Middle East And Africa Artificial Blood Substitutes Market

Market Size in USD Million

CAGR :

%

USD

1.03 Million

USD

5.64 Million

2025

2033

USD

1.03 Million

USD

5.64 Million

2025

2033

| 2026 –2033 | |

| USD 1.03 Million | |

| USD 5.64 Million | |

|

|

|

|

Middle East and Africa Artificial Blood Substitutes Market Size

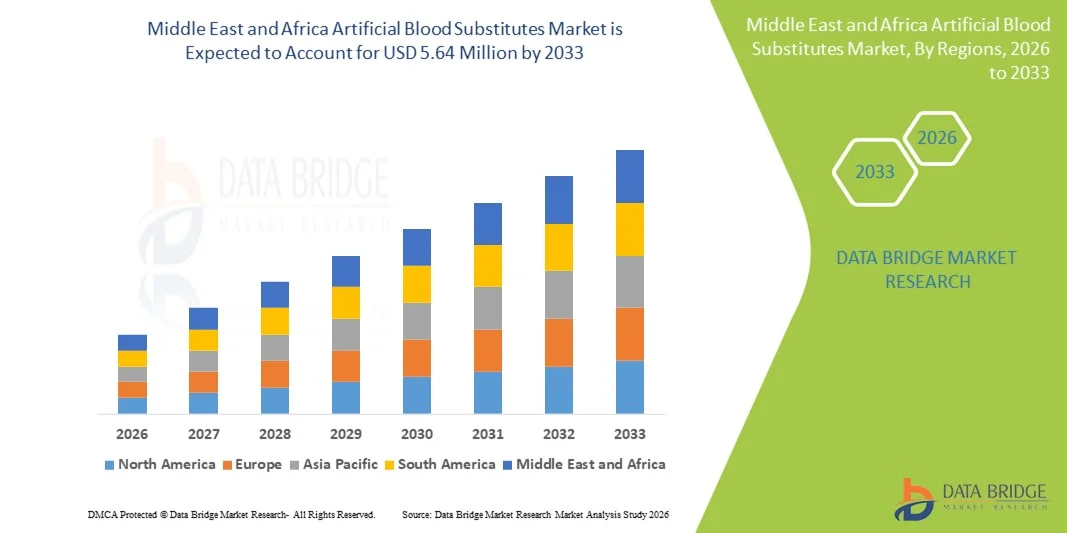

- The Middle East and Africa artificial blood substitutes market size was valued at USD 1.03 million in 2025 and is expected to reach USD 5.64 million by 2033, at a CAGR of 23.7% during the forecast period

- The market growth is largely fueled by the increasing demand for alternatives to traditional blood transfusions, driven by shortages of donor blood, technological advances in oxygen therapeutics, and rising clinical applications in emergency and surgical care

- Furthermore, heightened investments in healthcare infrastructure across key countries such as South Africa, rising trauma cases, and growing awareness of artificial blood substitute benefits are accelerating adoption, positioning these solutions as critical components in advanced clinical settings and significantly boosting industry growth

Middle East and Africa Artificial Blood Substitutes Market Analysis

- Artificial blood substitutes, designed to carry oxygen and provide a temporary replacement for human blood, are becoming increasingly vital components of trauma care, surgical procedures, and emergency medical settings in both Middle Eastern and African countries due to their ability to address blood shortages, reduce transfusion risks, and improve patient outcomes

- The escalating demand for artificial blood substitutes is primarily fueled by rising awareness of their clinical benefits, technological advancements in oxygen therapeutics, increasing trauma and surgical cases, and expanding healthcare infrastructure across key countries in the region

- Saudi Arabia dominated the market with the largest revenue share of 28.5% in 2025, supported by investments in advanced medical facilities, government initiatives to improve healthcare delivery, and the presence of medical hubs facilitating adoption of novel therapeutics

- Nigeria is expected to be the fastest growing country in the market during the forecast period due to increasing trauma incidents, rising prevalence of chronic conditions requiring transfusion alternatives, and growing healthcare expenditure aimed at reducing dependency on donor blood

- Hemoglobin-based oxygen carriers (HBOCs) segment dominated the artificial blood substitutes market with a market share of 45.9% in 2025, driven by their proven efficacy in oxygen transport, compatibility with existing transfusion protocols, and ongoing clinical research supporting their safety and application in various medical emergencies

Report Scope and Middle East and Africa Artificial Blood Substitutes Market Segmentation

|

Attributes |

Middle East and Africa Artificial Blood Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Artificial Blood Substitutes Market Trends

Innovative Oxygen Therapeutics and Trauma Care Applications

- A significant and accelerating trend in the Middle East and Africa artificial blood substitutes market is the development of next-generation oxygen therapeutics and hemoglobin-based carriers, which enhance the safety and efficacy of blood transfusions

- For instance, Hemospan, a hemoglobin-based oxygen carrier, is being increasingly used in surgical procedures and emergency trauma care to maintain oxygenation when donor blood is unavailable

- Advanced formulations are also being designed to reduce side effects such as vasoconstriction and improve tissue oxygen delivery, increasing clinical adoption in hospitals and emergency medical services

- These innovations are facilitating broader adoption in critical care and battlefield medicine, positioning artificial blood substitutes as a strategic solution for blood supply shortages

- The trend toward safer, more efficient, and versatile oxygen therapeutics is reshaping clinician and hospital expectations, driving demand in both private and public healthcare settings

- Increasing partnerships between biotech companies and hospitals are accelerating product development and clinical adoption, enabling faster access to cutting-edge oxygen therapeutics

- For instance, collaborations in Saudi Arabia are focused on combining artificial blood substitutes with rapid transfusion devices, streamlining emergency care delivery

Middle East and Africa Artificial Blood Substitutes Market Dynamics

Driver

Rising Demand Due to Blood Shortages and Surgical Needs

- The increasing prevalence of trauma incidents, surgical procedures, and chronic conditions in Middle Eastern and African countries is a significant driver for the heightened demand for artificial blood substitutes

- For instance, in 2025, a South African hospital network adopted HBOC solutions to supplement scarce donor blood in high-risk surgical cases, demonstrating practical applications and improved patient outcomes

- As healthcare providers seek alternatives to traditional transfusions, artificial blood substitutes offer rapid oxygen delivery, longer shelf life, and reduced infection risks, providing a compelling clinical advantage. For instance, Saudi Arabian emergency services are integrating artificial blood substitutes into trauma response kits to address urgent oxygenation needs during transport

- Furthermore, government initiatives and private investments to enhance healthcare infrastructure and emergency care capabilities are further boosting adoption, particularly in countries with limited blood bank access

- The rising awareness of clinical benefits and increasing availability of artificial blood substitutes in hospitals and trauma centers are key factors propelling market growth across the region

- Expanding military and disaster response programs in the region are creating new opportunities for deployment of artificial blood substitutes in field operations

- For instance, UAE armed forces are exploring artificial blood substitutes to ensure rapid oxygen supply during battlefield emergencies

Restraint/Challenge

Regulatory and Safety Concerns Limit Adoption

- Concerns surrounding potential side effects, safety issues, and stringent regulatory approvals pose significant challenges to broader adoption of artificial blood substitutes

- For instance, early HBOC products faced reports of hypertension and organ toxicity, making some hospitals cautious in integrating them into standard transfusion protocols

- Addressing these concerns through rigorous clinical trials, quality control, and post-market surveillance is crucial for building clinician and patient confidence

- For instance, regulatory bodies in Saudi Arabia and South Africa require extensive safety validation before approving widespread use, prolonging time-to-market for new products

- In addition, the relatively high cost of advanced artificial blood substitutes compared to donor blood can hinder adoption, particularly in budget-constrained hospitals or developing regions

- Overcoming these challenges through improved safety profiles, streamlined regulatory pathways, and cost-effective production is essential for sustained market growth

- Limited awareness and training among healthcare professionals on artificial blood substitute usage can delay adoption in smaller hospitals and clinics

- For instance, targeted education programs in Nigeria are being developed to train clinicians on safe handling and administration of artificial blood products

Middle East and Africa Artificial Blood Substitutes Market Scope

The market is segmented on the basis of product type, source, application, and end user.

- By Product Type

On the basis of product type, the market is segmented into Perfluorocarbons (PFCs) and Hemoglobin-Based Oxygen Carriers (HBOCs). The HBOCs segment dominated the market with the largest revenue share of 45.9% in 2025, driven by their proven clinical efficacy in oxygen transport and wide acceptance in surgical, trauma, and emergency care. HBOCs provide rapid oxygen delivery, are compatible with standard transfusion protocols, and have a longer shelf life than donor blood, making them a preferred choice in hospitals and trauma centers. The segment also benefits from ongoing clinical research improving safety profiles and reducing adverse effects, which increases clinician confidence. Hospitals in Saudi Arabia and South Africa are early adopters, deploying HBOCs in high-risk surgeries and critical care units. The segment’s dominance is further reinforced by collaborations between manufacturers and healthcare providers to expand usage and accessibility. HBOCs’ versatility in multiple medical scenarios, from cardiovascular emergencies to battlefield care, solidifies their leading position in the region.

The Perfluorocarbons (PFCs) segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing adoption in neonatal care, organ transplantation, and emergency medicine. PFCs can dissolve and transport oxygen efficiently, making them suitable for patients with blood shortages or rare blood types. Their growth is supported by research initiatives in the UAE and Nigeria focusing on biocompatible PFC formulations with minimal side effects. Rising investments in emergency response capabilities and trauma care infrastructure are further driving the uptake of PFCs. The segment is also benefiting from growing awareness among healthcare professionals about PFCs as temporary blood substitutes in critical care. Enhanced production techniques and cost optimization are making PFCs more accessible, contributing to higher adoption rates in hospitals and specialty clinics.

- By Source

On the basis of source, the market is segmented into human blood, animal blood, microorganism-based recombinant hemoglobin (rHB), synthetic polymers, and stem cells. The human blood-based segment dominated the market in 2025, owing to its closer compatibility with human physiology and higher oxygen-carrying efficiency. Hospitals prefer human blood-derived artificial substitutes for critical care applications such as surgery and trauma, as they minimize immunogenic reactions and adverse responses. The segment is further supported by established regulatory approvals and clinical guidelines facilitating hospital adoption. Countries such as Saudi Arabia and South Africa lead usage due to advanced transfusion programs and availability of human blood derivatives for therapeutic use. The segment’s dominance is also enhanced by ongoing investments in donor-independent technologies, ensuring a reliable supply of human blood-derived substitutes. Continuous R&D efforts to improve safety, shelf life, and storage conditions further strengthen the segment’s market position.

The microorganism-based recombinant hemoglobin (rHB) segment is expected to witness the fastest growth during the forecast period, driven by advances in genetic engineering and synthetic biology that allow large-scale production of hemoglobin substitutes. rHB products offer lower immunogenicity and improved consistency compared to traditional animal or human blood-derived products. Countries such as UAE and Nigeria are investing in biotech manufacturing facilities to support domestic production, reducing dependence on imported substitutes. The segment’s growth is fueled by increasing clinical trials demonstrating safety and efficacy in surgeries, trauma care, and neonatal applications. Cost-effectiveness and scalability of rHB production enhance its adoption potential in hospitals and specialized clinics. Awareness campaigns highlighting rHB’s benefits are also contributing to faster acceptance among healthcare providers.

- By Application

On the basis of application, the market is segmented into cardiovascular diseases, malignant neoplasms, injuries, neonatal conditions, organ transplant, and maternal conditions. The injuries segment dominated the market in 2025, driven by the rising incidence of trauma, accidents, and conflict-related injuries across the region. Artificial blood substitutes provide immediate oxygenation and are critical in emergency response, especially in areas with limited blood supply. Hospitals and emergency care units in South Africa, Nigeria, and Saudi Arabia rely on artificial blood substitutes to stabilize patients during transport and surgery. The segment’s dominance is further supported by government initiatives to improve trauma care infrastructure and ensure availability of blood alternatives. Increasing awareness of clinical benefits among surgeons and emergency responders also contributes to adoption. Partnerships between manufacturers and trauma centers to develop standardized protocols are enhancing the segment’s market share.

The neonatal conditions segment is expected to witness the fastest growth from 2026 to 2033 due to increasing awareness of artificial blood substitutes in treating preterm infants and newborns with critical oxygenation needs. PFCs and HBOCs are particularly valuable in neonatal intensive care units (NICUs) for maintaining adequate oxygen delivery without relying on donor blood. Countries such as UAE and South Africa are investing in neonatal healthcare programs, providing a favorable environment for adoption. Research and clinical trials focusing on neonatal applications are increasing the confidence of pediatricians and NICU specialists. The segment benefits from technological advancements that enhance safety, reduce side effects, and optimize dosing. Growing government funding for neonatal care in the Middle East and Africa also contributes to rapid adoption of artificial blood substitutes.

- By End User

On the basis of end user, the market is segmented into hospitals & clinics, blood banks, and others. The hospitals & clinics segment dominated the market in 2025, owing to their direct involvement in surgeries, trauma care, and emergency response where artificial blood substitutes are most urgently needed. Hospitals in Saudi Arabia and South Africa have established protocols for the use of HBOCs and PFCs, ensuring rapid access for critical patients. The segment’s dominance is supported by collaborations with manufacturers to maintain a consistent supply of artificial blood substitutes. Hospitals also benefit from training programs for staff to safely handle and administer these products. The segment’s leading position is further reinforced by increasing investments in critical care infrastructure and emergency preparedness. The availability of artificial blood substitutes in hospitals enhances patient outcomes, especially in high-volume surgical and trauma centers.

The blood banks segment is expected to witness the fastest growth from 2026 to 2033, driven by efforts to reduce reliance on donor blood and improve inventory management. Artificial blood substitutes allow blood banks to maintain a stable supply for emergencies and rare blood types. Countries such as UAE and Nigeria are investing in blood bank modernization programs that integrate HBOCs and rHB products into standard stock. Growth is supported by increasing partnerships with biotech manufacturers for supply chain reliability. Blood bank adoption also benefits from clinical guidelines promoting the use of substitutes during shortages. Rising awareness among healthcare administrators about efficiency and safety improvements further accelerates segment growth.

Middle East and Africa Artificial Blood Substitutes Market Regional Analysis

- Saudi Arabia dominated the market with the largest revenue share of 28.5% in 2025, supported by investments in advanced medical facilities, government initiatives to improve healthcare delivery, and the presence of medical hubs facilitating adoption of novel therapeutics

- Healthcare providers in these countries highly value the rapid oxygen delivery, reduced infection risks, and extended shelf life offered by artificial blood substitutes compared to traditional donor blood. Hospitals and trauma centers are increasingly integrating these products into standard protocols for critical care and surgical procedures

- This widespread adoption is further supported by government initiatives to improve healthcare delivery, availability of skilled medical professionals, and partnerships between hospitals and biotech companies, establishing artificial blood substitutes as a key solution for blood shortages and emergency medical situations across the region

The Saudi Arabia Artificial Blood Substitutes Market Insight

The Saudi Arabia artificial blood substitutes market captured the largest revenue share of 28.5% in 2025, driven by rising investments in advanced healthcare infrastructure and increasing surgical and trauma care procedures. Hospitals and emergency care centers are adopting HBOCs and PFCs to address blood shortages and improve patient outcomes. The growing focus on modernizing critical care units, coupled with government healthcare initiatives, is significantly contributing to market expansion. In addition, partnerships between local hospitals and biotech companies are facilitating clinical adoption and distribution of artificial blood substitutes. Increasing awareness among clinicians regarding the safety and efficacy of these products is further propelling adoption. The demand is also fueled by the integration of artificial blood substitutes into emergency response protocols and trauma care guidelines.

South Africa Artificial Blood Substitutes Market Insight

The South Africa market is anticipated to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing trauma incidents, high surgical volumes, and the rising need for blood alternatives. Hospitals and clinics are increasingly relying on artificial blood substitutes to manage emergency cases and optimize patient care. Government initiatives to improve healthcare infrastructure and support advanced transfusion technologies are fostering adoption. The presence of well-established medical research centers and hospitals accelerates clinical trials and product deployment. Clinical training programs for safe handling and administration of artificial blood substitutes further support market growth. The region is witnessing strong demand across private and public hospitals, particularly in urban centers with high patient volumes.

Nigeria Artificial Blood Substitutes Market Insight

The Nigeria artificial blood substitutes market is expected to grow at a noteworthy CAGR during the forecast period, driven by high trauma prevalence and limited availability of donor blood. Hospitals and emergency care units are increasingly adopting HBOCs and recombinant hemoglobin products to stabilize critical patients. Awareness campaigns by healthcare authorities and partnerships with international biotech firms are supporting adoption. Investment in emergency care infrastructure and blood bank modernization is enabling faster deployment of artificial blood substitutes. Nigeria’s growing focus on maternal and neonatal care also creates opportunities for these products in specialized applications. The market is further strengthened by pilot programs demonstrating clinical efficacy and safety in local healthcare facilities.

UAE Artificial Blood Substitutes Market Insight

The UAE artificial blood substitutes market is poised to grow at a fast CAGR during the forecast period, fueled by increasing urbanization, high-quality healthcare infrastructure, and the adoption of advanced medical technologies. Hospitals are integrating artificial blood substitutes into surgical, trauma, and neonatal protocols to reduce reliance on donor blood. Government healthcare initiatives promoting innovative therapeutics are contributing to growth. The region’s medical tourism and specialized healthcare services also drive demand for reliable blood alternatives. Moreover, the availability of well-established biotech partnerships ensures consistent supply and accessibility. Adoption is further supported by professional training programs and clinical validation studies demonstrating the products’ safety and efficacy.

Middle East and Africa Artificial Blood Substitutes Market Share

The Middle East and Africa Artificial Blood Substitutes industry is primarily led by well-established companies, including:

- HbO2 Therapeutics LLC (U.S.)

- KaloCyte, Inc. (U.S.)

- NuvOx Therapeutics (U.S.)

- HEMARINA SA (France)

- OxyVita, Inc. (U.S.)

- Prolong Pharmaceuticals, LLC (U.S.)

- Aurum Biosciences Ltd. (U.K.)

- Spheritech Ltd. (U.K.)

- NanoBlood LLC (U.S.)

- Boston Therapeutics, Inc. (U.S.)

- OPK Biotech LLC (U.S.)

- Membio (Canada)

- Fluoro2 Therapeutics (U.S.)

- Green Cross Corporation (South Korea)

- HemoBioTech Inc. (U.S.)

- Oxygen Biotherapeutics, Inc. (U.S.)

- SynZyme Technologies LLC (U.S.)

- Arteriocyte Inc. (U.S.)

- Acellera LLC (U.S.)

- DCL Corporation (U.S.)

What are the Recent Developments in Middle East and Africa Artificial Blood Substitutes Market?

- In June 2025, Japanese scientists developed a new universal, virus‑free artificial blood substitute that eliminates the need for blood type matching and offers a significantly extended shelf life compared to traditional donated blood. This innovation could play a crucial role in trauma, surgeries, and emergency medicine if clinical trials continue to show promising results

- In June 2025, an Israel‑based company RedC Biotech announced progress toward producing universal red blood cells from stem cells on an industrial scale, aiming to create lab‑grown blood that can be transfused to any patient and help alleviate global blood shortages. The technology focuses on mass production in large bioreactors to improve access and reliability of red blood cell supplies

- In March 2025, clinical trials for universal artificial blood began in Japan led by researchers at Nara Medical University, exploring the safety and efficacy of lab‑made blood that can be used for all blood types and stored for up to two years, potentially transforming emergency care and addressing chronic blood shortages worldwide. This initiative aims to reduce dependency on donor blood and accelerate access to lifesaving transfusions without compatibility testing

- In August 2024, Future Health GCC unveiled a state‑of‑the‑art cord blood banking facility in Dubai Healthcare City, expanding capabilities for long‑term stem cell and blood component storage and supporting future treatment research for blood and immune system conditions

- In July 2024, the Department of Health – Abu Dhabi (DoH) and M42 launched the Abu Dhabi Biobank, a hybrid cord blood banking initiative with the largest storage capacity in the region, aiming to support research and therapeutic treatments for blood‑related disorders and enhance medical innovation infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.