Middle East And Africa Compression Garments And Stockings Market

Market Size in USD Million

CAGR :

%

USD

91.59 Million

USD

127.26 Million

2024

2032

USD

91.59 Million

USD

127.26 Million

2024

2032

| 2025 –2032 | |

| USD 91.59 Million | |

| USD 127.26 Million | |

|

|

|

|

Middle East and Africa Compression Garments and Stockings Market Size

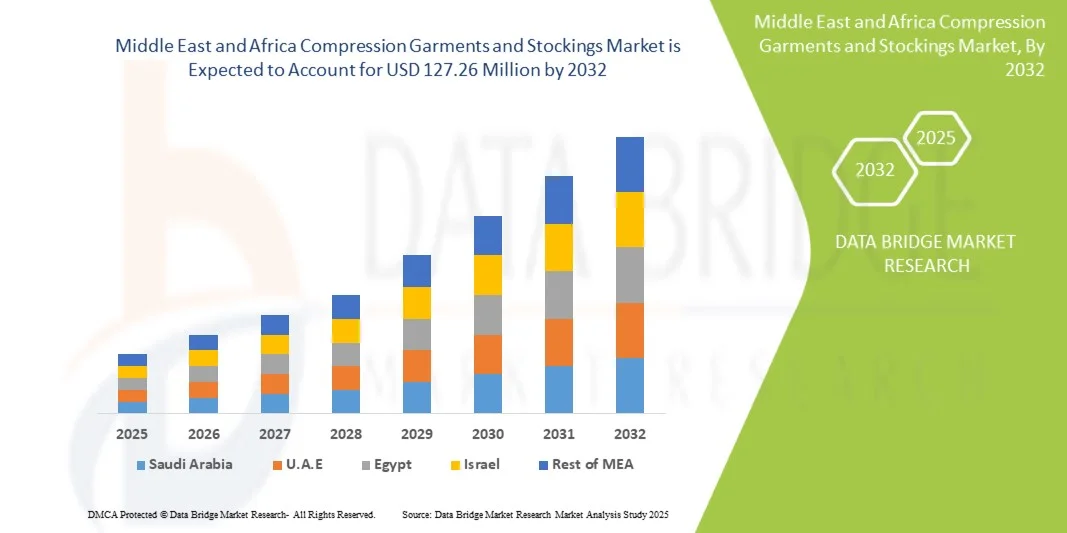

- The Middle East and Africa Compression Garments and Stockings Market size was valued at USD 91.59 million in 2024 and is expected to reach USD 127.26 million by 2032, at a CAGR of 4.33% during the forecast period

- The market growth is largely fueled by increasing awareness regarding venous disorders and the rising adoption of preventive healthcare solutions.

- Furthermore, the growing geriatric population, increasing incidence of varicose veins, and expanding use of compression stockings in post-surgical recovery are further driving demand.

Middle East and Africa Compression Garments and Stockings Market Analysis

- The market is driven by increasing cases of venous disorders, lymphedema, and diabetes-related swelling. Compression wear is becoming a preferred solution for managing chronic symptoms and improving patient comfort, especially among aging populations.

- Usage in post-operative recovery and sports recovery is boosting demand. Athletes and fitness enthusiasts increasingly adopt compression wear for enhanced circulation, reduced muscle fatigue, and faster healing, contributing to strong market traction.

- South Africa dominates the Middle East and Africa Compression Garments and Stockings Market with the largest revenue share of 22.42% in 2025, supported by high prevalence of venous disorders, strong healthcare infrastructure, favorable reimbursement policies, and widespread awareness about post-surgical recovery and preventive care solutions

- South Africa is expected to be the fastest-growing country in the Middle East and Africa Compression Garments and Stockings Market during the forecast period, fueled by increasing healthcare spending, growing aging population, rising awareness of compression therapy benefits, and expanding access to medical-grade garments across developing countries

- The compression stockings segment is expected to dominate the Middle East and Africa Compression Garments and Stockings Market with a market share of 71.29% in 2025, driven by rising cases of varicose veins, deep vein thrombosis (DVT), and chronic venous insufficiency, along with growing physician recommendations and hospital usage.

Report scope and Middle East and Africa Compression Garments and Stockings Market Segmentation

|

Attributes |

Middle East and Africa Compression Garments and Stockings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Compression Garments and Stockings Market Trends

“Increasing Obesity and Sedentary Lifestyles”

- The rising prevalence of obesity and sedentary lifestyles has led to increased usage of compression garments and stockings across various population groups. Prolonged sitting, lack of physical activity, and growing rates of metabolic disorders have contributed to a surge in vascular conditions such as varicose veins, deep vein thrombosis (DVT), and chronic venous insufficiency. In response, compression therapy is being adopted as a non-invasive, preventive, and therapeutic approach to support circulatory health and alleviate swelling and discomfort in the lower limbs.

- Healthcare providers are recommending compression wear not only for at-risk individuals but also for the general population as part of preventive wellness routines. Urbanization, desk-bound work cultures, and aging demographics particularly in developed markets are further contributing to wider adoption.

- As awareness of circulatory health risks increases, compression wear continues to gain traction in both medical and lifestyle applications, supporting sustained market growth.

- The rising prevalence of obesity and sedentary behavior continues to contribute significantly to vascular health issues worldwide. As these lifestyle trends persist, the need for effective, non-invasive solutions like compression garments grows stronger.

- Increasing awareness among healthcare providers and consumers is expanding the use of compression therapy beyond clinical settings into everyday wellness routines. This evolving landscape underscores the sustained potential for market growth driven by health-conscious and at-risk populations Middle East and Africaly..

Middle East and Africa Compression Garments and Stockings Market Dynamics

Driver

“Rising Use of Compression Wear in Sports Recovery”

- The growing focus on athletic performance and faster recovery has led to increased adoption of compression garments among professional athletes and fitness enthusiasts. Compression wear is recognized for its benefits in enhancing blood circulation, reducing muscle fatigue, minimizing swelling, and accelerating recovery post-exercise. Sports medicine specialists and physiotherapists frequently recommend compression stockings and sleeves to support muscle endurance and prevent injuries during both training and competition.

- Advancements in textile technology have enabled the production of lightweight, breathable, and ergonomically designed compression apparel that caters specifically to athletes’ needs. Additionally, rising participation in recreational sports and fitness activities Middle East and Africa alongside increasing awareness of injury prevention has expanded the market beyond elite athletes to the general population. This trend is further supported by endorsements from sports professionals and growing availability through e-commerce platforms, driving widespread consumer acceptance of compression wear as an essential component of sports recovery.

- The increasing adoption of compression garments in sports recovery reflects growing recognition of their benefits in reducing muscle fatigue, soreness, and inflammation after physical activity. Both athletes and fitness enthusiasts are leveraging these products to enhance recovery times and improve training outcomes.

Restraint/Challenge

“Shortage of Trained Personnel for Proper Fitting”

- Proper fitting of compression garments and stockings is critical to ensure therapeutic effectiveness and patient comfort. However, a significant shortage of trained healthcare professionals skilled in measuring, fitting, and educating patients poses a major challenge in the Middle East and Africa market. Incorrect sizing or improper application can lead to insufficient compression, skin irritation, or even worsened medical conditions, reducing user compliance and treatment outcomes.

- This shortage is especially acute in low-resource and rural healthcare settings, where access to specialized personnel like vascular nurses or certified fitters is limited. Additionally, limited awareness and training among general practitioners and caregivers further exacerbate the problem, hindering optimal prescription and use. As compression therapy increasingly moves into home and outpatient care, the lack of proper fitting guidance remains a critical barrier to widespread and effective adoption.

- According to the World Health Organization (WHO), there is a projected Middle East and Africa shortage of 11 million health workers by 2030, particularly affecting low- and lower-middle-income countries. This shortage includes healthcare professionals trained in the proper fitting of medical devices like compression garments. The lack of skilled personnel limits effective compression therapy delivery, leading to improper fitting, reduced treatment benefits, and lower patient compliance

- In December 2021, according to a study published National Library of Medecine, an educational nursing intervention significantly improved patient adherence to compression therapy and reduced the recurrence rate of venous leg ulcers. The structured program involved nurse-led training on proper stocking use, skin care, and self-monitoring techniques. Patients receiving this educational support demonstrated higher compliance with wearing compression stockings and experienced fewer ulcer recurrences compared to those who did not receive the intervention

- The effectiveness of compression therapy heavily depends on accurate fitting and patient education, both of which require trained personnel. However, a Middle East and Africa shortage of specialized healthcare workers, particularly in low-resource settings, continues to hinder proper usage and compliance. This limitation not only compromises therapeutic outcomes but also contributes to patient dissatisfaction and treatment discontinuation, posing a significant barrier to market expansion

Middle East and Africa Compression Garments and Stockings Market Scope

The Middle East and Africa Compression Garments and Stockings Market is categorized into seven notable segments which are on the basis of product type, compression level, application, material, gender, distribution channel, and end user.

- By Product Type

On the basis of product type, the market is segmented into compression stockings and compression garments. In 2025, the compression stockings segment is expected to dominate the market with a market share of 71.29% driven by increasing prevalence of chronic venous disorders, rising post-surgical usage, and strong physician recommendations for preventive and therapeutic compression therapy.

The compression stockings segment is anticipated to witness the fastest growth rate of 4.67% from 2025 to 2032, fueled by growing awareness of vein health, expanding aging population, and increasing adoption across both medical and non-medical applications, including sports recovery and occupational wellness.

- Compression Level

On the basis of application, the market is segmented into moderate compression, mild compression, firm compression, and extra-firm compression. In 2025, the moderate compression segment accounted for the largest revenue share of 35.99%, primarily due to the growing prevalence of venous disorders, increasing adoption in post-operative rehabilitation, and its effectiveness in managing chronic conditions such as lymphedema, deep vein thrombosis (DVT), and varicose veins. Moderate compression is also widely preferred by physicians as it balances therapeutic efficacy with patient comfort, making it the most prescribed and commonly used compression level across both preventive and therapeutic applications.

- By Application

On the basis of application, the market is segmented into medical use and non-medical use. The medical use segment held the largest market revenue share of 62.06% in 2025, driven by rising incidence of venous disorders, post-surgical recovery needs, and increased clinical adoption of compression therapy for chronic conditions such as lymphedema, DVT, and varicose veins.

The medical use segment is expected to witness the fastest CAGR of 4.72% from 2025 to 2032, driven by increasing demand for compression wear in sports performance, fitness recovery, occupational wellness, and lifestyle-related preventive care..

- By Material

On the basis of material, the market is segmented into nylon and spandex, cotton, microfiber, bamboo fiber, breathable mesh / moisture-wicking fabrics, wool blends, and recycled/organic materials. The nylon and spandex segment held the largest market revenue share of 32.70% in 2025, driven by its superior elasticity, durability, and ability to provide consistent compression pressure essential for medical and athletic applications.

The nylon and spandex segment is expected to witness the fastest CAGR of 5.26% from 2025 to 2032, favored for its lightweight nature, excellent stretchability, moisture-wicking capabilities, and enhanced wearer comfort across prolonged usage in both medical and non-medical settings..

- By Gender

On the basis of gender, the market is segmented into women, unisex, and men. The women segment accounted for the largest market revenue share of 42.89% in 2025, driven by higher prevalence of varicose veins, pregnancy-related venous issues, and greater adoption of compression wear for both medical and aesthetic purposes.

The women segment is expected to witness the fastest CAGR of 4.99% from 2025 to 2032, driven by rising health awareness, increased participation in fitness activities, and growing demand for stylish, comfortable compression solutions tailored to female users.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into offline and online. The offline segment accounted for the largest market revenue share of 60.08% in 2025, driven by strong presence of medical supply stores, pharmacies, and hospital procurement channels offering professional fitting support and immediate product availability.

The offline segment is expected to witness the fastest CAGR of 4.94% from 2025 to 2032, propelled by increasing e-commerce penetration, growing consumer preference for doorstep delivery, availability of a wide product range, and rising digital health awareness.

- By End User

On the basis of end user, the market is segmented into general consumers, healthcare institutions, sports teams and clubs, and corporate wellness programs. The general consumers segment accounted for the largest market revenue share of 41.99%in 2025, driven by increasing self-care awareness, rising demand for preventive health solutions, and widespread use of compression wear for everyday comfort and support.

The general consumers segment is expected to witness the fastest CAGR of 4.89% from 2025 to 2032, propelled by growing adoption of compression wear for enhanced athletic performance, muscle recovery, and injury prevention across both amateur and professional athletes.

Middle East and Africa Compression Garments and Stockings Market Regional Analysis

- South Africa dominates the Middle East and Africa Compression Garments and Stockings Market with the largest revenue share of 22.42% and is projected to grow at the fastest CAGR of 5.7% in 2025, driven by increasing prevalence of venous disorders, high awareness of compression therapy, and strong demand from both medical and athletic segments

- The region’s rich healthcare infrastructure, favorable reimbursement policies, and rising geriatric population further support market expansion. Additionally, growing fitness trends and preventive wellness awareness contribute to non-medical demand

- Major economies play a significant role in market growth, with the accounting for the lion’s share due to its advanced medical system, higher healthcare spending, and widespread product availability across both offline and online channels

Saudi Arabia Middle East and Africa Compression Garments and Stockings Market Insight

The Saudi Arabia accounted for the largest market revenue share in the Middle East and Africa region in 2025, attributed to rising awareness of venous health, increasing prevalence of chronic conditions such as diabetes and obesity, and expanding healthcare infrastructure supporting advanced compression therapy products.

Egypt Middle East and Africa Compression Garments and Stockings Market Insight

The Egypt. is expected to register the fastest CAGR in the region from 2025 to 2032, driven by rising awareness of preventive healthcare, growing demand for compression wear among aging and active populations, expanding e-commerce penetration, and continuous innovations in material technology and product design.

Middle East and Africa Compression Garments and Stockings Market Share

The Compression garments and stockings industry is primarily led by well-established companies, including:

- Bauerfeind (Germany)

- 3M (U.S.)

- Cardinal Health (U.S.)

- Thuasne (France)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- Tynor Orthotics Pvt. Ltd. (India)

- Gibaud (France)

- SIGVARIS Group (Switzerland)

- JUZO (Germany)

- SWISSLASTIC AG St. Gallen (Switzerland)

- Medi GmbH & Co. KG (Germany)

- ThermoTek (U.S.)

- Ames Walker (U.S.)

- Vissco Next (India)

- Calzificio Zeta S.r.l. (Italy)

- CEP (Germany)

- Sanyleg S.r.l. (Italy)

- Maxwell India (India)

- Heinz Schiebler GmbH & Co. KG (Germany)

- Gloria Med S.p.A. (Italy)

- NovaMed Europe Ltd. (U.K.)

- Rejuva Health (U.S.)

- Zensah (U.S.)

- Compressana GmbH (Germany)

Latest developments in Middle East and Africa Compression Garments and Stockings Market

- In January2024 Cardinal Health announced the construction of a new 340,000-square-foot distribution center in Fort Worth, Texas, to support its at-Home Solutions business. The facility will integrate advanced robotics and AI-powered warehouse systems to boost order fulfillment efficiency and safety. It will replace two existing warehouses, expand inventory capacity, and process around 10,000 packages daily. The center is expected to be fully operational by Summer 2025.

- In August2024 Cardinal Health announced plans to open a new 249,000 sq. ft. medical product distribution center in Walton Hills, Ohio, as part of its strategy to expand U.S. warehouse capacity and modernize operations. The facility, set to be operational by spring 2025, will replace the smaller Solon location and incorporate advanced automation and technology to enhance supply chain efficiency and employee safety.

- In November 2024Cardinal Health launched the Kendall SCD SmartFlow Compression System in the U.S., marking the next generation of its Kendall Compression Series. This advanced system features Vascular Refill Detection (VRD) and Patient Sensing technologies, delivering personalized intermittent pneumatic compression to improve blood flow, prevent VTE, and reduce venous stasis symptoms such as pain and swelling. The system aims to enhance both clinical outcomes and caregiver efficiency. An international launch is expected in early 2025.

- In November, 2024Sanyleg announced its participation in ISPO Munich 2024, where it will showcase its Made in Italy graduated compression sports socks. The company also released its first sustainability report, highlighting its commitment to ethical manufacturing, environmental responsibility, and employee well-being.

- In May 2024, Sockwell was featured in Parents.com's list of “The 8 Best Compression Socks for Pregnancy,” alongside top-rated brands like Bombas, Comrad, and Levsox. The article highlighted Sockwell’s expert-recommended design for its comfort, 15–20 mmHg compression, and effectiveness in reducing swelling and easing pregnancy-related discomfort.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT SCENARIO

4.2 PATENT ANALYSIS –

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 COMPETITIVE LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY OF SUPPLY

4.3.2 RELIABILITY AND TIMELINESS

4.3.3 COST COMPETITIVENESS

4.3.4 TECHNICAL CAPABILITY AND INNOVATION

4.3.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.3.6 FINANCIAL STABILITY

4.3.7 CUSTOMER SERVICE AND SUPPORT

4.4 BRAND OUTLOOK

4.5 COMPETITIVE BENCHMARKING ACROSS COMPRESSION LEVEL, FABRIC TYPE, AND DISTRIBUTION CHANNEL

4.5.1 COMPRESSION LEVEL BENCHMARKING

4.5.2 FABRIC TYPE BENCHMARKING

4.5.3 DISTRIBUTION CHANNEL BENCHMARKING

4.5.4 COMPETITIVE INSIGHTS

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 PROBLEM RECOGNITION AND AWARENESS

4.6.2 INFORMATION SEARCH

4.6.3 EVALUATION OF ALTERNATIVES

4.6.4 PURCHASE DECISION

4.6.5 POST-PURCHASE BEHAVIOUR

4.6.6 DEMOGRAPHIC INSIGHTS

4.6.7 CONCLUSION

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIAL COST DYNAMICS

4.7.2 MANUFACTURING AND PROCESSING COSTS

4.7.3 REGULATORY COMPLIANCE AND CERTIFICATION COSTS

4.7.4 PACKAGING AND DISTRIBUTION EXPENSES

4.7.5 R&D AND TECHNOLOGICAL INNOVATION COSTS

4.7.6 MARKET-BASED PRICE BENCHMARKS

4.7.7 GEOGRAPHICAL VARIATIONS IN COST STRUCTURES

4.7.8 IMPACT ON PROFITABILITY AND STRATEGIC IMPLICATIONS

4.7.9 CONCLUSION

4.8 PROFIT MARGIN SCENARIO

4.8.1 INTRODUCTION TO PROFIT MARGINS IN MEDICAL TEXTILES

4.8.2 COST STRUCTURES AND MARGIN INFLUENCERS

4.8.3 PROFITABILITY BY PRODUCT TYPE

4.8.4 GEOGRAPHICAL MARGIN COMPARISON

4.8.5 PRIVATE LABELS VS. BRANDED PRODUCTS

4.8.6 IMPACT OF REGULATIONS ON PROFIT MARGINS

4.8.7 DIGITAL DISTRIBUTION AND DIRECT-TO-CONSUMER (D2C) PROFITABILITY

4.8.8 CONCLUSION

4.9 END USER EVOLUTION ANALYSIS – MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.9.1 CONCLUSION

4.1 IMPACT OF SUSTAINABILITY AND CIRCULAR FASHION INITIATIVES ON PRODUCT DEVELOPMENT

4.10.1 RECYCLABLE FIBERS AND ECO-FRIENDLY MATERIALS

4.10.2 CIRCULAR DESIGN AND EXTENDED PRODUCT LIFE

4.10.3 ECO-COMPLIANT INNOVATIONS IN COMPRESSION TECHNOLOGY

4.10.4 MARKET DRIVERS FOR SUSTAINABILITY IN COMPRESSION WEAR

4.10.5 CHALLENGES IN SUSTAINABLE PRODUCT DEVELOPMENT

4.10.6 CONCLUSION

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 Joint Ventures

4.11.1.2 Mergers and Acquisitions

4.11.1.3 Licensing and Partnership

4.11.1.4 Technology Collaborations

4.11.1.5 Strategic Divestments

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 RAW MATERIAL COVERAGE

4.12.1 INTRODUCTION

4.12.2 FOUNDATION OF RAW MATERIAL USE

4.12.3 DEPENDENCE ON SYNTHETIC FIBERS

4.12.4 INTEGRATION OF NATURAL FIBERS

4.12.5 ADOPTION OF TECHNICAL AND FUNCTIONAL TEXTILES

4.12.6 SUSTAINABLE MATERIAL INNOVATIONS

4.12.7 REGULATORY AND QUALITY COMPLIANCE

4.12.8 SUPPLY CHAIN CONSIDERATIONS

4.12.9 LIFECYCLE AND PERFORMANCE ATTRIBUTES

4.12.10 CONCLUSION

4.13 VALUE CHAIN

4.13.1 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET VALUE CHAIN

4.13.2 RAW MATERIAL SOURCING & MANUFACTURING:

4.13.3 PRODUCT DESIGN & COMPONENT MANUFACTURING –

4.13.4 ASSEMBLY, BRANDING & PACKAGING

4.13.5 DISTRIBUTION & END-USE

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 RAW MATERIAL SUPPLIERS

4.14.2 TEXTILE MANUFACTURERS

4.14.3 GARMENT & COMPONENT MANUFACTURERS

4.14.4 DESIGN, TESTING & ASSEMBLY UNITS

4.14.5 DISTRIBUTORS & RETAIL CHANNELS

4.14.6 MEDICAL PROFESSIONALS / PRESCRIBERS

4.14.7 END USERS

4.15 PORTER’S FIVE FORCES

4.15.1 INTENSITY OF COMPETITIVE RIVALRY – MODERATE TO HIGH

4.15.2 BARGAINING POWER OF BUYERS/CONSUMERS (MODERATE TO HIGH)

4.15.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.15.4 THREAT OF SUBSITUTE PRODUCTS ( LOW TO MODERATE)

4.15.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.16 CLIMATE CHANGE SCENARIO

4.16.1 INTRODUCTION

4.16.2 ENVIRONMENTAL CONCERNS

4.16.3 INDUSTRY RESPONSE

4.16.4 GOVERNMENT’S ROLE

4.16.5 ANALYST RECOMMENDATIONS

4.16.6 CONCLUSION

4.17 INDUSTRY ECOSYSTEM ANALYSIS

4.18 INTRODUCTION

4.18.1 PROMINENT COMPANIES

4.18.2 SMALL & MEDIUM SIZE COMPANIES

4.18.3 END USERS

4.18.4 CONCLUSION

4.19 STRATEGIC INITIATIVE ASSESSMENTS (CORPORATE WELLNESS PARTNERSHIPS, RETAIL COLLABORATIONS, OEM/ODM ARRANGEMENTS) ACROSS KEY GEOGRAPHIES

4.19.1 CORPORATE WELLNESS PARTNERSHIPS: INTEGRATING COMPRESSION SOLUTIONS INTO HOLISTIC HEALTH FRAMEWORKS

4.19.2 RETAIL COLLABORATIONS

4.19.3 OEM/ODM ARRANGEMENTS: COST-OPTIMIZED, CUSTOM-BUILT MANUFACTURING PARTNERSHIPS

4.19.4 GEOGRAPHY-SPECIFIC STRATEGIES

4.19.5 STRATEGIC DECISIONS CROSS-FUNCTIONAL MIDDLE EAST AND AFRICA STRATEGY: UNIFYING PARTNERSHIPS FOR MARKET SYNERGY

4.19.6 CONCLUSION

4.2 TECHNOLOGICAL ADVANCEMENTS

4.20.1 TECHNOLOGICAL ADVANCEMENTS IN THE MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.20.2 SMART COMPRESSION TEXTILES AND WEARABLE SENSORS

4.20.3 3D KNITTING AND SEAMLESS CONSTRUCTION TECHNOLOGIES

4.20.4 ADVANCED AND FUNCTIONAL MATERIALS

4.20.5 AI-POWERED CUSTOMIZATION AND ON-DEMAND MANUFACTURING

4.20.6 INTEGRATION WITH DIGITAL THERAPEUTICS AND TELEHEALTH

4.20.7 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.20.8 AUTOMATION AND QUALITY CONTROL IN MANUFACTURING

4.20.9 CONCLUSION

4.21 TARIFFS & IMPACT ON THE MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.21.1 OVERVIEW

4.21.2 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.21.3 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

4.21.4 VENDOR SELECTION CRITERIA DYNAMICS

4.21.5 IMPACT ON SUPPLY CHAIN

4.21.5.1 Introduction

4.21.5.2 RAW MATERIAL PROCUREMENT

4.21.5.3 Manufacturing and Production

4.21.5.4 Logistics and Distribution

4.21.5.5 Conclusion

4.21.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.21.6.1 SUPPLY CHAIN OPTIMIZATION

4.21.6.2 JOINT VENTURE ESTABLISHMENTS

4.21.7 IMPACT ON PRICES

4.21.7.1 Influence of Raw Material and Textile Innovations

4.21.7.2 Technological Advancements and Customization

4.21.7.3 Regulatory Compliance and Quality Standards

4.21.7.4 Logistics, Distribution, and Retail Dynamics

4.21.7.5 Sustainability and Ethical Production

4.21.7.6 Economic and Middle East And Africa Trade Factors

4.21.8 REGULATORY INCLINATION

4.21.8.1 Evolving Classification Standards

4.21.8.2 Compliance and Quality Assurance

4.21.8.3 Cross-Border Challenges

4.21.8.4 Digital Integration and Regulation

4.21.8.5 Geopolitical Situation

4.21.8.6 Trade Partnerships Between the Countries

4.21.8.7 Free Trade Agreements

4.21.8.8 Alliances Establishments

4.21.8.9 Conclusion

4.21.9 STATUS ACCREDITATION (INCLUDING MFTN) IN THE MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.21.9.1 Medical Accreditation and Regulatory Compliance

4.21.9.2 Voluntary Certifications and Quality Seals

4.21.9.3 Role of MFTN (Medical Functional Textile Network)

4.21.9.4 Accreditation as a Strategic Differentiator

4.21.9.5 Domestic Course of Correction in the Middle East And Africa Compression Garments and Stockings Market

4.21.9.6 Incentive Schemes to Boost Production Outputs

4.21.9.7 Establishment of Special Economic Zones / Industrial Parks

4.21.9.8 Conclusion

4.22 PRICING ANALYSIS

4.23 PRODUCTION CONSUMPTION ANALYSIS

4.24 COMPANY COMPARATIVE ANALYSIS AND POSITIONING MATRICES FOR LIFESTYLE VS. THERAPEUTIC BRANDS

4.24.1 COMPANY COMPARATIVE ANALYSIS: LIFESTYLE VS. THERAPEUTIC FOCUS

4.24.2 POSITIONING MATRIX INSIGHTS:

4.24.2.1 BAUERFEIND AG

4.24.2.2 3M

4.24.2.3 CARDINAL HEALTH

4.24.2.4 THUASNE

4.24.2.5 LOHMANN & RAUSCHER GMBH & CO. KG

5 REGULATION COVERAGE

5.1 INTRODUCTION

5.2 PRODUCT CODES

5.3 CERTIFIED STANDARDS

5.4 SAFETY STANDARDS

5.5 MATERIAL HANDLING AND STORAGE

5.6 TRANSPORT AND PRECAUTIONS

5.7 HAZARD IDENTIFICATION

5.8 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING OBESITY AND SEDENTARY LIFESTYLES

6.1.2 RISING USE OF COMPRESSION WEAR IN SPORTS RECOVERY

6.1.3 ADVANCEMENTS IN TEXTILE TECHNOLOGY AND MATERIALS

6.1.4 GROWTH OF HOME-BASED AND OUTPATIENT CARE SERVICES

6.2 RESTRAINTS

6.2.1 SHORTAGE OF TRAINED PERSONNEL FOR PROPER FITTING

6.2.2 LIMITED CLINICAL BACKING IN NON-THERAPEUTIC USE CASES

6.3 OPPORTUNITIES

6.3.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY COMPRESSION FABRICS

6.3.2 COLLABORATION WITH FASHION AND WELLNESS BRANDS

6.3.3 GROWING SALES FROM E-COMMERCE SECTOR

6.4 CHALLENGES

6.4.1 LOW AWARENESS AND DIAGNOSTIC ACCESS IN RURAL AREAS

6.4.2 COMPLEX REGULATORY CLASSIFICATION ACROSS MARKETS

7 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 COMPRESSION STOCKINGS

7.3 COMPRESSION GARMENTS

8 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL

8.1 OVERVIEW

8.2 MODERATE COMPRESSION

8.3 MILD COMPRESSION

8.4 FIRM COMPRESSION

8.5 EXTRA-FIRM COMPRESSION

9 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL USE

9.3 NON-MEDICAL USE

10 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 NYLON & SPANDEX

10.3 COTTON

10.4 MICROFIBER

10.5 BAMBOO FIBER

10.6 BREATHABLE MESH / MOISTURE-WICKING FABRICS

10.7 WOOL BLENDS

10.8 RECYCLED/ORGANIC MATERIALS

11 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER

11.1 OVERVIEW

11.2 WOMEN

11.3 UNISEX

11.4 MEN

12 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER

13.1 OVERVIEW

13.2 GENERAL CONSUMERS

13.3 HEALTHCARE INSTITUTIONS

13.4 SPORTS TEAMS & CLUBS

13.5 CORPORATE WELLNESS PROGRAMS

14 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 EGYPT

14.1.4 U.A.E

14.1.5 ISRAEL

14.1.6 KUWAIT

14.1.7 QATAR

14.1.8 OMAN

14.1.9 BAHRAIN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

16.1 SWOT ANALYSIS FOR KEY SEGMENTS BY PRODUCT TYPE

17 DISTRIBUTOR COMPANY PROFILES

17.1 NOVOMED INC PVT. LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS/NEWS

17.2 TS COMPROZONE PVT. LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS/NEWS

17.3 SIMONSEN & WEEL

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENTS/NEWS

17.4 YASHODHAN ENTERPRISE

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENTS/NEWS

17.5 YOGI KRIPA

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS/NEWS

18 MANUFACTURERS, COMPANY PROFILE

18.1 BAUERFEIND

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 SWOT ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 3M

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 SWOT ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENTS/NEWS

18.3 CARDINAL HEALTH

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 SWOT ANALYSIS

18.3.5 PRODUCT PORTFOLIO

18.3.6 RECENT DEVELOPMENT

18.4 THUSANE

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 SWOT ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 LOHMANN & RAUSCHER GMBH & CO. KG

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 SWOT ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 AMES WALKER

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS/NEWS

18.7 CALZIFICIO ZETA SRL

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 CEP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 COMPRESSANA GMBH

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 GIBAUD

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GLORIA MED S.P.A.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 HEINZ SCHIEBLER GMBH & CO KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 JUZO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MAXWELL INDIA

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 MEDI GMBH & CO. KG

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 NOVAMED

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 REJUVA HEALTH

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 SANYLEG SRL A SOCIO UNICO

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 SCHOLL’S WELLNESS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 SWISSLASTIC AG ST. GALLEN

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SIGVARIS GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SOCKWELL

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS/NEWS

18.23 SURGIWEAR

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THERMOTEK

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 TYNOR ORTHOTICS PVT. LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 VIM & VIGR

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS/NEWS

18.27 VISSCO NEXT

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENTS/NEWS

18.28 ZENSAH

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 BRAND OUTLOOK: COMPRESSION STOCKINGS MARKET

TABLE 2 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA WORKWEAR COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA MODERATE COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA MILD COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA FIRM COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA EXTRA-FIRM COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA NYLON & SPANDEX IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA COTTON IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA MICROFIBER IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA BAMBOO FIBER IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BREATHABLE MESH / MOISTURE-WICKING FABRICS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA WOOL BLENDS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA RECYCLED/ORGANIC MATERIALS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA WOMEN IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA UNISEX IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA MEN IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA ONLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA HEALTHCARE INSTITUTIONS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA SPORTS TEAMS & CLUBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA CORPORATE WELLNESS PROGRAMS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH AFRICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH AFRICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 SOUTH AFRICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SOUTH AFRICA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SOUTH AFRICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SOUTH AFRICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH AFRICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH AFRICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH AFRICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 SOUTH AFRICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH AFRICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SOUTH AFRICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SOUTH AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 84 SOUTH AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 SOUTH AFRICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 SAUDI ARABIA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SAUDI ARABIA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SAUDI ARABIA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SAUDI ARABIA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SAUDI ARABIA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SAUDI ARABIA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SAUDI ARABIA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SAUDI ARABIA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SAUDI ARABIA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 100 SAUDI ARABIA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 SAUDI ARABIA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SAUDI ARABIA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SAUDI ARABIA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SAUDI ARABIA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 105 SAUDI ARABIA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 106 SAUDI ARABIA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 107 SAUDI ARABIA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 SAUDI ARABIA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 EGYPT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 EGYPT COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 EGYPT COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 EGYPT WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 EGYPT INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 EGYPT HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 EGYPT TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 EGYPT COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 EGYPT LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 EGYPT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 121 EGYPT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 EGYPT MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 EGYPT NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 EGYPT OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 EGYPT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 126 EGYPT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 127 EGYPT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 EGYPT OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 EGYPT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 130 EGYPT GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 EGYPT WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.A.E COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.A.E COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.A.E COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.A.E WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.A.E INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.A.E HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.A.E TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.A.E COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.A.E LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.A.E COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 142 U.A.E COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 U.A.E MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.A.E NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 U.A.E OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.A.E. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 147 U.A.E COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 148 U.A.E COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 149 U.A.E. OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.A.E COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 151 U.A.E GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.A.E WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 ISRAEL COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 ISRAEL COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 ISRAEL COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 ISRAEL WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 ISRAEL INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 ISRAEL HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 ISRAEL TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 ISRAEL COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 ISRAEL LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 ISRAEL COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 163 ISRAEL COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 164 ISRAEL MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 ISRAEL NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 ISRAEL OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 ISRAEL COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 168 ISRAEL COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 169 ISRAEL COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 170 ISRAEL OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 ISRAEL COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 172 ISRAEL GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 ISRAEL WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 KUWAIT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 KUWAIT COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 KUWAIT COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 KUWAIT WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 KUWAIT INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 KUWAIT HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 KUWAIT TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 KUWAIT COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 KUWAIT LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 KUWAIT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 184 KUWAIT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 KUWAIT MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 KUWAIT NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 KUWAIT OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 KUWAIT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 189 KUWAIT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 190 KUWAIT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 191 KUWAIT OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 KUWAIT COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 193 KUWAIT GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 KUWAIT WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 QATAR COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 QATAR COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 QATAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 QATAR WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 QATAR INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 QATAR HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 QATAR TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 QATAR COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 QATAR LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 QATAR COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 205 QATAR COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 206 QATAR MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 QATAR NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 QATAR OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 QATAR COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 210 QATAR COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 211 QATAR COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 212 QATAR OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 QATAR COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 214 QATAR GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 QATAR WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 OMAN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 OMAN COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 OMAN COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 OMAN WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 OMAN INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 OMAN HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 OMAN TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 OMAN COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 OMAN LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 OMAN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 226 OMAN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 227 OMAN MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 OMAN NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 OMAN OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 OMAN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 231 OMAN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 232 OMAN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 233 OMAN OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 OMAN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 235 OMAN GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 OMAN WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 BAHRAIN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 BAHRAIN COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 BAHRAIN COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 BAHRAIN WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 BAHRAIN INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 BAHRAIN HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 BAHRAIN TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 BAHRAIN COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 BAHRAIN LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 BAHRAIN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 247 BAHRAIN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 248 BAHRAIN MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 BAHRAIN NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 BAHRAIN OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 BAHRAIN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 252 BAHRAIN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 253 BAHRAIN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 254 BAHRAIN OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 BAHRAIN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 256 BAHRAIN GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 BAHRAIN WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 REST OF MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 9 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 11 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SEGMENTATION

FIGURE 13 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: EXECUTIVE SUMMARY

FIGURE 14 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: STRATEGIC DECISIONS

FIGURE 15 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE (2024)

FIGURE 16 INCREASING OBESITY AND SEDENTARY LIFESTYLES IS EXPECTED TO DRIVE THE GROWTH OF THE MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET FROM 2025 TO 2032

FIGURE 17 THE COMPRESSION STOCKINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET IN 2025 & 2032

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DISTRIBUTION OF PATENTS BY IPC CODE

FIGURE 20 COUNTRY-WISE PATENT COUNT

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 MIDDLE EAST AND AFRICA GARMENT AND COMPRESSIBLE STOCKING MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 23 PRODUCTION CONSUMPTION ANALYSIS: MIDDLE EAST AND AFRICA GARMENTS AND COMPRESSION STOCKINGS MARKET

FIGURE 24 DROC ANALYSIS

FIGURE 25 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, 2024

FIGURE 26 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 27 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 28 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 29 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, 2024

FIGURE 30 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 31 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, CAGR (2025- 2032)

FIGURE 32 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, LIFELINE CURVE

FIGURE 33 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, 2024

FIGURE 34 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 35 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 36 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 37 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, 2024

FIGURE 38 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, 2025 TO 2032 (USD THOUSAND)

FIGURE 39 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, CAGR (2025- 2032)

FIGURE 40 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 41 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, 2024

FIGURE 42 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 43 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, CAGR (2025- 2032)

FIGURE 44 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 45 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 46 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 47 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 48 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 49 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, 2024

FIGURE 50 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 51 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 52 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, LIFELINE CURVE

FIGURE 53 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SNAPSHOT (2024)

FIGURE 54 MIDDLE EAST AND AFRICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.