Middle East And Africa Extrusion Machinery Market

Market Size in USD Million

CAGR :

%

USD

997.32 Million

USD

1,333.20 Million

2024

2032

USD

997.32 Million

USD

1,333.20 Million

2024

2032

| 2025 –2032 | |

| USD 997.32 Million | |

| USD 1,333.20 Million | |

|

|

|

|

Middle East and Africa Extrusion Machinery Market Size

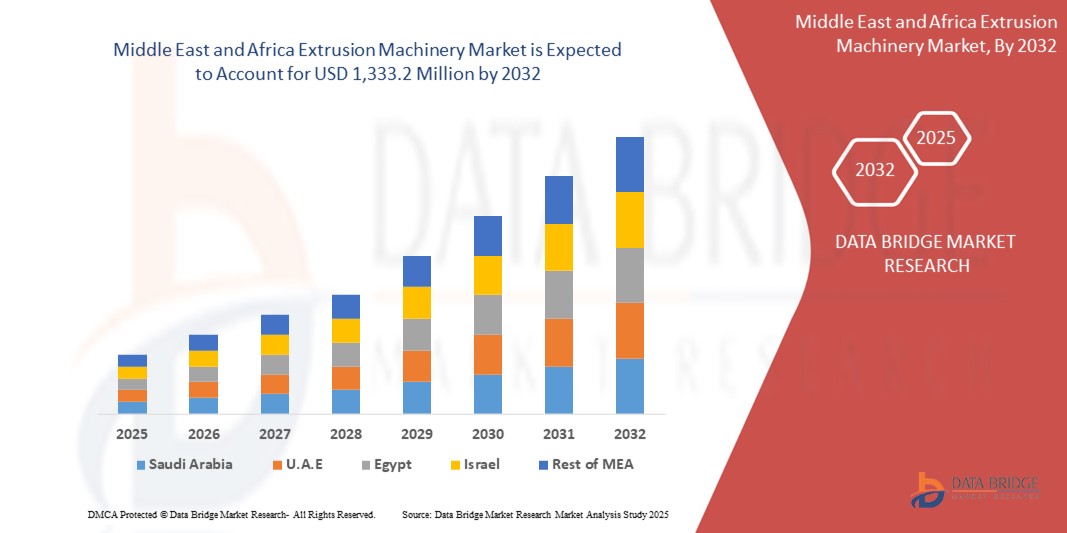

- The Middle East and Africa extrusion machinery market size was valued at USD 997.32 million in 2024 and is projected to reach USD 1,333.2 million by 2032, with a CAGR of 3.70% during the forecast period.

- Market growth is primarily driven by rising demand across industries such as packaging, construction, and automotive, along with increasing infrastructure development and industrialization in the region.

- Additionally, technological advancements in machinery design and automation, coupled with a growing focus on energy-efficient production processes, are enhancing the appeal and functionality of extrusion equipment. These factors collectively support steady market expansion across the Middle East and Africa.

Middle East and Africa Extrusion Machinery Market Analysis

- Extrusion machinery, essential for shaping materials like plastics, metals, and composites into continuous profiles, plays a critical role across industries such as packaging, construction, automotive, and consumer goods due to its high efficiency, precision, and adaptability to various material types

- Growing demand for lightweight and recyclable materials in automotive and packaging sectors, increasing construction activities in emerging economies, and advancements in automation and energy-efficient machinery are key drivers fueling the growth of the extrusion machinery market

- South Africa leads the Middle East and Africa extrusion machinery market with the largest revenue share in 2024, driven by rapid industrialization, a growing food processing sector, increasing demand for innovative products, and strong investments in manufacturing capabilities.

- Egypt is emerging as a key market within the region due to technological advancements, rising demand for processed foods, well-developed industrial infrastructure, and growing investments in automation and efficient production processes.

- Single-Screw Extruders segment dominated the market with a 41.8% share in 2024, favored for its cost-effectiveness, ease of operation, and widespread use in producing pipes, films, and sheets for industrial and commercial applications

Report Scope and Market Segmentation

|

Attributes |

Extrusion Machinery Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Extrusion Machinery Market Trends

Automation and Energy Efficiency Driving Next-Gen Machinery

- A prominent and accelerating trend in the extrusion machinery market is the integration of advanced automation technologies and energy-efficient systems to optimize productivity, reduce operational costs, and meet sustainability goals across industries such as packaging, construction, and automotive.

- For instance, leading manufacturers are incorporating programmable logic controllers (PLCs), human-machine interfaces (HMIs), and real-time monitoring systems into extrusion lines, enabling greater precision, reduced downtime, and improved quality control.

- Energy-efficient extrusion systems are gaining traction, with innovations such as variable frequency drives (VFDs), high-efficiency barrel heating, and closed-loop process controls significantly reducing energy consumption. For example, KraussMaffei’s BluePower series includes energy-optimized extruders that offer up to 20% savings in power usage.

- Additionally, the adoption of Industry 4.0 technologies is allowing manufacturers to implement predictive maintenance, remote diagnostics, and data analytics into their operations. This trend is particularly beneficial in regions like the Middle East and Africa, where industrial automation is on the rise to improve competitiveness.

- These advancements are not only improving operational efficiency but also aligning with global regulatory and environmental standards, particularly in sectors focused on reducing carbon footprints and material waste.

- As a result, demand is surging for modern extrusion machinery that combines precision engineering, automation, and energy efficiency—prompting key players such as Battenfeld-Cincinnati and Davis-Standard to focus on smart factory-compatible extrusion solutions that cater to both established and emerging markets.

Middle East and Africa Extrusion Machinery Market Dynamics

Driver

Rising Industrialization and Demand for High-Performance Manufacturing Equipment

- The steady pace of industrialization, particularly in emerging economies across the Middle East and Africa, is a key driver for the increasing demand for extrusion machinery, as industries seek efficient, high-volume manufacturing solutions for sectors such as construction, packaging, automotive, and consumer goods.

- For instance, the expansion of infrastructure and urban development projects in countries like Saudi Arabia and the UAE is significantly increasing the demand for extruded plastic and metal products used in piping, windows, panels, and cables, thereby fueling machinery sales.

- The shift toward lightweight and recyclable materials, especially in the packaging and automotive sectors, is further supporting the uptake of extrusion technology due to its ability to produce complex profiles with consistent quality and minimal waste.

- In addition, manufacturers are prioritizing productivity, cost-efficiency, and product customization, which extrusion machinery is well-positioned to deliver. The growing availability of modular and fully automated systems is also making it easier for companies to scale operations efficiently.

- The rise of smart manufacturing practices and Industry 4.0 integration is prompting further investments in extrusion systems with enhanced control systems, energy-saving components, and real-time monitoring features, enabling better quality assurance and operational optimization across production lines.

Restraint/Challenge

High Capital Investment and Skilled Labor Shortage

- One of the primary challenges facing the extrusion machinery market is the high initial capital investment required for purchasing and setting up advanced extrusion systems, which can deter small and medium-sized enterprises (SMEs) or businesses in regions with limited industrial funding.

- For instance, acquiring high-capacity, automated extrusion lines with energy-efficient features and smart controls can involve significant upfront costs, not including ongoing maintenance and operational expenses, making ROI a key concern for smaller manufacturers.

- Additionally, the efficient operation and maintenance of modern extrusion systems require skilled technical labor, which remains in short supply in several Middle Eastern and African countries. This lack of expertise can result in production inefficiencies, increased downtime, and higher operational risks, especially for facilities upgrading from older machinery to newer, more complex systems.

- Although some governments and industry players are investing in technical training programs, the gap between workforce skills and evolving machinery capabilities continues to impact adoption rates.

- Addressing these barriers through financing support, leasing models, and workforce development initiatives will be essential to support wider deployment of advanced extrusion machinery in the region and to unlock its full manufacturing potential.

Middle East and Africa Extrusion Machinery Market Scope

The market is segmented on the basis of type, product type, process output, end use.

- By Type

On the basis of type, the extrusion machinery market is segmented into direct extrusion, indirect extrusion, and hydrostatic extrusion. The direct extrusion segment dominated the market in 2024 with a revenue share of 52.4%, owing to its widespread applicability, cost-effectiveness, and ability to handle a broad range of materials including metals and plastics. Direct extrusion is favored for producing complex profiles with consistent quality and is widely used across industries such as construction and automotive.

The hydrostatic extrusion segment is expected to witness the fastest CAGR of 18.3% from 2025 to 2032. This growth is driven by its superior ability to extrude hard-to-deform materials, produce finer microstructures, and deliver high precision, making it attractive for high-tech applications like aerospace and defense. Increasing investments in advanced manufacturing and demand for lightweight, high-strength components support the rising adoption of hydrostatic extrusion technologies.

- By Product Type

Based on product type, the market is segmented into single-screw extruders, twin-screw extruders, and others. The single-screw extruders segment held the largest market share of 47.8% in 2024, largely due to its simplicity, lower maintenance costs, and versatility in processing a wide range of materials such as plastics and rubbers. Single-screw extruders are highly favored in applications like pipes, sheets, and films, especially in the packaging and construction sectors.

Twin-screw extruders are anticipated to register the fastest growth rate of 20.1% from 2025 to 2032. Their superior mixing capabilities, better control over processing parameters, and adaptability to complex compounding make them essential in the production of specialized plastic compounds and food products. Growing demand in consumer goods and food & beverage industries is propelling the adoption of twin-screw technology.

- By Process Output

On the basis of process output, the market is categorized into plastic, metal, rubber, and others. The plastic segment dominated the extrusion machinery market in 2024 with a 54.6% revenue share, driven by the booming demand for plastic products in packaging, construction, and automotive industries. Plastic extrusion machinery is preferred for its efficiency, adaptability, and ability to produce lightweight and cost-effective components.

The metal extrusion segment is expected to experience the fastest CAGR of 19.4% over the forecast period, fueled by increasing industrialization, infrastructure projects, and automotive manufacturing. Metal extrusion offers benefits such as enhanced mechanical properties, recyclability, and suitability for lightweight yet strong parts, leading to a surge in demand, especially in aerospace and defense sectors.

- By End Use

The extrusion machinery market is segmented by end use into construction, consumer goods, automotive, food and beverage, healthcare, aerospace & defense, and others. The construction segment held the largest market share of 38.5% in 2024, supported by rapid urbanization, infrastructure expansion, and rising demand for plastic and metal components such as pipes, window frames, and insulation materials. The segment benefits from continuous investment in residential and commercial projects across the region.

The food and beverage segment is projected to witness the fastest growth with a CAGR of 21.5% from 2025 to 2032, driven by increasing demand for processed and packaged food products. The need for high-quality, consistent extrusion in food production, such as snacks and pet food, coupled with automation and hygiene standards, is fueling growth. Additionally, rising consumer awareness of convenience foods supports expanding machinery adoption in this sector.

Middle East and Africa Extrusion Machinery Market Regional Insight

- South Africa is projected to dominate the Middle East and Africa extrusion machinery market in 2024, capturing the largest revenue share. This leadership position is attributed to the country’s accelerated pace of industrialization, which is creating a favorable environment for machinery adoption across diverse sectors.

- The expansion of the food processing industry plays a particularly crucial role, as extrusion technology is increasingly used in producing packaged foods, snacks, and other value-added products to meet rising consumer demand. In addition, growing consumer preference for innovative and customized products is encouraging manufacturers to invest in advanced extrusion machinery that supports flexibility and efficiency.

- Furthermore, robust investments in the country’s manufacturing infrastructure and technological capabilities are enhancing production capacities, boosting competitiveness, and positioning South Africa as a central hub for extrusion machinery growth in the broader MEA region.

South Africa Extrusion Machinery Market Insight

The South Africa extrusion machinery market is anticipated to witness steady growth, supported by increasing industrial production and the automotive sector’s expansion. The growing focus on upgrading manufacturing facilities to meet global standards is driving the adoption of advanced extrusion technologies. Additionally, government incentives aimed at industrial development and import substitution are bolstering market growth. The demand for versatile machinery that can cater to both local consumption and export markets remains strong.

Egypt Extrusion Machinery Market Insight

The Egypt extrusion machinery market is gaining traction due to the country’s expanding manufacturing base and supportive government policies encouraging industrial growth. Demand from sectors such as construction, automotive parts, and consumer goods is driving machinery adoption. Increasing foreign direct investment and infrastructure projects are expected to further stimulate market growth. Egypt’s strategic location also positions it as a hub for machinery distribution within the region.

Saudi Arabia Extrusion Machinery Market Insight

The Saudi Arabia extrusion machinery market is witnessing strong growth, fueled by the Kingdom’s ambitious industrial diversification under Vision 2030. Expanding demand from the construction, packaging, and automotive sectors is driving machinery adoption, supported by significant investments in advanced manufacturing technologies. The country’s large-scale infrastructure projects, rising urbanization, and robust demand for innovative consumer goods are further propelling market expansion. Moreover, strong government initiatives to localize production and reduce import dependency are positioning Saudi Arabia as a leading destination for extrusion machinery investments in the Middle East.

U.A.E. Extrusion Machinery Market Insight

The U.A.E. extrusion machinery market is gaining momentum, driven by the nation’s rapidly growing construction and packaging industries and its focus on building a knowledge-based, innovation-driven economy. Increasing adoption of advanced extrusion machinery is supported by high levels of foreign investment, favorable trade policies, and world-class industrial infrastructure. The country’s role as a regional trade and logistics hub enhances machinery distribution opportunities, while its strong emphasis on sustainability and smart manufacturing is encouraging the integration of modern, energy-efficient extrusion technologies. The U.A.E.’s dynamic business environment continues to make it an attractive market for global extrusion machinery players.

Middle East and Africa Extrusion Machinery Market Share

Middle East and Africa Extrusion Machinery Market Leaders Operating in the Market Are:

- Davis Standard (U.S.)

- Coperion GmbH (U.S.)

- Milacron, LLC (An Operating Company Of Hillenbrand) (U.S.)

- Leistritz Extrusionstechnik GmbH (Germany)

- NFM/Welding Engineers Inc. (U.S.)

- Gneuß Kunststofftechnik GmbH (Germany)

- Reifenhauser (Germany)

- " TECNOMATIC SRL" (Italy)

- KraussMaffei (Germany)

- Kabra ExtrusionTechnik Ltd.(India)

- Nordson Corporation (U.S.)

Recent Developments in Global Extrusion Machinery Market

- In June 2023, KraussMaffei Group, a leading German extrusion machinery manufacturer, announced the expansion of its production facility in Haiyan, China. This strategic move is aimed at strengthening its presence in the Asia-Pacific market and meeting growing regional demand for high-performance extrusion systems. The facility will focus on producing advanced machinery tailored for packaging, construction, and automotive sectors, emphasizing the company’s global commitment to localized manufacturing and customer-centric innovation.

- In May 2023, Davis-Standard LLC, a U.S.-based extrusion technology leader, launched its next-generation MEDD extruder platform designed specifically for medical tubing applications. This development enhances precision, process control, and cleanroom compatibility, addressing the growing demand in the healthcare industry. The introduction of the MEDD extruder underscores Davis-Standard’s continued focus on industry-specific solutions and advancing extrusion technology for high-growth markets.

- In April 2023, Battenfeld-Cincinnati, a key player in extrusion systems, introduced a new high-output, energy-efficient twin-screw extruder targeting the construction and infrastructure sectors. The launch took place at Chinaplas 2023, reflecting the company's emphasis on sustainable solutions and expanding global footprint. The new system delivers increased throughput and reduced energy consumption, supporting manufacturers’ goals for efficiency and environmental compliance.

- In March 2023, Hillenbrand, Inc., the parent company of Coperion and other industrial brands, announced a strategic collaboration with major polymer producers to develop customized compounding and extrusion lines. This initiative focuses on enhancing productivity and sustainability across plastics processing industries. The partnership reflects Hillenbrand’s strategic intent to deliver integrated, value-driven solutions that align with evolving customer needs in high-performance extrusion applications.

- In January 2023, Milacron, a global leader in plastics processing technologies, unveiled its upgraded extrusion platform at Plastindia 2023. The new system incorporates Industry 4.0 features, including real-time monitoring, predictive maintenance, and digital twin capabilities. Aimed at boosting operational efficiency and reducing downtime, this innovation highlights Milacron’s dedication to driving smart manufacturing practices and delivering future-ready extrusion machinery to a global customer base.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Extrusion Machinery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Extrusion Machinery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Extrusion Machinery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.