Middle East And Africa Data Center Construction Market

Market Size in USD Billion

CAGR :

%

USD

8.45 Billion

USD

13.48 Billion

2024

2032

USD

8.45 Billion

USD

13.48 Billion

2024

2032

| 2025 –2032 | |

| USD 8.45 Billion | |

| USD 13.48 Billion | |

|

|

|

|

Middle East and Africa Data Center Construction Market Size

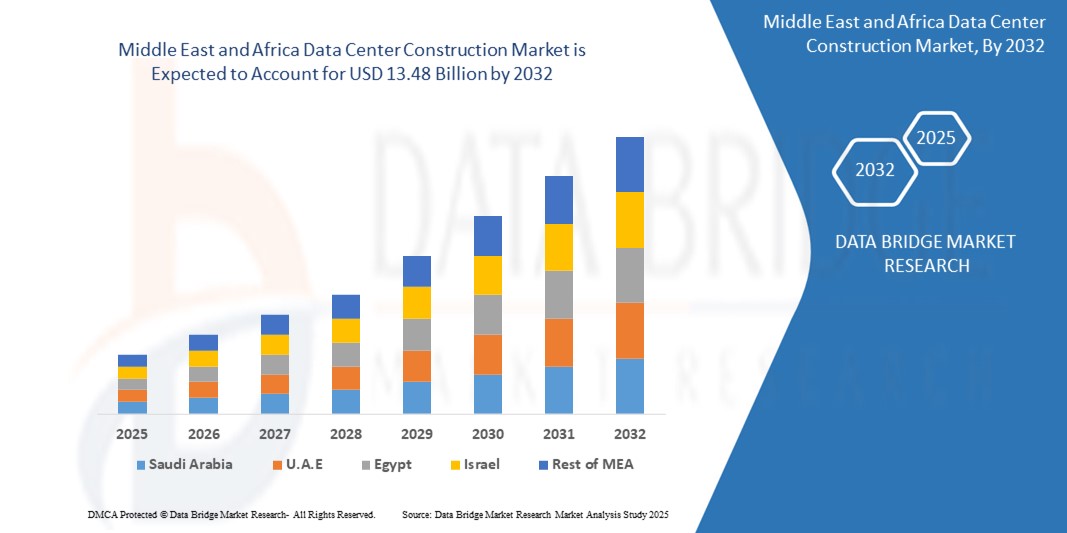

- The Middle East and Africa data center construction market size was valued at USD 8.45 billion in 2024 and is expected to reach USD 13.48 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fuelled by the rising demand for cloud services, increasing internet penetration, and growing investments from hyperscale providers and regional governments

- Expansion of smart city projects and digital transformation initiatives across countries such as the U.A.E. and Saudi Arabia are further accelerating the need for advanced data center infrastructure in the region

Middle East and Africa Data Center Construction Market Analysis

- The data center construction market is experiencing a surge in demand as businesses invest in digital infrastructure to support cloud computing and data storage needs across industries

- Growing adoption of artificial intelligence and big data analytics is prompting developers to build scalable and high-performance data centers to meet modern computing requirements

- U.A.E dominates the data center construction market within the Middle East, fuelled by government-led smart city projects and increasing cloud adoption by enterprises

- South Africa is expected to be the fastest growing region in the Middle East and Africa data center construction market during the forecast period due to

- The electrical infrastructure segment holds the largest market revenue share in 2024, driven by increasing demand for uninterrupted power systems, high-density computing, and scalable backup solutions. Data center operators prioritize advanced electrical systems for maintaining uptime and supporting complex server environments

Report Scope and Middle East and Africa Data Center Construction Market Segmentation

|

Attributes |

Middle East and Africa Data Center Construction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Middle East and Africa Data Center Construction Market Trends

“Rising Investment in Hyperscale Data Centers”

- Hyperscale data centers are rapidly emerging across the Middle East and Africa as demand grows for scalable, energy-efficient digital infrastructure to support cloud computing and big data applications

- For instance, Amazon Web Services launched new cloud zones in Cape Town, South Africa, to cater to growing enterprise cloud needs while improving local data storage capabilities

- These facilities support high-density computing environments that power artificial intelligence, machine learning, and advanced analytics workloads across industries

- For instance, Microsoft partnered with U.A.E-based Etisalat to develop sustainable, hyperscale data centers aligned with the country’s digital transformation agenda

- The surge in hyperscale investments is drawing foreign capital, boosting regional innovation, and positioning the region as a growing digital services hub

Middle East and Africa Data Center Construction Market Dynamics

Driver

“Growing Cloud Adoption and Digital Transformation Initiatives”

- Rapid adoption of cloud computing and digital transformation across sectors is driving demand for advanced data center infrastructure in the Middle East and Africa

- Governments and enterprises are investing heavily in digital projects such as smart cities, e-governance, and enhanced telecom networks to support growing data needs

- Major cloud providers such as Amazon Web Services, Microsoft, and Google are expanding their presence by building new data centers or partnering locally to provide scalable and secure services

- Increasing internet penetration and mobile connectivity, along with the rise of data-intensive applications such as video streaming and fintech, are accelerating the need for reliable, energy-efficient data centers

- Regional initiatives focusing on data sovereignty are boosting investments in hyperscale and edge data centers to ensure localized storage and processing

- For instance, Microsoft launched new cloud regions in the U.A.E to support local enterprises and government digital initiatives

Restraint/Challenge

“Infrastructure and Energy Challenges”

- Inconsistent power supply and limited access to renewable energy hinder efficient data center operations across many parts of the Middle East and Africa

- High energy costs and unstable grids increase the risk of downtime, affecting operational costs and service reliability

- Securing suitable land with reliable utilities is challenging due to regulatory issues and urban development limitations

- Shortages of skilled labour and supply chain disruptions delay construction and maintenance activities, raising project costs

- These factors contribute to higher capital and operational expenditures, potentially slowing market growth and discouraging new investments

- For instance, data center projects in regions such as Nigeria and Kenya face frequent power outages and logistical hurdles, impacting construction timelines and operational stability

Middle East and Africa Data Center Construction Market Scope

The market is segmented on the basis of infrastructure type, data center type, organization size, and vertical.

- By Infrastructure Type

On the basis of infrastructure type, the Asia-Pacific data center construction market is segmented into electrical infrastructure, mechanical infrastructure, and general construction. The electrical infrastructure segment holds the largest market revenue share in 2024, driven by increasing demand for uninterrupted power systems, high-density computing, and scalable backup solutions. Data center operators prioritize advanced electrical systems for maintaining uptime and supporting complex server environments.

The mechanical infrastructure segment is expected to grow at the fastest growth rate from 2025 to 2032, supported by the need for efficient cooling systems and energy optimization in high-performance data centers. Innovations in liquid cooling and thermal management solutions are gaining traction as facilities push for sustainability and performance excellence.

- By Data Center Type

On the basis of data center type, the Asia-Pacific data center construction market is segmented into Tier 1, Tier 2, Tier 3, and Tier 4. The Tier 3 segment accounts for the largest market revenue share in 2024 due to its balance between performance and cost efficiency, appealing to hyperscale’s and cloud providers. These centers offer high availability with redundant systems and are preferred for both enterprise and service provider use.

The Tier 4 segment is expected to grow at the fastest growth rate from 2025 to 2032, owing to its fault-tolerant design and maximum uptime features. As mission-critical applications expand across sectors such as finance and healthcare, Tier 4 facilities are increasingly favoured for their superior reliability and resilience.

- By Organization Size

On the basis of organization size, the Asia-Pacific data center construction market is segmented into small size organization, medium size organization, and large size organization. The large size organization segment dominates the market revenue share in 2024, driven by expansive IT infrastructure needs and continuous demand for scalable data storage and processing capabilities. Enterprises invest heavily in advanced data center infrastructure to support digital transformation and global operations.

The small size organization segment is expected to grow at the fastest growth rate from 2025 to 2032, enabled by the rise of cloud-based services, affordable colocation models, and digital adoption among start-ups and regional firms. These businesses are turning to modular and edge data centers to support agile operations and local data needs.

- By Vertical

On the basis of vertical, the market is segmented into banking, financial services and insurance, IT and telecommunications, government and defence, healthcare, retail colocation, power and energy, manufacturing, and others. The IT and telecommunications segment holds the largest market share in 2024, supported by rising demand for 5G, data processing, and content delivery networks. Leading tech firms continue to invest in hyperscale and regional data centers to enhance network capacity and minimize latency.

The healthcare segment is expected to grow at the fastest growth rate from 2025 to 2032, as digital health platforms, electronic medical records, and remote patient monitoring drive the need for secure and compliant data storage. Facilities designed to meet regulatory standards and ensure data integrity are increasingly in demand across this sector.

Middle East and Africa Data Center Construction Market Regional Analysis

- U.A.E dominates the data center construction market within the Middle East, fuelled by government-led smart city projects and increasing cloud adoption by enterprises

- Investments in advanced infrastructure and partnerships with international tech companies are expanding the number of hyperscale and edge data centers, supporting the country’s goal to become a regional digital hub

- The focus on sustainable and energy-efficient facilities is driving innovations in cooling and power management.

- In addition, the U.A. E’s strategic geographic location and strong connectivity infrastructure attract global cloud providers and data center operators

South Africa Data Center Market Insight

The South Africa is expected to be the fastest-growing region within the Middle East and Africa data center construction market, fuelled by increasing internet penetration, rising adoption of cloud computing, and expanding enterprise demand for digital services. Nations such as South Africa and Kenya are witnessing rapid growth in data center infrastructure to support growing technology ecosystems and regional digital transformation efforts. The expansion of telecommunications infrastructure and favourable government policies are accelerating investments, making Africa a dynamic and fast-evolving market in the data center construction landscape.

Middle East and Africa Data Center Construction Market Share

The Middle East and Africa Data Center Construction industry is primarily led by well-established companies, including:

- Etisalat Group (U.A.E)

- Liquid Intelligent Technologies (South Africa)

- G42 (U.A.E)

- Teraco Data Environments (South Africa)

- MTN Group (South Africa)

- STC Solutions (Saudi Arabia)

- Vodacom Group (South Africa)

- Gulf Data Hub (U.A.E)

- Dimension Data (South Africa)

- WIOCC (Kenya)

Latest Developments in Global Middle East and Africa Data Center Construction Market

- In August 2021, DPR Construction began building a new 960,000-square-foot data center for Facebook in Mesa, Arizona. The facility is designed to use 60% less water than traditional centers by leveraging fresh air for cooling. This sustainable approach not only reduces operational costs but also highlights a growing industry trend toward environmentally efficient data center infrastructure.

- In June 2021, NTT Ltd. announced the launch of its Global Data Center Interconnect (GDCI), a software-defined network fabric designed to enable secure, private connections between its global data centers and major cloud providers through a single physical port. This development aims to simplify hybrid and multi-cloud connectivity, enhancing flexibility and scalability for clients across regions, and strengthening NTT’s position in the global interconnection market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.