Middle East And Africa Boxes Packaging Market

Market Size in USD Billion

CAGR :

%

USD

21.34 Billion

USD

30.23 Billion

2025

2033

USD

21.34 Billion

USD

30.23 Billion

2025

2033

| 2026 –2033 | |

| USD 21.34 Billion | |

| USD 30.23 Billion | |

|

|

|

|

Middle East and Africa Boxes Packaging Market Size

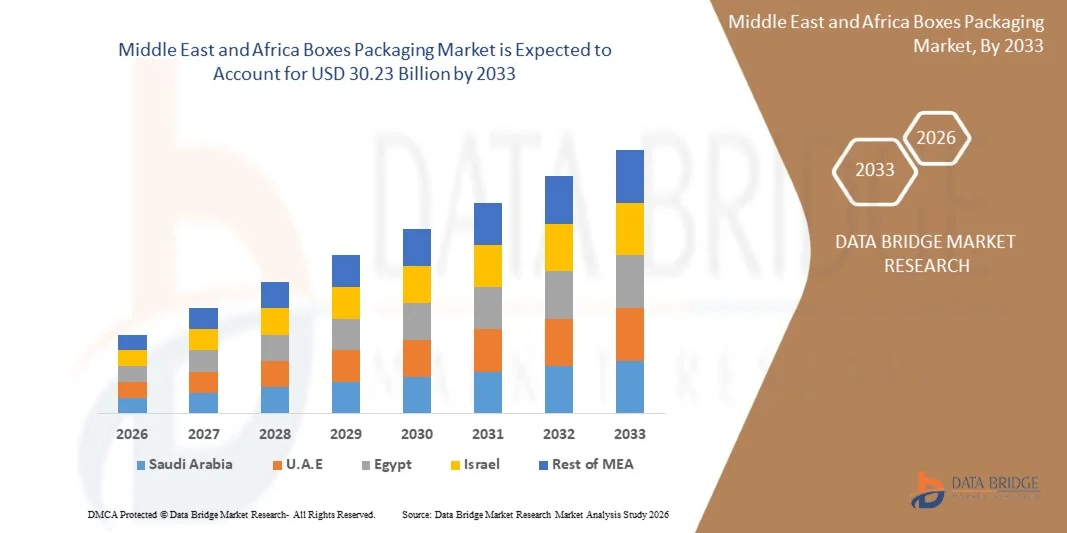

- The Middle East and Africa Boxes packaging market size was valued at USD 21.34 billion in 2025 and is expected to reach USD 30.23 billion by 2033, at a CAGR of 4.5% during the forecast period

- The market growth in the Middle East and Africa is increasingly supported by rising demand for sustainable, recyclable, and environmentally friendly packaging solutions across key end-use sectors, including food and beverages, pharmaceuticals, consumer goods, and industrial products. Ongoing advancements in paper conversion, corrugation technologies, and lightweight packaging materials are enhancing production efficiency and improving packaging durability, while also enabling greater digitalization and innovation across the regional packaging value chain.

- Strengthening consumer and corporate preference for eco-conscious packaging is reinforcing the shift toward fiber-based, biodegradable, and recyclable box formats as credible alternatives to conventional plastics. These sustainability-driven trends are accelerating the adoption of advanced box packaging solutions and substantially contributing to the expansion of the boxes packaging market across the Middle East and Africa.

Middle East and Africa Boxes Packaging Market Analysis

- Boxes packaging, particularly those made from paperboard, corrugated fiberboard, and other recyclable materials, is becoming increasingly essential across diverse industries in the Middle East and Africa—including food and beverages, consumer goods, pharmaceuticals, e-commerce, and industrial applications—due to its strength, versatility, sustainability, and ability to support safe transportation and product protection.

- The accelerating demand for boxes packaging in the region is driven by a strong shift toward eco-friendly, recyclable, and bio-based packaging solutions, rising environmental consciousness among consumers, and growing regulatory emphasis on reducing plastic waste and promoting sustainable packaging practices. These factors are collectively strengthening the adoption of fiber-based box packaging and significantly contributing to the expansion of the Middle East and Africa boxes packaging market.

- Saudi Arabia is the dominant force in the Middle East and Africa boxes packaging market, accounting for 54.79% of the region’s share in 2026, and is projected to expand at a strong 5.0% CAGR from 2026 to 2033. This growth is supported by rising adoption of advance ed packaging technologies, expanding manufacturing and retail sectors, and the strong presence of major packaging converters and distribution networks. In addition, increasing demand for high-quality, durable, and sustainable packaging solutions—particularly within food and beverages, consumer goods, pharmaceuticals, and e-commerce—continues to reinforce market expansion across the country.

- The Corrugated Boxes packaging segment is projected to dominate the market with a 39.37% share in 2026, driven by its extensive suitability for environmentally friendly packaging applications, growing preference for recyclable and biodegradable materials, and continued innovation focused on enhancing strength, printability, and sustainability attributes.

Report Scope and Middle East and Africa Boxes Packaging Market Segmentation

|

Attributes |

Middle East and Africa Boxes Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Boxes Packaging Market Trends

“Integration of Smart, Sustainable, and High-Performance Packaging Solutions”

- A key and rapidly accelerating trend in the Middle East and Africa boxes packaging market is the growing integration of advanced, eco-efficient materials and smart packaging technologies aimed at improving durability, supply-chain visibility, and sustainability performance. This shift is being reinforced by rising environmental regulations, brand commitments toward circular packaging, and the industry’s transition toward lightweight, renewable, and recyclable packaging formats.

- Leading industry participants are increasingly investing in fibre-based innovations, digitally enabled packaging, and material-optimized structural designs that enhance protection, reduce material wastage, and support automated logistics systems. Companies are developing next-generation corrugated and molded-fibre solutions engineered to deliver superior strength-to-weight ratios, improved moisture resistance, and enhanced print quality—helping brand owners meet both functional and sustainability requirements.

- High-performance fibre materials—such as reinforced kraft liners, specialty recycled fibres, and bio-enhanced pulp blends—are gaining traction due to their ability to improve load-bearing capacity, maintain structural stability during transportation, and support premium branding. Manufacturers are also working on formulations tailored for diverse climatic conditions, ensuring performance consistency across varied humidity, heat, and handling environments.

- Smart packaging technologies—including RFID-enabled boxes, QR-based traceability systems, and sensor-integrated shipping containers—are emerging as value-added features that allow real-time tracking, authentication, and condition monitoring across complex supply chains. These capabilities enhance operational efficiency and reduce losses related to damage, temperature fluctuations, and misrouting.

Middle East and Africa Boxes Packaging Market Dynamics

Driver

“Growing e-commerce and retail sector”

- The rapid expansion of global e-commerce and retail is increasingly becoming a key driver of the global boxes and packaging market. As consumers shift from traditional brick-and-mortar shopping to online retail, the need for protective, reliable, and efficient packaging solutions—especially corrugated boxes, cartons, and sustainable packaging—has surged.

- This structural shift in retail format is reshaping supply chains: more small parcels, frequent shipments, returns, and doorstep deliveries all demand standardized, scalable packaging solutions. Consequently, packaging is no longer a peripheral cost — it has become a fundamental enabler of e-commerce infrastructure, underpinning growth in global box-packaging demand.

For instances,

- In February 2025, the United States Census Bureau reported that U.S. retail e-commerce sales for the fourth quarter of 2024 totalled USD 308.9 billion, marking continued growth in online retail and strong parcel volumes that have driven expansion of distribution and fulfilment capacity through e-commerce and Digital retail.

- In February 2023, Eurostat reported that online shopping continued to grow across the European Union, with e-commerce penetration rising and major member states showing notable increases in online retail activity, prompting to the growth in e-commerce space.

- In April 2022, the Office for National Statistics, United Kingdom reported that internet sales remained materially above pre pandemic levels and that online sales comprised a sustained share of total retail, which in turn motivated expansion of e-Commerce and retail space.

- The systemic growth of e-commerce and evolving retail formats globally are clearly elevating demand for packaging — particularly boxes, cartons, and sustainable / corrugated solutions. As online retail expands further (including into new geographies, categories, and rapid delivery formats), packaging demand will continue to surge. For market analysts and investors, this underscores packaging not as a commodity by product, but as a strategic growth segment tightly linked to retail/e-commerce expansion

.Restraint/Challenge

“Volatility in pulp and paper prices”

- The manufacturing of paper-based packaging (corrugated boxes, cartons, containerboard) is heavily dependent on pulp, kraft paper, recycled fiber, and energy — all of which have experienced pronounced price swings in recent years. When pulp and paper prices surge unpredictably, producers’ costs jump, squeezing margins. Because packaging producers often operate under fixed contracts with downstream customers (retailers, e-commerce firms, manufacturers), they may be unable to pass on the increased costs quickly.

- This creates uncertainty, undermines profitability, discourages expansion or investment, and can reduce demand for traditional box-based packaging especially in price-sensitive segments.

- For Instance- In October 2024 Times of India, reported that kraft paper — a key raw material for corrugated boxes — had “skyrocketed by more than 20% in the last three months,” putting severe cost pressure on corrugated-box manufacturers, many of whom operate on slim margins.

- In February 2025, the pulp and paper times newsletter observed that depreciation of the Indian Rupee and rising global pulp prices (softwood pulp quoted around USD 890/ton) significantly increased the cost of imported raw materials for local paper manufacturers — adding strain on overall production costs.

- The inherent volatility of pulp, recycled fiber and paperboard raw materials — driven by supply-chain disruptions, energy-cost spikes, currency fluctuations, and shifting demand — imposes a significant restraint on the global boxes and packaging market. Because paper-based packaging relies heavily on these inputs, unpredictable cost swings erode profitability, make pricing unstable, and undermine the attractiveness of boxes for some users. For an industry built on volume and tight margins, such input-cost volatility can suppress growth, dampen investment, and restrict market expansion.

Middle East and Africa Boxes Packaging Market Scope

The Middle East and Africa boxes packaging market is segmented into six notable segments which are based on product, type, material, industry, sales channel, and size.

By Product

On the basis of product type, the Middle East and Africa boxes packaging market is categorized into Corrugated Boxes, Slotted Boxes, Folding Cartons, Rigid Boxes, Crates, and Other packaging formats. Among these, the Corrugated Boxes segment is anticipated to hold a leading position in 2026, accounting for 39.37% of the overall market share. This dominance can be attributed to the widespread adoption of corrugated packaging across multiple industries—including e-commerce, food and beverages, consumer goods, and industrial products—due to its cost-effectiveness, durability, lightweight nature, and recyclability. Furthermore, the segment is projected to register the highest compound annual growth rate (CAGR) of 4.6% during the forecast period spanning 2026 to 2033, reflecting increasing demand for efficient and sustainable packaging solutions globally. The robust growth trajectory of corrugated boxes underscores their critical role in providing protective, versatile, and environmentally friendly packaging solutions in a rapidly evolving market landscape.

By Type

On the basis of type, the Middle East and Africa boxes packaging market is classified into Standard Boxes and Specialty Boxes. The Standard Boxes segment is projected to lead the market in 2026, capturing a significant 75.91% share of the overall market. This strong market position is driven by the widespread applicability of standard boxes across diverse sectors such as e-commerce, retail, food and beverages, electronics, and consumer goods, where they serve as reliable, cost-effective, and versatile packaging solutions. Standard boxes are preferred due to their ease of manufacture, stackability, durability, and compatibility with automated packing systems, making them a core choice for high-volume packaging operations.

By Material

On the basis of material, the Middle East and Africa boxes packaging market is segmented into Paper & Paperboard, Plastics, Metal, Wood, and Others. Among these, the Paper & Paperboard segment is anticipated to dominate the market in 2026, holding a substantial 65.62%share. This dominance is largely attributed to the segment’s sustainability, cost-effectiveness, recyclability, and versatility, which make it highly suitable for a wide range of applications including food and beverages, electronics, consumer goods, and e-commerce packaging. Paper and paperboard materials also support branding and customization requirements, enabling manufacturers and retailers to deliver visually appealing packaging solutions while meeting environmental regulations and consumer demand for eco-friendly products.

By Industry

On the basis of industry, the Middle East and Africa boxes packaging market is segmented into Wholesale and Retail. In 2026, the Wholesale segment is projected to dominate the market, accounting for a significant 74.64% share. This dominance is driven by the large-scale distribution and bulk shipment requirements of manufacturers, distributors, and suppliers across various sectors such as food and beverages, consumer goods, pharmaceuticals, and e-commerce. Wholesale operations demand durable, cost-effective, and high-capacity packaging solutions that can ensure product safety during transportation and storage, which positions boxes as the preferred choice for bulk logistics.

By Sales Channel

On the basis of sales channel, the Middle East and Africa boxes packaging market is segmented into Direct Sales, Distributors/Wholesalers, and Retail Stores. In 2026, the Direct Sales segment is expected to lead the market, capturing a substantial 62.46% share. This dominance is attributed to manufacturers increasingly engaging directly with end-users and large corporate clients to provide customized, bulk, and high-quality packaging solutions. Direct sales facilitate stronger client relationships, faster response times, and tailored offerings that meet specific packaging requirements across industries such as e-commerce, consumer goods, pharmaceuticals, and food and beverages.

By Size

On the basis of size, the Middle East and Africa boxes packaging market is segmented into Small (Up to 5 kg), Medium (5–20 kg), Custom Sizes, Large (20–50 kg), and Extra-Large (Above 50 kg). In 2026, the Small (Up to 5 kg) segment is expected to lead the market, accounting for 48.60%of the total share. This dominance is driven by the growing demand for compact and convenient packaging solutions across industries such as e-commerce, food and beverages, personal care, and pharmaceuticals, where lightweight and easily manageable boxes are preferred. The trend toward smaller-sized packaging aligns with consumer preferences for portability, ease of handling, and reduced storage space requirements.

Boxes packaging Market Regional Analysis

The Middle East and Africa Boxes Packaging Market is witnessing steady and robust growth, fueled by rising demand for sustainable and eco-friendly packaging solutions, adoption of advanced packaging technologies, and increasing focus on recyclable and residue-free materials. The region is investing significantly in innovative packaging designs and materials to enhance product protection, operational efficiency, and environmental sustainability across sectors such as food and beverages, personal care, and e-commerce.

Saudi Arabia Boxes packaging Market Insight

Saudi Arabia is the dominant force in the Middle East and Africa boxes packaging market, accounting for 54.79% of the region’s share in 2026, and is projected to expand at a strong 5.0% CAGR from 2026 to 2033. This growth is supported by rising adoption of advance ed packaging technologies, expanding manufacturing and retail sectors, and the strong presence of major packaging converters and distribution networks. In addition, increasing demand for high-quality, durable, and sustainable packaging solutions—particularly within food and beverages, consumer goods, pharmaceuticals, and e-commerce—continues to reinforce market expansion across the country.

Middle East and Africa Boxes Packaging Market Share

The Boxes packaging industry is primarily led by well-established companies, including:

- Pratt Industries (U.S.)

- Green Bay Packaging Inc. (U.S.)

- TGI Packaging Pvt. Ltd. (India)

- International Paper (U.S.)

- DS Smith (U.K.)

- Mondi (U.K.)

- Amcor PLC (Switzerland)

- Smurfit WestRock (Ireland)

- Sealed Air Corporation (U.S.)

- Packaging Corporation of America (U.S.)

- Oji Holdings Corporation (Japan)

- Rengo Co., Ltd. (Japan)

- Stora Enso Oyj (Finland)

- Georgia-Pacific LLC (U.S.)

- Nine Dragons Paper Holdings Ltd. (China)

- Suneco Box (India)

- Avon Containers Pvt. Ltd. (India)

- Elite Custom Boxes (India)

- Ecom Packaging (India)

- Blue Box Packaging (India)

- Packtek (India)

- Packtek Packaging (India)

- Boxon Group AB (Sweden)

- Packhelp (Poland)

- Prem Industries India Limited (India)

- Altpac (Australia)

- Packman Packaging Private Limited (India)

Latest Developments in Middle East and Africa Boxes Packaging Market

- In January 2025, International Paper emphasized the ongoing trend of "paperization," shifting from plastics to paper-based packaging driven by environmental concerns. The company promotes reusable designs and transparency in sustainability to meet evolving consumer preferences

- In February 2024, Smurfit Westrock published its first “2024 Sustainability Report,” highlighting sustainable packaging solutions and circular‑economy focus. his shows commitment to sustainability and recyclable packaging increasingly important for e‑commerce customers and regulatory/environmental compliance worldwide; adds value to their packaging portfolio for online retailers.

- In October 2025, Klabin was honored with the 2025 Sesi SDG Award in the Social – Large Industry category for its “Klabin Transforms by Sowing Education” initiative, which strengthens public education in the regions where it operates. The program, active since 2019, has expanded to 20 municipalities across four Brazilian states, benefiting around 30,000 students, teachers, and school administrators. This recognition highlights Klabin’s commitment to sustainable regional development and its alignment with the UN Sustainable Development Goals through impactful community education efforts. .

- In November 2025 Mondi completed the acquisition of Schumacher Packaging’s Western Europe corrugated converting and solid-board operations. This acquisition added more than 1 billion square metres of additional packaging capacity, significantly strengthened Mondi’s footprint in Germany, Benelux and UK, and expanded its corrugated and solid-board capabilities — particularly for eCommerce and FMCG segments.

- In July 2025,Mondi launched an extended corrugated and solid-board packaging portfolio tailored to the food industry. The new offering targets major food segments and integrates solid-board solutions and digital printing capabilities — a development made possible after the Schumacher Packaging acquisition. This helps food clients improve shelf visibility, brand differentiation, handling efficiency, and compliance with regulatory standards.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 PRICING ANALYSIS

4.4 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.6 INDUSTRY ECOSYSTEM ANALYSIS MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET

4.6.1 PROMINENT COMPANIES

4.6.2 SMALL & MEDIUM-SIZED COMPANIES

4.6.3 END USERS

4.6.4 RESEARCH AND DEVELOPMENT

4.7 BRAND OUTLOOK

4.8 CONSUMER BUYING BEHAVIOUR

4.8.1 PACKAGING AS A CENTRAL INFLUENCER OF PURCHASE DECISIONS

4.8.2 PACKAGING ATTRIBUTES THAT DRIVE CONSUMER PREFERENCES

4.8.3 GROWING IMPACT OF SUSTAINABILITY ON BUYING BEHAVIOUR

4.8.4 PSYCHOLOGICAL AND EMOTIONAL DIMENSIONS OF PACKAGING INFLUENCE

4.8.5 INFLUENCE OF CONSUMER SEGMENTATION AND PURCHASE CONTEXT

4.8.6 CHALLENGES IN ALIGNING PACKAGING WITH CONSUMER BEHAVIOUR

4.8.7 STRATEGIC IMPLICATIONS FOR PACKAGING PRODUCERS AND BRAND OWNERS

4.8.8 CONCLUSION

4.9 COST ANALYSIS BREAKDOWN –

4.9.1 RAW MATERIAL COSTS

4.9.2 MANUFACTURING & PROCESSING COSTS

4.9.3 LABOR COSTS

4.9.4 LOGISTICS & TRANSPORTATION COSTS

4.9.5 PACKAGING MACHINERY & CAPITAL EXPENDITURE

4.9.6 ADMINISTRATIVE, SALES & DISTRIBUTION OVERHEADS

4.9.7 PROFIT MARGINS

4.1 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 Joint Ventures

4.10.1.2 Mergers and Acquisitions

4.10.1.3 Licensing and Partnership Agreements

4.10.1.4 Technology Collaborations

4.10.1.5 Strategic Divestments

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES AND MILESTONES

4.10.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.10.6 RISK ASSESSMENT AND MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 PATENT ANALYSIS –

4.11.1 OVERVIEW

4.11.2 PATENT FILINGS BY GEOGRAPHY

4.11.3 LEADING APPLICANTS

4.11.4 IPC (INTERNATIONAL PATENT CLASSIFICATION) ANALYSIS

4.11.5 PUBLICATION TREND ANALYSIS (2016–2025)

4.12 PROFIT MARGINS SCENARIO –

4.12.1 OVERALL MARGIN DYNAMICS IN THE BOXES PACKAGING INDUSTRY

4.12.2 MARGIN PERFORMANCE FOR STANDARD CORRUGATED BOXES

4.12.3 HIGHER MARGINS IN VALUE-ADDED AND SPECIALTY BOXES

4.12.4 PREMIUM PROFITABILITY IN LUXURY AND RIGID BOXES

4.12.5 REGIONAL DIFFERENCES IMPACTING PROFITABILITY

4.12.6 ADVANTAGE OF VERTICAL INTEGRATION ON MARGINS

4.12.7 E-COMMERCE DEMAND AS A MARGIN BOOSTER

4.13 RAW MATERIAL COVERAGE

4.13.1 OVERVIEW OF THE RAW MATERIAL LANDSCAPE

4.13.2 FIBRE-BASED SUBSTRATES

4.13.2.1 Corrugated Containerboard

4.13.2.2 Folding Cartonboard and Solid Boards

4.13.2.3 Balance of Virgin and Recycled Fibre

4.13.2.4 Alternative and Next-Generation Fibres

4.13.3 NON-FIBRE BOX MATERIALS

4.13.3.1 Plastics

4.13.3.2 Metal and Composite Boxes

4.13.3.3 Wooden and Plywood Boxes

4.13.4 ADHESIVES AND SEALING SYSTEMS

4.13.4.1 Water-Based Adhesives

4.13.4.2 Hot-Melt and Solvent-Based Adhesives

4.13.4.3 Tapes and Mechanical Closures

4.13.5 PRINTING INKS, COATINGS, AND FUNCTIONAL BARRIERS

4.13.5.1 Printing Inks

4.13.5.2 Surface Coatings

4.13.5.3 Barrier Films and Liners

4.13.6 CONCLUSION

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 TECHNOLOGY LANDSCAPE AND STRATEGIC CONTEXT

4.15.2 AUTOMATION, ROBOTICS, AND INDUSTRY 4.0 INTEGRATION

4.15.2.1 Automated Converting and Finishing Lines

4.15.2.2 Robotics in Handling and Palletizing

4.15.2.3 Industry 4.0, Connectivity, and Predictive Intelligence

4.15.3 DIGITAL PRINTING AND ADVANCED GRAPHICS

4.15.3.1 Shift Toward Digital Printing Platforms

4.15.3.2 Variable Data, Personalization, and Intelligent Marking

4.15.4 RIGHT-SIZED PACKAGING AND ON-DEMAND PRODUCTION

4.15.4.1 Intelligent Right-Sizing Systems

4.15.4.2 On-Demand Box-Making Technologies

4.15.5 SMART AND CONNECTED PACKAGING

4.15.5.1 Smart Functionality and Digital Integration

4.15.5.2 Rack-and-Trace and Authentication Technologies

4.15.5.3 Condition Monitoring and IoT-Driven Insights

4.15.6 ADVANCED MATERIALS, COATINGS, AND STRUCTURAL ENGINEERING

4.15.6.1 Strength-Optimized Board Structures

4.15.6.2 Functional, Recyclable, and Bio-Based Coatings

4.15.6.3 Interactive and Augmented Packaging Features

4.15.7 E-COMMERCE-DRIVEN PACKAGING AND FULFILMENT TECHNOLOGY

4.15.7.1 High-Velocity Packaging Systems

4.15.7.2 Integrated Warehouse Automation

4.16 VALUE CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 RAW MATERIAL SUPPLY

4.16.3 COMPONENT MANUFACTURING AND PROCESSING

4.16.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.16.5 DISTRIBUTION AND LOGISTICS

4.16.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.16.7 CONCLUSION

4.17 VENDOR SELECTION CRITERIA

4.17.1 QUALITY AND RELIABILITY OF MATERIALS

4.17.2 TECHNICAL CAPABILITY AND CUSTOMIZATION CAPACITY

4.17.3 PRODUCTION CAPACITY, DELIVERY RELIABILITY, AND SUPPLY CONTINUITY

4.17.4 COST, VALUE, AND TOTAL OWNERSHIP CONSIDERATIONS

4.17.5 INDUSTRY EXPERIENCE AND PROVEN TRACK RECORD

4.17.6 SUSTAINABILITY, ETHICAL STANDARDS, AND REGULATORY COMPLIANCE

4.17.7 SERVICE QUALITY, COMMUNICATION, AND RESPONSIVENESS

4.17.8 QUALITY ASSURANCE, TESTING CAPABILITIES, AND RISK MANAGEMENT

4.17.9 STRUCTURED EVALUATION AND VENDOR SELECTION FRAMEWORKS

4.17.10 CONCLUSION

5 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.1 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.2 VENDOR SELECTION CRITERIA DYNAMICS

5.3 IMPACT ON SUPPLY CHAIN

5.3.1 RAW MATERIAL PROCUREMENT

5.3.2 MANUFACTURING AND PRODUCTION

5.3.3 LOGISTICS AND DISTRIBUTION

5.3.4 PRICE PITCHING AND POSITION OF MARKET

5.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.4.1 SUPPLY CHAIN OPTIMIZATION

5.4.2 JOINT VENTURE ESTABLISHMENTS

5.5 IMPACT ON PRICES

5.6 REGULATORY INCLINATION

5.6.1 GEOPOLITICAL SITUATION

5.6.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.6.2.1 FREE TRADE AGREEMENTS

5.6.2.2 ALLIANCES ESTABLISHMENTS

5.6.3 STATUS ACCREDITATION (INCLUDING MFN)

5.6.4 DOMESTIC COURSE OF CORRECTION

5.6.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.6.4.2 ESTABLISHMENT OF SEZs/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING E-COMMERCE AND RETAIL SECTOR

7.1.2 SHIFT TOWARDS SUSTAINABLE PACKAGING SOLUTIONS

7.1.3 RISING DEMAND FOR SAFE AND TAMPER EVIDENT PACKAGING IN PHARMACEUTICAL AND HEALTHCARE

7.1.4 GROWING INTERNATIONAL TRADE

7.2 RESTRAINS

7.2.1 COMPETITION FROM OTHER PACKAGING FORMATS

7.2.2 VOLATILITY IN PULP AND PAPER PRICES

7.3 OPPORTUNITY

7.3.1 SMART BOX PACKAGING AND DIGITAL PRINTING INTEGRATION

7.3.2 CUSTOMIZATION AND PREMIUMIZATION TRENDS

7.4 CHALLENGES

7.4.1 REGULATORY COMPLIANCE AND WASTE MANAGEMENT

7.4.2 SUPPLY CHAIN DISRUPTIONS AND MATERIAL SHORTAGES

8 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 CORRUGATED BOXES

8.3 SLOTTED BOXES

8.4 FOLDING CARTONS

8.5 RIGID BOXES

8.6 CRATES

8.7 OTHERS

8.8 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 SINGLE WALL

8.8.2 DOUBLE WALL

8.8.3 TRIPLE WALL

8.8.4 CUSTOM / DESIGNER BOXES

8.9 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

8.9.1 C FLUTE

8.9.2 B FLUTE

8.9.3 A FLUTE

8.9.4 E FLUTE

8.9.5 F FLUTE

8.1 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 NORTH AMERICA

8.10.3 EUROPE

8.10.4 MIDDLE EAST AND AFRICA

8.10.5 SOUTH AMERICA

8.11 MIDDLE EAST AND AFRICA SLOTTED BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.11.1 ASIA-PACIFIC

8.11.2 NORTH AMERICA

8.11.3 EUROPE

8.11.4 MIDDLE EAST AND AFRICA

8.11.5 SOUTH AMERICA

8.12 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.12.1 TUCK TOP

8.12.2 SLEEVE

8.12.3 WINDOWED

8.12.4 DISPLAY CARTONS

8.12.5 OTHERS

8.13 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.13.1 ASIA-PACIFIC

8.13.2 NORTH AMERICA

8.13.3 EUROPE

8.13.4 MIDDLE EAST AND AFRICA

8.13.5 SOUTH AMERICA

8.14 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 THIN-WALLED RIGID BOXES

8.14.2 SET-UP / THICK-WALLED RIGID BOXES

8.15 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

8.15.1 STANDARD

8.15.2 LUXURY

8.16 MIDDLE EAST AND AFRICA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 PRODUCT PACKAGING BOXES

8.16.2 GIFT BOXES

8.17 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

8.17.1 MAGNETIC

8.17.2 RIBBON

8.17.3 SLIDING LID

8.17.4 OTHERS

8.18 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.18.1 ASIA-PACIFIC

8.18.2 NORTH AMERICA

8.18.3 EUROPE

8.18.4 MIDDLE EAST AND AFRICA

8.18.5 SOUTH AMERICA

8.19 MIDDLE EAST AND AFRICA CRATES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.19.1 ASIA-PACIFIC

8.19.2 NORTH AMERICA

8.19.3 EUROPE

8.19.4 MIDDLE EAST AND AFRICA

8.19.5 SOUTH AMERICA

8.2 MIDDLE EAST AND AFRICA OTHERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.20.1 ASIA-PACIFIC

8.20.2 NORTH AMERICA

8.20.3 EUROPE

8.20.4 MIDDLE EAST AND AFRICA

8.20.5 SOUTH AMERICA

9 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY TYPE

9.1 OVERVIEW

9.1.1 STANDARD BOXES

9.1.2 SPECIALTY BOXES

9.2 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.2.1 REGULAR SLOTTED CONTAINER (RSC)

9.2.2 DOUBLE COVERED BOXES

9.2.3 DIE-CUT BOXES

9.2.4 TELESCOPIC BOXES

9.2.5 HALF SLOTTED CONTAINER (HSC)

9.2.6 FULL OVERLAP CONTAINER (FOL)

9.2.7 OTHERS

9.3 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.3.1 ASIA-PACIFIC

9.3.2 NORTH AMERICA

9.3.3 EUROPE

9.3.4 MIDDLE EAST AND AFRICA

9.3.5 SOUTH AMERICA

9.4 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 PRINTED BOXES

9.4.2 HEAVY-DUTY BOXES

9.4.3 INSULATED BOXES

9.4.4 DANGEROUS GOODS (HAZARDOUS) BOXES

9.4.5 CUSTOMIZED BOXES

9.4.6 OTHERS

9.5 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 MIDDLE EAST AND AFRICA

9.5.5 SOUTH AMERICA

10 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY MATERIAL

10.1 OVERVIEW

10.1.1 PAPER & PAPERBOARD

10.1.2 PLASTICS

10.1.3 METAL

10.1.4 WOOD

10.1.5 OTHERS

10.2 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.2.1 KRAFT PAPER

10.2.2 COATED PAPER

10.2.3 WHITE TOP TESTLINER

10.2.4 CHIPBOARD

10.2.5 OTHERS

10.3 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 NORTH AMERICA

10.3.3 EUROPE

10.3.4 MIDDLE EAST AND AFRICA

10.3.5 SOUTH AMERICA

10.4 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.4.1 POLYPROPYLENE (PP)

10.4.2 POLYETHYLENE (PE)

10.4.3 PET

10.4.4 OTHERS

10.5 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 MIDDLE EAST AND AFRICA

10.5.5 SOUTH AMERICA

10.6 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.6.1 ALUMINIUM

10.6.2 TINPLATE

10.6.3 OTHERS

10.7 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 MIDDLE EAST AND AFRICA

10.7.5 SOUTH AMERICA

10.8 MIDDLE EAST AND AFRICA WOOD IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 MIDDLE EAST AND AFRICA

10.8.5 SOUTH AMERICA

10.9 MIDDLE EAST AND AFRICA OTHERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 MIDDLE EAST AND AFRICA

10.9.5 SOUTH AMERICA

11 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 WHOLESALE

11.3 RETAIL

11.4 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 INDUSTRIAL GOODS (2500,2000,0001)

11.4.2 FOOD & BEVERAGES (1000,1100)

11.4.3 LOGISTICS & TRANSPORTATION (4900)

11.4.4 AUTOMOTIVE (4600)

11.4.5 CONSUMER ELECTRONICS (2500)

11.4.6 COSMETICS & PERSONAL CARE (2000,0001)

11.4.7 PHARMACEUTICALS (2100)

11.4.8 HEALTHCARE EQUIPMENT (0001,2500)

11.4.9 OTHERS

11.5 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 MIDDLE EAST AND AFRICA

11.5.5 SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 ELECTRICAL PRODUCTS

11.6.2 ELECTRONICS

11.6.3 CHEMICALS

11.6.4 OTHER INDUSTRIAL APPLICATIONS

11.7 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.7.1 BAKERY

11.7.2 DAIRY FOODS

11.7.3 CONFECTIONERY

11.7.4 FROZEN FOODS

11.7.5 BEVERAGES

11.7.6 OTHERS

11.8 MIDDLE EAST AND AFRICA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 BULK TRANSPORT

11.8.2 COURIER, EXPRESS & PARCEL (CEP)

11.8.3 COLD CHAIN

11.8.4 OTHERS

11.9 MIDDLE EAST AND AFRICA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 COMPONENTS PACKAGING

11.9.2 BATTERIES & ELECTRONICS

11.9.3 SPECIALISED PACKAGING

11.9.4 OTHERS

11.1 MIDDLE EAST AND AFRICA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.10.1 VEHICLE PARTS EXPORT

11.10.2 MODIFICATION COMPONENT

11.10.3 OTHERS

11.11 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 MOBILE PHONES

11.11.2 LAPTOPS

11.11.3 TVS

11.11.4 ACCESSORIES

11.11.5 OTHERS

11.12 MIDDLE EAST AND AFRICA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.12.1 SKIN CARE

11.12.2 PERFUMES

11.12.3 ORAL CARE

11.12.4 HAIR CARE

11.12.5 MAKEUP

11.12.6 OTHERS

11.13 MIDDLE EAST AND AFRICA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.13.1 MEDICAL DEVICE

11.13.2 HEALTHCARE KIT

11.13.3 OTHERS

11.14 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.14.1 FOOD & BEVERAGES (1000,1100)

11.14.2 CONSUMER ELECTRONICS (2500)

11.14.3 INDUSTRIAL GOODS (2500,2000,0001)

11.14.4 LOGISTICS & TRANSPORTATION (4900)

11.14.5 COSMETICS & PERSONAL CARE (2000,0001)

11.14.6 PHARMACEUTICALS (2100)

11.14.7 AUTOMOTIVE (4600)

11.14.8 HEALTHCARE EQUIPMENT (0001,2500)

11.14.9 OTHERS

11.15 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.15.1 ASIA-PACIFIC

11.15.2 NORTH AMERICA

11.15.3 EUROPE

11.15.4 MIDDLE EAST AND AFRICA

11.15.5 SOUTH AMERICA

12 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 DISTRIBUTORS / WHOLESALERS

12.4 RETAIL STORES

12.5 MIDDLE EAST AND AFRICA DIRECT SALES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 NORTH AMERICA

12.5.3 EUROPE

12.5.4 MIDDLE EAST AND AFRICA

12.5.5 SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA DISTRIBUTORS / WHOLESALERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 NORTH AMERICA

12.6.3 EUROPE

12.6.4 MIDDLE EAST AND AFRICA

12.6.5 SOUTH AMERICA

12.7 MIDDLE EAST AND AFRICA RETAIL STORES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 NORTH AMERICA

12.7.3 EUROPE

12.7.4 MIDDLE EAST AND AFRICA

12.7.5 SOUTH AMERICA

13 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SIZE

13.1 OVERVIEW

13.1.1 SMALL (UP TO 5 KG)

13.1.2 MEDIUM (5–20 KG)

13.1.3 CUSTOM SIZES

13.1.4 LARGE (20–50 KG)

13.1.5 EXTRA-LARGE (ABOVE 50 KG)

13.2 MIDDLE EAST AND AFRICA SMALL (UP TO 5 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.2.1 ASIA-PACIFIC

13.2.2 NORTH AMERICA

13.2.3 EUROPE

13.2.4 MIDDLE EAST AND AFRICA

13.2.5 SOUTH AMERICA

13.3 MIDDLE EAST AND AFRICA MEDIUM (5–20 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.3.1 ASIA-PACIFIC

13.3.2 NORTH AMERICA

13.3.3 EUROPE

13.3.4 MIDDLE EAST AND AFRICA

13.3.5 SOUTH AMERICA

13.4 MIDDLE EAST AND AFRICA CUSTOM SIZES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 MIDDLE EAST AND AFRICA

13.4.5 SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA LARGE (20–50 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 MIDDLE EAST AND AFRICA

13.5.5 SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA EXTRA-LARGE (ABOVE 50 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.6.1 ASIA-PACIFIC

13.6.2 NORTH AMERICA

13.6.3 EUROPE

13.6.4 MIDDLE EAST AND AFRICA

13.6.5 SOUTH AMERICA

14 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UAE

14.1.3 SOUTH AFRICA

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 QATAR

14.1.7 KUWAIT

14.1.8 OMAN

14.1.9 BAHRAIN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 MANUFACTURERS COMPANY PROFILE

17.1 INTERNATIONAL PAPER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 SMURFIT WESTROCK

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 DS SMITH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 PACKAGING CORPORATION OF AMERICA.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 OJI HOLDINGS CORPORATION.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AVON CONTAINERS PVT. LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ALTPAC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 AMCOR PLC

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 BOXON AB

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 BLUE BOX PACKAGING

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ECB

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ECOM PACKAGING

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GREEN BAY PACKAGING INC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 GEORGIA-PACIFIC LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 GRAPHIC PACKAGING INTERNATIONAL, LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 KLABIN S.A

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 MONDI

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 MAYR-MELNHOF KARTON AG

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 PREM INDUSTRIES INDIA LIMITED

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 PACKHELP

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 PACKTEK

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 PACKMAN PACKAGING PRIVATE LIMITED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 PRATT INDUSTRIES, INC.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 RENGO CO., LTD

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 STORA ENSO

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENT

17.27 SEALED AIR

17.27.1 COMPANY SNAPSHOT

17.27.2 REVENUE ANALYSIS

17.27.3 PRODUCT PORTFOLIO

17.27.4 RECENT DEVELOPMENT

17.28 SUNECO BOX

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 TGIPACKAGING.IN.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 3M

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENT

18 DISTRIBUTOR COMPANY PROFILE

18.1 BUNZL PLC

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 IMPERIAL DADE

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 VERITIV OPERATING COMPANY

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 PAPER MART

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 ULINE

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 KEY CONCERNS AND THEIR IMPACTS

TABLE 2 BRAND OUTLOOK

TABLE 3 PATENT PUBLICATIONS SHOW A CLEAR UPWARD TREND:

TABLE 4 REGULATORY COVERAGE

TABLE 5 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SLOTTED BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA CRATES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA OTHERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA WOOD IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA OTHERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA DIRECT SALES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA DISTRIBUTORS / WHOLESALERS IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA RETAIL STORES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SMALL (UP TO 5 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA MEDIUM (5–20 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA CUSTOM SIZES IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA LARGE (20–50 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA EXTRA-LARGE (ABOVE 50 KG) IN BOXES PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 85 USD THOUSAND

TABLE 86 SAUDI ARABIA BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 87 SAUDI ARABIA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 88 SAUDI ARABIA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 SAUDI ARABIA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 SAUDI ARABIA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 SAUDI ARABIA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 92 SAUDI ARABIA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 SAUDI ARABIA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 SAUDI ARABIA BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 SAUDI ARABIA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 SAUDI ARABIA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 SAUDI ARABIA BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 98 SAUDI ARABIA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 SAUDI ARABIA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 SAUDI ARABIA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 SAUDI ARABIA BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 102 SAUDI ARABIA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 SAUDI ARABIA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 SAUDI ARABIA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 SAUDI ARABIA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 SAUDI ARABIA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 SAUDI ARABIA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 SAUDI ARABIA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 SAUDI ARABIA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 SAUDI ARABIA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 SAUDI ARABIA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 SAUDI ARABIA BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 113 SAUDI ARABIA BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 114 USD THOUSAND

TABLE 115 UAE BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 116 UAE CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 UAE CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 UAE FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 UAE RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 UAE RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 121 UAE LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 UAE RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 UAE BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 UAE STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 UAE SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 UAE BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 127 UAE PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 UAE PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 UAE METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 UAE BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 131 UAE WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 UAE INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 UAE FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 UAE LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 UAE AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 UAE COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 UAE CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 UAE COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 UAE HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 UAE RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 UAE BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 142 UAE BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 143 USD THOUSAND

TABLE 144 SOUTH AFRICA BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 145 SOUTH AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 SOUTH AFRICA CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 SOUTH AFRICA FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 SOUTH AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 SOUTH AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 150 SOUTH AFRICA LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 SOUTH AFRICA RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 SOUTH AFRICA BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 SOUTH AFRICA STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 SOUTH AFRICA SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 SOUTH AFRICA BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 156 SOUTH AFRICA PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 SOUTH AFRICA PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 SOUTH AFRICA METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 SOUTH AFRICA BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 160 SOUTH AFRICA WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 SOUTH AFRICA INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 SOUTH AFRICA FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 SOUTH AFRICA LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 SOUTH AFRICA AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 SOUTH AFRICA COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 SOUTH AFRICA CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 SOUTH AFRICA COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 SOUTH AFRICA HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 SOUTH AFRICA RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 SOUTH AFRICA BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 171 SOUTH AFRICA BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 172 USD THOUSAND

TABLE 173 EGYPT BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 174 EGYPT CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 EGYPT CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 EGYPT FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 EGYPT RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 EGYPT RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 179 EGYPT LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 EGYPT RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 EGYPT BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 EGYPT STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 EGYPT SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 EGYPT BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 185 EGYPT PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 EGYPT PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 EGYPT METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 EGYPT BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 189 EGYPT WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 EGYPT INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 EGYPT FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 EGYPT LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 EGYPT AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 EGYPT COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 EGYPT CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 EGYPT COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 EGYPT HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 EGYPT RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 EGYPT BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 200 EGYPT BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 201 USD THOUSAND

TABLE 202 ISRAEL BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 203 ISRAEL CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 ISRAEL CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 ISRAEL FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 ISRAEL RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 ISRAEL RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 208 ISRAEL LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 ISRAEL RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 ISRAEL BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 ISRAEL STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 ISRAEL SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 ISRAEL BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 214 ISRAEL PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 ISRAEL PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 ISRAEL METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 ISRAEL BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 218 ISRAEL WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 ISRAEL INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 ISRAEL FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 ISRAEL LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 ISRAEL AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 ISRAEL COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 ISRAEL CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 ISRAEL COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 ISRAEL HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 ISRAEL RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 ISRAEL BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 229 ISRAEL BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 230 USD THOUSAND

TABLE 231 QATAR BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 232 QATAR CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 QATAR CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 QATAR FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 QATAR RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 QATAR RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 237 QATAR LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 QATAR RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 QATAR BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 QATAR STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 QATAR SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 QATAR BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 243 QATAR PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 QATAR PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 QATAR METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 QATAR BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 247 QATAR WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 QATAR INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 QATAR FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 QATAR LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 QATAR AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 QATAR COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 QATAR CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 QATAR COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 QATAR HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 QATAR RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 QATAR BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 258 QATAR BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 259 USD THOUSAND

TABLE 260 KUWAIT BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 261 KUWAIT CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 KUWAIT CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 KUWAIT FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 KUWAIT RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 265 KUWAIT RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 266 KUWAIT LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 KUWAIT RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 KUWAIT BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 KUWAIT STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 KUWAIT SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 KUWAIT BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 272 KUWAIT PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 KUWAIT PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 274 KUWAIT METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 KUWAIT BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 276 KUWAIT WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 KUWAIT INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 KUWAIT FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 KUWAIT LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 280 KUWAIT AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 281 KUWAIT COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 282 KUWAIT CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 KUWAIT COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 284 KUWAIT HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 KUWAIT RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 KUWAIT BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 287 KUWAIT BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 288 USD THOUSAND

TABLE 289 OMAN BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 290 OMAN CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 OMAN CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 OMAN FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 OMAN RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 OMAN RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 295 OMAN LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 OMAN RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 OMAN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 OMAN STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 OMAN SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 300 OMAN BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 301 OMAN PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 OMAN PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 303 OMAN METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 304 OMAN BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 305 OMAN WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 OMAN INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 307 OMAN FOOD & BEVERAGES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 308 OMAN LOGISTICS & TRANSPORTATION IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 309 OMAN AUTOMOTIVE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 310 OMAN COMPONENTS PACKAGING IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 311 OMAN CONSUMER ELECTRONICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 312 OMAN COSMETICS & PERSONAL CARE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 313 OMAN HEALTHCARE EQUIPMENT IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 314 OMAN RETAIL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 315 OMAN BOXES PACKAGING MARKET, BY SALES CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 316 OMAN BOXES PACKAGING MARKET, BY SIZE, 2018-2033 (USD THOUSAND)

TABLE 317 USD THOUSAND

TABLE 318 BAHRAIN BOXES PACKAGING MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 319 BAHRAIN CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 BAHRAIN CORRUGATED BOXES IN BOXES PACKAGING MARKET, BY FLUTE TYPE, 2018-2033 (USD THOUSAND)

TABLE 321 BAHRAIN FOLDING CARTONS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 322 BAHRAIN RIGID BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 323 BAHRAIN RIGID BOXES IN BOXES PACKAGING MARKET, BY USE CASE, 2018-2033 (USD THOUSAND)

TABLE 324 BAHRAIN LUXURY IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 325 BAHRAIN RIGID BOXES IN BOXES PACKAGING MARKET, BY CLOSURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 326 BAHRAIN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 327 BAHRAIN STANDARD BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 328 BAHRAIN SPECIALTY BOXES IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 329 BAHRAIN BOXES PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 330 BAHRAIN PAPER & PAPERBOARD IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 331 BAHRAIN PLASTICS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 332 BAHRAIN METAL IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 BAHRAIN BOXES PACKAGING MARKET, BY INDUSTRY, 2018-2033 (USD THOUSAND)

TABLE 334 BAHRAIN WHOLESALE IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 335 BAHRAIN INDUSTRIAL GOODS IN BOXES PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)