Middle East And Africa Digital Health Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

15.69 Billion

USD

49.34 Billion

2024

2032

USD

15.69 Billion

USD

49.34 Billion

2024

2032

| 2025 –2032 | |

| USD 15.69 Billion | |

| USD 49.34 Billion | |

|

|

|

|

Middle East and Africa Digital Health Monitoring Devices Market Size

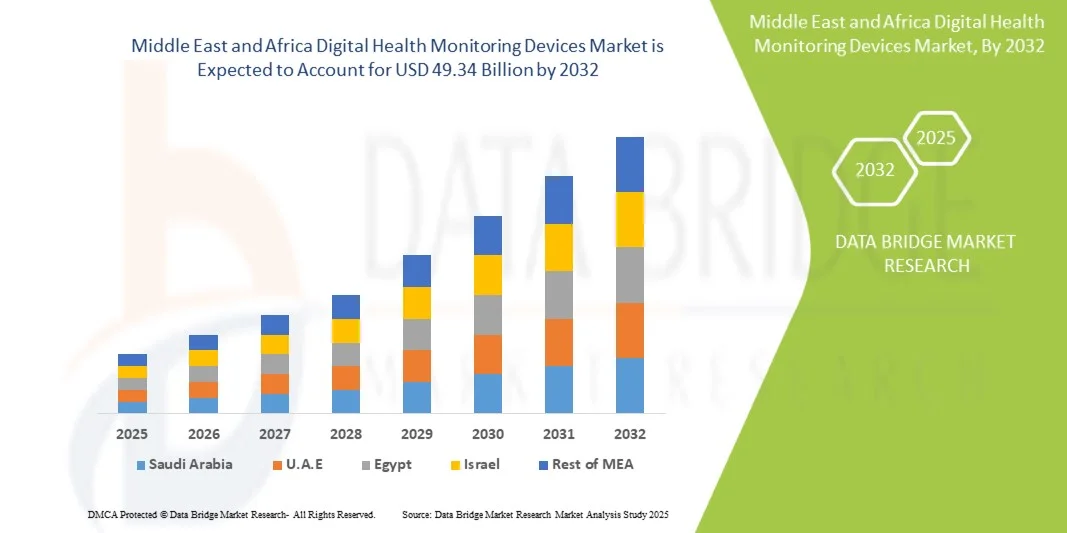

- The Middle East and Africa digital health monitoring devices market size was valued at USD 15.69 billion in 2024 and is expected to reach USD 49.34 billion by 2032, at a CAGR of15.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced healthcare technologies and digital health solutions, leading to greater remote patient monitoring and real-time health data collection across hospitals, clinics, and home care settings

- Furthermore, rising prevalence of chronic diseases, growing geriatric population, and increasing awareness about preventive healthcare are driving demand for accurate, reliable, and user-friendly monitoring devices. These converging factors are accelerating the uptake of Monitoring Devices solutions, thereby significantly boosting the industry's growth

Middle East and Africa Digital Health Monitoring Devices Market Analysis

- Digital Health monitoring devices, offering electronic or digital solutions for patient health tracking and clinical diagnostics, are increasingly vital components of modern healthcare systems in both hospitals and home-care settings due to their enhanced accuracy, real-time monitoring capabilities, and seamless integration with digital health platforms

- The escalating demand for monitoring devices is primarily fueled by the rising prevalence of chronic diseases, increasing adoption of telemedicine and remote patient monitoring, and a growing preference for real-time, data-driven healthcare solutions

- Saudi Arabia dominated the Middle East and Africa Digital Health Monitoring Devices Market with the largest revenue share of 34.8% in 2024, driven by rapid healthcare infrastructure expansion, high adoption of digital health technologies, and government initiatives under Vision 2030. The country has seen substantial growth due to the increasing use of advanced patient monitoring systems in hospitals, clinics, and specialty care centers, supported by innovations in wireless connectivity and AI-enabled monitoring solutions

- U.A.E. is expected to be the fastest growing region in the Middle East and Africa Digital Health Monitoring Devices Market during the forecast period, with a CAGR of 8.9% from 2025 to 2032, fueled by rising healthcare investments, expansion of private hospitals and diagnostic centers, and growing adoption of wearable and connected monitoring devices. The UAE’s focus on smart healthcare and telemedicine solutions is further accelerating market growth

- The Devices segment dominated the largest market revenue share of 46.3% in 2024, driven by the widespread adoption of wearable health monitors, blood pressure monitors, pulse oximeters, and ECG devices across hospitals, clinics, and homecare settings

Report Scope and Middle East and Africa Digital Health Monitoring Devices Market Segmentation

|

Attributes |

Middle East and Africa Digital Health Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Digital Health Monitoring Devices Market Trends

“Enhanced Convenience Through AI and Smart Health Integration”

- A significant and accelerating trend in the Middle East and Africa Digital Health Monitoring Devices Market is the deepening integration with artificial intelligence (AI) and popular digital health platforms. This fusion of technologies is significantly enhancing user convenience and control over personal and clinical health management systems

- For instance, the August Wi-Fi Digital Health Monitoring Devices seamlessly integrates with multiple health platforms, allowing users to access and track their health data through apps and connected devices. Similarly, Level Health+ can be controlled via mobile applications and smart assistants, offering a discreet Digital Health Monitoring Devices solution

- AI integration in monitoring devices enables features such as learning user health patterns to potentially suggest preventive measures and providing more intelligent alerts based on activity or readings. For instance, some devices utilize AI to improve measurement accuracy over time and can send intelligent alerts if unusual health parameters are detected. Furthermore, smart integration capabilities allow users to monitor their health remotely with minimal manual effort

- The seamless integration of monitoring devices with broader digital health ecosystems facilitates centralized management of personal or clinical health data. Through a single interface, users can track multiple health metrics, integrate with wearable devices, and monitor trends over time, creating a unified and automated health management experience

- This trend towards more intelligent, intuitive, and interconnected monitoring systems is fundamentally reshaping user expectations for personal and clinical health management. Consequently, companies such as WELOCK are developing AI-enabled monitoring devices with features such as automated alerts for abnormal readings and smart platform compatibility

- The demand for monitoring devices that offer seamless AI integration and smart platform connectivity is growing rapidly across both personal and institutional healthcare sectors, as consumers and healthcare providers increasingly prioritize convenience, real-time insights, and comprehensive health management functionality

Middle East and Africa Digital Health Monitoring Devices Market Dynamics

Driver

“Growing Need Due to Rising Health Awareness and Digital Adoption”

- The increasing prevalence of health concerns among populations, coupled with the accelerating adoption of digital health ecosystems, is a significant driver for the heightened demand for monitoring devices

- For instance, in April 2024, announced an advancement in IoT-based patient monitoring solutions, looking forward to integrating state-of-the-art sensors into its new monitoring platforms. Such strategies by key companies are expected to drive the Monitoring Devices industry growth in the forecast period

- As consumers and healthcare providers become more aware of potential health risks and seek enhanced monitoring capabilities, advanced monitoring devices offer features such as remote tracking, activity logs, and intelligent alerts, providing a compelling upgrade over traditional measurement tools

- Furthermore, the growing popularity of digital health devices and the desire for interconnected health management systems are making monitoring devices an integral component of both personal and clinical care, offering seamless integration with other digital tools and platforms

- The convenience of remote monitoring, continuous tracking for patients or at-risk individuals, and the ability to manage data through smartphone applications are key factors propelling the adoption of monitoring devices across both personal and institutional sectors. The trend towards DIY health monitoring setups and the increasing availability of user-friendly Monitoring Devices options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Data Security and High Initial Costs”

- Concerns surrounding the data security vulnerabilities of connected monitoring devices pose a significant challenge to broader market penetration. As these devices rely on network connectivity and software, they are susceptible to hacking attempts and data breaches, raising anxieties among potential consumers and healthcare providers about the privacy and security of their data

- For instance, high-profile reports of vulnerabilities in IoT healthcare devices have made some consumers and institutions hesitant to adopt digital health monitoring solutions

- Addressing these data security concerns through robust encryption, secure authentication protocols, and regular software updates is crucial for building trust. Companies such as August and Level Home emphasize their advanced encryption methods and security features in their product offerings to reassure potential buyers. Additionally, the relatively high initial cost of some advanced monitoring systems compared to traditional devices can be a barrier to adoption for price-sensitive consumers and healthcare facilities, particularly in developing regions or for budget-conscious users. While basic Digital Health Monitoring Devices have become more affordable, premium features such as continuous multi-parameter tracking, AI analytics, or cloud integration often come with a higher price tag

- While prices are gradually decreasing, the perceived premium for digital health technology can still hinder widespread adoption, especially for those who do not see an immediate need for advanced features

- Overcoming these challenges through enhanced data security measures, user education on privacy best practices, and the development of more affordable digital health monitoring devices options will be vital for sustained market growth

Middle East and Africa Digital Health Monitoring Devices Market Scope

The market is segmented on the basis of product, type, and end user.

• By Product

On the basis of product, the Middle East and Africa Digital Health Monitoring Devices Market is segmented into Devices, Software, and Services. The Devices segment dominated the largest market revenue share of 46.3% in 2024, driven by the widespread adoption of wearable health monitors, blood pressure monitors, pulse oximeters, and ECG devices across hospitals, clinics, and homecare settings. Devices enable real-time patient monitoring, accurate data collection, and integration with health IT platforms, improving clinical decision-making. Continuous innovations in sensor technology, miniaturization, and wireless connectivity further enhance adoption. The segment benefits from strong R&D investments by leading manufacturers and healthcare providers, as well as increasing awareness of chronic disease management. Integration with AI and cloud-based platforms adds value through predictive analytics and remote monitoring capabilities. High demand in critical care, telemedicine, and preventive healthcare supports consistent revenue growth. Government initiatives promoting digital healthcare adoption further drive expansion. Compatibility with electronic health records (EHRs) and mobile health applications makes devices versatile across clinical and home settings. Partnerships between device manufacturers and hospitals accelerate deployment and maintenance support. Overall, the Devices segment remains critical to the digital health ecosystem.

The Software and Services segment is expected to witness the fastest CAGR of 11.5% from 2025 to 2032, driven by increasing adoption of telehealth platforms, mHealth applications, and cloud-based analytics solutions. Software platforms enable secure storage, analysis, and sharing of patient data, supporting remote consultations and chronic disease management. Integration with wearable devices allows continuous health monitoring, while AI-driven insights improve patient outcomes and resource utilization. Rapid digitalization of healthcare, expansion of telemedicine networks, and rising demand for remote patient management fuel growth. Healthcare providers are investing in interoperable software to connect hospitals, clinics, and homecare solutions. Government initiatives to digitize healthcare records and promote telehealth accelerate adoption. The increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular disorders drives demand for connected monitoring and analytics solutions. User-friendly interfaces, mobile access, and real-time alerts enhance patient engagement. Emerging markets, particularly in Asia-Pacific and the Middle East, are increasingly implementing digital health platforms. The segment also benefits from subscription-based services, SaaS models, and integration with insurance providers. Continuous innovation, regulatory support, and scalable deployment contribute to sustained growth and strong future market potential.

• By Type

On the basis of type, the market is segmented into Wireless Health, mHealth, Telehealth, EHR/EMR, and Others. The Wireless Health segment dominated the market with a share of 39.8% in 2024, supported by the proliferation of wearable sensors, IoT-enabled devices, and real-time patient monitoring solutions. Wireless health devices allow continuous tracking of vital signs, enabling timely interventions and improved healthcare delivery. The segment benefits from technological advancements in low-power sensors, Bluetooth and Wi-Fi connectivity, and data analytics integration. High adoption in hospitals, homecare, and ambulatory care centers reinforces market dominance. Hospitals prefer wireless monitoring for ICU, cardiac, and chronic care management. Integration with cloud-based platforms and mobile applications facilitates remote monitoring, telemedicine consultations, and patient engagement. The segment also enjoys strong governmental support in developed countries, promoting adoption through incentives and pilot programs. Wearable devices, patches, and portable monitoring kits are increasingly deployed in clinical trials, research studies, and preventive healthcare programs. Compatibility with EHR/EMR systems allows seamless data sharing and interoperability. The reliability, convenience, and scalability of wireless health solutions solidify their position as the leading type segment.

The mHealth segment is anticipated to witness the fastest CAGR of 12.3% from 2025 to 2032, driven by surging adoption of mobile health applications and smartphone-integrated monitoring devices. mHealth solutions enable remote patient engagement, medication adherence tracking, and real-time communication with healthcare providers. Rising smartphone penetration, growing awareness of chronic disease management, and expansion of telemedicine services accelerate market growth. Mobile apps for fitness tracking, cardiac monitoring, and glucose management are becoming ubiquitous. Healthcare organizations are leveraging mHealth to extend care beyond hospitals and reduce patient readmissions. Cloud-based data storage and analytics allow predictive health insights and personalized interventions. Regulatory support, app certification, and secure patient data handling boost trust and adoption. Integration with wearable devices, AI algorithms, and healthcare platforms further enhances functionality. High patient convenience and cost-effectiveness drive adoption across homecare, clinics, and remote locations. Partnerships between tech companies and healthcare providers are expanding the mHealth ecosystem globally. Continuous innovation, multilingual interfaces, and cross-platform compatibility contribute to rapid market expansion.

• By End User

On the basis of end user, the market is segmented into Hospitals, Homecare Settings, Clinics, Ambulatory Surgical Centres, and Others. The Hospitals segment dominated the largest market revenue share of 44.6% in 2024, driven by the critical need for continuous patient monitoring, integration with health IT systems, and adoption of advanced diagnostic technologies. Hospitals deploy monitoring devices for ICU, cardiac care, emergency care, and surgical monitoring. Strong budgets, government funding, and partnerships with technology providers support high adoption. Hospitals also benefit from AI-enabled monitoring, predictive analytics, and remote monitoring for chronic care patients. Interoperability with EHR/EMR and telemedicine platforms ensures efficient workflows. The segment enjoys consistent demand due to rising patient volumes, aging populations, and prevalence of chronic diseases. Adoption of wireless health and telehealth solutions enhances patient outcomes and operational efficiency. Hospitals continue to invest in scalable, modular solutions to meet increasing care demands and ensure data-driven healthcare delivery.

The Homecare Settings segment is expected to witness the fastest CAGR of 10.9% from 2025 to 2032, fueled by increasing demand for remote patient monitoring, aging populations, and expansion of telemedicine. Connected health devices, wearables, and mHealth platforms enable patients to track vital signs, manage chronic diseases, and share real-time data with healthcare providers. Adoption is supported by rising awareness of preventive care, insurance reimbursement policies, and government initiatives for home-based healthcare. Integration with cloud-based platforms and mobile applications enhances convenience and care continuity. Growth is further accelerated by the development of user-friendly interfaces and low-cost monitoring solutions. The segment is witnessing strong traction in North America, Europe, and Asia-Pacific, driven by lifestyle diseases, technological adoption, and patient preference for home-based care.

Middle East and Africa Digital Health Monitoring Devices Market Regional Analysis

- The Middle East & Africa (MEA) monitoring devices market is poised for significant growth during the forecast period, driven by expanding healthcare infrastructure, rising adoption of digital health technologies

- Increasing awareness of connected patient monitoring solutions

- Government initiatives promoting smart healthcare, telemedicine, and AI-enabled health monitoring are further fueling the adoption of advanced monitoring devices across the region

Saudi Arabia Monitoring Devices Market Insight

Saudi Arabia monitoring devices market dominated the Middle East and Africa Digital Health Monitoring Devices Market with the largest revenue share of 34.8% in 2024, driven by rapid healthcare infrastructure expansion, high adoption of digital health technologies, and government initiatives under Vision 2030. The country has seen substantial growth due to the increasing use of advanced patient monitoring systems in hospitals, clinics, and specialty care centers, supported by innovations in wireless connectivity and AI-enabled monitoring solutions.

U.A.E. Monitoring Devices Market Insight

The U.A.E. monitoring devices market is expected to be the fastest-growing country in the MEA Monitoring Devices market during the forecast period, with a CAGR of 8.9% from 2025 to 2032, fueled by rising healthcare investments, expansion of private hospitals and diagnostic centers, and growing adoption of wearable and connected monitoring devices. The UAE’s focus on smart healthcare and telemedicine solutions is further accelerating market growth.

Middle East and Africa Digital Health Monitoring Devices Market Share

The Digital Health Monitoring Devices industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V (Netherlands)

- GE Healthcare (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- Masimo Corporation (U.S.)

- iRhythm Technologies, Inc. (U.S.)

- BioTelemetry, Inc. (U.S.)

- ResMed Inc. (U.S.)

- Omron Healthcare, Inc. (Japan)

- AliveCor, Inc. (U.S.)

- Withings (France)

- Beurer GmbH (Germany)

- iHealth Labs, Inc. (U.S.)

- Fitbit (U.S.)

- Garmin Ltd. (Switzerland)

Latest Developments in Middle East and Africa Digital Health Monitoring Devices Market

- In September 2024, Oman’s Ministry of Health launched a new feature in the Shifa App to reduce missed appointments by surveying absent patients. The initiative enables data-driven insights into no-show reasons and supports more efficient care delivery. It encourages patient participation and optimizes healthcare resource utilization

- In August 2024, Kuwait’s Ministry of Health unveiled a digital linkage system between hospitals and warehouses in Subhan, standardizing medical supply orders and streamlining medicine distribution. The initiative initially connected Farwaniya, Mubarak, and Jahra hospitals, with plans to expand further

- In March 2025, Saudi Arabia's Seha Virtual Hospital was recognized as the world's largest virtual hospital by the Guinness Book of Records. The hospital provides remote medical care to patients using video consultations and monitoring devices, addressing challenges of geographical access, specialized resources, and healthcare costs. Seha coordinates with 224 hospitals and offers 44 specialized services, enabling non-urgent care through virtual means

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.