Middle East And Africa Body Composition Analyzers Market

Market Size in USD Million

CAGR :

%

USD

90.02 Million

USD

193.67 Million

2025

2033

USD

90.02 Million

USD

193.67 Million

2025

2033

| 2026 –2033 | |

| USD 90.02 Million | |

| USD 193.67 Million | |

|

|

|

|

Middle East and Africa Body Composition Analyzers Market Size

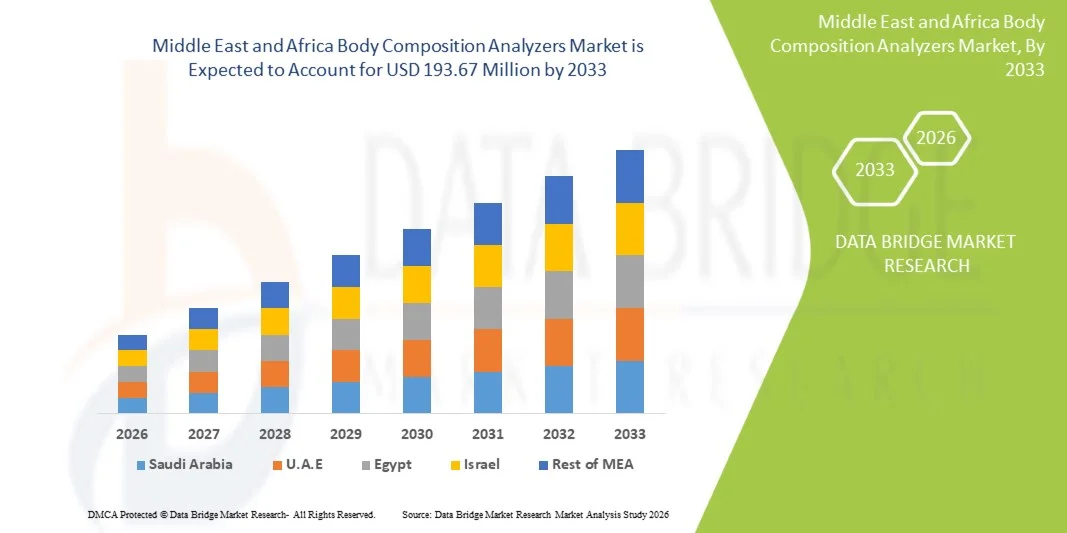

- The Middle East and Africa body composition analyzers market size was valued at USD 90.02 million in 2025 and is expected to reach USD 193.67 million by 2033, at a CAGR of 10.05% during the forecast period

- The market growth is largely fueled by the rising prevalence of obesity and chronic diseases, increasing health awareness, expansions in healthcare infrastructure, and growing adoption of body composition analyzers in fitness centers, clinics, and home settings

- Furthermore, rising consumer demand for precise, user-friendly, and integrated solutions for body composition measurement is establishing these analyzers as the modern assessment tool of choice. These converging factors are accelerating the uptake of body composition analyzers, thereby significantly boosting the industry’s growth in the MEA region

Middle East and Africa Body Composition Analyzers Market Analysis

- Body composition analyzers, providing precise measurement of body fat, muscle mass, water content, and other health metrics, are becoming essential tools in modern healthcare, fitness, and wellness programs across both residential and commercial settings due to their accuracy, ease of use, and integration with digital health platforms

- The rising demand for body composition analyzers is primarily fueled by increasing health awareness, growing prevalence of obesity and chronic diseases, and a shift towards preventive healthcare and personalized fitness monitoring

- Saudi Arabia dominated the Middle East & Africa body composition analyzers market with the largest revenue share of 38.2% in 2025, driven by expanding healthcare infrastructure, growing wellness and fitness trends, and rising adoption in hospitals, clinics, and fitness centers across the country

- South Africa is expected to be the fastest growing country in the Middle East & Africa body composition analyzers market during the forecast period, supported by increasing health-conscious populations and investments in healthcare technology

- Bio Impedance Analyzers segment dominated the body composition analyzers market with a market share of 46.5% in 2025, driven by its non-invasive nature, ease of use, and ability to provide quick, accurate, and repeatable results for both clinical and personal health monitoring

Report Scope and Middle East and Africa Body Composition Analyzers Market Segmentation

|

Attributes |

Middle East and Africa Body Composition Analyzers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Body Composition Analyzers Market Trends

“Integration with Digital Health and Fitness Platforms”

- A significant and accelerating trend in the MEA body composition analyzers market is the integration of devices with digital health platforms, mobile apps, and cloud-based fitness tracking systems, enhancing user engagement and data accessibility

- For instance, InBody 770 allows users to sync body composition data directly to mobile apps, enabling long-term tracking and integration with nutrition and fitness programs. Similarly, Tanita RD-953 connects with cloud platforms to monitor trends over time for clinical or personal use

- Integration with AI-enabled analytics provides personalized insights, such as predictive health recommendations, fitness optimization, and anomaly detection in body metrics. For instance, some Omron analyzers use AI to suggest personalized exercise or diet plans based on body composition trends

- The seamless connectivity with broader digital health ecosystems allows healthcare providers and fitness coaches to manage multiple clients’ data remotely, offering centralized monitoring and reporting

- This trend toward interconnected, data-driven, and intelligent body composition measurement systems is fundamentally reshaping expectations for health monitoring in the region. Consequently, companies such as InBody are developing devices that combine AI-driven insights, cloud integration, and mobile connectivity

- The demand for body composition analyzers with integrated digital and AI capabilities is growing rapidly across hospitals, fitness centers, and home users, as consumers increasingly prioritize convenience, personalization, and continuous health monitoring

Middle East and Africa Body Composition Analyzers Market Dynamics

Driver

“Rising Health Awareness and Preventive Healthcare Adoption”

- The increasing prevalence of obesity, lifestyle-related diseases, and rising health consciousness among the population is a key driver for the growing adoption of body composition analyzers

- For instance, in March 2025, InBody launched initiatives in MEA to expand access to digital health monitoring in clinics and gyms, aiming to encourage preventive healthcare and fitness tracking

- As healthcare providers and consumers recognize the value of early intervention and continuous monitoring, body composition analyzers offer actionable insights into fat, muscle, and hydration levels, supporting wellness programs

- Furthermore, the increasing penetration of gyms, wellness centers, and corporate wellness programs is making body composition analyzers a standard tool for health assessments and fitness tracking

- The convenience of non-invasive measurement, quick results, and smartphone-enabled tracking are key factors propelling adoption in both commercial and home-use settings. The growing availability of user-friendly devices further supports market expansion

- Expansion of digital health infrastructure and government-led wellness initiatives in MEA is driving increased investments and adoption of body composition analyzers

- Corporate wellness and insurance programs increasingly incentivize the use of body composition analyzers to monitor employee health, creating additional market demand

Restraint/Challenge

“High Cost and Technical Training Requirements”

- The relatively high cost of advanced body composition analyzers and the need for trained personnel to operate them pose significant barriers to market adoption across price-sensitive segments

- For instance, some high-end InBody and Tanita models require professional guidance for accurate interpretation, limiting accessibility in smaller clinics or low-income households

- While mobile and simplified devices are becoming available, premium features such as multi-frequency bioelectrical impedance analysis and AI-driven predictive analytics often come at a high price point, reducing affordability

- Moreover, healthcare facilities and fitness centers may face challenges in staff training and integration with existing digital health infrastructure, affecting adoption speed

- Overcoming these challenges through more affordable devices, simplified user interfaces, and training programs for professionals and consumers will be crucial for sustained market growth in the MEA region

- Inconsistent electricity supply and limited internet connectivity in some areas can hinder the effectiveness of digital and cloud-based analyzers, restricting usage in remote locations

- Privacy concerns regarding the storage and sharing of sensitive health data may slow adoption, requiring stricter compliance and secure data management practices by manufacturers

Middle East and Africa Body Composition Analyzers Market Scope

The market is segmented on the basis of product type, compartment model type, and end user.

- By Product Type

On the basis of product type, the MEA body composition analyzers market is segmented into bio impedance analyzers, dual energy x-ray absorptiometry (DEXA), skinfold caliper, air displacement plethysmography, and others. The Bio Impedance Analyzers (BIA) segment dominated the market with the largest revenue share of 46.5% in 2025, driven by their non-invasive measurement, ease of use, and affordability compared to other advanced technologies. BIA devices are widely adopted in fitness centers, hospitals, and clinics for regular health monitoring and wellness tracking. The rapid availability of portable BIA analyzers has further expanded their reach in both professional and home-use segments. Integration with mobile apps and digital platforms also enhances user engagement and long-term health tracking. In addition, healthcare providers prefer BIA devices due to their ability to provide quick and repeatable results without requiring specialized training. The segment’s strong presence in the MEA region is supported by growing consumer awareness regarding preventive healthcare and fitness monitoring.

The Air Displacement Plethysmography (ADP) segment is expected to witness the fastest growth at a CAGR of 11.8% from 2026 to 2033, driven by increasing demand for highly accurate body composition analysis in premium hospitals, sports science facilities, and research centers. ADP devices offer precise measurements of body volume and density, making them suitable for clinical studies and elite athletic assessments. Rising disposable incomes and growing adoption of personalized fitness programs are encouraging the installation of ADP devices. Their non-invasive and rapid measurement process appeals to both professionals and consumers seeking detailed health insights. Technological advancements and reduced setup costs are further contributing to the segment’s growth. Adoption in corporate wellness programs is also fueling demand for ADP analyzers.

- By Compartment Model Type

On the basis of compartment model type, the MEA body composition analyzers market is segmented into two-compartment model, three-compartment model, and multi-compartment models. The Two-Compartment Model segment dominated the market with the largest revenue share of 52.3% in 2025, attributed to its simplicity, reliability, and cost-effectiveness for general health and fitness monitoring. This model separates the body into fat mass and fat-free mass, offering sufficient insights for clinical assessments, wellness programs, and fitness tracking. Healthcare facilities and fitness centers widely adopt two-compartment devices due to their ease of use and minimal training requirements. Their affordability compared to advanced multi-compartment models allows broader accessibility in the MEA region. Integration with mobile and desktop software further enhances user engagement. Increasing consumer interest in basic body composition tracking for preventive healthcare also supports the dominance of this segment.

The Multi-Compartment Model segment is expected to witness the fastest growth at a CAGR of 12.4% from 2026 to 2033, driven by demand for highly detailed and accurate body composition analysis in hospitals, research labs, and elite sports facilities. Multi-compartment models provide separate measurements for fat, muscle, bone, water, and other tissues, making them ideal for clinical and athletic applications. Rising awareness of personalized health and wellness programs is boosting adoption. Technological advancements and AI integration are improving measurement accuracy and usability. Growing availability of cloud-based analytics and telehealth applications is further supporting the adoption of multi-compartment analyzers. Increasing investments in advanced diagnostic infrastructure across MEA countries contribute to this rapid growth.

- By End User

On the basis of end user, the MEA body composition analyzers market is segmented into health fitness clubs, hospitals & clinics, academies, and others. The Hospitals & Clinics segment dominated the market with the largest revenue share of 44.8% in 2025, driven by the need for regular patient health monitoring, obesity management, and chronic disease prevention. Hospitals prefer analyzers that provide accurate and quick results for clinical assessments. Integration with electronic health records and digital health platforms improves operational efficiency. The growing focus on preventive healthcare and patient wellness programs supports high adoption rates. Hospitals in urban MEA regions are increasingly investing in advanced analyzers to meet patient expectations. In addition, healthcare providers value the non-invasive nature and repeatability of measurements, making analyzers suitable for routine diagnostics.

The Health Fitness Club segment is expected to witness the fastest growth at a CAGR of 13.1% from 2026 to 2033, fueled by rising consumer awareness about fitness, wellness, and body composition monitoring. Clubs and gyms increasingly use analyzers to provide personalized fitness and diet plans. Growing membership in premium gyms and wellness centers drives demand for advanced analyzers capable of detailed metrics. Integration with mobile apps and fitness tracking platforms enhances member engagement. Rising corporate wellness programs also encourage adoption in commercial fitness spaces. Technological innovations, such as AI-enabled insights, are further accelerating uptake in the fitness sector across the MEA region.

Middle East and Africa Body Composition Analyzers Market Regional Analysis

- Saudi Arabia dominated the Middle East & Africa body composition analyzers market with the largest revenue share of 38.2% in 2025, driven by expanding healthcare infrastructure, growing wellness and fitness trends, and rising adoption in hospitals, clinics, and fitness centers across the country

- Consumers and healthcare providers in Saudi Arabia value the convenience, accuracy, and non-invasive nature of body composition analyzers, as well as their ability to provide actionable insights for fitness, wellness, and clinical monitoring

- This widespread adoption is further supported by expanding healthcare infrastructure, government initiatives promoting health and wellness, and increasing investments in fitness and wellness centers, establishing body composition analyzers as a preferred tool for both clinical and personal health monitoring in the country

Saudi Arabia Body Composition Analyzers Market Insight

The Saudi Arabia body composition analyzers market captured the largest revenue share of 38.2% in 2025 within the Middle East & Africa, driven by rising health awareness, growing prevalence of obesity and lifestyle-related diseases, and the increasing adoption of preventive healthcare solutions. Consumers and healthcare providers highly value the convenience, non-invasive measurement, and accuracy of these analyzers for clinical, fitness, and wellness monitoring. The expansion of healthcare infrastructure, coupled with government initiatives promoting wellness programs and fitness centers, is further propelling market growth. In addition, the adoption of digital health platforms and integration with mobile applications is enhancing usability and long-term tracking of health metrics. Hospitals, clinics, and gyms are increasingly incorporating body composition analyzers into routine health assessments, reinforcing their position as essential wellness tools.

South Africa Body Composition Analyzers Market Insight

The South Africa body composition analyzers market is expected to grow at a noteworthy CAGR during the forecast period, fueled by increasing health consciousness, lifestyle changes, and the growing demand for personalized fitness and wellness solutions. Fitness centers, wellness clubs, and healthcare facilities are increasingly using analyzers to provide data-driven insights for preventive healthcare and personalized nutrition and exercise plans. Rising investments in digital health infrastructure and telemedicine services are promoting the integration of analyzers with health management systems. Consumers are adopting these devices for at-home monitoring, complementing clinical use. Furthermore, corporate wellness programs and fitness initiatives in urban areas are creating additional demand. The combination of technological innovation, mobile connectivity, and AI-enabled analysis is accelerating the adoption of body composition analyzers across the country.

UAE Body Composition Analyzers Market Insight

The UAE body composition analyzers market is anticipated to expand at a considerable CAGR throughout the forecast period, driven by the high focus on preventive healthcare, growing fitness culture, and increasing disposable incomes. Consumers and healthcare providers value the analyzers for their accuracy, speed, and non-invasive testing capabilities. Wellness centers, hospitals, and clinics are increasingly leveraging these devices for monitoring patients and clients, supporting targeted diet and fitness plans. Government initiatives promoting healthy lifestyles and fitness programs are further encouraging adoption. In addition, the rise of luxury gyms and corporate wellness programs is boosting demand for advanced analyzers capable of providing comprehensive body metrics. The integration of body composition analyzers with mobile apps and digital health platforms enhances user engagement and long-term health tracking.

Egypt Body Composition Analyzers Market Insight

The Egypt body composition analyzers market is poised to grow at the fastest CAGR in the Middle East & Africa during the forecast period, driven by rising awareness of obesity, chronic diseases, and preventive health monitoring. Hospitals, clinics, and fitness centers are increasingly incorporating body composition analyzers to provide precise and actionable insights for patient care and wellness programs. Adoption of digital health solutions and mobile integration is facilitating remote monitoring and personalized fitness tracking. Rising urbanization and a growing middle-class population are expanding the market base. In addition, corporate wellness initiatives and school-based health programs are creating new opportunities for adoption. Technological advancements and AI-driven analytics are further boosting the market’s appeal among healthcare providers and consumers.

Middle East and Africa Body Composition Analyzers Market Share

The Middle East and Africa Body Composition Analyzers industry is primarily led by well-established companies, including:

- InBody India Pvt. Ltd. (South Korea)

- TANITA CORP of America, (Japan)

- seca (Germany)

- COSMED s.r.l (Italy)

- RJL Systems, (U.S.)

- Hologic, Inc. (U.S.)

- Omron Corporation (Japan)

- Bodystat Limited, (U.K.)

- Charder Electronic Co. Ltd (Taiwan)

- Beurer GmbH (Germany)

- SELVA Healthcare, Inc. (South Korea)

- Maltron International Ltd (U.K.)

- AKERN SRL (Italy)

- ImpediMed Limited (Australia)

- ACCUFITNESS, LLC (U.S.)

- Swissray International, Inc. (U.S.)

- OSTEOSYS Corp. (South Korea)

- BioTekna (Italy)

- Fit3D (U.S.)

- Neko Health AB (U.S.)

What are the Recent Developments in Middle East and Africa Body Composition Analyzers Market?

- In September 2025, Springbok Analytics announced a precision body‑composition analysis using rapid MRI, targeting regions including Saudi Arabia, UAE and South Africa (MEA). The advanced MRI‑based system provides detailed muscle, bone and fat profiling beyond traditional methods

- In June 2025, seca launched the seca TRU Alpha, a new body composition analyzer for the fitness industry offering muscle‑build, fat mass, and segmental muscle distribution analysis, with cloud‑connected software integrations signalling readiness for advanced adoption in wellness centres including the MEA region

- In January 2025, InBody announced it would showcase its advanced body composition analyzers at CES 2025, reaffirming its global growth strategy and by extension its regional presence via its MEA distribution network

- In October 2021, InBody announced via its newsfeed its intent to expand into household health‑monitoring products, including body‑composition analyzers, which supports broader consumer access in MEA markets

- In March 2024, InBody launched its next‑generation devices “InBody 380” and “InBody 580”, featuring enhanced segmental muscle/fat analysis and portable form factors. While global, these devices are available in MEA via the MEA website

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.