Middle East And Africa Cocoa Beans Market

Market Size in USD Million

CAGR :

%

USD

834.45 Million

USD

1,364.47 Million

2024

2032

USD

834.45 Million

USD

1,364.47 Million

2024

2032

| 2025 –2032 | |

| USD 834.45 Million | |

| USD 1,364.47 Million | |

|

|

|

|

Middle East and Africa Cocoa Beans Market Size

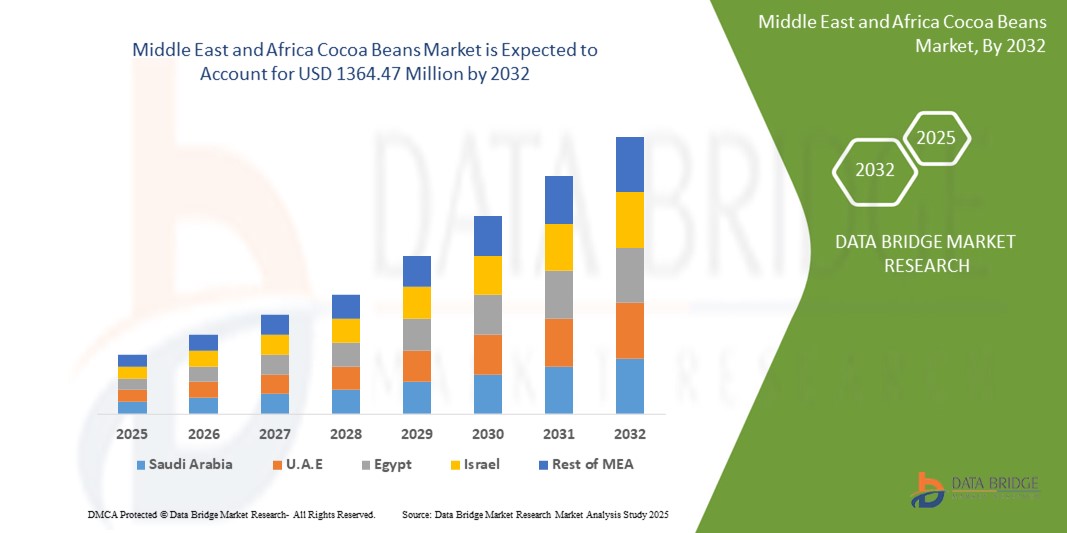

- The Middle East and Africa cocoa beans market size was valued at USD 834.45 million in 2024 and is expected to reach USD 1364.47 million by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by the increasing demand for chocolate and cocoa-based products, driven by rising disposable incomes, evolving consumer preferences, and the expansion of the confectionery and bakery sectors in both developed and emerging economies

- Furthermore, growing awareness of sustainable and ethically sourced cocoa, along with technological advancements in cocoa farming and processing, is enhancing yield, quality, and traceability. These converging factors are boosting the overall supply chain efficiency and significantly driving the growth of the cocoa beans market

Middle East and Africa Cocoa Beans Market Analysis

- Cocoa beans are the primary raw material used in chocolate production and a wide range of food, beverage, and personal care products. They are processed into cocoa liquor, cocoa butter, and cocoa powder, which serve as essential ingredients in confectionery, bakery, beverages, cosmetics, and nutraceuticals

- The escalating demand for cocoa beans is primarily fueled by the growing consumption of chocolate products worldwide, increasing preference for high-quality and specialty cocoa varieties, and rising investment in sustainable cocoa cultivation practices by major manufacturers to ensure long-term supply security

- South Africa dominated the cocoa beans market in 2024, due to increasing consumption of chocolate and cocoa-based products and growing investments in cocoa processing and specialty chocolate production

- U.A.E. is expected to be the fastest growing country in the cocoa beans market during the forecast period due to increasing demand for premium and specialty cocoa products and growing adoption of sustainable sourcing practices

- Forastero cocoa bean segment dominated the market with a market share of 63% in 2024, due to its high yield, disease resistance, and widespread cultivation in key producing countries such as Ivory Coast and Ghana. Forastero beans are favored by major chocolate manufacturers for their robust flavor, consistent quality, and lower cost, making them the backbone of global cocoa production. The segment’s dominance is further reinforced by extensive processing infrastructure, easy availability, and suitability for mass-market chocolate products

Report Scope and Middle East and Africa Cocoa Beans Market Segmentation

|

Attributes |

Middle East and Africa Cocoa Beans Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Cocoa Beans Market Trends

Increasing Demand for Chocolate Products

- The cocoa beans market is experiencing strong growth due to the rising demand for chocolate products across confectionery, bakery, and beverage sectors. Chocolate continues to dominate as a preferred indulgence item, driving higher consumption of cocoa beans worldwide

- For instance, Mondelez International has increased its investments in expanding chocolate production in emerging regions, meeting the growing demand for premium and mass-market chocolate products. Their initiatives underline how cocoa bean demand is strongly tied to confectionery expansion

- The rise of artisanal and premium chocolate brands is further driving cocoa bean demand as consumers show greater willingness to pay for high-quality and ethically sourced products. This shift towards premiumization emphasizes both flavor innovation and ethical sourcing practices

- In addition, chocolate integration into a variety of bakery, ice cream, and beverage products has further broadened cocoa bean applications. The trend is particularly strong in cafés and quick-service restaurants, where chocolate-based menu innovations continuously support market demand

- Emerging economies with rising disposable incomes are becoming important growth hubs for chocolate consumption. Countries in Asia-Pacific are witnessing higher urban consumption of cocoa-based products, making the region central to the long-term growth of the cocoa beans market

- Altogether, the surge in chocolate product demand across multiple segments—from mass market to premium—highlights cocoa beans as the foundation of a resilient supply chain expected to evolve with changing consumer preferences

Middle East and Africa Cocoa Beans Market Dynamics

Driver

Growing Awareness about the Health Benefits of Cocoa

- Cocoa consumption is being increasingly supported by rising awareness of health benefits such as cardiovascular wellness, antioxidant properties, and cognitive function support. Dark chocolate and cocoa-based functional products are now promoted as healthy indulgence options

- For instance, Barry Callebaut has introduced cocoa-derived products that promote flavanol-rich ingredients, catering to both consumer wellness demand and food industry innovation. Such initiatives demonstrate how health-oriented messaging is shaping cocoa consumption patterns globally

- Scientific studies highlighting the role of cocoa flavonoids in reducing blood pressure, improving mood, and supporting brain health have increased consumer interest. This alignment of cocoa with wellness and preventive nutrition significantly strengthens its global demand drivers

- In addition, food and beverage manufacturers are launching cocoa-based products that appeal to health-conscious market segments. The infusion of cocoa into protein bars, nutritional supplements, and energy drinks has created entirely new growth avenues for bean demand

- This increasing consumer prioritization of wellness ensures cocoa beans remain central to innovation in both confectionery and health-based product markets. Their dual role as indulgence and functional ingredients strengthens long-term growth trajectories across industries

Restraint/Challenge

Fluctuations and Volatility in Cocoa Prices

- The cocoa beans market is significantly impacted by volatility in cocoa prices, influenced by climatic conditions, political instability in producing countries, and supply-demand imbalances. This unpredictability disrupts both producers and buyers, creating uncertainty for long-term planning

- For instance, cocoa supply from major producers such as Côte d’Ivoire and Ghana has faced disruptions due to weather variability and regional conflicts, impacting cocoa bean pricing and availability for chocolate manufacturers

- Fluctuations in cocoa prices often squeeze profit margins for confectionery companies and increase costs for consumers. Smallholder farmers, who account for the majority of cocoa production, are also highly vulnerable to income instability caused by price swings

- In addition, speculative trading and currency fluctuations further exacerbate market instability. High volatility makes it difficult for producers and businesses across the supply chain to establish secure contracts and maintain consistent operations

- Addressing this challenge requires developing sustainable sourcing frameworks, diversifying production regions, and introducing fair-trade mechanisms. Stabilizing the cocoa beans market will be essential for price security, ensuring equitable incomes, and supporting the sustainable future of chocolate production

Middle East and Africa Cocoa Beans Market Scope

The market is segmented on the basis of cocoa bean type, product type, nature, and application.

- By Cocoa Bean Type

On the basis of cocoa bean type, the market is segmented into Forastero, Trinitario, and Criollo cocoa beans. The Forastero segment dominated the market with the largest revenue share of 63% in 2024, driven by its high yield, disease resistance, and widespread cultivation in key producing countries such as Ivory Coast and Ghana. Forastero beans are favored by major chocolate manufacturers for their robust flavor, consistent quality, and lower cost, making them the backbone of global cocoa production. The segment’s dominance is further reinforced by extensive processing infrastructure, easy availability, and suitability for mass-market chocolate products.

The Trinitario segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising consumer demand for premium and specialty chocolates with nuanced flavor profiles. Trinitario beans, being a hybrid of Forastero and Criollo, offer a balance of quality and yield, attracting artisan chocolatiers and high-end brands. Growing awareness of unique cocoa origins and flavor differentiation is encouraging the adoption of Trinitario beans in gourmet products and luxury confectionery.

- By Product Type

On the basis of product type, the market is segmented into roasted and unroasted cocoa beans. The roasted cocoa bean segment dominated the largest market share in 2024 due to its ready-to-use nature in chocolate production, bakery products, and confectionery. Roasting enhances the flavor, aroma, and color of cocoa, making it the preferred choice for manufacturers seeking consistent quality. The segment’s growth is supported by established processing techniques, easy storage, and long shelf life, ensuring widespread adoption in industrial and commercial applications.

The unroasted cocoa bean segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing consumer preference for natural, minimally processed, and raw food products. Unroasted beans are considered rich in antioxidants and retain more of their natural nutrients, appealing to health-conscious consumers and specialty food producers. The rising trend of functional foods and raw chocolate products is further accelerating the demand for unroasted cocoa beans globally.

- By Nature

On the basis of nature, the market is segmented into conventional and organic cocoa beans. The conventional segment held the largest revenue share in 2024 due to its established supply chains, higher production volumes, and lower cost compared to organic variants. Conventional cocoa beans continue to dominate the chocolate market, serving as a primary ingredient for mass-market and commercial confectionery. The segment’s dominance is also supported by consistent quality, accessibility in major cocoa-growing regions, and compatibility with large-scale processing technologies.

The organic segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing consumer awareness about sustainable farming practices and chemical-free food products. Organic cocoa beans, cultivated without synthetic fertilizers and pesticides, appeal to health-conscious consumers and premium chocolate brands. Growth in the organic food and beverage sector, along with certifications such as USDA Organic and Fair Trade, is further bolstering adoption.

- By Application

On the basis of application, the market is segmented into food, beverages, personal care & cosmetics, dietary supplements, pharmaceutical, sports nutrition, and others. The food segment dominated the market with the largest revenue share in 2024, owing to the extensive use of cocoa in chocolate, confectionery, bakery, and snack products. Cocoa’s versatility, flavor profile, and functional benefits make it a staple ingredient in both mass-market and premium food products. High consumer demand for chocolate and cocoa-based delicacies worldwide continues to reinforce the segment’s dominance.

The personal care & cosmetics segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing incorporation of cocoa butter and cocoa extracts in skincare, haircare, and cosmetic formulations. Cocoa’s moisturizing, antioxidant, and anti-inflammatory properties are fueling its adoption in premium and natural personal care products. Rising consumer preference for natural and plant-based ingredients is further accelerating market growth in this segment.

Middle East and Africa Cocoa Beans Market Regional Analysis

- South Africa dominated the cocoa beans market with the largest revenue share in 2024, driven by increasing consumption of chocolate and cocoa-based products and growing investments in cocoa processing and specialty chocolate production

- The country’s leadership is reinforced by well-established cocoa supply chains, modern processing facilities, and a focus on sustainable and ethically sourced cocoa

- Rising consumer preference for high-quality, traceable cocoa, along with initiatives supporting local farmers and improving production efficiency, further strengthens South Africa’s position. Strategic partnerships with international cocoa suppliers and expansion of distribution networks continue to support the country’s market dominance

U.A.E. Cocoa Beans Market Insight

The U.A.E. is projected to register the fastest CAGR in the Middle East & Africa market from 2025 to 2032, fueled by increasing demand for premium and specialty cocoa products and growing adoption of sustainable sourcing practices. Investments in high-end chocolate manufacturing, modern processing technologies, and innovative cocoa-based product offerings are driving market expansion. Government initiatives promoting food quality standards and partnerships with international cocoa suppliers are enhancing market growth. Rising consumer awareness of ethically sourced cocoa and the health benefits of cocoa further accelerates adoption in the U.A.E.

Saudi Arabia Cocoa Beans Market Insight

Saudi Arabia is expected to witness steady growth between 2025 and 2032, supported by the expansion of its chocolate and confectionery sector and increasing consumption of cocoa-based products. Growing awareness of premium cocoa varieties and sustainable sourcing practices is boosting market penetration. Investments in modern production facilities, collaborations with international cocoa suppliers, and the adoption of advanced processing techniques are enhancing market efficiency. Rising demand for chocolate products and cocoa derivatives for both domestic consumption and export further contributes to steady growth in Saudi Arabia’s cocoa beans market.

Middle East and Africa Cocoa Beans Market Share

The cocoa beans industry is primarily led by well-established companies, including:

- Olam International Limited (Singapore)

- MABCO (Switzerland)

- Meridian Cacao Co (Portland)

- Costa Esmeraldas Cacao Co. (Ecuador)

- SUCDEN (France)

- ECOM Agroindustrial Corp. Limited. (Switzerland)

- Cacaitos (Spain)

- Cocoabean (India)

- Pappa's Heritage (India)

- TWIN TRACK COCOA PRODUCTS INTERNATIONAL (India)

Latest Developments in Middle East and Africa Cocoa Beans Market

- In August 2025, Nestlé introduced a patented technology to increase cocoa utilization by up to 30% of the cocoa fruit, aiming to maximize yield and value for cocoa farmers. This innovation addresses sustainability challenges by reducing waste and improving the economic viability of cocoa farming. By enabling higher extraction efficiency, the technology strengthens the overall supply chain, supports environmentally conscious production practices, and meets growing market demand for ethically sourced and high-quality cocoa products

- In July 2025, Nestlé inaugurated a new chocolate manufacturing facility in Neemrana, Rajasthan, marking a significant expansion of its production footprint in India. This facility is designed to support the growing consumption of chocolate products in the region while enhancing supply chain efficiency. The plant also enables closer integration with local cocoa sourcing initiatives, which helps stabilize raw material availability, supports local farmers, and meets rising consumer demand for high-quality and sustainably produced chocolate products

- In April 2024, Nestlé S.A. partnered with Cargill, Incorporated, to achieve net-zero emissions by 2050 through an innovative agroforestry scheme focused on cocoa communities. This collaboration is aimed at enhancing sustainability across the cocoa supply chain while addressing climate change and improving the socio-economic conditions of cocoa farmers. By integrating environmentally friendly farming practices and diversifying income sources for farmers, this initiative is strengthening the resilience of cocoa sourcing and promoting responsible production, which is increasingly demanded by consumers and manufacturers

- In February, 2024 ECOM Agroindustrial Corp. Limited. announced its strategic commitment to achieving net-zero emissions by 2030, aligning with North America sustainability goals. This initiative underscores Ecom’s dedication to reducing its carbon footprint across its supply chain, focusing on sustainable practices and innovative solutions. The company plans to implement advanced technologies and processes to enhance operational efficiency while minimizing environmental impact. By prioritizing sustainability, Ecom aims to contribute positively to the environment and promote responsible sourcing in the agricultural commodities market. This move positions Ecom as a leader in the industry, emphasizing the importance of corporate responsibility in addressing climate change

- In November 2022, Barry Callebaut announced the expansion of its business through the launch of a new chocolate factory in Rajasthan, India. This move is part of the company’s strategy to increase production capacity and cater to the region’s growing demand for chocolate products. With cocoa beans being the primary raw material, the factory expansion ensures a more reliable and localized supply chain, enabling faster delivery, reduced costs, and improved availability of high-quality cocoa-based products in the Indian market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Cocoa Beans Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Cocoa Beans Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Cocoa Beans Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.