Middle East And Africa Compressed Natural Gas Cng Market

Market Size in USD Billion

CAGR :

%

USD

8.41 Billion

USD

11.16 Billion

2024

2032

USD

8.41 Billion

USD

11.16 Billion

2024

2032

| 2025 –2032 | |

| USD 8.41 Billion | |

| USD 11.16 Billion | |

|

|

|

|

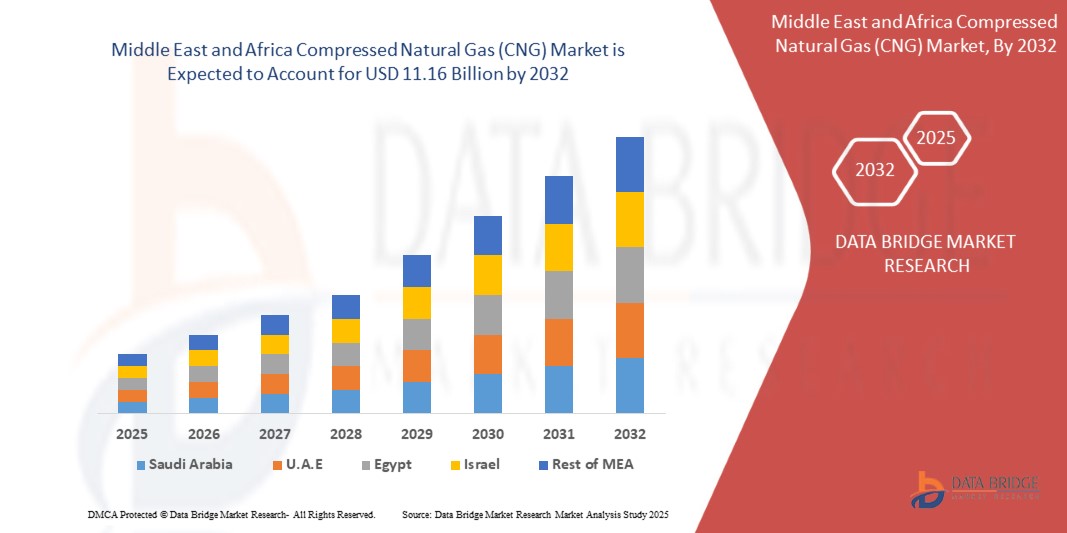

Middle East and Africa Compressed Natural Gas (CNG) Market Size

- The Middle East and Africa compressed natural gas market size was valued at USD 8.41 Billion in 2024 and is expected to reach USD 11.16 Billion by 2032, registering a CAGR of 3.6% during the forecast period

- Market growth is primarily driven by the region’s abundant natural gas reserves, government policies promoting fuel diversification, and growing concerns over reducing dependence on expensive liquid fuels

- Furthermore, rising demand for affordable and cleaner fuels is pushing adoption, particularly in public transport fleets and commercial vehicles across countries such as Egypt, South Africa, Nigeria, and the Gulf states

- Strong investments in compressed natural gas infrastructure development, including refueling stations and distribution pipelines, are creating new opportunities for both local and international players

- Collectively, these factors are accelerating the shift toward compressed natural gas adoption, making it a vital component of the energy transition strategy in the Middle East and Africa

Middle East and Africa Compressed Natural Gas (CNG) Market Analysis

- The Middle East and Africa compressed natural gas market is witnessing strong momentum, supported by large domestic natural gas reserves that provide a cost-effective alternative to gasoline and diesel. Countries such as Iran, Qatar, Nigeria, and Egypt are actively leveraging their abundant gas resources to expand compressed natural gas adoption across transport and industrial sector

- The light motor vehicle segment is leading adoption due to rising fuel prices and affordability concerns among private vehicle owners. However, medium and heavy-duty vehicle fleets, particularly in logistics and public transport, are projected to see significant growth in compressed natural gas adoption during the forecast period

- Iran dominated market for compressed natural gas in the Middle East and Africa with the largest market share of 36.14%, supported by its vast natural gas reserves and a well-established network of refueling stations. The country’s strong government-backed programs for vehicle conversion, especially in taxis and buses, have made it the regional leader in 2024

- Saudi Arabia has emerged as the fastest-growing market with the CAGR of 12.36% in the region, even though its current adoption levels remain below those of Iran and Egypt

- The non-associated gas segment dominated the largest market revenue share of 56.12% in 2024, underpinned by giant, dedicated gas fields across the Middle East and North Africa that provide steady

Report Scope and Middle East and Africa Compressed Natural Gas (CNG) Market Segmentation

|

Attributes |

Middle East and Africa Compressed Natural Gas (CNG) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to insights on market value, growth rate, segmentation, geographical coverage, and major players, the report includes: in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain and value chain analysis, raw material overview, vendor selection criteria, PESTLE Analysis, Porter’s Five Forces Analysis, and regulatory framework. |

Middle East and Africa Compressed Natural Gas (CNG) Market Trends

Government-Backed CNG Infrastructure Expansion and Adoption Programs

- A key trend shaping the Middle East and Africa compressed natural gas market is the accelerated investment in compressed natural gas infrastructure, supported by government-backed policies and subsidies aimed at reducing dependence on conventional fuels. Countries such as Egypt, Nigeria, and Iran are expanding compressed natural gas refueling stations and offering incentives for vehicle conversions to meet energy security and sustainability goals

- Public transport systems in cities such as Cairo, Johannesburg, and Lagos are increasingly adopting compressed natural gas -powered buses and taxis as part of broader green mobility initiatives. This is creating a ripple effect across the automotive aftermarket industry, boosting demand for compressed natural gas kits, cylinders, and conversion services

- The trend is further reinforced by public-private partnerships (PPPs) where global energy majors are collaborating with regional governments to scale up infrastructure. For instance, agreements in the Gulf states focus on deploying composite compressed natural gas tanks and sequential kits to enhance vehicle efficiency and safety standards

- Increasing alignment with global climate targets and COP agreements is also driving regulatory reforms across the region. Countries are positioning compressed natural gas as a bridge fuel, encouraging its adoption until renewable energy and electric mobility solutions achieve full maturity

- In addition, rising urbanization, along with consumer preference for lower-cost fuels, is accelerating penetration of compressed natural gas in light motor vehicles (LMVs) and small fleets, highlighting the region’s shift toward sustainable and economically viable transport solutions

Middle East and Africa Compressed Natural Gas (CNG) Market Dynamics

Driver

Rising Demand for Cost-Effective and Cleaner Fuel Alternatives

- The Middle East and Africa compressed natural gas market is being driven by the growing need for low-cost and environmentally friendly fuel solutions. With crude oil price volatility and rising air pollution levels, governments and consumers are increasingly looking toward compressed natural gas as a sustainable alternative to gasoline and diesel

- The availability of large reserves of natural gas in countries such as Qatar, Iran, Nigeria, and Algeria strengthen supply security and supports the regional adoption of compressed natural gas. These reserves provide the foundation for large-scale deployment of compressed natural gas infrastructure

- Government-led programs, such as fuel subsidy reforms and green transport policies, are encouraging vehicle conversions and new compressed natural gas vehicle purchases. In addition, incentives such as tax breaks, financing schemes, and preferential licensing for compressed natural gas vehicles are further boosting adoption across public and private sectors

- Rapid population growth, urbanization, and increasing reliance on public transportation systems are creating significant opportunities for compressed natural gas -powered buses, minibuses, and taxis, positioning compressed natural gas as a vital component of the region’s sustainable transport agenda

Restraint/Challenge

Infrastructure Limitations and High Initial Conversion Costs

- Despite strong potential, the compressed natural gas market in the Middle East and Africa faces significant restraints in the form of limited infrastructure availability, particularly the inadequate number of refueling stations outside urban centers. This limits consumer confidence and creates adoption disparities between metropolitan and rural areas

- For instance, high upfront costs of compressed natural gas vehicle conversion kits and composite cylinders are a deterrent for cost-sensitive consumers. Many vehicle owners, especially in emerging economies within the region, continue to perceive compressed natural gas adoption as financially burdensome despite long-term savings

- Technical challenges, including maintenance complexities, storage safety concerns, and lack of skilled workforce, are creating barriers to smooth adoption. In certain countries, limited regulatory enforcement also raises risks related to low-quality or counterfeit compressed natural gas kits

- Regional conflicts, political instability, and uneven investment priorities across African and Middle Eastern nations further hinder consistent market development, slowing down large-scale adoption of compressed natural gas -powered fleets

- Overcoming these barriers will require coordinated investments, regulatory frameworks, and public awareness campaigns to encourage consumer trust and industry-wide competitiveness

Middle East and Africa Compressed Natural Gas (CNG) Market Scope

The market is segmented on the basis of source, kit, distribution, and end use.

• By Source

On the basis of source, the Middle East & Africa compressed natural gas market is segmented into associated gas, non-associated gas, and unconventional gas. The non-associated gas segment dominated the largest market revenue share of 56.12% in 2024, underpinned by giant, dedicated gas fields across the Middle East and North Africa that provide steady, large-volume supply for city-gas networks and transport fuels. Abundant reserves, mature upstream infrastructure, and long-term gas production contracts enabled utilities and fuel retailers to secure predictable feedstock at competitive costs. This stability, combined with established transmission pipelines and mother-station networks, positioned non-associated gas as the backbone of regional compressed natural gas availability.

The unconventional gas segment is anticipated to witness the fastest growth rate of 22,16% from 2025 to 2032, propelled by ongoing development of tight/sour gas and early-stage shale resources as countries diversify supply. Advances in drilling and processing, plus fiscal incentives to monetize domestic resources, are accelerating pilot-to-scale transitions in selected basins. As grids extend and compression logistics improve, unconventional molecules are expected to flow more consistently into compressed natural gas chains. This will broaden supply optionality and reduce import exposure for emerging African markets.

• By Kit

On the basis of kits, the market is segmented into bi-fuel conversion kits (retrofit), sequential injection kits, and dedicated OEM compressed natural gas systems. Bi-fuel conversion kits dominated market revenue in 2024, driven by large-scale fleet retrofit programs in taxis, minibuses, and light commercial vehicles where payback from fuel savings is rapid. The retrofit route minimizes upfront capex versus new vehicle purchases, enabling quicker penetration across fragmented owner-operator fleets. Widespread availability of parts and technicians further reinforced the retrofit ecosystem in metro corridors.

Dedicated OEM compressed natural gas systems are expected to register the fastest CAGR from 2025 to 2032, supported by fleet tenders specifying factory-built buses and trucks for reliability, emissions compliance, and warranty coverage. As total cost of ownership narrows, logistics and municipal operators are shifting procurement toward purpose-built platforms with larger tanks and optimized powertrains. Meanwhile, sequential injection kits will benefit from performance and emissions advantages in higher-duty use, but OEM growth will outpace as manufacturers localize assembly and financing improves.

• By Distribution

On the basis of distribution, the market is segmented into fast-fill public stations (mother & daughter networks), time-fill depot stations (captive fleets), and virtual pipeline/mobile compressed natural gas (cascade trailers, daughter stations). Fast-fill public stations captured the largest share in 2024, anchored by urban corridors with high taxi/bus density and by national oil & gas companies expanding forecourt footprints. Mother-daughter configurations allowed rapid scaling even where pipeline connections were limited, ensuring adequate peak-hour throughput. Consistent service levels and strategic siting near depots and bus hubs sustained volume leadership.

The time-fill depot and virtual pipeline segments are poised for the fastest growth during 2025–2032 as operators extend compressed natural gas access beyond trunk pipelines and into secondary cities and industrial clusters. Time-fill solutions match overnight refueling rhythms of captive fleets, cutting queuing and operating costs. In parallel, virtual pipeline logistics (mother → cascade trailers → daughter stations) enable early market activation in infrastructure-light geographies, particularly across Sub-Saharan Africa, until pipeline buildouts mature.

• By End Use

On the basis of end-use, the market is segmented into transportation, residential, commercial, and industrial/power generation. The transportation segment dominated the largest market revenue share in 2024, as public transit agencies, ride-hail/taxi operators, and last-mile delivery fleets scaled compressed natural gas to reduce fuel bills and tailpipe emissions. Government-backed conversion incentives, preferential tariffs, and low-emission zone policies reinforced adoption in light and heavy vehicle categories. Growing city-bus orders and private logistics deployments kept utilization high at fast-fill hubs.

The industrial/power generation segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by diesel-to-gas switching for boilers, small turbines, and distributed generation where pipeline access is improving. Compressed natural gas offers a flexible bridge where LNG or pipeline gas is unavailable, enabling factories, hotels, and estates to meet emissions targets and stabilize energy costs. As reliability of supply and bulk- compressed natural gas logistics strengthen, this segment will expand its share alongside captive micro-grid and cogeneration projects.

Middle East and Africa Compressed Natural Gas (CNG) Market Regional Analysis

- Iran dominated market for compressed natural gas in the Middle East and Africa with the largest market share of 36.14%, supported by its vast natural gas reserves and a well-established network of refueling stations

- Iran emerged as the clear market leader in 2024. With some of the world’s largest natural gas reserves and a well-developed domestic refueling infrastructure, Iran has successfully promoted the widespread adoption of compressed natural gas as a cost-effective and cleaner transportation fuel

- The government has supported large-scale vehicle conversion programs for taxis, buses, and passenger cars, which has firmly positioned Iran at the forefront of regional compressed natural gas usage. Its long-standing infrastructure advantage and abundant supply base ensure that Iran will continue to dominate the market

U.A.E. Compressed Natural Gas (CNG) Market Insight

The U.A.E. is another major contributor to regional growth, driven by rapid infrastructure expansion and energy diversification policies. Under the U.A.E. Energy Strategy 2050, the government has prioritized reducing reliance on oil and cutting emissions, making CNG an attractive fuel alternative. State-owned ADNOC Gas has been investing heavily in building new CNG fueling stations, with adoption particularly strong in commercial fleets and government-operated vehicles. This has made the U.A.E. one of the fastest-expanding compressed natural gas markets in the Middle East

Egypt Compressed Natural Gas (CNG) Market Insight

Egypt stands out as the leading market for compressed natural gas adoption. The Egyptian government, through the Egyptian Natural Gas Holding Company (EGAS), has implemented aggressive initiatives to convert thousands of vehicles to run on compressed natural gas. Alongside this, significant investments in expanding the network of compressed natural gas stations have made the fuel more accessible for the masses. Public transport vehicles, including taxis, minibuses, and city buses, form the backbone of compressed natural gas demand in the country, making Egypt the undisputed leader of the African compressed natural gas landscape.

Saudi Arabia Compressed Natural Gas (CNG) Market Insight

Saudi Arabia has emerged as the fastest-growing market with the CAGR of 12.36% in the region, even though its current adoption levels remain below those of Iran and Egypt. Driven by the country’s Vision 2030, which emphasizes reducing carbon emissions and diversifying the energy mix, Saudi Arabia is actively investing in the conversion of public and private fleets to compressed natural gas. The government, in partnership with private investors, is also expanding compressed natural gas refueling infrastructure. These initiatives are expected to accelerate market penetration, positioning Saudi Arabia as one of the most dynamic growth hubs in the Middle East and Africa compressed natural gas market over the coming years.

The Middle East and Africa compressed natural gas industry is primarily led by well-established companies, including:

- Eni S.p.A (regional operations) (Italy)

- QatarEnergy (Qatar)

- Egyptian Natural Gas Holding Company (EGAS) (Egypt)

- National Iranian Gas Company (NIGC) (Iran)

- Sasol Limited (South Africa)

- Nigerian National Petroleum Corporation (NNPC) (Nigeria)

- Gazprom (operations in MEA) (Russia/U.A.E.)

- TotalEnergies (regional operations) (France)

- Abu Dhabi National Oil Company (ADNOC) (U.A.E.)

Latest Developments in Global Middle East and Africa Compressed Natural Gas (CNG) Market

- In January 2025, QatarEnergy announced the expansion of its CNG infrastructure initiative, unveiling plans to install over 200 new refueling stations across the Gulf region by 2030. This move aims to diversify energy use, reduce emissions, and accelerate adoption of CNG in public and private transportation fleets. The project underscores Qatar’s role as a key player in the natural gas sector and highlights the government’s strong support for clean mobility solutions

- In September 2024, TotalEnergies (France) partnered with ADNOC Distribution (U.A.E.) to launch a joint venture for developing large-scale CNG distribution networks across the U.A.E.. The collaboration focuses on providing reliable supply, fleet conversions, and fueling infrastructure for heavy vehicles. This development strengthens the availability of CNG in the GCC region and aligns with national decarbonization goals

- In June 2024, Egypt’s Ministry of Petroleum and Mineral Resources inaugurated 100 new CNG fueling stations under the "Natural Gas Vehicles Expansion Program." This initiative is part of Egypt’s broader strategy to reduce reliance on imported fuels, improve air quality, and promote energy self-sufficiency. The rapid rollout of stations has significantly boosted adoption among light and medium motor vehicles

- In April 2024, Eni (Italy) expanded its presence in North Africa by investing in CNG distribution projects in Algeria. The investment includes the development of composite manifold-based refueling solutions designed to cater to rural and semi-urban regions. The project highlights how international energy firms are supporting African nations in their clean energy transition

- In October 2023, Gazprom (Russia) signed an agreement with South African energy firms to pilot CNG-powered public transport buses in Johannesburg and Cape Town. This marks one of the first large-scale efforts in Sub-Saharan Africa to introduce CNG in urban mobility systems, aimed at reducing diesel dependency and curbing emissions in high-density cities

- In August 2023, Saudi Aramco launched a pilot CNG program to supply CNG to large transport fleets in Riyadh and Jeddah. The company is also testing hybrid fueling models that combine CNG with hydrogen, positioning itself to lead in cleaner fuel innovations for the transport sector in the Middle East

- In May 2023, Nigeria’s National Gas Expansion Program (NGEP) accelerated its rollout of CNG adoption incentives, including subsidies for conversion kits and tax exemptions for CNG fleet operators. This policy-driven push is expected to significantly increase the penetration of CNG across light and heavy vehicles in Nigeria, one of Africa’s largest automotive markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Compressed Natural Gas Cng Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Compressed Natural Gas Cng Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Compressed Natural Gas Cng Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.