Middle East And Africa Construction Product Certification Market

Market Size in USD Billion

CAGR :

%

USD

1.92 Billion

USD

3.11 Billion

2025

2033

USD

1.92 Billion

USD

3.11 Billion

2025

2033

| 2026 –2033 | |

| USD 1.92 Billion | |

| USD 3.11 Billion | |

|

|

|

|

Middle East and Africa Construction Product Certification Market Size

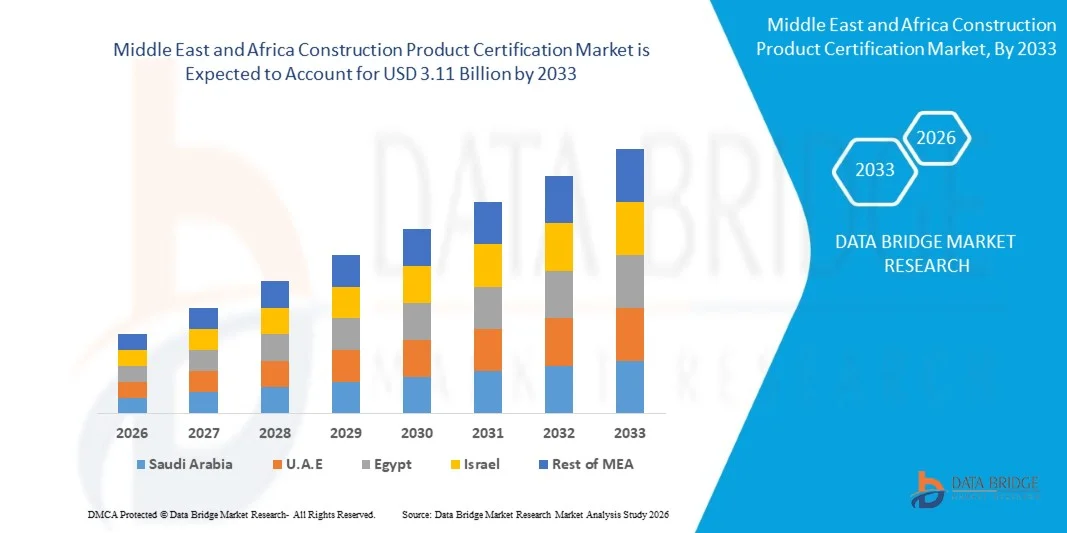

- The Middle East and Africa Construction Product Certification Market size was valued at USD 1.92 billion in 2025 and is projected to reach USD 3.11 billion by 2033, growing at a CAGR of 6.20% during the forecast period.

- The market expansion is primarily driven by increasing urbanization, infrastructure development, and stringent regulatory requirements for building safety and quality across the region.

- Additionally, the rising emphasis on sustainable construction practices and the adoption of advanced building materials and technologies are encouraging developers and contractors to seek certified products, further propelling market growth.

Middle East and Africa Construction Product Certification Market Analysis

- Construction product certification, which ensures that building materials and products meet safety, quality, and regulatory standards, is becoming increasingly critical in both residential and commercial projects across the Middle East and Africa, driven by growing infrastructure development and compliance requirements.

- The rising demand for certified construction products is primarily fueled by stricter building codes, increasing awareness of sustainable and safe construction practices, and the need for reliable, high-quality materials in large-scale urban development projects.

- U.A.E. dominated the Middle East and Africa Construction Product Certification Market with the largest revenue share of 33.2% in 2025, driven by rapid infrastructure expansion, government mandates on building safety, and high investment in commercial and residential projects, with the UAE and Saudi Arabia leading in adoption of internationally certified building products.

- Saudi Arabia is expected to be the fastest-growing region in the Middle East and Africa Construction Product Certification Market during the forecast period, supported by urbanization, increased construction activities, and rising government initiatives to improve building standards.

- The construction and building products segment dominated the market with the largest revenue share of 38.6% in 2025, driven by high demand for certified structural materials, HVAC components, and building fixtures in large-scale infrastructure and urban development projects

Report Scope and Middle East and Africa Construction Product Certification Market Segmentation

|

Attributes |

Middle East and Africa Construction Product Certification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Middle East and Africa Construction Product Certification Market Trends

“Enhanced Compliance and Efficiency Through Digital and AI-Enabled Certification”

- A significant and accelerating trend in the Middle East and Africa Construction Product Certification Market is the increasing integration of digital platforms and artificial intelligence (AI) to streamline certification processes, improve accuracy, and ensure compliance with evolving building codes and safety standards. This technological convergence is significantly enhancing convenience and efficiency for manufacturers, developers, and regulatory bodies.

- For instance, platforms such as SGS Digicomply and Bureau Veritas’ CertifyMe enable companies to submit documentation, track product testing, and receive certification approvals digitally, reducing turnaround times and minimizing manual errors. Similarly, Intertek’s AI-enabled inspection systems can automatically flag non-compliant products and generate detailed reports for regulatory review.

- AI integration in certification processes allows predictive analytics to identify potential quality or compliance issues before they occur, assess risk factors, and provide actionable recommendations. For example, some TUV Rheinland digital tools utilize AI to evaluate testing data trends, ensuring more accurate certification outcomes and reducing the likelihood of post-market product recalls.

- The seamless integration of certification platforms with broader digital project management and supply chain systems facilitates centralized oversight across multiple projects and geographies. Through a single interface, stakeholders can manage product compliance, track testing schedules, and maintain up-to-date certification records, ensuring transparency and efficiency throughout the construction lifecycle.

- This trend towards more intelligent, automated, and interconnected certification solutions is fundamentally reshaping expectations for compliance and quality assurance in construction. Consequently, companies such as UL and DNV are developing AI-enabled certification platforms with features such as predictive compliance analytics, digital document management, and integration with regional regulatory portals.

- The demand for digital and AI-enabled construction product certification solutions is growing rapidly across both residential and commercial sectors, as stakeholders increasingly prioritize efficiency, accuracy, and regulatory confidence in their building projects.

Middle East and Africa Construction Product Certification Market Dynamics

Driver

“Growing Need Due to Stricter Regulations and Quality Assurance Demands”

- The increasing emphasis on building safety, regulatory compliance, and quality assurance across the Middle East and Africa is a significant driver for the heightened demand for construction product certification.

- For instance, in 2025, the U.A.E. government updated its building code regulations to mandate certification for structural materials and electrical components, prompting developers and manufacturers to adopt certified products. Such initiatives by regulatory authorities are expected to drive market growth during the forecast period.

- As stakeholders become more aware of the risks associated with non-compliant or substandard construction products, certification ensures adherence to safety standards, durability, and performance, providing a compelling rationale for adoption over non-certified alternatives.

- Furthermore, the growing trend toward sustainable and green building practices is making certified materials essential, as many certifications validate environmental performance, energy efficiency, and compliance with regional and international sustainability standards.

- The need for reliable documentation, third-party validation, and assurance of material performance is key in both residential and commercial sectors. The trend toward large-scale infrastructure projects and urban development further reinforces the demand for certified construction products.

Restraint/Challenge

“Concerns Regarding Costs and Complex Certification Processes”

- The cost of certification and the complexity of compliance procedures pose significant challenges to broader adoption in the Middle East and Africa Construction Product Certification Market. Obtaining certifications often involves rigorous testing, documentation, and inspection, which can be time-consuming and costly for manufacturers and contractors.

- For instance, smaller local manufacturers may face difficulties in meeting the stringent requirements set by international certification bodies, limiting their ability to compete in regulated markets.

- Streamlining certification processes, offering digital submission platforms, and providing clear guidance on compliance are crucial for encouraging adoption. Companies such as SGS and Bureau Veritas emphasize efficient testing and reporting solutions to help clients navigate complex regulatory requirements.

- Additionally, the higher upfront costs associated with certified materials compared to non-certified alternatives can be a barrier, particularly for cost-sensitive projects in developing regions. While the long-term benefits of certified products—such as safety, durability, and regulatory compliance—are significant, the initial financial investment can hinder adoption among smaller developers or budget-conscious stakeholders.

- Overcoming these challenges through simplified certification processes, cost-effective testing solutions, and awareness campaigns highlighting the value of certified products will be vital for sustained market growth.

Middle East and Africa Construction Product Certification Market Scope

The construction product certification market is segmented on the basis of product, application and end user.

• By Product

On the basis of product, the Middle East and Africa Construction Product Certification Market is segmented into construction and building products, power generation and energy storage, industrial and hazardous location equipment, information and communications technology (ICT), lighting products, medical and laboratory equipment, personal protective equipment (PPE), tools and outdoor equipment, and others. The construction and building products segment dominated the market with the largest revenue share of 38.6% in 2025, driven by high demand for certified structural materials, HVAC components, and building fixtures in large-scale infrastructure and urban development projects.

The industrial and hazardous location equipment segment is anticipated to witness the fastest CAGR of 19.8% from 2026 to 2033, supported by increasing industrialization, stringent safety regulations, and the need for reliable, certified equipment in hazardous environments, ensuring worker safety and regulatory compliance.

• By Application

On the basis of application, the Middle East and Africa Construction Product Certification Market is segmented into insulation, roofing, exterior siding, interior finishing, and others. The roofing segment accounted for the largest market revenue share of 34.5% in 2025, attributed to rapid commercial and residential construction, as well as increasing adoption of certified roofing materials that ensure durability, fire resistance, and compliance with regional safety standards.

The insulation segment is expected to witness the fastest CAGR of 20.3% from 2026 to 2033, fueled by rising awareness of energy efficiency, sustainable building practices, and government mandates encouraging thermal and acoustic insulation solutions in modern constructions. Certified insulation materials are increasingly preferred for their verified performance and contribution to green building certifications.

• By End User

On the basis of end user, the Middle East and Africa Construction Product Certification Market is segmented into industrial, commercial, and residential sectors. The commercial sector dominated the market with a revenue share of 40.2% in 2025, driven by the proliferation of office complexes, hotels, and retail spaces requiring certified building materials and systems to meet safety and quality standards.

The residential sector is expected to register the fastest CAGR of 21.1% from 2026 to 2033, supported by rising construction of smart homes, urban housing projects, and high-rise residential buildings. Homeowners and developers increasingly demand certified products to ensure compliance with safety regulations, durability, and enhanced living quality, driving certification adoption in the residential segment.

Middle East and Africa Construction Product Certification Market Regional Analysis

- U.A.E. dominated the Middle East and Africa Construction Product Certification Market with the largest revenue share of 33.2% in 2025, driven by rapid infrastructure development, large-scale commercial and residential projects, and stringent regulatory requirements for building safety and quality.

- Developers, contractors, and government authorities in the region prioritize certified construction products to ensure compliance with safety standards, durability, and performance, reflecting a strong commitment to high-quality construction practices.

- This widespread adoption is further supported by substantial government investments in urban development, rising awareness of sustainable and green building practices, and the presence of international and regional certification providers, establishing certified construction products as a preferred choice for residential, commercial, and industrial projects across the region.

Saudi Arabia Construction Product Certification Market Insight

The Saudi Arabia construction product certification market captured the largest revenue share of 36% in 2025, driven by rapid infrastructure expansion, large-scale residential and commercial projects, and stringent government regulations on building safety and quality. Developers and contractors are increasingly prioritizing certified construction materials to ensure compliance with local and international standards. The ongoing Vision 2030 initiatives, focused on urban development and sustainable building practices, are further accelerating market adoption, making certified products essential for high-profile infrastructure and real estate projects.

U.A.E. Construction Product Certification Market Insight

The U.A.E. construction product certification market is projected to expand at a substantial CAGR during the forecast period, fueled by large-scale urban development, government mandates for building safety, and the adoption of green building practices. Dubai and Abu Dhabi, as leading construction hubs, are witnessing strong demand for certified building materials, particularly in commercial, residential, and mixed-use developments. The emphasis on sustainability, energy efficiency, and quality assurance continues to drive the adoption of certified products across new constructions and renovation projects.

South Africa Construction Product Certification Market Insight

The South Africa construction product certification market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing urbanization, infrastructure modernization, and regulatory initiatives to ensure construction safety. Developers and industrial players are increasingly adopting certified materials to comply with national building codes and international quality standards. The rise in commercial, residential, and industrial construction projects, coupled with growing awareness of safety and durability requirements, is fostering strong demand for certified products in the region.

Egypt Construction Product Certification Market Insight

The Egypt construction product certification market is poised to grow at a considerable CAGR, supported by the country’s infrastructure development programs, urban expansion, and government regulations promoting building safety. Certified construction products are gaining traction in both residential and commercial projects, particularly in Cairo and Alexandria. Additionally, initiatives to improve energy efficiency, sustainability, and compliance with international construction standards are driving adoption. The growing construction activity in real estate, industrial complexes, and public infrastructure projects is expected to sustain market growth in Egypt over the forecast period.

Middle East and Africa Construction Product Certification Market Share

The Construction Product Certification industry is primarily led by well-established companies, including:

- SGS (Switzerland)

- Bureau Veritas (France)

- Intertek Group (U.K.)

- TÜV SÜD (Germany)

- TÜV Rheinland (Germany)

- UL (U.S.)

- DNV (Norway)

- Kiwa (Netherlands)

- Dekra (Germany)

- Applus+ (Spain)

- BVQI (France)

- Element Materials Technology (U.K.)

- CSA Group (Canada)

- MET Laboratories (U.S.)

- Lloyd’s Register (U.K.)

- RINA (Italy)

- FM Approvals (U.S.)

- Eurofins (Luxembourg)

- TQC (South Africa)

- NQA (U.K.)

What are the Recent Developments in Middle East and Africa Construction Product Certification Market?

- In April 2024, Bureau Veritas, a global leader in testing, inspection, and certification, launched a strategic initiative in Saudi Arabia aimed at enhancing construction safety and quality through its advanced product certification services. This initiative emphasizes the company’s commitment to delivering reliable and internationally recognized certification solutions tailored to the unique regulatory and safety requirements of the local construction sector. By leveraging its global expertise, Bureau Veritas is reinforcing its position in the rapidly growing Middle East and Africa Construction Product Certification Market.

- In March 2024, SGS Group, a Switzerland-based certification company, introduced specialized certification programs for U.A.E. developers focusing on sustainable building materials and green construction practices. The program is designed to ensure compliance with both local regulations and international standards, highlighting SGS’s dedication to promoting safer, more sustainable construction practices across commercial and residential projects in the region.

- In March 2024, Intertek Group successfully launched a comprehensive construction product testing and certification initiative in South Africa, aimed at improving safety and compliance in large-scale infrastructure and urban development projects. This effort underscores Intertek’s commitment to leveraging innovative testing methodologies to support safer and more resilient building practices in the region.

- In February 2024, TÜV Rheinland, a global provider of technical certification services, partnered with Egypt’s Ministry of Housing, Utilities, and Urban Communities to implement a streamlined certification process for building materials used in residential and commercial projects. The collaboration aims to ensure compliance with national and international safety standards while enhancing operational efficiency for construction stakeholders.

- In January 2024, UL (Underwriters Laboratories) launched its advanced certification program for construction products in the GCC region, featuring digital reporting and AI-enabled compliance verification tools. This program highlights UL’s commitment to integrating technology into the certification process, offering developers and manufacturers enhanced convenience, transparency, and assurance of product quality and safety across both residential and commercial construction projects.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Construction Product Certification Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Construction Product Certification Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Construction Product Certification Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.