Middle East And Africa Blood Warmer Devices Market

Market Size in USD Million

CAGR :

%

USD

17.40 Million

USD

27.94 Million

2024

2032

USD

17.40 Million

USD

27.94 Million

2024

2032

| 2025 –2032 | |

| USD 17.40 Million | |

| USD 27.94 Million | |

|

|

|

|

Middle East and Africa Blood Warmer Devices Market Size

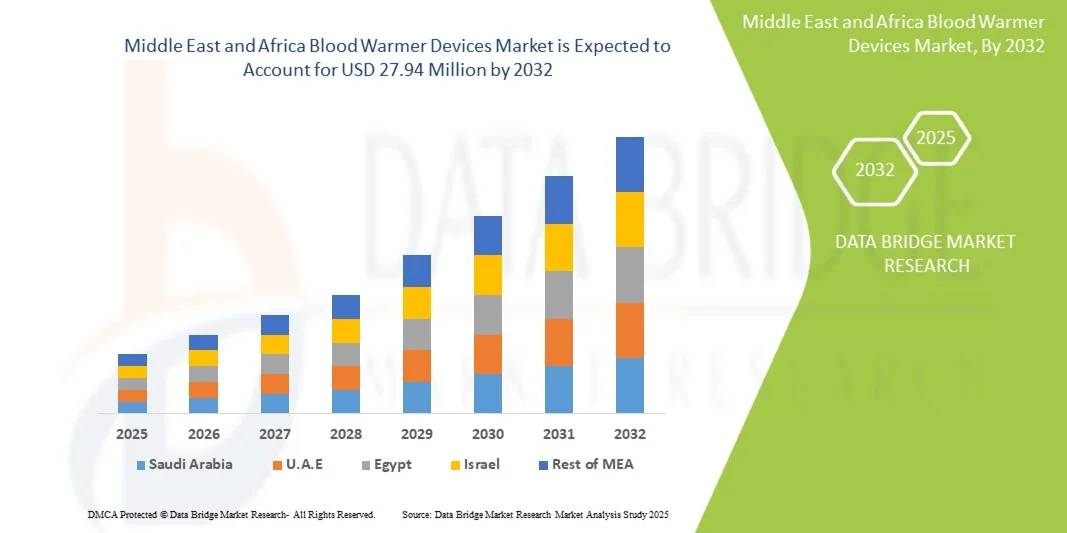

- The Middle East and Africa blood warmer devices market size was valued at USD 17.40 million in 2024 and is expected to reach USD 27.94 million by 2032, at a CAGR of 6.1% during the forecast period

- The market growth is largely driven by the rising prevalence of hypothermia cases during surgeries, trauma care, and emergency transfusions, alongside the increasing number of hospitals and advanced healthcare facilities across the region

- Furthermore, the growing adoption of portable and automated blood warming technologies, coupled with government initiatives to improve patient safety standards, is strengthening the market outlook. These converging factors are accelerating the use of blood warmer devices, thereby significantly boosting the industry’s growth

Middle East and Africa Blood Warmer Devices Market Analysis

- Blood warmer devices, which ensure safe transfusion and infusion of blood and fluids by maintaining optimal body temperature, are becoming increasingly vital across hospitals and trauma centers in the Middle East and Africa, particularly in surgical and emergency care settings where hypothermia prevention is essential

- The rising demand for blood warmer devices is primarily driven by the growing incidence of road accidents, increased surgical procedures, and expanding access to modern healthcare infrastructure across the region

- Saudi Arabia dominated the Middle East and Africa blood warmer devices market with the largest revenue share of 35.2% in 2024, supported by significant government investments in healthcare modernization, strong hospital infrastructure, and the presence of global medical device suppliers

- South Africa is expected to be the fastest-growing country in the market during the forecast period, driven by rising healthcare expenditure, growing awareness of patient temperature management, and the increasing number of trauma and emergency care centers

- The portable blood warmer segment dominated the market with a share of 41.3% in 2024, fueled by its increasing use in emergency medical services, military applications, and remote healthcare facilities due to its mobility, efficiency, and rapid warming performance

Report Scope and Middle East and Africa Blood Warmer Devices Market Segmentation

|

Attributes |

Middle East and Africa Blood Warmer Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Blood Warmer Devices Market Trends

“Rising Demand for Portable and Automated Blood Warming Technologies”

- A significant and accelerating trend in the Middle East and Africa blood warmer devices market is the growing adoption of portable and automated systems, particularly in emergency medical services, military operations, and remote healthcare facilities where rapid warming and mobility are essential

- For instance, the Belmont Buddy Lite portable blood and fluid warmer is increasingly being deployed in military and pre-hospital emergency settings across Gulf countries due to its compact design and rapid heating performance. Similarly, portable devices from companies such as 3M and Stryker are witnessing higher adoption in trauma care units

- Automation in blood warmers is enabling precise temperature control, real-time monitoring, and enhanced safety through features such as automatic shut-off and alarm systems. For instance, advanced models such as the Barkey plasmatherm incorporate intelligent sensors to prevent overheating and ensure consistent warming efficiency during transfusions

- The integration of smart sensors and digital interfaces allows healthcare professionals to maintain optimal patient temperatures even in resource-limited environments, improving outcomes in critical care scenarios

- This trend toward portable and intelligent devices is reshaping transfusion practices, particularly in rural and mobile healthcare systems across the Middle East and Africa. Consequently, companies such as MEQU and QinFlow are developing next-generation portable warmers optimized for field use and ambulance applications

- The demand for compact, energy-efficient, and automated blood warmers is expanding rapidly as healthcare providers prioritize patient safety, operational efficiency, and flexibility in emergency and surgical care environments

Middle East and Africa Blood Warmer Devices Market Dynamics

Driver

“Increasing Surgical Procedures and Emergency Care Expansion”

- The growing number of surgical procedures, trauma cases, and emergency medical interventions across the Middle East and Africa is a significant driver fueling demand for blood warmer devices

- For instance, in February 2024, the Saudi Ministry of Health launched an initiative to expand advanced trauma and emergency care centers, creating a surge in demand for warming devices in operating and intensive care units

- As the incidence of road accidents and critical injuries continues to rise, hospitals are increasingly adopting advanced blood and fluid warming technologies to prevent perioperative hypothermia and ensure safe transfusions

- Furthermore, the ongoing development of healthcare infrastructure, along with rising investments in surgical facilities and intensive care capabilities, is strengthening the market outlook

- The need for reliable temperature management systems during major surgeries, neonatal care, and emergency transfusions is driving hospitals to replace conventional warmers with modern, automated models

- The growing collaboration between regional hospitals and global medical device manufacturers is further accelerating this trend

- The focus on improving patient outcomes and adhering to international safety standards is propelling the adoption of high-performance blood warmer systems across both public and private healthcare facilities in the region

Restraint/Challenge

“High Equipment Cost and Limited Technical Expertise”

- The high procurement and maintenance costs of advanced blood warming systems pose a major restraint to market expansion, particularly in resource-constrained healthcare settings across Africa

- For instance, budget limitations in public hospitals often delay the replacement of outdated warming systems, restricting access to advanced devices that offer better temperature precision and patient safety

- Moreover, the shortage of trained biomedical engineers and healthcare professionals familiar with the operation and calibration of modern automated warmers presents an additional challenge for smooth clinical adoption

- Some regions face irregular electricity supply and limited technical support, which hampers the consistent use of powered blood warming systems in remote or rural healthcare centers

- While portable battery-operated models are emerging as potential solutions, their higher upfront cost and limited awareness among small-scale healthcare providers still impede widespread usage

- Overcoming these challenges through targeted government subsidies, training programs for clinical staff, and the introduction of cost-effective portable devices will be essential for ensuring sustainable market growth in the Middle East and Africa

Middle East and Africa Blood Warmer Devices Market Scope

The market is segmented on the basis of type, product, devices, sample, and patient type.

- By Type

On the basis of type, the Middle East and Africa blood warmer devices market is segmented into portable and non-portable systems. The portable segment dominated the market with the largest revenue share of 41.3% in 2024, primarily due to its extensive use in emergency medical services, military operations, and ambulatory care. Portable warmers are designed for rapid deployment in field environments and enable precise warming during patient transport. Their compact design, lightweight nature, and battery-powered operation make them highly effective in critical and pre-hospital situations. In countries such as Saudi Arabia and the UAE, where trauma care and military medical support are expanding, portable devices are being rapidly adopted to enhance emergency readiness. The ability of portable blood warmers to deliver consistent performance in variable conditions drives their preference among healthcare providers.

The non-portable segment is projected to witness the fastest growth during the forecast period, supported by increasing installations in operating rooms, intensive care units (ICUs), and blood banks. These systems provide continuous warming for longer procedures and transfusions, ensuring optimal temperature maintenance in controlled hospital settings. The rising number of surgical procedures and government initiatives to upgrade healthcare infrastructure in South Africa and Egypt are fueling the segment’s growth. Their high precision and integration with hospital monitoring systems make them ideal for use in complex clinical environments.

- By Product

On the basis of product, the market is divided into surface warming systems, intravenous warming systems, and patient warming accessories. The intravenous warming system segment dominated the market with the highest revenue share in 2024, owing to its critical role in blood and fluid transfusion during surgeries, trauma care, and emergency treatments. These systems offer real-time temperature regulation and are widely used to prevent transfusion-related hypothermia. Hospitals in Saudi Arabia, the UAE, and South Africa have increasingly adopted intravenous warmers to ensure safe and effective thermal management during critical care. The continuous innovation in this segment, including advanced sensors and automatic shut-off mechanisms, enhances safety and efficiency. The reliability of these systems in maintaining stable temperatures during rapid infusions contributes to their strong market hold.

The surface warming system segment is anticipated to grow at the fastest CAGR during the forecast period, driven by its broad use in preoperative, intraoperative, and postoperative patient warming. Surface systems, such as warming blankets and pads, are increasingly preferred for neonatal and pediatric applications due to their non-invasive nature. Growing awareness of patient temperature management and the adoption of enhanced recovery protocols in regional hospitals are key growth drivers. In addition, technological advancements such as reusable, energy-efficient surface warming devices are making them more affordable and accessible across healthcare facilities.

- By Devices

On the basis of devices, the market is categorized into sample warmers and others. The sample warmers segment dominated the market in 2024, accounting for the largest share due to their extensive use in laboratories, fertility centers, and blood banks. Sample warmers play a crucial role in maintaining biological materials such as blood, plasma, and cells at controlled temperatures to prevent degradation. The growing focus on quality assurance and compliance with safety standards in medical testing laboratories across the Middle East is fueling demand. Hospitals and diagnostic centers are increasingly integrating advanced sample warming units to support accurate diagnostic and storage processes. The availability of digitally controlled and portable sample warmers with precise temperature calibration features further strengthens the segment’s leadership.

The “others” segment, which includes combined warming and monitoring devices, is expected to register the fastest growth rate during the forecast period. The expansion of multi-functional warming systems capable of serving diverse clinical purposes such as infusion, transfusion, and laboratory applications is driving this trend. Increased investments in research and development and rising adoption of integrated warming technologies by regional hospitals and clinics are key factors supporting growth.

- By Sample

On the basis of sample type, the market is segmented into blood, embryo, ovum, and semen. The blood segment dominated the market in 2024, holding the largest revenue share due to the widespread use of blood warmers in transfusion and infusion procedures. These devices are essential for maintaining normothermia in patients undergoing surgeries, trauma treatment, or massive blood transfusions. The growing number of road accidents, coupled with the rise in surgical volumes, has intensified the need for reliable blood warming systems across Saudi Arabia, Egypt, and South Africa. In addition, ongoing government initiatives to improve transfusion safety standards are fueling segment growth. The emphasis on patient safety and the integration of temperature-controlled transfusion practices have solidified this segment’s dominance.

The embryo segment is anticipated to grow at the fastest rate during the forecast period, driven by the expanding number of fertility and in-vitro fertilization (IVF) centers in the region. Blood warmers and related temperature-regulated devices play a critical role in preserving embryo viability during handling and storage. Countries such as the UAE and South Africa are witnessing rapid development in assisted reproductive technology (ART), boosting demand for specialized warming equipment. Technological advancements in precision warming and increased investments in reproductive healthcare infrastructure further enhance this segment’s growth prospects.

- By Patient Type

On the basis of patient type, the market is segmented into pediatric and neonates and adults. The adult segment dominated the market with the highest share in 2024, primarily due to the larger volume of surgeries, trauma cases, and chronic illness treatments in the adult population. Adult patients undergoing complex surgeries or massive transfusions require precise thermal management to prevent hypothermia-related complications. Increasing investments in operating room equipment and temperature management systems across major hospitals in Saudi Arabia and South Africa have contributed to the segment’s dominance. The adoption of advanced blood warming systems that ensure safety and consistency during prolonged procedures further drives growth.

The pediatric and neonates segment is expected to witness the fastest growth during the forecast period, supported by rising awareness of neonatal hypothermia and an increasing focus on improving infant care outcomes. Premature and low-birth-weight infants are particularly susceptible to temperature loss, making warming systems essential in neonatal intensive care units (NICUs). The growing establishment of specialized neonatal centers and the introduction of portable and non-invasive warming systems suitable for infants in the UAE, Egypt, and Kenya are propelling this segment’s expansion. Enhanced government focus on reducing neonatal mortality and improving perinatal care infrastructure further accelerates growth.

Middle East and Africa Blood Warmer Devices Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa blood warmer devices market with the largest revenue share of 35.2% in 2024, supported by significant government investments in healthcare modernization, strong hospital infrastructure, and the presence of global medical device suppliers

- Healthcare providers in the region are increasingly adopting modern blood warming technologies to prevent hypothermia during transfusions, emergency treatments, and critical care procedures, ensuring improved patient safety and clinical outcomes

- This growing adoption is further supported by expanding healthcare infrastructure, increasing government investments in hospital modernization, and rising awareness of perioperative temperature management, positioning blood warmer devices as an essential component of medical and emergency care systems across the region

Saudi Arabia Blood Warmer Devices Market Insight

The Saudi Arabia blood warmer devices market is anticipated to witness robust growth during the forecast period, primarily attributed to the rising number of surgical procedures, trauma cases, and transfusion requirements. The Kingdom’s Vision 2030 healthcare transformation program emphasizes improving patient safety and clinical outcomes, encouraging hospitals to adopt advanced warming systems. Furthermore, strong government funding and infrastructure investments, coupled with an increasing focus on emergency care readiness, are supporting the integration of blood warming technologies across public and private healthcare sectors.

South Africa Blood Warmer Devices Market Insight

The South Africa blood warmer devices market is expected to grow at a considerable CAGR during the forecast period, driven by an increasing burden of road accidents, surgical interventions, and the growing awareness of temperature management in critical care. Public and private hospitals are expanding their adoption of modern patient-warming systems to reduce transfusion-related complications. In addition, ongoing initiatives to strengthen healthcare access in rural and urban regions, along with the rising presence of international medical device suppliers, are expected to accelerate market expansion across the country.

Egypt Blood Warmer Devices Market Insight

The Egypt blood warmer devices market is gaining momentum due to the country’s efforts to modernize healthcare infrastructure and improve the quality of emergency and surgical care. Rising investments in public hospitals, coupled with international partnerships to equip healthcare facilities with advanced medical devices, are boosting demand for blood warming systems. In addition, the growing prevalence of trauma cases and increased awareness of patient temperature management are propelling the adoption of portable and automated blood warmers across both government and private healthcare institutions.

The UAE Blood Warmer Devices Market Insight

The UAE blood warmer devices market captured a notable revenue share in 2024, driven by the country’s strong focus on healthcare modernization and the adoption of advanced medical technologies. The rise in elective and emergency surgeries, coupled with the expansion of private healthcare facilities, is fostering the demand for reliable and precise blood warming equipment. In addition, increasing collaborations with global medical device manufacturers and government initiatives to elevate clinical care standards are boosting market growth across hospitals, ambulatory centers, and defense healthcare units.

Middle East and Africa Blood Warmer Devices Market Share

The Middle East and Africa Blood Warmer Devices industry is primarily led by well-established companies, including:

- ICU Medical, Inc. (U.S.)

- Belmont Medical Technologies (U.S.)

- 3M (U.S.)

- QinFlow. (Israel)

- Geratherm Medical AG (Germany)

- Smiths Medical (U.K.)

- Vyaire Medical (U.S.)

- Stryker (U.S.)

- Baxter (U.S.)

- Halyard Health (U.S.)

- EMIT Corporation (U.S.)

- Narang Medical Limited (India)

- Combat Medical Systems (U.K.)

- Barkey GmbH & Co. KG (Germany)

- Stihler Electronic GmbH (Germany)

- Enthermics Medical Systems (U.S.)

- Biegler GmbH (Germany)

- Keewell Medical Technology Co., Ltd. (China)

- Estill Medical Technologies (U.S.)

What are the Recent Developments in Middle East and Africa Blood Warmer Devices Market?

- In June 2024, trade and industry coverage highlighted Arab Health’s increasing focus on medical device adoption across the Middle East & Africa the event and coverage have been used by device makers to launch and showcase warming/critical-care products targeted at MEA purchasers and hospital buyers

- In August 2024, an American–Israeli group donated a rapid blood-infuser for use treating wounded patients in Gaza the story highlights real deployments of blood-warming/infusion equipment in an active Middle East conflict zone

- In June 2023, the WHO Regional Office for Africa used World Blood Donor Day to call on governments and partners to invest in and strengthen national blood programmes a policy push that includes investments in safe transfusion practices and equipment

- In November 2023, South Africa’s updated clinical guidelines for use of blood and blood products were published the update reinforced patient-blood-management best practices and clinical transfusion safety measures that increase demand for proper warming/handling of blood in hospitals

- In October 2021, QinFlow and 410 Medical publicly announced collaboration to combine QinFlow’s blood/IV warming technology with 410 Medical’s rapid infusion systems a technical partnership that made faster delivery of warmed blood more viable for prehospital and hospital adopters globally, including MEA emergency systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.