Middle East And Africa Flame Retardant For Electronic Electrical And Appliances Market

Market Size in Thousand

CAGR :

%

395,113.82 Thousand

506,893.99 Thousand

2024

2032

395,113.82 Thousand

506,893.99 Thousand

2024

2032

| 2025 –2032 | |

| USD 395,113.82 Thousand | |

| USD 506,893.99 Thousand | |

|

|

|

|

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Size

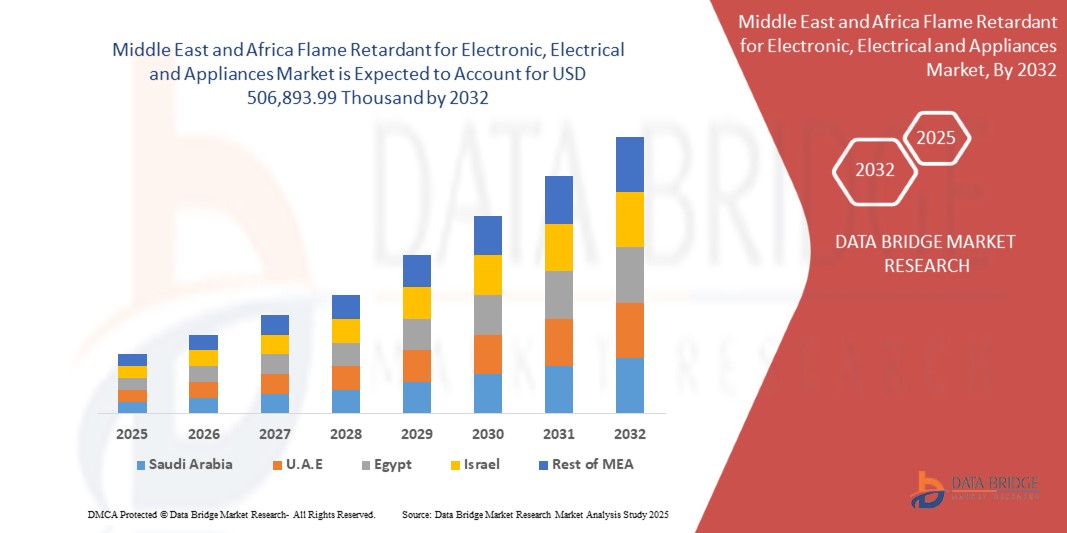

- The Middle East and Africa Flame retardant for electronic, electrical and appliances market size was valued at USD 395,113.82 thousand in 2024 and is expected to reach USD 506,893.99 thousand by 2032, at a CAGR of 3.24% during the forecast period

- This growth is driven by factors such as the Increasing demand for consumer electronics and rising use in industrial and commercial applications

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Analysis

- Flame retardant for electronic, electrical and appliancess are used to reduce or prevent fire risks in electronic, electrical and appliances components. These substances are essential for improving fire safety in products such as circuit boards, cables, connectors, and appliance housings

- The demand for these microscopes is significantly driven by rising use in industrial and commercial applications and expansion of electrical infrastructure

- Saudi Arabia is expected to dominate the Flame retardant for electronic, electrical and appliancess market due to its growing industrial base, increasing demand for electronic products, and the rise in manufacturing activities in the country

- Saudi Arabia is expected to be the fastest growing country in the Flame retardant for electronic, electrical and appliances market during the forecast period due to rapid industrialization, with a focus on expanding its electronics, electrical, and appliance manufacturing sectors

- Non-halogenated segment is expected to dominate the market with a market share of 61.14% due to increasing environmental concerns, stricter regulations regarding the use of halogenated chemicals, and growing demand for safer, more sustainable alternatives

Report Scope and Flame retardant for electronic, electrical and appliances Market Segmentation

|

Attributes |

Flame retardant for electronic, electrical and appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Trends

“Advancements in Operating Microscopes & 3D Visualization for Intraocular Surgery”

- One prominent trend in the evolution of operating microscopes and 3D visualization systems for intraocular surgery is the increasing integration of advanced optics and digital enhancements

- These innovations enhance surgical precision by offering high-definition, real-time visualization of intraocular structures, improving accuracy in delicate procedures.

- For instance, modern 3D visualization systems provide superior depth perception, enabling surgeons to navigate complex intraocular anatomy with greater clarity, which is particularly beneficial for vitreoretinal surgeries and minimally invasive glaucoma procedures.

- These advancements are transforming intraocular surgery, improving patient outcomes, and driving the demand for next-generation surgical microscopes with cutting-edge visualization capabilities

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Dynamics

Driver

“Increasing demand for consumer electronics”

- Demand for electronic devices such as smartphones, tablets, laptops, televisions, and smart home appliances has surged dramatically

- These devices require a complex assembly of components, Printed Circuit Boards (PCBs), connectors, casings, and wires, all of which must comply with stringent fire safety standards to prevent electrical fires and enhance end-user safety

- In emerging markets, rising disposable incomes and increasing internet penetration are driving higher adoption rates of personal electronics

For instance,

- In July 2023, as per the Department of Ecology, manufacturers added flame retardants to the plastic casings of electronic devices, such as televisions and computers, to meet flammability standards and reduce fire risks. This practice helps prevent the spread of flames in case of internal malfunctions

- The booming consumer electronics industry significantly accelerates demand for flame retardants worldwide. As devices become more integrated, compact, and widespread, the need for advanced, safe, and sustainable fire-resistant materials will only grow—positioning the flame retardant market as a vital enabler of safety and innovation in electronics

Opportunity

“Technological innovation in data centers and 5g infrastructure”

- The rollout of 5G technology and the expansion of data centers are driving the demand for high-performance, flame-retardant materials in the Electrical and Electronics (E&E) sector

- The growing number of data centers, which house high-capacity servers and electrical equipment, amplifies the need for flame-retardant materials.

- With the increased density of components in modern data centers, the risk of electrical fires rises, making flame-retardant cables and circuit boards essential for fire safety and regulatory compliance

For instance,

- In August 2024, the International Telecommunication Union (ITU) emphasized the need for flame-retardant materials in the construction of 5G base stations and equipment. As 5G technology requires denser infrastructure with more powerful electrical components, the use of flame-retardant cables and circuit boards becomes critical to prevent fire hazards in high-density environments. This push for safety standards is driving increased demand for flame-retardant materials in 5G infrastructure

- To meet the demands of both 5G networks and data centers, manufacturers are turning to advanced flame-retardant materials, including halogen-free and low-toxicity solutions. These innovations enhance fire safety while minimizing environmental impact. As both 5G and data center infrastructure continue to grow, the demand for flame-retardant components will increase, presenting significant opportunities for the flame-retardant market.

Restraint/Challenge

“Recycling challenges due to contamination and processing limitations”

- The increasing use of flame-retardant materials in various industries has led to significant challenges in recycling these materials, particularly due to contamination and limitations in processing capabilities

- Flame-retardant chemicals, such as brominated and chlorinated compounds, are often added to plastics, textiles, and electronic components to reduce flammability. However, these substances complicate the recycling process due to their chemical properties

- The presence of flame retardants can contaminate recycled materials, making them unsuitable for reuse in new products. The recycling process typically involves shredding, melting, and remolding materials, but when flame-retardant chemicals are present, they can release toxic fumes or cause undesirable chemical reactions during these stages, leading to unsafe materials for consumer products

For instance,

- In May 2024, a report by the Swedish Environmental Protection Agency addressed the growing concern over the presence of flame-retardant chemicals in textiles and plastic products. The agency highlighted that the use of these chemicals in consumer goods has created barriers to the recycling of post-consumer waste, particularly in clothing and plastic packaging. The challenge is particularly pronounced in the textile industry, where recycling rates are low, and the presence of flame retardants further complicates the process

- Consequently, To ensure sustainability, innovations in safer, recyclable flame retardants and improved recycling technologies are essential for mitigating environmental and health risks

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Plastic |

|

|

By End Use |

|

In 2025, the non-halogenated is projected to dominate the market with a largest share in type segment

The non-halogenated segment is expected to dominate the Flame retardant for electronic, electrical and appliances market with the largest share of 61.14% in 2025 due to its excellent thermal stability, high impact resistance, and optical clarity, making it an ideal choice for electronic, electrical and appliances applications.

The PC is expected to account for the largest share during the forecast period in plastic segment

In 2025, the PC segment is expected to dominate the market with the largest market share of 36.92% due to its excellent thermal stability, high impact resistance, and optical clarity, making it an ideal choice for electronic, electrical and appliances applications.

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Regional Analysis

“Saudi-Arabia Holds the Largest Share in the Flame retardant for electronic, electrical and appliances Market”

- Saudi-Arabia dominates the Flame retardant for electronic, electrical and appliances market, driven by rapid industrialization, a high concentration of electronics and electrical manufacturing, and strong demand for consumer electronics

- The Saudi-Arabia holds a significant share due to its robust electronics and appliance manufacturing base, favorable government policies, and increasing domestic consumption

- The country benefits from well-established supply chains, availability of raw materials, and the presence of leading Middle East and Africa manufacturers

- In addition, the Increasing awareness regarding fire safety regulations and the need for flame retardant materials in household and industrial electronic products further fuels market expansion

“Saudi-Arabia is Projected to Register the Highest CAGR in the Flame retardant for electronic, electrical and appliances Market”

- The Saudi-Arabia country is expected to witness the highest growth rate in the Flame retardant for electronic, electrical and appliances market, driven by continuous growth in consumer electronics, increasing adoption of electric and smart appliances, and rising urbanization

- The country is seeing a surge in demand for innovative and high-performance materials, particularly in electronics and appliance manufacturing, as domestic consumption continues to rise

- Additionally, the need for lightweight, durable, and thermally resistant components in electronics and appliances will further fuel the market growth in Saudi Arabia

Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF (Germany)

- Clariant (Germany)

- DIC CORPORATION (Japan)

- LANXESS (Germany)

- Plastibends (India)

- Albemarle Corporation (U.S.)

- Ampacet Corporation (U.S.)

- Nouryo (Netherlands)

- Gabriel-Chemie GmbH (Austria)

- Blendcolours (India)

- Americhem (U.S.)

- Tosaf Compounds Ltd (Israel)

Latest Developments in Middle East and Africa Flame Retardant for Electronic, Electrical and Appliances Market

- In January 2025, BASF's advanced flame-retardant grade of Ultramid T6000 polyphthalamide (PPA) was adopted for terminal block applications, replacing non-FR materials to improve safety in inverter and motor systems of Electric Vehicles (EVs). It supports electrical safety enhancement in electric vehicles, making it a functional upgrade with direct implications for thermal protection, reliability, and compliance in automotive electrical systems.

- In July 2022, BASF and THOR GmbH combined their expertise in non-halogenated flame retardant additives to offer a comprehensive solution that improved sustainability and performance in select plastic compounds while meeting strict fire safety standards.

- In May 2022, BASF expanded its Polyphthalamide (PPA) portfolio with various flame-retardant grades offering high thermal stability, excellent electrical insulation, and low water uptake. These halogen-free materials featured RTI values above 140°C, improved color stability, and enabled safer, more reliable applications across e-mobility, electronics, appliances, and power connectors.

- In October 2023, Clariant inaugurated a new USD 66.78 million Exolit OP flame retardant plant in Daya Bay, China. Aimed at meeting Asia’s demand for sustainable fire protection, the facility enhances local supply capabilities. A second production line is under construction, set to launch in 2024

- In September 2022, Gabriel-Chemie introduced a new series of halogen-free flame retardant masterbatches for the electrical conduits and tubes market, emphasizing the company's commitment to sustainability. These masterbatches comply with flame retardant standard EN 61386, halogen-free standard EN 50642, and low smoke standard IEC 61304-2. Benefits include reduced toxic gas emissions during fires, enhanced recyclability, and minimized corrosion of electronic equipment and machinery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF BUYERS

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.4.1 OVERVIEW OF FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES PRICES

4.4.2 FACTORS INFLUENCING PRICING TRENDS

4.4.3 PRICE VOLATILITY AND MARKET OUTLOOK

4.4.4 CONCLUSION

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 RAW MATERIAL COVERAGE

4.8.1 SUPPLY CHAIN CONSIDERATIONS:

4.8.2 ENVIRONMENTAL AND REGULATORY TRENDS:

4.8.3 CONCLUSION:

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TARIFFS AND THEIR IMPACT ON MARKET

4.10.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.10.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.10.3 VENDOR SELECTION CRITERIA DYNAMICS

4.10.4 IMPACT ON SUPPLY CHAIN

4.10.4.1 RAW MATERIAL PROCUREMENT

4.10.4.2 MANUFACTURING AND PRODUCTION

4.10.4.3 LOGISTICS AND DISTRIBUTION

4.10.4.4 PRICE PITCHING AND POSITION OF MARKET

4.10.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.10.5.1 SUPPLY CHAIN OPTIMIZATION

4.10.5.2 JOINT VENTURE ESTABLISHMENTS

4.10.6 IMPACT ON PRICES

4.10.7 REGULATORY INCLINATION

4.10.7.1 GEOPOLITICAL SITUATION

4.10.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.10.7.2.1 FREE TRADE AGREEMENTS

4.10.7.2.2 ALLIANCE ESTABLISHMENTS

4.10.7.3 STATUS ACCREDITATION (INCLUDING MFN)

4.10.7.4 DOMESTIC COURSE OF CORRECTION

4.10.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.10.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.11.1 DEVELOPMENT OF HALOGEN-FREE FLAME RETARDANTS

4.11.2 ECO-FRIENDLY AND SUSTAINABLE FORMULATIONS

4.11.3 NANO-TECHNOLOGY INTEGRATION

4.11.4 SYNERGISTIC ADDITIVE SYSTEMS

4.11.5 SMART AND REACTIVE FLAME RETARDANTS

4.12 WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE) REGULATIONS

4.12.1 RESTRICTION OF HAZARDOUS FLAME RETARDANTS

4.12.2 DESIGN FOR RECYCLING AND ECO-FRIENDLY MATERIALS

4.12.3 EXTENDED PRODUCER RESPONSIBILITY (EPR)

4.12.4 TRANSPARENCY AND MATERIAL DOCUMENTATION

4.12.5 CONCLUSION

4.13 FLAME RETARDANT DATA TABLE

4.14 REQUIREMENT

4.15 DATA SOURCING ANALYSIS

4.15.1 PRIMARY SOURCING

4.15.2 SECONDARY SOURCING

4.15.2.1 CHEMICAL INDUSTRIES

4.15.2.2 SCIENTIFIC RESEARCH

4.15.2.3 ARTICLES & LITERATURE REVIEW

4.15.2.4 AMONG OTHERS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CONSUMER ELECTRONICS

6.1.2 EXPANSION OF ELECTRICAL INFRASTRUCTURE

6.1.3 RISING USE IN INDUSTRIAL AND COMMERCIAL APPLICATIONS

6.2 RESTRAINTS

6.2.1 COMPLEXITY OF MANUFACTURING PROCESS

6.2.2 DEPENDENCY ON RAW MATERIALS FROM SPECIFIC REGIONS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL INNOVATION IN DATA CENTERS AND 5G INFRASTRUCTURE

6.3.2 ADVANCEMENTS IN ECO-FRIENDLY FLAME RETARDANTS

6.4 CHALLENGES

6.4.1 RECYCLING CHALLENGES DUE TO CONTAMINATION AND PROCESSING LIMITATIONS

6.4.2 HEALTH HAZARDS AND ENVIRONMENTAL TOXICITY

7 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-HALOGENATED

7.3 HALOGENATED

8 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC

8.1 OVERVIEW

8.2 PC

8.3 ABS

8.4 PP

8.5 PE

8.6 PS

8.7 OTHERS

9 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE

9.1 OVERVIEW

9.2 ELECTRICAL AND ELECTRONICS

9.3 HOUSEHOLD APPLIANCES

9.4 PROFESSIONAL APPLIANCES

10 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION

10.1 MIDDLE EAST & AFRICA

10.1.1 SAUDI ARABIA

10.1.2 U.A.E.

10.1.3 SOUTH AFRICA

10.1.4 EGYPT

10.1.5 QATAR

10.1.6 KUWAIT

10.1.7 OMAN

10.1.8 ISRAEL

10.1.9 BAHRAIN

10.1.10 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ALBEMARLE CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 BASF

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 WEIFANG MINGRUN CHEMICAL CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 DIC CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 RECENT FINANCIALS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 CLARIANT

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 INDUSTRIES PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 AMERICHEM

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMPACET CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 BLENDCOLOURS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 CROMEX S/A

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DONGGUAN JIEFU FLAME RETARDANT MATERIAL CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 DOVER CHEMICAL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 GABRIEL-CHEMIE GESELLSCHAFT M.B.H.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 GREEN VIEW TECHNOLOGY AND DEVELOPMENT CO., LTD

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 KANDUI INDUSTRIES PRIVATE LIMITED

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LANXESS

13.15.1 COMPANY SNAPSHOT

13.15.2 RECENT FINANCIALS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 NOURYON

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 PLASTIBLENDS

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 SHANDONG HAIWANG CHEMICAL CO., LTD

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 TOSAF COMPOUNDS LTD.

13.19.1 COMPANY SNAPSHOT

13.19.2 SOLUTION PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 XINOMER AG

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA -HALOGENATED

TABLE 2 MIDDLE EAST AND AFRICA -NON_HALOGENATED

TABLE 3 MIDDLE EAST AND AFRICA -HALOGENATED

TABLE 4 MIDDLE EAST AND AFRICA -NON_HALOGENATED

TABLE 5 MIDDLE EAST AND AFRICA -HALOGENATED

TABLE 6 MIDDLE EAST AND AFRICA -NON_HALOGENATED

TABLE 7 REGULATORY COVERAGE

TABLE 8 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 10 MIDDLE EAST AND AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (TONS)

TABLE 12 MIDDLE EAST AND AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PC IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA ABS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PP IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA PE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA PS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA OTHERS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 40 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 42 MIDDLE EAST AND AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SAUDI ARABIA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SAUDI ARABIA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 59 SAUDI ARABIA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SAUDI ARABIA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 SAUDI ARABIA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.A.E. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.A.E. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 76 U.A.E. NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.A.E. PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.A.E. CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.A.E. HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.A.E. BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.A.E. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 82 U.A.E. FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 83 U.A.E. ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 U.A.E. ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.A.E. ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.A.E. ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.A.E. HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 U.A.E. HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.A.E. PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 90 U.A.E. PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 93 SOUTH AFRICA NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH AFRICA PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SOUTH AFRICA HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 EGYPT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 EGYPT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 110 EGYPT NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 EGYPT PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 EGYPT CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 EGYPT HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 EGYPT BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 EGYPT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 116 EGYPT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 117 EGYPT ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 EGYPT ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 EGYPT ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 EGYPT ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 EGYPT HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 EGYPT HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 EGYPT PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 EGYPT PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 QATAR FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 QATAR FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 127 QATAR NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 QATAR PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 QATAR CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 QATAR HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 QATAR BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 QATAR FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 133 QATAR FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 134 QATAR ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 135 QATAR ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 QATAR ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 QATAR ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 QATAR HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 QATAR HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 QATAR PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 QATAR PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 KUWAIT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 KUWAIT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 144 KUWAIT NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 KUWAIT PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 KUWAIT CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 KUWAIT HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 KUWAIT BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 KUWAIT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 150 KUWAIT FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 151 KUWAIT ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 152 KUWAIT ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 KUWAIT ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 KUWAIT ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 KUWAIT HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 KUWAIT HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 KUWAIT PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 KUWAIT PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 OMAN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 OMAN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 161 OMAN NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 OMAN PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 OMAN CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 OMAN HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 OMAN BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 OMAN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 167 OMAN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 168 OMAN ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 OMAN ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 OMAN ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 OMAN ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 OMAN HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 173 OMAN HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 OMAN PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 OMAN PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 ISRAEL FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 ISRAEL FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 178 ISRAEL NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 ISRAEL PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 ISRAEL CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 ISRAEL HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ISRAEL BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ISRAEL FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 184 ISRAEL FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 185 ISRAEL ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 186 ISRAEL ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 ISRAEL ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 ISRAEL ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 ISRAEL HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 190 ISRAEL HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 ISRAEL PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 192 ISRAEL PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 BAHRAIN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 BAHRAIN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 195 BAHRAIN NON-HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 BAHRAIN PHOSPHORUS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 BAHRAIN CHLOROPHOSPHATE IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BAHRAIN HALOGENATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 BAHRAIN BROMINATED IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 BAHRAIN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY PLASTIC, 2018-2032 (USD THOUSAND)

TABLE 201 BAHRAIN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 202 BAHRAIN ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 BAHRAIN ELECTRICAL CABLES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 BAHRAIN ELECTRICAL FACILITIES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 BAHRAIN ELECTRICAL AND ELECTRONICS IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 BAHRAIN HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 207 BAHRAIN HOUSEHOLD APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 BAHRAIN PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 209 BAHRAIN PROFESSIONAL APPLIANCES IN FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 REST OF MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 REST OF MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE, 2018-2032 (TONS)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 2 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET END USE COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: SEGMENTATION

FIGURE 12 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASING DEMAND FOR CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 THE NON-HALOGENATED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET

FIGURE 24 TOTAL NUMBER OF MOBILE PHONES SOLD WORLDWIDE EACH YEAR

FIGURE 25 TOP STATES FOR UTILITY- AND SMALL-SCALE SOLAR (COMBINED) CAPACITY AND GENERATION IN 2023

FIGURE 26 MIDDLE EAST AND AFRICA MOTOR VEHICLE SALES BY COUNTRY IN 2021

FIGURE 27 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY TYPE, 2024

FIGURE 28 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY PLASTIC, 2024

FIGURE 29 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: BY END USE, 2024

FIGURE 30 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: SNAPSHOT (2024)

FIGURE 31 MIDDLE EAST AND AFRICA FLAME RETARDANT FOR ELECTRONIC, ELECTRICAL AND APPLIANCES MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Flame Retardant For Electronic Electrical And Appliances Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Flame Retardant For Electronic Electrical And Appliances Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Flame Retardant For Electronic Electrical And Appliances Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.