Middle East And Africa Cocoa Products Market

Market Size in USD Million

CAGR :

%

USD

750.20 Million

USD

957.74 Million

2024

2032

USD

750.20 Million

USD

957.74 Million

2024

2032

| 2025 –2032 | |

| USD 750.20 Million | |

| USD 957.74 Million | |

|

|

|

|

Middle East and Africa Cocoa Products Market Size

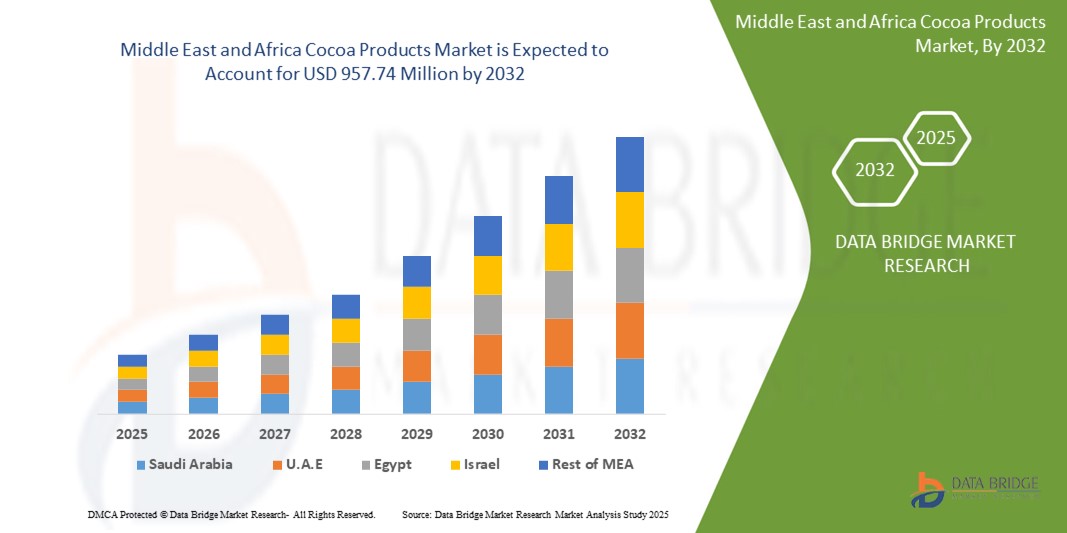

- The global Middle East and Africa cocoa products market size was valued at USD 750.20 million in 2024 and is expected to reach USD 957.74 million by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is largely fuelled by the rising demand for chocolate confectioneries, expanding middle-class population with increased disposable income, and growing awareness of the health benefits of cocoa-based products

- In addition, the increasing penetration of Western-style bakeries and cafes, along with the rapid urbanization and evolving food preferences in emerging economies such as India, China, and Indonesia, is supporting market expansion

Middle East and Africa Cocoa Products Market Analysis

- The region is witnessing strong growth in cocoa products consumption, driven by changing dietary habits, increasing demand for premium chocolate, and rising urbanization

- In addition, the growth of the health and wellness trend has encouraged the consumption of dark chocolate and low-sugar cocoa products, further stimulating market demand across the region

- South Africa cocoa products market captured the largest revenue share in the Middle East and Africa region in 2024, driven by rising demand for chocolate confectionery, increasing urbanization, and growing consumer interest in premium and functional cocoa-based products

- Saudi Arabia is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa cocoa products market due to rising disposable incomes, growing Western dietary influence, increased health awareness, and expanding retail infrastructure supporting the demand for high-quality and wellness-focused cocoa products

- Forastero cocoa segment dominated the market with the largest revenue share in 2024, primarily due to its widespread cultivation, high yield, and cost-effectiveness. This type of cocoa is commonly used in mass-market chocolate products and processed goods, making it a preferred choice among commercial manufacturers

Report Scope and Middle East and Africa Cocoa Products Market Segmentation

|

Attributes |

Middle East and Africa Cocoa Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Organic and Ethically Sourced Cocoa Ingredients |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Cocoa Products Market Trends

Cocoa Products Market Trends

“Rising Preference for Premium and Artisanal Chocolate Products”

- Consumers across the Middle East and Africa are increasingly opting for premium and handcrafted chocolate products due to evolving taste preferences and growing interest in artisanal offerings

- Growth in disposable income and greater exposure to Western confectionery culture are driving demand for high-quality, bean-to-bar chocolates across urban centers in the region

- Brands are launching origin-specific and ethically sourced cocoa products to cater to both luxury and wellness-focused segments

- Unique flavor innovations such as cardamom, rose, pistachio, and sea salt-infused chocolates are gaining popularity among consumers seeking novel taste experiences

- For instance, in South Africa, local chocolatiers have introduced single-origin, artisanal dark chocolates made from ethically sourced beans, appealing to premium and sustainability-driven consumers

Middle East and Africa Cocoa Products Market Dynamics

Driver

“Increasing Health Awareness Boosting Demand for Functional Cocoa Products”

- Health-conscious consumers in the Middle East and Africa are driving demand for cocoa products rich in flavonoids and antioxidants

- Cocoa is increasingly incorporated into functional foods such as protein bars, nutritional shakes, and dietary supplements across the region

- Rising middle-class population and growing wellness awareness in countries such as the UAE and South Africa are fuelling demand for dark chocolate and low-sugar cocoa variants

- Manufacturers are innovating with clean-label, organic, and high-cocoa-content products to cater to the region’s health-focused demographic

- For instance, in the UAE, local brands have introduced premium dark chocolate lines emphasizing heart health and antioxidant benefits, targeting the region’s growing fitness-conscious consumer base

Restraint/Challenge

“Volatility in Cocoa Prices and Supply Chain Disruptions”

- Global cocoa price fluctuations due to weather issues and political instability impact input costs for cocoa product manufacturers in the Middle East and Africa

- Heavy reliance on cocoa imports exposes the region to foreign exchange risks and shipping delays, affecting production timelines and cost efficiency

- Supply chain disruptions, such as port congestion and transportation bottlenecks, create challenges in sourcing raw cocoa ingredients across the region

- Small and medium-sized enterprises (SMEs) in the Middle East and Africa struggle to manage price volatility, affecting their profitability and long-term competitiveness

- For instance, during the COVID-19 pandemic, several Middle Eastern and African countries experienced cocoa supply shortages due to disrupted imports and rising global cocoa prices

Middle East and Africa Cocoa Products Market Scope

The market is segmented into five notable segments based on type of cocoa, product type, source, application, and distribution channel.

• By Type of Cocoa

On the basis of type of cocoa, the Middle East and Africa cocoa products market is segmented into Forastero cocoa, Criollo cocoa, and Trinitario cocoa. The Forastero cocoa segment dominated the market with the largest revenue share in 2024, primarily due to its widespread cultivation, high yield, and cost-effectiveness. This type of cocoa is commonly used in mass-market chocolate products and processed goods, making it a preferred choice among commercial manufacturers.

The Criollo cocoa segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for premium and single-origin chocolate. Criollo beans are known for their fine flavor profile and are being increasingly adopted by artisanal and gourmet chocolate brands across countries such as Japan and Australia, where consumers are showing greater interest in high-quality, ethically sourced cocoa products.

• By Product Type

On the basis of product type, the market is segmented into cocoa butter, cocoa beans, cocoa powder & cake, cocoa liquor & paste, cocoa nibs, and others. The cocoa powder & cake segment held the largest market revenue share in 2024, driven by its extensive use in bakery, confectionery, and beverage applications. It is widely used by both commercial and household consumers for its affordability and versatility.

The cocoa butter segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising use in chocolates, cosmetics, and skincare formulations. The growing demand for clean-label and natural beauty products across Middle East and Africa has particularly increased cocoa butter’s relevance in the personal care and cosmetics industry.

• By Source

On the basis of source, the market is segmented into inorganic and organic. The inorganic segment accounted for the highest revenue share in 2024, supported by its established supply chains, cost-efficiency, and availability for large-scale manufacturing needs. Inorganic cocoa products are commonly utilized in high-volume commercial food and beverage processing.

The organic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing health consciousness, rising preference for chemical-free and sustainably sourced ingredients, and the proliferation of organic product offerings across retail channels in India, China, and Australia.

• By Application

On the basis of application, the Middle East and Africa cocoa products market is segmented into food & beverages, dietary supplements, personal care & cosmetics, and others. The food & beverages segment led the market in 2024 with the highest revenue share, attributed to the wide application of cocoa in chocolates, confectionery, dairy products, and ready-to-drink beverages.

The dietary supplements segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the expanding wellness trend and the increased inclusion of cocoa extracts in functional foods and nutraceuticals. Consumers in urban centers across Japan and South Korea are increasingly opting for cocoa-enriched supplements aimed at improving heart health and mood.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and indirect. The indirect segment dominated the market in 2024, backed by the growing reach of supermarkets, hypermarkets, convenience stores, and online platforms. The increasing popularity of e-commerce platforms and food delivery apps in Middle East and Africa has made cocoa-based products more accessible to consumers.

The direct segment is expected to witness the fastest growth rate from 2025 to 2032, particularly among business-to-business buyers, including food manufacturers and cosmetic companies sourcing cocoa ingredients directly from processors and certified cocoa cooperatives for greater quality control and traceability.

Middle East and Africa Cocoa Products Market Regional Analysis

- The South Africa cocoa products market captured the largest revenue share in the Middle East and Africa region in 2024, driven by rising demand for chocolate confectionery, increasing urbanization, and growing consumer interest in premium and functional cocoa-based products

- The country’s well-established food and beverage industry, combined with an expanding middle class, is fueling domestic cocoa consumption. In addition, South African manufacturers are increasingly focusing on value-added offerings such as dark chocolate, cocoa beverages, and wellness-oriented snacks

- The presence of organized retail chains and e-commerce platforms is further enhancing product accessibility and encouraging market growth across both urban and semi-urban areas

Saudi Arabia Cocoa Products Market Insight

The Saudi Arabia cocoa products market is expected to witness the fastest growth rate from 2025 to 2032, supported by changing consumer lifestyles, rising health awareness, and increasing demand for high-quality cocoa-based products. The growing popularity of Western confectionery, combined with investments in food manufacturing and retail modernization, is driving market expansion. Moreover, the country’s young population and rising interest in functional and gourmet chocolate products are accelerating adoption across foodservice and retail channels.

Middle East and Africa Cocoa Products Market Share

The Middle East and Africa Cocoa Products industry is primarily led by well-established companies, including:

- Plot Enterprise Ghana Ltd (Ghana)

- Cocoa Processing Company Limited (Ghana)

- Niche Cocoa Industry Ltd (Ghana)

- Ghana Cocoa Board – COCOBOD (Ghana)

- Tulip Cocoa Processing Ltd (Nigeria)

- FoodPro Limited (Nigeria)

- Afrotropic Cocoa Processing Ltd (Ghana)

- Barfoods Ltd (Kenya)

- Tiger Brands (South Africa)

- Crown Cocoa Products Ltd (Nigeria)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 MIDDLE EAST CHOCOLATE CONSUMPTION, BY COUNTRY, 2022-2031, (USD MILLION) (KILO TONS)

9.1.1 SOUTH AFRICA

9.1.2 U.A.E.

9.1.3 EGYPT

9.1.4 JORDAN

9.1.5 MOROCCO

9.1.6 SAUDI ARABIA

9.1.7 BAHRAIN

9.1.8 OMAN

9.1.9 QATAR

9.1.10 KUWAIT

9.1.11 REST OF MIDDLE EAST AND AFRICA

10 PRODUCTION CAPACITY OF KEY MANUFACTURERES

11 BRAND OUTLOOK

11.1 COMPARATIVE BRAND ANALYSIS

11.2 PRODUCT VS BRAND OVERVIEW

12 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET, BY PRODUCT TYPE, (2022-2031) (USD MILLION) (KILO TONS)

12.1 OVERVIEW

12.2 COCOA BUTTER

12.2.1 COCOA BUTTER, BY TYPE

12.2.1.1. PARTIALLY DEODORIZED

12.2.1.2. FULLY DEODORIZED

12.3 COCOA POWDER

12.3.1 COCOA POWDER, BY TYPE

12.3.1.1. NATURALLY PROCESSED COCOA POWDER

12.3.1.2. BENSDROP DUTCH PROCESS COCOA POWDER

12.3.1.3. BROWN ALKALIZED COCOA POWDER

12.3.1.4. REDDISH BROWN ALKALIZED COCOA POWDER

12.3.1.5. RED ALKALIZED COCOA POWDER

12.3.1.6. BLACK ALKALIZED COCOA POWDER

12.3.1.7. DOUBLE DUTCH COCOA BLEND

12.3.1.8. COCOA ROUGE POWDER

12.4 COCOA LIQUOR & PASTE

12.4.1 COCOA LIQUOR & PASTE, BY FORM

12.4.1.1. BLOCKS

12.4.1.2. INGOTS

12.4.1.3. EASY-TO-MELT LIQUOR THINS

12.5 COCOA NIBS

12.6 COCOA LIQUID EXTRACTS

12.7 OTHERS

13 MIDDLE EAST AND AFRICA COCOA PRODUCTS, BY COCOA BEAN TYPE, (2022-2031) (USD MILLION)

13.1 OVERVIEW

13.2 FORASTERO COCOA

13.3 CRIOLLO COCOA

13.4 TRINITARIO COCOA

13.5 OTHERS

14 MIDDLE EAST AND AFRICA COCOA PRODUCTS, BY COCOA COLOR, (2022-2031) (USD MILLION)

14.1 OVERVIEW

14.2 BROWN

14.2.1 LIGHT BROWN

14.2.2 DARK BROWN

14.3 RED

14.3.1 LIGHT RED

14.3.2 DARK RED

15 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET, BY NATURE, (2022-2031) (USD MILLION)

15.1 OVERVIEW

15.2 CONVENTIONAL

15.3 ORGANIC

16 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET, BY APPLICATION, (2022-2031) (USD MILLION)

16.1 OVERVIEW

16.2 FOOD AND BEVERAGES

16.2.1 CONFECTIONERY

16.2.1.1. CONFECTIONERY, BY TYPE

16.2.1.1.1. CHOCOLATE

16.2.1.1.1.1 WHITE CHOCOLATES

16.2.1.1.1.2 DARK CHOCOLATES

16.2.1.1.1.3 MILK CHOCOLATES

16.2.1.1.2. HARD-BOILED SWEETS

16.2.1.1.3. MINTS

16.2.1.1.4. GUMS & JELLIES

16.2.1.1.5. CHOCOLATE SYRUPS

16.2.1.1.6. CARAMELS & TOFFEES

16.2.1.1.7. OTHERS

16.2.2 BAKERY PRODUCTS

16.2.2.1. BAKERY PRODUCT, BY TYPE

16.2.2.1.1. BREAD & ROLLS

16.2.2.1.2. CAKES, PASTRIES & TRUFFLE

16.2.2.1.3. BISCUIT

16.2.2.1.4. TART & PIES

16.2.2.1.5. BROWNIES

16.2.2.1.6. COOKIES & CRACKERS

16.2.2.1.7. OTHERS

16.2.3 DAIRY PRODUCTS

16.2.3.1. SDAIRY PRODUCTS, BY TYPE

16.2.3.1.1. YOGURT

16.2.3.1.2. ICE CREAM

16.2.3.1.3. DAIRY DESSERTS

16.2.3.1.4. OTHERS

16.2.4 PROCESSED FOODS

16.2.5 FUNCTIONAL FOODS

16.2.6 DRESSINGS

16.2.7 SPORTS NUTRITION

16.2.8 DAIRY ALTERNATIVE

16.2.8.1. DAIRY ALTERNATIVE, BY TYPE

16.2.8.1.1. DAIRY MILK ALTERNATIVE

16.2.8.1.2. DAIRY YOGURT ALTERNATIVE

16.2.8.1.3. DAIRY ICE CREAM ALTERNATIVE

16.2.8.1.4. OTHERS

16.2.8.2. FOOD, BY PRODUCT TYPE

16.2.8.2.1. COCOA BUTTER

16.2.8.2.2. COCOA POWDER

16.2.8.2.3. COCOA LIQUOR & PASTE

16.2.8.2.4. COCOA NIBS

16.2.8.2.5. COCOA LIQUID EXTRACTS

16.2.8.2.6. OTHERS

16.2.9 BEVERAGES

16.2.9.1. BEVERAGES, BY TYPE

16.2.9.1.1. ALCOHOLIC

16.2.9.1.1.1 ALCOHOLIC, BY TYPE

16.2.9.1.1.1.1. RUM

16.2.9.1.1.1.2. WHIISKEY

16.2.9.1.1.1.3. BEER

16.2.9.1.1.1.4. VODKA

16.2.9.1.1.1.5. WINE

16.2.9.1.1.1.6. CHAMPAYGNE

16.2.9.1.1.1.7. OTHERS

16.2.9.2. NON-ALCOHOLIC

16.2.9.2.1. NON-ALCOHOLIC, BY TYPE

16.2.9.2.1.1 RTD COFFEE

16.2.9.2.1.2 FLAVOURED DAIRY MILK

16.2.9.2.1.3 FLAVORED PLANT-BASED MILK

16.2.9.2.1.4 SPORTS DRINKS

16.2.9.2.1.5 SMOOTHIES

16.2.9.2.1.6 OTHERS

16.2.9.3. BEVERAGES, BY PRODUCT TYPE

16.2.9.3.1. COCOA BUTTER

16.2.9.3.2. COCOA POWDER

16.2.9.3.3. COCOA LIQUOR & PASTE

16.2.9.3.4. COCOA NIBS

16.2.9.3.5. COCOA LIQUID EXTRACTS

16.2.9.3.6. OTHERS

16.3 PERSONAL CARE

16.3.1 PERSONAL CARE, BY TYPE

16.3.1.1. SKIN CARE

16.3.1.1.1. MOISTURIZER & LOTIN

16.3.1.1.2. SERUM

16.3.1.1.3. CREAM

16.3.1.1.4. MASSAGE OIL

16.3.1.1.5. SCRUB

16.3.1.1.6. SOAP & BODYWASH

16.3.1.1.7. LIP CARE PRODUCTS

16.3.1.1.8. OTHERS

16.3.1.2. HAIR CARE

16.3.1.2.1. SERUM & OINTMENTS

16.3.1.2.2. CONDITIONER

16.3.1.2.3. SHAMPOO

16.3.1.2.4. OTHERS

16.3.2 PERSONAL CARE PRODUCTS, BY PRODUCT TYPE

16.3.2.1. COCOA BUTTER

16.3.2.2. COCOA POWDER

16.3.2.3. COCOA LIQUOR & PASTE

16.3.2.4. COCOA NIBS

16.3.2.5. COCOA LIQUID EXTRACTS

16.3.2.6. OTHERS

16.4 PHARMACEUTICALS

16.4.1 PHARMACEUTICALS , BY TYPE

16.4.1.1. SYRUPS

16.4.1.2. CHEWABLE TABLETS

16.4.1.3. SUSPENSIONS OR GUMS

16.4.1.4. OTHERS

16.4.2 PHARMACEUTICALS , BY PRODUCT TYPE

16.4.2.1. COCOA BUTTER

16.4.2.2. COCOA POWDER

16.4.2.3. COCOA LIQUOR & PASTE

16.4.2.4. COCOA NIBS

16.4.2.5. COCOA LIQUID EXTRACTS

16.4.2.6. OTHERS

16.5 COSMETIC

16.5.1 COSMETIC, BY TYPE

16.5.1.1. RUMINANT FEED

16.5.1.2. POULTRY FEED

16.5.1.3. SWINE FEED

16.5.1.4. AQUAFEED

16.5.2 COSMETIC, BY PRODUCT TYPE

16.5.2.1. COCOA BUTTER

16.5.2.2. COCOA POWDER

16.5.2.3. COCOA LIQUOR & PASTE

16.5.2.4. COCOA NIBS

16.5.2.5. COCOA LIQUID EXTRACTS

16.5.2.6. OTHERS

16.6 OTHERS

17 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 DIRECT SALES

17.3 INDIRECT SALES

17.3.1 OFFLINE

17.3.1.1. SUPERMARKETS/HYPERMARKETS

17.3.1.2. CONVENIENCE STORES

17.3.1.3. SPECIALTY STORES

17.3.1.4. OTHERS

17.3.2 ONLINE

17.3.2.1. COMPANY OWNED WEBSITES

17.3.2.2. 3RD PARTY WEBSITES

18 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

18.2 MERGERS & ACQUISITIONS

18.3 NEW PRODUCT DEVELOPMENT & APPROVALS

18.4 EXPANSIONS & PARTNERSHIP

18.5 REGULATORY CHANGES

19 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET, BY COUNTRY, (2022-2031) (USD MILLION) (KILO TONS)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

19.1 MIDDLE EAST AND AFRICA

19.1.1 SOUTH AFRICA

19.1.2 U.A.E.

19.1.3 EGYPT

19.1.4 JORDAN

19.1.5 MOROCCO

19.1.6 SAUDI ARABIA

19.1.7 BAHRAIN

19.1.8 OMAN

19.1.9 QATAR

19.1.10 KUWAIT

19.1.11 REST OF MIDDLE EAST AND AFRICA

20 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET, SWOT & DBMR ANALYSIS

21 MIDDLE EAST AND AFRICA COCOA PRODUCTS MARKET, COMPANY PROFILES

21.1 THE HERSHEY COMPANY

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENTS

21.2 OLAM INTERNATIONAL LIMITED

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 CARGILL, INCORPORATED

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENTS

21.4 BARRY CALLEBAUT

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENTS

21.5 NESTLÉ S.A.

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENTS

21.6 ALTINMARKA

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 PLOT GHANA

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENTS

21.8 MONER COCOA, S.A.

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 KERRY GROUP PLC

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 PURATOS

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 CONCLUSION

24 QUESTIONNAIRE

25 ABOUT DATA BRIDGE MARKET RESEARCH

Middle East And Africa Cocoa Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Cocoa Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Cocoa Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.