Middle East And Africa Animal Feed Organic Trace Minerals Market

Market Size in USD Million

CAGR :

%

USD

78.38 Million

USD

127.94 Million

2024

2032

USD

78.38 Million

USD

127.94 Million

2024

2032

| 2025 –2032 | |

| USD 78.38 Million | |

| USD 127.94 Million | |

|

|

|

|

Middle East and Africa Animal Feed Organic Trace Minerals Market Size

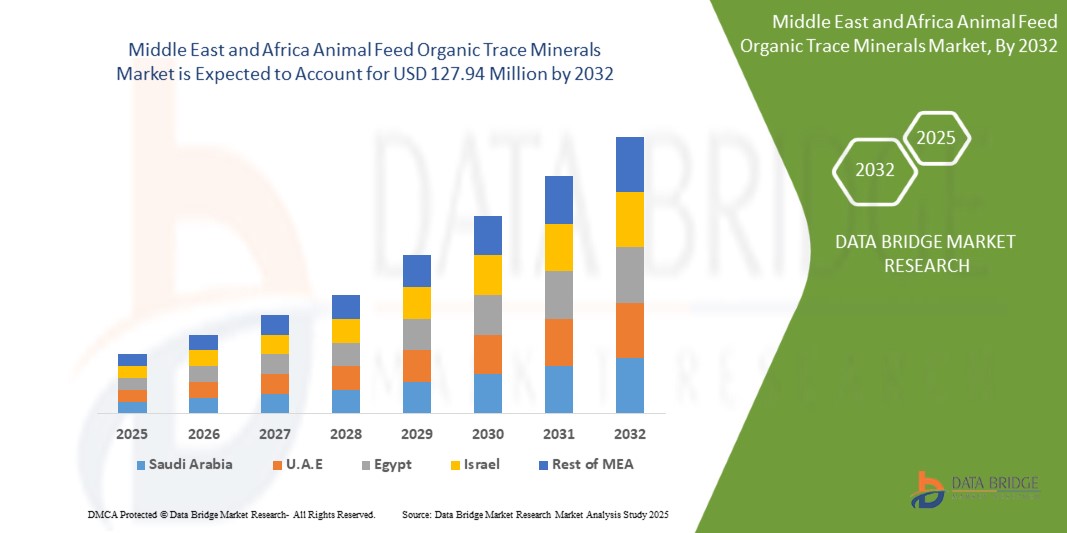

- The Middle East and Africa Animal Feed Organic Trace Minerals Market was valued at USD 78.38 million in 2024 and is expected to reach USD 127.94 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.42%, primarily driven by rising demand in rising demand for nutrient-enriched animal-derived food products and increased focus on improving livestock health

- This growth is driven by factors such as the productivity and growing shift toward organic and sustainable feed additives and government regulations limiting use of synthetic feed components

Middle East and Africa Animal Feed Organic Trace Minerals Market Analysis

- The Middle East and Africa Animal Feed Organic Trace Minerals Market in the Middle East and Africa is witnessing steady growth, driven by rising demand for nutritionally fortified livestock feed and improved animal productivity. These minerals—such as zinc, copper, manganese, and iron—are chelated or protein-bound, offering superior bioavailability compared to inorganic counterparts. Their role in enhancing immunity, reproduction, and feed efficiency is gaining prominence across commercial poultry, swine, and ruminant farming sectors. However, challenges persist in standardizing formulations, ensuring traceability, and balancing mineral levels to prevent toxicity or environmental runoff.

- The livestock industry’s shift toward performance-enhancing and sustainable feed additives is a primary driver, especially as producers seek alternatives to Antibiotic Growth Promoters (AGPs). Organic trace minerals support gut health, skeletal development, and immune modulation, aligning with the region’s growing emphasis on animal welfare and productivity. Regulatory changes and a rising preference for sustainable farming practices are further accelerating the adoption of organic mineral supplements.

- South Africa dominates the Middle East and Africa market, supported by its well-established poultry and ruminant sectors, increasing adoption of sustainable feed solutions, and rising demand for high-quality animal protein. Growing investments in modern feed technologies and the use of organic trace minerals to improve feed conversion ratios and reduce environmental impact are strengthening South Africa’s leading position.

- Market players are focusing on advanced chelation technologies to enhance mineral absorption and minimize excretion. Product innovation is centered on species-specific formulations, encapsulation methods, and integration with functional additives like probiotics and enzymes. Strengthening traceability and compliance with international feed quality standards will be key for maintaining competitiveness and meeting rising demand across the region.

Report Scope and Middle East and Africa Animal Feed Organic Trace Minerals Market Segmentation

|

Attributes |

Middle East and Africa Animal Feed Organic Trace Minerals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Animal Feed Organic Trace Minerals Market Trends

Precision Nutrition and Sustainable Mineral Sourcing in Livestock Feed

- One prominent trend in the Middle East and Africa Animal Feed Organic Trace Minerals Market is the growing focus on precision nutrition and the adoption of sustainably sourced mineral formulations tailored to species-specific dietary requirements

- The market is witnessing increased demand for chelated and proteinate trace minerals due to their superior bioavailability, reduced environmental excretion, and improved animal performance. This shift is driven by rising concerns over feed efficiency, animal health, and the ecological footprint of livestock operations

- For example, in 2024, Zinpro Corporation launched a new line of species-optimized organic mineral blends that improve absorption rates while lowering environmental impact. These products are developed using Life Cycle Assessment (LCA) methodologies and are aligned with Middle East and Africa sustainability standards such as the FAO’s LEAP guidelines

- Major players are integrating data-driven formulation technologies—leveraging feed intake monitoring, growth modeling, and health analytics—to deliver precision mineral dosing. Simultaneously, there is increasing emphasis on responsible mineral sourcing practices, such as traceable supply chains, ethical mining certifications (e.g., IRMA), and carbon-neutral manufacturing processes

- With regulatory bodies and end-users demanding traceability and environmental compliance, organic trace mineral producers are focusing on clean-label feed additives, third-party sustainability audits, and ESG-aligned reporting, helping them build competitive differentiation and long-term buyer trust in international markets

Middle East and Africa Animal Feed Organic Trace Minerals Market Dynamics

Driver

Rising demand for nutrient-enriched animal-derived food products

- One of the primary drivers fueling the Middle East and Africa Animal Feed Organic Trace Minerals Market is the rising demand for nutrient-enriched animal-derived food products, including fortified meat, milk, and eggs. As consumers worldwide become increasingly health-conscious, there is greater emphasis on the nutritional quality and functional benefits of animal-based foods

- Organic trace minerals—such as chelated zinc, copper, selenium, and manganese—contribute to higher nutrient density in animal-derived products by enhancing mineral absorption and retention in livestock. This supports improved meat quality, milk composition, and egg nutrient content, aligning with consumer demand for healthier, value-added food options

- Growing awareness of micronutrient deficiencies in human diets has prompted livestock producers and feed manufacturers to optimize feed formulations with organic minerals, which are more bioavailable than their inorganic counterparts and ensure better transfer of essential nutrients through the food chain

- As Middle East and Africa markets increasingly prioritize food security, nutrition, and sustainability, the use of organic trace minerals in animal feed is becoming a key strategy to improve animal health, enhance product quality, and meet evolving dietary and regulatory standards—ultimately driving long-term market growth across regions.

Opportunity

Technological advancements in chelation and micro-encapsulation

- New chelation methods are enabling stronger bonding of minerals with amino acids and organic ligands, which significantly enhances bioavailability and absorption in livestock. This ensures more efficient nutrient utilization compared to traditional inorganic forms

- Micro-encapsulation technologies are being increasingly adopted to protect trace minerals from degradation during feed processing and digestion. These innovations enable controlled release and targeted delivery at the absorption site

- Advanced encapsulation systems are also allowing the combination of minerals with other functional additives, such as probiotics and vitamins, creating multi-nutrient delivery platforms tailored to specific species needs

- These technological improvements not only boost feed efficiency and animal performance but also reduce mineral wastage and environmental runoff, aligning with sustainability and regulatory requirements in modern animal agriculture

- Companies investing in validated chelation processes and next-generation encapsulation platforms are gaining competitive advantages by offering more consistent performance, compliance with quality standards, and eco-friendly solutions

Restraint/Challenge

Balancing Nutrition with Affordability

- One of the primary challenges restraining the growth of the Middle East and Africa Animal Feed Organic Trace Minerals Market is the difficulty in balancing high-performance nutrition with cost-effectiveness. While organic trace minerals offer superior bioavailability and animal health benefits, their higher production and formulation costs limit accessibility, especially in developing regions.

- Feed manufacturers and livestock producers often face pricing pressure to keep overall feed costs competitive. As a result, the adoption of premium organic minerals is sometimes deprioritized in favor of more affordable inorganic alternatives, even at the expense of long-term animal productivity and environmental efficiency.

- Small- and medium-scale producers, in particular, struggle to absorb the additional costs associated with organic mineral inclusion, despite the potential return on investment through improved feed conversion ratios, immunity, and reproductive performance.

- Volatility in raw material costs, coupled with limited local production capacity in certain regions, further complicates the pricing dynamics—forcing manufacturers to make trade-offs between nutritional quality and economic viability in feed formulations.

- Until cost optimization technologies become more widespread and the value proposition is better communicated across the supply chain, affordability will remain a critical barrier to the large-scale adoption of organic trace minerals in Middle East and Africa animal nutrition strategies.

Middle East and Africa Animal Feed Organic Trace Minerals Market Scope

The Middle East and Africa Animal Feed Organic Trace Minerals Market is segmented into six notable segments based on product, form, chelate type, life cycle, application, and livestock.

• By Product

On the basis of product, the Middle East and Africa Animal Feed Organic Trace Minerals Market is segmented into calcium, phosphorus, magnesium, sodium, chloride, sulfur, potassium, zinc, iron, copper, iodine, cobalt, manganese, selenium, chromium, molybdenum, and others. In 2025, the calcium segment is projected to dominate with a market share of 17.32%, owing to its critical role in bone development, eggshell formation, and muscle function in livestock. Widespread use across poultry, swine, and ruminants supports its strong share.

Calcium is anticipated to gain traction with the CAGR of 7.75% during the forecast period of 2025 to 2032, driven by their essential roles in immunity and reproduction. Their growing adoption in precision nutrition programs positions them as key contributors to long-term market growth.

• By Form

On the basis of form, the market is categorized into dry and liquid. In 2025, the dry segment is expected to dominate with a market share of 85.56%, largely due to its ease of storage, handling, and incorporation into compound feed formulations. Dry forms also ensure greater stability during feed processing and transportation.

The dry segment is projected to expand steadily with a CAGR of 6.51% as it gains popularity in intensive farming practices, particularly in poultry and aquaculture.

• By Chelate Type

On the basis of chelate type, the market is segmented into proteinate, amino acid complex, polysaccharide complex (Zn chelate), copper chelate, magnesium chelates, and others. In 2025, the proteinate segment is forecasted to dominate with a market share of 34.83%, attributed to its superior bioavailability and efficiency in delivering minerals directly bound to proteins or amino acids. Their proven effectiveness in enhancing animal growth, reproduction, and immunity sustains their demand.

The proteinate segment is likely to witness accelerated growth of 7.27% during the forecast period, supported by innovations in chelation technology that improve mineral stability and absorption.

• By Life Cycle

On the basis of life cycle, the market is segmented into grower feed, finisher feed, starter feed, and brooder feed. In 2025, the grower feed segment is projected to dominate with a market share of 43.88%, driven by the crucial role of trace minerals in promoting optimal weight gain, muscle development, and metabolic efficiency during the growth phase of livestock.

The grower feed segment is gaining importance and growing with the CAGR of 6.90% due to rising demand for optimized weight gain, muscle development, and feed efficiency during the critical growth phase of livestock.

• By Application

On the basis of application, the market is segmented into growth promotion, disease prevention, fertility enhancement, performance optimization, and others. In 2025, the growth promotion segment is anticipated to dominate with a market share of 35.50%, supported by rising Middle East and Africa demand for higher meat and dairy yields. Producers are increasingly shifting to mineral supplementation as a sustainable alternative to antibiotic growth promoters.

The growth promotion segment is expected to grow at a CAGR of 7.15%, riven by the rising demand for higher meat and dairy yields, improved feed efficiency, and the shift toward sustainable alternatives to antibiotic growth promoters.

• By Livestock

On the basis of livestock, the market is segmented into ruminants, poultry, swine, aquaculture, pets, equine, and others. In 2025, the ruminant’s segment is projected to lead with a market share of 32.22%, owing to the large Middle East and Africa cattle population and the critical role of trace minerals in milk production, fertility, and disease resistance.

The ruminant’s segment is anticipated to record the fastest growth of 7.60% during 2025 to 2032, driven by the increasing Middle East and Africa demand for milk and beef, along with the adoption of chelated minerals to enhance fertility, immunity, and feed efficiency in cattle and other ruminants.

Middle East & Africa Middle East and Africa Animal Feed Organic Trace Minerals Market – Regional Analysis

- The Middle East & Africa market is expected to expand steadily, driven by rising demand for sustainable livestock production, increasing investments in modern feed manufacturing, and growing awareness of animal nutrition benefits

- Adoption of organic trace minerals is supported by efforts to improve feed efficiency, enhance animal health, and reduce environmental impact, particularly in regions with intensifying poultry and dairy production

- South Africa dominates the regional market, supported by its advanced livestock sector, expanding poultry and beef industries, and rising consumer preference for high-quality and traceable animal products

South Africa Middle East and Africa Animal Feed Organic Trace Minerals Market Insight

South Africa represents the leading market for organic trace minerals in the Middle East & Africa, supported by its advanced livestock sector and well-established poultry and beef industries. The country’s modern feed manufacturing infrastructure, growing adoption of precision nutrition, and rising emphasis on animal health and productivity drive demand. Increasing consumer preference for high-quality, traceable, and antibiotic-free animal products, along with industry initiatives to enhance feed efficiency and reduce nutrient excretion, further strengthen South Africa’s market position.

Saudi Arabia Middle East and Africa Animal Feed Organic Trace Minerals Market Insight

Saudi Arabia is emerging as a key market in the Middle East, driven by government investments in food security, self-sufficiency, and livestock farming modernization. The country’s strong focus on poultry and dairy production, coupled with supportive policies to reduce dependence on imports, is accelerating the adoption of organic trace minerals. Rising consumer demand for premium-quality meat and dairy, advancements in feed production technologies, and initiatives promoting sustainable livestock practices further enhance market growth in Saudi Arabia.

The Major Market Leaders Operating in the Market Are:

- ADM (U.S)

- Nutreco (Netherlands)

- Adisseo (France)

- Novus International, Inc. (U.S)

- Alltech (U.S)

- dsm-firmenich (Switzerland)

- Phibro Animal Health Corporation (U.S)

- Cargill, Incorporated (U.S)

- BASF (Germany)

- Zinpro (U.S)

- Biochem Zusatzstoffe Handels- und Produktionsgesellschaft mbH (Germany)

Latest Developments in Middle East and Africa Animal Feed Organic Trace Minerals Market

- In July 2025, Adisseo announced the upcoming launch of a new MetaSmart production facility, expected in late H2 2025, to meet the growing needs of the global dairy industry. This capacity expansion will bolster Adisseo’s ability to supply protected methionine, crucial for ruminant nutrition. The development supports the company’s strategic focus on sustainable dairy production and enhances its global supply reliability

- In February 2023, Adisseo announced the acquisition of Nor-Feed, a company specializing in natural plant-based additives for animal nutrition. This strategic move strengthens Adisseo’s portfolio in specialty feed ingredients and enhances its position in the sustainable and natural additives segment. The acquisition supports Adisseo’s innovation strategy and growth in the functional feed market

- In April 2025, NOVUS International expanded its presence in the Asian market by supporting Vietnam’s swine and poultry industries through targeted nutritional solutions and technical services. This initiative strengthens NOVUS’s regional market engagement, boosts brand visibility, and fosters customer loyalty. By addressing local production challenges with its key offerings—such as methionine supplements, enzyme feed additives, and gut health solutions—NOVUS enhances its market positioning and drives the adoption of its animal nutrition innovations across Vietnam

- In May 2025, At the FENAVI Valle event, NOVUS highlighted its ongoing commitment to unlocking soybean efficiency and promoting sustainable agricultural solutions. By showcasing their innovative approaches to enhancing crop yield and minimizing environmental impact, NOVUS underscored its leadership in the sector. Their contributions to the discussion on sustainable farming practices not only reinforce their role as industry pioneers but also align with Middle East and Africa efforts to increase food security and reduce resource use. This engagement positions NOVUS as a key player in the agri-tech space, enhancing its reputation and potential for long-term growth by tapping into the growing demand for eco-friendly farming solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 PATENT ANALYSIS

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 REGIONAL PATENT LANDSCAPE

4.2.4 IP STRATEGY AND MANAGEMENT

4.2.5 CONCLUSION

4.3 PRICING ANALYSIS

4.4 RAW MATERIAL COVERAGE – MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET

4.4.1 PRIMARY MINERAL SOURCES

4.4.2 ORGANIC LIGANDS AND CHELATING AGENTS

4.4.3 AUXILIARY ADDITIVES AND PROCESSING INPUTS

4.4.4 SOURCING TRENDS AND SUPPLY CHAIN CONSIDERATIONS

4.4.5 CONCLUSION

4.5 COMPANY EVALUATION QUADRANT

4.6 IMPORT EXPORT SCENARIO

4.6.1 IMPORT DATA SETS

4.6.2 EXPORT DATA SETS

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.7.1 PRODUCTION

4.7.2 CONSUMPTION

4.8 IMPORT EXPORT SCENARIO

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS.

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.9.1.1 JOINT VENTURES

4.9.1.2 MERGERS AND ACQUISITIONS

4.9.1.3 LICENSING AND PARTNERSHIPS

4.9.1.4 TECHNOLOGY COLLABORATIONS

4.9.2 PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 COST ANALYSIS BREAKDOWN

4.10.1 RAW MATERIAL COSTS (40%–55% OF TOTAL COST)

4.10.2 PROCESSING AND MANUFACTURING COSTS (20%–30%)

4.10.3 REGULATORY COMPLIANCE AND QUALITY CONTROL (5%–10%)

4.10.4 PACKAGING, LABELING, AND LOGISTICS (5%–8%)

4.10.5 RESEARCH AND DEVELOPMENT (3%–6%)

4.10.6 MARKETING, SALES, AND DISTRIBUTION (2%–5%)

4.10.7 ADMINISTRATIVE AND OVERHEAD COSTS (5%–8%)

4.11 BRAND OUTLOOK

4.12 SUPPLY CHAIN ANALYSIS

4.12.1 OVERVIEW

4.12.2 LOGISTIC COST SCENARIO

4.12.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.13 VALUE CHAIN ANALYSIS

4.13.1 RAW MATERIAL SUPPLIERS: THE BASIS OF BIOAVAILABILITY

4.13.2 ORGANIC TRACE MINERAL MANUFACTURERS: CREATING HIGH-PERFORMANCE NUTRITIONAL INPUTS

4.13.3 PREMIX AND FEED MANUFACTURERS: INTEGRATING NUTRITION INTO THE DAILY DIET

4.13.4 DISTRIBUTORS AND SUPPLY CHAIN PARTNERS: ENSURING ACCESSIBILITY AND EFFICIENCY

4.13.5 LIVESTOCK PRODUCERS AND END-USERS: THE DRIVERS OF NUTRITIONAL DEMAND

4.13.6 REGULATORY AGENCIES AND COMPLIANCE FRAMEWORKS: SHAPING MARKET PRACTICES

4.13.7 RESEARCH INSTITUTIONS AND INDUSTRY ASSOCIATIONS: CATALYSTS FOR SCIENTIFIC ADVANCEMENT

4.14 TECHNOLOGICAL ADVANCEMENTS

4.14.1 CHELATION AND COMPLEXATION TECHNOLOGIES

4.14.2 ENCAPSULATION & CONTROLLED-RELEASE DELIVERY SYSTEMS

4.14.3 NANOTECHNOLOGY IN TRACE MINERALS

4.14.4 FERMENTATION-BASED MINERAL PRODUCTION

4.14.5 PRECISION NUTRITION AND AI-DRIVEN FORMULATION TOOLS

4.14.6 SUSTAINABILITY-FOCUSED INNOVATIONS

4.14.7 DIGITAL TRACEABILITY & BLOCKCHAIN INTEGRATION

4.14.8 USE OF IOT AND SENSORS IN MINERAL EFFICACY MONITORING

4.14.9 DEVELOPMENT OF MINERAL BLENDS WITH FUNCTIONAL ADDITIVES

4.14.10 ADVANCED QUALITY CONTROL AND ANALYTICAL TESTING

4.15 VENDOR SELECTION CRITERIA.

4.15.1 PRODUCT QUALITY AND CERTIFICATION

4.15.2 MANUFACTURING CAPABILITIES

4.15.3 RESEARCH AND DEVELOPMENT (R&D) AND INNOVATION

4.15.4 REGULATORY COMPLIANCE AND TRACEABILITY

4.15.5 SUPPLY CHAIN RELIABILITY

4.15.6 PRICING AND COMMERCIAL TERMS

4.15.7 PACKAGING AND LOGISTICS

4.15.8 TECHNICAL SUPPORT AND ADVISORY SERVICES

4.15.9 SUSTAINABILITY AND ESG PRACTICES

4.15.10 REPUTATION AND CLIENT REFERENCES

4.15.11 DOCUMENTATION AND LEGAL COMPLIANCE

4.15.12 CUSTOMER RELATIONSHIP MANAGEMENT

4.16 TARIFFS & IMPACT ON THE MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET

4.16.1 TARIFF LANDSCAPE: APPLICABLE DUTIES ON ORGANIC TRACE MINERAL INPUTS AND FINISHED PREMIXES

4.16.2 IMPACT OF TARIFFS ON COST AND SUPPLY CHAIN DYNAMICS

4.16.3 INFLUENCE OF TRADE POLICIES AND GEOPOLITICAL DEVELOPMENTS

4.16.4 MARKET TRENDS AMPLIFYING TARIFF IMPACT

4.16.5 COMPETITIVE IMPLICATIONS FOR MARKET PLAYERS

4.16.6 CHALLENGES AND OPPORTUNITIES ARISING FROM TARIFFS

4.16.7 KEY PLAYERS

4.16.8 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR NUTRIENT-ENRICHED ANIMAL-DERIVED FOOD PRODUCTS

6.1.2 INCREASED FOCUS ON IMPROVING LIVESTOCK HEALTH AND PRODUCTIVITY

6.1.3 GROWING SHIFT TOWARD ORGANIC AND SUSTAINABLE FEED ADDITIVES

6.1.4 GOVERNMENT REGULATIONS LIMITING USE OF SYNTHETIC FEED COMPONENTS

6.2 RESTRAINTS

6.2.1 HIGHER PRODUCTION AND FORMULATION COSTS OF ORGANIC TRACE MINERALS

6.2.2 LIMITED FARMER AWARENESS IN LOW-INCOME OR RURAL LIVESTOCK MARKETS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN CHELATION AND MICRO-ENCAPSULATION

6.3.2 GROWING FOCUS ON PRECISION NUTRITION AND CUSTOMIZED FORMULATIONS

6.3.3 EXPANSION OF THE AQUAFEED MARKET

6.4 CHALLENGES

6.4.1 BALANCING NUTRITION WITH AFFORDABILITY

6.4.2 COMPETITION FROM CONVENTIONAL INORGANIC MINERALS

7 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CALCIUM

7.3 PHOSPHOROUS

7.4 MAGNESIUM

7.5 SODIUM

7.6 CHLORIDE

7.7 SULFUR

7.8 POTASSIUM

7.9 ZINC

7.1 IRON

7.11 COPPER

7.12 IODINE

7.13 COBALT

7.14 MANGANESE

7.15 SELENIUM

7.16 CHROMIUM

7.17 MOLYBDENUM

7.18 OTHERS

8 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM

8.1 OVERVIEW

8.2 DRY

8.3 LIQUID

9 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE

9.1 OVERVIEW

9.2 PROTEINATE

9.3 AMINO-ACID COMPLEX

9.4 POLYSACCHARIDE COMPLEX (ZN CHELATE)

9.5 COPPER CHELATE

9.6 MAGNESIUM CHELATE

9.7 OTHERS

10 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE

10.1 OVERVIEW

10.2 GROWER FEED

10.3 FINISHER FEED

10.4 STARTER FEED

10.5 BROODER FEED

11 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 GROWTH PROMOTION

11.3 DISEASE PREVENTION

11.4 FERTILITY ENHANCEMENT

11.5 PERFORMANCE OPTIMIZATION

11.6 OTHERS

12 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK

12.1 OVERVIEW

12.2 RUMINANTS

12.3 POULTRY

12.4 SWINE

12.5 AQUACULTURE

12.6 PETS

12.7 EQUINE

12.8 OTHERS

13 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 EGYPT

13.1.4 U.A.E.

13.1.5 ISRAEL

13.1.6 KUWAIT

13.1.7 OMAN

13.1.8 QATAR

13.1.9 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 RECENT FINANCIALS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 NUTRECO

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 ADISSEO

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 NOVUS INTERNATIONAL, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 ALLTECH

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 BASF

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS/NEWS

16.7 BIOCHEM ZUSATZSTOFFE HANDELS- UND PRODUKTIONSGESELLSCHAFT MBH

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CARGILL, INCORPORATED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DSM-FIRMENICH

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 PHIBRO ANIMAL HEALTH CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS/NEWS

16.11 ZINPRO

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 TIMELINES AND MILESTONES

TABLE 2 RISK ASSESSMENT AND MITIGATION

TABLE 3 BRAND OUTLOOK: ANIMAL FEED ORGANIC TRACE MINERALS MARKET

TABLE 4 REGULATORY COVERAGE

TABLE 5 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND TON)

TABLE 7 MIDDLE EAST AND AFRICA CALCIUM ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA PHOSPHOROUS ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA MAGNESIUM ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA SODIUM ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA CHLORIDE ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA SULFUR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA POTASSIUM ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA ZINC ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA IRON ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA COPPER ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA IODINE ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA COBALT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA MANGANESE ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA SELENIUM ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA CHROMIUM ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA MOLYBDENUM ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA OTHERS ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 26 MIDDLE EAST AND AFRICA DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA LIQUID IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 32 MIDDLE EAST AND AFRICA PROTEINATE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA AMINO-ACID COMPLEX IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA POLYSACCHARIDE COMPLEX (ZN CHELATE) IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA COPPER CHELATE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA MAGNESIUM CHELATE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TON)

TABLE 40 MIDDLE EAST AND AFRICA GROWER FEED IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA FINISHER FEED IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA STARTER FEED IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA BROODER FEED IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 46 MIDDLE EAST AND AFRICA GROWTH PROMOTION IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA DISEASE PREVENTION IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA FERTILITY ENHANCEMENT IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PERFORMANCE OPTIMIZATION IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 53 MIDDLE EAST AND AFRICA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY COUNTRY, 2018-2032 (THOUSAND TONS)

TABLE 77 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 79 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 81 MIDDLE EAST AND AFRICA DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 85 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 87 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 89 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 91 MIDDLE EAST AND AFRICA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 108 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 110 SOUTH AFRICA DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH AFRICA POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 114 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 115 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 116 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 118 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 119 SOUTH AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 120 SOUTH AFRICA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SOUTH AFRICA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 122 SOUTH AFRICA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH AFRICA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH AFRICA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SOUTH AFRICA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH AFRICA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SOUTH AFRICA CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH AFRICA FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SOUTH AFRICA MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH AFRICA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 SOUTH AFRICA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH AFRICA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH AFRICA EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH AFRICA OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 137 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 139 SAUDI ARABIA DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 143 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 144 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 145 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 147 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 148 SAUDI ARABIA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 149 SAUDI ARABIA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SAUDI ARABIA RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 151 SAUDI ARABIA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SAUDI ARABIA POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 153 SAUDI ARABIA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 155 SAUDI ARABIA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SAUDI ARABIA FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SAUDI ARABIA AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 160 SAUDI ARABIA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SAUDI ARABIA PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 162 SAUDI ARABIA EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 163 SAUDI ARABIA OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 164 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 165 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 166 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 167 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 168 EGYPT DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 172 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 174 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 176 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 177 EGYPT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 178 EGYPT RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 EGYPT RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 180 EGYPT POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 EGYPT POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 182 EGYPT SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 EGYPT SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 184 EGYPT AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 EGYPT CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 EGYPT FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 EGYPT MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 EGYPT AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 189 EGYPT PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 EGYPT PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 191 EGYPT EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 192 EGYPT OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 193 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 194 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 195 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 196 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 197 U.A.E. DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 U.A.E. POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 201 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 202 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 203 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 205 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 206 U.A.E. ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 207 U.A.E. RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 U.A.E. RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 209 U.A.E. POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 U.A.E. POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 211 U.A.E. SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 U.A.E. SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 213 U.A.E. AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 U.A.E. CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 U.A.E. FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 U.A.E. MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 U.A.E. AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 218 U.A.E. PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 U.A.E. PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 220 U.A.E. EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 221 U.A.E. OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 222 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 223 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 224 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 225 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 226 ISRAEL DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ISRAEL POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 230 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 231 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 232 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 233 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 234 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 235 ISRAEL ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 236 ISRAEL RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 ISRAEL RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 238 ISRAEL POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 ISRAEL POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 240 ISRAEL SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 ISRAEL SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 242 ISRAEL AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 ISRAEL CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 ISRAEL FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 ISRAEL MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 ISRAEL AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 247 SRAEL PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 ISRAEL PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 249 ISRAEL EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 250 ISRAEL OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 251 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 252 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 253 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 254 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 255 KUWAIT DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 KUWAIT POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 259 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 260 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 261 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 262 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 263 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 264 KUWAIT ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 265 KUWAIT RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 KUWAIT RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 267 KUWAIT POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 KUWAIT POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 269 KUWAIT SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 KUWAIT SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 271 KUWAIT AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 KUWAIT CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 KUWAIT FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 KUWAIT MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 KUWAIT AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 276 KUWAIT PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 KUWAIT PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 278 KUWAIT EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 279 KUWAIT OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 280 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 281 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 282 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 283 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 284 OMAN DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 OMAN POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 288 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 289 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 290 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 291 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 292 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 293 OMAN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 294 OMAN RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 OMAN RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 296 OMAN POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 OMAN POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 298 OMAN SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 OMAN SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 300 OMAN AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 OMAN CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 OMAN FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 OMAN MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 OMAN AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 305 OMAN PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 OMAN PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 307 OMAN EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 308 OMAN OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 309 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 310 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 311 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 312 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 313 QATAR DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 QATAR POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 317 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 318 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 319 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 320 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 321 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 322 QATAR ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 323 QATAR RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 QATAR RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 325 QATAR POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 QATAR POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 327 QATAR SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 QATAR SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 329 QATAR AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 QATAR CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 QATAR FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 QATAR MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 QATAR AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 334 QATAR PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 QATAR PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 336 QATAR EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 337 QATAR OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 338 BAHRAIN

TABLE 339 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 340 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

TABLE 341 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 342 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 343 BAHRAIN DRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 BAHRAIN POWDER IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY CHELATE TYPE, 2018-2032 (THOUSAND TONS)

TABLE 347 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (USD THOUSAND)

TABLE 348 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIFE CYCLE, 2018-2032 (THOUSAND TONS)

TABLE 349 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 350 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY APPLICATION, 2018-2032 (THOUSAND TONS)

TABLE 351 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (USD THOUSAND)

TABLE 352 BAHRAIN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY LIVESTOCK, 2018-2032 (THOUSAND TONS)

TABLE 353 BAHRAIN RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 BAHRAIN RUMINANTS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 355 BAHRAIN POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 BAHRAIN POULTRY IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 357 BAHRAIN SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 BAHRAIN SWINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 359 BAHRAIN AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 BAHRAIN CRUSTACEANS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 BAHRAIN FISH IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 BAHRAIN MOLLUSKS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 BAHRAIN AQUACULTURE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 364 BAHRAIN PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 BAHRAIN PETS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 366 BAHRAIN EQUINE IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 367 BAHRAIN OTHERS IN ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 368 REST OF MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 369 REST OF MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT, 2018-2032 (THOUSAND TONS)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET

FIGURE 2 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: SEGMENTATION

FIGURE 12 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: EXECUTIVE SUMMARY

FIGURE 13 SEVENTEEN SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET, BY PRODUCT (2024)

FIGURE 14 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR NUTRIENT-ENRICHED ANIMAL-DERIVED FOOD PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE CALCIUM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 NUMBER OF PATENTS V/S YEAR

FIGURE 19 NUMBER OF PATENTS PER APPLICANT

FIGURE 20 COUNTRY V/S NUMBER OF PATENTS

FIGURE 21 PRICING ANALYSIS

FIGURE 22 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 23 DROC ANALYSIS

FIGURE 24 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: BY PRODUCT, 2024

FIGURE 25 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: BY FORM, 2024

FIGURE 26 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: BY CHELATE TYPE, 2024

FIGURE 27 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: BY LIFE CYCLE, 2024

FIGURE 28 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: BY APPLICATION, 2024

FIGURE 29 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: BY LIVESTOCK, 2024

FIGURE 30 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: SNAPSHOT (2024)

FIGURE 31 MIDDLE EAST AND AFRICA ANIMAL FEED ORGANIC TRACE MINERALS MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Animal Feed Organic Trace Minerals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Animal Feed Organic Trace Minerals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Animal Feed Organic Trace Minerals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.