Middle East And Africa Busway Market

Market Size in USD Million

CAGR :

%

USD

658.35 Million

USD

980.80 Million

2024

2032

USD

658.35 Million

USD

980.80 Million

2024

2032

| 2025 –2032 | |

| USD 658.35 Million | |

| USD 980.80 Million | |

|

|

|

|

Middle East and Africa Busway Market Size

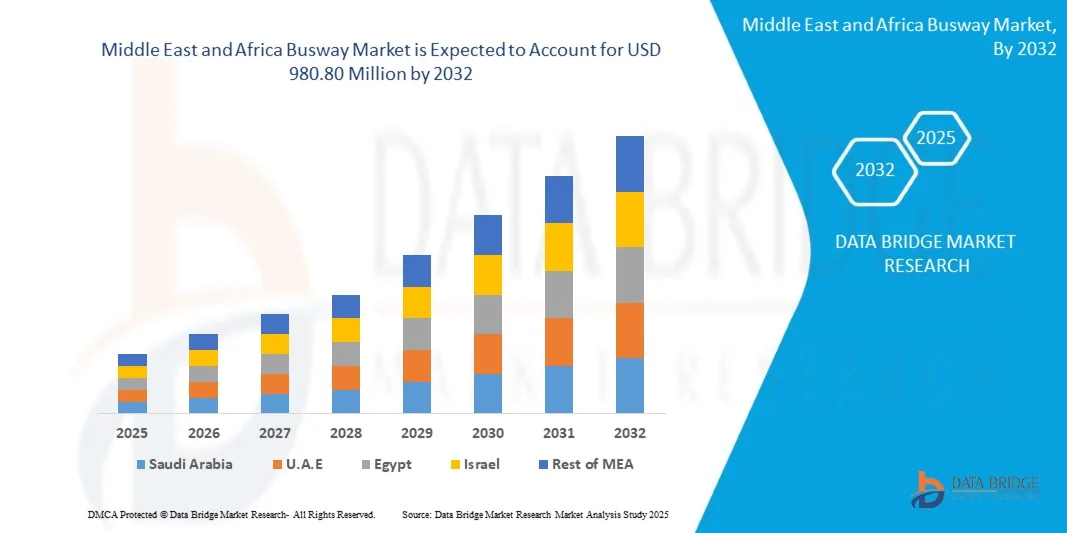

- The Middle East and Africa Busway Market was valued at USD 658.35 Million in 2024 and is expected to reach USD 980.80 Million by 2032, at a CAGR of 5.2% during the forecast period

- This growth is driven by factors such as the integration of electrical systems in industrial automation further support market expansion.

Middle East and Africa Busway Market Analysis

- The Middle East and Africa Busway Market is experiencing robust growth, increasing demand for energy-efficient distribution systems, rising construction of commercial and industrial facilities, and the push for modernization of aging power infrastructure. The shift towards smart buildings, adoption of renewable energy sources, and the integration of electrical systems in industrial automation further support market expansion. However, market expansion is challenged by high initial costs, complex retrofitting in legacy systems, and compliance with regional electrical codes and standards such as IEC, NEC, and UL.

- Emerging trends include the development of smart busway systems integrated with sensors and IoT for real-time monitoring, demand-driven energy distribution, and predictive maintenance. The Middle East and Africa market continues to witness investment in R&D, product innovations, and strategic collaborations aimed at enhancing system reliability, safety, and scalability.

- Saudi Arabia is expected to dominate the Middle East and Africa Middle East and Africa Busway Market, holding the largest revenue share of 20.95% in 2025, attributed to its vast population base, increase in commercial buildings, malls, hotels, industrial zones, and high-rise developments in Saudi cities such as Riyadh, Jeddah, and Dammam.

- Saudi Arabia is projected to be the fastest-growing country in the market during the forecast period with a CAGR of 6.9%, driven by its widespread adoption for efficient, continuous compounding and growing demand for high-quality busbars across various industries.

- The Product segment is expected to dominate the Middle East and Africa Busway Market, with a market share of 78.03%in 2025, owing to the by its widespread adoption for efficient, continuous compounding and growing demand for high-quality busbars across various industries.

Report Scope and Middle East and Africa Busway Market Segmentation

|

Attributes |

Busway Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Busway Market Trends

“Rising deployment of busways in data centers and cloud facilities”

- One prominent trend in the Middle East and Africa Busway Market is the data centers and hyperscale cloud facilities has brought new attention to the reliability and flexibility of power distribution infrastructure.

- The shift has been further encouraged by cloud giants Such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, whose expansion strategies involve building and upgrading hundreds of high-density facilities.

- For instance, in May 2025, Renyun (Hunan) Busbar Co., Ltd. recently hosted a valued customer at its headquarters, marking another milestone in the company’s commitment to building strong, long-term partnerships. The visit included a guided tour of Renyun’s state-of-the-art manufacturing facilities, where the customer observed advanced production processes, rigorous quality testing, and innovative product designs. In-depth discussions focused on ongoing projects, performance feedback, and opportunities for future cooperation. The event highlighted the mutual benefits of close collaboration, reinforcing Renyun’s dedication to delivering high-quality solutions and fostering customer success in both domestic and international markets.

- Data centers, where uptime is non-negotiable, busways are being integrated to provide streamlined and reconfigurable power delivery, allowing operators to scale infrastructure without extended downtime. Their plug-and-play nature has been valued for enabling quick rack power connections and supporting dynamic load shifts—needs that have become common in both hyperscale and edge computing scenarios.

- The World Bank’s energy development programs further highlight how electrification is being linked with sustainable industrial growth in emerging economies. In smart industrial zones and government-led infrastructure corridors, busways are being considered as part of low-voltage distribution strategies—particularly where speed, flexibility, and long-term safety are required.

Middle East and Africa Busway Market Dynamics

Driver

“Increasing Electrification in Developing Countries”

- One of the key trends propelling the Middle East and Africa Busway Market is the growing push for electrification in developing countries is reshaping how energy infrastructure is designed, built, and maintained

- The ongoing wave of industrial modernization, including smart manufacturing, renewable energy projects, and urban development initiatives, is driving consistent demand for Busway in equipment fabrication, structural components, and fluid handling systems.

- For instance, in 2025, Furukawa Electric Co., Ltd. developed the world’s first 100 mW optical power x 16-channel blind mate ELS (External Laser Source) for Co-Packaged Optics (CPO). This product achieves 100 mW optical power per channel at a case temperature of 55°C, designed for next-generation network switch servers in hyperscale and edge data centers. The product will be exhibited at OFC 2024, with sample deliveries starting in April 2024 and commercialization planned for FY2025.

- As electrification efforts continue to expand across developing regions, a shift toward modular, efficient, and scalable power distribution has been clearly observed. Busway systems have been increasingly favored in these settings not only for their ease of installation and safety, but also for their ability to adapt to evolving infrastructure needs in fast-growing urban and industrial environments.

- A report by the United Nations’ Sustainable Energy for All (SEforALL) initiative echoes this direction, noting that modern electrification efforts are no longer limited to grid expansion alone. Instead, integrated power distribution solutions, including busways, are being deployed in utility-scale, microgrid, and off-grid systems to support both reliability and efficiency as access improves.

Restraint/Challenge

“High initial installation and material costs compared to conventional cabling”

- The Middle East and Africa Busway Market is significantly impacted by the higher installation costs and premium material pricing have been perceived as initial deterrents when compared to traditional cable-based systems. While long-term operational efficiency, reduced downtime, and easier maintenance are commonly cited advantages of busways, these benefits have frequently been overlooked in budget-constrained environments where capital expenditure is closely scrutinized.

- A lack of universally accepted performance benchmarks, cost-to-benefit metrics, and lifecycle-based return models has made it difficult for engineers and planners to conduct accurate cost comparisons with conventional cabling. As a result, long-term economic advantages of busways have often remained underrepresented during procurement discussions.

- For instance, in 2025, Furukawa Electric will integrate its optical fiber cable business under the new brand Lightera. This rebranding aims to streamline operations and enhance the company’s focus on the optical communications sector. The move will improve brand recognition, boost operational efficiency, and strengthen Furukawa Electric’s market position in the rapidly growing fiber-optic networks and telecommunications industry

- The long-term performance benefits and reduced maintenance associated with busway systems, adoption in many regions has been slowed by the high initial capital outlay required for installation and materials. These upfront costs have often been viewed as barriers, particularly in price-sensitive sectors or retrofit projects. Without standardized ROI benchmarks or consistent cost-justification frameworks, stakeholders have been hesitant to transition from conventional cabling.

- Decision-makers in such industries have generally prioritized immediate uptime and cost containment over long-term infrastructural agility. As a result, innovations Such as intelligent busway monitoring, plug-in configurations, and integrated fault-detection have seen limited uptake in these sectors, despite their advantages.

Middle East and Africa Busway Market Scope

The Middle East and Africa Busway Market is segmented into Offering, Components, Type, Implementation, Installation Location, Conductor Material, Phase Type, Power Rating, Vertical/ Application.

- By Offering

On the basis of Offering, the market is segmented into product and service. In 2025, the Product segment is expected to dominate the market with a share of 78.03% and is projected to reach USD 783.94 million by 2032, growing with the highest CAGR of 5.5% during the forecast period. This growth is attributed to its widespread adoption in industrial and commercial setups for efficient, low-maintenance power distribution, along with increasing demand for modular and scalable energy systems, driving their rapid adoption and consistent market growth.

- By Components

On the basis of Components, the market is segmented into busbars, enclosure, tap-off units, joint connectors, end caps and end feeds, and grounding system. In 2025, the Busbars segment is expected to dominate the market with a share of 41.97% and is projected to reach USD 430.18 million by 2032, growing with the highest CAGR of 5.8%. Busbars are central to efficient power transmission, reduced energy loss, and enhanced safety in high-load applications, making them indispensable in modern electrical infrastructure, driving their rapid adoption and consistent market growth.

- By Type

On the basis of Type, the market is segmented into 3-phase 4-wire and 3-phase 5-wire. In 2025, the 3-Phase 4-Wire segment is expected to dominate with a market share of 61.12% and is projected to reach USD 607.28 million by 2032, growing with the highest CAGR of 5.4%. This dominance is due to its cost-effectiveness, compatibility with legacy systems, and strong suitability for industrial and commercial power distribution, driving their rapid adoption and consistent market growth.

- By Implementation

On the basis of Implementation, the market is segmented into ceiling overhead and raised floor. In 2025, the Ceiling Overhead segment is expected to dominate with a market share of 68.32% and is projected to reach USD 686.15 million by 2032, growing with the highest CAGR of 5.5%. This growth is driven by space optimization, enhanced safety, and ease of installation, especially in high-ceiling industrial and commercial facilities, driving their rapid adoption and consistent market growth.

- By Installation Location

On the basis of Installation Location, the market is segmented into indoor and outdoor. In 2025, the Indoor segment is anticipated to dominate the market with a share of 79.55% and is projected to reach USD 798.85 million by 2032, growing with the highest CAGR of 5.5%. The rise in factory setups, commercial infrastructure, and data centers requiring compact and efficient power distribution systems is fueling this growth, driving their rapid adoption and consistent market growth.

- By Conductor Material

On the basis of Conductor Material, the market is segmented into copper busway, aluminum busway, and hybrid busway. In 2025, the Copper Busway segment is expected to dominate with a 54.04% market share and is projected to reach USD 521.95 million by 2032. Meanwhile, the Aluminum Busway segment is expected to grow with the highest CAGR of 5.8%, supported by its superior conductivity, thermal performance, and long-term reliability in both low and medium voltage applications, driving their rapid adoption and consistent market growth.

- By Phase Type

On the basis of Phase Type, the market is segmented into segregated phase, non-segregated phase, plug-in, and feeder. In 2025, the Non-Segregated Phase segment is expected to dominate with a market share of 48.19% and is projected to reach USD 488.91 million by 2032, growing with the highest CAGR of 5.7%. Its compact design, cost efficiency, and broad applicability in moderate power environments make it a preferred choice, driving their rapid adoption and consistent market growth.

- By Power Rating

On the basis of Power Rating, the market is segmented into low power busway, medium power busway, and high-power busway. In 2025, the Medium Power Busway segment is expected to dominate the market with a 50.22% share and is projected to reach USD 501.52 million by 2032, growing with the highest CAGR of 5.5%. Its versatility and applicability across centralized and decentralized power distribution systems in industrial and commercial settings ensure efficient energy delivery, driving their rapid adoption and consistent market growth.

- By Application

On the basis of Application, the market is segmented into industrial facilities, commercial buildings, IT (telecommunication and broadcasting), energy, healthcare, transportation, residential, government and military, education institutes, entertainment and sports venues, and others. In 2025, the Industrial Facilities segment is expected to dominate with a 24.78% market share and is projected to reach USD 260.38 million by 2032, growing with the highest CAGR of 6.2%. The need for efficient, scalable, and high-capacity power distribution infrastructure in manufacturing, processing industries, and energy-intensive operations is a key driver, driving their rapid adoption and consistent market growth.

Middle East and Africa Busway Market Regional Analysis

- Saudi Arabia is expected to dominate the Middle East and Africa Middle East and Africa Busway Market, holding the largest revenue share of 20.95% in 2025, attributed to its vast population base, increase in commercial buildings, malls, hotels, industrial zones, and high-rise developments in Saudi cities such as Riyadh, Jeddah, and Dammam.

- Saudi Arabia is projected to be the fastest-growing country in the market during the forecast period with a CAGR of 6.9%, driven by its widespread adoption for efficient, continuous compounding and growing demand for high-quality busbars across various industries

- The Middle East and Africa (MEA) region is witnessing a growing demand for modern, efficient, and scalable power distribution solutions, with busway systems increasingly favored over conventional cabling methods. Driven by rapid urbanization, infrastructure development, and industrial growth—particularly in the Gulf Cooperation Council (GCC) countries and parts of Sub-Saharan Africa—busway systems are gaining traction in commercial buildings, large-scale infrastructure projects, and smart city developments. National visions such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero 2050 initiative are promoting the adoption of sustainable and energy-efficient technologies, including advanced busway systems, in both public and private sector projects.

Saudi Arabia Middle East and Africa Busway Market Insight

The Saudi Arabia Middle East and Africa Busway Market is projected to register a robust CAGR of 6.9% from 2025 to 2032, making it one of the fastest-growing markets for busway systems within the Middle East and Africa (MEA) region. This growth is primarily driven by rapid industrialization, spurred by the country’s ongoing economic diversification efforts under the Saudi Vision 2030 initiative. The government’s large-scale investments in mega infrastructure projects—including NEOM, The Line, and numerous industrial and logistics zones—are significantly increasing the need for reliable, scalable, and energy-efficient power distribution solutions like busways. Additionally, the expansion of manufacturing, construction, oil & gas, and data center industries is creating strong demand for high-performance electrical systems. As sustainability and smart city development gain momentum, busways are increasingly preferred due to their low maintenance, modular design, and space efficiency, aligning with the country’s modernization and green energy goals.

U.A.E. Middle East and Africa Busway Market Insight

The U.A.E. Middle East and Africa Busway Market is expected to grow at a healthy CAGR of 6.5% between 2025 and 2032 in the regional Middle East and Africa Busway Market. This growth is underpinned by accelerating urbanization, an increasing number of smart city projects, and continued infrastructure modernization across sectors such as hospitality, healthcare, and commercial real estate. As the country positions itself as a hub for clean energy, electric mobility, and digital innovation, there is rising adoption of busway systems in emerging sectors like electric vehicle (EV) infrastructure, data centers, and renewable energy facilities. The U.A.E.’s proactive investment in sustainable construction standards and energy-efficient technologies supports the shift from traditional cabling to advanced busway solutions. Moreover, the growing demand for modular, space-saving, and fire-resistant power distribution systems in high-rise buildings and industrial environments is further fueling the market expansion.

Middle East and Africa Busway Market Share

The busway industry is primarily led by well-established companies, including:

- Furukawa Electric Co., Ltd. (Japan)

- Schneider Electric SE (France)

- TAIAN‑ECOBAR TECHNOLOGY CO., LTD. (Taiwan)

- Siemens AG (Germany)

- LS Electric (South Korea)

- Eaton Corporation plc (Ireland)

- ABB Ltd. (Switzerland)

- Dingsheng Group Co., Ltd. (China)

- RITTAL GmbH & Co. KG (Germany)

- Vertiv Holdings Co. (U.S.)

- Powell Industries (U.S.)

- Elsewedy Electric (Egypt)

- Lapp Connecto Oy (Finland)

- LEGRAND SA (France)

- Tai Sin Electric Limited (Hong Kong)

- Panduit Corp (U.S.)

- ANORD MARDIX (U.K.)

- Busway Electric India Private Limited (India)

- Furutec Electrical Sdn. Bhd. (Malaysia)

- Delta Electronics, Inc. (Taiwan)

- Zhenjiang Sunshine Electric Group Co., Ltd. (China)

- Power Plug Busduct Sdn. Bhd. (Malaysia)

- Chatsworth Products (U.S.)

- Renyun (China)

- Ohory Electric Busway (China)

- 2Melectricgroup (Egypt)

- Bahra Cables Company (India)

- Wetown (China)

- EAE Inc. (Turkey)

- Megabarre Group, Ltd. (Brazil)

- Elcom International (India)

Latest Developments in Middle East and Africa Busway Market

- In 2025, Schneider Electric in its Busway Systems Overview, the company recommends sandwich busway designs for demanding applications such as manufacturing plants, high-rise towers, and data centers due to their thermal performance, fire resistance, and space efficiency.

- In 2025, Siemens has further noted that its SENTRON sandwich busway systems are being applied in critical facilities such as data centers and automotive manufacturing units, where operational continuity and high electrical loads are essential. The compact structure and high fault tolerance of sandwich busways were highlighted as key reasons for adoption in these high-density layouts.

- In October 2024, Furukawa Electric will integrate its optical fiber cable business under the new brand Lightera. This rebranding aims to streamline operations and enhance the company’s focus on the optical communications sector. The move will improve brand recognition, boost operational efficiency, and strengthen Furukawa Electric’s market position in the rapidly growing fiber-optic networks and telecommunications industry.

- In January 2025, siemens introduced advanced industrial AI and digital twin technologies designed to enhance operational efficiency with real-time decision-making. They launched the Siemens Industrial Co-pilot for Operations, bringing AI directly to the shop floor. Siemens also announced a partnership with Jet Zero to develop a fuel-efficient, zero-emission blended-wing aircraft. These innovations highlight Siemens’ focus on driving sustainability and digital transformation across industries.

- In June 2025, Tokamak Energy and Furukawa Electric Group have advanced their partnership to develop limitless fusion energy. This collaboration aims to combine their expertise in fusion technology to accelerate the commercialization of fusion energy systems. The partnership will help Furukawa Electric expand its role in the renewable energy sector, contributing to sustainable energy solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Busway Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Busway Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Busway Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.