Middle East And Africa Automotive Soft Trim Interior

Market Size in USD Million

CAGR :

%

USD

473.47 Million

USD

663.08 Million

2024

2032

USD

473.47 Million

USD

663.08 Million

2024

2032

| 2025 –2032 | |

| USD 473.47 Million | |

| USD 663.08 Million | |

|

|

|

|

Middle East and Africa Automotive Soft Trim Interior Materials Market Size

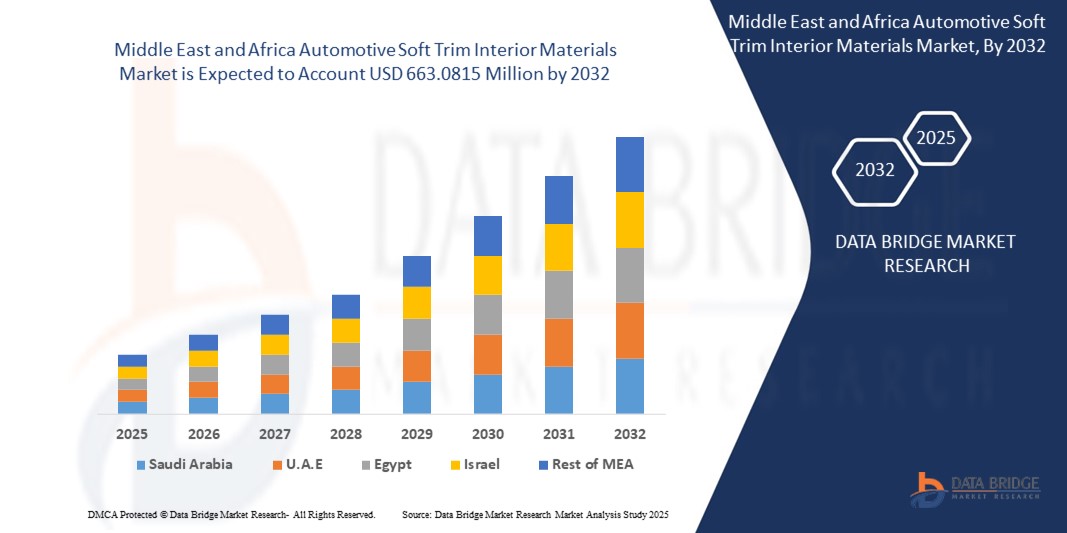

- The Middle East and Africa automotive soft trim interior materials market size was valued at USD 473.47 million in 2024 and is projected to reach USD 663.0815 million by 2032, growing at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by rising automotive production, growing consumer preference for enhanced vehicle aesthetics and comfort, and increasing demand for premium interior finishes in both passenger and commercial vehicles

- Additionally, advancements in lightweight and sustainable materials, along with rising disposable incomes and evolving lifestyle preferences in the region, are further fueling demand for soft trim interior materials, positively impacting market expansion

Middle East and Africa Automotive Soft Trim Interior Materials Market Analysis

- Automotive soft trim interior materials, such as fabrics, leathers, foams, and plastics used in seats, dashboards, and door panels, are essential for enhancing vehicle aesthetics, comfort, and tactile appeal across both economy and luxury segments

- The rising demand for automotive soft trim interior materials in the Middle East and Africa is driven by increasing vehicle production, growing consumer preference for enhanced comfort and luxury, and a shift toward lightweight and sustainable materials to improve fuel efficiency and meet regulatory standards.

- Saudi Arabia is expected to dominate in the market due to significant shift towards sustainable and eco-friendly materials, driven by increasing consumer awareness and demand for environmentally responsible products.

- The region is expected to witness strong market growth during the forecast period due to government initiatives promoting local automotive production, increasing sales of passenger vehicles, and rising demand for advanced interior materials in SUVs and luxury cars.

- Leather segment dominated the automotive soft trim interior materials market with a market share of 38.7% in 2024, favored for its premium feel, durability, and increasing adoption across mid-range to high-end vehicles to enhance passenger comfort and aesthetics.

Report Scope and Market Segmentation

|

Attributes |

Automotive Soft Trim Interior Materials Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Automotive Soft Trim Interior Materials Market Trends

Sustainable and Premium Interior Materials Driving Consumer Preference

- A prominent and accelerating trend in the Middle East and Africa automotive soft trim interior materials market is the rising demand for sustainable, lightweight, and premium-quality interior materials that enhance both environmental performance and passenger comfort in vehicles

- Automakers are increasingly incorporating eco-friendly materials such as recycled fabrics, plant-based leathers, and low-VOC foams to meet evolving regulatory standards and address growing consumer concerns about environmental impact. For example, global OEMs operating in the region are introducing interior trims made from recycled PET bottles and bio-based polyurethane

- Simultaneously, the push for premiumization in vehicle interiors is driving demand for high-quality finishes such as synthetic suede, soft-touch plastics, and perforated leathers, especially in mid-range and luxury segments. These materials provide enhanced tactile appeal and noise insulation, significantly improving the in-cabin experience

- Major manufacturers are investing in advanced manufacturing technologies like 3D knitting and laser-cutting to produce seamless, ergonomic designs that align with modern automotive aesthetics while optimizing material usage and reducing waste

- The integration of ambient lighting, customizable textures, and multi-material layering in dashboards, door panels, and seats is becoming increasingly popular as consumers prioritize both style and comfort. Brands are focusing on delivering visually cohesive and sensory-rich interiors to create a more immersive driving environment

- This trend toward sustainable innovation and premium interior customization is reshaping how automakers design vehicle cabins, with companies actively partnering with material science firms to develop next-generation soft trim solutions that cater to evolving consumer expectations and regional market demands

Middle East and Africa Automotive Soft Trim Interior Materials Market Dynamics

Driver

Rising Demand for Vehicle Comfort, Aesthetics, and Sustainable Materials

- Growing consumer expectations for enhanced in-cabin comfort, visual appeal, and sustainability are key drivers accelerating the demand for automotive soft trim interior materials across the Middle East and Africa

- Automakers are increasingly focusing on interior quality as a key differentiator, especially in mid-range and premium vehicles, where buyers prioritize plush seating, soft-touch dashboards, and premium finishes. For example, leading OEMs in the region are introducing models with upgraded interiors using synthetic leathers, foams, and high-quality fabrics to improve ride experience and perceived value

- Additionally, sustainability trends are shaping material innovation, with manufacturers incorporating eco-friendly alternatives such as recycled textiles, bio-based leathers, and low-emission foams to align with global emissions regulations and environmental awareness. The use of lightweight materials also contributes to improved fuel efficiency and lower emissions

- Demand is further fueled by rising vehicle ownership in urban areas, growing middle-class populations, and consumer preference for visually appealing, durable, and comfortable interiors. As competition intensifies, soft trim enhancements are becoming a standard feature, even in entry-level vehicles

- Automakers are also offering customizable interior options, allowing customers to choose trims and textures that reflect personal style and enhance driving experience, supporting market growth across diverse consumer segments

Restraint/Challenge

High Cost of Premium Materials and Limited Local Manufacturing Capabilities

- The relatively high cost of premium soft trim materials such as genuine leather, Alcantara, or multi-layer composite fabrics remains a key barrier to widespread adoption, particularly in price-sensitive markets across Africa and the Middle East

- Many regional manufacturers rely heavily on imports for high-quality interior materials due to limited local production capabilities. This dependency increases costs and supply chain complexity, especially in countries lacking robust automotive ecosystems

- Additionally, the use of premium or sustainable materials can drive up vehicle prices, making it difficult for automakers to maintain affordability in budget segments. As a result, many vehicles in the low- to mid-price range are limited to basic fabric trims, reducing consumer exposure to high-end interior finishes

- Moreover, local suppliers often face challenges in meeting global quality standards or keeping pace with rapid innovation in material technologies, which can limit collaboration with global OEMs

- To overcome these constraints, investment in local material manufacturing, government incentives for sustainable production, and strategic partnerships with global suppliers will be essential to reduce costs and expand the adoption of advanced soft trim materials across the region

Middle East and Africa Automotive Soft Trim Interior Materials Market Scope

The market is segmented on the basis of material, application, distribution channel, and vehicle type.

- By Material

On the basis of material, the automotive soft trim interior materials market is segmented into fabric, leather, thermoplastic polyurethanes (TPU), thermoplastic elastomers, thermoplastic polymers, and thermoplastic olefins (TPO). The fabric segment dominated the largest market revenue share in 2024, driven by its cost-effectiveness, breathability, and wide use in mid-range and mass-market passenger vehicles. Fabric interiors are highly favored for their versatility, ease of customization, and comfort levels, especially in regions with warmer climates. In addition, advancements in stain-resistant and durable fabric technologies further enhance consumer preference, making it a long-standing dominant choice in both OEM and aftermarket supply chains.

The thermoplastic polyurethanes (TPU) segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for lightweight, eco-friendly, and recyclable materials in modern automotive design. TPU provides excellent flexibility, abrasion resistance, and durability, which align well with automakers’ push for sustainable and high-performance interiors. Growing adoption in electric and premium vehicles, where both aesthetics and sustainability are prioritized, is also driving TPU’s expansion. Its compatibility with advanced manufacturing processes and ease of integration into complex interior structures make it a rapidly growing choice for next-generation automotive interiors.

- By Application

On the basis of application, the market is segmented into seats, cockpit and dashboard, door trim, trunk, headliner, pillar trim, and others. The seats segment dominated the largest market revenue share in 2024, as seats are the most critical interior component influencing both comfort and vehicle aesthetics. Consumers prioritize seat materials for durability, cushioning, and luxury appeal, while automakers increasingly enhance seating with ergonomic designs and integrated smart features. The heavy demand for customizable fabrics, leathers, and advanced composites in seating applications secures its dominant position in the market.

The cockpit and dashboard segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing consumer demand for sophisticated infotainment systems, digital instrument clusters, and premium surface finishes. The dashboard has become a focal point in vehicle design, combining safety, style, and connectivity features. Rising adoption of thermoplastic polymers and TPU in dashboards enables lightweight structures while providing durability and aesthetic appeal. With the growing popularity of electric and autonomous vehicles, where cockpit design is central to user experience, this segment is expected to witness rapid expansion.

- By Distribution Channel

On the basis of distribution channel, the market is divided into OEM and aftermarket. The OEM segment dominated the largest market share in 2024, supported by the automotive industry’s reliance on factory-installed trim materials that ensure quality, consistency, and integration with vehicle designs. OEM channels benefit from long-term contracts with automakers, guaranteeing stable demand for bulk supplies of fabrics, leathers, and polymers. Furthermore, increased focus on vehicle branding and premiumization by leading car manufacturers boosts the dominance of the OEM segment.

The aftermarket segment is expected to record the fastest growth from 2025 to 2032, fueled by rising consumer interest in vehicle customization, refurbishment, and maintenance services. Car owners increasingly seek aftermarket solutions to upgrade seat covers, door trims, and dashboards with premium materials. The popularity of DIY upgrades and the growing second-hand car market also create significant opportunities for aftermarket suppliers. With the emergence of online platforms and specialized automotive accessory retailers, the aftermarket channel is gaining traction as a cost-effective and flexible distribution route.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, commercial vehicles, and electric vehicles. The passenger cars segment held the largest revenue share in 2024, driven by the sheer volume of car production and consumer preference for comfort and aesthetics in daily-use vehicles. Interior materials play a pivotal role in differentiating vehicle classes, with fabric dominating entry-level cars and leather or premium composites preferred in luxury models. Rapid urbanization, rising disposable incomes, and a strong demand for mid-range passenger cars reinforce this segment’s dominance.

The electric vehicles (EVs) segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by automakers’ emphasis on lightweight, sustainable, and high-performance materials to enhance energy efficiency and eco-friendliness. EV manufacturers increasingly adopt TPU, TPO, and recycled fabrics to align with green mobility initiatives. In addition, EV interiors are designed with a futuristic approach, focusing on minimalism, advanced dashboards, and comfort-enhancing trims. Rising government incentives, coupled with consumer interest in sustainable vehicles, will further accelerate material innovation and adoption in this rapidly growing segment.

Middle East and Africa Automotive Soft Trim Interior Materials Market Regional Analysis

- Saudi Arabia is expected to dominate in the market 38.7% in 2024, driven by a significant shift towards sustainable and eco-friendly materials.

- Consumers are showing a growing preference for eco-friendly and technologically advanced materials, such as recycled fabrics and smart textiles, prompting automakers to enhance customization and incorporate smart features in vehicle interiors.

- This trend is supported by government initiatives promoting sustainability, expanding luxury vehicle segments, and the region’s harsh climate, which drives demand for durable, high-performance soft trim materials.

U.A.E. Smart Lock Market Insight

The U.A.E. smart lock market is experiencing steady growth supported by high technological adoption rates and extensive smart city development, especially in Dubai and Abu Dhabi. Rising investments in smart buildings and luxury real estate sectors are fueling demand for smart locks with advanced features such as biometric authentication, remote access, and voice assistant compatibility. Increasing security awareness and consumer preference for connected home devices are contributing to market expansion. The U.A.E.’s robust infrastructure and government focus on innovation make it a leading smart lock market in the Middle East.

South Africa Smart Lock Market Insight

South Africa’s smart lock market is witnessing gradual growth driven by urbanization and increasing safety concerns. The expanding middle class is adopting smart home technology, with demand focused on affordable, easy-to-install smart locks suitable for both residential and commercial properties. Rising awareness about digital security and home automation supports market penetration, especially in metropolitan areas. Despite infrastructural challenges, growing smartphone penetration and interest in DIY smart home solutions are fostering market expansion. South Africa represents a promising emerging market for smart lock manufacturers targeting security-conscious consumers.

Egypt Smart Lock Market Insight

Egypt’s smart lock market is growing steadily, fueled by rapid urbanization and rising disposable incomes. Increasing consumer awareness of home security and convenience is boosting demand for smart locks integrated with mobile applications and smart home systems. Government efforts to promote digital transformation and smart city initiatives support market adoption across residential and commercial sectors. The availability of affordable smart lock options and improving internet infrastructure are further enabling growth. Egypt is poised to become a key market for smart locks within the Middle East and Africa region in the coming years.

Israel Smart Lock Market Insight

Israel’s smart lock market benefits from a highly advanced technology ecosystem and strong consumer interest in smart home innovations. Cybersecurity concerns and preference for secure, connected devices are significant growth drivers. Smart locks integrated with IoT platforms, biometric authentication, and remote control capabilities are gaining traction across residential and commercial segments. The country’s startup culture and innovation focus facilitate rapid adoption of cutting-edge security technologies. Israel’s market is characterized by early adopters and tech-savvy consumers who value privacy and convenience, making it a vibrant market for smart lock products.

Kuwait Smart Lock Market Insight

Kuwait’s smart lock market is developing steadily, driven by rising urbanization and growing security awareness among consumers. The demand for technologically advanced, user-friendly locking solutions is increasing in residential areas, offices, and commercial buildings. Integration with home automation systems and mobile applications is becoming common, enhancing convenience and control. Despite market infancy, government investments in smart infrastructure and increasing disposable incomes support market growth. Kuwait’s market shows potential for expansion as more consumers and businesses adopt connected security devices to address burglary and safety concerns.

Qatar Smart Lock Market Insight

Qatar’s smart lock market is expanding in line with the country’s push toward smart infrastructure and real estate development, especially ahead of global events like the FIFA World Cup. Demand for smart locks that offer enhanced security, remote management, and integration with smart home ecosystems is rising in residential, commercial, and hospitality sectors. Government investments in digital transformation and smart city projects support adoption. Consumer preference for convenience and advanced technology further stimulates market growth. Qatar is expected to continue seeing steady smart lock market development supported by economic stability and urban growth.

Middle East and Africa Automotive Soft Trim Interior Materials Market Share

Automotive Soft Trim Interior Materials Market Leaders Operating in the Market Are:

- Pangea (U.S.)

- MACAUTO INDUSTRIAL CO., LTD. (Taiwan)

- Mayur Uniquoters Limited (India)

- Antolin (Spain)

- SEIREN CO., LTD. (Japan)

- Magna International Inc. (Canada)

- TOYOTA BOSHOKU CORPORATION (Japan)

- FORVIA (France)

- Adient plc. (U.S.)

- Lear (U.S.)

Recent Developments section written for the Automotive Soft Trim Interior Materials

- In April 2023, Lear Corporation, a global leader in automotive seating and interior systems, announced the launch of its new sustainable soft trim materials line designed to reduce environmental impact while enhancing interior comfort. This initiative reflects Lear’s commitment to innovation and sustainability, targeting premium electric and hybrid vehicle manufacturers aiming to meet stringent eco-friendly standards.

- In March 2023, Adient plc, a major automotive seating supplier, partnered with a leading chemical company to develop advanced bio-based polyurethane foam for use in vehicle interiors. This collaboration aims to improve both occupant comfort and sustainability, aligning with increasing consumer demand for environmentally responsible automotive components.

- In March 2023, Magna International Inc. expanded its automotive interior materials portfolio by introducing a lightweight, recyclable synthetic leather designed for luxury vehicles. This new product combines durability with high-end aesthetics, addressing the industry trend toward reducing vehicle weight and improving fuel efficiency without compromising on quality.

- In February 2023, Toyota Boshoku Corporation unveiled an innovative soft trim material incorporating noise-absorbing technology to enhance in-cabin comfort. This development is part of Toyota’s broader effort to improve passenger experience in next-generation electric and autonomous vehicles through advanced interior solutions.

- In January 2023, Faurecia SE announced the integration of smart textile technology into automotive soft trim interiors, enabling features such as temperature regulation and touch-sensitive controls. This breakthrough represents a significant step towards creating more interactive and comfortable vehicle cabins, reinforcing Faurecia’s position as a pioneer in automotive interior innovation.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.