Middle East And Africa Flooring Materials Market

Market Size in USD Billion

CAGR :

%

USD

23.46 Billion

USD

37.96 Billion

2024

2032

USD

23.46 Billion

USD

37.96 Billion

2024

2032

| 2025 –2032 | |

| USD 23.46 Billion | |

| USD 37.96 Billion | |

|

|

|

|

Middle East and Africa Flooring Materials Market Size

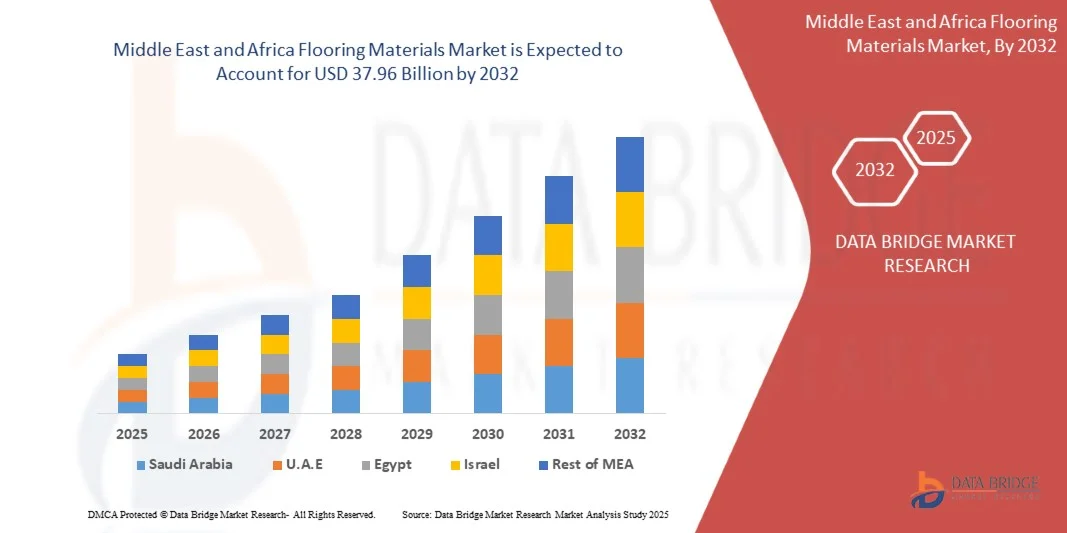

- The Middle East and Africa Flooring Materials Market was valued at USD 23.46 billion in 2024 and is projected to reach USD 37.96 billion by 2032, growing at a CAGR of 6.20% during the forecast period

- Market growth is being driven by rapid urbanization, expanding infrastructure projects, and increasing investments in commercial and residential construction across the region

- Additionally, rising demand for durable, aesthetically appealing, and cost-effective flooring solutions is encouraging innovation in material types and installation technologies, significantly accelerating market expansion

Middle East and Africa Flooring Materials Market Analysis

- Flooring materials, encompassing products such as tiles, carpets, vinyl, laminate, and hardwood, are becoming essential elements in residential, commercial, and industrial infrastructure across the Middle East and Africa due to their durability, aesthetic appeal, and functional benefits

- The growing demand for flooring materials is primarily driven by rapid urban development, rising construction activity, and a surge in remodeling and renovation projects, especially in emerging economies within the region

- U.A.E. dominated the Middle East and Africa Flooring Materials Market with the largest revenue share of 37.01% in 2024, supported by significant infrastructure investments, rising tourism-related construction, and large-scale residential developments

- Saudi Arabia is expected to be the fastest-growing region in the Middle East and Africa Flooring Materials Market during the forecast period due to increasing urbanization, population growth, and government efforts to improve housing and public infrastructure

- The non-resilient flooring segment dominated the market with the largest revenue share of 45.6% in 2024, driven by its wide usage in both residential and commercial buildings due to its durability, aesthetic appeal, and ease of maintenance

Report Scope and Middle East and Africa Flooring Materials Market Segmentation

|

Attributes |

Flooring Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Flooring Materials Market Trends

“Innovative Designs and Eco-Friendly Materials Driving Market Growth”

- A significant and accelerating trend in the Middle East and Africa Flooring Materials Market is the growing demand for innovative, sustainable, and design-forward flooring solutions. This shift is largely influenced by evolving consumer preferences, urbanization, and the increasing adoption of green building practices across both residential and commercial construction projects.

- For instance, companies such as Oriental Weavers and Tarkett are offering a wide range of eco-friendly flooring options that utilize recycled materials and low-emission manufacturing processes. These sustainable alternatives appeal to environmentally conscious consumers and developers looking to meet green certification standards such as LEED or Estidama in the region.

- Innovation in flooring design is also playing a major role, with digitally printed vinyl tiles, modular carpets, and decorative ceramic tiles gaining popularity. These products offer not only aesthetic versatility but also improved durability and ease of maintenance, making them highly attractive for high-traffic areas such as malls, schools, and offices.

- The integration of new technologies such as antimicrobial coatings, acoustic insulation layers, and slip-resistant surfaces is further enhancing the functional value of modern flooring materials. These features are particularly in demand in healthcare, hospitality, and educational sectors where safety and hygiene are top priorities.

- As regional governments continue to invest in smart city infrastructure and large-scale urban development—particularly in Saudi Arabia, the UAE, and Egypt—flooring manufacturers are aligning their product portfolios to cater to high-performance, design-centric, and sustainable construction standards.

- This growing emphasis on eco-conscious, tech-enhanced, and design-driven flooring solutions is reshaping industry standards and consumer expectations across the Middle East and Africa. As a result, both regional and international players are investing in R&D, local production, and advanced manufacturing techniques to gain a competitive edge in this evolving market landscape.

Middle East and Africa Flooring Materials Market Dynamics

Driver

“Growing Demand Driven by Urbanization and Infrastructure Expansion”

- The rapid pace of urbanization and infrastructure development across the Middle East and Africa is a major driver of growth in the flooring materials market. Governments and private developers are heavily investing in residential, commercial, and industrial construction, particularly in Gulf Cooperation Council (GCC) countries, Egypt, and Sub-Saharan Africa.

- For instance, Saudi Arabia's Vision 2030 initiative includes large-scale smart city projects like NEOM, while the UAE continues to expand its tourism and commercial infrastructure. These projects are significantly increasing demand for durable, aesthetically appealing, and cost-effective flooring materials.

- The rise in population, growing middle-class income, and increased focus on housing and real estate development in emerging markets like Nigeria, Kenya, and Egypt are further fueling construction activity. Flooring materials such as ceramic tiles, vinyl, and laminates are seeing strong demand due to their affordability, ease of installation, and versatility.

- Additionally, government-backed housing initiatives and public infrastructure projects, including schools, hospitals, and transportation hubs, are generating sustained demand for high-performance flooring solutions. These include materials that offer moisture resistance, noise reduction, and low maintenance.

- The commercial sector, including hospitality, retail, and office spaces, is also contributing significantly to market expansion, with demand rising for design-forward, durable flooring that aligns with branding and user experience goals.

Restraint/Challenge

“Fluctuating Raw Material Costs and Lack of Skilled Labor”

- A major challenge facing the Middle East and Africa Flooring Materials Market is the fluctuation in prices and availability of key raw materials such as PVC, rubber, ceramic, and wood. These cost pressures, often driven by global supply chain disruptions, currency volatility, or geopolitical factors, can directly impact production costs and retail pricing.

- For instance, global inflationary trends and regional supply chain bottlenecks in 2023 and 2024 led to increased import costs for finished flooring products and raw materials, particularly in countries heavily reliant on imports.

- Another pressing issue is the shortage of skilled labor for proper flooring installation, especially in rapidly developing markets. Improper installation can result in product failure, increased maintenance costs, and decreased customer satisfaction, affecting long-term market growth.

- Furthermore, in some Sub-Saharan African markets, the lack of advanced machinery and modern manufacturing facilities limits the local production of innovative flooring solutions, leading to higher dependency on imports and longer project timelines.

- To overcome these challenges, market players are focusing on localizing production, optimizing supply chains, and offering training programs for installers. Additionally, investing in digital tools for design, planning, and installation is helping reduce errors and improve efficiency, especially in high-volume commercial projects.

Middle East and Africa Flooring Materials Market Scope

The market is segmented on the basis of Product type, material type, end usre, distribution channel.

• By Type

On the basis of type, the Middle East and Africa flooring materials market is segmented into resilient flooring, non-resilient flooring, soft covering, and others. The non-resilient flooring segment dominated the market with the largest revenue share of 45.6% in 2024, driven by its wide usage in both residential and commercial buildings due to its durability, aesthetic appeal, and ease of maintenance. Ceramic and stone tiles, common non-resilient materials, are preferred in hot climates typical of the region due to their cooling effect and resistance to wear.

The resilient flooring segment is projected to witness the fastest growth rate of 18.4% from 2025 to 2032, fueled by rising demand for flexible, moisture-resistant, and cost-effective solutions. Increasing construction in urban areas and the need for sustainable, easy-to-install options are driving the adoption of vinyl and linoleum products, particularly in healthcare and educational institutions.

• By Material

On the basis of material, the market is segmented into wood, vinyl, carpet, tiles, laminate, stone, and others. The tiles segment held the largest market revenue share of 38.9% in 2024, attributed to their suitability for the regional climate, high resistance to humidity and heat, and widespread application in both interior and exterior flooring. Tiles, especially ceramic and porcelain, offer durability and ease of cleaning, which are highly valued in residential and commercial properties across the Middle East and Africa.

The vinyl segment is anticipated to register the fastest CAGR of 20.3% from 2025 to 2032, driven by its cost-effectiveness, ease of installation, and growing demand in modern residential spaces and healthcare settings. Technological advancements in luxury vinyl tiles (LVTs), which offer aesthetic appeal similar to natural materials, are also contributing to this rapid growth.

• By End-User

On the basis of end-user, the market is segmented into residential, commercial, industrial, institutional, and others. The residential segment accounted for the largest market revenue share of 47.5% in 2024, supported by rising urbanization, increasing disposable incomes, and growing investment in home renovation projects. Demand is particularly strong in urban centers where population growth and housing demand are spurring new construction and remodeling activities, with consumers opting for a mix of traditional and modern flooring solutions.

The commercial segment is expected to experience the fastest CAGR of 19.1% from 2025 to 2032, due to increased construction of offices, retail spaces, and hospitality venues. Flooring in commercial spaces must meet durability and aesthetic standards, leading to higher demand for resilient and easy-to-maintain materials like vinyl and laminate.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline channels. The offline segment dominated the market in 2024, accounting for 82.7% of the total revenue, as consumers in the Middle East and Africa still prefer purchasing building materials from physical outlets where they can assess product quality directly. Strong relationships between retailers, contractors, and manufacturers also reinforce the dominance of brick-and-mortar sales channels in the region.

The online segment, however, is projected to record the fastest growth rate of 22.6% from 2025 to 2032, driven by increasing internet penetration, digitalization of retail, and the emergence of e-commerce platforms offering wide product ranges, convenience, and delivery services. The COVID-19 pandemic has further accelerated the shift toward online purchasing behaviors in both urban and semi-urban areas.

Middle East and Africa Flooring Materials Market Regional Analysis

- U.A.E. dominated the Middle East and Africa flooring materials market with the largest revenue share of 37.01% in 2024, driven by rapid urbanization, large-scale construction projects, and increased investments in residential, commercial, and hospitality sectors.

- Consumers and developers in the region highly prioritize flooring materials that combine durability, aesthetics, and ease of maintenance, with a strong preference for carpets, vinyl, and tiles suited to local climate conditions.

- This robust demand is further supported by rising disposable incomes, growing real estate developments, and government initiatives focused on smart city infrastructure, positioning flooring materials as an essential element of modern building design across both residential and commercial properties.

Saudi Arabia Flooring Materials Market Insight

The Saudi Arabia flooring materials market is witnessing substantial growth, driven by the country’s ambitious infrastructure development projects and the increasing number of residential and commercial construction activities. The government’s Vision 2030 initiative, aimed at diversifying the economy and boosting urban development, is a key factor propelling demand for modern and sustainable flooring solutions. Consumers and developers are increasingly favoring durable, eco-friendly, and aesthetically versatile materials such as ceramic tiles, vinyl, and engineered wood. Additionally, the rising hospitality and retail sectors are driving demand for high-quality flooring options to enhance interior design and functionality. The ongoing expansion of smart city projects is further fostering market growth.

South Africa Flooring Materials Market Insight

The South Africa flooring materials market is experiencing steady growth, underpinned by increasing urbanization, rising disposable incomes, and expanding residential and commercial construction sectors. There is a growing consumer preference for affordable, durable, and environmentally sustainable flooring materials such as laminate, ceramic tiles, and vinyl. The expansion of retail and hospitality sectors is contributing to higher demand for versatile flooring solutions that balance cost and aesthetics. Furthermore, government initiatives aimed at improving urban infrastructure and housing development projects are expected to propel the market forward. The emphasis on eco-friendly and low-maintenance flooring options aligns well with the evolving market dynamics.

Middle East and Africa Flooring Materials Market Share

The Flooring Materials industry is primarily led by well-established companies, including:

- Mohawk Industries (U.S.)

- Interface Middle East (U.S.)

- Beaulieu Flooring (Belgium)

- Tarkett S.A. (France)

- Shaw Industries Group, Inc. (U.S.)

- Balta Group (Belgium)

- Al Sorayai Group (Saudi Arabia)

- Abdullatif Carpets (Saudi Arabia)

- Al Mira Carpet Factory (Saudi Arabia)

- Abu Dhabi National Carpet Factory (United Arab Emirates)

- Mac Carpet (Egypt)

- Prado Egypt For Carpet (Egypt)

- Oriental Weavers (Egypt)

- Gheytaran Carpet (Iran)

- Standard Carpets Ind. LLC. (United Arab Emirates)

- Saida Carpets (Jordan)

What are the Recent Developments in Middle East and Africa Flooring Materials Market?

- In April 2023, Al Futtaim Group, a leading conglomerate in the Middle East, launched a strategic initiative to expand its sustainable flooring solutions portfolio across the UAE and Saudi Arabia. This move aims to address the growing demand for eco-friendly, durable flooring materials in residential and commercial sectors. By leveraging innovative production techniques and regional expertise, Al Futtaim is strengthening its position in the rapidly expanding Middle East and Africa flooring materials market, supporting green building initiatives and urban development projects.

- In March 2023, Decoland Group, a prominent flooring manufacturer in South Africa, introduced a new range of high-performance vinyl flooring designed specifically for the hospitality and retail sectors. The launch focuses on durability, ease of maintenance, and aesthetic appeal to meet the evolving needs of commercial spaces. This product advancement highlights Decoland’s commitment to providing versatile, cost-effective flooring solutions while driving growth in the South African flooring materials market.

- In March 2023, RAK Ceramics, a major tile manufacturer headquartered in the UAE, secured a contract to supply flooring materials for the King Salman Park development in Riyadh, Saudi Arabia. The project, one of the largest urban development initiatives in the region, underscores RAK Ceramics’ pivotal role in providing high-quality, sustainable flooring products that align with modern architectural trends and environmental standards. This contract further cements the company’s leadership in the Middle East flooring materials industry.

- In February 2023, Krauss Flooring, a South African flooring solutions provider, announced a strategic partnership with local construction firms to promote the use of eco-friendly laminate and engineered wood flooring in new residential projects. The collaboration aims to enhance sustainability in housing developments while improving overall floor durability and design. This initiative reflects Krauss Flooring’s commitment to innovation and environmental responsibility within the expanding South African flooring market.

- In January 2023, Emirates Ceramic Company unveiled its latest collection of premium porcelain tiles at the Middle East Building & Construction Show. The new product line combines advanced manufacturing technology with contemporary design trends, catering to luxury residential and commercial markets in the UAE and broader Middle East region. Emirates Ceramic Company’s launch showcases its focus on quality, innovation, and market leadership in the competitive Middle East and Africa flooring materials sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Flooring Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Flooring Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Flooring Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.