Middle East And Africa E Commerce Packaging Market

Market Size in USD Billion

CAGR :

%

USD

2.82 Billion

USD

6.06 Billion

2025

2033

USD

2.82 Billion

USD

6.06 Billion

2025

2033

| 2026 –2033 | |

| USD 2.82 Billion | |

| USD 6.06 Billion | |

|

|

|

|

Middle East and Africa E-Commerce Packaging Market Size

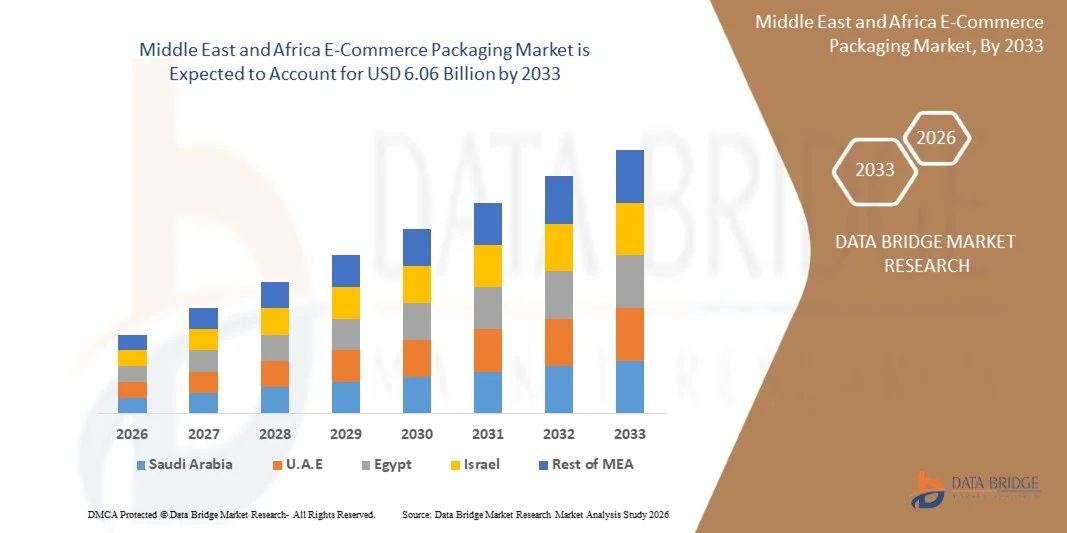

- The Middle East and Africa E-Commerce Packaging Market was valued at USD 2.82 Billion in 2025 and is expected to reach USD 6.06 Billion by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 10.1%, primarily driven by increasing consumer engagement in recreational, social, and family-oriented activities, which has significantly expanded the demand for strategy-based and educational board games—key categories that often rely on specialized, durable, and aesthetically appealing packaging formats.

- Additionally, the expansion of Middle East and Africa’s manufacturing and transportation infrastructure, combined with rising trade volumes across both domestic and international markets, is accelerating the adoption of advanced packaging solutions. The region’s strong emphasis on modern logistics, sustainability initiatives, and consumer convenience further supports consistent market momentum.

Middle East and Africa E-Commerce Packaging Market Analysis

- The Middle East and Africa E-Commerce Packaging Market is rapidly as brands integrate advanced technologies to improve efficiency, sustainability, and consumer engagement. While automation is traditionally associated with logistics and port operations, similar trends—such as digitalization, AI-driven analytics, automated stacking mechanisms, and intelligent inventory management—are increasingly shaping packaging operations across sectors including chemicals, food & beverage, pharmaceuticals, agriculture, construction, mining & minerals, waste & recycling, and consumer goods.

- These technologies are strengthening the region’s supply chain by reducing manual processes, accelerating delivery timelines, optimizing warehouse space, and supporting extensive online retail networks. Automated Stacking Cranes (ASCs), AI-guided systems, and advanced monitoring tools enable optimized storage, reduced handling time, and continuous visibility into inventory levels, helping manufacturers, distributors, and e-commerce platforms maintain supply consistency and reduce operational costs.

- The adoption of smart distribution platforms and predictive demand planning is further enhancing replenishment cycles, particularly during peak sales, new product launches, and promotional events.

- Saudi Arabia is expected to dominate the Middle East and Africa E-Commerce Packaging Market with the largest revenue share of 16.06% in 2026, driven by significant investments in logistics automation, digital infrastructure, and supply chain resilience initiatives. Major ports such as Los Angeles, Long Beach, and New York/New Jersey have already implemented ASCs, AGVs, and advanced Terminal Operating Systems (TOS) to improve throughput and reduce congestion, while key operators like APM Terminals, SSA Marine, and DP World continue to modernize handling equipment and operations.

- U.A.E. is expected to be the fastest-growing region in the Middle East and Africa E-Commerce Packaging Market during the forecast period with a CAGR of 10.7%, supported by rising containerized trade, modernization of logistics hubs, and the adoption of AI-enabled inventory tracking, autonomous vehicles, and remote-controlled cranes.

- In 2026, the Corrugated Boxes segment is expected to dominate the market with a 36.53% market share, as these packaging solutions offer an ideal balance of affordability, durability, scalability, and operational flexibility. Their ability to support high-volume e-commerce demand while maintaining cost efficiency makes them the preferred choice for manufacturers, distributors, and last-mile delivery companies across the region.

Report Scope and Middle East and Africa E-Commerce Packaging Market Segmentation

|

Attributes |

Middle East and Africa E-Commerce Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa E-Commerce Packaging Market Trends

“Adoption of Automation and Right-Sizing Systems in Fulfillment”

- Adoption of automation and right-sizing systems in fulfillment has emerged as a significant opportunity for the Middle East and Africa E-Commerce Packaging Market. As order volumes scale and SKU diversity increases, manual packing and fulfillment processes have become costlier, slower and error-prone. Automation through robotics, AI-driven picking/packing systems and right-size packaging machinery offers enhanced efficiency, reduced labor dependency, consistent throughput and optimized material usage, all of which align closely with e-commerce demand and sustainability goals. This shift positions packaging automation as a value-adding lever for firms to reduce logistics costs, improve fulfilment speed and enable scalable growth.

- In January 2025, Smart-Robotics.io reported that by 2025 an estimated four million warehouse robots are expected to be installed across 50,000 warehouses in Middle East and Africa, with automation penetration set to rise from 18 % at end-2021 to 26 % by 2027.

- In September 2024, a press release noted that the Middle East and Africa packaging automation market (covering automated packing, sealing and labelling systems) was projected to rise from USD 64.70 billion in 2022 to USD 136.47 billion by 2032.

- In July 2025, a warehouse-automation blog on eShipz cited that automation in warehouse operations can reduce costs by up to 30 % and boost throughput by over 40 %, making automation a strategic necessity in dynamic, high-volume markets such as India.

- The growing adoption of automation and right-sizing systems in e-commerce fulfillment is creating a structural opportunity for packaging suppliers and technology providers. Automation reduces cost per package, accelerates throughput, improves accuracy and supports scalability. As fulfillment centers invest in robotics and right-sizing technology, demand for automated packaging lines, modular packaging systems and smart packaging solutions is expected to rise substantially, driving growth and innovation within the Middle East and Africa E-Commerce Packaging Market

Middle East and Africa E-Commerce Packaging Market Dynamics

Driver

“Regional Internet & Smartphone Penetration in Emerging Markets”

- Regional increases in internet and smartphone penetration across emerging markets have emerged as a key driver for growth in the Middle East and Africa E-Commerce Packaging Market. As more consumers gain reliable access to mobile internet—and smartphones become the primary gateway to online shopping—online retail penetration expands rapidly, generating greater demand for packaging across diverse geographies. This digital penetration fuels higher volumes of small-parcel shipments, frequent order cycles and amplified cross-border commerce, all of which increase the need for varied, scalable packaging solutions aligned with e-commerce logistics requirements.

- In October 2023, the International Telecommunication Union (ITU) reported that 78 per cent of the Middle East and Africa population aged 10 and over owned a mobile phone, a share 11 percentage points higher than Middle East and Africa Internet-use penetration.

- In October 2024, the GSMA State of Mobile Internet Connectivity report indicated that 4.6 billion people—approximately 57 per cent of the Middle East and Africa population—were using mobile internet on personal devices, pointing to accelerating digital penetration in emerging regions.

- In July 2025, the World Bank Middle East and Africa Findex Digital Connectivity Tracker revealed that in low- and middle-income countries, smartphone adoption and digital payment usage rose markedly, reflecting broader digital commerce capabilities and enabling e-commerce growth outside high-income regions.

- In October 2025, Middle East and Africa estimates indicated that approximately 6.04 billion individuals—about 73 per cent of the world population—used the Internet, underscoring the expanding digital consumer base that underpins demand for e-commerce packaging.

- Rising internet and smartphone penetration in emerging markets is expanding the addressable base for online retail, thereby driving higher demand for e-commerce packaging. As digital inclusion broadens, packaging suppliers can anticipate sustained volume growth and diversification of packaging formats, reinforcing packaging volume expansion as a structural growth lever for the Middle East and Africa E-Commerce Packaging Market

Restraint/Challenge

“Packaging Waste Regulations and Compliance Costs”

- Packaging waste regulations and compliance costs have emerged as a significant restraining factor for the Middle East and Africa E-Commerce Packaging Market. As regulators worldwide tighten rules on packaging design, material composition, recyclability, and waste responsibility, e-commerce companies face growing pressures, from redesigning packaging to meet new standards, increasing use of recycled materials, reducing empty space, and extending producer responsibility (EPR). These regulatory burdens raise compliance costs, complicate cross-border shipments, and can force firms to re-engineer supply chains or pass costs to consumers. For a market driven by speed, convenience and low-cost shipping, stricter packaging waste laws may dampen growth or limit margin expansion.

- In December 2024, India’s Environment Ministry introduced a draft of the Environment Protection (Extended Producer Responsibility for Packaging) Rules, 2024, which, once implemented from April 2026, will require producers, importers and brand-owners to manage the full lifecycle of packaging.

- In April 2024, the European Parliament reached a provisional agreement to adopt tougher packaging rules, including targets to reduce packaging waste by 5% by 2030 (10% by 2035, 15% by 2040), bans on many single-use plastic packaging formats, and requirements that all packaging be recyclable.

- In March 2024, the Council of the European Union and European Parliament reached a provisional deal to overhaul packaging and packaging waste regulation, tightening design, recyclability, and labelling standards for all packaging, including e-commerce shipments.

- In December 2024, the Council formally adopted the new Packaging and Packaging Waste Regulation 2025/40 (PPWR), setting binding re-use and recycled-content targets, restricting single-use plastics, and requiring minimised packaging weight/volume.

- On 11 February 2025, the PPWR entered into force, thereby establishing a harmonised legal framework across the EU for all packaging placed on the market, which includes e-commerce packaging, and signalling a shift toward circular-economy compliance burdens for online retailers.

- Packaging-waste regulations have been tightened across major economies, increasing mandatory requirements for recyclability, reuse, reporting and material reduction. These measures elevate compliance costs for e-commerce packaging producers through stricter design standards, traceability obligations, recycled-content mandates and expanded producer responsibility. As regulatory thresholds rise, firms face higher operational, auditing and redesign expenses, narrowing margins and complicating market entry for smaller suppliers. Consequently, escalating compliance demands are expected to act as a structural restraint on the Middle East and Africa E-Commerce Packaging Market by increasing cost burdens and limiting flexibility in material and format selection

Middle East and Africa E-Commerce Packaging Market Scope

The Middle East and Africa E-Commerce Packaging Market is segmented into four segments based on Packaging, Material, End user, Distribution channel.

- By Packaging

On the basis of packaging, the Middle East and Africa E-Commerce Packaging Market is segmented into corrugated boxes, bags, mailers, labels, protective packaging, pallet boxes, tapes, postal packaging, and shrink film. In 2026, the Corrugated Boxes segment is expected to dominate the market with a 36.53% market share, driven by rising online shopping volumes, increasing demand for durable and cost-efficient packaging, and the rapid expansion of omnichannel retail networks. Corrugated boxes remain the preferred choice due to their high strength, recyclability, customization flexibility, and suitability for a wide range of products—from electronics and household goods to apparel, cosmetics, and consumer essentials. Additionally, the growth of subscription-based e-commerce models, improved printing technologies, and heightened sustainability requirements are reinforcing the segment’s leadership.

The Corrugated Boxes segment is the fastest-growing in the Middle East and Africa E-Commerce Packaging Market, with a CAGR of 10.7%, driven by the surge in parcel shipments, increasing adoption of sustainable and lightweight packaging solutions, and rising consumer expectations for secure, damage-free delivery. The expansion of fulfillment centers, advancements in automated box-making systems, and the shift toward right-sized packaging are further accelerating demand. Moreover, increased emphasis on recyclable materials, eco-friendly packaging mandates, and the growing presence of major e-commerce players across the U.S., Canada, and Mexico are expected to strengthen the dominance of corrugated packaging in the coming years.

- By Material

On the basis of material, the Middle East and Africa E-Commerce Packaging Market is segmented into fiber-based, recycled content and post-consumer recycled (PCR) plastics, bio-based materials, conventional plastics (virgin plastics), and others. In 2026, the fiber-based segment is expected to dominate with a 49.85% market share, driven by strong demand for sustainable, recyclable, and lightweight packaging solutions across major e-commerce categories. The shift toward eco-friendly packaging, rising environmental awareness among consumers, and the implementation of stricter sustainability regulations in the U.S. and Canada are accelerating the adoption of fiber-based materials. Additionally, the expansion of corrugated packaging production, advancements in paper strength and lightweighting technologies, and the growing preference for plastic-free packaging among brands and retailers further support the segment’s leadership.

The Bio-Based Materials segment is the fastest-growing segment in the Middle East and Africa E-Commerce Packaging Market, with a CAGR of 10.9%, driven by increasing investment in biodegradable and compostable packaging, heightened corporate sustainability commitments, and consumer preference for low-impact alternatives. Bio-based mailers, films, cushioning materials, and molded fiber solutions are gaining traction as companies work toward reducing carbon footprints and meeting ESG goals. Furthermore, innovations in plant-based polymers, government-backed green initiatives, and the rapid expansion of eco-conscious direct-to-consumer brands are accelerating market adoption across the region.

- By End User

On the basis of end-user, the Middle East and Africa E-Commerce Packaging Market is segmented into apparels and accessories (excluding leather-based), electronics and electrical, textile, household, personal care, food and beverages, pharmaceuticals, automotive, fabricated metal products, chemical products, agriculture, furniture, wood and wood products (excluding furniture), leather and leather goods, construction materials, tobacco products, and others. In 2026, the Apparels and Accessories (Ex. leather based) segment is expected to dominate the market with 14.50% market share, driven by rapid growth of online fashion retail, fast-fashion brands, and D2C apparel companies. Increasing consumer preference for convenient returns, personalized fashion subscriptions, and seasonal product launches is pushing demand for durable and lightweight packaging solutions. The rise of social commerce, influencer-led apparel promotions, and high-volume shipping cycles further reinforces the segment’s leadership in the Middle East and Africa e-commerce packaging industry.

Electronics & Electrical is the fastest-growing segment with CAGR of 11.0% in the Middle East and Africa E-Commerce Packaging Market driven by increasing online sales of consumer electronics, smart devices, home automation products, and small appliances. As these items require protective, shock-resistant, and tamper-proof packaging, demand for specialized materials such as protective mailers, molded fiber inserts, corrugated boxes, and multi-layered packaging continues to rise. Additionally, rapid product innovation, frequent device upgrades, and growing adoption of e-commerce platforms for high-value electronics—combined with the expansion of refurbished electronics marketplaces—are accelerating the need for advanced and sustainable packaging solutions across the region.

- By Distribution Channel

On the basis of distribution channel, the Middle East and Africa E-Commerce Packaging Market is segmented into direct and indirect channels. In 2026, the Direct segment is expected to dominate the market with 68.94% market share, driven by strong procurement volumes from large-scale e-commerce companies, third-party logistics (3PL) providers, and major retail organizations that prefer purchasing packaging materials directly from manufacturers. Direct channels offer benefits such as bulk pricing, customized packaging solutions, faster lead times, and long-term supplier partnerships, which are increasingly preferred by high-volume e-commerce operators. Additionally, the growing trend of vertically integrated supply chains, subscription-based packaging procurement, and automation-enabled packaging lines further strengthens the dominance of the direct distribution channel.

Direct is the fastest-growing segment with a CAGR of 10.2% in the Middle East and Africa E-Commerce Packaging Market driven by the increasing preference of e-commerce companies, fulfillment centers, and 3PL providers to source packaging materials directly from manufacturers for better cost efficiency, consistent quality, and supply reliability. Direct procurement enables large buyers to secure bulk orders, benefit from negotiated pricing, access customized packaging solutions, and streamline inventory management—critical advantages in a market where order volumes and shipment frequencies continue to rise.

Middle East and Africa E-Commerce Packaging Market Regional Analysis

- Saudi Arabia is expected to dominate the Middle East and Africa E-Commerce Packaging Market with the largest revenue share of 16.06% in 2026, supported by the country’s highly mature retail and e-commerce ecosystem, strong consumer spending power, and the presence of major online retailers, logistics providers, and packaging manufacturers. Large-scale operations by companies such as Amazon, Walmart, Target, UPS, and FedEx drive substantial demand for corrugated boxes, mailers, protective packaging, and sustainable materials. Additionally, the U.S. continues to invest heavily in automation, warehouse optimization, supply chain digitalization, and environmentally responsible packaging, further solidifying its dominant position in the region.

- United Arab Emirates (UAE) is expected to be the fastest-growing region in the Middle East and Africa E-Commerce Packaging Market during the forecast period with a CAGR of 10.7%, fueled by rapid expansion of e-commerce penetration, increasing cross-border trade, rising adoption of digital payment systems, and improving last-mile delivery infrastructure. Investments in modern logistics centers, packaging production facilities, and government initiatives supporting manufacturing competitiveness further accelerate market development. Moreover, the growth of SMEs and D2C brands in Mexico is contributing to increased consumption of flexible mailers, corrugated boxes, and protective packaging.

- Overall, increasing digital retail adoption, growth in cross-border e-commerce, sustainability-driven product innovation, and ongoing investments in logistics and fulfillment technologies are collectively strengthening the Middle East and African Middle East and Africa E-Commerce Packaging Market.

The Major Market Leaders Operating in the Market Are:

- International Paper Company (U.S.)

- Amcor PLC (Switzerland)

- DS Smith PLC (U.K.)

- Smurfit WestRock (U.S.)

- Packaging Corporation of America (PCA) (U.S.)

- Mondi PLC (U.K.)

- Klabin S.A. (Brazil)

- Oji Holdings Corporation (Japan)

- Sealed Air Corporation (U.S.)

- Nine Dragons Paper Holdings Ltd. (Hong Kong)

- 3M Company (U.S.)

- Avery Dennison Corporation (U.S.)

- Green Bay Packaging Inc. (U.S.)

- Cosmo Films (India)

- Georgia-Pacific LLC (U.S.)

- Ranpak Holdings Corp. (U.S.)

- Boxon Group AB (Sweden)

- Stora Enso (Finland)

- Pratt Industries (U.S.)

- Prem Industries India Limited (India)

- Pregis LLC (U.S.)

- Packtek (India)

- Packman Packaging Private Limited (India)

- Packhelp (Poland)

- IPG (U.S.)

- Filmar Group (Poland)

- ECB (U.S.)

- Ecom Packaging (India)

- Blue Box Packaging (U.S.)

- Altpac (India)

Latest Developments in Middle East and Africa E-Commerce Packaging

- In July 2022, Packhelp launched “carbon‑labelling” for its packaging products allowing customers to see the estimated carbon footprint of packaging orders. This aligns with growing demand for sustainable packaging in e‑commerce. Packhelp continues to position itself as a custom‑packaging marketplace with low minimum order quantities which remains attractive for e‑commerce sellers, startups, and small D2C brands who need custom packaging but don’t order in large volumes

- In April 2025, Pratt Industries, Inc. announced a commitment to invest US$ 5 billion in U.S. recycling, clean‑energy infrastructure, and manufacturing jobs, supporting a broad re‑industrialization drive.

- In September 2025, Pregis opened a new 477,000-square-foot paper converting center in Elgin, Illinois. The facility will support over 500 manufacturing jobs and can produce more than 1 billion curbside recyclable paper packaging solutions annually.

- In August 2025, Ranpak Holdings Corp. announced a major expansion of its existing relationship with Walmart. Under the terms of this strategic agreement, Walmart will install numerous Ranpak AutoFill systems across its five Next Generation Fulfillment Centers, streamlining its fulfillment process, reducing packaging waste, and simplifying work for associates.

- In September 2025, Sealed Air Corporation is advancing its strategy as a one-stop shop for fulfillment operations with the launch of the AUTOBAG 850HB Hybrid Bagging Machine, a new automated bagging system engineered to run both poly and paper mailers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY EVALUATION QUADRANT

4.3 PATENT ANALYSIS

4.3.1 PATENT FILING DISTRIBUTION BY COUNTRY

4.3.2 KEY APPLICANTS (TOP INNOVATORS)

4.3.3 TECHNOLOGY SEGMENTATION BY IPC CODES

4.3.4 PATENT TREND OVER TIME (2016–2025)

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 Packaging waste volumes and landfill pressure

4.7.1.2 Plastic pollution & microplastics

4.7.1.3 Deforestation and pulp supply stress

4.7.1.4 Greenhouse gas (GHG) emissions across the lifecycle

4.7.1.5 Water and chemical pollution

4.7.1.6 Supply chain vulnerability to extreme weather

4.7.1.7 Regulatory and consumer pressure

4.7.2 INDUSTRY RESPONSE

4.7.2.1 Material substitution and lightweighting

4.7.2.2 Design for recycling & circularity

4.7.2.3 Adoption of recycled and bio-based feedstocks

4.7.2.4 Investment in recycling & recovery partnerships

4.7.2.5 Supply-chain optimization & right-sizing

4.7.2.6 Process & energy efficiency at converters

4.7.2.7 Certification & eco-labeling

4.7.2.8 Innovation in protective solutions

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 Regulation & mandates

4.7.3.2 Standards, labelling & transparency

4.7.3.3 Fiscal instruments & incentives

4.7.3.4 Infrastructure investment

4.7.3.5 Public procurement leadership

4.7.3.6 R&D & standards support

4.7.4 ANALYST RECOMMENDATIONS

4.8 CONSUMER BUYING BEHAVIOR

4.8.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY PACKAGING

4.8.2 PREFERENCE FOR SECURE AND DAMAGE-RESISTANT PACKAGING

4.8.3 RISING IMPORTANCE OF CONVENIENCE AND EASE OF UNBOXING

4.8.4 INFLUENCE OF AESTHETIC APPEAL AND BRAND IDENTITY

4.8.5 INCREASING CONSUMER NEED FOR TRANSPARENCY AND INFORMATION

4.8.6 SHIFT TOWARD PERSONALIZED PACKAGING EXPERIENCES

4.8.7 CONCERNS ABOUT PACKAGING WASTE AND RECYCLING CONVENIENCE

4.8.8 WILLINGNESS TO PAY FOR PREMIUM PACKAGING IN CERTAIN CATEGORIES

4.8.9 CONCLUSION

4.9 COST ANALYSIS BREAKDOWN

4.9.1 TOP-LEVEL COST BUCKETS

4.9.1.1 Raw Materials

4.9.1.2 Manufacturing & Converting

4.9.1.3 Protective Inserts & Cushioning

4.9.1.4 Labour & Fulfilment Handling

4.9.1.5 Packaging Design / Customization / Printing

4.9.1.6 Logistics & Dimensional Weight Impact

4.9.1.7 Returns & Reverse Logistics

4.9.1.8 Sustainability Premium & Compliance Costs

4.9.1.9 Overheads & CAPEX Amortization

4.9.1.10 Supplier Margin / Distributor Markup

4.9.2 TYPICAL COST SHARES

4.9.2.1 Raw Materials + Converting: 50-65% of Total Packaging Cost

4.9.2.2 Labour & Fulfilment Handling: 10-20%

4.9.2.3 Protective Inserts & Void Fill: 5-15%

4.9.2.4 Design / Printing / Customization: 3-10%

4.9.2.5 Sustainability Premium / Compliance: 5-15%

4.9.2.6 Packaging as % of Fulfilment Cost: 15-20%

4.1 INDUSTRY ECOSYSTEM ANALYSIS

4.10.1 PROMINENT COMPANIES

4.10.2 SMALL & MEDIUM-SIZED COMPANIES

4.10.3 END USERS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 17.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGIN OUTLOOK AND SCENARIO ASSESSMENT

4.12.1 INTRODUCTION

4.12.2 EXPECTED MARGIN PERFORMANCE (BASE CASE)

4.12.3 MARGIN UPSIDE POTENTIAL (FAVOURABLE MARKET ENVIRONMENT)

4.12.4 MARGIN COMPRESSION RISKS (ADVERSE MARKET CONDITIONS)

4.12.5 EXPOSURE TO RAW MATERIAL PRICE VOLATILITY

4.12.6 MARGIN VARIATION BY PRODUCT CATEGORY

4.12.7 INFLUENCE OF SCALE AND AUTOMATION ON COST EFFICIENCY

4.12.8 SENSITIVITY TO DEMAND CYCLICALITY AND PRICING DYNAMICS

4.12.9 FINANCIAL IMPACT OF SUSTAINABILITY REQUIREMENTS

4.12.10 COMPETITIVE INTENSITY AND ITS EFFECT ON MARGIN STRUCTURE

4.12.11 STRATEGIC MARGIN ENHANCEMENT OPPORTUNITIES

4.12.12 CONCLUSION

4.13 RAW MATERIAL COVERAGE

4.13.1 PAPER AND PAPERBOARD: THE DOMINANT RAW MATERIAL

4.13.2 PLASTICS: FLEXIBLE, PROTECTIVE, AND LIGHTWEIGHT

4.13.3 BIODEGRADABLE AND COMPOSTABLE MATERIALS

4.13.4 MOLDED FIBER AND PULP-BASED MATERIALS

4.13.5 FOAMS AND CUSHIONING MATERIALS

4.13.6 ADHESIVES, COATINGS, AND INKS

4.13.7 EMERGING RAW MATERIALS FOR SMARTER PACKAGING

4.13.8 CONCLUSION

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 OVERVIEW

4.14.2 LOGISTIC COST SCENARIO

4.14.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.15 TECHNOLOGICAL ADVANCEMENTS

4.15.1 SMART PACKAGING AND IOT INTEGRATION

4.15.2 AUTOMATION AND ROBOTICS IN FULFILMENT CENTRES

4.15.3 RIGHT-SIZING AND ON-DEMAND PACKAGING TECHNOLOGIES

4.15.4 SUSTAINABLE AND ADVANCED MATERIAL INNOVATIONS

4.15.5 ARTIFICIAL INTELLIGENCE AND DATA-DRIVEN DESIGN

4.15.6 ANTI-COUNTERFEIT AND SECURITY TECHNOLOGIES

4.15.7 ENHANCED CUSTOMIZATION AND DIGITAL PRINTING

4.15.8 CONCLUSION

4.16 VALUE CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 RAW MATERIAL SUPPLY

4.16.3 COMPONENT MANUFACTURING AND PROCESSING

4.16.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.16.5 DISTRIBUTION AND LOGISTICS

4.16.6 END-USERS

4.16.7 CONCLUSION

4.17 VENDOR SELECTION CRITERIA

4.17.1 PRODUCT QUALITY, DURABILITY, AND COMPLIANCE

4.17.2 SUSTAINABILITY AND ENVIRONMENTAL CERTIFICATIONS

4.17.3 TECHNOLOGICAL CAPABILITIES AND INNOVATION

4.17.4 CUSTOMIZATION, BRANDING, AND CONSUMER EXPERIENCE

4.17.5 COST EFFICIENCY AND TOTAL COST OF OWNERSHIP (TCO)

4.17.6 SUPPLY CHAIN STRENGTH AND MIDDLE EAST AND AFRICA REACH

4.17.7 CERTIFICATIONS, SAFETY STANDARDS, AND INDUSTRY EXPERTISE

4.17.8 AFTER-SALES SUPPORT AND TECHNICAL ASSISTANCE

4.17.9 CONCLUSION

5 TARIFFS AND IMPACT ANALYSIS

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZs/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 REGIONAL INTERNET & SMARTPHONE PENETRATION IN EMERGING MARKETS

7.1.2 RISING CONSUMER EXPECTATIONS FOR PRODUCT PROTECTION AND DELIVERY EXPERIENCE

7.1.3 RAPID GROWTH OF ONLINE RETAIL AND FULFILLMENT NETWORKS

7.1.4 SUSTAINABILITY SHIFT TOWARD RECYCLABLE AND FIBER-BASED FORMATS

7.2 RESTRAINS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES (PAPER, RESINS, ADHESIVES)

7.2.2 PACKAGING WASTE REGULATIONS AND COMPLIANCE COSTS

7.3 OPPORTUNITY

7.3.1 ADOPTION OF AUTOMATION AND RIGHT-SIZING SYSTEMS IN FULFILLMENT

7.3.2 PREMIUMIZATION VIA DIGITAL PRINTING AND BRAND PERSONALIZATION

7.4 CHALLENGES

7.4.1 BALANCING PROTECTION WITH MATERIAL REDUCTION TARGETS

7.4.2 REVERSE LOGISTICS AND RETURNS PACKAGING OPTIMIZATION

8 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING.

8.1 OVERVIEW

8.2 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

8.2.1 CORRUGATED BOXES

8.2.2 BAGS

8.2.3 MAILER

8.2.4 LABELS

8.2.5 PROTECTIVE PACKAGING

8.2.6 PALLET BOXES

8.2.7 TAPES

8.2.8 POSTAL PACKAGING

8.2.9 SHRINK FILM

8.3 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

8.3.1 CORRUGATED BOXES

8.3.2 BAGS

8.3.3 MAILER

8.3.4 LABELS

8.3.5 PROTECTIVE PACKAGING

8.3.6 PALLET BOXES

8.3.7 TAPES

8.3.8 POSTAL PACKAGING

8.3.9 SHRINK FILM

8.4 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 NORTH AMERICA

8.4.3 EUROPE

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.5.1 ASIA-PACIFIC

8.5.2 NORTH AMERICA

8.5.3 EUROPE

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 POLYTHENE BAGS

8.6.2 COURIER BAGS

8.6.3 WOVEN SACK BAGS

8.6.4 FOAM BAGS

8.6.5 TEMPER PROOF BAGS

8.6.6 LOCK BAGS

8.6.7 OTHERS

8.7 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.7.1 POLYTHENE BAGS

8.7.2 COURIER BAGS

8.7.3 WOVEN SACK BAGS

8.7.4 FOAM BAGS

8.7.5 TEMPER PROOF BAGS

8.7.6 LOCK BAGS

8.7.7 OTHERS

8.8 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 NORTH AMERICA

8.8.3 EUROPE

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.9.1 ASIA-PACIFIC

8.9.2 NORTH AMERICA

8.9.3 EUROPE

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 MIDDLE EAST AND AFRICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 ASIA-PACIFIC

8.10.2 NORTH AMERICA

8.10.3 EUROPE

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST & AFRICA

8.11 MIDDLE EAST AND AFRICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.11.1 ASIA-PACIFIC

8.11.2 NORTH AMERICA

8.11.3 EUROPE

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 MIDDLE EAST AND AFRICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA-PACIFIC

8.12.2 NORTH AMERICA

8.12.3 EUROPE

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 MIDDLE EAST AND AFRICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.13.1 ASIA-PACIFIC

8.13.2 NORTH AMERICA

8.13.3 EUROPE

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 SELF-ADHESIVE BOPP TAPES

8.14.2 PRINTED TAPES

8.14.3 REINFORCED PAPER TAPES

8.14.4 PVC PACKING TAPES

8.14.5 PACKAGING SEALING ADHESIVE TAPES

8.14.6 RESEALABLE BAG SEALING TAPES

8.14.7 OTHERS

8.15 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.15.1 SELF-ADHESIVE BOPP TAPES

8.15.2 PRINTED TAPES

8.15.3 REINFORCED PAPER TAPES

8.15.4 PVC PACKING TAPES

8.15.5 PACKAGING SEALING ADHESIVE TAPES

8.15.6 RESEALABLE BAG SEALING TAPES

8.15.7 OTHERS

8.16 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA-PACIFIC

8.16.2 NORTH AMERICA

8.16.3 EUROPE

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

8.17 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.18.1 AIR BUBBLE ROLLS

8.18.2 CORRUGATED ROLLS

8.18.3 OTHERS

8.19 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

8.19.1 AIR BUBBLE ROLLS

8.19.2 CORRUGATED ROLLS

8.19.3 OTHERS

8.2 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.20.1 ASIA-PACIFIC

8.20.2 NORTH AMERICA

8.20.3 EUROPE

8.20.4 SOUTH AMERICA

8.20.5 MIDDLE EAST & AFRICA

8.21 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.21.1 ASIA-PACIFIC

8.21.2 NORTH AMERICA

8.21.3 EUROPE

8.21.4 SOUTH AMERICA

8.21.5 MIDDLE EAST & AFRICA

8.22 MIDDLE EAST AND AFRICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.22.1 ASIA-PACIFIC

8.22.2 NORTH AMERICA

8.22.3 EUROPE

8.22.4 SOUTH AMERICA

8.22.5 MIDDLE EAST & AFRICA

8.23 MIDDLE EAST AND AFRICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 MIDDLE EAST AND AFRICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.24.1 ASIA-PACIFIC

8.24.2 NORTH AMERICA

8.24.3 EUROPE

8.24.4 SOUTH AMERICA

8.24.5 MIDDLE EAST & AFRICA

8.25 MIDDLE EAST AND AFRICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.25.1 ASIA-PACIFIC

8.25.2 NORTH AMERICA

8.25.3 EUROPE

8.25.4 SOUTH AMERICA

8.25.5 MIDDLE EAST & AFRICA

8.26 MIDDLE EAST AND AFRICA SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.26.1 ASIA-PACIFIC

8.26.2 NORTH AMERICA

8.26.3 EUROPE

8.26.4 SOUTH AMERICA

8.26.5 MIDDLE EAST & AFRICA

8.27 MIDDLE EAST AND AFRICA SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

8.27.1 ASIA-PACIFIC

8.27.2 NORTH AMERICA

8.27.3 EUROPE

8.27.4 SOUTH AMERICA

8.27.5 MIDDLE EAST & AFRICA

9 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY MATERIAL.

9.1 OVERVIEW

9.2 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

9.2.1 FIBER-BASED

9.2.2 RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS

9.2.3 BIO-BASED MATERIALS

9.2.4 CONVENTIONAL PLASTICS (VIRGIN PLASTICS)

9.2.5 OTHERS

9.3 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 CORRUGATED BOARD

9.3.2 PAPER & PAPERBOARD

9.4 MIDDLE EAST AND AFRICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 SINGLE WALL

9.4.2 DOUBLE WALL

9.4.3 SINGLE FACE

9.4.4 TRIPLE WALL

9.4.5 OTHERS

9.5 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 NORTH AMERICA

9.5.3 EUROPE

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 MIDDLE EAST AND AFRICA RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 NORTH AMERICA

9.6.3 EUROPE

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 MIDDLE EAST AND AFRICA BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 NORTH AMERICA

9.7.3 EUROPE

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 MIDDLE EAST AND AFRICA CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 ASIA-PACIFIC

9.8.2 NORTH AMERICA

9.8.3 EUROPE

9.8.4 SOUTH AMERICA

9.8.5 MIDDLE EAST & AFRICA

9.9 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA-PACIFIC

9.9.2 NORTH AMERICA

9.9.3 EUROPE

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

10 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY END-USER.

10.1 OVERVIEW

10.2 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

10.2.1 APPARELS AND ACCESSORIES (EX. LEATHER BASED) (0001)

10.2.2 ELECTRONICS & ELECTRICAL (2500)

10.2.3 TEXTILE (0001)

10.2.4 HOUSEHOLD (2000,0001)

10.2.5 PERSONAL CARE (2000,0001)

10.2.6 FOOD AND BEVERAGES (1000,1100)

10.2.7 PHARMACEUTICALS (2100)

10.2.8 AUTOMOTIVE (4600)

10.2.9 FABRICATED METAL PRODUCTS (2500)

10.2.10 CHEMICAL PRODUCTS (2000)

10.2.11 AGRICULTURE (0100)

10.2.12 FURNITURE (0001)

10.2.13 WOOD AND WOOD PRODUCTS (EX. FURNITURE) (0001)

10.2.14 LEATHER AND LEATHER GOODS (0001)

10.2.15 CONSTRUCTION MATERIALS (2000,0001)

10.2.16 TOBACCO PRODUCTS (0001)

10.3 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.3.1 RETAIL

10.3.2 WHOLESALE

10.4 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.4.1 CORRUGATED BOXES

10.4.2 BAGS

10.4.3 MAILER

10.4.4 LABELS

10.4.5 PROTECTIVE PACKAGING

10.4.6 PALLET BOXES

10.4.7 TAPES

10.4.8 POSTAL PACKAGING

10.4.9 SHRINK FILM

10.5 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 ASIA-PACIFIC

10.5.2 NORTH AMERICA

10.5.3 EUROPE

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST & AFRICA

10.6 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.6.1 RETAIL

10.6.2 WHOLESALE

10.7 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.7.1 CORRUGATED BOXES

10.7.2 BAGS

10.7.3 MAILER

10.7.4 LABELS

10.7.5 PROTECTIVE PACKAGING

10.7.6 PALLET BOXES

10.7.7 TAPES

10.7.8 POSTAL PACKAGING

10.7.9 SHRINK FILM

10.8 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.8.1 COMPUTERS, ELECTRONIC AND OPTICAL PRODUCTS

10.8.2 ELECTRICAL EQUIPMENT

10.8.3 OTHERS

10.9 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.9.1 ASIA-PACIFIC

10.9.2 NORTH AMERICA

10.9.3 EUROPE

10.9.4 SOUTH AMERICA

10.9.5 MIDDLE EAST & AFRICA

10.1 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.10.1 RETAIL

10.10.2 WHOLESALE

10.11 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.11.1 CORRUGATED BOXES

10.11.2 BAGS

10.11.3 MAILER

10.11.4 LABELS

10.11.5 PROTECTIVE PACKAGING

10.11.6 PALLET BOXES

10.11.7 TAPES

10.11.8 POSTAL PACKAGING

10.11.9 SHRINK FILM

10.12 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.13.1 RETAIL

10.13.2 WHOLESALE

10.14 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.14.1 CORRUGATED BOXES

10.14.2 BAGS

10.14.3 MAILER

10.14.4 LABELS

10.14.5 PROTECTIVE PACKAGING

10.14.6 PALLET BOXES

10.14.7 TAPES

10.14.8 POSTAL PACKAGING

10.14.9 SHRINK FILM

10.15 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.15.1 ASIA-PACIFIC

10.15.2 NORTH AMERICA

10.15.3 EUROPE

10.15.4 SOUTH AMERICA

10.15.5 MIDDLE EAST & AFRICA

10.16 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.16.1 RETAIL

10.16.2 WHOLESALE

10.17 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.17.1 CORRUGATED BOXES

10.17.2 BAGS

10.17.3 MAILER

10.17.4 LABELS

10.17.5 PROTECTIVE PACKAGING

10.17.6 PALLET BOXES

10.17.7 TAPES

10.17.8 POSTAL PACKAGING

10.17.9 SHRINK FILM

10.18 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA-PACIFIC

10.18.2 NORTH AMERICA

10.18.3 EUROPE

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.19.1 RETAIL

10.19.2 WHOLESALE

10.2 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.20.1 CORRUGATED BOXES

10.20.2 BAGS

10.20.3 MAILER

10.20.4 LABELS

10.20.5 PROTECTIVE PACKAGING

10.20.6 PALLET BOXES

10.20.7 TAPES

10.20.8 POSTAL PACKAGING

10.20.9 SHRINK FILM

10.21 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.21.1 FOOD

10.21.2 BEVERAGES

10.22 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.22.1 ASIA-PACIFIC

10.22.2 NORTH AMERICA

10.22.3 EUROPE

10.22.4 SOUTH AMERICA

10.22.5 MIDDLE EAST & AFRICA

10.23 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.23.1 RETAIL

10.23.2 WHOLESALE

10.24 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.24.1 CORRUGATED BOXES

10.24.2 BAGS

10.24.3 MAILER

10.24.4 LABELS

10.24.5 PROTECTIVE PACKAGING

10.24.6 PALLET BOXES

10.24.7 TAPES

10.24.8 POSTAL PACKAGING

10.24.9 SHRINK FILM

10.25 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.25.1 ASIA-PACIFIC

10.25.2 NORTH AMERICA

10.25.3 EUROPE

10.25.4 SOUTH AMERICA

10.25.5 MIDDLE EAST & AFRICA

10.26 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.26.1 RETAIL

10.26.2 WHOLESALE

10.27 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

10.27.1 CORRUGATED BOXES

10.27.2 BAGS

10.27.3 MAILER

10.27.4 LABELS

10.27.5 PROTECTIVE PACKAGING

10.27.6 PALLET BOXES

10.27.7 TAPES

10.27.8 POSTAL PACKAGING

10.27.9 SHRINK FILM

10.28 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

10.28.1 SPARE PARTS

10.28.2 VEHICLE MODIFICATION PARTS

10.29 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.29.1 ASIA-PACIFIC

10.29.2 NORTH AMERICA

10.29.3 EUROPE

10.29.4 SOUTH AMERICA

10.29.5 MIDDLE EAST & AFRICA

10.3 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.30.1 RETAIL

10.30.2 WHOLESALE

10.31 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.32 ASIA-PACIFIC

10.32.1 NORTH AMERICA

10.32.2 EUROPE

10.32.3 SOUTH AMERICA

10.32.4 MIDDLE EAST & AFRICA

10.33 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.33.1 RETAIL

10.33.2 WHOLESALE

10.34 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.34.1 ASIA-PACIFIC

10.34.2 NORTH AMERICA

10.34.3 EUROPE

10.34.4 SOUTH AMERICA

10.34.5 MIDDLE EAST & AFRICA

10.35 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.35.1 RETAIL

10.35.2 WHOLESALE

10.36 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.36.1 FERTILIZERS

10.36.2 FISHING AND AQUACULTURE PRODUCTS

10.36.3 PLANTS

10.36.4 SEEDS

10.36.5 OTHERS

10.37 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.37.1 ASIA-PACIFIC

10.37.2 NORTH AMERICA

10.37.3 EUROPE

10.37.4 SOUTH AMERICA

10.37.5 MIDDLE EAST & AFRICA

10.38 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.38.1 RETAIL

10.38.2 WHOLESALE

10.39 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.39.1 ASIA-PACIFIC

10.39.2 NORTH AMERICA

10.39.3 EUROPE

10.39.4 SOUTH AMERICA

10.39.5 MIDDLE EAST & AFRICA

10.4 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.40.1 RETAIL

10.40.2 WHOLESALE

10.41 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.41.1 ASIA-PACIFIC

10.41.2 NORTH AMERICA

10.41.3 EUROPE

10.41.4 SOUTH AMERICA

10.41.5 MIDDLE EAST & AFRICA

10.42 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.42.1 RETAIL

10.42.2 WHOLESALE

10.43 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.43.1 ASIA-PACIFIC

10.43.2 NORTH AMERICA

10.43.3 EUROPE

10.43.4 SOUTH AMERICA

10.43.5 MIDDLE EAST & AFRICA

10.44 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.44.1 RETAIL

10.44.2 WHOLESALE

10.45 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.45.1 ASIA-PACIFIC

10.45.2 NORTH AMERICA

10.45.3 EUROPE

10.45.4 SOUTH AMERICA

10.45.5 MIDDLE EAST & AFRICA

10.46 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.46.1 RETAIL

10.46.2 WHOLESALE

10.47 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.47.1 ASIA-PACIFIC

10.47.2 NORTH AMERICA

10.47.3 EUROPE

10.47.4 SOUTH AMERICA

10.47.5 MIDDLE EAST & AFRICA

10.48 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

10.48.1 CORRUGATED BOXES

10.48.2 BAGS

10.48.3 MAILER

10.48.4 LABELS

10.48.5 PROTECTIVE PACKAGING

10.48.6 PALLET BOXES

10.48.7 TAPES

10.48.8 POSTAL PACKAGING

10.48.9 SHRINK FILM

10.49 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.49.1 ASIA-PACIFIC

10.49.2 NORTH AMERICA

10.49.3 EUROPE

10.49.4 SOUTH AMERICA

10.49.5 MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL.

11.1 OVERVIEW

11.2 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

11.2.1 DIRECT

11.2.2 INDIRECT

11.3 MIDDLE EAST AND AFRICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 COMPANY OWNED WEBSITES

11.3.2 FIELD AGENTS

11.3.3 DIRECT CONTRACTS

11.4 MIDDLE EAST AND AFRICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.4.1 DISTRIBUTORS / WHOLESALERS

11.4.2 VALUE-ADDED RESELLERS (VARS)

11.4.3 THIRD-PARTY ONLINE MARKETPLACES

11.5 MIDDLE EAST AND AFRICA DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 NORTH AMERICA

11.5.3 EUROPE

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 MIDDLE EAST AND AFRICA INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 NORTH AMERICA

11.6.3 EUROPE

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY GEOGRAPHY

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 UNITED ARAB EMIRATES (UAE)

12.1.3 EGYPT

12.1.4 ISRAEL

12.1.5 SOUTH AFRICA

12.1.6 QATAR

12.1.7 KUWAIT

12.1.8 BAHRAIN

12.1.9 OMAN

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET: COMPANY LANDSCAPE

13.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 MANUFACTURERS COMPANY PROFILE

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 AMCOR PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DS SMITH

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SMURFIT WESTROCK

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 PACKAGING CORPORATION OF AMERICA.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ALTPAC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AVERY DENNISON CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BLUE BOX PACKAGING

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BOXON AB

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COSMO FILMS

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 ECOM PACKAGING

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ECB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 FILMAR GROUP

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GEORGIA-PACIFIC LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 GREEN BAY PACKAGING INC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 IPG

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 KLABIN S.A

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MONDI

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 OJI HOLDINGS CORPORATION.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 PACKHELP

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PACKMAN PACKAGING PRIVATE LIMITED.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 PACKTEK

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 PRATT INDUSTRIES INC.

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 PREGIS LLC

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 PREM INDUSTRIES INDIA LIMITED

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 RANPAK

15.28.1 COMPANY SNAPSHOT

15.28.2 REVENUE ANALYSIS

15.28.3 PRODUCT PORTFOLIO

15.28.4 RECENT DEVELOPMENT

15.29 SEALED AIR

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 STORA ENSO

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENT

16 DISTRIBUTOR COMPANY PROFILE

16.1 BUNZL PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 MACFARLANE PACKAGING (A SUBSIDIARY COMPANY OF MACFARLANE GROUP PLC)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 RAJAPACK LTD

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 ULINE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 VERITIV OPERATING COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 BRAND COMPARATIVE ANALYSIS

TABLE 3 CONSUMER PREFERENCE MATRIX

TABLE 4 REGULATORY COVERAGE

TABLE 5 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 7 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 9 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 11 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 13 MIDDLE EAST AND AFRICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA MAILER IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 15 MIDDLE EAST AND AFRICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA LABELS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 17 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 19 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 21 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 23 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 25 MIDDLE EAST AND AFRICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PALLET BOXES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 27 MIDDLE EAST AND AFRICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA POSTAL PACKAGING IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 29 MIDDLE EAST AND AFRICA SHRINK FILM IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA SHRINK FILMING E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 31 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA RECYCLED CONTENT & POST-CONSUMER RECYCLED (PCR) PLASTICS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA BIO-BASED MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA CONVENTIONAL PLASTICS (VIRGIN PLASTICS) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA DIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA INDIRECT SALE IN E-COMMERCE PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA

TABLE 93 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA

TABLE 95 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 96 THOUSAND

TABLE 97 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 99 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 101 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 103 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 105 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA TEXTILE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA HOUSEHOLD IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA AUTOMOTIVE IN E-COMMERCE PACKAGING MARKET, BY COMMODITY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA FABRICATED METAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA CHEMICAL PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA AGRICULTURE IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA FURNITURE IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA WOOD AND WOOD PRODUCTS (EX. FURNITURE) IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA LEATHER AND LEATHER GOODS PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA CONSTRUCTION MATERIALS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA TOBACCO PRODUCTS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA OTHERS IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA E-COMMERCE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA DIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA INDIRECT SALES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 SAUDI ARABIA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 143 SAUDI ARABIA E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (THOUSAND UNITS)

TABLE 144 SAUDI ARABIA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 SAUDI ARABIA BAGS IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 146 SAUDI ARABIA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 SAUDI ARABIA TAPES IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 148 SAUDI ARABIA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 SAUDI ARABIA PROTECTIVE PACKAGING IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS )

TABLE 150 SAUDI ARABIA E-COMMERCE PACKAGING MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 151 SAUDI ARABIA FIBER-BASED IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 SAUDI ARABIA CORRUGATED BOARD IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 SAUDI ARABIA E-COMMERCE PACKAGING MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 154 SAUDI ARABIA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 SAUDI ARABIA APPAREL & ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 156 SAUDI ARABIA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY CHANNEL TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 SAUDI ARABIA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 158 SAUDI ARABIA ELECTRONICS & ELECTRICAL IN E-COMMERCE PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)