Middle East And Africa Drug Delivery Devices Market

Market Size in USD Billion

CAGR :

%

USD

28.60 Billion

USD

54.12 Billion

2024

2032

USD

28.60 Billion

USD

54.12 Billion

2024

2032

| 2025 –2032 | |

| USD 28.60 Billion | |

| USD 54.12 Billion | |

|

|

|

|

Middle East and Africa Drug Delivery Devices Market Size

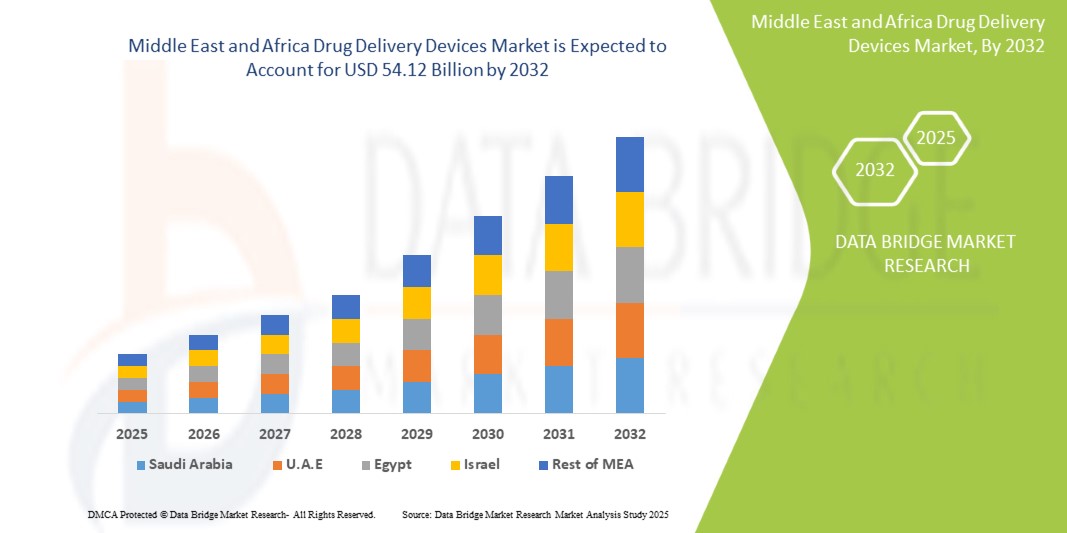

- The Middle East and Africa drug delivery devices market size was valued at USD 28.60 billion in 2024 and is expected to reach USD 54.12 billion by 2032, at a CAGR of 8.30% during the forecast period

- The market growth is largely fuelled by the increasing prevalence of chronic diseases, rising healthcare expenditure, and growing adoption of advanced drug delivery technologies across the region

- The expanding pharmaceutical manufacturing sector in countries such as Saudi Arabia and South Africa is also contributing to the market growth by boosting local production and innovation in drug delivery devices

Middle East and Africa Drug Delivery Devices Market Analysis

- The rising incidence of diabetes, cancer, and cardiovascular diseases is driving demand for efficient and patient-friendly drug delivery devices in the region

- Governments and private healthcare providers are investing in modern healthcare infrastructure, promoting the use of innovative drug delivery systems such as insulin pumps, inhalers, and injectors

- South Africa dominated the Middle East and Africa drug delivery devices market in 2024, capturing the largest revenue share, driven by its well-established private healthcare sector, strong distribution channels, and growing prevalence of non-communicable diseases

- South Arabia is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa drug delivery devices market due to strong government support for healthcare modernization under Vision 2030, increased healthcare spending, rising adoption of innovative medical technologies, and a growing patient population demanding efficient and minimally invasive therapeutic solutions

- The oral drug delivery segment accounted for the largest market revenue share in 2024, driven by its ease of administration, patient compliance, and cost-effectiveness. Tablets and capsules remain the preferred choice across a wide spectrum of therapeutic areas due to their non-invasive nature, stable formulations, and extended shelf life, particularly suitable for mass medication programs and chronic disease management in the region

Report Scope and Middle East and Africa Drug Delivery Devices Market Segmentation

|

Attributes |

Middle East and Africa Drug Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Drug Delivery Devices Market Trends

Increasing Adoption of Self-Administration and Minimally Invasive Delivery Systems

- The rising preference for self-administration drug delivery devices is transforming the healthcare landscape in the Middle East and Africa by enabling patients to manage treatments conveniently at home. These devices, including auto-injectors and inhalers, improve patient compliance and reduce hospital visits, which is especially beneficial in remote and underserved areas. This trend supports better health outcomes and lowers healthcare costs

- Growing demand for minimally invasive delivery methods, such as microneedles and transdermal patches, is accelerating innovation in the region. These systems reduce pain and risk of infection compared to traditional injections, appealing to patients with chronic conditions and improving acceptance of long-term therapies. Government initiatives promoting advanced healthcare technologies further fuel this adoption

- Affordability and ease of use are key drivers making drug delivery devices attractive for widespread use across diverse patient populations. The increasing availability of user-friendly devices helps improve treatment adherence and allows healthcare providers to monitor therapy progress remotely, enhancing overall disease management

- For instance, in 2023, several hospitals in the UAE adopted auto-injectors for diabetes and allergy treatments, resulting in improved patient satisfaction and reduced emergency room visits. This adoption highlights the practical benefits and growing acceptance of innovative delivery devices in the region

- While these trends are positively impacting market growth, sustained advancement depends on continuous device innovation, patient education, and regulatory support to ensure accessibility and safe usage

Middle East and Africa Drug Delivery Devices Market Dynamics

Driver

Expanding Healthcare Infrastructure and Increasing Prevalence of Chronic Diseases

- The rapid expansion of healthcare infrastructure across the Middle East and Africa is enabling broader access to modern drug delivery devices. Investments in healthcare facilities, along with improved supply chains, support the availability of advanced devices in urban and rural areas alike, driving market growth

- The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions is pushing demand for efficient, patient-centric drug delivery solutions. This rise in chronic illnesses necessitates sustained medication management, boosting the need for self-administration and home-use devices

- Public and private sector initiatives focused on improving healthcare accessibility and outcomes have enhanced the adoption of drug delivery technologies. Subsidized healthcare programs and partnerships with pharmaceutical companies are facilitating device distribution and awareness across diverse populations

- For instance, in 2022, Saudi Arabia launched a national initiative to promote diabetes management, incorporating auto-injectors and insulin pumps into standard treatment protocols, significantly increasing device uptake across the country

- While infrastructure growth and disease prevalence are strong growth drivers, ensuring affordability and regulatory harmonization remain essential to maintaining momentum

Restraint/Challenge

High Costs and Regulatory Complexities Limiting Market Penetration

- The relatively high costs associated with advanced drug delivery devices pose affordability challenges, especially in lower-income segments and rural communities. This limits widespread adoption and restricts market growth primarily to urban and affluent populations

- Complex regulatory requirements and lengthy approval processes in various Middle Eastern and African countries delay device commercialization and add uncertainty for manufacturers. Diverse regulatory frameworks also complicate market entry and increase compliance costs

- Inadequate healthcare professional training on device usage and limited patient awareness hinder effective adoption and optimal utilization. These knowledge gaps contribute to underuse and reduced patient confidence in novel delivery systems

- For instance, in 2023, several African countries reported slow uptake of inhaler devices due to a lack of healthcare provider training and patient education, limiting the impact of these technologies despite their availability

- Addressing cost barriers, streamlining regulations, and enhancing stakeholder education are critical to overcoming these challenges and unlocking the full potential of the drug delivery devices market in the region

Middle East and Africa Drug Delivery Devices Market Scope

The market is segmented on the basis of product type, end user, and distribution channel.

• By Product Type

On the basis of product type, the Middle East and Africa drug delivery devices market is segmented into oral drug delivery, injectable drug delivery, topical drug delivery, inhalers, ophthalmic drug delivery, nasal drug delivery, pulmonary drug delivery, transmucosal drug delivery, and implantable drug delivery. The oral drug delivery segment accounted for the largest market revenue share in 2024, driven by its ease of administration, patient compliance, and cost-effectiveness. Tablets and capsules remain the preferred choice across a wide spectrum of therapeutic areas due to their non-invasive nature, stable formulations, and extended shelf life, particularly suitable for mass medication programs and chronic disease management in the region.

The injectable drug delivery segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the increasing incidence of chronic conditions requiring biologics, vaccines, and insulin therapies. Advances in self-injection technologies, such as auto-injectors and prefilled syringes, along with expanding immunization campaigns and greater adoption of biologic treatments, are driving demand. Improved patient awareness, coupled with expanded access to cold chain logistics and healthcare infrastructure, is also enhancing injectable drug uptake across urban and rural areas.

• By End User

Based on end user, the market is segmented into hospitals, home healthcare, clinics, community healthcare, and others. The hospitals segment led the market in 2024 owing to the high volume of patient admissions, access to advanced medical infrastructure, and widespread use of drug delivery devices for inpatient treatments, surgical recovery, and emergency care. Hospitals are pivotal for implementing high-precision drug administration methods, such as intravenous infusion and controlled-release therapies, ensuring treatment adherence and dosage accuracy.

The home healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing aging population, rise in chronic diseases, and patient preference for at-home treatment options. The availability of portable drug delivery systems and remote monitoring devices has made home-based care increasingly viable, with insurers and healthcare providers encouraging cost-efficient alternatives to prolonged hospitalization.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, hospital pharmacies, pharmacy stores, and online pharmacy. The direct tenders segment dominated the market in 2024 due to strong procurement ties with government hospitals, public health programs, and non-governmental organizations. Large-scale purchases through centralized tenders ensure standardized pricing, supply consistency, and distribution to under-resourced healthcare facilities across the region.

The online pharmacy segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising internet penetration, growing consumer trust in e-commerce platforms, and convenience of doorstep medicine delivery. The increasing use of smartphones and digital payment systems, along with awareness campaigns around regulated online pharmacies, is accelerating the adoption of online channels for prescription and over-the-counter drug delivery devices.

Middle East and Africa Drug Delivery Devices Market Regional Analysis

- South Africa dominated the Middle East and Africa drug delivery devices market in 2024, capturing the largest revenue share, driven by its well-established private healthcare sector, strong distribution channels, and growing prevalence of non-communicable diseases

- The rising need for patient-centric treatments and at-home care options has accelerated the use of self-administered drug delivery devices across chronic therapy areas such as diabetes, asthma, and cancer

- The country’s strategic partnerships with global pharmaceutical and medical device companies, along with improvements in regulatory approvals and medical supply chains, continue to foster market growth

Saudi Arabia Drug Delivery Devices Market Insight

The Saudi Arabia drug delivery devices market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by large-scale healthcare investments under the Vision 2030 initiative. This initiative promotes digital health transformation, localization of medical device production, and broader access to preventive and primary care. The increasing adoption of wearable drug delivery systems, automated injectors, and smart inhalers is aligning with the government’s efforts to reduce hospital dependency and promote patient self-care.

Middle East and Africa Drug Delivery Devices Market Share

The Middle East and Africa drug delivery devices industry is primarily led by well-established companies, including:

- Julphar (U.A.E.)

- Aspen Pharmacare (South Africa)

- Cipla Medpro (South Africa)

- Tabuk Pharmaceuticals (Saudi Arabia)

- Hikma Pharmaceuticals (Jordan)

- Pharco Pharmaceuticals (Egypt)

- Jamjoom Pharma (Saudi Arabia)

- Sandoz Egypt (Egypt)

- Neopharma (U.A.E.)

- Adcock Ingram (South Africa)

Latest Developments in Middle East and Africa Drug Delivery Devices Market

- In August 2023, Janssen Pharmaceutical Companies of Johnson & Johnson Services, Inc. submitted the supplemental Biologics License Application (sBLA) to the U.S. Food and Drug Administration (FDA) seeking sanction of DARZALEX in combination with Kyprolis and dexamethasone for relapsed/refractory multiple myeloma. If approved, this will increase the product portfolio and also revenue generation of the company, which is relevant to the Middle East and Africa drug delivery devices market as it reflects the rising adoption of advanced biologics and targeted therapies in the region, driving demand for innovative delivery systems to support complex treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.