Middle East And Africa Esim Market

Market Size in USD Million

CAGR :

%

USD

858.53 Million

USD

1,029.82 Million

2024

2032

USD

858.53 Million

USD

1,029.82 Million

2024

2032

| 2025 –2032 | |

| USD 858.53 Million | |

| USD 1,029.82 Million | |

|

|

|

|

Middle East and Africa E-Sim Market Size

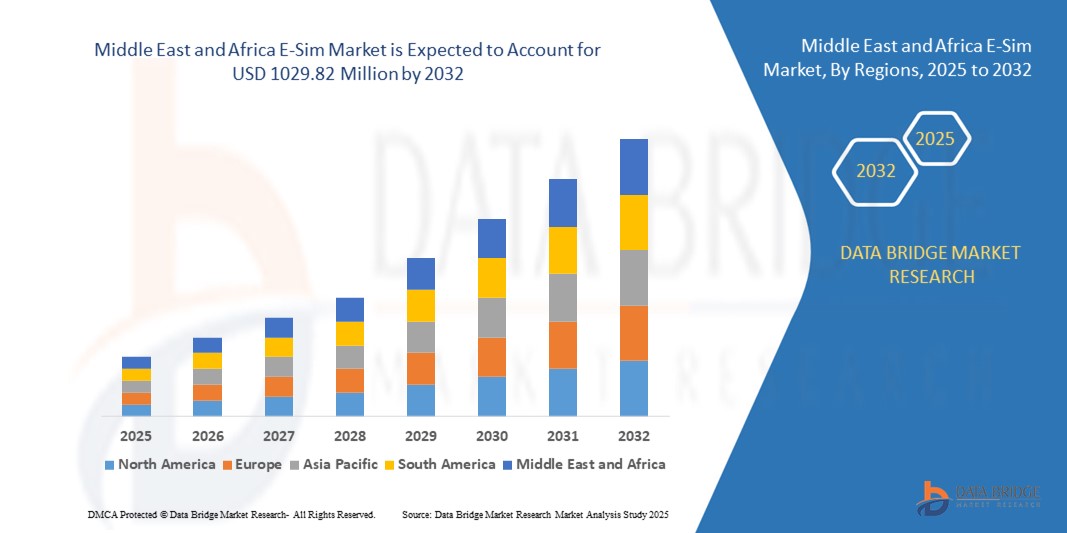

- The Middle East and Africa E-Sim market size was valued at USD 858.53 million in 2024 and is expected to reach USD 1029.82 million by 2032, at a CAGR of 2.30% during the forecast period

- The market growth is largely fuelled by the rising demand for remote SIM provisioning, increasing deployment in connected devices, and growing support from telecom operators for E-Sim-enabled services

- The expansion of 5G networks and increasing demand for compact and flexible connectivity solutions in consumer electronics are expected to further propel market growth

Middle East and Africa E-Sim Market Analysis

- The market is witnessing robust adoption across smartphones, laptops, smartwatches, and automotive applications due to enhanced user convenience and operational flexibility

- Integration of E-Sims in connected vehicles and IoT devices is expanding significantly, allowing real-time data exchange and remote device management

- Saudi Arabia E-Sim market dominated the market in 2024, driven by the country’s strategic focus on digital transformation and smart infrastructure development under Vision 2030. Growing adoption of E-Sims in consumer electronics, automotive, and IoT applications is supported by robust investments in 5G rollout and smart city initiatives

- South Africa is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa E-Sim market due to rising smartphone adoption, growing demand for flexible mobile connectivity, and expanding telecom infrastructure supporting next-generation connectivity solutions

- The hardware segment accounted for the largest market share in 2024, attributed to the growing adoption of embedded SIM chips in smartphones, tablets, and wearable devices. Manufacturers are increasingly integrating E-Sims at the production stage to streamline connectivity, reduce the need for physical SIM slots, and enable flexible design options

Report Scope and Middle East and Africa E-Sim Market Segmentation

|

Attributes |

Middle East and Africa E-Sim Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

• e& (Etisalat Group) (U.A.E.) • Cell C (South Africa) |

|

Market Opportunities |

• Expansion of E-Sim Integration in Connected Vehicles and Industrial IoT |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Middle East and Africa E-Sim Market Trends

Proliferation of Consumer Electronics with Embedded Connectivity

- The growing adoption of smartphones, smartwatches, and tablets with embedded SIM technology is reshaping the consumer electronics landscape by eliminating the need for physical SIM cards. This supports more compact designs and allows users to switch carriers remotely, enhancing user convenience and boosting market demand

- Consumer preference for minimalist designs and uninterrupted connectivity is encouraging manufacturers to integrate E-Sims into next-generation devices. This trend is gaining momentum as users seek more flexible, cross-network compatibility and improved global roaming experiences

- The surge in demand for wearable devices and fitness trackers is further accelerating the use of E-Sims, as they allow these devices to maintain standalone cellular connectivity without being tethered to smartphones

- For instance, in 2024, several leading electronics brands launched E-Sim-enabled smartwatches with cellular capabilities, allowing users to make calls, stream music, and access applications independently, further validating the trend toward embedded connectivity

- While the integration of E-Sims enhances device functionality and mobility, continued standardization, telecom interoperability, and user-friendly activation processes will be vital to ensuring smooth adoption across various consumer segments

Middle East and Africa E-Sim Market Dynamics

Driver

Surge in Demand for Remote Connectivity and Flexible Network Provisioning

• The increasing need for seamless, remote connectivity across multiple devices is a primary driver behind the growing E-Sim market. Businesses and consumers alike are turning to E-Sims to enable flexible network switching, especially in environments where physical SIM replacement is impractical or disruptive

• E-Sims allow for multiple carrier profiles on a single chip, enabling users to switch networks without changing physical SIM cards. This has vast implications for sectors such as logistics, smart appliances, and travel, where uninterrupted connectivity is essential for productivity and efficiency

• The rise of digital transformation initiatives is pushing companies to deploy E-Sims in fleet management, remote monitoring systems, and wearable technologies. Their ability to support real-time data transfer and centralized control offers significant cost and operational benefits

• For instance, in 2023, several enterprise mobility management firms adopted E-Sim-enabled solutions to streamline connectivity across global operations, enhancing device management and minimizing roaming costs

• While the driver is clear, ensuring compatibility across mobile operators and improving the user experience during remote provisioning will be key to unlocking E-Sim’s full potential across consumer and enterprise landscapes

Restraint/Challenge

Complex Activation Processes and Limited Consumer Awareness

• Despite the technological advantages, the activation and provisioning process for E-Sims remains a challenge for many users. Complex onboarding procedures, lack of universal standards, and inconsistent carrier support can create friction during activation, leading to dissatisfaction and hesitancy among potential adopters

• The limited awareness about E-Sim functionality and benefits among general consumers further hinders market penetration. Many users still rely on traditional SIM cards due to familiarity and perceived reliability, especially in regions where telecom operators have yet to fully embrace E-Sim infrastructure

• Device compatibility is another hurdle, as not all smartphones and wearables are E-Sim-ready. This limits the consumer’s ability to transition easily and restricts adoption to premium device users or tech-savvy individuals

• For instance, in 2024, several mobile retailers reported that a significant portion of their customer base required in-person assistance for E-Sim activation, reflecting the gap in user understanding and self-service enablement

• While the E-Sim market holds strong potential, addressing the complexity of provisioning processes, expanding user education, and improving interoperability will be essential to drive widespread adoption and market maturity

Middle East and Africa E-Sim Market Scope

The market is segmented on the basis of component, connectivity, data plan, architecture, pricing models, network type, deployment model, compatible device, and end-user.

- By Component

On the basis of component, the Middle East and Africa E-Sim market is segmented into hardware and services. The hardware segment accounted for the largest market share in 2024, attributed to the growing adoption of embedded SIM chips in smartphones, tablets, and wearable devices. Manufacturers are increasingly integrating E-Sims at the production stage to streamline connectivity, reduce the need for physical SIM slots, and enable flexible design options.

The services segment is expected to witness the fastest growth from 2025 to 2032 due to rising demand for remote SIM provisioning, carrier profile management, and connectivity solutions tailored for enterprise and IoT applications. Service providers are enhancing E-Sim onboarding support and subscription management platforms to enable seamless user experiences and operational efficiency.

- By Connectivity

On the basis of connectivity, the Middle East and Africa E-Sim market is segmented into voice, SMS and data, and data only. The voice, SMS and data segment dominated the market in 2024 owing to widespread usage of E-Sims in smartphones and mobile devices requiring full network capabilities. Consumers prefer multi-functional connectivity plans that offer communication flexibility across regions.

The data only segment is expected to witness the fastest growth from 2025 to 2032, driven by its use in tablets, smart meters, and IoT devices that rely solely on data transmission. Enterprises and telecom operators are increasingly offering data-centric plans to meet rising demand for lightweight, always-connected solutions.

- By Data Plan

On the basis of data plan, the Middle East and Africa E-Sim market is segmented into Less Than 2GB, 2GB–5GB, 5GB–10GB, 10GB–25GB, and More Than 25GB. The 5GB–10GB segment held the largest share in 2024 due to its suitability for most smartphone users who seek balanced data usage without excessive monthly costs. This plan tier also attracts consumers using multiple connected devices.

The More Than 25GB segment is expected to witness the fastest growth from 2025 to 2032, spurred by increasing video streaming, remote work, and cloud-based application usage, particularly in E-Sim-enabled laptops and business devices.

- By Architecture

On the basis of architecture, the Middle East and Africa E-Sim market is segmented into M2M E-Sim architecture and consumer electronics E-Sim architecture. The consumer electronics E-Sim architecture dominated the market in 2024, led by widespread usage in smartphones, wearables, and tablets that rely on seamless carrier switching and over-the-air provisioning.

The M2M E-Sim architecture segment is expected to witness the fastest growth from 2025 to 2032, driven by its integration in smart meters, automotive telematics, and industrial IoT deployments that require stable, secure, and remotely manageable connectivity.

- By Pricing Models

On the basis of pricing model, the Middle East and Africa E-Sim market is segmented into pay as you go SIMs and pay monthly SIMs. The pay monthly SIMs segment held the largest market share in 2024, as many users prefer consistent billing cycles and bundled data plans for E-Sim-enabled smartphones and tablets.

The pay as you go SIMs segment is expected to witness the fastest growth from 2025 to 2032 due to its popularity among tourists, casual users, and businesses seeking flexible connectivity solutions without long-term contracts.

- By Network Type

On the basis of network type, the Middle East and Africa E-Sim market is bifurcated into public and private. The public network segment led the market in 2024, supported by strong adoption in consumer electronics and telecom subscriber services. Public E-Sim networks allow wider accessibility and integration with existing carrier ecosystems.

The private network segment is expected to witness the fastest growth from 2025 to 2032, driven by enterprise adoption for secure, managed connectivity across manufacturing plants, logistics operations, and smart campuses where dedicated bandwidth and enhanced security are critical.

- By Deployment Model

On the basis of deployment model, the Middle East and Africa E-Sim market is segmented into on premises and cloud. The cloud segment captured the dominant market share in 2024 owing to the growing preference for cloud-based subscription management, remote SIM provisioning, and real-time analytics. Enterprises and telecom providers benefit from scalability, centralized control, and reduced operational overhead.

The on premises segment is expected to witness the fastest growth from 2025 to 2032 as select organizations, particularly in sensitive sectors, opt for localized control over E-Sim provisioning and device management infrastructure.

- By Compatible Device

On the basis of compatible device, the Middle East and Africa E-Sim market is segmented into mobile phones, tablets, laptops, wearables, smart meters, and IoT. Mobile phones accounted for the largest share in 2024, with rising consumer demand for network flexibility, international roaming convenience, and embedded connectivity.

The IoT segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing use of E-Sims in industrial automation, fleet tracking, healthcare monitoring systems, and smart agriculture, where reliable and scalable connectivity is crucial.

- By End-User

On the basis of end-user, the Middle East and Africa E-Sim market is categorized into consumer electronics, automotive, manufacturing, retail, energy and utilities, transportation and logistics, residential, sports and entertainment, agriculture, and others. The consumer electronics segment led the market in 2024 due to widespread adoption of E-Sims in personal devices such as smartphones, tablets, and smartwatches.

The automotive segment is expected to witness the fastest growth from 2025 to 2032, as connected vehicles increasingly integrate E-Sims for navigation, infotainment, telematics, and emergency response functions, enhancing safety and user experience.

Middle East and Africa E-Sim Market Regional Analysis

- Saudi Arabia E-Sim market dominated the market in 2024, driven by the country’s strategic focus on digital transformation and smart infrastructure development under Vision 2030. Growing adoption of E-Sims in consumer electronics, automotive, and IoT applications is supported by robust investments in 5G rollout and smart city initiatives

- Telecom operators are increasingly offering E-Sim-compatible plans, enhancing flexibility and convenience for users

- Saudi Arabia’s commitment to advancing technological innovation and connectivity positions it as the dominant player in the Middle East and Africa E-Sim market

South Africa E-SIM Market Insight

The South Africa E-Sim market is expected to witness the fastest growth from 2025 to 2032, fuelled by rising smartphone usage, growing demand for flexible data plans, and expanding digital infrastructure. Increased consumer awareness of E-Sim benefits and the country’s push for enhanced mobile connectivity are encouraging adoption across both urban and semi-urban areas. Local telecom providers are gradually integrating E-Sim support into their offerings, enabling a broader range of connected devices. South Africa’s digital readiness and increasing mobile penetration make it a key growth driver in the regional E-Sim market.

Middle East and Africa E-Sim Market Share

The Middle East and Africa E-Sim industry is primarily led by well-established companies, including:

• e& (Etisalat Group) (U.A.E.)

• stc

• Zain Group (Kuwait)

• MTN Group (South Africa)

• Vodacom Group (South Africa)

• Cell C (South Africa)

• Orange Egypt (Egypt)

• Omantel (Oman)

• du – Emirates Integrated Telecommunications Company (U.A.E.)

• Glo Mobile (Nigeria)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.