Middle East And Africa Blockchain Identity Management Market

Market Size in USD Billion

CAGR :

%

USD

0.28 Billion

USD

35.68 Billion

2024

2032

USD

0.28 Billion

USD

35.68 Billion

2024

2032

| 2025 –2032 | |

| USD 0.28 Billion | |

| USD 35.68 Billion | |

|

|

|

|

Blockchain Identity Management Market Size

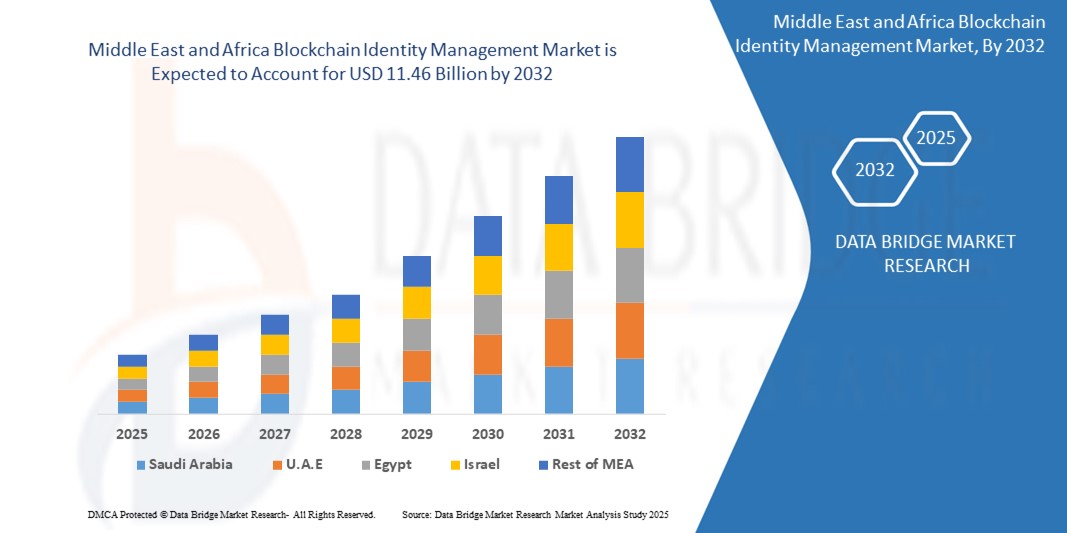

- The Middle East and Africa Blockchain Identity Management market size was valued at USD 0.28 billion in 2024 and is expected to reach USD 35.68 billion by 2032, at a CAGR of 83.30% during the forecast period

- The market’s remarkable growth is being driven by rapid digital transformation initiatives across key sectors including banking, government, telecom, and healthcare, where secure identity verification is critical for operational resilience, regulatory compliance, and cyber risk mitigation.

- Countries such as the United Arab Emirates (UAE), Saudi Arabia, South Africa, and Nigeria are leading the charge in adopting blockchain-based e-governance, digital KYC, and national identity management systems, boosting regional demand for scalable, decentralized identity solutions.

Blockchain Identity Management Market Analysis

- Blockchain Identity Management solutions are redefining identity verification and access management across major sectors in the Middle East and Africa, including banking, government, healthcare, telecom, and education. These platforms offer secure, immutable, and decentralized control of identity credentials—critical for addressing escalating cybersecurity concerns, especially in regions facing rapid digital onboarding.

- The market is being accelerated by the rise of self-sovereign identity (SSI) models, which grant individuals full control over their digital identities without centralized data custodianship. This model aligns with growing regional demands for data privacy, autonomy, and trust, particularly in countries implementing digital sovereignty laws.

- United Arab Emirates (UAE) leads the Blockchain Identity Management market in the Middle East and Africa with 41.6% regional market share in 2024, driven by government-led smart city initiatives, such as Smart Dubai and UAE Pass, which leverage blockchain for unified national ID and digital services integration. The UAE Digital Economy Strategy 2031 has further positioned identity infrastructure as a core enabler of trusted services.

- Saudi Arabia is forecasted to exhibit the fastest CAGR from 2025 to 2032, propelled by Vision 2030’s emphasis on e-governance, smart public services, and blockchain-enabled citizen identity platforms. In 2024, the National Digital Identity Program partnered with blockchain startups to roll out decentralized identity verification pilots for cross-border travel and digital commerce.

- The Software segment dominates with 42.9% market share in 2024, supported by growing enterprise investments in cloud-native identity solutions, decentralized authentication layers, and API-based integrations for government and banking services. In October 2023, Huawei Cloud expanded its Blockchain Service portfolio to MEA, offering DID (Decentralized Identity) platforms tailored for public sector and healthcare providers.

Report Scope and Blockchain Identity Management Market Segmentation

|

Attributes |

Blockchain Identity Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blockchain Identity Management Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- The Middle East and Africa Blockchain Identity Management market is witnessing a surge in AI and voice assistant integration, revolutionizing user interaction with smart access platforms. These technologies are driving demand across residential, hospitality, and enterprise environments by offering hands-free control, personalized experiences, and intelligent automation.

- In February 2024, Yale Middle East upgraded its Yale Access App to support multilingual voice assistant commands via Google Assistant and Amazon Alexa, catering to urban consumers in the UAE, Saudi Arabia, and South Africa seeking AI-driven convenience in home automation.

- In November 2023, Schlage’s Encode Plus™ Smart WiFi Deadbolt, launched in select MEA markets, introduced Apple Home Key support, enabling seamless unlocking via iPhone and Apple Watch—especially popular among tech-savvy users in cities like Dubai, Riyadh, and Cape Town.

- In October 2023, SALTO Systems, in partnership with local system integrators in Nigeria and Kenya, launched KS (Keys as a Service)—a cloud-based platform with AI-powered access analytics, offering predictive behavior insights and anomaly detection in multi-tenant commercial buildings.

- The AI-focused product strategies are also evident in August Smart Locks, which incorporated voice-enabled notifications and smart geofencing features through Alexa integrations in MEA smart housing pilots launched in Qatar and Oman in 2023.

Blockchain Identity Management Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The Middle East and Africa region is undergoing rapid smart urbanization, increasing the demand for real-time, secure, and remote-access identity solutions. Blockchain Identity Management systems are becoming integral to modern smart cities, digital housing, and infrastructure management.

- In April 2024, ASSA ABLOY introduced its ENTR™ Smart Lock System in Dubai and Abu Dhabi, tailored for residential complexes and hospitality. The solution integrates blockchain-based digital keys with mobile apps for guest access and security audit trails.

- In March 2024, the Smart Riyadh Project deployed blockchain-backed identity verification modules for public parking, government building access, and e-services as part of its push to enhance citizen service delivery through smart credentials.

- In January 2024, ZKTeco Middle East launched a bio-blockchain smart lock solution with facial recognition and identity verification tailored for offices and co-living hubs in Egypt, Morocco, and the UAE.

- Cost-effective solutions are also gaining ground—the Aqara Smart Lock U100, introduced in late 2023, offers Matter compatibility and affordable installation in rental units and suburban homes across South Africa and Jordan, appealing to middle-income consumers.

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Despite growing adoption, cybersecurity risks remain a major challenge in the MEA region. Vulnerabilities such as unencrypted firmware, lack of multi-factor authentication, and cloud misconfigurations have drawn regulatory scrutiny.

- A December 2023 study by the UAE Cybersecurity Council flagged vulnerabilities in imported smart lock systems, leading to new mandates for end-to-end encryption and localized data hosting for identity systems in smart infrastructure.

- In 2023, Kenya’s ICT Authority imposed strict testing protocols for smart devices integrated into government buildings, citing risks of data leaks and unauthorized access.

- High upfront costs of advanced Blockchain Identity Management solutions—such as those from SALTO and Dormakaba, priced upwards of $400 per unit—limit adoption across rural areas and small businesses in North and West Africa.

- In response, in Q4 2023, Startups like Tinkr ID (UAE) introduced modular identity kits starting from USD 80, with options to scale as per property type—aimed at startups, schools, and small clinics across Bahrain, Oman, and Nigeria.

Blockchain Identity Management Market Scope

The market is segmented on the basis of component, provider, network, organization size, vertical.

- By Component

The market is segmented into Software and Services.

The Software segment dominated the market in 2024, accounting for the largest revenue share. This is driven by increased adoption of blockchain platforms offering secure digital identity wallets, identity lifecycle management, and role-based access. Vendors such as IBM Blockchain, Microsoft Azure, and Huawei Cloud are expanding BaaS (Blockchain-as-a-Service) offerings to support regional governments and enterprises in digital ID transformation.

The Services segment is expected to witness rapid growth due to increasing demand for deployment, consulting, and integration services. Countries like Saudi Arabia and South Africa are outsourcing implementation support for national eID frameworks and smart city rollouts, pushing growth in managed services.

• By Provider

The market is segmented into Application Providers, Middleware Providers, and Infrastructure Providers.

Application Providers held the largest share in 2024, offering ready-to-integrate decentralized identity applications for sectors like BFSI and healthcare. Companies like Evernym and uPort are collaborating with African governments to implement SSI-based digital ID applications for welfare access and medical record portability.

Middleware Providers are projected to experience the highest CAGR from 2025 to 2032. The rise in demand for API-based identity federation, interoperability protocols, and smart contract middleware (e.g., Hyperledger Indy, Sovrin, uPort Connect) is creating new opportunities for seamless integration with legacy systems.

• By Network

The market is segmented into Permissioned and Permissionless networks.

Permissioned networks dominated the market in 2024, as they offer controlled access, regulatory compliance, and scalable performance, which are critical for high-security sectors like government and finance. For instance, Qatar’s Ministry of Transport and Communications is piloting permissioned blockchain networks for national identity verification systems.

The Permissionless segment is projected to grow steadily, particularly in grassroots and decentralized applications for education and social services across underserved populations. Projects like IDBox in Ethiopia and BanQu in Kenya are utilizing public blockchains to provide immutable, decentralized identity credentials for the unbanked.

• By Organization Size

The market is segmented into Large Enterprises and Small and Medium Enterprises (SMEs).

Large Enterprises held the largest market share in 2024, driven by widespread adoption in telecom, defense, and banking sectors. Enterprises in UAE, Nigeria, and Israel are investing in blockchain to mitigate data breach risks and comply with cross-border regulatory mandates.

The SMEs segment is expected to grow at the fastest pace, driven by increased availability of affordable, modular identity tools tailored for small-scale use. In 2023, IBM and Oracle launched SME-targeted blockchain identity kits in North African countries, supporting small businesses in managing user access, contract signing, and digital KYC.

• By Vertical

The market is segmented into BFSI, Government, Healthcare, Telecom & IT, Retail & E-Commerce, and Others.

The Government vertical led the market in 2024, supported by initiatives like UAE PASS, Saudi Arabia’s Blockchain for Digital Identity Framework, and South Africa’s Blockchain Property Registry Pilot. These projects are enabling transparent, inclusive, and interoperable identity management for public services.

The BFSI segment is projected to experience the fastest growth, as regional banks adopt blockchain for customer onboarding, fraud prevention, and cross-border compliance. In 2024, First Abu Dhabi Bank (FAB) and Standard Bank South Africa started integrating blockchain-based e-KYC modules to automate identity checks and reduce verification costs.

Healthcare is emerging as a key adopter, particularly post-pandemic, for maintaining tamper-proof digital health records and vaccination certificates. The Moroccan Ministry of Health, for instance, piloted a blockchain identity system in late 2023 for credentialing and verifying medical staff across rural clinics.

Blockchain Identity Management Market Regional Analysis

- Middle East and Africa is emerging as a promising region in the Blockchain Identity Management market, forecasted to grow at a CAGR of 83.30% during the forecast period. This exponential growth is driven by national digital transformation agendas, identity verification mandates in fintech and telecom, and rising investments in smart governance and e-services platforms.

- Countries such as UAE, Saudi Arabia, South Africa, and Nigeria are rapidly integrating blockchain into national identity infrastructure, public service delivery, and cross-border authentication frameworks. Governments are adopting self-sovereign identity (SSI) models to promote user privacy, reduce data silos, and streamline KYC/AML processes across sectors.

- The expansion of cybersecurity regulations, including UAE’s National Cybersecurity Strategy, Saudi Arabia’s Digital Government Authority (DGA) regulations, and South Africa’s POPIA Act, is further propelling the need for secure, decentralized digital identity systems.

UAE Blockchain Identity Management Market Insight

The United Arab Emirates is at the forefront of blockchain adoption in the region, supported by the UAE Blockchain Strategy 2021 and subsequent initiatives under Dubai’s Smart Government vision. In 2024, Dubai’s Department of Economic Development expanded its blockchain-based business registration platform to support decentralized identity for corporate onboarding and licensing.

The UAE PASS—a national digital identity platform—is being enhanced with blockchain layers to provide residents and businesses with tamper-proof, single-sign-on credentials for over 6,000 government and private sector services. Partnerships with players like Avanza Innovations and Consensys are accelerating use cases in healthcare, travel, and fintech.

Saudi Arabia Blockchain Identity Management Market Insight

Saudi Arabia is leveraging blockchain as part of its Vision 2030 digital transformation plan, with key projects in healthcare, education, and e-government. In 2023, the Ministry of Health piloted a blockchain-based professional licensing and credentialing platform for doctors and healthcare workers. The Digital Government Authority (DGA) is also testing decentralized ID systems to authenticate citizens across public portals and reduce fraud.

Collaborations with blockchain startups and regional system integrators like Elm Company and STC Solutions are fostering an ecosystem focused on permissioned identity chains, smart contracts, and secure user authentication. Riyadh and NEOM are becoming innovation hubs for identity-linked smart city applications.

Blockchain Identity Management Market Share

The Blockchain Identity Management industry is primarily led by well-established companies, including:

- Amazon Web Services, Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Bitfury Group Limited (Netherlands)

- Civic Technologies, Inc. (U.S.)

- Evernym, Inc. (U.S.)

- ConsenSys (U.S.)

- Coinfirm Limited (Poland)

- Dock Labs AG (Switzerland)

Latest Developments in Middle East and Africa Blockchain Identity Management Market

- In May 2024, the UAE’s Digital Dubai Authority announced the integration of blockchain-based digital ID modules into the UAE Pass ecosystem, enabling residents and businesses to access over 7,000 federal and local services through self-sovereign identity (SSI) frameworks. This upgrade includes Verifiable Credentials (VCs) and supports compliance with regional data privacy mandates.

- In April 2024, Avanza Innovations launched a blockchain-powered identity layer for the Dubai Land Department (DLD) to manage property transaction authentication and digital notarization. The system utilizes smart contracts and decentralized identity tokens to validate ownership and prevent fraud in the emirate’s growing real estate sector.

- In March 2024, South Africa’s Standard Bank partnered with IBM Blockchain to pilot a decentralized digital KYC solution across its retail banking operations. The system allows users to own and control access to their financial identity, reducing onboarding time by 60% and enhancing security for remote account creation.

- In February 2024, Saudi Arabia’s Digital Government Authority (DGA), in collaboration with STC Solutions, launched a sandbox initiative to test blockchain-based national digital identity prototypes. These solutions aim to unify access to healthcare, education, and financial services via a permissioned blockchain infrastructure.

- In January 2024, Kenya’s Ministry of ICT and Digital Economy unveiled the Maisha Namba project—an enhanced blockchain-supported digital ID system that leverages decentralized storage to secure birth records, driving licenses, and social benefit credentials. The system is built on an open-source blockchain stack and is currently being rolled out in Nairobi and Kisumu counties.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.