evident in Senvelgo, offering a solution that is not only simple and safe but also highly convenient for both feline patients and their caregivers

- In 2023, Merck & Co., Inc. received approval from the U.S. Food and Drug Administration (FDA) for KEYTRUDA, its anti-PD-1 therapy, in combination with chemoradiotherapy (CRT) for treating patients with FIGO 2014 Stage III-IVA cervical cancer. This approval is based on positive results from the Phase 3 KEYNOTE-A18 trial, where KEYTRUDA combined with CRT showed a 41% reduction in the risk of disease progression or death compared to a placebo plus CRT. The median progression-free survival (PFS) was not reached in either group. This marks the third indication for KEYTRUDA in cervical cancer, emphasizing its effectiveness, and it is the 39th overall indication for KEYTRUDA in the United States. This milestone underscores Merck's commitment to advancing treatment options for patients with various types of cancer

- In July 2023, Biogenesis Bago announced BIOAFTOGEN under the Food and Agriculture Organization of the United Nations (FAO). This marks a historic moment as BIOAFTOGEN becomes the first FMD vaccine to receive such prequalification. This achievement enhances the company´s position as a global leader in FMD prevention and reinforces its commitment to collaboration with leading technical and scientific organizations, contributing to food safety and animal health status worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.