Middle East And Africa Automated Guided Vehicles Market

Market Size in USD Million

CAGR :

%

USD

208.70 Million

USD

487.93 Million

2024

2032

USD

208.70 Million

USD

487.93 Million

2024

2032

| 2025 –2032 | |

| USD 208.70 Million | |

| USD 487.93 Million | |

|

|

|

|

Middle East and Africa Automated Guided Vehicle Market Size

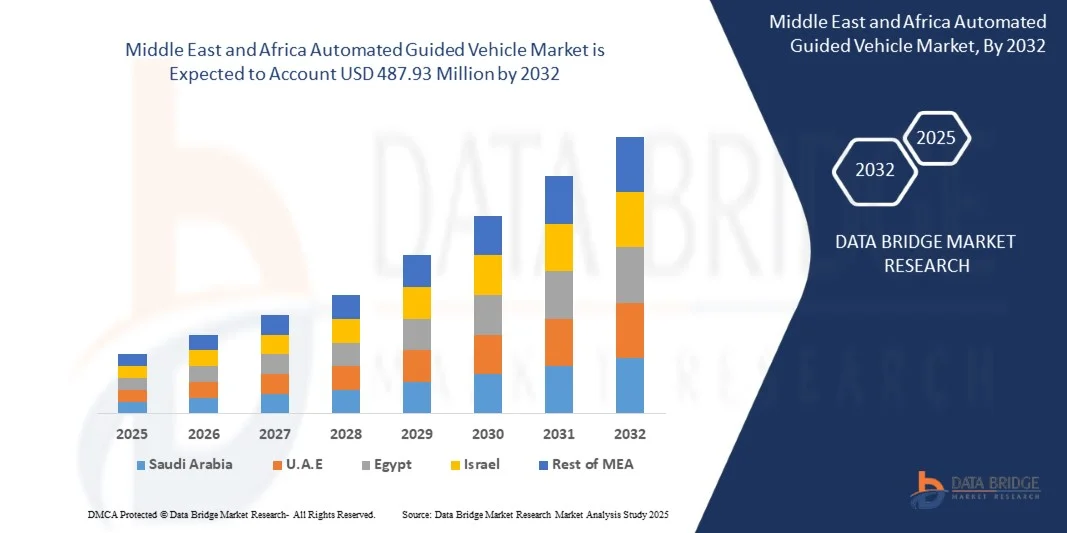

- The Middle East and Africa Automated Guided Vehicle Market size was valued at USD 208.7 million in 2024 and is expected to reach USD 487.93 million by 2032, at a CAGR of 11.2% during the forecast period

- The market growth is largely fueled by the rising demand for automation across manufacturing, logistics, and warehousing sectors, driven by labor shortages, increasing labor costs, and the push for operational efficiency

- Furthermore, the integration of AGVs with Industry 4.0 technologies such as IoT, AI, and machine learning is enabling smarter, more flexible, and data-driven material handling systems. These factors are accelerating AGV adoption across industries, significantly contributing to market expansion

Middle East and Africa Automated Guided Vehicle Market Analysis

- Automated guided vehicles are self-operating transport systems used for material handling and movement across warehouses, factories, and distribution centers. They rely on technologies such as laser guidance, magnetic strips, vision navigation, and AI-based routing to perform repetitive tasks efficiently and with minimal human intervention

- The increasing deployment of AGVs is primarily driven by the need to improve supply chain efficiency, reduce operational costs, and minimize workplace accidents. In addition, the growing adoption of e-commerce, along with the rise in smart factory initiatives, is fueling the demand for scalable and intelligent automation solutions such as AGVs

- South Africa dominated the Middle East and Africa Automated Guided Vehicle Market in 2024, due to the country’s growing automotive and manufacturing sectors, increasing adoption of automation in logistics operations, and expanding use of AGVs for material handling and warehousing

- U.A.E. is expected to be the fastest growing country in the Middle East and Africa Automated Guided Vehicle Market during the forecast period due to large-scale investments in smart logistics, industrial automation, and smart city development

- Tow vehicles segment dominated the market with a market share of 39% in 2024, due to their proven efficiency in transporting heavy loads over long distances within industrial facilities. Their ability to reduce labor dependency and enhance operational safety makes them a preferred choice in manufacturing and logistics environments. In addition, tow vehicles offer high adaptability to different floor layouts and can be integrated seamlessly with warehouse management systems, further strengthening their demand

Report Scope and Middle East and Africa Automated Guided Vehicle Market Segmentation

|

Attributes |

Automated Guided Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Middle East and Africa Automated Guided Vehicle Market Trends

“Increasing Demand for Automation in Logistics and Manufacturing”

- The automated guided vehicle (AGV) market is experiencing substantial growth due to the rising need for automation across logistics and manufacturing industries. Companies are integrating AGVs to streamline material handling, reduce human dependency, and enhance overall operational efficiency across production and warehouse facilities

- For instance, Toyota Material Handling introduced advanced AGV solutions integrated with AI-driven navigation and fleet management systems for warehouses operated by Amazon and BMW. These vehicles enable precise movement of goods while optimizing route efficiency and ensuring workplace safety

- The adoption of AGVs is accelerating as factories and distribution centers move toward Industry 4.0 standards. The technology offers seamless connectivity with warehouse management systems (WMS) and enterprise resource planning (ERP) software, providing real-time visibility into operations and improving inventory accuracy

- In addition, industries such as automotive, food and beverage, and pharmaceuticals are utilizing AGVs for repetitive and high-volume material transport tasks. This shift is enhancing productivity and reducing risks associated with manual labor in high-demand manufacturing environments

- The growing trend of e-commerce and the need for faster order fulfillment are also driving demand for automated logistics solutions. AGVs equipped with sensors and AI systems support efficient goods movement in large-scale fulfillment centers, ensuring cost savings and improved throughput

- Overall, the increasing integration of automation technologies across industrial and logistics operations is positioning AGVs as a core component of modern supply chain infrastructure. This trend is reshaping material handling processes globally and driving advancements in flexible manufacturing systems

Middle East and Africa Automated Guided Vehicle Market Dynamics

Driver

“Increasing Demand for Material Handling Efficiency”

- The surge in industrial automation and the need for efficient material flow within manufacturing units are key factors driving AGV adoption. Organizations are turning to automated systems to achieve consistent throughput, reduce operational risks, and improve handling accuracy in dynamic production environments

- For instance, KUKA AG and Daifuku Co., Ltd. developed intelligent AGVs integrated with precision sensors and laser-guided navigation to manage complex warehouse layouts effectively. Their deployment in automotive assembly plants has significantly reduced handling times and minimized logistics errors

- AGVs enhance production efficiency by enabling continuous material movement between workstations without human intervention. This operational consistency reduces downtime and improves synchronization between manufacturing and storage operations, particularly in lean production setups

- In addition, the integration of AGVs with IoT-based monitoring platforms allows supervisors to track performance metrics in real time. This connectivity supports predictive maintenance and data-driven decision-making, improving overall equipment efficiency

- The shift toward digital manufacturing and automated warehouses continues to reinforce the necessity for fast, safe, and precise material movement. Consequently, AGVs are becoming indispensable assets for industries seeking to maintain competitiveness and operational agility

Restraint/Challenge

“Initial Investment Cost Limits Adoption Rate”

- The high initial investment required to deploy automated guided vehicles poses a major challenge for small and medium-sized enterprises (SMEs). Costs associated with advanced navigation systems, sensors, and integration with existing warehouse management systems can limit budget allocation for automation projects

- For instance, smaller logistics firms and warehouse operators have faced difficulties adopting AGV systems supplied by companies such as Swisslog and Jungheinrich AG due to high setup and customization costs. These expenses include software integration, mapping, and worker training, which delay full-scale adoption

- Maintaining and upgrading AGV fleets further adds to overall operational expenditure. Complex components and specialized maintenance requirements necessitate skilled technicians, which can elevate service costs for industrial users with limited technical resources

- In addition, integrating AGVs into legacy manufacturing systems often demands infrastructure modifications, such as floor guidance or wireless connectivity upgrades. These adjustments are costly and can temporarily disrupt existing workflows during installation phases

- To ensure broader adoption, manufacturers must focus on developing scalable and cost-efficient AGV platforms. Reducing integration complexity and offering leasing or modular solutions will be essential for promoting AGV utilization among cost-sensitive sectors and small-scale operators

Middle East and Africa Automated Guided Vehicle Market Scope

The market is segmented on the basis of type, navigation technology, battery type, application, and industry.

• By Type

On the basis of type, the AGV market is segmented into Tow Vehicles, Unit Load Carriers, Forklift Trucks, Pallet Trucks, Assembly Line Vehicles, and Others. The Tow Vehicles segment dominated the market with the largest revenue share of 39% in 2024, driven by their proven efficiency in transporting heavy loads over long distances within industrial facilities. Their ability to reduce labor dependency and enhance operational safety makes them a preferred choice in manufacturing and logistics environments. In addition, tow vehicles offer high adaptability to different floor layouts and can be integrated seamlessly with warehouse management systems, further strengthening their demand.

The Unit Load Carriers segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by rising adoption in e-commerce fulfillment centers and large-scale warehouses. Their capability to transport standardized loads efficiently while reducing handling time and minimizing product damage makes them attractive to businesses aiming for faster throughput. The modular design and compatibility with advanced navigation systems also contribute to their rapid uptake across various sectors.

• By Navigation Technology

On the basis of navigation technology, the AGV market is segmented into Magnetic Guidance, Laser Guidance, Vision Guidance, Optical Tape Guidance, Inductive Guidance, and Others. The Laser Guidance segment held the largest revenue share in 2024, owing to its high precision and flexibility in route planning without requiring physical floor modifications. Laser-guided AGVs are widely preferred for dynamic warehouse layouts and manufacturing setups where adaptability and safety are critical. Their advanced sensor systems allow real-time obstacle detection, enhancing operational efficiency and reducing downtime.

The Vision Guidance segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing implementation of AI-based visual systems in AGVs. Vision-guided AGVs can navigate complex environments autonomously, recognize objects, and optimize paths for faster material handling. Their ability to operate in unstructured environments and integrate with smart factory systems is accelerating adoption in advanced manufacturing and logistics sectors.

• By Battery Type

On the basis of battery type, the AGV market is segmented into Lead, Lithium Ion, Nickel Based, and Others. The Lithium Ion segment dominated the market with the largest revenue share in 2024, attributed to its longer lifespan, faster charging capabilities, and higher energy density compared to conventional batteries. Lithium-ion batteries enhance the operational efficiency of AGVs by reducing downtime and maintenance requirements, making them suitable for continuous industrial operations. Their lightweight design also contributes to energy savings and improved maneuverability in tight spaces.

The Nickel Based segment is anticipated to witness the fastest growth from 2025 to 2032, driven by growing demand for cost-effective and environmentally resilient battery solutions in developing markets. Nickel-based batteries provide reliable performance in high-temperature environments and are preferred in applications where safety and durability are prioritized over energy density. Increasing industrial automation in emerging economies is boosting the adoption of these battery types.

• By Application

On the basis of application, the AGV market is segmented into Work in Process Movement, Handling Raw Materials, Pallet Handling, Final Product Handling, Container Handling, Roll Handling, Trailer Loading, and Others. The Pallet Handling segment held the largest revenue share in 2024, driven by its critical role in optimizing warehouse operations and streamlining the storage and retrieval of goods. Pallet-handling AGVs reduce manual labor requirements, minimize product damage, and enable real-time tracking of inventory, which is vital for high-volume industries such as retail and logistics.

The Work in Process Movement segment is expected to witness the fastest growth from 2025 to 2032, fueled by the adoption of smart manufacturing principles and Industry 4.0 frameworks. AGVs used for moving work-in-progress items increase production line efficiency, reduce bottlenecks, and support just-in-time manufacturing strategies. Their integration with production monitoring systems allows for seamless coordination and predictive maintenance, enhancing overall operational productivity.

• By Industry

On the basis of industry, the AGV market is segmented into Healthcare, Manufacturing, Logistics, Retail, Food & Beverages, Paper & Printing, Tobacco, Chemical, and Others. The Manufacturing segment dominated the market with the largest revenue share in 2024, owing to the high requirement for automated material handling and process optimization in assembly lines and production facilities. AGVs in manufacturing help reduce operational costs, improve safety standards, and enable high throughput while maintaining consistent quality.

The Logistics segment is anticipated to witness the fastest growth from 2025 to 2032, driven by surging e-commerce demand and the need for faster, more reliable warehouse and distribution center operations. Logistics companies are increasingly deploying AGVs for inventory transport, loading/unloading, and order fulfillment to meet tight delivery timelines and enhance supply chain efficiency. Advanced tracking and navigation capabilities further accelerate adoption in this sector.

Middle East and Africa Automated Guided Vehicle Market Regional Analysis

- South Africa dominated the Middle East and Africa Automated Guided Vehicle Market with the largest revenue share in 2024, driven by the country’s growing automotive and manufacturing sectors, increasing adoption of automation in logistics operations, and expanding use of AGVs for material handling and warehousing

- The nation’s well-established industrial infrastructure, government support for smart manufacturing, and partnerships with global automation providers reinforce its leadership in the regional market

- Rising demand for operational efficiency, labor optimization, and workplace safety continues to accelerate AGV integration across key industries. Ongoing investments in renewable energy, automotive production, and digital transformation initiatives further strengthen South Africa’s dominant position

U.A.E. Middle East and Africa Automated Guided Vehicle Market Insight

The U.A.E. is projected to register the fastest CAGR in the Middle East & Africa Middle East and Africa Automated Guided Vehicle Market from 2025 to 2032, fueled by large-scale investments in smart logistics, industrial automation, and smart city development. The country’s growing emphasis on innovation, coupled with government-backed initiatives supporting digital transformation and sustainable infrastructure, is driving AGV adoption across logistics hubs, ports, and manufacturing facilities. Strategic collaborations with global automation technology providers and advancements in AI-driven navigation systems are enhancing efficiency and precision. The U.A.E.’s commitment to building future-ready industrial ecosystems positions it as the fastest-growing market in the region.

Saudi Arabia Middle East and Africa Automated Guided Vehicle Market Insight

Saudi Arabia is expected to witness steady growth between 2025 and 2032, supported by Vision 2030 initiatives aimed at industrial diversification, automation, and logistics modernization. The adoption of AGVs is expanding in automotive, food & beverage, and warehousing applications to improve productivity and safety. Growing foreign investments in industrial automation and the establishment of advanced manufacturing zones are driving market expansion. Collaborations with global AGV manufacturers and integration of smart material handling technologies are improving efficiency across industrial operations. Saudi Arabia’s continued focus on technological innovation and industrial sustainability underpins its long-term market growth outlook.

Middle East and Africa Automated Guided Vehicle Market Share

The automated guided vehicle industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Hanwha Techwin Co., Ltd. (South Korea)

- Honeywell International Inc. (U.S.)

- Schneider Electric (France)

- Axis Communications AB (Sweden)

- Johnson Controls (Ireland)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- NetApp (U.S.)

- Dahua Technology (China)

- KEDACOM (China)

- Verint Systems Inc. (U.S.)

- LTIMindtree Limited (India)

- AxxonSoft. (U.S.)

- eInfochips (U.S.)

- Panasonic Holdings Corporation (Japan)

- Panopto (U.S.)

- Backstreet Surveillance (U.S.)

- Eagle Eye Solutions Group Plc. (U.S.)

- Arcules, Inc. (U.S.)

Latest Developments in Middle East and Africa Automated Guided Vehicle Market

- In July 2024, Bastian Solutions, LLC, inaugurated its new manufacturing and corporate campus in Noblesville, Indiana. This strategically located, consolidated facility is expected to enhance the company’s operational efficiency and production capacity, strengthening its competitive position in the Middle East and Africa Automated Guided Vehicle Market and supporting the growing demand for advanced automation solutions across key industries

- In June 2023, Mitsubishi Logisnext Americas and Jungheinrich expand their partnership, forming Rocrich AGV Solutions in North America. This collaboration leverages the combined expertise of Jungheinrich and Rocla to offer a comprehensive range of AGVs and automated forklifts, catering to diverse customer needs from standard to specialized applications

- In August 2022, Swissport initiates a pilot program at Frankfurt Airport, deploying unmanned Automated Guided Vehicles (AGVs) for unit load devices in its new cargo center. This move aims to enhance efficiency by replacing manual cargo transport, showcasing Swissport's commitment to innovative cargo logistics and handling solutions

- In March 2022, Third Wave Automation (TWA) and CLARK Material Handling Company announce a partnership, revealing plans for the "TWA Reach," an automated reach truck set for release in spring 2023. The collaboration integrates TWA's automation technology and intelligent fleet management capabilities with CLARK's NPX reach truck, offering advanced autonomous materials handling solutions

- In March 2022, KNAPP and Covariant strengthen their collaboration to develop AI-powered robot solutions further. Focused on enhancing warehouse efficiency, their joint efforts center around KNAPP's Pick-it-Easy Robot, known for its versatility in handling diverse items. This partnership aims to expand market presence and advance AI robotics in logistics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.