Middle East And Africa Flat Glass Market

Market Size in USD Million

CAGR :

%

USD

8,552.92 Million

USD

15,253.95 Million

2022

2030

USD

8,552.92 Million

USD

15,253.95 Million

2022

2030

| 2023 –2030 | |

| USD 8,552.92 Million | |

| USD 15,253.95 Million | |

|

|

|

Middle East and Africa Flat Glass Market Analysis and Size

The Middle East and Africa flat glass market is expected to grow with a significant rate during the forecast period. This growth is mainly attributed to the growing sales of automotive vehicles in this region. Flat glass has numerous applications in the automotive industry such as manufacturing of headlights, windshields, windows, and other automotive components. Moreover, increasing number of solar energy installations and the growing penetration of glass architecture in non-residential and residential constructions across this region are projected to enhance market growth in the forecast period.

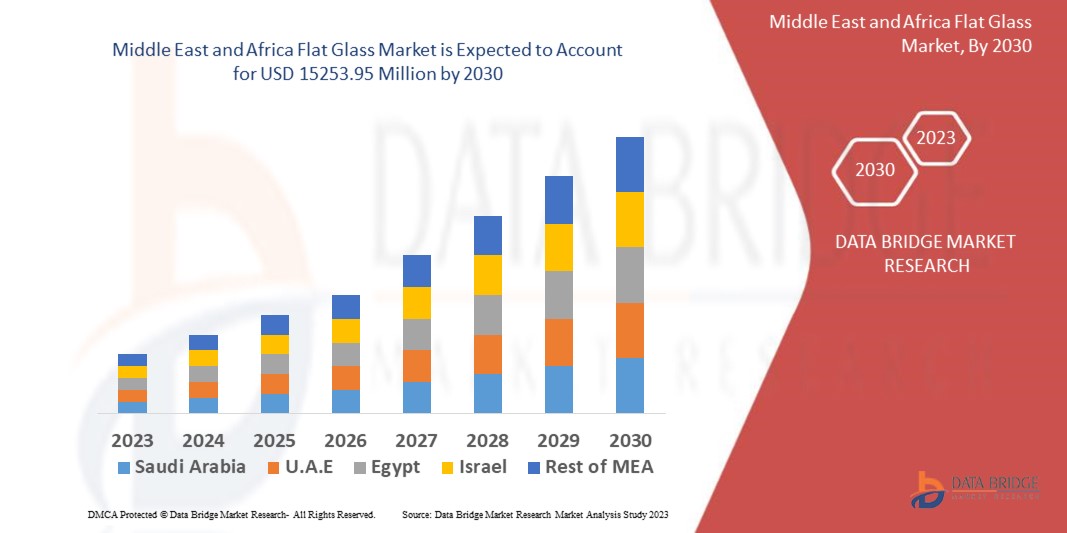

Data Bridge Market Research analyses that the flat glass market is expected to reach USD 15253.95 million by 2030, which is USD 8552.92 million in 2022, registering a CAGR of 7.50% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Middle East and Africa Flat Glass Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 - 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Tempered, Flat, Annealed, Mirror Glass, Float Glass, Extra Clear Glass, Clear Glass, Cast Glass, Tinted Glass, Wired Glass, Special Flat Glass, Patterned Glass or Textured Glass, Blown Flat Glass and Others), Function (UV Filter Glass, Heat Insulation Glass, Safety Glazing, Soundproofed Glazing, Self-Cleaning Glass, ION Exchange Glass and Others), Product (Coated and Uncoated), Application (Building and Construction, Automotive, Aerospace, Electronic Appliances, Solar Energy, Furniture and Others) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) |

|

Market Players Covered |

Nippon Sheet Glass Co., Ltd., (Japan), Saint-Gobain (France), Sisecam (Turkey), SCHOTT AG (Germany), Taiwan Glass Ind. Corp. (Taiwan), Xinyi Glass Holdings Limited., (China), AGC Inc., (Japan), Central Glass Co. Ltd., (Japan), Cardinal Glass Industries, Inc., (U.S.), CEVITAL (Algeria), China Glass Holdings Limited (China), GUARDIAN INDUSTRIES (U.S.), Fuyao Glass Industry Group Co., Ltd., (China), Saint-Gobain (France), Beijing Northglass Technologies Co. Ltd., (China), arcon Flach- und Sicherheitsglas GmbH & Co. KG (Germany), Dellner Romag Ltd., (U.K.), Qingdao Tsing Glass Co. Limited (China) and Guangzhou Topo Glass Co., Ltd., (China) |

|

Market Opportunities |

|

Market Definition

Flat glass is made by a molten glass. The flat glass formed when molten glass is spread out into the sheets on the metal plane. This glass is available in the flat sheets of paper, also known as sheet glass and plate glass. Flat glass is normally used in automotive glass, mirrors, doors, window and solar panels. Sometimes, it is bent after manufacture, to use in architectural and automotive areas, which is also measured as recent flat glass applications.

Middle East and Africa Flat Glass Market Dynamics

Drivers

- Surging demand of flat glass due to various advantages

The flat glass used in residential and non-residential areas provides several advantages, such as dust resistance; refraction, transmission, absorption of light; efficiency in terms of rust resistance; cost and energy; better insulation; weather resistance; many colour options and flexibility. The flat glass provides better features such as theft protection, protection from harmful radiations, and several other facilities. The rising demand for flat glass due to various advantages is expected to drive the market's growth rate.

- Increasing demand of flat glass in construction sector

Rapidly growing construction activities have increased government focus on developing commercial infrastructure, including smart cities. With the growing construction industry, increase the demand of different types of materials in construction industry which includes flat glass. This is also the major factor which is expected to drive the growth rate of the market during forecast period.

Opportunities

- Growing demand of flat glass in multiple sector

Increasing end-use industries such as architecture, automotive, energy among others is expected to increase the demand for flat glass in the forecast period. The growth and expansion of the building and construction sector is expected to create numerous opportunities for the market growth over the forecast period. For instance, according to Global Construction Perspectives and Oxford Economics data, the global construction sector is anticipated to reach around US$ 17.5 trillion by 2030, which is US$ 8 trillion growth from 2015. Moreover, increasing demand for energy efficient products is anticipated to boost the demand for these glasses in energy applications. For instance, flat glass is also used in the manufacture of low-E glass, solar control glass and others. Thus, increasing adoption of energy efficient products will create immense opportunities for the market growth over the forecast period.

Restraints/ Challenges

- Fluctuating cost of raw materials of flat glass

The demand of the flat glass may be restrained by fluctuating cost of raw materials used in the glass sector such as heavy fuel oil (HFO), silica sand, limestone and natural gas (NG), soda ash, and others. These glasses are more expensive than other ones, restraining the demand from the consumer’s perspective and obstructing the growth rate of the flat glass market.

This flat glass market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the flat glass market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Flat Glass Market

The outbreak of Covid-19 was started from Wuhan city after that it spread overall the globe. Now it has become a global crisis. The governments have imposed stringent rule which includes lockdown and social distancing guidelines globally during this pandemic. The flat glass market is also affected by the lockdown because production works are halted. Lack of production has affected the supply and demand of the flat glass. The construction industries are the main consumer of flat glass and due to this lockdown the construction works are on a pause which has decreased the demand for flat glass. Furthermore, the major market players of the flat glass are trying their best to upsurge the market's growth rate and is anticipated to witness high demand after the post-covid condition.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In 2021, KCC Glass Corporation, South Korea-based flat glass manufacturer, started the construction of a new float glass plant in Indonesia worth US$ 350 million. This new glass plant is anticipated to be operational by 2024.

- In 2022, Compagnie de Saint-Gobain S.A. is a France-based multinational corporation. This company is manufacturing glasses and other construction materials have announced that the company attained zero carbon production during manufacture of flat glass by using green energy and recycled materials and. This initiative is anticipated to support company’s strategy to objective carbon neutrality by 2050.

Middle East and Africa Flat Glass Market Scope

The flat glass market is segmented on the basis of type, function, product and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Tempered

- Flat

- Annealed

- Mirror Glass

- Float Glass

- Extra Clear Glass

- Clear Glass

- Cast Glass

- Tinted Glass

- Wired Glass

- Special Flat Glass

- Patterned Glass or Textured Glass

- Blown Flat Glass

- Others

Function

- UV Filter Glass

- Heat Insulation Glass

- Safety Glazing

- Soundproofed Glazing

- Self-Cleaning Glass

- ION Exchange Glass

- Others

Product

- Coated

- Uncoated

Application

- Building and Construction

- Automotive

- Aerospace

- Electronic Appliances

- Solar Energy

- Furniture

- Others

Flat Glass Market Regional Analysis/Insights

The flat glass market is analyzed and market size insights and trends are provided by country, type, function, product and application as referenced above.

The countries covered in the flat glass market report are Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

U.A.E is expected to dominate the flat glass in terms of market share and revenue growth owing to the increasing usage of tempered products in commercial construction industry in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Flat Glass Market Share Analysis

The flat glass market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to flat glass market.

Some of the major players operating in the flat glass market are:

- Nippon Sheet Glass Co., Ltd., (Japan)

- Saint-Gobain (France)

- Sisecam (Turkey)

- SCHOTT AG (Germany)

- Taiwan Glass Ind. Corp. (Taiwan)

- Xinyi Glass Holdings Limited., (China)

- AGC Inc., (Japan)

- Central Glass Co. Ltd., (Japan)

- Cardinal Glass Industries, Inc., (U.S.)

- CEVITAL (Algeria)

- China Glass Holdings Limited (China)

- GUARDIAN INDUSTRIES (U.S.)

- Fuyao Glass Industry Group Co., Ltd., (China)

- Saint-Gobain (France)

- Beijing Northglass Technologies Co. Ltd., (China)

- arcon Flach- und Sicherheitsglas GmbH & Co. KG (Germany)

- Dellner Romag Ltd., (U.K.)

- Qingdao Tsing Glass Co. Limited (China)

- Guangzhou Topo Glass Co., Ltd., (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA FLAT GLASS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA FLAT GLASS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 MIDDLE EAST AND AFRICA FLAT GLASS MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6. PRICE INDEX

7. PRODUCTION CAPACITY OVERVIEW

8. SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9. CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10. MIDDLE EAST AND AFRICA FLAT GLASS MARKET, BY TYPE, (2018-2032), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

10.1 OVERVIEW

10.2 FLOAT GLASS

10.2.1 ASP

10.2.2 VALUE

10.2.3 VOLUME

10.3 CAST GLASS

10.3.1 ASP

10.3.2 VALUE

10.3.3 VOLUME

10.4 BLOWN FLAT GLASS

10.4.1 ASP

10.4.2 VALUE

10.4.3 VOLUME

10.5 CLEAR GLASS

10.5.1 ASP

10.5.2 VALUE

10.5.3 VOLUME

10.6 TINTED GLASS

10.6.1 ASP

10.6.2 VALUE

10.6.3 VOLUME

10.7 PATTERNED GLASS OR TEXTURED GLASS

10.7.1 ASP

10.7.2 VALUE

10.7.3 VOLUME

10.8 WIRED GLASS

10.8.1 ASP

10.8.2 VALUE

10.8.3 VOLUME

10.9 EXTRA CLEAR GLASS

10.9.1 ASP

10.9.2 VALUE

10.9.3 VOLUME

10.10 SPECIAL FLAT GLASS

10.10.1 ASP

10.10.2 VALUE

10.10.3 VOLUME

10.11 ARCHITECTURAL GLASS

10.11.1 ASP

10.11.2 VALUE

10.11.3 VOLUME

10.12 SECURITY GLASS

10.12.1 ASP

10.12.2 VALUE

10.12.3 VOLUME

10.12.4 SECURITY GLASS, BY TYPE

10.12.4.1. BULLET PROOF GLASS

10.12.4.2. FIRE PROOF GLASS

10.12.4.3. BLAST PROOF

10.12.4.4. ATTACK PROOF

10.12.4.5. OTHERS

10.13 OTHERS

10.13.1 ASP

10.13.2 VALUE

10.13.3 VOLUME

11. MIDDLE EAST AND AFRICA FLAT GLASS MARKET, BY PRODUCT, (2018-2032), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

11.1 OVERVIEW

11.2 UNCOATED

11.2.1 ASP

11.2.2 VALUE

11.2.3 VOLUME

11.3 COATED

11.3.1 ASP

11.3.2 VALUE

11.3.3 VOLUME

11.3.4 COATED, BY COATING RESIN

11.3.4.1. POLYURETHANE

11.3.4.2. EPOXY

11.3.4.3. ACRYLIC

11.3.4.4. ALKYD RESIN

11.3.4.5. SILICONE RESIN

11.3.4.6. OTHERS

11.3.5 COATED, BY COATING TECHNOLOGY

11.3.5.1. SOLVENT-BASED

11.3.5.2. WATER-BASED

11.3.5.3. NANO COATINGS

11.3.6 COATED, BY COATING PROCESS

11.3.6.1. PHYSICAL VAPOR DEPOSITION (PVD) (MAGNETRON SPUTTERING)

11.3.6.2. SOL-GEL

11.3.6.3. CHEMICAL VAPOR DEPOSITION (CVD) (PYROLYTIC)

11.3.6.3.1. PLASMA-ENHANCED (PECVD)

11.3.6.3.2. ATMOSPHERIC PRESSURE (APCVD)

11.3.6.3.3. LOW PRESSURE (LPCVD)

12. MIDDLE EAST AND AFRICA FLAT GLASS MARKET, BY FUNCTION, (2018-2032), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

12.1 OVERVIEW

12.2 UV FILTER GLASS

12.2.1 ASP

12.2.2 VALUE

12.2.3 VOLUME

12.3 HEAT INSULATION GLASS

12.3.1 ASP

12.3.2 VALUE

12.3.3 VOLUME

12.4 SAFETY GLAZING

12.4.1 ASP

12.4.2 VALUE

12.4.3 VOLUME

12.5 SOUNDPROOFED GLAZING

12.5.1 ASP

12.5.2 VALUE

12.5.3 VOLUME

12.6 SELF-CLEANING GLASS

12.6.1 ASP

12.6.2 VALUE

12.6.3 VOLUME

12.7 ION EXCHANGE GLASS

12.7.1 ASP

12.7.2 VALUE

12.7.3 VOLUME

12.8 OTHERS

12.8.1 ASP

12.8.2 VALUE

12.8.3 VOLUME

13. MIDDLE EAST AND AFRICA FLAT GLASS MARKET, BY THICKNESS, (2018-2032), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

13.1 OVERVIEW

13.2 2 MM

13.2.1 ASP

13.2.2 VALUE

13.2.3 VOLUME

13.3 3 MM

13.3.1 ASP

13.3.2 VALUE

13.3.3 VOLUME

13.4 4 MM

13.4.1 ASP

13.4.2 VALUE

13.4.3 VOLUME

13.5 5 MM

13.5.1 ASP

13.5.2 VALUE

13.5.3 VOLUME

13.6 6 MM

13.6.1 ASP

13.6.2 VALUE

13.6.3 VOLUME

13.7 8 MM

13.7.1 ASP

13.7.2 VALUE

13.7.3 VOLUME

13.8 10 MM

13.8.1 ASP

13.8.2 VALUE

13.8.3 VOLUME

13.9 12 MM

13.9.1 ASP

13.9.2 VALUE

13.9.3 VOLUME

13.10 OTHERS

13.10.1 ASP

13.10.2 VALUE

13.10.3 VOLUME

14. MIDDLE EAST AND AFRICA FLAT GLASS MARKET, BY APPLICATION, (2018-2032), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

14.1 OVERVIEW

14.2 BUILDING AND CONSTRUCTION

14.2.1 ASP

14.2.2 VALUE

14.2.3 VOLUME

14.2.4 BUILDING AND CONSTRUCTION, BY APPLICATION

14.2.4.1. RESIDENTIAL

14.2.4.2. COMMERCIAL

14.2.4.3. INDUSTRIAL

14.2.4.4. INSTITUTIONAL

14.2.5 BUILDING AND CONSTRUCTION, BY TYPE

14.2.5.1. FLOAT GLASS

14.2.5.2. CAST GLASS

14.2.5.3. BLOWN FLAT GLASS

14.2.5.4. CLEAR GLASS

14.2.5.5. TINTED GLASS

14.2.5.6. PATTERNED GLASS OR TEXTURED GLASS

14.2.5.7. WIRED GLASS

14.2.5.8. EXTRA CLEAR GLASS

14.2.5.9. SPECIAL FLAT GLASS

14.2.5.10. ARCHITECTURAL GLASS

14.2.5.11. SECURITY GLASS

14.2.5.12. OTHERS

14.3 FURNITURE

14.3.1 ASP

14.3.2 VALUE

14.3.3 VOLUME

14.3.4 FURNITURE, BY TYPE

14.3.4.1. FLOAT GLASS

14.3.4.2. CAST GLASS

14.3.4.3. BLOWN FLAT GLASS

14.3.4.4. CLEAR GLASS

14.3.4.5. TINTED GLASS

14.3.4.6. PATTERNED GLASS OR TEXTURED GLASS

14.3.4.7. WIRED GLASS

14.3.4.8. EXTRA CLEAR GLASS

14.3.4.9. SPECIAL FLAT GLASS

14.3.4.10. ARCHITECTURAL GLASS

14.3.4.11. SECURITY GLASS

14.3.4.12. OTHERS

14.4 AEROSPACE

14.4.1 ASP

14.4.2 VALUE

14.4.3 VOLUME

14.4.4 AEROSPACE, BY TYPE

14.4.4.1. FLOAT GLASS

14.4.4.2. CAST GLASS

14.4.4.3. BLOWN FLAT GLASS

14.4.4.4. CLEAR GLASS

14.4.4.5. TINTED GLASS

14.4.4.6. PATTERNED GLASS OR TEXTURED GLASS

14.4.4.7. WIRED GLASS

14.4.4.8. EXTRA CLEAR GLASS

14.4.4.9. SPECIAL FLAT GLASS

14.4.4.10. ARCHITECTURAL GLASS

14.4.4.11. SECURITY GLASS

14.4.4.12. OTHERS

14.5 ELECTRONIC APPLIANCES

14.5.1 ASP

14.5.2 VALUE

14.5.3 VOLUME

14.5.4 ELECTRONIC APPLIANCES, BY TYPE

14.5.4.1. FLOAT GLASS

14.5.4.2. CAST GLASS

14.5.4.3. BLOWN FLAT GLASS

14.5.4.4. CLEAR GLASS

14.5.4.5. TINTED GLASS

14.5.4.6. PATTERNED GLASS OR TEXTURED GLASS

14.5.4.7. WIRED GLASS

14.5.4.8. EXTRA CLEAR GLASS

14.5.4.9. SPECIAL FLAT GLASS

14.5.4.10. ARCHITECTURAL GLASS

14.5.4.11. SECURITY GLASS

14.5.4.12. OTHERS

14.6 SOLAR ENERGY

14.6.1 ASP

14.6.2 VALUE

14.6.3 VOLUME

14.6.4 SOLAR ENERGY, BY TYPE

14.6.4.1. PHOTOVOLTAIC SOLAR POWER SYSTEM

14.6.4.2. CONCENTRATED SOLAR POWER SYSTEM

14.6.5 SOLAR ENERGY, BY TYPE

14.6.5.1. FLOAT GLASS

14.6.5.2. CAST GLASS

14.6.5.3. BLOWN FLAT GLASS

14.6.5.4. CLEAR GLASS

14.6.5.5. TINTED GLASS

14.6.5.6. PATTERNED GLASS OR TEXTURED GLASS

14.6.5.7. WIRED GLASS

14.6.5.8. EXTRA CLEAR GLASS

14.6.5.9. SPECIAL FLAT GLASS

14.6.5.10. ARCHITECTURAL GLASS

14.6.5.11. SECURITY GLASS

14.6.5.12. OTHERS

14.7 AUTOMOTIVE

14.7.1 ASP

14.7.2 VALUE

14.7.3 VOLUME

14.7.4 AUTOMOTIVE, BY APPLICATION

14.7.4.1. OEM

14.7.4.2. AFTERMARKET

14.7.5 AUTOMOTIVE, BY TYPE

14.7.5.1. FLOAT GLASS

14.7.5.2. CAST GLASS

14.7.5.3. BLOWN FLAT GLASS

14.7.5.4. CLEAR GLASS

14.7.5.5. TINTED GLASS

14.7.5.6. PATTERNED GLASS OR TEXTURED GLASS

14.7.5.7. WIRED GLASS

14.7.5.8. EXTRA CLEAR GLASS

14.7.5.9. SPECIAL FLAT GLASS

14.7.5.10. ARCHITECTURAL GLASS

14.7.5.11. SECURITY GLASS

14.7.5.12. OTHERS

14.8 OTHERS

14.8.1 ASP

14.8.2 VALUE

14.8.3 VOLUME

14.8.4 OTHERS, BY TYPE

14.8.4.1. FLOAT GLASS

14.8.4.2. CAST GLASS

14.8.4.3. BLOWN FLAT GLASS

14.8.4.4. CLEAR GLASS

14.8.4.5. TINTED GLASS

14.8.4.6. PATTERNED GLASS OR TEXTURED GLASS

14.8.4.7. WIRED GLASS

14.8.4.8. EXTRA CLEAR GLASS

14.8.4.9. SPECIAL FLAT GLASS

14.8.4.10. ARCHITECTURAL GLASS

14.8.4.11. SECURITY GLASS

14.8.4.12. OTHERS

15. MIDDLE EAST AND AFRICA FLAT GLASS MARKET, BY COUNTRY, (2018-2032), (USD MILLION) (TONS)

15.1 MIDDLE EAST AND AFRICA FLAT GLASS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 MIDDLE EAST AND AFRICA

15.2.1 SOUTH AFRICA

15.2.2 EGYPT

15.2.3 NIGERIA

15.2.4 ALGERIA

15.2.5 MOROCCO

15.2.6 SAUDI ARABIA

15.2.7 UNITED ARAB EMIRATES

15.2.8 ISRAEL

15.2.9 REST OF MIDDLE EAST AND AFRICA

16. MIDDLE EAST AND AFRICA FLAT GLASS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16.2 MERGERS AND ACQUISITIONS

16.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.4 EXPANSIONS

16.5 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17. SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18. MIDDLE EAST AND AFRICA FLAT GLASS MARKET - COMPANY PROFILES

18.1 AGC INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 PRODUCTION CAPACITY OVERVIEW

18.1.4 SWOT ANALYSIS

18.1.5 REVENUE ANALYSIS

18.1.6 RECENT UPDATES

18.2 NIPPON SHEET GLASS CO., LTD.

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 PRODUCTION CAPACITY OVERVIEW

18.2.4 SWOT ANALYSIS

18.2.5 REVENUE ANALYSIS

18.2.6 RECENT UPDATES

18.3 SAINT-GOBAIN.

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 PRODUCTION CAPACITY OVERVIEW

18.3.4 SWOT ANALYSIS

18.3.5 REVENUE ANALYSIS

18.3.6 RECENT UPDATES

18.4 SCHOTT

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 PRODUCTION CAPACITY OVERVIEW

18.4.4 SWOT ANALYSIS

18.4.5 REVENUE ANALYSIS

18.4.6 RECENT UPDATES

18.5 ŞIŞECAM

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 PRODUCTION CAPACITY OVERVIEW

18.5.4 SWOT ANALYSIS

18.5.5 REVENUE ANALYSIS

18.5.6 RECENT UPDATES

18.6 CEVITAL

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 PRODUCTION CAPACITY OVERVIEW

18.6.4 SWOT ANALYSIS

18.6.5 REVENUE ANALYSIS

18.6.6 RECENT UPDATES

18.7 GUARDIAN INDUSTRIES HOLDINGS SITE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 PRODUCTION CAPACITY OVERVIEW

18.7.4 SWOT ANALYSIS

18.7.5 REVENUE ANALYSIS

18.7.6 RECENT UPDATES

18.8 CSG HOLDING CO.,LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 PRODUCTION CAPACITY OVERVIEW

18.8.4 SWOT ANALYSIS

18.8.5 REVENUE ANALYSIS

18.8.6 RECENT UPDATES

18.9 GULF GLASS INDUSTRIES CO. LLC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 PRODUCTION CAPACITY OVERVIEW

18.9.4 SWOT ANALYSIS

18.9.5 REVENUE ANALYSIS

18.9.6 RECENT UPDATES

18.10 EMIRATES FLOAT GLASS (EFG) LLC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 PRODUCTION CAPACITY OVERVIEW

18.10.4 SWOT ANALYSIS

18.10.5 REVENUE ANALYSIS

18.10.6 RECENT UPDATES

18.11 ARABIAN UNITED FLOAT GLASS COMPANY

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 PRODUCTION CAPACITY OVERVIEW

18.11.4 SWOT ANALYSIS

18.11.5 REVENUE ANALYSIS

18.11.6 RECENT UPDATES

18.12 UNIVERSAL GLASS AND ALUMINIUM LLC.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 PRODUCTION CAPACITY OVERVIEW

18.12.4 SWOT ANALYSIS

18.12.5 REVENUE ANALYSIS

18.12.6 RECENT UPDATES

18.13 DUBAI GLASS INDUSTRY

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 PRODUCTION CAPACITY OVERVIEW

18.13.4 SWOT ANALYSIS

18.13.5 REVENUE ANALYSIS

18.13.6 RECENT UPDATES

18.14 BURHANI GLASS FACTORY

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 PRODUCTION CAPACITY OVERVIEW

18.14.4 SWOT ANALYSIS

18.14.5 REVENUE ANALYSIS

18.14.6 RECENT UPDATES

18.15 GLASS WORLD INDUSTRIES

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 PRODUCTION CAPACITY OVERVIEW

18.15.4 SWOT ANALYSIS

18.15.5 REVENUE ANALYSIS

18.15.6 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19. RELATED REPORTS

20. QUESTIONNAIRE

21. CONCLUSION

22. ABOUT DATA BRIDGE MARKET RESEARCH

Middle East And Africa Flat Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Flat Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Flat Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.