Middle East And Africa B1 Sheetfed Offset Press Market

Market Size in USD Million

CAGR :

%

USD

82.49 Million

USD

125.87 Million

2025

2033

USD

82.49 Million

USD

125.87 Million

2025

2033

| 2026 –2033 | |

| USD 82.49 Million | |

| USD 125.87 Million | |

|

|

|

|

Middle East and Africa B1 Sheetfed Offset Press Market Size

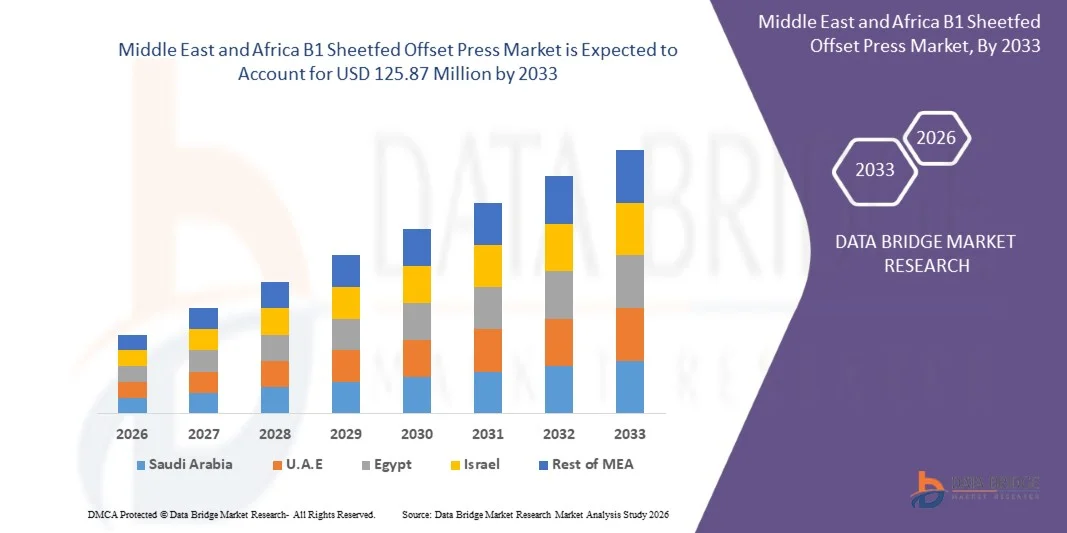

- The Middle East and Africa B1 Sheetfed Offset Press Market is expected to reach USD 125.87 million by 2033 from USD 82.49 million in 2025, growing with a substantial CAGR of 5.6% in the forecast period of 2026 to 2033

- The Middle East and Africa B1 Sheetfed Offset Press Market growth is significantly driven by the increasing demand for high-quality packaging and commercial printing across key sectors like e-commerce, food and beverage, and consumer goods. The need for sustainable printing solutions and customized packaging is also a major driver, alongside innovations in automation and digital/hybrid press technologies that enable faster and more efficient production.

- Market expansion is further supported by technological advancements that enhance press efficiency, reduce operational costs, and improve print quality. The growing focus on eco-friendly practices, such as recyclable materials and low-emission inks, is also boosting demand. Additionally, the rise of short-run printing and personalized packaging solutions, driven by the increasing adoption of on-demand printing and variable data printing, continues to fuel growth in the region.

Middle East and Africa B1 Sheetfed Offset Press Market Analysis

- The Middle East and Africa B1 Sheetfed Offset Press Market is primarily driven by the rapid growth of e-commerce, which is fueling the demand for high-quality, sustainable packaging in sectors like food and beverage, consumer goods, and electronics. There is also an increasing focus on eco-friendly packaging solutions and recyclable materials, pushing both commercial printers and packaging converters to adopt sustainable printing technologies.

- Technological advancements, including automation and digital/hybrid integration, are enabling B1 presses to handle short-run jobs and personalized printing efficiently. The growing need for short-run and customized print jobs is encouraging the adoption of B1 presses that offer flexibility and fast turnaround times.

- South Africa. dominated country in the Middle East and Africa B1 Sheetfed Offset Press Market, accounting for over 25.34% market share in 2025, driven by its strong demand for high-quality commercial printing and packaging solutions. The growth of e-commerce, sustainability trends, and a highly competitive printing industry contribute to the dominance of B1 presses, particularly in sectors like food, electronics, and consumer goods.

- Furthermore, the Saudi Arabia is the fastest-growing country in the region, supported by technological advancements in automation and digital/hybrid press integration, as well as the increasing demand for personalized and short-run prints. The market benefits from a push for sustainable printing practices and the need for cost-effective, high-quality packaging solutions driven by both regulatory pressures and consumer preferences.

- In 2025, conventional (offset) presses segment is expected to dominate the market with market share of 58.57% due to their long-standing presence in the industry, established reliability, and high print quality. They are widely used for large-volume printing in sectors like commercial printing and packaging, where high precision and efficiency are required.

Report Scope and Middle East and Africa B1 Sheetfed Offset Press Market Segmentation

|

Attributes |

Middle East and Africa B1 Sheetfed Offset Press Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Middle East and Africa B1 Sheetfed Offset Press Market Trends

“Technological Advancements in B1 Sheetfed Offset Presses”

- Technological advancements in B1 sheetfed offset presses are transforming the printing industry. One key development is the integration of automation, such as automatic plate changing and ink adjustment, which reduces human error and speeds up production while ensuring consistent quality.

- In addition, these presses now feature smart technology with sensors and real-time data monitoring. This allows operators to track machine performance, predict maintenance needs, and optimize workflows, ultimately reducing downtime and improving efficiency.

- Another major trend is the hybridization of offset and digital printing, allowing B1 presses to handle both high-volume runs and short-run digital jobs, making them more versatile. Finally, advancements in print quality are becoming a focus, with innovations in ink, coating technologies, and color consistency ensuring sharper details and more vibrant colors.

- These improvements meet the growing demand for high-quality products, especially in sectors like premium packaging and commercial printing. Together, these technologies are making B1 presses faster, more flexible, and cost-effective, driving growth in the market.

Middle East and Africa B1 Sheetfed Offset Press Market Dynamics

Driver

“Expansion of Packaging & Commercial Printing Industry”

- The growth of packaging and commercial printing is increasingly shaping demand in the Global Middle East and Africa B1 Sheetfed Offset Press Market, as broader industry trends show that print applications tied to packaging and business communications remain resilient even amid digital shifts. Packaging print including labels, folding cartons, and branded graphics continues to expand globally, driven by factors such as e-commerce demand and consumer preference for visually engaging product experiences. Annual industry forecasts underscore robust growth in the overall packaging printing market, which is projected to increase substantially over the coming decade due to sustained demand for printed packaging across food, beverage, pharmaceutical, and consumer goods sectors.

- Commercial printing remains a foundational use case for sheetfed offset presses, as enterprises and brands continue to source high-quality brochures, catalogs, and marketing collateral in medium-to-large runs where offset offers cost advantages and superior image fidelity. While digital printing is expanding in some niche areas, commercial print markets overall are substantial and still anchored in traditional offset technologies in many regions. Combined with packaging demand, this creates a supportive backdrop for continued investment in B1 sheetfed offset presses capable of delivering high precision and flexibility across substrates.

- Overall, the growth trajectories of packaging and commercial printing are pivotal drivers of the Global Middle East and Africa B1 Sheetfed Offset Press Market. Packaging’s robust expansion propelled by product branding needs, regulatory drivers, and e-commerce increasingly absorbs printing capacity and underpins demand for sheetfed offset equipment capable of high-quality, multi-color output. Meanwhile, commercial printing, though facing digital competition, remains a substantial market segment where offset technology delivers efficiency and visual quality advantages. Together, these forces suggest that investments in sheetfed offset press capacity are likely to continue, as printers balance legacy demand with evolving requirements for premium packaging and business print applications.

Restraint/Challenge

“Shift Toward Digital Printing”

- The shift toward digital printing has emerged as a significant restraint for the Global Middle East and Africa B1 Sheetfed Offset Press Market, particularly affecting traditional offset equipment demand. Digital printing technologies (such as inkjet and electrophotography) have gained traction because they eliminate the need for plates, reduce setup time, and enable on‑demand, short‑run printing advantages that directly challenge the traditional strength of offset presses in high‑volume runs. Industry sources highlight that digital printing is growing rapidly in applications such as print‑on‑demand books, transactional print, and advertising, which are eroding some segments historically supplied by offset technology. This trend is reinforced by changing customer preferences for faster turnaround, greater customization, and integration with web‑to‑print services, all of which favor digital workflows over conventional offset processes.

- Moreover, established industry data indicate that digital printing’s market value and volume are increasing at a faster rate than offset, accelerating its influence on the broader printing ecosystem. Offset demand especially in heatset and coldset segments has been declining due to reduced consumption of traditional media like newspapers and magazines, a decline partly attributable to digital media consumption trends. While sheetfed offset retains relevance especially in packaging, the rising share of digital printing in shorter runs limits the utilization rates and investment appeal for new traditional presses.

- While B1 sheetfed offset presses continue to dominate high-volume, premium-quality printing, the shift toward digital printing for short-run, customizable, and on-demand applications poses a restraint on market growth. Digital printing’s speed, flexibility, and lower setup costs divert smaller jobs away from traditional sheetfed offset platforms, limiting the expansion of B1 press adoption to specific high-volume and specialized production segments.

Middle East and Africa B1 Sheetfed Offset Press Market Scope

The Middle East and Africa B1 Sheetfed Offset Press Market is segmented into by press type, automation level, color configuration, application, and end user.

• By Press Type

On the basis of press type, the market is segmented into conventional (offset) presses, UV curing presses, digital/hybrid B1 presses, others. In 2025, the conventional (offset) presses segment dominated the market with a share of 58.57% due to their long-standing presence in the industry, established reliability, and high print quality. They are widely used for large-volume printing in sectors like commercial printing and packaging, where high precision and efficiency are required.

The digital/hybrid B1 presses segment is projected to register the highest CAGR of 6.3% during the forecast period of 2026 to 2033, as these presses offer greater flexibility and shorter setup times, enabling high-quality output for short-run jobs and customized prints. The ability to integrate digital printing features into offset printing helps meet the growing demand for personalized and on-demand printing.

• By Automation Level

On the basis of automation level, the market is segmented into fully automated inline systems, standalone systems, semi-automated / manual. In 2025, the fully automated inline systems segment dominated the market with a share of 53.90%, owing to their ability to streamline workflows, reduce human intervention, and improve efficiency. These systems offer continuous production with minimal downtime and faster turnaround times, making them ideal for high-volume and commercial printing applications.

Moreover, this segment is projected to register the highest CAGR of 5.7% during the forecast period of 2026 to 2033, driven by their advantages in speed, quality, and cost-efficiency, especially in high-volume production.

• By Color Configuration

On the basis of color configuration, the market is segmented into multicolor presses (4–8 colors), two-color press, single color presses, others. In 2025, the multicolor presses (4–8 colors) segment dominated the market with a share of 67.77% owing to their versatility and ability to produce vibrant, high-quality prints for commercial printing, packaging, and publishing. Multicolor presses are in high demand due to their capacity to meet diverse and complex printing requirements across various industries.

Moreover, this segment is projected to register the highest CAGR of 5.8% during the forecast period of 2026 to 2033, driven by the increasing demand for high-quality packaging and commercial print products that require more complex color configurations.

• By Application

On the basis of application, the market is segmented into packaging printing, commercial printing, publication printing (magazines, books), label printing, security printing, others. In 2025, the packaging printing dominated the market with a share of 58.98% owing to the growing demand for premium packaging solutions, especially in food and beverage, cosmetics, and electronics. Additionally, the rise of e-commerce and brand differentiation drives the need for innovative packaging solutions.

The commercial printing segment is projected to register the highest CAGR of 5.9%during the forecast period of 2026 to 2033, driven by the increased demand for personalized marketing materials, direct mail, and variable data printing.

• By End User

On the basis of end user, the market is segmented into packaging converters, printing companies, publishers, in-plant printers (corporate/institutional), others. In 2025, the packaging converters dominated the market with a share of 45.43% as demand for innovative and sustainable packaging solutions continues to rise. Packaging converters require B1 presses for large-volume production of branded packaging, labels, and folding cartons.

The printing companies segment is projected to register the highest CAGR of 5.8% during the forecast period of 2026 to 2033, driven by the growth in short-run printing and personalized services, especially in industries like advertising, direct mail, and on-demand printing.

Middle East and Africa B1 Sheetfed Offset Press Market Regional Analysis

- The South Africa is the dominant player in Middle East and Africa’s Middle East and Africa B1 Sheetfed Offset Press Market, driven by strong demand in commercial printing and packaging sectors. E-commerce growth is fueling packaging needs, particularly for retail and electronics. There is also a shift toward sustainable packaging solutions, supported by government regulations and consumer demand for eco-friendly products. Key sectors driving this growth include food and beverage, consumer goods, and pharmaceuticals.

- In Saudi Arabia, the demand for B1 sheetfed offset presses is growing due to the rise in high-quality packaging and short-run printing needs. The market is heavily influenced by sectors such as healthcare, retail, and automotive. Like the South Africa, there is a strong focus on sustainability, with printers adopting recyclable and biodegradable materials to meet environmental goals and consumer expectations.

- U.A.E. is experiencing growth in manufacturing and export-oriented industries, including automotive and electronics. There is also a rise in demand for packaging solutions as e-commerce grows. The market is witnessing a shift toward cost-effective, sustainable printing technologies, driven by both local demand and export needs to Middle East and Africa and beyond.

South Africa Middle East and Africa B1 Sheetfed Offset Press Market Insight

The South Africa Middle East and Africa B1 Sheetfed Offset Press Market is primarily driven by the growing demand for high-quality commercial printing and packaging solutions, particularly in sectors like e-commerce, food and beverage, consumer goods, and pharmaceuticals. The rise of sustainable packaging solutions, influenced by government regulations and consumer demand for eco-friendly products, also plays a major role. Additionally, the push for shorter print runs and customized packaging further fuels the adoption of B1 sheetfed offset presses across various industries.

Saudi Arabia Middle East and Africa B1 Sheetfed Offset Press Market Insight

Saudi Arabia Middle East and Africa B1 Sheetfed Offset Press Market is primarily driven by the growth in manufacturing, particularly in automotive and electronics, alongside the expansion of the e-commerce sector. The increasing demand for cost-effective, high-quality packaging and short-run printing solutions is also a key factor. Additionally, the push for sustainable printing technologies to meet both local and export needs is contributing to market expansion.

Middle East and Africa B1 Sheetfed Offset Press Market Share

The B1 Sheetfed Offset Press industry is primarily led by well-established companies, including:

- HEIDELBERGER DRUCKMASCHINEN AG (Germany)

- Komori Corporation (Japan)

- KOENIG & BAUER AG (Germany)

- Langley Holdings plc (U.K.)

- RMGT (RYOBI MHI GRAPHIC TECHNOLOGY) (Japan)

- Haverer Group (Germany)

- Nilpeter (Denmark)

- MGI Digital Technology (France)

- Comexi (Spain)

- FUJIFILM Europe GmbH (Germany)

- Wanjie Machine (China)

- Landa Corporation Ltd. (Israel)

- Shanghai UPG International Industry and Trade Group Co., Ltd. (China)

- SCREEN Europe (Netherlands)

- Kunshan RUIYUAN Intelligent Equipment Co., Ltd. (China)

- MPS Printing B.V. (Netherlands)

- Shanghai Printyoung International Industry Co., Ltd. (China)

- Good Choice Machinery Co., Ltd. (China)

- Anhui Innovo Bochen Machinery Manufacturing Co., Ltd. (China)

- Hangzhou Ecoographix Digital Technology Co., Ltd. (China)

Latest Developments in Middle East and Africa B1 Sheetfed Offset Press Market

- In April, Komori announced the addition of the Lithrone GX29 advance offset printing press to its product lineup. This new 29‑inch press is designed to deliver world‑class return on investment by printing high‑quality work even on specialty materials like clear film and metallized paper. The machine supports larger sheet sizes (up to 610 × 750 mm), speeds up production, reduces setup time and waste, and helps optimize the whole workflow.

- In January 2025, Koenig & Bauer Durst has opened a dedicated VariJET 106 Customer Experience Center in Radebeul, Germany, where customers can demo and test digital, offset, and post-print production on site using their own files and substrates. The facility highlights the hybrid VariJET 106 press, developed with Durst, showcasing its flexibility and performance for folding carton printing to global visitors.

- In 2025, Comexi officially presented the Comexi F4 Origin, a new generation of compact presses ideal for short runs and label markets with improved performance and energy efficiency, as confirmed on the company’s Pioneering Flexible Solutions at K 2025 page.

- In August, 2024 Komori announced that the new 37‑inch offset printing presses, the Lithrone E37 and E37P, were added to its lineup. These compact, high‑performance models offer stable, high‑quality printing with an optimal speed of about 13,000 sheets per hour and support a wide range of sheet sizes. They feature user‑friendly design, excellent cost performance with reduced waste, and include Komori’s Smart Inking Flow technology and cloud‑connected monitoring to improve efficiency and reduce energy use.

- In May 2024, Landa Digital Printing and Gelato announced a strategic collaboration to combine Landa’s Nanographic Printing technology with Gelato’s global software platform, GelatoConnect, enabling on-demand, short-to-medium run digital printing with high quality and efficiency. The partnership leverages Gelato’s fulfillment network in over 32 countries to streamline workflows, expand market reach, and support sustainable production. By integrating Landa’s fast, high-fidelity B1 printing with Gelato’s platform, the collaboration enhances production speed, creative flexibility, cost-effectiveness, and customer experience, while also highlighting the global impact and innovation of Landa Corporation Ltd.’s Nanography technology.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRESS TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 VENDOR SELECTION CRITERIA

4.2.1 TECHNICAL PERFORMANCE & PRINT QUALITY

4.2.2 AUTOMATION & OPERATIONAL EFFICIENCY

4.2.3 FLEXIBILITY & SUBSTRATE VERSATILITY

4.2.4 RELIABILITY, SERVICE & SUPPORT

4.2.5 COST STRUCTURE & TOTAL COST OF OWNERSHIP (TCO)

4.2.6 INNOVATION & TECHNOLOGY ROADMAP

4.2.7 MARKET REPUTATION & TRACK RECORD

4.2.8 SUSTAINABILITY & ENVIRONMENTAL COMPLIANCE

4.2.9 CUSTOMIZATION & SCALABILITY

4.3 TECHNOLOGICAL ADVANCEMENTS

4.3.1 ADVANCED AUTOMATION & SMART MAKEREADY

4.3.2 INLINE COLOR & QUALITY CONTROL

4.3.3 HIGH-SPEED & HIGH-VOLUME PRODUCTIVITY

4.3.4 SUBSTRATE VERSATILITY & SPECIALTY MEDIA HANDLING

4.3.5 ENERGY EFFICIENCY & SUSTAINABILITY

4.3.6 INLINE FINISHING & VALUE-ADDED FEATURES

4.4 INVESTMENT OPPORTUNITY BY 2033

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS – MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET

4.5.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.5.1.1 Joint Ventures

4.5.1.2 Mergers and Acquisitions

4.5.1.3 Licensing and Partnership

4.5.1.4 Technology Collaborations

4.5.1.5 Strategic Divestments

4.5.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.5.3 STAGE OF DEVELOPMENT

4.5.4 TIMELINES AND MILESTONES

4.5.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.5.6 RISK ASSESSMENT AND MITIGATION

4.5.7 FUTURE OUTLOOK

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL SOURCING & PROCUREMENT

4.6.2 PROCESSING & PRODUCT MANUFACTURING (PRODUCTION)

4.6.3 SUPPLY CHAIN & DISTRIBUTION LOGISTICS (TRANSPORTATION)

4.6.4 RETAIL & COMMERCIAL BUYER CHANNELS (DISTRIBUTION & SALES)

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 INDUSTRY ECOSYSTEM ANALYSIS

4.8.1 INTRODUCTION

4.8.2 PROMINENT COMPANIES

4.8.3 SMALL & MEDIUM SIZE COMPANIES

4.8.4 END USERS

4.9 PRICING ANALYSIS

4.9.1 COMPREHENSIVE PRICING CONTEXT

4.9.2 GRADUAL PRICE ESCALATION DRIVEN BY TECHNOLOGICAL INTEGRATION (2026–2027)

4.9.3 MID-TERM PRICING ACCELERATION REFLECTING STRUCTURAL COST PRESSURES (2028–2030)

4.9.4 LATE-STAGE PRICING MATURITY AND VALUE CONSOLIDATION (2031–2033)

4.9.5 STRATEGIC IMPLICATIONS OF PRICING TRENDS

4.9.6 CONCLUSION

5 TARIFFS & IMPACT ON THE MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.5.3 IMPACT ON PRICES

5.5.4 REGULATORY INCLINATION

5.5.5 GEOPOLITICAL SITUATION

5.5.6 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.5.6.1 Free Trade Agreements

5.5.6.2 Alliances Establishments

5.5.7 STATUS ACCREDITATION (INCLUDING MFN)

5.5.8 DOMESTIC COURSE OF CORRECTION

5.5.8.1 Incentive Schemes to Boost Production Outputs

5.5.8.2 Establishment of SEZs / Industrial Parks

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.4 REGION-WISE REGULATORY CROSS-MAPPING

6.4.1 EUROPE

6.4.2 ASIA-PACIFIC

6.4.3 AMERICAS

6.5 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 EXPANSION OF PACKAGING & COMMERCIAL PRINTING INDUSTRY

7.1.2 INCLINATION TOWARDS HIGH-QUALITY AND COST-EFFICIENT PRINTING MACHINES

7.1.3 INTEGRATION OF ADVANCED TECHNOLOGIES IN SHEETFED PRINTING PRESSES

7.2 RESTRAINTS

7.2.1 SHIFT TOWARD DIGITAL PRINTING

7.2.2 HIGH INITIAL INVESTMENT & OPERATING COSTS OF EQUIPMENT

7.3 OPPORTUNITIES

7.3.1 EXPANSION AND INVESTMENTS IN EMERGING MARKETS

7.3.2 AUGUMENTATION IN PUBLICATION AND LABEL PRINTING

7.4 CHALLENGES

7.4.1 VOLATILITY IN RAW MATERIAL PRICES

7.4.2 LIMITED ACCESS TO SKILLED LABOR

8 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE

8.1 OVERVIEW

8.2 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

8.2.1 CONVENTIONAL (OFFSET) PRESSES

8.2.2 UV CURING PRESSES

8.2.3 DIGITAL/HYBRID B1 PRESSES

8.2.4 OTHERS

8.3 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

8.3.1 CONVENTIONAL (OFFSET) PRESSES

8.3.2 UV CURING PRESSES

8.3.3 DIGITAL/HYBRID B1 PRESSES

8.3.4 OTHERS

8.4 MIDDLE EAST AND AFRICA CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

8.4.1 FULLY AUTOMATED INLINE SYSTEMS

8.4.2 STANDALONE SYSTEMS

8.4.3 SEMI-AUTOMATED / MANUAL

8.5 MIDDLE EAST AND AFRICA UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

8.5.1 FULLY AUTOMATED INLINE SYSTEMS

8.5.2 STANDALONE SYSTEMS

8.5.3 SEMI-AUTOMATED / MANUAL

8.6 MIDDLE EAST AND AFRICA DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

8.6.1 FULLY AUTOMATED INLINE SYSTEMS

8.6.2 STANDALONE SYSTEMS

8.6.3 SEMI-AUTOMATED / MANUAL

8.7 MIDDLE EAST AND AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

8.7.1 FULLY AUTOMATED INLINE SYSTEMS

8.7.2 STANDALONE SYSTEMS

8.7.3 SEMI-AUTOMATED / MANUAL

9 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET , BY AUTOMATION LEVEL.

9.1 OVERVIEW

9.2 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

9.2.1 FULLY AUTOMATED INLINE SYSTEMS

9.2.2 STANDALONE SYSTEMS

9.2.3 SEMI-AUTOMATED / MANUAL

9.3 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (UNITS)

9.3.1 FULLY AUTOMATED INLINE SYSTEMS

9.3.2 STANDALONE SYSTEMS

9.3.3 SEMI-AUTOMATED / MANUAL

10 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET , BY COLOR CONFIGURATION.

10.1 OVERVIEW

10.2 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

10.2.1 MULTICOLOR PRESSES (4–8 COLORS)

10.2.2 TWO-COLOR PRESS

10.2.3 SINGLE COLOR PRESSES

10.2.4 OTHERS

10.3 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

10.3.1 MULTICOLOR PRESSES (4–8 COLORS)

10.3.2 TWO-COLOR PRESS

10.3.3 SINGLE COLOR PRESSES

10.3.4 OTHERS

10.4 MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

10.4.1 4-COLOR PRESSES

10.4.2 6-COLOR PRESSES

10.4.3 5-COLOR PRESSES

10.4.4 8-COLOR PRESSES

10.5 MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

10.5.1 4-COLOR PRESSES

10.5.2 6-COLOR PRESSES

10.5.3 5-COLOR PRESSES

10.5.4 8-COLOR PRESSES

11 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 PACKAGING PRINTING

11.2.2 COMMERCIAL PRINTING

11.2.3 PUBLICATION PRINTING (MAGAZINES, BOOKS)

11.2.4 LABEL PRINTING

11.2.5 SECURITY PRINTING

11.2.6 OTHERS

11.3 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

11.3.1 PACKAGING PRINTING

11.3.2 COMMERCIAL PRINTING

11.3.3 PUBLICATION PRINTING (MAGAZINES, BOOKS)

11.3.4 LABEL PRINTING

11.3.5 SECURITY PRINTING

11.3.6 OTHERS

11.4 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

11.4.1 PACKAGING CONVERTERS

11.4.2 PRINTING COMPANIES

11.4.3 PUBLISHERS

11.4.4 IN-PLANT PRINTERS (CORPORATE/INSTITUTIONAL)

11.4.5 OTHERS

12 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER

12.1 OVERVIEW

12.2 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

12.3 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

12.3.1 PACKAGING CONVERTERS

12.3.2 PRINTING COMPANIES

12.3.3 PUBLISHERS

12.3.4 IN-PLANT PRINTERS (CORPORATE/INSTITUTIONAL)

12.3.5 OTHERS

13 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 UNITED ARAB EMIRATES

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 BAHRAIN

13.1.7 KUWAIT

13.1.8 OMAN

13.1.9 QATAR

13.1.10 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 MANUFACTURER COMPANY PROFILE

16.1 HEIDELBERGER DRUCKMASCHINEN AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 KOMORI CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 KOENIG & BAUER AG

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 LANGLEY HOLDINGS PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 RMGT (RYOBI MHI GRAPHIC TECHNOLOGY)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ANHUI INNOVO BOCHEN MACHINERY MANUFACTURING CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 COMEXI.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 FUJIFILM EUROPE GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 GOOD CHOICE MACHINERY CO., LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 HANGZHOU ECOOGRAPHIX DIGITAL TECHNOLOGY CO., LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 HAVERER GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 JIANGSU HANSHENG PRINTING MACHINERY CO., LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 KUNSHAN RUIYUAN INTELLIGENT EQUIPMENT CO

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 LANDA CORPORATION LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 MGI DIGITAL TECHNOLOGY

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 MPS.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NILPETER

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SCREEN EUROPE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SHANGHAI PRINTYOUNG INTERNATIONAL INDUSTRY CO., LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHANGHAI UPG INTERNATIONAL INDUSTRY AND TRADE GROUP CO., LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 HEBEI WANJIE GROUP

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

17 DISTRIBUTOR COMPANY PROFILE

17.1 ALLFORPRINTMARKET

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 ORSAY MATBAA VE AMBALAJ MAKINALARI A.Ş.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 PRESSXCHANGE

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 SHANGHAI SHM INTERNATIONAL TRADING CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 SUPPLY CHAIN OVERVIEW

TABLE 2 CLIMATE CHANGE SCENARIO: MARKET IMPACT AND STRATEGIC OUTLOOK

TABLE 3 REGULATORY INTELLIGENCE COMPARISON – VALUE-DRIVEN VIEW

TABLE 4 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 6 MIDDLE EAST AND AFRICA CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA FULLY AUTOMATED INLINE SYSTEMS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA STANDALONE SYSTEMS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA SEMI-AUTOMATED / MANUAL IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (UNITS)

TABLE 19 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA TWO-COLOR PRESS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA SINGLE COLOR PRESSES B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 25 MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 27 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA PACKAGING PRINTING IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA COMMERCIAL PRINTING IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA PUBLICATION PRINTING (MAGAZINES, BOOKS) IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA LABEL PRINTING IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA SECURITY PRINTING IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 35 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 37 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA PACKAGING CONVERTERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PRINTING COMPANIES IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PUBLISHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA IN-PLANT PRINTERS (CORPORATE/INSTITUTIONAL) IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COUNTRY, 2018-2033 (UNITS)

TABLE 45 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 47 MIDDLE EAST AND AFRICA CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 53 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 55 MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 57 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 59 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 61 USD THOUSAND

TABLE 62 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 64 SOUTH AFRICA CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 65 SOUTH AFRICA UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 66 SOUTH AFRICA DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 67 SOUTH AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 68 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 69 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 70 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 71 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 72 SOUTH AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 73 SOUTH AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 74 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 75 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 76 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 77 SOUTH AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 78 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 80 SAUDI ARABIA CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 81 SAUDI ARABIA UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 82 SAUDI ARABIA DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 83 SAUDI ARABIA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 84 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 85 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 86 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 87 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 88 SAUDI ARABIA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 89 SAUDI ARABIA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 90 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 91 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 92 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 93 SAUDI ARABIA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 94 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 96 UNITED ARAB EMIRATES CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 97 UNITED ARAB EMIRATES UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 98 UNITED ARAB EMIRATES DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 99 UNITED ARAB EMIRATES OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 100 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 101 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 102 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 103 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 104 UNITED ARAB EMIRATES MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 105 UNITED ARAB EMIRATES MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 106 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 107 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 108 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 109 UNITED ARAB EMIRATES B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 110 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 112 EGYPT CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 113 EGYPT UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 114 EGYPT DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 115 EGYPT OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 116 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 117 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 118 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 119 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 120 EGYPT MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 121 EGYPT MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 122 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 123 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 124 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 125 EGYPT B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 126 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 128 ISRAEL CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 129 ISRAEL UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 130 ISRAEL DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 131 ISRAEL OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 132 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 133 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 134 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 135 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 136 ISRAEL MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 137 ISRAEL MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 138 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 139 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 140 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 141 ISRAEL B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 142 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 144 BAHRAIN CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 145 BAHRAIN UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 146 BAHRAIN DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 147 BAHRAIN OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 148 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 149 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 150 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 151 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 152 BAHRAIN MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 153 BAHRAIN MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 154 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 155 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 156 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 157 BAHRAIN B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 158 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 160 KUWAIT CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 161 KUWAIT UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 162 KUWAIT DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 163 KUWAIT OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 164 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 165 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 166 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 167 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 168 KUWAIT MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 169 KUWAIT MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 170 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 171 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 172 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 173 KUWAIT B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 174 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 176 OMAN CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 177 OMAN UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 178 OMAN DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 179 OMAN OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 180 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 181 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 182 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 183 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 184 OMAN MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 185 OMAN MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 186 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 187 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 188 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 189 OMAN B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 190 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 192 QATAR CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 193 QATAR UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 194 QATAR DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 195 QATAR OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 196 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 197 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 198 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 199 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 200 QATAR MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 201 QATAR MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 202 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 203 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 204 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 205 QATAR B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 206 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 208 REST OF MIDDLE EAST AND AFRICA CONVENTIONAL (OFFSET) PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 209 REST OF MIDDLE EAST AND AFRICA UV CURING PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 210 REST OF MIDDLE EAST AND AFRICA DIGITAL/HYBRID B1 PRESSES IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 211 REST OF MIDDLE EAST AND AFRICA OTHERS IN B1 SHEETFED OFFSET PRESS MARKET, BY AUTOMATION LEVEL, 2018-2033 (USD THOUSAND)

TABLE 212 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 213 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 214 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 215 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY COLOR CONFIGURATION, 2018-2033 (UNITS)

TABLE 216 REST OF MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (USD THOUSAND)

TABLE 217 REST OF MIDDLE EAST AND AFRICA MULTICOLOR PRESSES (4–8 COLORS) IN B1 SHEETFED OFFSET PRESS MARKET, BY NUMBER OF PRINTING UNITS, 2018-2033 (UNITS)

TABLE 218 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 219 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 220 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 221 REST OF MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2018-2033 (UNITS)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: MULTIVARIVATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: PRESS TYPE TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: APPLICATION COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: SEGMENTATION

FIGURE 13 FOUR SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY PRESS TYPE (2025)

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO BE THE DOMINANT AND FASTEST GRWOING REGION IN THE MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: EXECUTIVE SUMMARY

FIGURE 16 STRATEGIC DECISIONS

FIGURE 17 EXPANSION OF PACKAGING & COMMERCIAL PRINTING INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 18 CONVENTIONAL (OFFSET) PRESSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET IN 2025 & 2033

FIGURE 19 ASIA-PACIFIC THE FASTEST-GROWING REGION FOR THE MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 20 AVERAGE PRICE TREND OF B1 SHEETFED OFFSET PRESSES (2025–2033)

FIGURE 21 DROC

FIGURE 22 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET , BY PRESS TYPE, 2025

FIGURE 23 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET , BY AUTOMATION LEVEL, 2025

FIGURE 24 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET , BY COLOR CONFIGURATION, 2025

FIGURE 25 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET , BY APPLICATION, 2025

FIGURE 26 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET, BY END USER, 2025

FIGURE 27 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: SNAPSHOT (2025)

FIGURE 28 MIDDLE EAST AND AFRICA B1 SHEETFED OFFSET PRESS MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.