Middle East And Africa Digital Signage Market

Market Size in USD Billion

CAGR :

%

USD

1.10 Billion

USD

1.81 Billion

2024

2032

USD

1.10 Billion

USD

1.81 Billion

2024

2032

| 2025 –2032 | |

| USD 1.10 Billion | |

| USD 1.81 Billion | |

|

|

|

|

Digital Signage Market Size

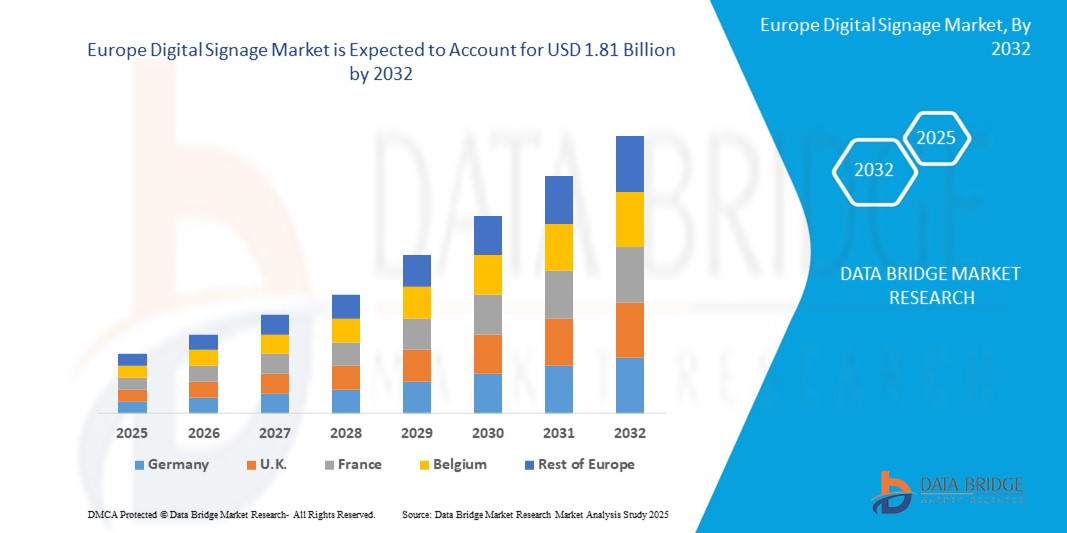

- The Middle East and Africa Digital Signage Market size was valued at USD 1.1 billion in 2024 and is expected to reach USD 1.81 billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely fueled by the growing rapidly thanks to businesses seeking more dynamic and engaging ways to communicate with customers. Advances in display technology, like LED and OLED screens, offer vibrant visuals that attract attention.

- Furthermore, increasing use of digital signage in retail, transportation, and hospitality sectors is boosting demand. The rise of smart cities and interactive displays is also fueling growth. Additionally, easy integration with social media and real-time content update makes digital signage more appealing. Overall, businesses value digital signage for its ability to enhance customer experience and drive sales.

Digital Signage Market Analysis

- Also known as dynamic signage, digital signage involves advertising and marketing on an electronic screen and works on hardware components to ensure the delivery of high-quality content. Digital signage involves the advertising and marketing of products and services over advanced technological screens such as LED and LCD. Nowadays, digital signage is used by both public and private institutions to engage their customers/audiences with its wider viewing angle.

- Saudi Arabia dominates the Digital Signage market with the largest revenue share of 49.36% in 2025, characterized by growing demand for bright and power-efficient display panels and decline in demand for traditional billboards.

- UAE is expected to be the fastest growing region in the Digital Signage market during the forecast period due to Rising introduction of new and innovative products and services across the globe

- Kiosks segment is expected to dominate the Digital Signage market with a market share of 41.56% in 2025, driven by its growing demand for self-service solutions across retail, transportation, and healthcare sectors.

Report Scope and Digital Signage Market Segmentation

|

Attributes |

Digital Signage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Signage Market Trends

“Integration of Augmented Reality (AR) for Immersive Experiences”

- Augmented Reality (AR) is adding a fresh, interactive twist to digital signage by blending virtual visuals with the real world. Instead of just showing static ads, AR lets users see and engage with digital content right where they stand—like trying on clothes virtually or exploring products in 3D. This makes ads more fun and memorable. Retailers love it because it grabs attention and keeps customers interested longer. It's also being used in places like airports and museums to offer guided experiences.

- By making information feel more personal and engaging, AR helps businesses connect better with their audiences. As AR tech becomes cheaper and more advanced, expect to see it used even more in digital signage. It’s not just about showing something—it’s about letting people interact with it. This trend is reshaping how brands tell their stories in public spaces.

- For Instance, In 2024, Delta Airlines implemented interactive wayfinding kiosks at major airports. These kiosks utilize AR to guide passengers through terminals, providing real-time navigation and personalized information. The integration of AR technology improves the travel experience by offering intuitive and engaging assistance to travelers.

Digital Signage Market Dynamics

Driver

“Advancements in Display Technology and Interactivity”

- The rapid evolution of display technologies is significantly enhancing the capabilities of digital signage. Innovations such as ultra-high-definition (UHD), flexible OLED, and microLED displays are providing businesses with high-quality, visually appealing options. These advancements enable more dynamic and engaging content delivery, attracting and retaining consumer attention.

- Moreover, the integration of interactive features like touchscreens, gesture controls, and augmented reality (AR) is transforming passive displays into interactive experiences. This interactivity allows consumers to engage directly with content, leading to increased dwell time and improved customer satisfaction.

- For instance, In April 2024, Shanghai Xianshi Electronic Technology Co., Ltd. introduced a new display technology to its signage products. This technology offers high resolution, ultra-thin design, curved screens for diverse applications, holographic displays, and energy efficiency.

Restraint/Challenge

“High Initial Investment Costs”

- High upfront costs are one of the biggest hurdles for companies wanting to adopt digital signage. Buying displays, media players, and content software isn’t cheap, especially for smaller businesses with tight budgets. On top of that, there are installation fees and ongoing maintenance to consider. Even though digital signage can pay off in the long run by improving customer engagement and streamlining operations, the initial price tag can scare some companies away.

- It’s a tough decision when resources are limited. Many businesses want the benefits but can’t justify the steep starting costs. This slows down wider adoption, particularly among local stores and startups. Until prices drop or more flexible payment models emerge, this cost barrier will likely remain a key restraint.

- For instance, In August 2021, a director of a large restaurant corporation in the USA shared on Reddit that obtaining approval for outdoor digital menu boards (DMBs) took 6–9 months, and the process didn't commence until well into construction. This delay and the associated costs highlight the financial and logistical challenges businesses face when adopting digital signage solutions.

Digital Signage Market Scope

The market is segmented on the basis product type, technology type, component type, application and location.

- By Product Type

Based on the product type, the digital signage market is segmented into kiosks, billboards, signboards, menu boards, others. The Kiosks segment is expected to dominate the Digital Signage market with a market share of 41.56% in 2025, driven by its growing demand for self-service solutions across retail, transportation, and healthcare sectors.

The billboards segment is anticipated to witness the fastest growth rate of 20.1% from 2025 to 2032, fueled by increasing demand for large-scale, high-visibility advertising in urban areas. Advancements in LED and digital display technologies are making billboards more dynamic and engaging. Brands are turning to these eye-catching formats to reach wider audiences and boost campaign impact.

- By Technology Type

Based on the technology type, the digital signage market is segmented into LCD, LED, OLED, front projection. The LCD held the largest market revenue share in 2025 of, driven by the affordability, energy efficiency, and wide availability. They offer clear visuals and are suitable for both indoor and outdoor applications, making them a versatile choice for many industries. Their long-standing presence and continued innovation have kept them in high demand.

The LED segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its superior brightness, energy efficiency, and durability compared to other display technologies. These qualities make LED ideal for vibrant, large-format digital signage in both indoor and outdoor settings. Growing demand for eye-catching, high-quality displays is fueling this rapid expansion.

- By Component Type

Based on the component type, the digital signage market is segmented into hardware, software, service. The software held the largest market revenue share in 2025, driven by the increasing need for advanced content management systems that enable easy scheduling, customization, and real-time updates. Growing demand for interactive and personalized digital signage experiences has further boosted software adoption. Additionally, cloud-based solutions have made software more accessible and scalable for businesses.

The hardware segment held a significant market share in 2025, favored for its crucial role in delivering high-quality displays and reliable performance. Advances in durable screens, media players, and connectivity options have made hardware more efficient and versatile. Strong demand from sectors like retail and transportation has supported consistent hardware growth.

- By Application

Based on the application, the digital signage market is segmented into transportation, retail, education, government, healthcare, banking, education, entertainment and others. The transportation segment accounted for the largest market revenue share in 2024, driven by the growing use of digital signage for real-time passenger information and advertising in airports, train stations, and bus terminals. Increasing investments in smart transportation infrastructure have further boosted demand. Enhanced communication and improved passenger experience remain key factors fueling this growth.

The retail segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising adoption of digital signage for personalized promotions and interactive customer engagement. Retailers are leveraging advanced technologies to enhance in-store experiences and boost sales. Growing competition and demand for innovative marketing solutions are also driving this trend.

- By Location

Based on the location, the digital signage market is segmented into indoor and outdoor. The indoor segment accounted for the largest market revenue share in 2024, driven by the widespread use of digital signage in retail stores, corporate offices, and hospitality venues. Controlled indoor environments allow for better display performance and targeted content delivery. Increasing demand for interactive and dynamic indoor advertising continues to fuel growth.

The outdoor segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the advancements in weather-resistant and high-brightness display technologies that ensure visibility in all conditions. Increasing investments in smart city projects and outdoor advertising campaigns are also driving demand. This trend is fueled by the need for impactful, large-scale messaging in public spaces.

Digital Signage Market Regional Analysis

- SAUDI ARABIA dominates the Digital Signage market with the largest revenue share of 49.36% in 2025, characterized by growing demand for bright and power-efficient display panels and decline in demand for traditional billboards.

- Advanced technology infrastructure and high adoption rates across various industries. Strong retail, healthcare, and transportation sectors drive widespread use of digital signage solutions.

- Additionally, significant investments in smart cities and digital advertising contribute to market leadership. The presence of major technology companies and startups fosters continuous innovation. Growing consumer demand for interactive and personalized content further boosts adoption. Overall, the SAUDI ARABIA market benefits from a favorable environment for digital signage growth and development.

UAE Digital Signage Market Insight

The UAE Digital Signage market captured the largest revenue share of 68% within Middle East and Africa in 2025, fueled by the strong investments in retail and transportation sectors. Increasing adoption of advanced digital displays in public spaces and smart city initiatives has driven growth. Supportive government policies promoting digital transformation also contribute significantly.

Digital Signage Market Share

The Digital Signage industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V.,

- LG Display Co., Ltd.,

- Microsoft,

- SAMSUNG,

- Sony Corporation,

- Panasonic Corporation,

- Planar Systems,

- Omnivex Corporation,

- SHARP CORPORATION,

- NEC Corporation,

- AU Optronics Corp.,

- Goodview Compay,

- Scala.,

- Keywest Technology, Inc.,

- BrightSign LLC.,

- Honeywell International Inc.,

- NXP Semiconductors.,

- Microchip Technology Inc.,

- Cypress Semiconductor Corporation.,

- Texas Instruments Incorporated

Latest Developments in Middle East and Africa Digital Signage Market

-

In February 2025, PPDS unveiled the Interactive 3000 Series at Integrated Systems Europe (ISE) 2025 in Barcelona. This series offers enhanced touch responsiveness and versatility for various applications, including education and retail. The displays are designed to facilitate interactive learning and dynamic customer engagement. They feature advanced touch technology and are optimized for seamless integration into diverse environments. The launch reflects PPDS's commitment to providing innovative solutions that meet the evolving needs of businesses

- In February 2025, Samsung introduced its next-generation interactive displays and smart signage at ISE 2025. The new models include the WAF Interactive Display, QPD-5K, and QHFX series, featuring AI capabilities and enhanced user experiences. These displays are designed to improve collaboration and engagement in various settings, such as corporate environments and public spaces. The integration of AI technologies enables features like real-time content adaptation and personalized interactions. Samsung's commitment to innovation is evident in these advanced signage solutions.

- In January 2025, LG introduced advanced commercial display advertising solutions through its LG Business Cloud platform. The platform now includes LG DOOH Ads and LG Pro:Centric Stay, tailored for diverse B2B environments. LG DOOH Ads utilizes AI camera technology to analyze viewer demographics and behavior, delivering customized advertisements. This solution aims to streamline the management and operation of LG commercial displays and hotel TVs. The enhancements reflect LG's commitment to providing innovative and efficient solutions for businesses.

- In April 2025, PPDS introduced new outdoor Direct View LED (DVLED) solutions. These displays are engineered to deliver high brightness and durability, making them suitable for outdoor advertising and public spaces. The DVLED solutions are designed to withstand various environmental conditions while providing clear and vibrant visuals. They offer flexibility in installation and are compatible with a range of content management systems. The launch underscores PPDS's focus on expanding its product offerings to meet the demands of outdoor digital signage applications.

- In March 2025, Samsung showcased its Transparent MICRO LED display, offering a new dimension in digital signage. This display combines transparency with high-resolution visuals, allowing for immersive experiences in retail and architectural applications. The Transparent MICRO LED is designed to blend seamlessly into its surroundings while delivering captivating content. Its unique design opens up new possibilities for creative installations and interactive displays. Samsung's launch of this product highlights its leadership in cutting-edge display technologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Digital Signage Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Digital Signage Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Digital Signage Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.