Middle East And Africa Breast Implants Market

Market Size in USD Million

CAGR :

%

USD

110.00 Million

USD

211.26 Million

2025

2033

USD

110.00 Million

USD

211.26 Million

2025

2033

| 2026 –2033 | |

| USD 110.00 Million | |

| USD 211.26 Million | |

|

|

|

|

Middle East and Africa Breast Implants Market Size

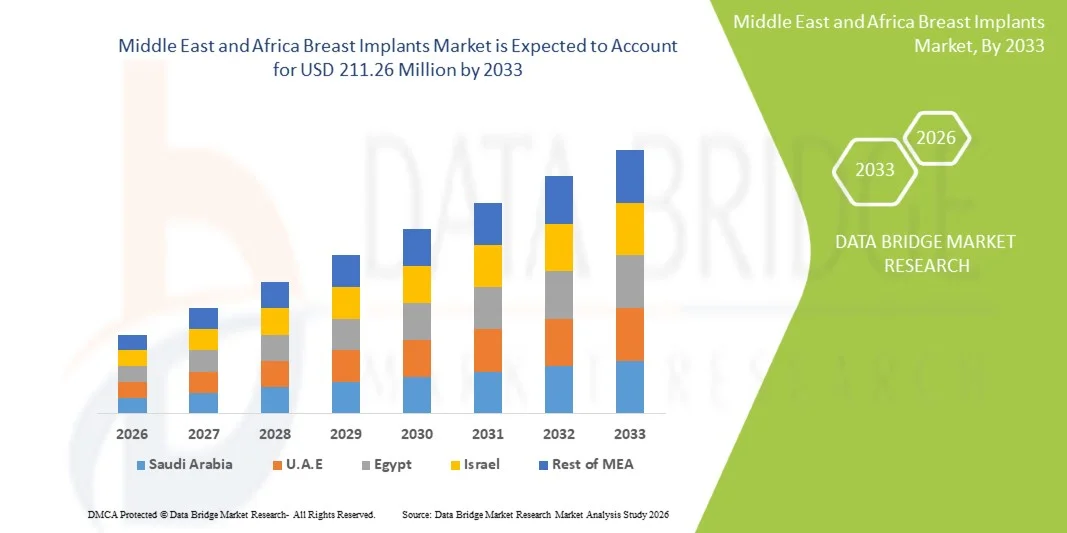

- The Middle East and Africa Breast Implants Market size was valued at USD 110.00 Million in 2025 and is expected to reach USD 211.26 Million by 2033, at a CAGR of 8.50% during the forecast period

- The market growth is largely fueled by increasing awareness of aesthetic enhancement and reconstructive procedures, along with continuous technological advancements in implant materials and designs, leading to wider adoption of breast implant solutions across both cosmetic and medical applications

- Furthermore, rising consumer demand for safe, natural-looking, and long-lasting cosmetic solutions, combined with improving access to skilled plastic surgeons and advanced healthcare facilities, is establishing breast implants as a preferred choice for aesthetic and reconstructive surgeries. These converging factors are accelerating the uptake of breast implant solutions, thereby significantly boosting the industry’s growth

Middle East and Africa Breast Implants Market Analysis

- Breast implants, used in cosmetic augmentation and post-mastectomy reconstruction procedures, have become an integral part of modern aesthetic and reconstructive surgery due to advancements in implant materials, improved safety profiles, and increasingly natural outcomes, supporting adoption across hospitals, specialty clinics, and ambulatory surgical centers

- The rising demand for breast implants is primarily driven by growing awareness of cosmetic procedures, increased acceptance of aesthetic surgery, advancements in silicone and saline implant technologies, and a higher number of breast reconstruction surgeries following cancer treatments

- Saudi Arabia dominated the Middle East and Africa Breast Implants Market with the largest revenue share of approximately 32.8% in 2025, supported by a high demand for cosmetic procedures, increasing medical tourism, advanced healthcare infrastructure, and growing awareness about aesthetic and reconstructive surgeries. The availability of skilled plastic surgeons and favorable government initiatives for healthcare development have further strengthened Saudi Arabia’s market position

- U.A.E. is expected to be the fastest-growing region in the Middle East and Africa Breast Implants Market during the forecast period, registering a high CAGR due to rising disposable incomes, rapid urbanization, increasing acceptance of cosmetic procedures, growth in medical tourism, and expanding availability of specialized aesthetic clinics across major cities

- The cosmetic surgery segment dominated the market with a revenue share of 58.7% in 2025, driven by rising aesthetic awareness

Report Scope and Middle East and Africa Breast Implants Market Segmentation

|

Attributes |

Middle East and Africa Breast Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Breast Implants Market Trends

“Advancements in Implant Materials and Customization”

- A significant and accelerating trend in the global Middle East and Africa Breast Implants Market is the continuous advancement in implant materials and an increased emphasis on personalized design to meet diverse patient requirements. Manufacturers worldwide are focusing on developing improved silicone gel formulations, lightweight structures, and anatomically optimized implant designs to enhance both safety and aesthetic outcomes

- For instance, several leading global manufacturers have introduced highly cohesive silicone gel breast implants that offer better shape retention, reduced leakage risk, and improved durability, supporting long-term patient satisfaction. These innovations are gaining widespread acceptance among surgeons and patients seeking more natural-looking results

- Ongoing technological improvements have enabled greater flexibility in implant size, shape, and surface characteristics, allowing surgeons to tailor procedures to individual anatomical needs and aesthetic preferences. The introduction of lightweight and ergonomically designed implants further contributes to improved comfort and reduced stress on surrounding tissues

- In addition, advancements in implant surface technology, including smooth and microtextured surfaces, are improving tissue integration and reducing post-surgical complications. Such developments are enhancing clinical outcomes across both cosmetic and reconstructive applications

- This shift toward safer, more durable, and customizable implant solutions is fundamentally reshaping expectations in the breast aesthetics and reconstruction landscape. As a result, companies such as Allergan, Mentor, and Motiva continue to expand their product portfolios with innovative breast implant offerings designed to meet evolving patient and surgeon demands

- The global demand for advanced breast implants with improved safety profiles, longevity, and natural results is increasing steadily across both developed and emerging markets as aesthetic awareness and acceptance of cosmetic procedures rise worldwide

Middle East and Africa Breast Implants Market Dynamics

Driver

“Rising Prevalence of Cosmetic Enhancement and Reconstructive Surgeries”

- The growing preference for cosmetic enhancement procedures, along with the increasing number of breast reconstruction surgeries following mastectomy or trauma, is a key driver accelerating growth in the global Middle East and Africa Breast Implants Market

- For instance, several multinational healthcare organizations have reported a consistent rise in reconstructive breast surgeries worldwide, reinforcing the essential role of breast implants in restoring physical appearance and improving patient quality of life. Such developments are expected to further drive Middle East and Africa Breast Implants Market growth during the forecast period

- Increased awareness of body aesthetics, influenced by evolving beauty standards, social media exposure, and improved access to cosmetic surgery, is encouraging more individuals globally to undergo breast augmentation procedures

- Furthermore, advancements in surgical techniques, improved safety standards, and the expanding availability of trained plastic surgeons across regions are making breast implant procedures more accessible and reliable

- The combination of rising disposable incomes, growing acceptance of aesthetic treatments, and continued innovation in implant technology is significantly propelling the adoption of breast implants in both cosmetic and reconstructive applications globally

Restraint/Challenge

“Safety Concerns, Regulatory Scrutiny, and High Procedure Costs”

- Ongoing concerns related to the safety of breast implants, potential post-surgical complications, and long-term health risks continue to pose challenges to broader global market adoption. Issues such as capsular contracture, implant rupture, and the need for revision surgeries contribute to patient hesitation

- For instance, heightened regulatory scrutiny and periodic safety reviews by health authorities in various countries have raised awareness around implant-related risks, influencing patient decision-making and slowing adoption in some regions

- To address these challenges, manufacturers are prioritizing rigorous clinical testing, compliance with international regulatory standards, and transparent communication regarding implant safety and performance. Leading companies emphasize long-term clinical data and post-market surveillance to build patient and surgeon confidence

- In addition, the high overall cost associated with breast implant procedures—including surgical fees, hospital stays, and follow-up care—can be a significant barrier, particularly in cost-sensitive healthcare systems. Premium implant materials and advanced surgical options often result in higher treatment expenses

- Although gradual price stabilization and financing options are improving accessibility, the perception of breast implants as a high-cost elective procedure continues to restrain market expansion. Addressing safety concerns, improving affordability, and enhancing patient education will be critical for sustained global market growth

Middle East and Africa Breast Implants Market Scope

The market is segmented on the basis of type, technology, shape, surface, placement, surgery, end user, and distribution channel.

• By Type

On the basis of type, the Middle East and Africa Breast Implants Market is segmented into silicone implants, form-stable implants, saline implants, and structured saline implants. The silicone implants segment dominated the largest market revenue share of 46.8% in 2025, driven by their natural texture, softness, and close resemblance to natural breast tissue. Silicone implants are widely preferred in cosmetic augmentation procedures due to higher patient satisfaction and predictable aesthetic outcomes. Improved cohesive gel technology enhances durability and reduces rupture risk. Surgeons favor silicone implants for both primary and revision surgeries owing to reliable performance. Rising cosmetic awareness globally supports demand. Availability across multiple sizes and profiles allows high customization. Regulatory approvals in major markets reinforce adoption. Strong clinical history improves patient confidence. Silicone implants are also extensively used in reconstructive surgeries. High surgeon familiarity sustains demand. Premium brand availability further strengthens dominance. These factors collectively support market leadership.

The form-stable implants segment is expected to witness the fastest CAGR of 7.9% from 2026 to 2033, mainly due to growing demand for long-lasting shape retention. These implants maintain structural integrity even if rupture occurs, improving safety perception. Increasing awareness of gummy bear implants fuels adoption. Surgeons prefer form-stable implants for reconstructive procedures due to contour stability. Rising post-mastectomy reconstruction cases support growth. Technological advancements improve comfort and reduce complications. Higher adoption in developed markets accelerates expansion. Patient willingness to opt for premium implants supports demand. Increasing surgeon training enhances usage. Expanding regulatory approvals in emerging markets contribute to growth. Rising preference for anatomical appearance drives demand. This segment shows strong future growth potential.

• By Technology

On the basis of technology, the Middle East and Africa Breast Implants Market is segmented into inframammary, peri-areolar, trans-axillary, and transumbilical approaches. The inframammary technique dominated with a market revenue share of 41.6% in 2025, owing to superior surgical access and precision. This approach allows accurate implant placement and reduced complication risk. Surgeons prefer inframammary incisions for handling larger implants. It provides direct visibility, improving surgical outcomes. Reduced implant malposition risk supports adoption. This technique is widely used in reconstructive surgeries. Scarring is well concealed under the breast fold. High predictability strengthens surgeon confidence. Compatibility with most implant types boosts demand. Low revision rates reinforce preference. Patient outcomes are consistent and reliable. These factors maintain strong dominance.

The trans-axillary approach is anticipated to grow at the fastest CAGR of 8.4% from 2026 to 2033, driven by rising demand for scar-hidden procedures. This technique avoids incisions on the breast itself. Cosmetic-conscious patients increasingly prefer this method. Technological advancements in endoscopic surgery improve accuracy. Growing adoption in aesthetic clinics supports growth. Less visible scarring improves patient satisfaction. Rising demand among younger patients accelerates adoption. Increased surgeon expertise supports procedural safety. Popularity is rising in Asia and Latin America. Short recovery time enhances appeal. Growing awareness drives market expansion. This approach is gaining momentum globally.

• By Shape

On the basis of shape, the Middle East and Africa Breast Implants Market is segmented into round implant shape, anatomical implant shape, and gummy bear shape. The round implant shape segment dominated the market with a revenue share of 44.3% in 2025, due to versatility and cost-effectiveness. Round implants offer enhanced upper breast fullness favored in cosmetic surgeries. Symmetrical shape minimizes rotation risk. Surgeons prefer round implants for predictable results. Lower procedural complexity supports adoption. Availability in multiple projections boosts customization. Widely used in outpatient cosmetic procedures. Strong patient familiarity drives demand. Lower pricing compared to anatomical shapes supports volume sales. Suitable for diverse body types. Widely accepted globally. These factors support consistent dominance.

The gummy bear shape segment is expected to register the fastest CAGR of 8.7% from 2026 to 2033, due to demand for natural breast contouring. These implants retain shape under pressure. Rising use in reconstructive surgery accelerates growth. Improved safety and durability enhance acceptance. Surgeons recommend these implants for complex cases. Patients prefer long-term aesthetic stability. Expanding availability supports adoption. Premium positioning attracts high-income patients. Growing awareness of advanced implant technologies boosts demand. Increasing clinical evidence supports safety. Strong growth is expected across regions.

• By Surface

On the basis of surface, the Middle East and Africa Breast Implants Market is segmented into textured and smooth implants. The smooth surface segment accounted for the largest market revenue share of 52.1% in 2025, driven by comfort and safety. Smooth implants move naturally within the breast pocket. Lower irritation risk improves patient comfort. Regulatory approvals favor smooth implants. Widely used in cosmetic augmentation. Surgeons report ease of placement. Reduced complication risks enhance acceptance. Soft texture produces natural appearance. Lower association with adverse conditions supports dominance. Broad patient acceptance drives demand. Long clinical usage history strengthens trust. These factors sustain leadership.

The textured surface segment is projected to grow at a CAGR of 6.8% from 2026 to 2033, supported by improved positional stability. Textured implants reduce implant rotation. Commonly used with anatomical shapes. Advances in surface design enhance safety. Adoption is strong in reconstructive applications. Surgeons value tissue adherence benefits. Improved manufacturing standards support growth. Selective usage sustains demand. Reconstruction-focused hospitals support growth. Patient-specific demand drives adoption. This segment continues steady expansion.

• By Placement

On the basis of placement, the Middle East and Africa Breast Implants Market is segmented into subpectoral insertion, subglandular insertion, and submuscular insertion. The subpectoral insertion segment dominated with 39.4% revenue share in 2025, driven by better aesthetic outcomes. Placement under muscle reduces implant visibility. Lower capsular contracture risk supports adoption. Widely preferred in thin patients. Used extensively in reconstruction. Long-term stability improves outcomes. Surgeons favor this method. Improved imaging compatibility enhances safety. Strong clinical support sustains dominance. Balanced appearance drives demand. Reliable outcomes reinforce usage.

The subglandular insertion segment is expected to grow at a CAGR of 7.6% from 2026 to 2033, due to faster recovery. Less muscle manipulation reduces pain. Shorter surgery time supports demand. Increased cosmetic procedures support growth. Improved implant technology enhances safety. Clinics prefer this placement for aesthetic surgeries. Growing patient comfort boosts adoption. Lower procedure complexity improves efficiency. Increasing outpatient surgeries fuel demand. Suitable for experienced surgeons. This segment shows strong growth.

• By Surgery

On the basis of surgery, the Middle East and Africa Breast Implants Market is segmented into cosmetic surgery and reconstructive surgery. The cosmetic surgery segment dominated the market with a revenue share of 58.7% in 2025, driven by rising aesthetic awareness. Social acceptance of cosmetic enhancement supports growth. Increased disposable income fuels procedures. Media influence drives demand. Improved surgical safety enhances confidence. Growing urban population supports growth. High procedure volumes sustain leadership. Technological improvements improve outcomes. Clinic availability boosts accessibility. Younger demographics drive demand. Cosmetic focus strengthens dominance.

The reconstructive surgery segment is anticipated to witness the fastest CAGR of 8.9% from 2026 to 2033, supported by increasing breast cancer cases. Post-mastectomy reconstruction demand is rising. Government reimbursements support procedures. Psychological benefits drive patient preference. Hospitals lead adoption. Advancements in surgical techniques improve safety. Increasing awareness boosts acceptance. Growing healthcare infrastructure supports growth. Surgeon specialization accelerates expansion. Rising survival rates support demand. Strong growth outlook is expected.

• By End User

On the basis of end user, the Middle East and Africa Breast Implants Market is segmented into hospitals and cosmetology clinics. The hospitals segment dominated with a 54.2% market share in 2025, due to advanced infrastructure. Availability of skilled surgeons supports procedures. Preferred for reconstruction and complex cases. Better post-operative care improves outcomes. Strong regulatory compliance supports trust. High patient volume sustains dominance. Insurance coverage favors hospital procedures. Access to multidisciplinary care supports demand. Advanced equipment enhances safety. Government hospitals boost reconstruction demand. Hospitals remain key end users.

The cosmetology clinics segment is expected to grow at the fastest CAGR of 9.1% from 2026 to 2033, driven by outpatient cosmetic procedures. Personalized services attract patients. Shorter waiting times improve preference. Competitive pricing boosts adoption. Growth in private clinics supports demand. Urbanization accelerates expansion. Advanced aesthetic equipment improves outcomes. Clinic branding enhances patient trust. Increased cosmetic awareness fuels growth. Surgeons increasingly shift to clinics. Strong expansion is anticipated.

• By Distribution Channel

On the basis of distribution channel, the Middle East and Africa Breast Implants Market is segmented into direct and indirect channels. The direct channel accounted for the largest revenue share of 61.3% in 2025, driven by strong manufacturer-hospital relationships. Direct supply ensures product authenticity. Better pricing control supports adoption. Technical training enhances surgeon confidence. Reliable supply chains benefit hospitals. After-sales support improves satisfaction. Faster product availability boosts efficiency. Regulatory compliance strengthens trust. Large-volume procurement sustains dominance. Innovation feedback loops improve products. This channel maintains leadership.

The indirect channel is projected to grow at a CAGR of 7.4% from 2026 to 2033, driven by wider market reach. Distributor networks expand access in emerging markets. Clinics rely on distributors for supply. Improved logistics enhance efficiency. Cost flexibility supports smaller providers. Regional penetration boosts growth. Distributor expertise supports adoption. Expanding private clinics fuel demand. Increasing cosmetic centers improve uptake. Supply chain diversification aids growth. This channel continues to expand steadily.

Middle East and Africa Breast Implants Market Regional Analysis

- The Middle East and Africa Breast Implants Market is expected to grow at the fastest CAGR during the forecast period from 2026 to 2033, driven by rising aesthetic awareness, increasing disposable incomes, and improving access to advanced cosmetic and reconstructive surgical procedures across countries such as Saudi Arabia, UAE, Egypt, and South Africa. Rapid urbanization and evolving lifestyle preferences are encouraging higher acceptance of cosmetic enhancement procedures. The expansion of private healthcare facilities, growing medical tourism, and the increasing availability of skilled plastic surgeons are strengthening regional market growth

- Technological advancements in implant materials, improved safety profiles, and shorter recovery times are further supporting adoption. Rising awareness regarding post-mastectomy reconstruction is also boosting demand. Hospitals and cosmetology clinics across the Middle East and Africa are increasingly offering modern breast implant solutions to meet patient demand. Government initiatives to develop healthcare infrastructure and support medical tourism in key countries are further contributing to market growth

- Increasing exposure to global beauty trends and higher social acceptance of aesthetic procedures among younger populations are driving demand. Regional investments in training programs for plastic surgeons ensure improved accessibility and procedural quality. These factors collectively make the Middle East and Africa a rapidly expanding market for breast implants

Saudi Arabia Middle East and Africa Breast Implants Market Insight

The Saudi Arabia Middle East and Africa Breast Implants Market dominated the Middle East and Africa region with the largest revenue share of approximately 32.8% in 2025, supported by high demand for cosmetic procedures and increasing medical tourism. Advanced healthcare infrastructure and growing awareness about aesthetic and reconstructive surgeries are key drivers. The presence of a large number of skilled plastic surgeons ensures access to safe and effective procedures. Government initiatives promoting healthcare development and medical tourism further strengthen market adoption. Rising disposable incomes and exposure to international beauty standards are contributing to increasing acceptance of breast augmentation and reconstructive surgeries. Hospitals and private clinics are offering modern breast implant options to meet growing patient demand. The availability of advanced implant materials with improved safety and natural outcomes supports higher adoption. Social acceptance of aesthetic procedures among younger demographics is accelerating growth. Improved post-surgical care and shorter recovery times enhance patient satisfaction. Technological advancements in implant design further reinforce Saudi Arabia’s leading position in the regional market.

UAE Middle East and Africa Breast Implants Market Insight

The UAE Middle East and Africa Breast Implants Market is witnessing steady growth, driven by rising aesthetic awareness, increasing disposable incomes, and the country’s status as a hub for medical tourism in the Middle East. The demand for cosmetic procedures, including breast augmentation and reconstructive surgeries, is growing among both residents and international patients seeking high-quality healthcare services. Advanced healthcare infrastructure, availability of skilled plastic surgeons, and internationally accredited hospitals support widespread adoption. Exposure to global beauty trends and higher social acceptance of aesthetic procedures among younger populations are contributing to market expansion. Hospitals and private clinics in the UAE are increasingly offering technologically advanced breast implant options with improved safety, durability, and natural outcomes. Government initiatives to promote healthcare development and support medical tourism further strengthen the market. Rising awareness of post-mastectomy reconstruction and short recovery time procedures is encouraging patients to opt for implants. The market is also supported by the presence of premium implant brands and access to modern surgical techniques. Increasing patient education on cosmetic and reconstructive options enhances confidence and adoption. These factors collectively position the UAE as a key growth market within the Middle East and Africa region.

Middle East and Africa Breast Implants Market Share

The Breast Implants industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Mentor Worldwide LLC (U.S.)

- Sientra, Inc. (U.S.)

- GC Aesthetics (Ireland)

- Establishment Labs Holdings Inc. (Costa Rica)

- HansBiomed Co., Ltd. (South Korea)

- Sebbin (France)

- Polytech Health & Aesthetics GmbH (Germany)

- Cereplas (France)

- LabCorp Aesthetics & Medical (Brazil)

- Koken Co., Ltd. (Japan)

- Silimed (Brazil)

- Nagor Ltd. (U.K.)

- Arion Laboratories (France)

- Groupe Sebbin SAS (France)

Latest Developments in Middle East and Africa Breast Implants Market

- In October 2021, Establishment Labs (Motiva) launched JOY, a patient-centric breast aesthetics program built around its next-generation Ergonomix2 implants — a commercial program that pairs the new implant technology with expanded patient support and warranty offerings

- In October 2021, the U.S. Food and Drug Administration (FDA) issued strengthened requirements and communications on breast implant safety, taking steps to improve risk information and ordering changes to ensure patients receive clearer safety communication when considering implants. (This was a major regulatory action affecting the market going forward

- In March 2023, Sientra published preliminary clinical study results showing promising volume-retention rates for its Viality fat-transfer system (an adjunctive technology used in augmentation/reconstruction workflows), signaling growth of complementary technologies in implant and reconstruction pathways

- In May 2023, IDEAL IMPLANT’s parent company announced it had ceased operations (the company ended manufacturing of its structured-saline “IDEAL IMPLANT”), a material market development affecting availability and warranty support for that product line

- In May 2023, Sientra also received FDA clearance for its Portfinder technology (a clinical-use device in the company’s reconstructive portfolio), reflecting product diversification by implant manufacturers into supporting devices and surgical aids

- In December 2024, Mentor (a Johnson & Johnson MedTech company) received FDA approval for its MemoryGel Enhance breast implant family (expanded sizes for reconstruction) and announced a commercial launch plan — a notable product approval addressing reconstruction needs for larger sizes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.