Middle East And Africa Autonomous Forklifts Market

Market Size in USD Billion

CAGR :

%

USD

2.55 Billion

USD

4.37 Billion

2024

2032

USD

2.55 Billion

USD

4.37 Billion

2024

2032

| 2025 –2032 | |

| USD 2.55 Billion | |

| USD 4.37 Billion | |

|

|

|

|

Middle East and Africa Autonomous Forklifts Market Size

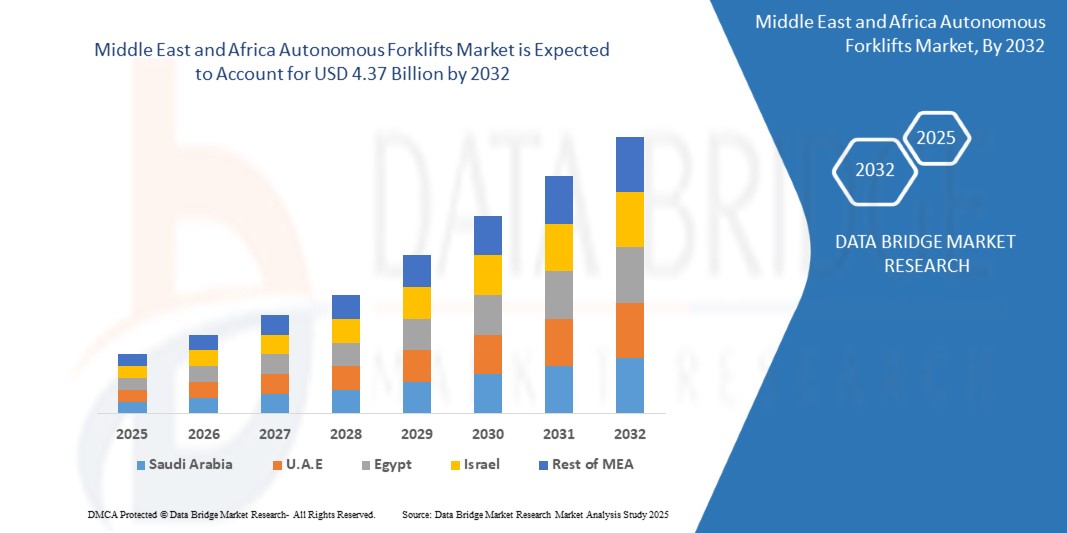

- Middle East and Africa Autonomous Forklifts Market was valued at USD 2.55 Billion in 2024 and is projected to reach USD 4.37 Billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- Growth is driven by the increasing demand for unmanned material handling, reduced labor dependency, and the adoption of Industry 4.0 automation solutions across logistics, warehousing, and manufacturing environments in the region.

Middle East and Africa Autonomous Forklifts Market Analysis

- The Middle East and Africa Autonomous Forklifts Market is experiencing strong momentum as companies in sectors such as logistics, construction, food & beverage, and retail increasingly prioritize automation to reduce labor dependency and enhance operational efficiency.

- Governments in the region are investing in smart logistics hubs and digital infrastructure, supporting the integration of autonomous systems in warehouses and distribution centers.

- Rapid growth in e-commerce, particularly in Gulf countries and South Africa, is accelerating the need for intelligent material handling and fleet management solutions that reduce delivery lead times and improve inventory control.

- Labor shortages, rising wages, and growing safety regulations across the region are prompting industries to adopt Level 2 and Level 3 autonomous forklifts for repetitive, high-volume warehouse tasks such as pallet handling, stacking, and towing.

- Increasing collaboration between global forklift manufacturers and regional automation integrators is driving innovation in autonomous forklift fleets with real-time analytics, AI-based navigation, and IoT connectivity tailored to the Middle Eastern and African operating conditions.

Report Scope and Middle East and Africa Autonomous Forklifts Market Segmentation

|

Attributes |

Middle East and Africa Autonomous Forklifts Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Autonomous Forklifts Market Trends

Warehouse Digitization, Electrification, and Intelligent Fleet Management Driving Growth

- The integration of artificial intelligence (AI) and machine learning is enabling forklifts to navigate dynamic warehouse environments autonomously, with enhanced safety through obstacle detection, route planning, and real-time decision-making.

- With increasing environmental regulations and sustainability goals across the region, there is a significant shift toward electric autonomous forklifts. Battery-powered units are replacing traditional internal combustion forklifts due to lower emissions, noise reduction, and reduced operational costs.

- Autonomous forklifts are being deployed as part of broader smart warehouse ecosystems. They are increasingly integrated with warehouse management systems (WMS), ERP software, and IoT platforms to enable real-time inventory tracking, predictive maintenance, and workflow optimization.

- Growing demand for space optimization is fueling the adoption of autonomous forklifts that operate in narrow aisles and high-rack storage systems—particularly in e-commerce, logistics hubs, and urban distribution centers.

- The trend toward collaborative robotics (cobots) is also evident in autonomous forklifts. These systems are being designed to safely work alongside human operators in shared spaces, enhancing operational flexibility without compromising safety.

Middle East and Africa Autonomous Forklifts Market Dynamics

Driver

Rising E-Commerce, Smart Logistics, and Infrastructure Investment

- The rapid growth of e-commerce and retail logistics in the Middle East and Africa is driving demand for autonomous forklifts to improve efficiency, speed, and scalability of operations.

- Governments across the region are investing in smart infrastructure and industrial automation, promoting warehouse modernization through autonomous material handling solutions.

The need for labor cost reduction, safety improvements, and 24/7 operational capabilities is pushing adoption of self-driving forklifts in sectors like FMCG, automotive, and third-party logistics.

- National transformation agendas such as Saudi Vision 2030 and UAE Smart Logistics initiatives are encouraging public and private sector investment in warehouse robotics and intelligent supply chain systems.

Restraint/Challenge

High Initial Costs and Technology Adoption Barriers

- The high capital investment associated with autonomous forklift procurement, system integration, and training poses a challenge, especially for small and mid-sized businesses.

- Infrastructural limitations such as outdated warehouse layouts and insufficient connectivity hinder seamless deployment of advanced automation technologies.

- A lack of skilled operators and technicians familiar with autonomous systems creates dependence on international expertise and delays in implementation.

- Regulatory uncertainty and safety compliance standards for unmanned vehicles remain underdeveloped across several African markets, limiting wider adoption.

Middle East and Africa Autonomous Forklifts Market Scope

The market is segmented on the basis of by type, tonnage, component, sales channel, function and end-users

- By Type

The market includes Electric Motor Narrow Aisle Forklifts, Electric Pallet Jacks, Rough Terrain Forklift Trucks, and more. Electric Motor Narrow Aisle Forklifts are increasingly popular for high-density storage environments due to their compact size and maneuverability. Rough Terrain Forklifts remain vital in construction and mining sectors across the region.

- By Function

Warehousing dominates this segment, reflecting strong demand for automation in distribution centers and e-commerce hubs. Logistics & Freight is growing rapidly as autonomous forklifts enhance port operations, customs handling, and supply chain optimization.

- By Sales Channel

In-house purchase is preferred among large manufacturers and logistics companies focused on building long-term autonomous infrastructure. However, leasing is becoming attractive to SMEs seeking operational flexibility and minimal upfront cost.

- By Component

Hardware holds the largest market share, comprising sensors, robotic systems, navigation modules, and lifting arms. Software, driven by AI and IoT integration, is critical for navigation, fleet orchestration, and safety compliance. Services include retrofitting, AMR training, and preventive maintenance—growing steadily with adoption.

- By End-Users

Transportation & Logistics and Automotive sectors lead in adoption due to their need for precise inventory tracking and 24/7 throughput. Retail and Food & Beverages are seeing rapid growth, driven by cold-chain automation and omnichannel retailing. Construction and Wood Industry segments also show increasing interest in outdoor autonomous load handling.

Middle East and Africa Autonomous Forklifts Market Regional Analysis

Middle East and Africa is emerging as a key growth region in the global Autonomous Forklifts Market, fueled by increasing investments in warehouse automation, smart logistics infrastructure, and industrial modernization. The region’s focus on improving operational efficiency, reducing labor dependency, and integrating Industry 4.0 technologies is accelerating adoption across diverse sectors including manufacturing, retail, and logistics.

The growth is particularly strong in Gulf Cooperation Council (GCC) countries, where large-scale logistics hubs, free trade zones, and e-commerce fulfillment centers are deploying autonomous forklifts to enhance real-time inventory tracking, space optimization, and safe material handling. Infrastructure development in Sub-Saharan Africa and rising demand in sectors like automotive assembly, construction materials, and food distribution are also boosting market penetration.

Saudi Arabia

Saudi Arabia is leading the Middle East market, driven by its Vision 2030 economic diversification initiative. The Kingdom is heavily investing in smart logistics cities, such as NEOM and King Abdullah Economic City, which are adopting autonomous forklift fleets for digital warehousing and goods movement. The growing presence of automotive and retail industries is also contributing to strong uptake.

U.A.E

The UAE is witnessing rapid adoption of autonomous forklifts in its thriving logistics, trade, and port operations—especially in Dubai and Abu Dhabi. With a high concentration of regional distribution centers, 3PL providers, and smart warehouses, the country is leveraging AI and robotics for automation in last-mile delivery and cargo handling, driving significant market growth.

South Africa

South Africa represents the largest market in Sub-Saharan Africa, driven by increasing automation in manufacturing, automotive assembly, and mining supply chains. The growing need for operational safety, energy-efficient equipment, and data-driven fleet management is encouraging adoption among large-scale industrial players. Government support for advanced manufacturing is also fostering digital transformation.

Egypt Middle

Egypt’s market is expanding steadily with strong investment in industrial parks, logistics zones along the Suez Canal, and manufacturing hubs. The rise of e-commerce, coupled with growing interest in lean warehousing and modern material handling, is driving demand for autonomous forklifts in both public and private sector logistics infrastructure.

Nigeria Middle

Nigeria is experiencing early-stage adoption of autonomous forklifts in warehousing, food processing, and industrial goods distribution. While infrastructure limitations pose challenges, rising investments in logistics modernization and smart city developments are opening new opportunities, particularly among multinational manufacturers and port authorities.

Middle East and Africa Autonomous Forklifts Market Share

The Middle East and Africa autonomous forklifts market is primarily led by a combination of global forklift manufacturers, warehouse automation leaders, and intralogistics solution providers. These companies are investing in autonomous navigation systems, lithium-ion battery integration, fleet management software, and advanced safety technologies to enhance operational efficiency, reduce labor dependency, and support warehouse digitalization across key industries such as logistics, automotive, and manufacturing:

- Toyota Industries Corporation (Japan)

- KION Group AG (Germany)

- Jungheinrich AG (Germany)

- Mitsubishi Logisnext Co., Ltd. (Japan)

- Crown Equipment Corporation (U.S.)

- Hyster-Yale Materials Handling, Inc. (U.S.)

- Linde Material Handling GmbH (Germany)

- Komatsu Ltd. (Japan)

- Hangcha Group Co., Ltd. (China)

- BALYO SA (France)

- Seegrid Corporation (U.S.)

- Oceaneering International, Inc. (U.S.)

- E&K Automation GmbH (Germany)

- Agilox Services GmbH (Austria)

Latest Developments in Middle East and Africa Autonomous Forklifts Market

- In May 2025, Toyota Industries Corporation unveiled its next-gen autonomous forklift equipped with AI-powered obstacle detection, enhanced path planning algorithms, and 3D LiDAR for complex warehouse navigation—targeted at improving throughput and safety in multi-shift operations.

- In April 2025, KION Group AG partnered with a major German logistics firm to deploy a fleet of lithium-ion-powered autonomous forklifts integrated with fleet management software and real-time telemetry for dynamic task allocation and battery optimization.

- In March 2025, Jungheinrich AG introduced an upgraded version of its ERC 216zi autonomous pallet stacker, featuring compact chassis design, sensor fusion technology, and deep-learning capabilities for improved performance in narrow aisles and high-density warehouses.

- In February 2025, Hyster-Yale Materials Handling, Inc. announced pilot tests of its hybrid autonomous forklifts designed for indoor-outdoor use. These vehicles support mixed-mode operations (manual and autonomous), making them ideal for large-scale manufacturing facilities.

- In January 2025, Mitsubishi Logisnext Co., Ltd. showcased its new autonomous forklift series at LogiMAT 2025, featuring advanced SLAM navigation, voice-command integration, and safety systems aligned with EU compliance standards for warehouse robotics.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.